Global Lubricants Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5243

December 2024

88

About the Report

Global Lubricants Market Overview

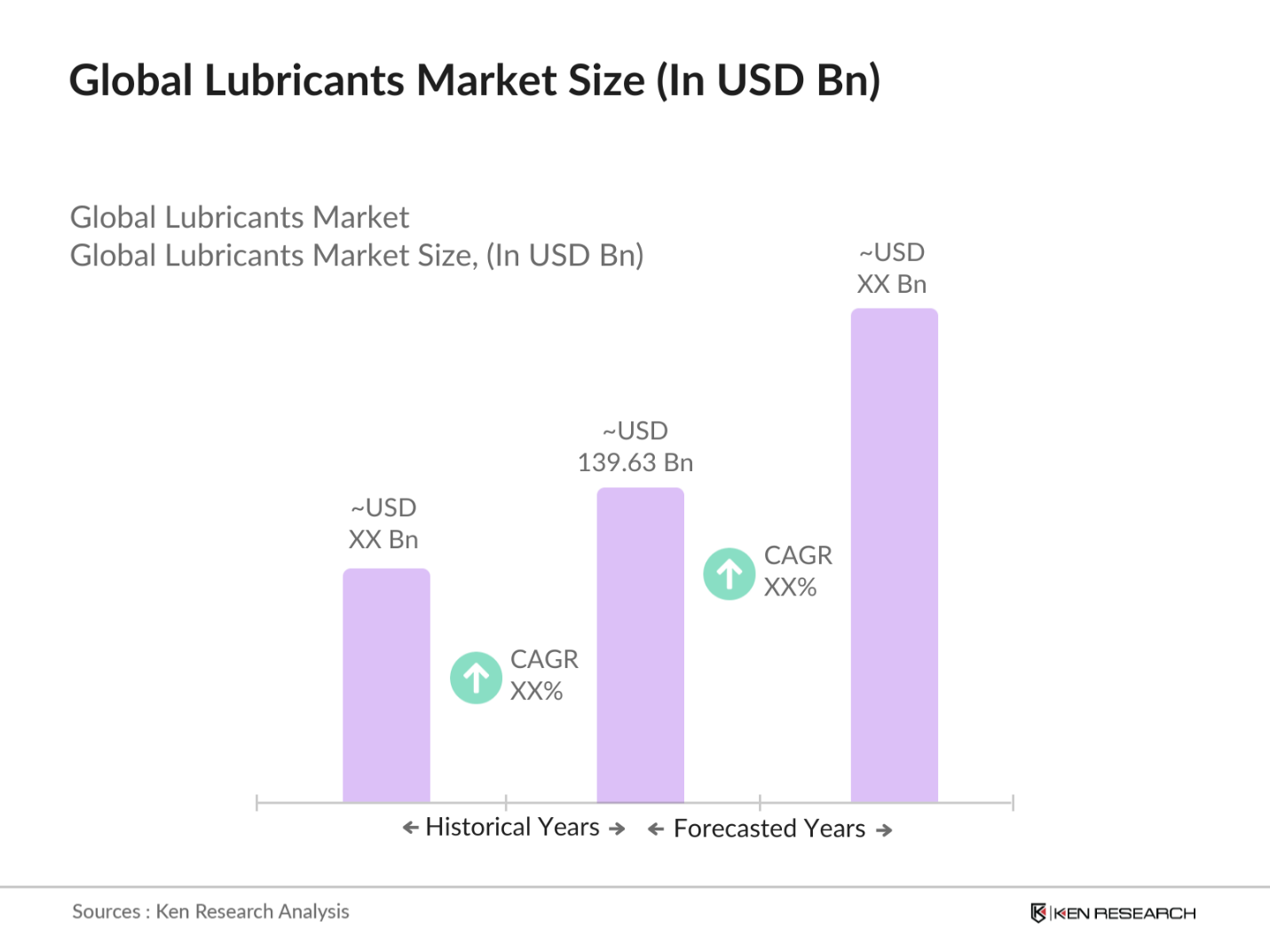

- The global lubricants market is currently valued at USD 139.63 Billion as of 2023. This market is driven by the increasing industrialization and urbanization in developing economies, primarily in Asia-Pacific. The automotive sector, one of the largest end-users, accounts for a significant share of the global lubricant consumption. The rise in vehicle ownership in emerging markets like China, India, and Brazil is a major contributor to market growth. The demand for engine oils, transmission fluids, and other automotive lubricants continues to rise with the increasing number of vehicles.

