Global Low-Speed Vehicles Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD7243

December 2024

97

About the Report

Global Low-Speed Vehicles Market Overview

- The Global Low-Speed Vehicles Market is valued at USD 12 billion based on a detailed analysis of historical trends. This market has been primarily driven by the increasing adoption of electric low-speed vehicles across urban and suburban areas for personal and commercial transportation. Growth in the market is also influenced by sustainability initiatives, where eco-friendly transportation solutions are increasingly being encouraged through government subsidies and incentives.

- The market is dominated by key countries, including the United States, Japan, and Germany. These countries hold a strong position due to their advanced infrastructure, strong automotive manufacturing base, and favorable regulations for low-speed electric vehicles. Moreover, cities with dense urban populations and strict emissions regulations, such as New York, Tokyo, and Berlin, drive the higher demand for low-speed vehicles, where such vehicles are used for short commutes and recreational purposes.

- Emission regulations are playing a significant role in the development of low-speed vehicles. The European Unions Euro 7 standards, set to be implemented in 2025, are pushing manufacturers to focus on zero-emission low-speed vehicles. Similarly, the U.S. Environmental Protection Agency (EPA) requires a 20% reduction in vehicle emissions compared to 2020 levels, which also applies to low-speed electric models. These regulations are encouraging the production of more efficient low-speed electric vehicles.

