Global Magnetic Levitation Train Market Outlook to 2030

Region:Global

Author(s):Sanjna Verma

Product Code:KROD8307

November 2024

89

About the Report

Global Magnetic Levitation Train Market Overview

- The global magnetic levitation (maglev) train market is valued at USD 3 billion. This market is primarily driven by the increasing demand for high-speed, energy-efficient transportation systems. Countries with densely populated cities and extensive transportation needs are increasingly adopting maglev technology due to its potential for faster travel times and lower maintenance costs compared to traditional rail systems.

- China and Japan are among the dominant players in the global maglev train market. Both countries have heavily invested in developing high-speed rail networks, with China being home to the worlds longest maglev line. The dominance of these regions is due to significant government support, robust infrastructure development, and technological expertise in the field. The Chinese government's focus on reducing carbon emissions and enhancing domestic transportation networks, combined with Japan's early adoption of maglev technology, makes these countries key contributors to the market's overall expansion.

- Governments worldwide are enforcing stricter emission control regulations to reduce the environmental impact of transportation systems. The European Union, through its Green Deal initiative, introduced new regulations in 2024 aimed at drastically reducing emissions in the rail sector. These regulations are pushing for a shift toward electric and Maglev train systems, which emit zero direct emissions. For example, Germany has committed to reducing overall transportation emissions by 40% by 2030, partly through investments in clean rail technology like Maglev.

Global Magnetic Levitation Train Market Segmentation

By Type: The global magnetic levitation train market is segmented by type into Electromagnetic Suspension (EMS), Electrodynamic Suspension (EDS), and Hybrid Suspension. EMS currently dominates this segmentation, due to its widespread adoption for commercial applications in both passenger and cargo transport. EMS is preferred because it offers smoother and quieter rides, making it ideal for urban transportation systems. Furthermore, the lower operational cost associated with this system makes it a more economically viable option for many countries that are exploring high-speed rail solutions.

