Global Logistics Market Outlook to 2030

Region:Global

Author(s):Rebecca

Product Code:KROD-022

June 2025

90

About the Report

Global Logistics Market Overview

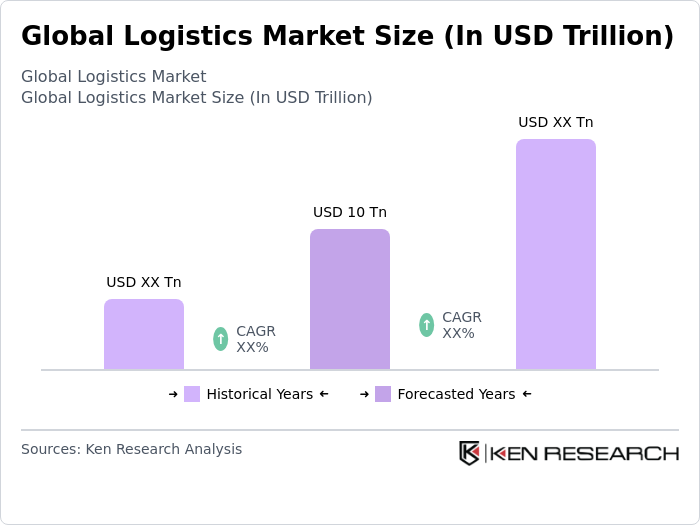

- The Global Logistics Market was valued at USD 10 trillion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for efficient supply chain management, e-commerce expansion, and globalization of trade. The rise in consumer expectations for faster delivery times and the need for cost-effective logistics solutions have further propelled market growth.

- Key players in this market include the United States, China, and Germany, which dominate due to their advanced infrastructure, strategic geographic locations, and robust manufacturing capabilities. The U.S. benefits from a vast transportation network, while China is a manufacturing powerhouse with extensive export activities. Germany's central location in Europe enhances its logistics efficiency, making it a critical hub for trade.

- In 2023, the European Union advanced its Logistics Action Plan, aimed at enhancing the efficiency and sustainability of logistics operations across member states. This regulation focuses on reducing carbon emissions in the logistics sector by promoting the use of alternative fuels and optimizing transport routes, thereby encouraging a shift towards greener logistics practices.

Global Logistics Market Segmentation

By Mode of Transport: The logistics market is primarily segmented into road, rail, air, and sea transport. Among these, road transport dominates the market due to its flexibility and ability to reach remote areas. The increasing demand for last-mile delivery services, particularly in urban areas, has further solidified road transport's position. Additionally, advancements in technology, such as GPS tracking and route optimization software, have enhanced the efficiency of road logistics, making it a preferred choice for many businesses.

By Service Type: The logistics market is segmented into transportation, warehousing, and value-added services. Transportation services hold the largest market share, driven by the increasing need for efficient movement of goods across various regions. The rise of e-commerce has significantly boosted demand for transportation services, as businesses seek to deliver products quickly to consumers. Additionally, the integration of technology in logistics operations, such as automated warehousing and inventory management systems, is enhancing service efficiency and customer satisfaction.