Global Low-Speed Vehicles Market Segmentation

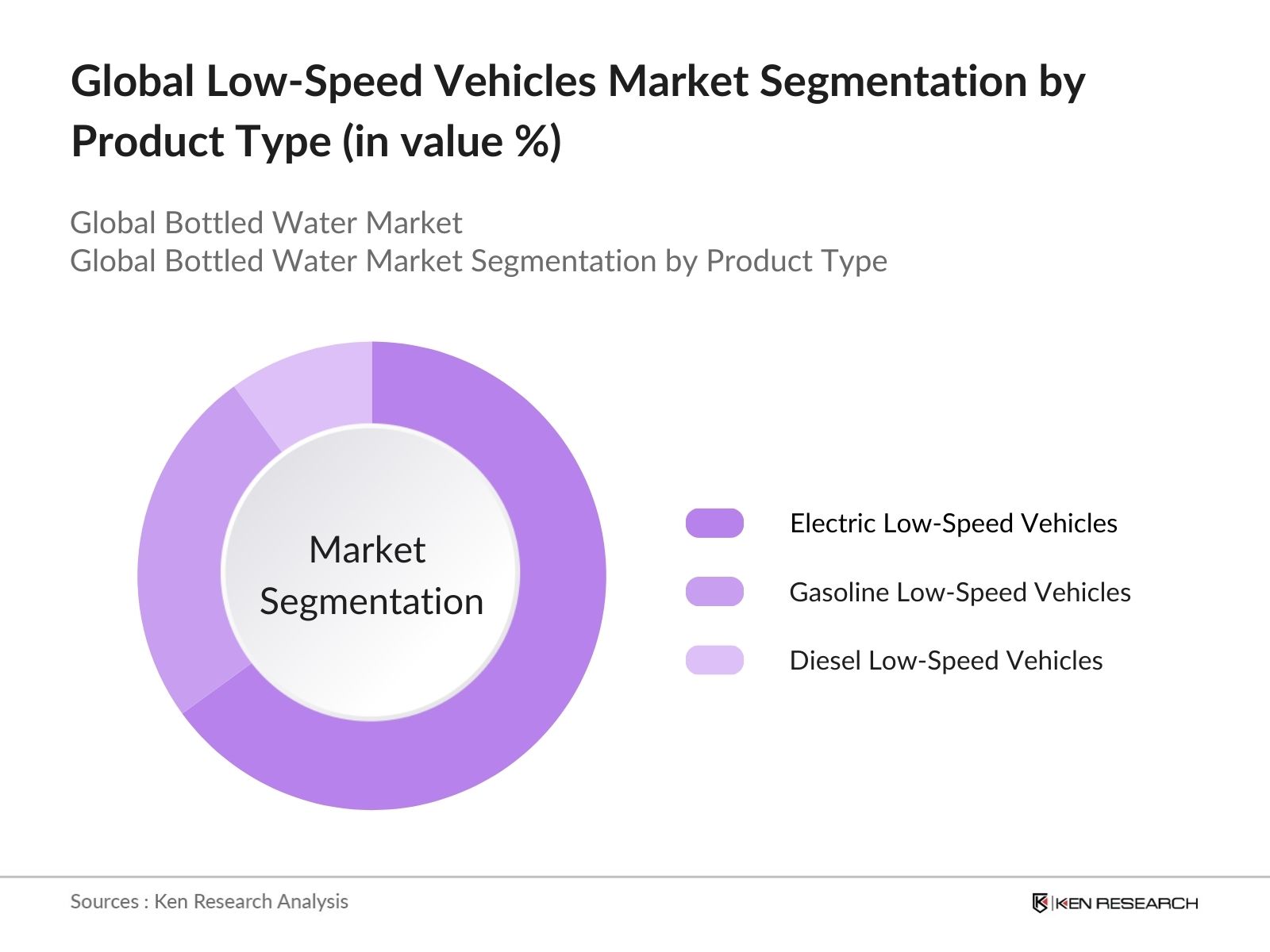

- By Product Type: The global Low-Speed Vehicles market is segmented by product type into electric low-speed vehicles, gasoline low-speed vehicles, and diesel low-speed vehicles. Electric low-speed vehicles dominate this segment due to increasing environmental concerns and government incentives promoting zero-emission vehicles. This sub-segment has witnessed significant adoption, especially in urban centers and for personal use, driven by the rising availability of charging infrastructure and advancements in battery technology. Gasoline and diesel vehicles are seeing declining interest due to environmental policies.

