Global Luxury Hotel Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD9305

October 2024

99

About the Report

Global Luxury Hotel Market Overview

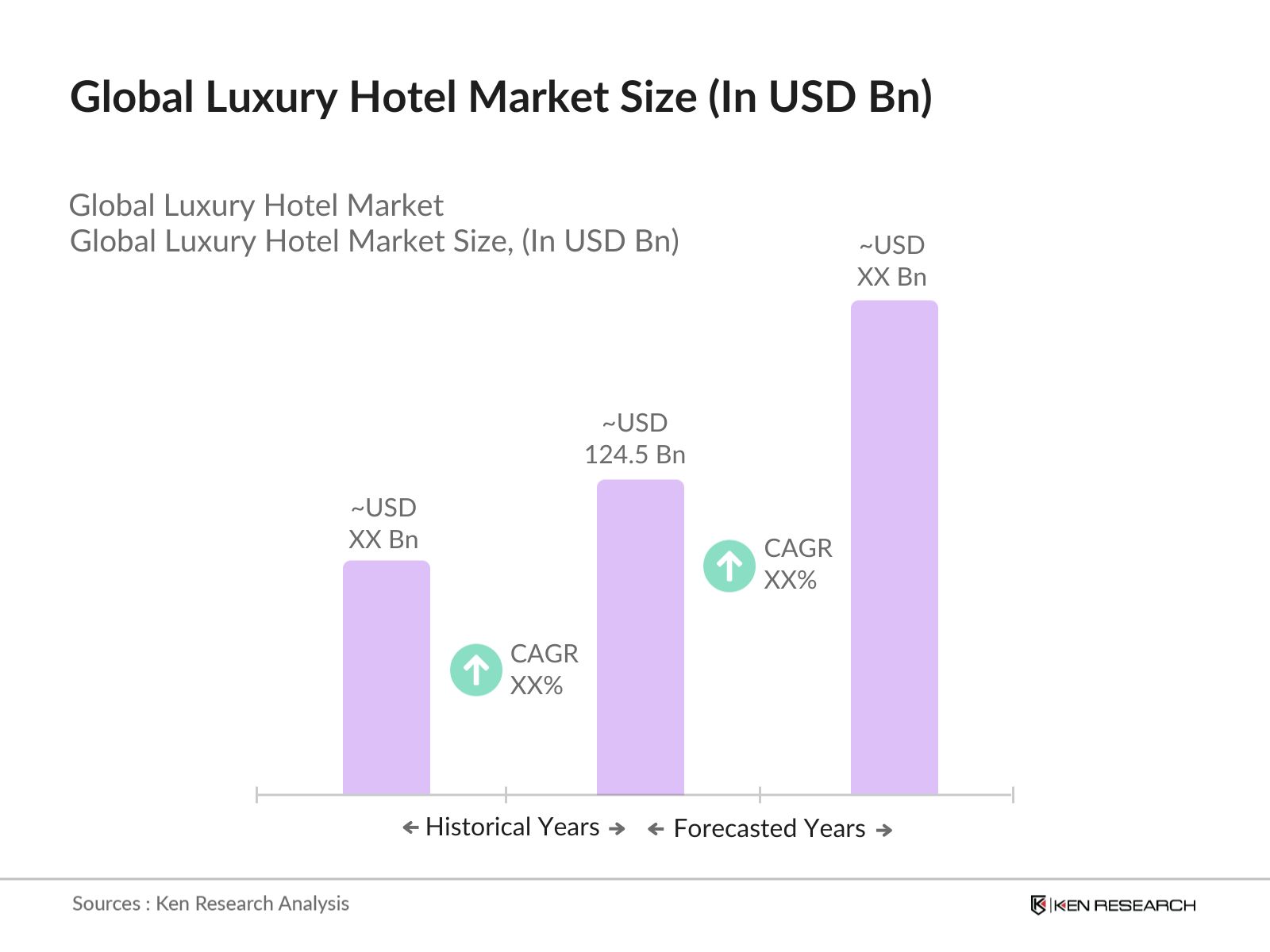

- The global luxury hotel market is valued at USD 124.5 billion, driven by increasing disposable income, rising demand for experiential travel, and the rapid growth of the tourism industry. As international travel has rebounded following the pandemic, high-net-worth individuals and affluent travelers have resumed frequenting luxury destinations, leading to consistent demand for high-end hotel experiences. The markets growth is also fueled by increased business travel and premium leisure services, contributing to strong revenue generation in this segment.