Global Logistics Market Competitive Landscape

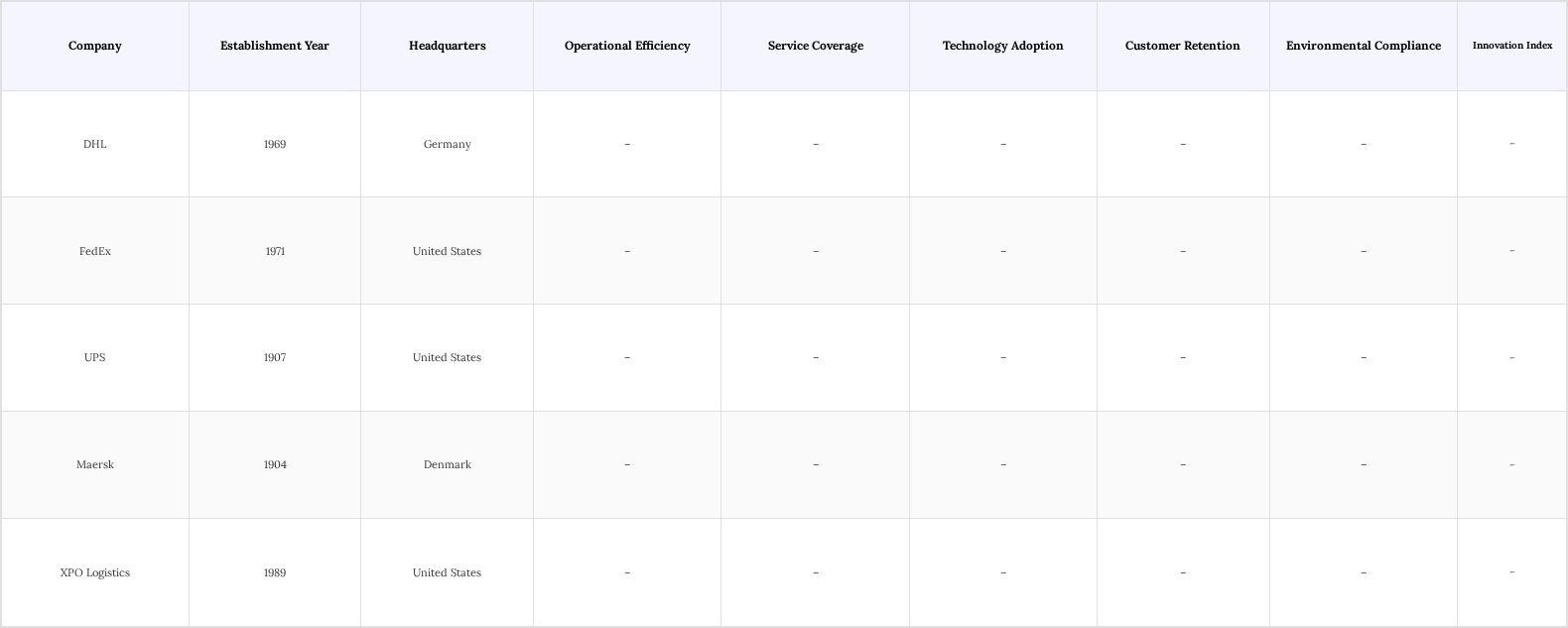

The Global Logistics Market is characterized by intense competition among key players such as DHL, FedEx, UPS, Maersk, and XPO Logistics. These companies leverage advanced technologies and extensive networks to enhance their service offerings and operational efficiency. The market is marked by a mix of local and international players, with a focus on innovation and sustainability to meet evolving consumer demands.

Global Logistics Market Industry Analysis

Growth Drivers

- Increasing E-commerce Activities: Global retail e-commerce sales reached an estimated $6 trillion in 2024, with projections indicating continued strong growth, especially in Asia, where e-commerce revenue neared $2 trillion that year. E-commerce sales accounted for around 19% of total retail sales in 2023, up from 14% in 2019, reflecting a significant shift in consumer shopping behavior. This surge in online shopping has placed unprecedented pressure on logistics networks, particularly in last-mile delivery, which can represent up to 41% of total supply chain costs.

- Global Trade Expansion: The global e-commerce market's rapid expansion is a primary driver for the logistics sector. With global retail e-commerce sales reaching an estimated $6 trillion in 2024 and accounting for approximately 19% of total retail sales in 2023 (up from 14% in 2019), the volume of online orders continues to surge. This growth directly translates into heightened demand for efficient and fast logistics solutions. Companies are compelled to invest in advanced last-mile delivery capabilities, optimized warehousing, and sophisticated inventory management to meet consumer expectations for rapid shipping.

- Technological Advancements in Supply Chain Management: The logistics sector is rapidly transforming through technology adoption, driving significant improvements in efficiency and sustainability. For example, companies implementing fleet tracking and GPS technology have reported a 20% reduction in transit times and a 30% decrease in carbon footprint due to optimized routing strategies. These operational gains translate into faster deliveries and lower environmental impact, enhancing customer satisfaction and cost-effectiveness

Market Challenges

- Rising Fuel Costs: Fuel price volatility continues to pose challenges for the logistics industry, directly impacting transportation expenses—one of the sector's most significant cost components. As fuel prices rise, logistics providers often face increased shipping costs, which can erode profit margins and potentially deter customers. To manage these pressures, companies must invest in route optimization and fuel-efficient technologies to maintain cost-effectiveness and service reliability.

- Regulatory Compliance Issues: The logistics industry is subject to a wide range of regulatory requirements, including those related to safety, environmental protection, and cross-border customs. Emerging environmental regulations are adding complexity and increasing compliance demands for logistics providers. Adapting to these requirements often necessitates investments in compliance training, monitoring systems, and updated operational practices. Non-compliance can result in financial penalties and reputational damage, underscoring the need for proactive regulatory management.

Global Logistics Market Future Outlook

The logistics market is poised for significant transformation driven by technological advancements and evolving consumer expectations. As e-commerce continues to expand, logistics providers will need to enhance their capabilities in last-mile delivery and real-time tracking. Additionally, sustainability initiatives will shape operational strategies, with companies increasingly adopting green logistics practices. The integration of AI and automation will streamline processes, improve efficiency, and reduce costs, positioning the logistics sector for robust growth in the coming years.

Market Opportunities

- Adoption of Automation and Robotics: The logistics industry is rapidly embracing automation and robotics to enhance operational efficiency, reduce labor costs, and improve accuracy in inventory management. By 2025, automation technologies such as autonomous drones, automated guided vehicles (AGVs), robotic arms, and automated storage and retrieval systems (AS/RS) are expected to be widely deployed across warehousing and transportation operations.