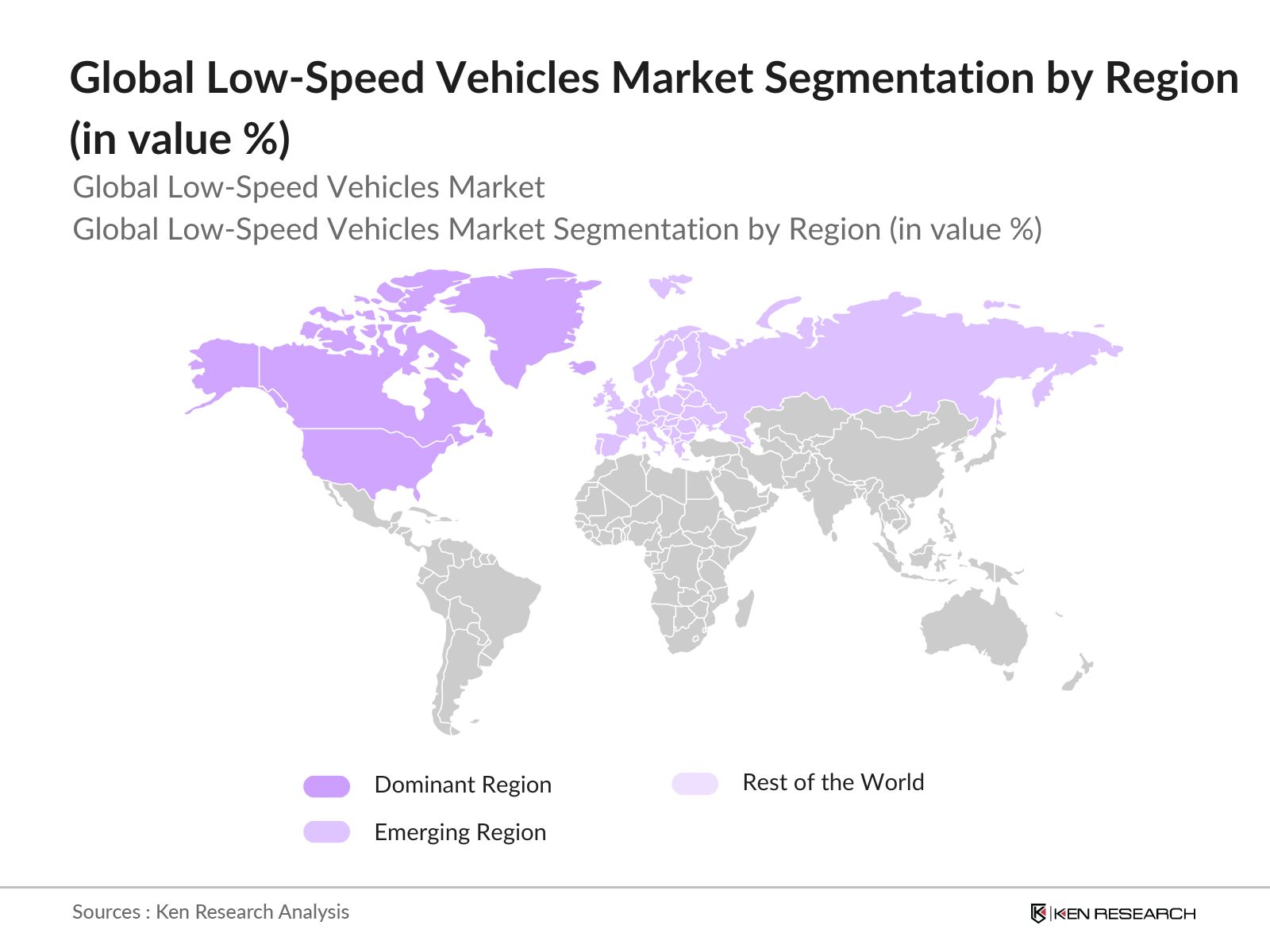

- By Region: The market is segmented regionally into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America dominates the regional segment due to widespread adoption in the United States, where the Low-Speed Vehicles market benefits from favorable policies and infrastructure for electric vehicles. Additionally, the popularity of low-speed vehicles in leisure activities, particularly in states like Florida and California, contributes to this region's dominance. Asia-Pacific is an emerging market with high potential growth, especially in countries like Japan and China, where government regulations encourage the adoption of electric low-speed vehicles.

- By Application: The Low-Speed Vehicles market is segmented by application into personal transportation, commercial use, industrial use, and government use. Personal transportation dominates due to its growing usage in residential communities, short-distance commuting, and leisure. Golf carts and neighborhood electric vehicles are becoming popular for personal transport, especially in gated communities and eco-friendly cities, where low-speed vehicles are preferred for convenience and lower operating costs.

Global Low-Speed Vehicles Market Competitive Landscape

The Global Low-Speed Vehicles Market is highly competitive, with a mix of established global players and emerging regional manufacturers. The market is consolidated, with major players focusing on expanding their product portfolio, strategic partnerships, and research and development to stay competitive. The competitive landscape is characterized by the dominance of players such as Polaris Inc., Club Car LLC, and Yamaha Golf-Car Company, who have a strong foothold due to their extensive distribution networks and continued product innovations.

|

Company |

Establishment Year |

Headquarters |

Powertrain Types |

Revenue (2023) |

Market Focus |

Employee Strength |

Product Innovations |

|

Polaris Inc. |

1954 |

USA |

- |

- |

- |

- |

- |

|

Club Car LLC |

1958 |

USA |

- |

- |

- |

- |

- |

|

Textron Inc. |

1923 |

USA |

- |

- |

- |

- |

- |

|

Yamaha Golf-Car Company |

1955 |

Japan |

- |

- |

- |

- |

- |

|

Garia A/S |

2005 |

Denmark |

- |

- |

- |

- |

- |

Global Low-Speed Vehicles Market Analysis

Growth Drivers

- Urbanization: The rise in urbanization is driving the demand for low-speed vehicles in densely populated cities, particularly for short-distance travel. According to the World Bank, the global urban population reached 57% by 2023, leading to an increased need for eco-friendly and compact transportation solutions in urban areas. In India, about 35% of the population lived in urban centers by 2023, boosting the demand for low-speed vehicles designed for intra-city travel. This shift towards urban living necessitates alternative transportation modes such as low-speed electric vehicles.