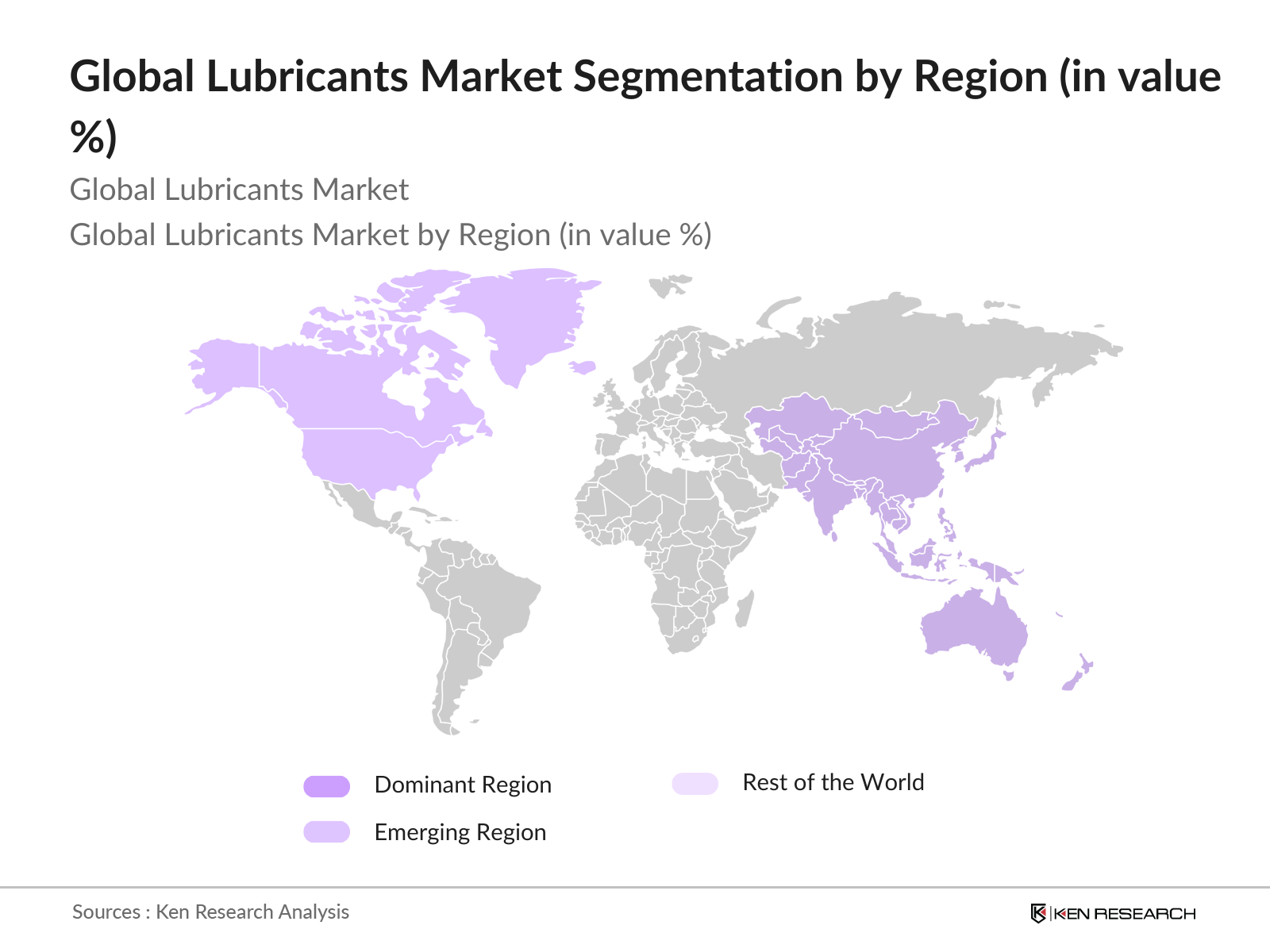

- The Asia-Pacific region dominates the global lubricants market, accounting for the largest share due to its rapid industrialization and the growth of its automotive sector. Countries such as China, India, and Japan are driving the demand, with China being the largest consumer in the world. North America holds the second-largest market share, led by the United States, where the automotive and industrial sectors continue to generate substantial demand for high-performance lubricants.