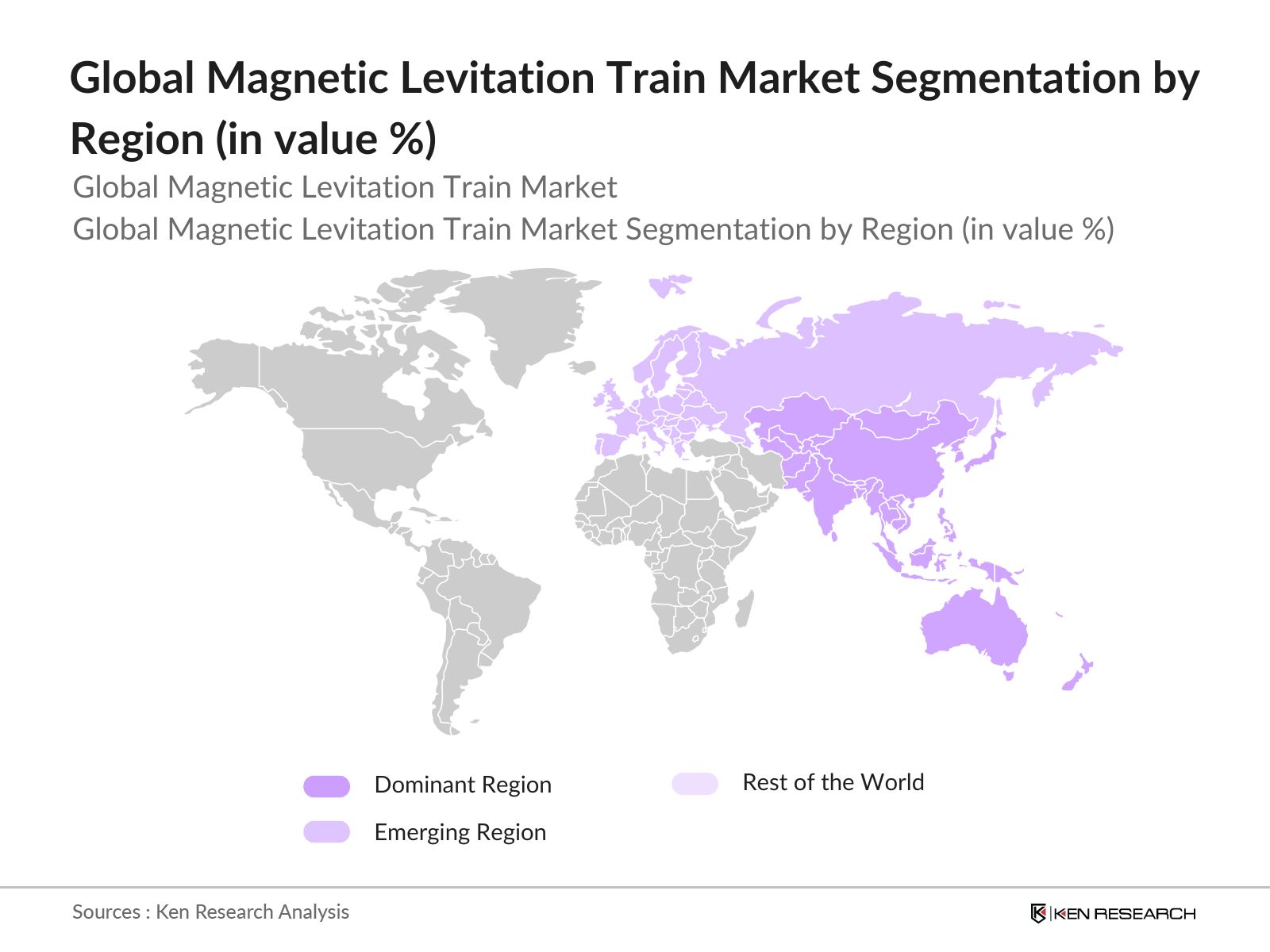

By Region: The market is segmented regionally into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Asia Pacific holds the dominant market share due to massive investments in infrastructure projects in countries like China and Japan. These nations have been at the forefront of adopting advanced maglev technologies for both commercial and governmental projects. The region's significant share can be attributed to its focus on reducing urban congestion and promoting high-speed, low-emission transport solutions.

By Application: The market is segmented by application into passenger transport, cargo transport, urban transportation, and intercity transportation. Passenger transport holds the largest market share, primarily driven by the need for faster commute times between major cities. This sub-segment benefits from the ability of maglev trains to reduce travel times significantly compared to conventional rail and road transport. Governments in densely populated areas are increasingly focusing on passenger convenience and efficient transport, thereby boosting the demand for maglev trains in this sub-segment.

Global Magnetic Levitation Train Market Competitive Landscape

The global magnetic levitation train market is dominated by key players that have extensive expertise in rail technology, as well as partnerships with national governments. The competitive landscape is marked by collaborations between public and private sector companies to expand rail networks and incorporate cutting-edge technologies. Companies like CRRC Corporation Limited and Siemens AG have focused on research and development to enhance the efficiency and safety of maglev trains. These companies hold a significant influence over the market, thanks to their strong global presence and continued innovation in rail transport technologies.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

R&D Investment (USD Mn) |

No. of Employees |

Installed Base (Units) |

Geographical Reach |

Market Share (%) |

|

CRRC Corporation Limited |

2015 |

Beijing, China |

- |

- |

- |

- |

- |

- |

|

Siemens AG |

1847 |

Munich, Germany |

- |

- |

- |

- |

- |

- |

|

Mitsubishi Heavy |

1950 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

|

Alstom |

1928 |

Saint-Ouen, France |

- |

- |

- |

- |

- |

- |

|

Hitachi Rail |

1920 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

Global Magnetic Levitation Train Market Analysis

Growth Drivers

- Infrastructure Modernization Initiatives: Investment in rail infrastructure has seen a significant rise globally, with countries like China investing $117 billion in rail development in 2023 to modernize their high-speed transport systems, according to the Ministry of Transport of China. The United States has allocated $66 billion for rail upgrades through its Bipartisan Infrastructure Law, aimed at supporting advanced technologies like magnetic levitation (Maglev) trains. Such investments are a strong driver for the Maglev market, as governments prioritize fast, efficient, and low-emission transportation.

- Environmental Regulations on Emissions: Environmental regulations on emissions are driving the adoption of Maglev trains, as traditional diesel-powered locomotives contribute heavily to air pollution. According to the European Environment Agency (EEA), rail transport in the European Union accounted for 0.4% of the total transport emissions in 2023. This has spurred demand for Maglev technology, which operates with zero direct emissions. Countries such as Japan and Germany are encouraging the use of cleaner, more sustainable transport options, helping boost the Maglev market.

- Technological Advancements in High-Speed Transport: Technological innovations in transportation have resulted in Maglev trains reaching speeds of over 600 km/h. Japan's Chuo Shinkansen line, which is being developed by Central Japan Railway, is expected to complete a segment of its Maglev service by 2027, bringing new opportunities in high-speed transit. According to the Japanese Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), advancements in propulsion and magnetic systems have significantly improved energy efficiency and reduced travel times, positioning Maglev as a critical solution for future urban mobility needs.

Challenges

- High Capital and Maintenance Costs: The construction of Maglev train systems require extensive capital investment, with Chinas Shanghai Maglev, the worlds first commercial Maglev, costing approximately $1.3 billion for a 30-kilometer stretch. Maintenance expenses for magnetic levitation technology also remain high compared to traditional rail systems due to the advanced infrastructure required. This challenge limits the number of countries willing to adopt the technology, particularly in emerging economies that prioritize cost-effective solutions.