- Cities such as New York, Paris, and Dubai dominate the luxury hotel market due to their established reputations as global hubs for business, leisure, and culture. These cities attract a steady influx of international travelers seeking luxury accommodations. New Yorks status as a financial center, Pariss draw as a cultural capital, and Dubais rapidly growing tourism infrastructure make these locations pivotal to the luxury hotel market's success.

- Governments are incentivizing sustainable practices within the luxury hotel sector. In 2023, the European Union introduced tax breaks for hotels that obtain green certifications, covering up to 30% of their sustainable investments. Similarly, the U.S. government offers tax credits for energy-efficient hotel buildings through the Energy Policy Act. These incentives are encouraging more luxury hotels to adopt eco-friendly practices, thus reducing their carbon footprint and operating costs.

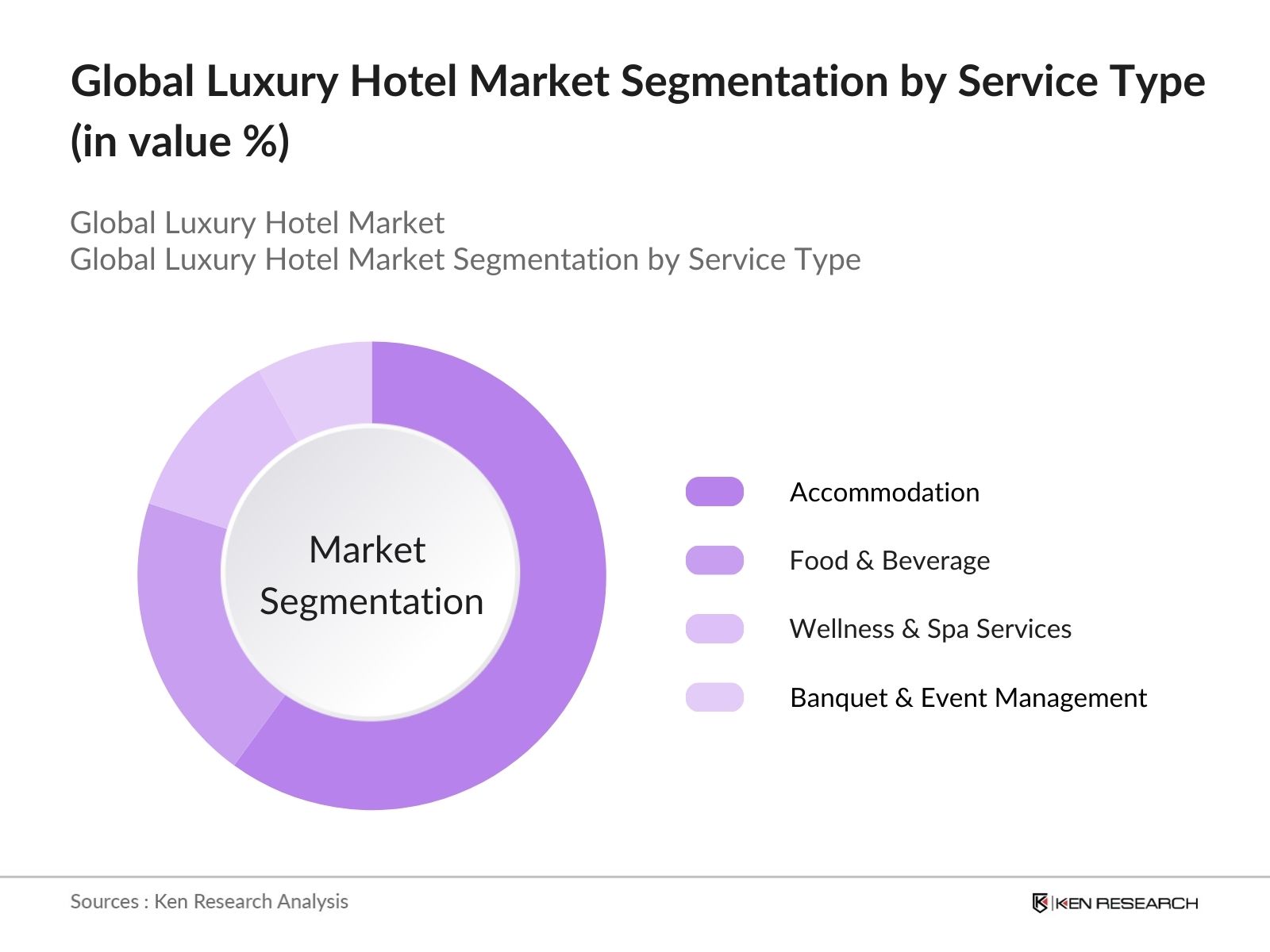

Global Luxury Hotel Market Segmentation

- By Service Type: The global luxury hotel market is segmented by service type into accommodation, food & beverage, wellness & spa services, and banquet & event management. Accommodation services hold a dominant market share within this segmentation due to the primary nature of hotels offering lodging to travelers. With increasing demand for high-end amenities and exclusive experiences, luxury hotel chains have focused on upgrading their accommodation services. High occupancy rates and premium pricing for suites and exclusive rooms significantly contribute to the dominance of this sub-segment.

- By Region: The global luxury hotel market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America continues to dominate the regional segmentation, with major cities like New York and Los Angeles playing a crucial role. The strong economy, high levels of inbound international tourism, and established hotel chains in this region drive its leadership in the luxury hotel market. Additionally, North American consumers penchant for premium travel experiences keeps demand consistently high.

- By Hotel Type: The luxury hotel market is categorized by hotel type into urban luxury hotels, resort hotels, boutique luxury hotels, and eco-friendly luxury hotels. Urban luxury hotels are dominant in this segmentation due to their prime locations in metropolitan areas. Business travelers and tourists looking for convenient access to financial districts and cultural landmarks prefer these hotels. Urban hotels have a competitive advantage as they offer a blend of opulence and accessibility, driving their continued success in high-traffic global cities.

Global Luxury Hotel Market Competitive Landscape

The global luxury hotel market is highly competitive, with prominent global and regional players competing for market share. The market is dominated by established hotel chains with significant brand recognition, expansive property portfolios, and strong loyalty programs. These companies consistently innovate to enhance the guest experience, focusing on personalized services, exclusive amenities, and digital engagement. The following table lists the five major players in the global luxury hotel market.

