Global Low-Cost Airlines Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11384

December 2024

88

About the Report

Global Low-Cost Airlines Market Overview

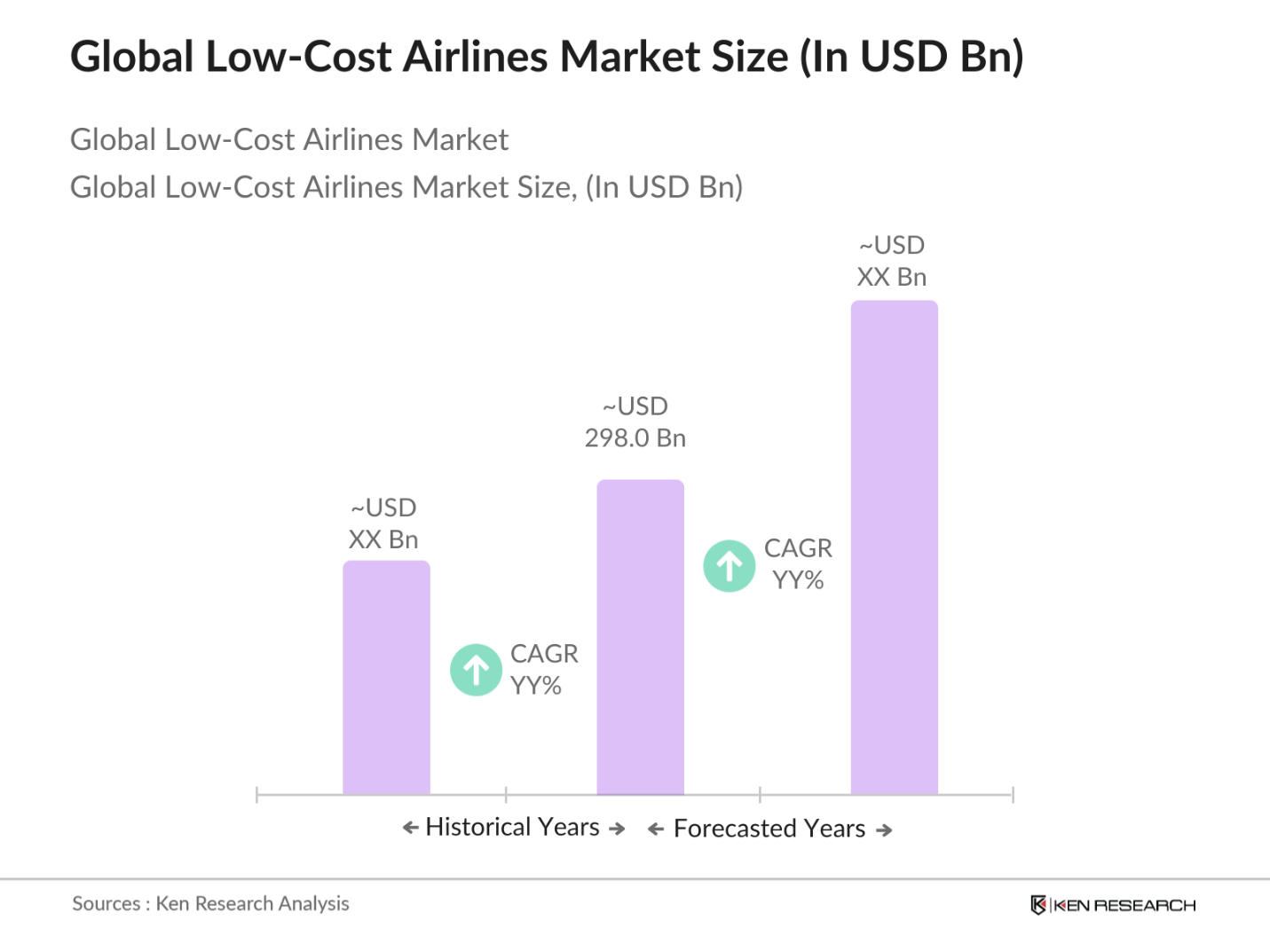

- The global low-cost airlines market is valued at USD 298.0 billion, driven by increasing demand for affordable air travel due to growing middle-class populations and rising disposable incomes, especially in emerging economies. The market growth is further propelled by airlines expanding their route networks and fleet sizes, coupled with advancements in fuel-efficient aircraft that help in maintaining competitive fares while managing operational costs.

