Global Machine Vision Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD7256

November 2024

81

About the Report

Global Machine Vision Market Overview

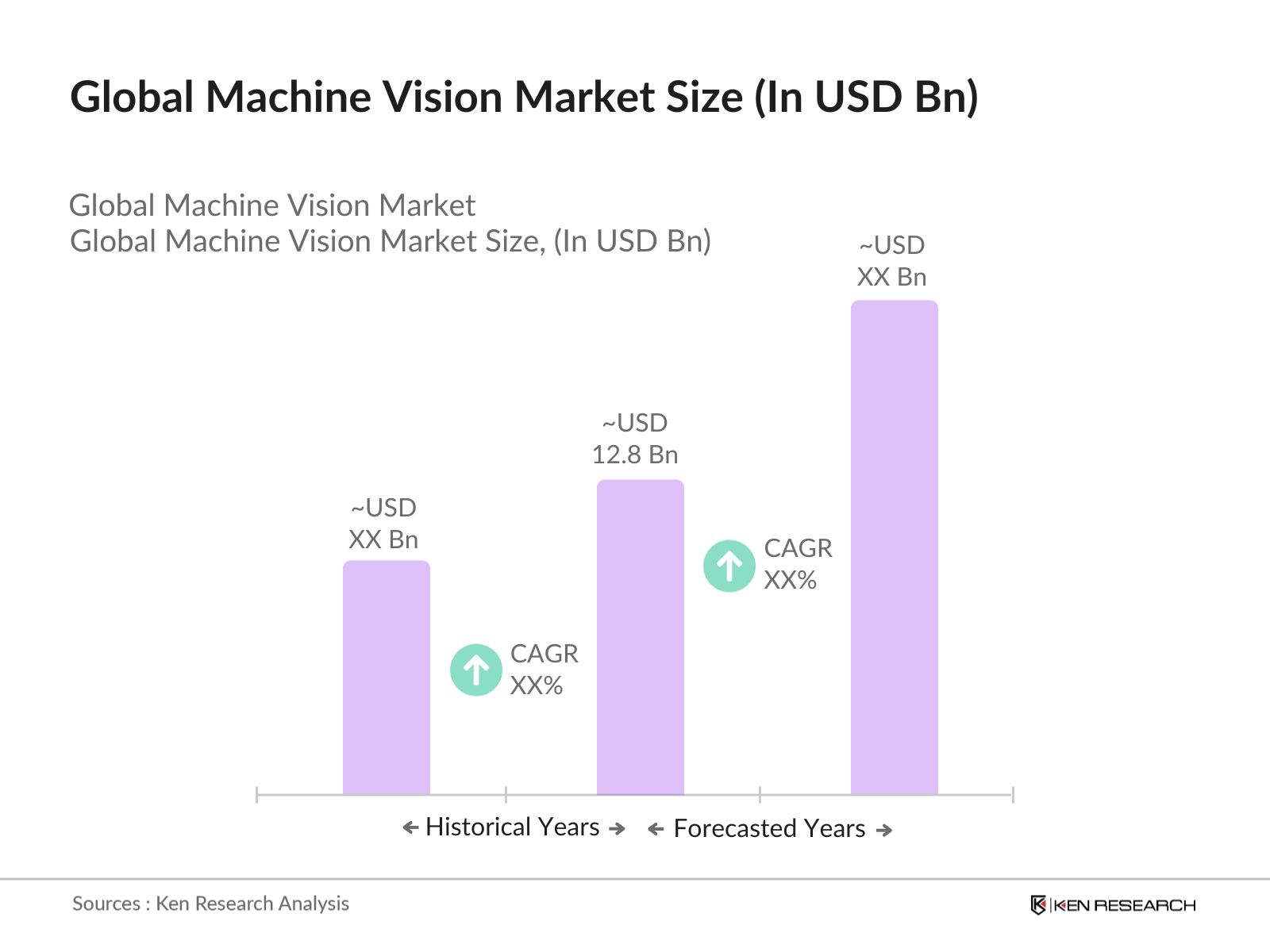

- The global machine vision market is valued at USD 12.8 billion based on a five-year historical analysis. This market is driven by the increasing integration of artificial intelligence (AI) and automation in industries like automotive, electronics, and manufacturing. The demand for machine vision systems for quality assurance and defect detection in the production process has significantly expanded due to advancements in robotics and AI technology. Additionally, the increased focus on precision manufacturing and the adoption of smart factories are major growth drivers.