- Growth in Emerging Markets: Emerging markets, especially in Asia-Pacific and Africa, are fueling logistics sector growth through rapid economic development and increasing consumer demand. These regions are experiencing strong GDP growth rates, which are boosting infrastructure improvements and expanding urbanization. As road networks, ports, and digital connectivity improve, logistics providers gain greater access to previously underserved areas, enabling more efficient transportation and distribution.

Scope of the Report

| By Mode of Transport |

Road Rail Air Sea |

| By Service Type |

Transportation Warehousing Value-added services |

| By End-User Industry |

Retail Manufacturing Healthcare Automotive Aerospace |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology |

IoT Blockchain Artificial Intelligence Big Data Analytics |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Maritime Commission, Department of Transportation)

Manufacturers and Producers

Distributors and Retailers

Logistics Service Providers

Technology Providers

Industry Associations (e.g., Council of Supply Chain Management Professionals)

Financial Institutions

Companies

Players Mentioned in the Report:

DHL

FedEx

UPS

Maersk

XPO Logistics

TransGlobal Freight Solutions

Nexus Cargo Services

SwiftLink Logistics

Horizon Freight Network

Atlas Supply Chain Solutions

Table of Contents

1. Global Logistics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Logistics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Logistics Market Analysis

3.1. Growth Drivers

3.1.1. Increasing E-commerce Activities

3.1.2. Global Trade Expansion

3.1.3. Technological Advancements in Supply Chain Management

3.2. Market Challenges

3.2.1. Rising Fuel Costs

3.2.2. Regulatory Compliance Issues

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Adoption of Automation and Robotics

3.3.2. Growth in Emerging Markets

3.3.3. Sustainability Initiatives in Logistics

3.4. Trends

3.4.1. Digital Transformation in Logistics

3.4.2. Increased Focus on Last-Mile Delivery Solutions

3.4.3. Integration of Artificial Intelligence and Machine Learning

3.5. Government Regulation

3.5.1. International Trade Agreements

3.5.2. Environmental Regulations

3.5.3. Safety and Security Standards

3.5.4. Customs and Tariff Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Logistics Market Segmentation

4.1. By Mode of Transport

4.1.1. Road

4.1.2. Rail

4.1.3. Air

4.1.4. Sea

4.2. By Service Type

4.2.1. Transportation

4.2.2. Warehousing

4.2.3. Value-added services

4.3. By End-User Industry

4.3.1. Retail

4.3.2. Manufacturing

4.3.3. Healthcare

4.3.4. Automotive

4.3.5. Aerospace

4.4. By Region

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

4.5. By Technology

4.5.1. IoT

4.5.2. Blockchain

4.5.3. Artificial Intelligence

4.5.4. Big Data Analytics

5. Global Logistics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. DHL

5.1.2. FedEx

5.1.3. UPS

5.1.4. Maersk

5.1.5. XPO Logistics

5.1.6. TransGlobal Freight Solutions

5.1.7. Nexus Cargo Services

5.1.8. SwiftLink Logistics

5.1.9. Horizon Freight Network

5.1.10. Atlas Supply Chain Solutions

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Customer Satisfaction Index

5.2.4. Operational Efficiency Metrics

5.2.5. Technology Adoption Rate

5.2.6. Geographic Reach

5.2.7. Service Diversification

5.2.8. Sustainability Practices

6. Global Logistics Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Logistics Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Logistics Market Future Market Segmentation

8.1. By Mode of Transport

8.1.1. Road

8.1.2. Rail

8.1.3. Air

8.1.4. Sea

8.2. By Service Type

8.2.1. Transportation

8.2.2. Warehousing

8.2.3. Value-added services

8.3. By End-User Industry

8.3.1. Retail

8.3.2. Manufacturing

8.3.3. Healthcare

8.3.4. Automotive

8.3.5. Aerospace

8.4. By Region

8.4.1. North America

8.4.2. Europe

8.4.3. Asia-Pacific

8.4.4. Latin America

8.4.5. Middle East & Africa

8.5. By Technology

8.5.1. IoT

8.5.2. Blockchain

8.5.3. Artificial Intelligence

8.5.4. Big Data Analytics

9. Global Logistics Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Logistics Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Logistics Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Logistics Market.

Frequently Asked Questions

01. How big is the Global Logistics Market?

The Global Logistics Market is valued at USD 10 trillion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Logistics Market?

Key challenges in the Global Logistics Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Logistics Market?

Major players in the Global Logistics Market include DHL, FedEx, UPS, Maersk, XPO Logistics, among others.

04. What are the growth drivers for the Global Logistics Market?

The primary growth drivers for the Global Logistics Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.