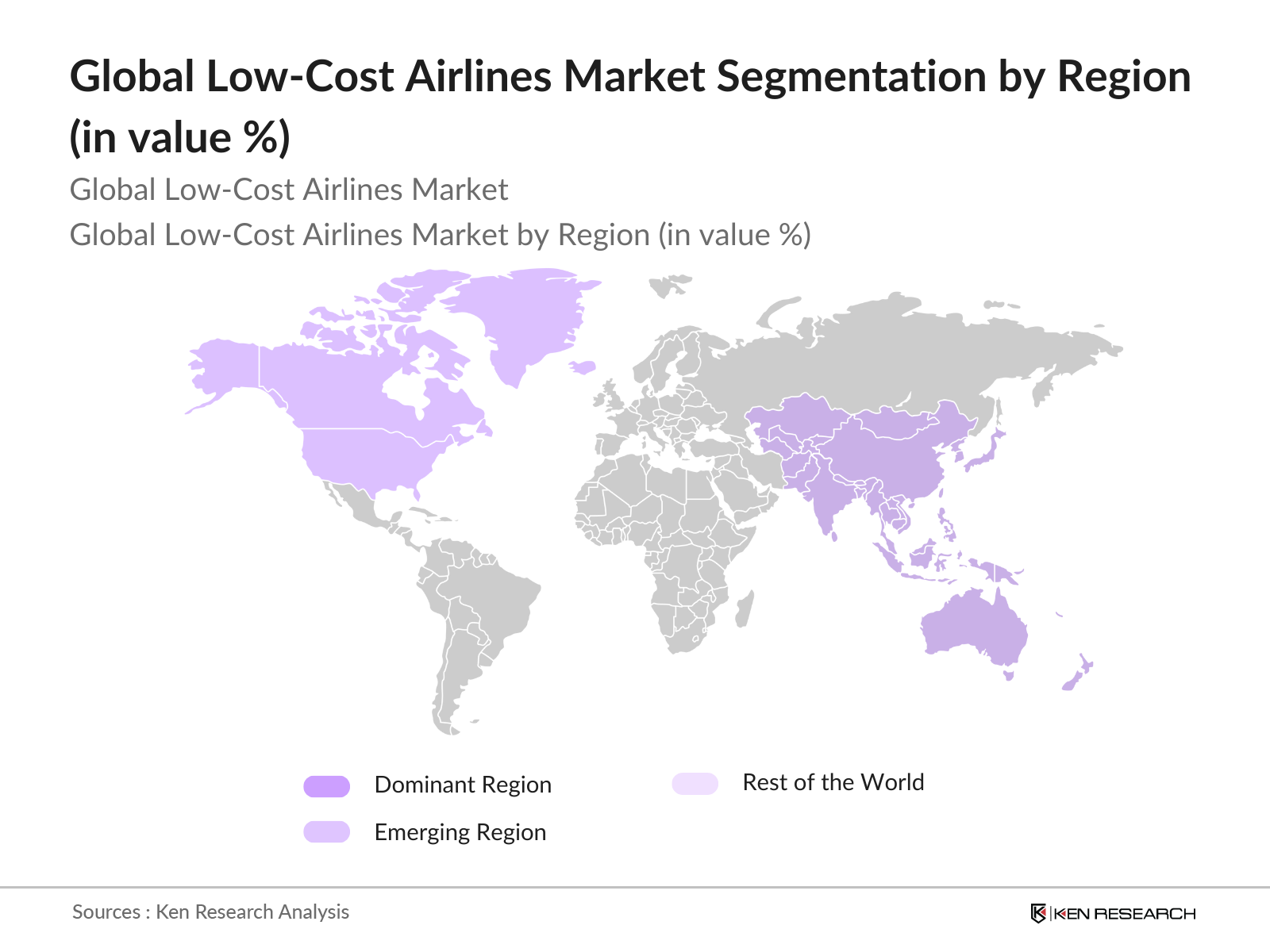

- Countries like the United States, India, and China dominate the low-cost airlines market. The United States, with its extensive domestic network, has a high demand for budget-friendly air travel. India and China, with their large populations and increasing regional connectivity, drive growth in the Asia-Pacific region. The strong dominance of these countries is attributed to expanding middle classes, governmental policies supporting aviation infrastructure, and rising consumer preferences for cost-effective travel options.