- Electrification: Electrification is a major growth driver for low-speed vehicles. The International Energy Agency (IEA) reported that over 10 million electric vehicles were sold in 2022, with a notable portion being low-speed electric models used in urban areas and gated communities. Governments are promoting electrification by investing in infrastructure, such as the $5 billion allocated by the United States for charging infrastructure in 2023, further boosting the adoption of electric low-speed vehicles.

- Sustainability Initiatives: Sustainability initiatives are enhancing the adoption of low-speed vehicles as governments worldwide seek to reduce emissions. For instance, Chinas green mobility initiatives have led to the sale of over 1 million electric low-speed vehicles by the end of 2023, aligning with international agreements like the Paris Agreement. Countries are increasing investments in sustainable transport, making low-speed vehicles a key element in reducing carbon footprints.

Challenges

- Battery Technology: Battery performance is a major challenge in the market, as limited range and degradation hinder adoption. According to the World Bank, the average driving range of low-speed electric vehicles is between 50 to 70 kilometers on a single charge, with battery costs accounting for 40-50% of the vehicles total price. These high costs and limited technology improvements in lithium-ion batteries are slowing the widespread adoption of low-speed vehicles.

- Infrastructure Limitations: A lack of sufficient charging infrastructure, especially in developing regions, presents a significant challenge. The International Energy Agency reported that Europe had over 450,000 public charging points in 2023, while regions like Africa and Southeast Asia had fewer than 10,000 stations. This infrastructure gap limits the expansion of electric low-speed vehicles in underdeveloped areas.

Global Low-Speed Vehicles Market Future Outlook

Over the next five years, the Global Low-Speed Vehicles Market is expected to witness substantial growth driven by increased adoption of electric low-speed vehicles, advancements in battery technology, and supportive government policies promoting clean energy transportation. Expanding infrastructure for electric vehicles and the rising demand for sustainable urban mobility solutions will further drive market growth, especially in developed regions like North America and Europe.

Market Opportunities

- Expansion in Tourism and Leisure Sectors: The tourism and leisure industries are increasingly adopting low-speed vehicles, especially in areas where environmental regulations restrict high-emission vehicles. According to the United Nations World Tourism Organization (UNWTO), international tourism receipts reached$1 trillionin 2022, reflecting a significant rebound from the pandemic. Many resorts are shifting towards electric low-speed vehicles to offer eco-friendly guest transportation options.

UNWTO Tourism Data - Electrification of Low-Speed Vehicles: The move towards electrification in low-speed vehicles is gaining momentum, especially in sectors like agriculture and industry. Governments are providing financial incentives to boost electrification efforts. In India, the FAME II (Faster Adoption and Manufacturing of Electric Vehicles) initiative provided subsidies of up to $2,500 for electric vehicle purchases in 2023, which has significantly encouraged the adoption of electric low-speed vehicles.

Scope of the Report

|

Segmentation |

Sub-Segments |

|

By Product Type |

Electric Low-Speed Vehicles |

|

Gasoline Low-Speed Vehicles |

|

|

Diesel Low-Speed Vehicles |

|

|

By Application |

Personal Transportation |

|

Commercial Use |

|

|

Industrial Use |

|

|

Government Use |

|

|

By Powertrain Type |

Electric |

|

Hybrid |

|

|

Internal Combustion Engine (ICE) |

|

|

By Speed Range |

15-25 km/h |

|

25-40 km/h |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East & Africa |

Products

Key Target Audience

Electric Vehicle Manufacturers

Energy and Utilities Companies

Urban Mobility Solution Providers

Tourism and Leisure Industry Players

Battery Technology Providers

Vehicle Fleet Operators

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Environmental Protection Agency, Department of Transportation)

Companies

Players Mentioned in the Report

Polaris Inc.

Club Car LLC

Textron Inc.

Yamaha Golf-Car Company

Garia A/S

Columbia Vehicle Group Inc.