- Limited Geographic Adoption: Although the technology is promising, its adoption remains geographically limited. Currently, operational Maglev lines are confined to a few countries, such as Japan, China, and South Korea. In 2024, there are fewer than five Maglev lines in operation globally, according to the International Union of Railways. Limited knowledge transfer and infrastructure compatibility issues restrict Maglev expansion into newer regions.

Global Magnetic Levitation Train Market Future Outlook

Over the next five years, the global magnetic levitation train market is expected to show significant growth. This expansion is driven by government initiatives focusing on reducing carbon footprints and enhancing transportation efficiency. Countries are likely to continue investing in sustainable transportation solutions, further supporting the demand for maglev systems. Additionally, innovations in magnetic levitation technology are poised to enhance the speed, safety, and energy efficiency of these systems, making them more attractive for urban and intercity transportation.

Market Opportunities

- Emerging Markets for High-Speed Rail: Countries like India and Indonesia are showing growing interest in developing high-speed rail systems, with significant opportunities for Maglev technology. The Indian governments National Rail Plan aims to modernize the nations rail network by 2030, allocating $50 billion for high-speed rail projects. This opens up new avenues for Maglevs entry into the market, particularly as a solution for long-term, sustainable transport.

- Technological Innovations in Magnetic Levitation Systems: Recent innovations in magnetic levitation technology, including advancements in superconducting magnets and energy-efficient systems, offer the potential to reduce operational costs. In 2023, scientists at Germanys Fraunhofer Institute developed a more energy-efficient Maglev propulsion system, which could decrease energy consumption by 30% compared to older models. These innovations enhance the competitiveness of Maglev solutions for governments looking for sustainable transport technologies.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Type |

Electromagnetic Suspension (EMS) Electrodynamic Suspension (EDS) Hybrid Suspension |

|

By Speed |

Low-Speed (<150 km/h) High-Speed (150-300 km/h) Ultra High-Speed (>300 km/h) |

|

By Application |

Passenger Transport Cargo Transport Urban Transportation Intercity Transportation |

|

By Technology |

Contactless Power Transmission Wireless Communication Technologies Magnetic Field Containment Systems |

|

By Region |

North America Europe Asia Pacific Middle East and Africa Latin America |

Products

Key Target Audience

Maglev Train Manufacturers

Rail Infrastructure Developers

Energy and Power Providers

Technology Providers (Magnetic Levitation Technology Firms)

Logistic and Cargo Transport Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministries of Transport, National Rail Networks)

Companies

Players Mentioned in the Report

CRRC Corporation Limited

Siemens AG

Mitsubishi Heavy Industries

Alstom

Hitachi Rail

Central Japan Railway Company

Nippon Sharyo

Hyundai Rotem

Transrapid International

Bombardier Transportation

Table of Contents

1. Global Magnetic Levitation Train Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Lifecycle Stage

1.4. Historical and Current Market Trends

1.5. Key Market Dynamics

2. Global Magnetic Levitation Train Market Size (In USD Bn)

2.1. Historical Market Size (In USD Bn)

2.2. Year-On-Year Market Growth Analysis

2.3. Key Milestones and Developments

2.4. Region-Wise Market Size Breakdown

3. Global Magnetic Levitation Train Market Analysis

3.1. Growth Drivers (Rail Infrastructure Investment, Transportation Demand, Energy Efficiency, Urbanization)

3.1.1. Infrastructure Modernization Initiatives

3.1.2. Environmental Regulations on Emissions

3.1.3. Technological Advancements in High-Speed Transport

3.1.4. Growing Population Density in Urban Areas

3.2. Market Challenges (High Initial Investment, Technical Complexity, Regulatory Constraints)

3.2.1. High Capital and Maintenance Costs

3.2.2. Limited Geographic Adoption

3.2.3. Resistance from Traditional Rail Operators

3.2.4. Supply Chain Dependencies

3.3. Opportunities (Public-Private Partnerships, Expansion of Rail Networks, International Collaborations)

3.3.1. Emerging Markets for High-Speed Rail

3.3.2. Technological Innovations in Magnetic Levitation Systems

3.3.3. Rise of Green Transport Initiatives

3.3.4. Investment in Sustainable Transportation Solutions

3.4. Trends (Hybrid Systems, Autonomous Operation, Smart City Integration)

3.4.1. Integration with Smart Mobility Systems

3.4.2. Adoption of Autonomous Magnetic Levitation Trains

3.4.3. Expansion of Urban and Suburban Magnetic Levitation Networks

3.4.4. Introduction of Hybrid Systems for Energy Efficiency

3.5. Government Regulations (Rail Safety Standards, Emission Standards, Public Funding Policies)

3.5.1. Emission Control Legislations for Rail Transportation

3.5.2. Subsidy and Incentive Policies

3.5.3. International Rail Safety Standards and Certifications

3.5.4. Public-Private Partnership Regulations

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis (Supplier Power, Buyer Power, Threat of Substitutes, Industry Rivalry, Entry Barriers)