|

Company |

Establishment Year |

Headquarters |

Number of Properties |

Revenue (USD Bn) |

Luxury Brand(s) |

Geographical Presence |

Loyalty Program |

|

Four Seasons Hotels & Resorts |

1961 |

Toronto, Canada |

|||||

|

The Ritz-Carlton Hotel Co. |

1983 |

Chevy Chase, USA |

|||||

|

Aman Resorts |

1988 |

Singapore |

|||||

|

Mandarin Oriental Hotel Group |

1963 |

Hong Kong |

|||||

|

Marriott International |

1927 |

Bethesda, USA |

Global Luxury Hotel Industry Analysis

Growth Drivers

- Increased Tourism: Tourism continues to be a major growth driver for the luxury hotel market. In 2023, international tourism arrivals reached 960 million globally, according to the World Tourism Organization. Countries such as France, Spain, and the United States saw millions of tourists opting for luxury accommodations. The IMF estimates that tourism-related GDP will surpass $9 trillion in 2024, bolstered by increased air travel and improved visa processes. The luxury hotel segment benefits directly from this influx, with more high-net-worth individuals and affluent travelers seeking premium experiences.

- Rising Disposable Income: Disposable income in key luxury hotel markets, including the United States and China, has surged. According to the World Bank, global household income grew by over $2 trillion between 2022 and 2023. In 2024, the disposable income per capita in the U.S. is projected to exceed $56,000, allowing more consumers to afford high-end travel experiences. This growth, especially in emerging markets like India and Southeast Asia, will support continued demand for luxury hospitality services.

- Demand for Experiential Travel: Experiential travel, focusing on unique and personalized experiences, is shaping the luxury hotel market. More than 70% of affluent travelers now prefer immersive cultural experiences, according to a study by the United Nations World Tourism Organization (UNWTO). The demand for niche luxury services, such as adventure-based stays, cultural immersions, and culinary experiences, is rising sharply. The IMF states that global tourism expenditure is expected to reach $1.4 trillion in 2024, with experiential travel making up a significant portion of this.

Market Restraints

- High Operational Costs: Operational costs for luxury hotels have soared in recent years. In 2023, electricity and gas prices in Europe increased by nearly 20%, according to Eurostat. Luxury properties, which often consume higher energy levels, have faced mounting expenses. Additionally, the International Labour Organization (ILO) reports that labor costs in the hospitality sector grew by 12% from 2022 to 2023, driven by increased wages and staffing shortages. This significantly impacts profit margins in the luxury segment.