- Governments across the globe are increasingly imposing regulations to ensure the use of eco-friendly lubricants, which has boosted the demand for bio-based and synthetic alternatives. In Europe, regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) aim to restrict the use of harmful substances in lubricants and mandate the use of environmentally sustainable products. In India, the implementation of BS-VI (Bharat Stage VI) emission norms has increased the demand for higher-grade lubricants that reduce emissions and enhance engine performance.

Global Lubricants Market Segmentation

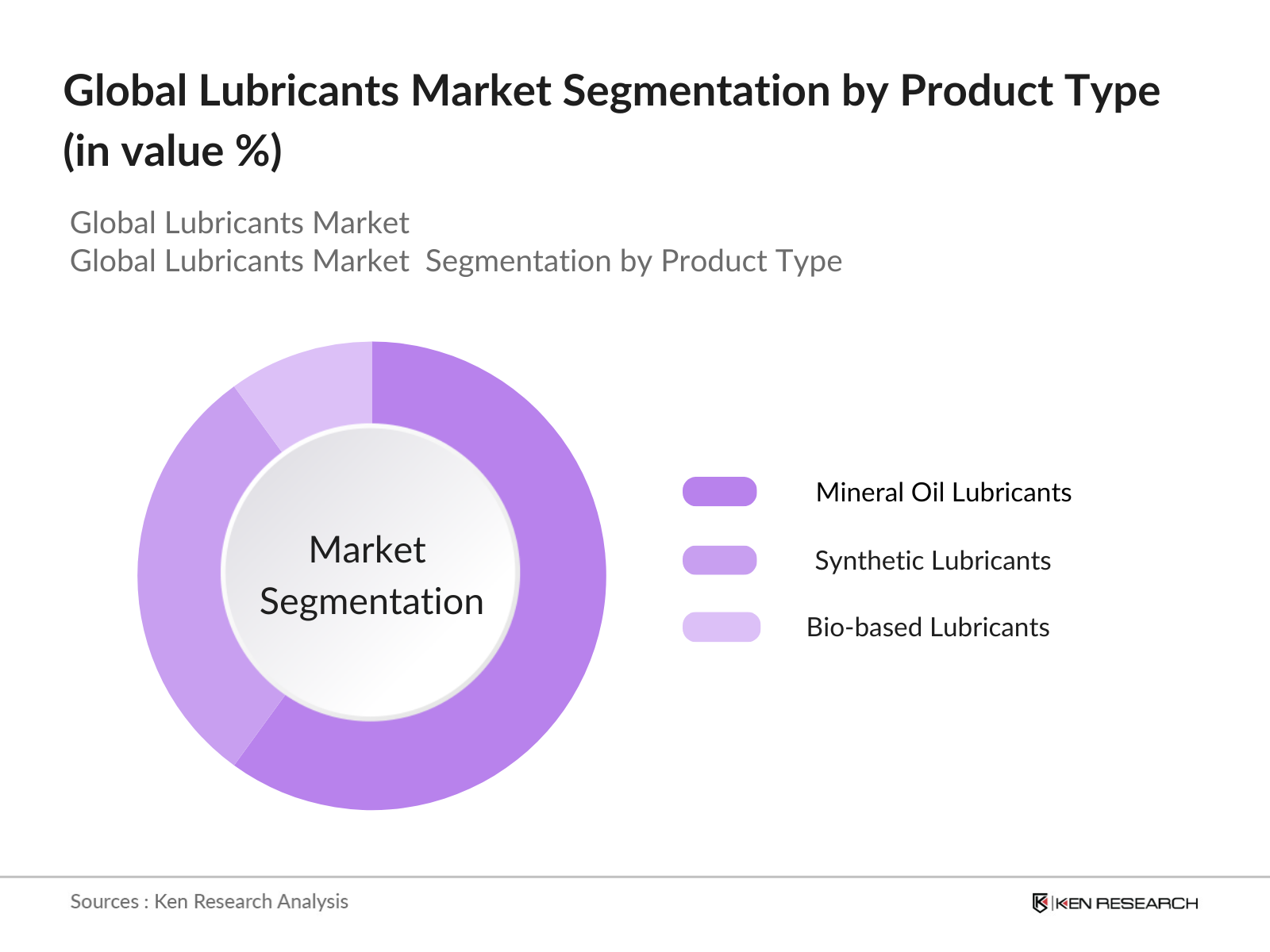

By Product Type: The global lubricants market is divided into mineral oil lubricants, synthetic lubricants, and bio-based lubricants. Each product type caters to different industries and applications based on performance requirements, pricing, and environmental considerations. Mineral Oil Lubricants of the market in 2023, mineral oil lubricants are widely used due to their cost-effectiveness and availability. They are primarily used in the automotive and industrial sectors in developing regions where price sensitivity is higher. However, environmental concerns about mineral oil lubricants are shifting the market towards more sustainable alternatives.

By Region: The market is also segmented by region, including Asia-Pacific, North America, Europe, Latin America, and Middle East & Africa. Asia-Pacific: The Asia-Pacific region holds the largest share of the global market, accounting for of the total sales. This dominance is due to the rapid industrialization, urbanization, and increasing vehicle ownership in countries such as China, India, and Japan.

Global Lubricants Market Competitive Landscape

The global lubricants market is highly fragmented, with a mix of global giants and regional players competing across various product categories. The competition is primarily driven by the need for innovation, adherence to environmental regulations, and expanding product portfolios that cater to diverse industries such as automotive, industrial machinery, aviation, marine, and others. Major players are focusing on the development of sustainable lubricants, such as bio-based and synthetic oils, to meet evolving consumer preferences and regulatory requirements. Investments in R&D, mergers and acquisitions, and strategic partnerships are common strategies adopted by key players to strengthen their market positions. These companies are also focusing on increasing their geographical footprint, particularly in emerging markets, where industrial growth and automotive ownership are on the rise.