- Governments globally are strengthening aviation safety regulations, which impact the low-cost airline sector. In 2023, the European Union Aviation Safety Agency (EASA) introduced stricter maintenance standards for aircraft used by low-cost airlines, adding operational costs. In the U.S., the Federal Aviation Administration (FAA) revised regulations to ensure more rigorous training for pilots of low-cost carriers. These regulatory updates aim to improve passenger safety but can also increase the financial burden on airlines that operate with tighter margins.

Global Low-Cost Airlines Market Segmentation

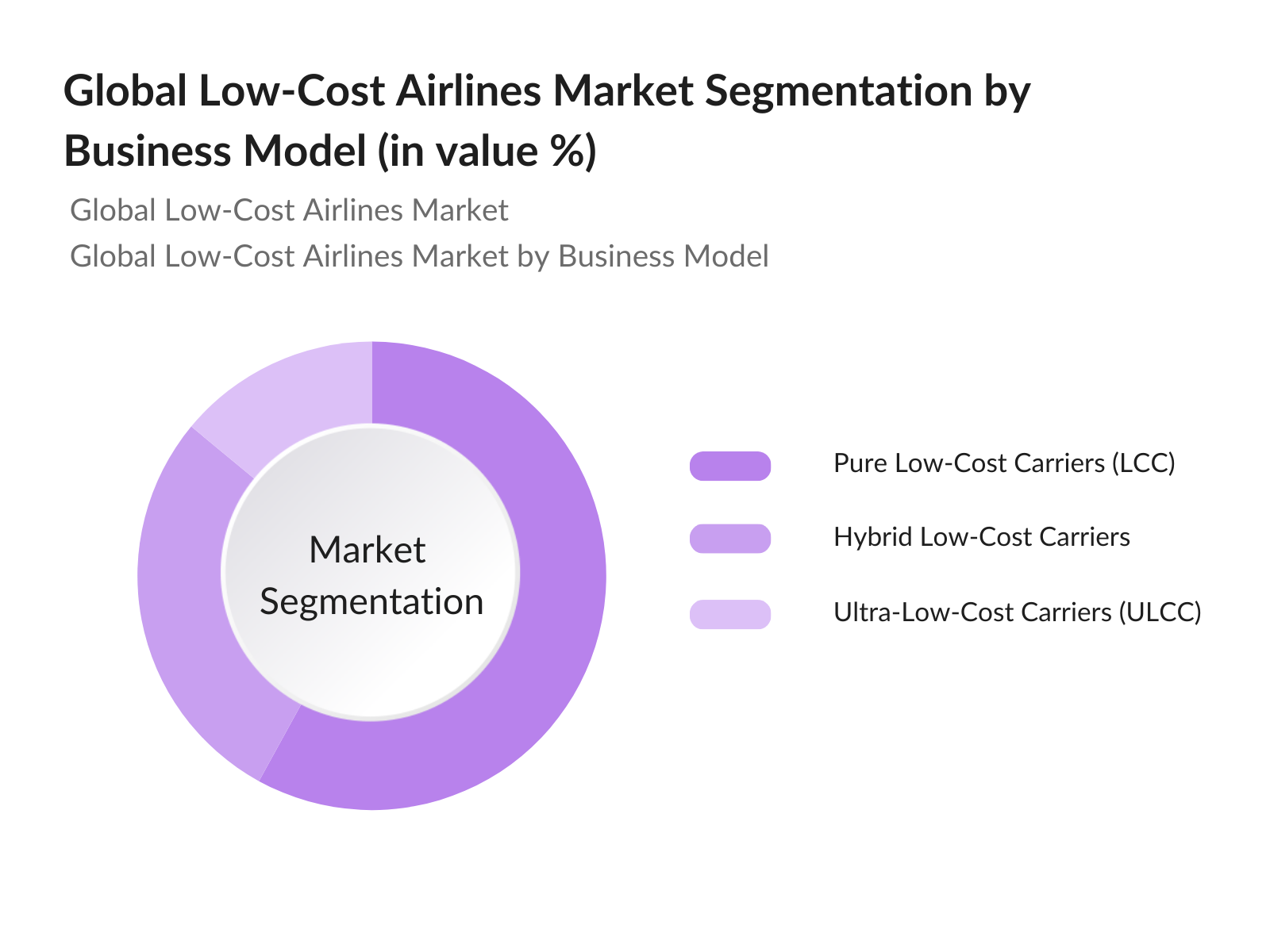

By Business Model: The global low-cost airlines market is segmented by business model into pure low-cost carriers (LCC), hybrid low-cost carriers, and ultra-low-cost carriers (ULCC). Among these, pure low-cost carriers hold the largest market share. This dominance is attributed to the straightforward, no-frills model, which focuses on efficiency, cost control, and providing affordable travel options to consumers. Pure LCCs, such as Ryanair and Southwest Airlines, maintain a significant presence due to their established routes, large fleets, and ability to offer consistently low fares through stringent operational practices.