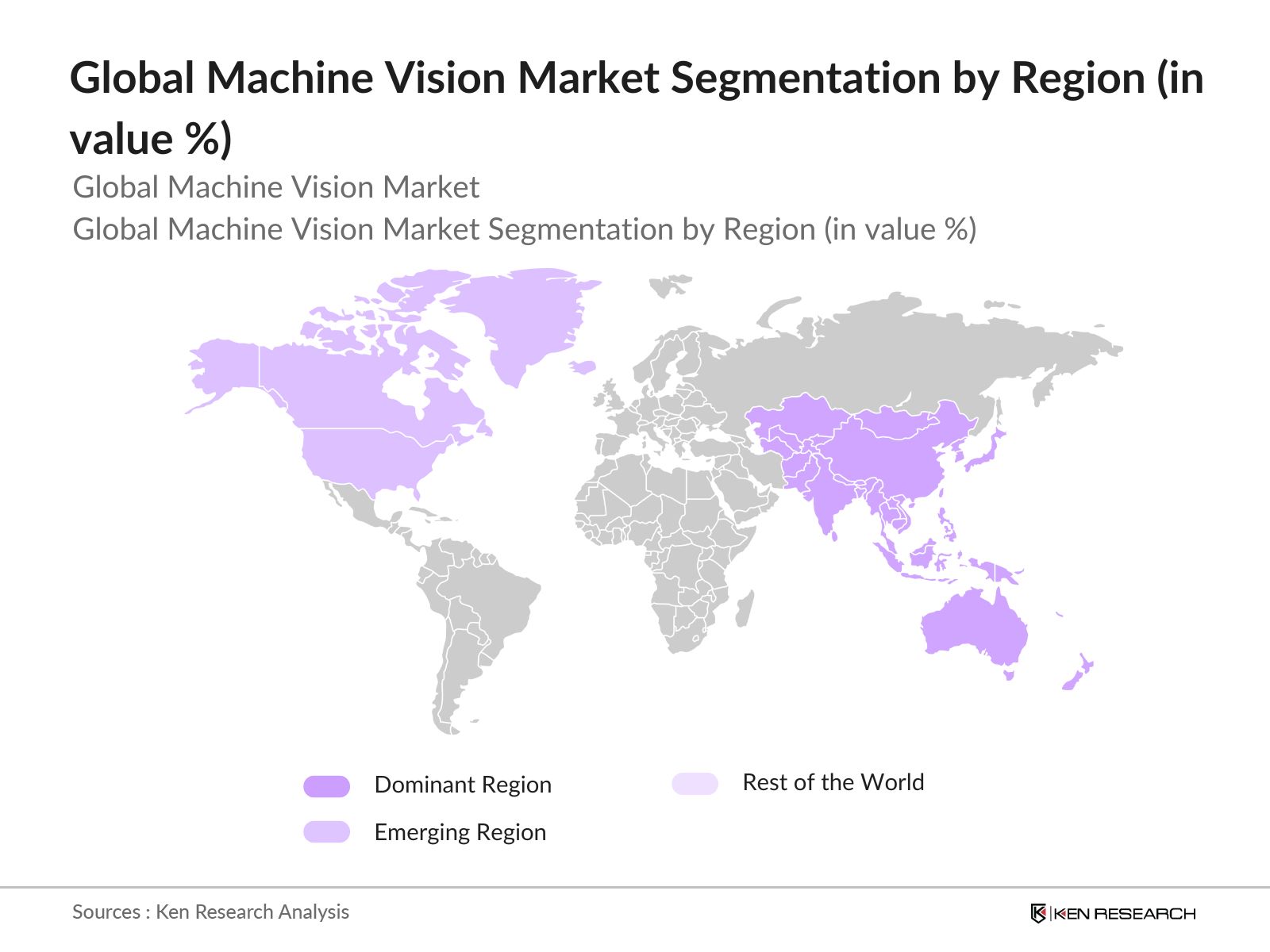

- The dominant regions in the global machine vision market include North America, particularly the United States, and Asia Pacific, led by China and Japan. North Americas dominance stems from its early adoption of automation technology and strong investments in AI research. Meanwhile, Asia Pacific, particularly China, has seen rapid industrial expansion and widespread adoption of automation in manufacturing, making it a key player in the global machine vision market.