|

Company |

Year Founded |

HQ |

Revenue (USD bn) |

Key Products |

R&D Investment |

Market Share |

|

Royal Dutch Shell |

1907 |

Netherlands |

||||

|

ExxonMobil |

1870 |

Texas, USA |

||||

|

BP (Castrol) |

1909 |

UK |

Global Lubricants Market Analysis

Global Lubricants Market Growth Drivers

- Rising Demand from the Automotive Industry

The automotive sector is the largest consumer of lubricants, accounting for nearly 50% of the global lubricants market. As of 2023, there are more than 1.4 billion vehicles in use worldwide, with the number expected to rise significantly, especially in emerging markets like China and India. The increasing demand for engine oils, transmission fluids, and other automotive lubricants is driven by the growing number of passenger and commercial vehicles, as well as advancements in automotive technologies. The push for higher fuel efficiency and lower emissions has led to increased demand for synthetic lubricants, which offer superior performance and longer service life compared to traditional mineral oils. - Technological Advancements in Industrial Machinery

The industrial sector is a significant consumer of lubricants, with lubricants playing a critical role in reducing friction and wear in machinery, enhancing operational efficiency, and extending equipment life, this sector continues to grow, so does the demand for high-performance lubricants. The introduction of advanced machinery in sectors such as manufacturing, mining, and construction has increased the need for specialized lubricants that can withstand extreme operating conditions. As industries continue to adopt automation and smart manufacturing practices, the demand for lubricants with enhanced thermal stability and load-carrying capacity is expected to rise. - Increasing Adoption of Synthetic and Bio-based Lubricants

The adoption of synthetic and bio-based lubricants is on the rise, driven by environmental regulations and the need for improved performance. Synthetic lubricants currently account for of the global lubricants market and are favored for their superior properties, such as better thermal stability, reduced oxidation, and longer service intervals. The increasing awareness of the environmental impact of traditional mineral-based lubricants has also contributed to the growing demand for bio-based lubricants, which are derived from renewable resources.