By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific dominates, owing to the rapid growth of low-cost airlines in countries like India, China, and Southeast Asia. The growing middle class, government initiatives to boost regional connectivity, and increasing leisure travel are key factors driving market growth in this region. North America and Europe follow, driven by established airline networks and consistent demand for affordable travel options.

Global Low-Cost Airlines Market Competitive Landscape

The global low-cost airlines market is dominated by a few key players, each vying for market share through fleet expansion, competitive pricing, and strategic partnerships. These companies, such as Ryanair and Southwest Airlines, have solidified their positions through large-scale operations and efficient business models that capitalize on cost-effective measures. The consolidation within the industry highlights the competitive nature of the market, where economies of scale and network optimization play crucial roles.

|

Company |

Established Year |

Headquarters |

Fleet Size |

Revenue (USD bn) |

Route Network |

Ancillary Revenue |

Load Factor |

Sustainability Initiatives |

Customer Satisfaction Ratings |

|

Ryanair Holdings |

1984 |

Dublin, Ireland |

500+ |

9.1 |

|||||

|

Southwest Airlines |

1967 |

Dallas, USA |

750+ |

22.6 |

|||||

|

easyJet Plc |

1995 |

Luton, UK |

300+ |

8.3 |

|||||

|

AirAsia Group |

1993 |

Sepang, Malaysia |

250+ |

2.9 |

|||||

|

Indigo Airlines |

2006 |

Gurgaon, India |

270+ |

5.7 |

Global Low-Cost Airlines Market Analysis

Market Growth Drivers

- Increasing Air Passenger Traffic: In 2023, global air passenger traffic reached approximately 4.4 billion passengers, with a substantial portion attributed to low-cost airlines. According to IATA, air travel demand has significantly rebounded, largely driven by domestic and short-haul international travel. Emerging markets in regions like Asia-Pacific, Latin America, and Africa witnessed notable growth in passenger numbers, supported by rising middle-class incomes. In India, for instance, over 150 million domestic air passengers were recorded in 2023, with a considerable share traveling via low-cost carriers. The global recovery of tourism further contributed to the increase in air travel numbers.

- Expansion of Regional Connectivity: Regional air connectivity has been expanding significantly in 2023, particularly in emerging markets like Southeast Asia and Africa, where governments are investing in enhancing airport infrastructure. The African Unions Single African Air Transport Market (SAATM) initiative is driving an increase in intra-African flights, contributing to the growth of the low-cost airline sector. Similarly, Indias UDAN (Ude Desh ka Aam Naagrik) scheme introduced more than 700 new routes in 2023, boosting regional connectivity and expanding access to underserved areas. This infrastructure development is fostering the growth of low-cost airlines in these regions.

- Price-Sensitive Consumers: Global economic conditions in 2024, marked by inflationary pressures and slower GDP growth rates, have reinforced consumer demand for affordable travel options. Low-cost carriers are capitalizing on this trend, with Europe and Asia-Pacific leading in the low-cost airline segment. In Europe, Ryanair recorded over 150 million passengers in 2023, a significant portion of which consisted of price-sensitive travelers. The rise of budget-conscious travelers is also evident in India and Southeast Asia, where the middle class continues to seek affordable travel options as disposable incomes gradually increase.

Market Opportunities:

- Expanding Middle-Class Income in Emerging Markets: The global middle class is expected to reach 4 billion people by 2024, with much of this growth coming from Asia and Africa. In India, the middle-class population is projected to rise to over 600 million by 2025. Rising disposable incomes are driving demand for affordable air travel options, positioning low-cost carriers to capitalize on this expanding consumer base. In Southeast Asia, markets like Indonesia, with a middle-class population exceeding 70 million.

- Strategic Alliances and Partnerships: Low-cost airlines are increasingly forming strategic partnerships to expand their route networks and reduce operational costs. For instance, in 2023, Ryanair and Turkish Airlines signed a codeshare agreement, enabling both carriers to offer more route options and increase market reach across Europe and the Middle East. Similarly, Latin American low-cost airlines like Gol have formed partnerships with global airlines to expand their market presence. These alliances allow low-cost carriers to compete with full-service airlines and offer a broader range of destinations to passengers.