- Countries are increasingly developing national frameworks to regulate AI and robotics, which include machine vision systems. As of 2023, 52 countries had implemented national AI policies, according to a report by the United Nations Conference on Trade and Development (UNCTAD). These frameworks provide guidelines for ethical AI use, data privacy, and the integration of robotics in industries, ensuring that machine vision technology is utilized responsibly and in compliance with international standards.

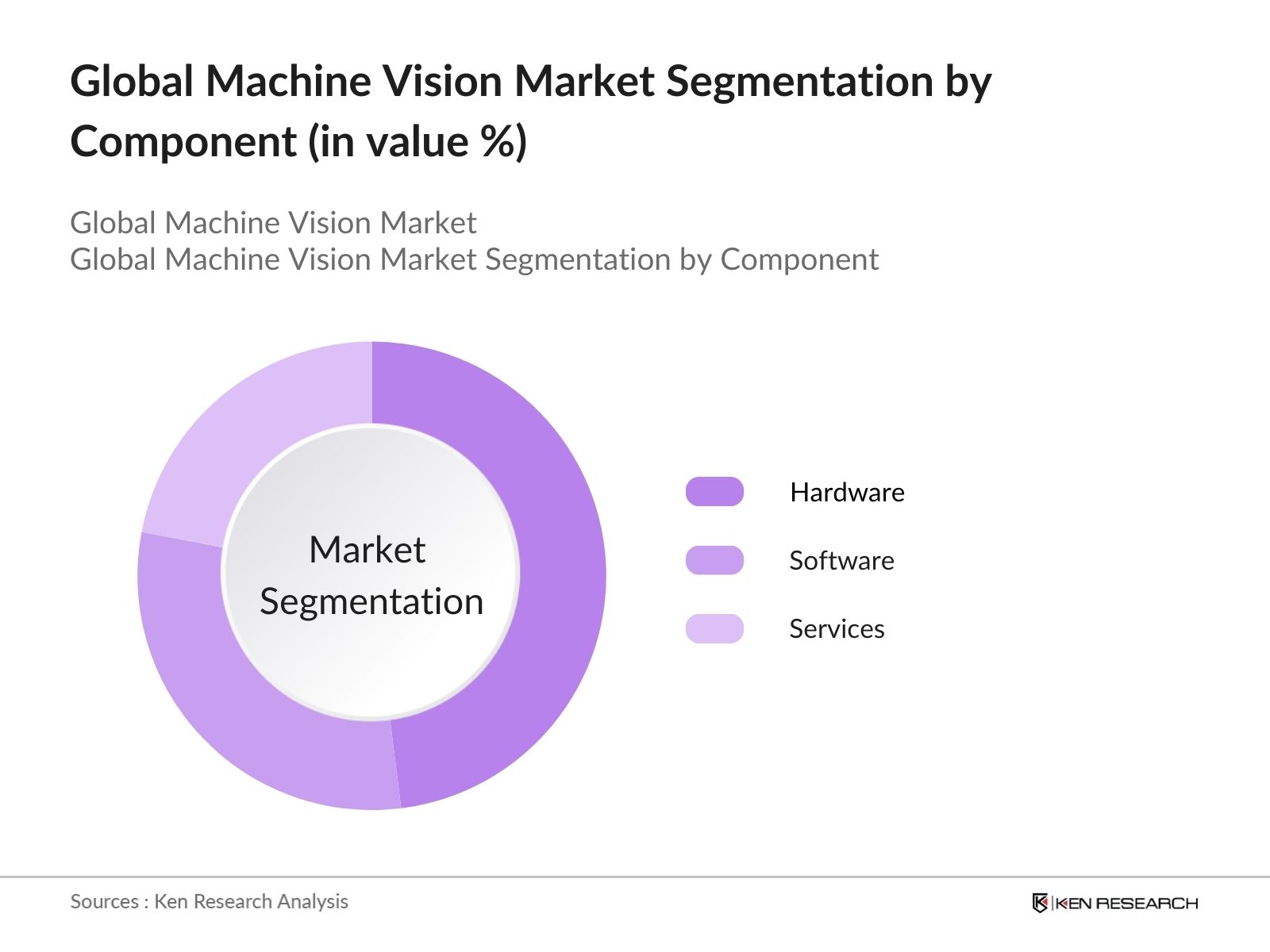

Global Machine Vision Market Segmentation

- By Component: The machine vision market is segmented by component into hardware, software, and services. Among these, the hardware segment, including cameras and sensors, holds the largest share due to its critical role in capturing images and enabling real-time processing. These components are essential for high-precision industrial applications, such as defect detection, quality control, and object recognition, which drive their demand. The continuous innovation in camera technology, including 3D and thermal imaging, further strengthens this segments dominance.

- By Region: Geographically, the machine vision market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Asia Pacific dominates the market with the largest share, primarily due to the presence of major electronics and automotive manufacturing hubs in China, Japan, and South Korea. The rapid industrialization in these countries and the growing need for automation and precision manufacturing are major factors driving the market in this region.

- By Application: The machine vision market is also segmented by application into quality assurance and inspection, positioning and guidance, measurement, and identification. Quality assurance and inspection hold the dominant share due to their essential role in the manufacturing industry. Automated systems reduce human errors, ensuring product consistency and compliance with industry standards. The increasing demand for zero-defect production across industries like automotive and electronics further bolsters the market dominance of this sub-segment.

Global Machine Vision Market Competitive Landscape

The global machine vision market is dominated by several key players that have established themselves through extensive R&D investments, strong global presence, and product innovation. Major players include Cognex Corporation, Keyence Corporation, and Basler AG. These companies lead due to their comprehensive hardware and software offerings, along with their ability to cater to diverse industrial applications.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue |

R&D Investment |

Global Presence |

Technological Advancements |

Key Products |

|

Cognex Corporation |

1981 |

Natick, MA, USA |

||||||

|

Keyence Corporation |

1974 |

Osaka, Japan |

||||||

|

Basler AG |

1988 |

Ahrensburg, Germany |

||||||

|

Teledyne Technologies Inc. |

1960 |

Thousand Oaks, CA, USA |

||||||

|

Omron Corporation |

1933 |

Kyoto, Japan |

Global Machine Vision Industry Analysis

Growth Drivers

- Increasing Adoption of Automation (Industrial Adoption Rate): The adoption of automation technologies is rapidly increasing, especially in manufacturing industries. According to the International Federation of Robotics (IFR), the number of industrial robots deployed globally reached over 3 million units by 2023, driven by rising labor costs and the need for precision. The World Bank reports a significant increase in automation investment in countries like China, which recorded over $65 billion in automation equipment purchases in 2022, positioning itself as a leader in industrial automation adoption. This automation trend is creating significant demand for machine vision systems used in quality control and production efficiency monitoring.

- Technological Advancements in AI and Deep Learning (AI Integration): AI and deep learning technologies are becoming critical in enhancing machine vision systems. According to a 2023 World Economic Forum report, AI integration in machine vision has enabled systems to achieve up to 99% accuracy in object detection and anomaly identification. Moreover, AI investments reached approximately $194 billion globally in 2022, as per the International Monetary Fund, showing rapid advancements. This AI integration allows machine vision to operate autonomously, improving efficiency in industrial environments and offering higher accuracy in inspections.

- Surge in Robotics and Industrial IoT (Robotics Deployment): Robotics deployment in industrial sectors has surged, particularly with the integration of Industrial IoT (IIoT). The IFR noted that robot sales grew by 31% between 2022 and 2023, with industries like electronics and automotive leading the adoption. As IIoT enhances data connectivity between robots and vision systems, machine visions role in enhancing robotics functionality is paramount. The World Bank estimated that by 2024, 80% of new manufacturing equipment will be IIoT-enabled, significantly boosting the demand for machine vision technologies.