Global Lubricants Market Challenges

- Environmental Regulations and Compliance Costs

The increasing stringency of environmental regulations in major markets, particularly in Europe and North America, has put pressure on lubricant manufacturers to develop eco-friendly formulations. Regulations such as REACH in Europe and emission standards set by the Environmental Protection Agency (EPA) in the United States have increased compliance costs for lubricant manufacturers. These regulations require manufacturers to reduce the environmental impact of their products, which often involves investing in research and development to produce bio-based and synthetic lubricants that meet regulatory requirements. - Volatility in Crude Oil Prices

Lubricants are derived from crude oil, and fluctuations in global oil prices have a direct impact on the cost of producing mineral oil-based lubricants. The volatility of crude oil prices over the past few years has created uncertainty for lubricant manufacturers, particularly those that rely heavily on traditional mineral oils. Price fluctuations affect profit margins and lead to price sensitivity among consumers, especially in developing markets. As the market shifts towards synthetic and bio-based lubricants, the reliance on crude oil may decrease, but mineral oil lubricants continue to dominate in many regions.

Global Lubricants Market Future Outlook

The global lubricants market is projected to grow steadily through 2028, driven by the increasing adoption of synthetic and bio-based lubricants and the rising demand from the automotive and industrial sectors. The Asia-Pacific region is expected to maintain its dominance, with countries like China and India leading the market in both production and consumption of lubricants. The automotive sector, particularly in emerging economies, will continue to be a significant driver of demand, while the industrial sector will also contribute to growth as manufacturing and construction activities expand globally.

Future Trends:

- In North America and Europe, the focus will be on developing sustainable and eco-friendly lubricants in response to stringent environmental regulations. The adoption of synthetic lubricants is expected to grow, particularly in high-performance applications such as automotive, aviation, and industrial machinery. Additionally, advancements in technology, such as the integration of IoT and AI in industrial operations, will create new opportunities for lubricant manufacturers to develop specialized products that cater to the evolving needs of industries.

- The demand for bio-based lubricants is also expected to increase, particularly in regions like Europe, where government incentives and consumer awareness are driving the shift toward sustainable products. By 2028, bio-based lubricants are projected to account for a larger share of the market, with continued investments in research and development aimed at improving their performance and reducing production costs.

Scope of the Report

|

By Product Type |

Mineral oil lubricants Synthetic lubricants Bio-based lubricants |

|

By Application |

Engine Oils Hydraulic Fluids Gear Oils Transmission Fluids Metalworking Fluids |

|

By Base Oil |

Group I (Conventional) Group II (Hydrocracked) Group III (Synthetic) Group IV (PAO - Polyalphaolefin) Group V (Other Synthetics) |

|

By Sales Channel |

OEM (Original Equipment Manufacturer) Aftermarket Online Retail Distributors |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Automotive Manufacturers

Industrial Equipment Manufacturers

Marine and Aviation Operators

Oil and Gas Companies

Government and Regulatory Bodies (e.g., EPA, REACH)

Lubricant Distributors and Wholesalers

Venture Capital and Investment Firms

Research and Development Institutes

Companies

Players Mention in the Report

Royal Dutch Shell

ExxonMobil

BP (Castrol)

Chevron Corporation

TotalEnergies

Fuchs Petrolub

Valvoline

Idemitsu Kosan Co. Ltd.