Global Low-Cost Airlines Market Future Outlook

Over the next few years, the global low-cost airlines market is poised for significant growth, driven by an increasing demand for affordable air travel options and continued expansion in emerging markets. Factors such as rising disposable incomes, urbanization, and the availability of low-cost travel alternatives will further stimulate the market. Additionally, technological advancements, including the integration of digital sales platforms and the adoption of sustainable aviation practices, will shape the future of the industry, ensuring airlines meet evolving consumer and environmental demands.

Market Opportunities:

- Expanding Middle-Class Income in Emerging Markets: The global middle class is expected to reach 4 billion people by 2024, with much of this growth coming from Asia and Africa. In India, the middle-class population is projected to rise to over 600 million by 2025. Rising disposable incomes are driving demand for affordable air travel options, positioning low-cost carriers to capitalize on this expanding consumer base. In Southeast Asia, markets like Indonesia, with a middle-class population exceeding 70 million, are also fueling demand for low-cost airlines as regional air travel becomes increasingly accessible.

- Strategic Alliances and Partnerships: Low-cost airlines are increasingly forming strategic partnerships to expand their route networks and reduce operational costs. For instance, in 2023, Ryanair and Turkish Airlines signed a codeshare agreement, enabling both carriers to offer more route options and increase market reach across Europe and the Middle East. Similarly, Latin American low-cost airlines like Gol have formed partnerships with global airlines to expand their market presence. These alliances allow low-cost carriers to compete with full-service airlines and offer a broader range of destinations to passengers.

Scope of the Report

|

By Business Model |

Pure Low-Cost Carriers (LCC) Hybrid Low-Cost Carriers Ultra-Low-Cost Carriers (ULCC) |

|

By Service Type |

Domestic Flights |

|

By Passenger Type |

Leisure Travelers |

|

By Distribution Channel |

Direct Sales (Airline Websites, Mobile Apps) Indirect Sales (Online Travel Agencies, Travel Agents) |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Low-Cost Airlines Operators

Aviation Fleet Manufacturers

Travel and Tourism Companies

Government and Regulatory Bodies (Federal Aviation Administration, International Civil Aviation Organization)

Airport Authorities

Investments and Venture Capitalist Firms

Airline Technology Providers

Fuel Suppliers and Aviation Service Companies

Companies

Players Mention in the Report

Ryanair Holdings

Southwest Airlines

easyJet Plc

AirAsia Group

Indigo Airlines

Jetstar Airways

Wizz Air

Spirit Airlines

Norwegian Air Shuttle

Viva Aerobus

Eurowings

Frontier Airlines

Flydubai

Scoot

Pegasus Airlines

Table of Contents

1. Global Low-Cost Airlines Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Low-Cost Airlines Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Passenger Traffic Growth, Revenue Per Seat, Average Ticket Price)

2.3. Key Market Developments and Milestones

3. Global Low-Cost Airlines Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Air Passenger Traffic

3.1.2. Expansion of Regional Connectivity

3.1.3. Price-Sensitive Consumers

3.1.4. Fleet Modernization Initiatives

3.2. Market Challenges

3.2.1. Fuel Price Volatility

3.2.2. Regulatory Restrictions (Airline Regulations, Bilateral Agreements)

3.2.3. Infrastructure Limitations (Airport Capacity, Slots)

3.3. Opportunities

3.3.1. Expanding Middle-Class Income in Emerging Markets

3.3.2. Strategic Alliances and Partnerships

3.3.3. Growth in Digital Sales Channels (Mobile Ticketing, Online Bookings)

3.4. Trends

3.4.1. Increasing Focus on Ancillary Revenues (Baggage Fees, Seat Selection, On-Board Purchases)

3.4.2. Use of Data Analytics for Route Optimization

3.4.3. Green Aviation Initiatives (Sustainable Fuels, Carbon Offset Programs)

3.5. Government Regulation

3.5.1. Aviation Safety Standards

3.5.2. Deregulation Policies (Open Skies Agreements, Slot Allocations)

3.5.3. Subsidies for Regional Connectivity

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Airports, Aircraft Manufacturers, Travel Agencies)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Threat of New Entrants, Threat of Substitutes, Industry Rivalry)