Market Restraints

- Lack of Standardization (Global Standard Index): The lack of global standardization for machine vision systems is another key challenge. The Global Automation Index developed by the International Standards Organization (ISO) showed that only 55% of machine vision technologies adhered to internationally recognized standards in 2023. The disparity between countries leads to compatibility issues across industries, especially when exporting automation equipment. Regions such as Latin America and parts of Africa still lag behind in implementing global standards for automation technologies.

- Limited Skilled Workforce for Operation (Skill Gap Ratio): A significant challenge in the machine vision market is the shortage of skilled operators who can effectively manage and maintain these systems. As per the 2022 International Labor Organization (ILO) report, the skill gap in the automation and robotics sector was recorded at 20% globally, with many emerging markets facing higher deficits. This shortage of trained personnel is particularly problematic in regions such as South Asia, where only 30% of the required workforce is skilled enough to manage these advanced systems.

Global Machine Vision Market Future Outlook

Over the next five years, the global machine vision market is expected to show significant growth, driven by advancements in AI, deep learning, and automation. The continuous demand for high-quality manufacturing processes across industries such as automotive, electronics, and pharmaceuticals will be pivotal in shaping the future of this market. Additionally, the growing trend of smart factories and Industry 4.0 will propel the integration of machine vision systems into various industrial applications.

Market Opportunities

- Expanding Applications in Non-Industrial Sectors (Healthcare, Agriculture): The application of machine vision technology is expanding beyond industrial use cases into sectors like healthcare and agriculture. In healthcare, machine vision is increasingly used for diagnostic imaging and surgery assistance, contributing to the $50 billion growth in medical technology adoption in 2023, according to the World Health Organization (WHO). In agriculture, machine vision systems are employed for crop monitoring and yield optimization, especially in precision farming practices. The World Bank reported that agricultural technology investments reached $6 billion in 2023, with machine vision playing a crucial role in yield improvement.

- Increasing Integration of AI with Edge Computing (Edge Computing Deployment): The integration of AI with edge computing technologies offers new growth avenues for machine vision, especially in real-time decision-making processes. The World Economic Forum noted that in 2023, 60% of new industrial machines incorporated edge computing capabilities to enhance data processing at the machine level. This shift allows industries to use machine vision more efficiently, reducing latency and improving decision-making accuracy. The global AI hardware market, which supports these edge devices, was valued at $58 billion in 2023.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Component |

Hardware: Cameras, Processors, Sensors; Software: Vision Software, Deep Learning Software; Services: Consulting, Installation |

|

By Application |

Quality Assurance & Inspection, Positioning & Guidance, Measurement, Identification |

|

By End-User Industry |

Automotive, Electronics & Semiconductor, Healthcare & Pharmaceuticals, Food & Packaging, Logistics & Warehousing |

|

By Deployment Type |

PC-Based, Smart Cameras |

|

By Region |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Products

Key Target Audience

Machine Vision System Manufacturers

Automation and Robotics Companies

AI & Deep Learning Technology Providers

Automotive Manufacturers

Electronics & Semiconductor Companies

Food and Packaging Companies

Government and Regulatory Bodies (U.S. Department of Commerce, European Commission)

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Cognex Corporation

Keyence Corporation

Basler AG

Teledyne Technologies Inc.

Omron Corporation

Allied Vision Technologies

National Instruments

Intel Corporation

Sony Corporation

Sick AG

FLIR Systems

Baumer Group

IDS Imaging Development Systems

Datalogic S.p.A

ISRA Vision AG

Table of Contents

1. Global Machine Vision Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Machine Vision Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Machine Vision Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Automation (Industrial Adoption Rate)