- Economic Downturn: Global economic uncertainty is a significant challenge for the luxury hotel industry. According to the IMF, global GDP growth is forecasted to slow down to 2.7% in 2024. Key luxury markets like Europe and North America are expected to face economic contraction. As disposable incomes shrink, luxury travelers may reduce spending on high-end accommodations. Additionally, inflation rates in Europe hit 6.1% in 2023, putting further pressure on the spending capacity of affluent travelers.

Global Luxury Hotel Market Future Outlook

Over the next five years, the global luxury hotel market is expected to witness substantial growth, driven by increasing demand for exclusive travel experiences, rising disposable incomes, and the return of international tourism. Additionally, advancements in technology, such as digital guest engagement platforms and enhanced booking systems, will further support the markets expansion. As travelers continue to prioritize personalized, wellness-focused, and sustainable travel options, luxury hotels will evolve to meet these preferences, ensuring continued market growth.

Market Opportunities

- Expanding into Emerging Markets: Luxury hotel chains are aggressively expanding into emerging markets such as Southeast Asia and Africa. According to the World Bank, Southeast Asias GDP is expected to grow by 5.1% in 2024, boosting the demand for high-end accommodations. African markets, especially in countries like South Africa and Kenya, are also experiencing a rise in tourism, with international tourist arrivals in Africa growing by 25 million between 2022 and 2023. This provides significant opportunities for luxury hotels to tap into new affluent customer bases.

- Integration of Technology: The integration of advanced technology into luxury hospitality is a growing opportunity. As per the International Telecommunication Union (ITU), nearly 67% of hotel bookings in 2023 were made via mobile devices, underscoring the need for digital innovations in luxury hotels. AI-driven customer service platforms, smart rooms, and personalized apps are increasingly becoming standard in luxury hotels, enhancing the guest experience. This shift toward tech integration is expected to further drive growth in the luxury segment.

Scope of the Report

Scope Table: Global Luxury Hotel Market

|

Segment |

Sub-segment |

|

Service Type |

Accommodation |

|

Food & Beverage |

|

|

Wellness & Spa Services |

|

|

Banquet & Event Management |

|

|

Hotel Type |

Urban Luxury Hotels |

|

Resort Hotels |

|

|

Boutique Luxury Hotels |

|

|

Eco-Friendly Luxury Hotels |

|

|

End User |

Leisure Travelers |

|

Business Travelers |

|

|

High Net-Worth Individuals (HNWIs) |

|

|

Group Events & Conferences |

|

|

Booking Platform |

Online Travel Agencies (OTAs) |

|

Direct Bookings |

|

|

Corporate Channels |

|

|

Traditional Travel Agencies |

|

|

Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Middle East & Africa |

|

|

Latin America |

Products

Key Target Audience

Luxury Hotel Chains

Independent Boutique Hotel Owners

Travel and Hospitality Investors

Real Estate Developers (Luxury Hotel Segment)

High Net-Worth Individuals (HNWIs)

Government and Regulatory Bodies (e.g., Department of Tourism, Local Governments)

International Travel and Tour Operators

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Four Seasons Hotels & Resorts

The Ritz-Carlton Hotel Company

Aman Resorts

Mandarin Oriental Hotel Group

Marriott International

Hyatt Hotels Corporation

InterContinental Hotels Group (IHG)

AccorHotels

Shangri-La Hotels and Resorts

Rosewood Hotels & Resorts

Belmond Ltd.

The Peninsula Hotels

Jumeirah Group

Oberoi Hotels & Resorts

Kempinski Hotels

Table of Contents

1. Global Luxury Hotel Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Luxury Hotel Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Luxury Hotel Market Analysis

3.1 Growth Drivers [Increased Tourism, Disposable Income, Demand for Experiential Travel, Luxury Leisure Travel]

3.2 Market Challenges [High Operational Costs, Economic Downturn, Impact of Pandemic, Regulatory Constraints]

3.3 Opportunities [Expanding into Emerging Markets, Integration of Technology, Sustainable Hospitality Practices, Personalization of Services]

3.4 Trends [Rise in Boutique Hotels, Focus on Wellness Tourism, Digitization in Hotel Services, Green Certifications for Luxury Hotels]