3.9. Competitive Ecosystem

4. Global Low-Cost Airlines Market Segmentation

4.1. By Business Model (In Value %)

4.1.1. Pure Low-Cost Carriers (LCC)

4.1.2. Hybrid Low-Cost Carriers

4.1.3. Ultra-Low-Cost Carriers (ULCC)

4.2. By Service Type (In Value %)

4.2.1. Domestic Flights

4.2.2. International Flights

4.2.3. Long-Haul Budget Flights

4.3. By Passenger Type (In Value %)

4.3.1. Leisure Travelers

4.3.2. Business Travelers

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales (Airline Websites, Mobile Apps)

4.4.2. Indirect Sales (Online Travel Agencies, Travel Agents)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Low-Cost Airlines Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ryanair Holdings

5.1.2. Southwest Airlines

5.1.3. easyJet Plc

5.1.4. AirAsia Group

5.1.5. Indigo Airlines

5.1.6. Jetstar Airways

5.1.7. Wizz Air

5.1.8. Spirit Airlines

5.1.9. Norwegian Air Shuttle

5.1.10. Viva Aerobus

5.1.11. Eurowings

5.1.12. Frontier Airlines

5.1.13. Flydubai

5.1.14. Scoot

5.1.15. Pegasus Airlines

5.2. Cross Comparison Parameters (Fleet Size, Route Network, Headquarters, Ancillary Revenue, Load Factor, Profit Margins, Sustainability Initiatives, Customer Satisfaction Ratings)

5.3. Market Share Analysis (By Revenue, By Passengers)

5.4. Strategic Initiatives (Fleet Expansion, Service Enhancements)

5.5. Mergers and Acquisitions (Partnerships, Alliances)

5.6. Investment Analysis (CapEx, Funding for Growth)

5.7. Venture Capital and Private Equity Investments

5.8. Government Grants and Subsidies

6. Global Low-Cost Airlines Market Regulatory Framework

6.1. Aviation Regulations (Safety Standards, Operational Rules)

6.2. Compliance Requirements (Security Measures, Environmental Regulations)

6.3. Certification Processes (IATA Certifications, FAA Approvals)

7. Global Low-Cost Airlines Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Population Growth, Rising Middle Class)

8. Global Low-Cost Airlines Future Market Segmentation

8.1. By Business Model (In Value %)

8.2. By Service Type (In Value %)

8.3. By Passenger Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Low-Cost Airlines Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Leisure vs Business)

9.3. Marketing Initiatives (Price Positioning, Branding)

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by mapping the low-cost airline industrys ecosystem, identifying critical stakeholders such as airline operators, regulatory bodies, and aviation infrastructure providers. Extensive secondary research is conducted to gather relevant data on these stakeholders, which helps in defining the key variables that influence the market.

Step 2: Market Analysis and Construction

Historical data pertaining to the low-cost airline industry, including fleet sizes, passenger volumes, and ancillary revenue statistics, is compiled and analyzed. This step helps in establishing a clear understanding of market trends and growth drivers, ensuring the analysis is grounded in factual information.

Step 3: Hypothesis Validation and Expert Consultation

To verify the accuracy of the data and refine market projections, expert consultations are conducted through structured interviews with professionals from leading airlines. Their insights provide operational perspectives, helping to fine-tune revenue estimates and market forecasts.

Step 4: Research Synthesis and Final Output

In the final phase, the gathered data is synthesized into a comprehensive market report. This includes verifying the findings through triangulation methods, comparing different data sources, and validating the trends observed with industry insights to ensure a robust analysis of the global low-cost airline market.

Frequently Asked Questions

01. How big is the global low-cost airlines market?

The global low-cost airlines market is valued at USD 298.0 billion, driven by rising demand for budget-friendly air travel, particularly in emerging markets and among leisure travelers.

02. What are the key challenges in the global low-cost airlines market?

The market faces challenges such as volatile fuel prices, regulatory restrictions in certain regions, and infrastructure limitations at key airports, which can hamper airlines' operational efficiency and expansion plans.

03. Who are the major players in the global low-cost airlines market?

Key players include Ryanair Holdings, Southwest Airlines, AirAsia Group, and easyJet, among others. These companies have strong brand presence, large fleet sizes, and expansive route networks that contribute to their market dominance.

04. What are the growth drivers of the global low-cost airlines market?

The market is driven by factors such as increasing air travel demand, expansion of regional air connectivity, and the growth of middle-class populations, particularly in emerging economies like India and China.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.