3.1.2. Technological Advancements in AI and Deep Learning (AI Integration %)

3.1.3. Surge in Robotics and Industrial IoT (Robotics Deployment)

3.1.4. Growing Demand for Quality Inspection and Surveillance (Inspection Accuracy %)

3.2. Market Challenges

3.2.1. High Cost of Installation (Initial Investment per Unit)

3.2.2. Lack of Standardization (Global Standard Index)

3.2.3. Limited Skilled Workforce for Operation (Skill Gap Ratio)

3.3. Opportunities

3.3.1. Expanding Applications in Non-Industrial Sectors (Healthcare, Agriculture)

3.3.2. Increasing Integration of AI with Edge Computing (Edge Computing Deployment)

3.3.3. Growing Opportunities in Emerging Markets (Emerging Market Penetration %)

3.4. Trends

3.4.1. Shift Towards 3D Vision Systems (3D Vision Adoption Rate)

3.4.2. Rising Use of Embedded Vision Systems (Embedded System Share %)

3.4.3. Integration with Cloud Computing for Real-Time Data (Cloud Computing Integration)

3.5. Government Regulations

3.5.1. Industry 4.0 Compliance Standards

3.5.2. Government Incentives for Automation Adoption (Incentive Schemes)

3.5.3. National AI and Robotics Frameworks (Policy Implementation Rates)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Machine Vision Market Segmentation

4.1. By Component (In Value %)

4.1.1. Hardware

4.1.1.1. Cameras

4.1.1.2. Processors

4.1.1.3. Sensors

4.1.2. Software

4.1.2.1. Vision Software

4.1.2.2. Deep Learning Software

4.1.3. Services

4.1.3.1. Consulting

4.1.3.2. Installation

4.2. By Application (In Value %)

4.2.1. Quality Assurance & Inspection

4.2.2. Positioning & Guidance

4.2.3. Measurement

4.2.4. Identification

4.3. By End-User Industry (In Value %)

4.3.1. Automotive

4.3.2. Electronics & Semiconductor

4.3.3. Healthcare & Pharmaceuticals

4.3.4. Food & Packaging

4.3.5. Logistics & Warehousing

4.4. By Deployment Type (In Value %)

4.4.1. PC-Based

4.4.2. Smart Cameras

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Machine Vision Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Cognex Corporation

5.1.2. Keyence Corporation

5.1.3. Basler AG

5.1.4. Teledyne Technologies Inc.

5.1.5. Omron Corporation

5.1.6. Allied Vision Technologies

5.1.7. National Instruments

5.1.8. Intel Corporation

5.1.9. Sony Corporation

5.1.10. Sick AG

5.1.11. FLIR Systems

5.1.12. Baumer Group

5.1.13. IDS Imaging Development Systems

5.1.14. Datalogic S.p.A

5.1.15. ISRA Vision AG

5.2. Cross Comparison Parameters (Market Presence, Technology Portfolio, Revenue, R&D Investment, Global Expansion)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Machine Vision Market Regulatory Framework

6.1. Compliance Requirements

6.2. Certification Processes

6.3. Industry Standards (ISO, IEC)

7. Global Machine Vision Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Machine Vision Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. White Space Opportunity Analysis

8.3. Customer Acquisition Strategies

8.4. Innovation and Product Differentiation Recommendations

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves creating a detailed ecosystem map of the global machine vision market, identifying all major stakeholders including manufacturers, suppliers, and end-users. This step utilizes extensive desk research from secondary and proprietary databases.

Step 2: Market Analysis and Construction

We then compile and analyze historical data related to the adoption and revenue generation in the machine vision market. This includes evaluating technological developments, industrial applications, and their direct impact on market growth.

Step 3: Hypothesis Validation and Expert Consultation

In this step, market hypotheses are formulated based on data and validated through direct interviews with industry experts. Insights from these interviews contribute to validating the data gathered from desk research.

Step 4: Research Synthesis and Final Output

The final phase consolidates all data and findings, ensuring a comprehensive analysis of the global machine vision market. Primary insights from leading manufacturers are used to complement the findings derived from secondary research.

Frequently Asked Questions

1. How big is the global machine vision market?

The global machine vision market is valued at USD 12.8 billion based on a five-year historical analysis, primarily driven by increasing industrial automation and advancements in AI and robotics technology.

2. What are the challenges in the global machine vision market?

Challenges include the high initial cost of installation, a lack of standardization across industries, and the shortage of skilled labor for operating complex systems.

3. Who are the major players in the global machine vision market?

Key players include Cognex Corporation, Keyence Corporation, Basler AG, Teledyne Technologies Inc., and Omron Corporation, all of whom lead due to their innovative product offerings and strong global presence.

4. What are the growth drivers of the global machine vision market?

The market is driven by increasing adoption of automation, advancements in AI and machine learning, and the growing need for quality assurance in industries like automotive and electronics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.