Sinopec Lubricants

Petronas Lubricants International

Repsol

Indian Oil Corporation

Phillips 66

Gazprom Neft

Gulf Oil International

Table of Contents

01. Global Lubricants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Drivers

1.4. Market Trends

02. Global Lubricants Market Size (in USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Developments and Milestones

03. Global Lubricants Market Analysis

3.1. Growth Drivers (in-depth stats-based)

3.2. Market Challenges

3.3. Market Opportunities

3.4. Market Trends

04. Global Lubricants Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Mineral Oil Lubricants

4.1.2. Synthetic Lubricants

4.1.3. Bio-based Lubricants

4.2. By Application (in Value %)

4.2.1. Automotive

4.2.2. Industrial

4.2.3. Marine

4.2.4. Aviation

4.3. By Region (in Value %)

4.3.1. Asia-Pacific

4.3.2. North America

4.3.3. Europe

4.3.4. Latin America

4.3.5. Middle East & Africa

05. Global Lubricants Market Competitive Landscape

5.1. Profiles of Major Companies (15 Major Players)

5.1.1. Royal Dutch Shell

5.1.2. ExxonMobil

5.1.3. BP (Castrol)

5.1.4. Chevron Corporation

5.1.5. TotalEnergies

5.1.6. Fuchs Petrolub

5.1.7. Valvoline

5.1.8. Idemitsu Kosan Co. Ltd.

5.1.9. Sinopec Lubricants

5.1.10. Petronas Lubricants International

5.1.11. Repsol

5.1.12. Indian Oil Corporation

5.1.13. Phillips 66

5.1.14. Gazprom Neft

5.1.15. Gulf Oil International

5.2. Cross-Comparison Parameters (Employees, Headquarters, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

06. Global Lubricants Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

07. Global Lubricants Market Future Size (in USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

08. Global Lubricants Market Analyst Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. White Space Opportunity Analysis

09. Global Lubricants Market Future Segmentation

9.1. By Product Type

9.2. By Application

9.3. By Region

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the first phase, the identification of critical variables influencing the global lubricants market was undertaken. This involved extensive desk research that analyzed various industry reports, government regulations, and key stakeholder insights. Secondary data was gathered from trusted industry bodies such as OPEC, IEA, and U.S. Energy Information Administration (EIA) to map the major demand drivers and challenges for different lubricant segments.

Step 2: Market Analysis and Construction

After the initial identification of variables, quantitative data from both public and proprietary databases was used to analyze trends such as lubricant consumption patterns, industrial penetration rates, and environmental compliance statistics. The data was then structured to project future demand and understand historical market performance in major regions, including Asia-Pacific, North America, and Europe.

Step 3: Hypothesis Validation and Expert Consultation

To validate our market assumptions, in-depth interviews were conducted with key executives from Royal Dutch Shell, ExxonMobil, and Fuchs Petrolub, among others. These consultations provided critical insights into the market dynamics, including emerging trends, challenges with raw material prices, and the rising adoption of bio-based lubricants. This expert feedback helped fine-tune our projections and growth drivers.

Step 4: Synthesis of Findings and Final Report

In the final phase, all the collected data and insights were synthesized into a comprehensive report. Both qualitative and quantitative analysis methods were employed to ensure the robustness of the forecasts. The report includes a balanced mix of market size projections, segmentation analysis, competitive landscape assessments, and expert commentary on key growth areas for the global lubricants market.

Frequently Asked Questions

01. How big is the global lubricants market in 2023?

The global lubricants market is valued at USD 139.63 Billion, driven by demand from automotive, industrial, marine, and aviation sectors. The market is expanding rapidly due to increasing industrialization and the adoption of synthetic lubricants.

02. What are the main challenges facing the global lubricants market?

Some key challenges include stringent environmental regulations, fluctuating crude oil prices, and rising competition from synthetic and bio-based lubricants. Compliance with regulations like REACH in Europe has increased operational costs for lubricant manufacturers.

03. Who are the leading players in the global lubricants market?

The major players in the lubricants market include Royal Dutch Shell, ExxonMobil, BP (Castrol), Chevron Corporation, and TotalEnergies. These companies lead the market due to their strong distribution networks and extensive R&D investments.

04. What is driving the growth of synthetic lubricants?

The growth of synthetic lubricants is driven by their superior performance in extreme temperatures and high-stress conditions, as well as their longer lifespan compared to mineral oil-based lubricants. Increased environmental awareness and stringent regulations are pushing industries to adopt synthetic lubricants.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.