3.5 Government Regulations [Tourism Laws, Health & Safety Compliance, Labor Laws in the Hospitality Sector, Tax Incentives for Green Hospitality Practices]

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape [Analysis of Market Leaders, Challenger Brands, New Entrants]

4. Global Luxury Hotel Market Segmentation

4.1 By Service Type [in Value %]

4.1.1 Accommodation

4.1.2 Food & Beverage

4.1.3 Wellness & Spa Services

4.1.4 Banquet & Event Management

4.2 By Hotel Type [in Value %]

4.2.1 Urban Luxury Hotels

4.2.2 Resort Hotels

4.2.3 Boutique Luxury Hotels

4.2.4 Eco-Friendly Luxury Hotels

4.3 By End User [in Value %]

4.3.1 Leisure Travelers

4.3.2 Business Travelers

4.3.3 High Net-Worth Individuals (HNWIs)

4.3.4 Group Events & Conferences

4.4 By Booking Platform [in Value %]

4.4.1 Online Travel Agencies (OTAs)

4.4.2 Direct Bookings

4.4.3 Corporate Channels

4.4.4 Traditional Travel Agencies

4.5 By Region [in Value %]

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global Luxury Hotel Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Four Seasons Hotels and Resorts

5.1.2 The Ritz-Carlton Hotel Company

5.1.3 Aman Resorts

5.1.4 Mandarin Oriental Hotel Group

5.1.5 Marriott International, Inc.

5.1.6 Hyatt Hotels Corporation

5.1.7 InterContinental Hotels Group (IHG)

5.1.8 AccorHotels

5.1.9 Shangri-La International Hotel Management Ltd.

5.1.10 Rosewood Hotels & Resorts

5.1.11 Belmond Ltd.

5.1.12 The Peninsula Hotels

5.1.13 Jumeirah Group

5.1.14 Oberoi Hotels & Resorts

5.1.15 Kempinski Hotels

6. Global Luxury Hotel Market Regulatory Framework

6.1 Tourism & Hospitality Regulations

6.2 Licensing & Compliance Requirements

6.3 Sustainability and Environmental Standards

6.4 Health, Safety, and Hygiene Regulations

6.5 Employment and Labor Laws

7. Global Luxury Hotel Future Market Size (in USD Bn)

7.1 Future Market Size Projections

7.2 Key Drivers of Future Market Growth

8. Global Luxury Hotel Future Market Segmentation

8.1 By Service Type [in Value %]

8.2 By Hotel Type [in Value %]

8.3 By End User [in Value %]

8.4 By Booking Platform [in Value %]

8.5 By Region [in Value %]

9. Global Luxury Hotel Market Analysts Recommendations

9.1 Customer Preference Analysis

9.2 White Space Opportunity Analysis

9.3 Marketing and Brand Positioning Strategies

9.4 Competitive Positioning Strategies

Research Methodology

Step 1: Identification of Key Variables

The research process began by identifying and mapping the key stakeholders in the global luxury hotel market. Desk research was conducted using secondary and proprietary databases, focusing on gathering data related to key market variables, such as revenue drivers and guest behavior.

Step 2: Market Analysis and Construction

Historical data for the luxury hotel market was analyzed to assess market trends and revenue growth. This phase involved evaluating market penetration, service adoption, and pricing structures. The data collected helped in estimating the overall market performance and identifying key drivers of market growth.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through interviews with industry experts, including hotel management teams and consultants. This feedback was essential for refining our understanding of market dynamics, competitive strategies, and future growth trends.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the data and insights gathered throughout the research process. Direct engagement with luxury hotel brands helped to verify the accuracy of market projections, competitive landscape analysis, and segmentation data.

Frequently Asked Questions

01. How big is the global luxury hotel market?

The global luxury hotel market is valued at USD 124.5 billion, driven by rising international travel, increasing disposable incomes, and strong demand for premium hospitality services.

02. What are the challenges in the global luxury hotel market?

The challenges include high operational costs, increased competition from boutique hotels, and regulatory challenges related to environmental sustainability and labor laws.

03. Who are the major players in the global luxury hotel market?

Key players include Four Seasons Hotels & Resorts, The Ritz-Carlton Hotel Company, Aman Resorts, Mandarin Oriental Hotel Group, and Marriott International.

04. What are the growth drivers of the global luxury hotel market?

The market is driven by increasing demand for personalized experiences, rising disposable incomes, and a rebound in international tourism, which are expected to fuel market growth in the coming years.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.