HDK Electric Vehicles

Evolution Electric Vehicles

American Custom Golf Cars (ACG)

Bintelli Electric Vehicles

Table of Contents

1. Global Low-Speed Vehicles Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Low-Speed Vehicles Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Low-Speed Vehicles Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization

3.1.2. Electrification

3.1.3. Sustainability Initiatives

3.2. Market Challenges

3.2.1. Battery Technology

3.2.2. Infrastructure Limitations

3.2.3. Regulatory Constraints

3.3. Opportunities

3.3.1. Expansion in Tourism and Leisure Sectors

3.3.2. Electrification of Low-Speed Vehicles

3.3.3. Government Incentives

3.4. Trends

3.4.1. Adoption of Smart and Autonomous Technologies

3.4.2. Increased Electrification of Low-Speed Vehicles

3.5. Government Regulation

3.5.1. Emission Standards

3.5.2. Safety Regulations

3.5.3. Tax Incentives for Electric Low-Speed Vehicles

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Low-Speed Vehicles Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Electric Low-Speed Vehicles

4.1.2. Gasoline Low-Speed Vehicles

4.1.3. Diesel Low-Speed Vehicles

4.2. By Application (In Value %)

4.2.1. Personal Transportation

4.2.2. Commercial Use (Tourism, Golf Carts)

4.2.3. Industrial Use (Warehouse, Factory Transport)

4.2.4. Government Use (Public Safety, Campus Transport)

4.3. By Powertrain Type (In Value %)

4.3.1. Electric

4.3.2. Hybrid

4.3.3. Internal Combustion Engine (ICE)

4.4. By Speed Range (In Value %)

4.4.1. 15-25 km/h

4.4.2. 25-40 km/h

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Low-Speed Vehicles Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Polaris Inc.

5.1.2. Club Car LLC

5.1.3. Textron Inc.

5.1.4. Yamaha Golf-Car Company

5.1.5. Columbia Vehicle Group Inc.

5.1.6. Garia A/S

5.1.7. American Custom Golf Cars (ACG)

5.1.8. Bintelli Electric Vehicles

5.1.9. HDK Electric Vehicles

5.1.10. Evolution Electric Vehicles

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Product Launch Year, Global Market Presence, Powertrain Types)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Global Low-Speed Vehicles Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Low-Speed Vehicles Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Low-Speed Vehicles Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Powertrain Type (In Value %)

8.4. By Speed Range (In Value %)

8.5. By Region (In Value %)

9. Global Low-Speed Vehicles Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives (Targeted Marketing Campaigns, Digital Advertising)

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research process began by constructing an ecosystem map encompassing all major stakeholders in the global Low-Speed Vehiclesmarket. Extensive desk research was conducted using proprietary databases and secondary sources to identify and define critical market variables, including product types, powertrain technologies, and application areas.

Step 2: Market Analysis and Construction

Historical data from industry reports were used to compile a comprehensive market analysis. This phase involved assessing market penetration rates, revenue generation trends, and the number of players across different regions. The reliability of revenue estimates was cross-verified with industry standards and service quality statistics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses derived from secondary research were validated through direct interviews with industry experts. These consultations provided insights into product performance, customer preferences, and emerging trends in the Low-Speed Vehiclesmarket, thereby helping to refine the data.

Step 4: Research Synthesis and Final Output

The research synthesis involved detailed engagements with electric vehicle manufacturers to verify the statistical data obtained. This ensured the accuracy of market segmentation, competitive landscape insights, and overall market projections.

Frequently Asked Questions

01. How big is the Global Low-Speed Vehicles Market?

The global Low-Speed Vehicles market is valued at USD 12 billion, driven by strong demand in urban transportation and commercial sectors, coupled with rising environmental concerns.

02. What are the key challenges in the Global Low-Speed Vehicles Market?

Challenges in Global Low-Speed Vehicles Market include high initial costs, limited infrastructure for electric vehicles, and stringent government regulations regarding safety and emissions standards.

03. Who are the major players in the Global Low-Speed Vehicles Market?

Key players in Global Low-Speed Vehicles Market include Polaris Inc., Club Car LLC, Yamaha Golf-Car Company, and Textron Inc. These companies have a strong market presence due to their advanced technology and wide product portfolios.

04. What is driving the growth of the Global Low-Speed Vehicles Market?

Growth in Global Low-Speed Vehicles Market is driven by increased demand for eco-friendly transportation solutions, government incentives for electric vehicles, and advancements in battery technology that enhance the efficiency and range of low-speed vehicles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.