3.8. Industry Stakeholder Ecosystem (Suppliers, Manufacturers, End-Users, Governments)

3.9. Competitive Landscape Overview

4. Global Magnetic Levitation Train Market Segmentation

4.1. By Type (In Value %)

4.1.1. Electromagnetic Suspension (EMS)

4.1.2. Electrodynamic Suspension (EDS)

4.1.3. Hybrid Suspension

4.2. By Speed (In Value %)

4.2.1. Low-Speed (<150 km/h)

4.2.2. High-Speed (150-300 km/h)

4.2.3. Ultra High-Speed (>300 km/h)

4.3. By Application (In Value %)

4.3.1. Passenger Transport

4.3.2. Cargo Transport

4.3.3. Urban Transportation

4.3.4. Intercity Transportation

4.4. By Technology (In Value %)

4.4.1. Contactless Power Transmission

4.4.2. Wireless Communication Technologies

4.4.3. Magnetic Field Containment Systems

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. Latin America

5. Global Magnetic Levitation Train Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. CRRC Corporation Limited

5.1.2. Alstom

5.1.3. Siemens AG

5.1.4. Mitsubishi Heavy Industries

5.1.5. Transrapid International

5.1.6. Central Japan Railway Company

5.1.7. Hyundai Rotem

5.1.8. Nippon Sharyo

5.1.9. Hitachi Rail

5.1.10. Bombardier Transportation

5.2. Cross Comparison Parameters (Revenue, Market Share, Installed Base, R&D Spending, Technological Innovations, Geographical Presence, Rail Network Partnerships, Production Capacity)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Collaborations, Technological Partnerships, Joint Ventures)

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Venture Capital Investments

5.8. Government Subsidies and Grants

5.9. Private Equity Investments

6. Global Magnetic Levitation Train Market Regulatory Framework

6.1. Global Rail Safety Standards

6.2. Emission Compliance

6.3. Certification and Approval Processes

7. Global Magnetic Levitation Train Market Future Size (In USD Bn)

7.1. Projected Market Size

7.2. Key Factors for Future Market Growth

8. Global Magnetic Levitation Train Market Future Segmentation

8.1. By Type (In Value %)

8.2. By Speed (In Value %)

8.3. By Application (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Global Magnetic Levitation Train Market Analysts Recommendations

9.1. Market Expansion Opportunities

9.2. Customer Segmentation Strategies

9.3. Investment Opportunities Analysis

9.4. Strategic Partnerships Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping all major stakeholders within the global magnetic levitation train market. This is achieved through extensive desk research and the utilization of secondary and proprietary data sources. The goal is to identify the variables influencing market dynamics, such as technological advancements and government policies.

Step 2: Market Analysis and Construction

Next, historical data related to market penetration, infrastructure development, and transportation needs is collected and analyzed. The analysis includes evaluating key metrics like revenue generation from high-speed rail services and advancements in maglev technologies.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are developed based on the data and are validated through interviews with industry experts and stakeholders, including rail manufacturers and infrastructure developers. These consultations provide valuable insights into the operational dynamics of the market.

Step 4: Research Synthesis and Final Output

The final stage involves engaging with manufacturers and transport authorities to verify the data collected. This ensures that the findings are accurate and representative of the market's current conditions. The synthesis of these insights results in a comprehensive, data-driven report.

Frequently Asked Questions

01. How big is the Global Magnetic Levitation Train Market?

The global magnetic levitation train market is valued at USD 3 billion in 2023. This valuation is driven by increasing infrastructure investments in high-speed transportation and the demand for energy-efficient systems.

02. What are the major challenges in the Global Magnetic Levitation Train Market?

Challenges of Global Magnetic Levitation Train Market include high initial investment costs, limited geographic adoption, and complex regulatory hurdles. The technical requirements and the need for continuous innovation also add complexity to the market.

03. Who are the major players in the Global Magnetic Levitation Train Market?

Key players in Global Magnetic Levitation Train Market include CRRC Corporation Limited, Siemens AG, Mitsubishi Heavy Industries, Alstom, and Hitachi Rail. These companies lead the market due to their technological innovations and extensive global presence.

04. What is driving growth in the Global Magnetic Levitation Train Market?

Global Magnetic Levitation Train Market is driven by government support for reducing carbon emissions, technological advancements in rail transportation, and the need for faster, more efficient transit solutions in urban and intercity regions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.