Global Marine Electronics Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD983

December 2024

91

About the Report

Global Marine Electronics Market Overview

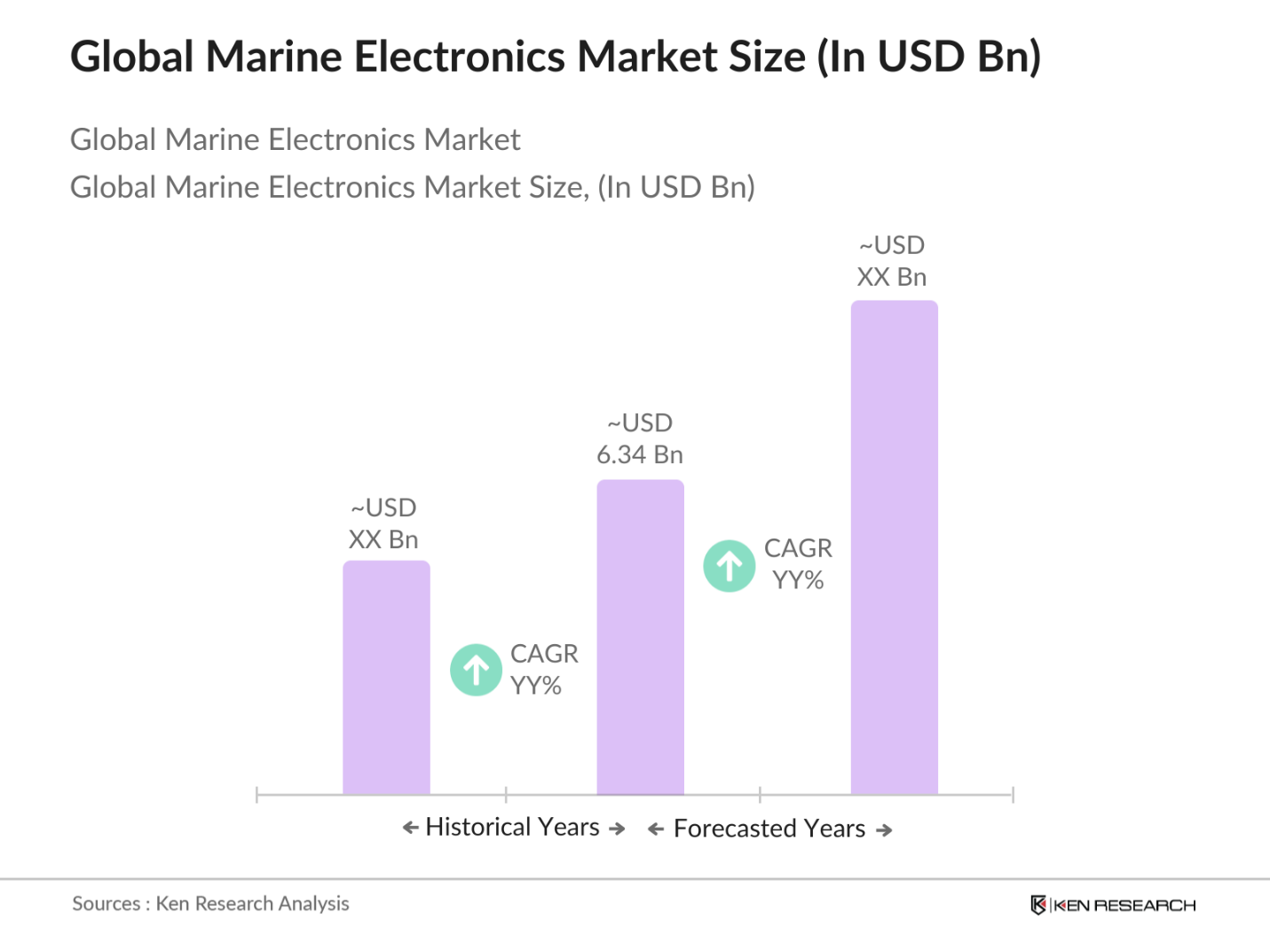

- The Global Marine Electronics market reached a valuation of approximately USD 6.34 billion, driven primarily by a surge in global seaborne trade and advancements in navigation technology. The demand for accurate GPS and radar systems has been a significant factor, especially in commercial and military shipping sectors, as they prioritize safety and operational efficiency. Increasing emphasis on fuel efficiency and environmental compliance further supports the adoption of sophisticated marine electronics across diverse applications.

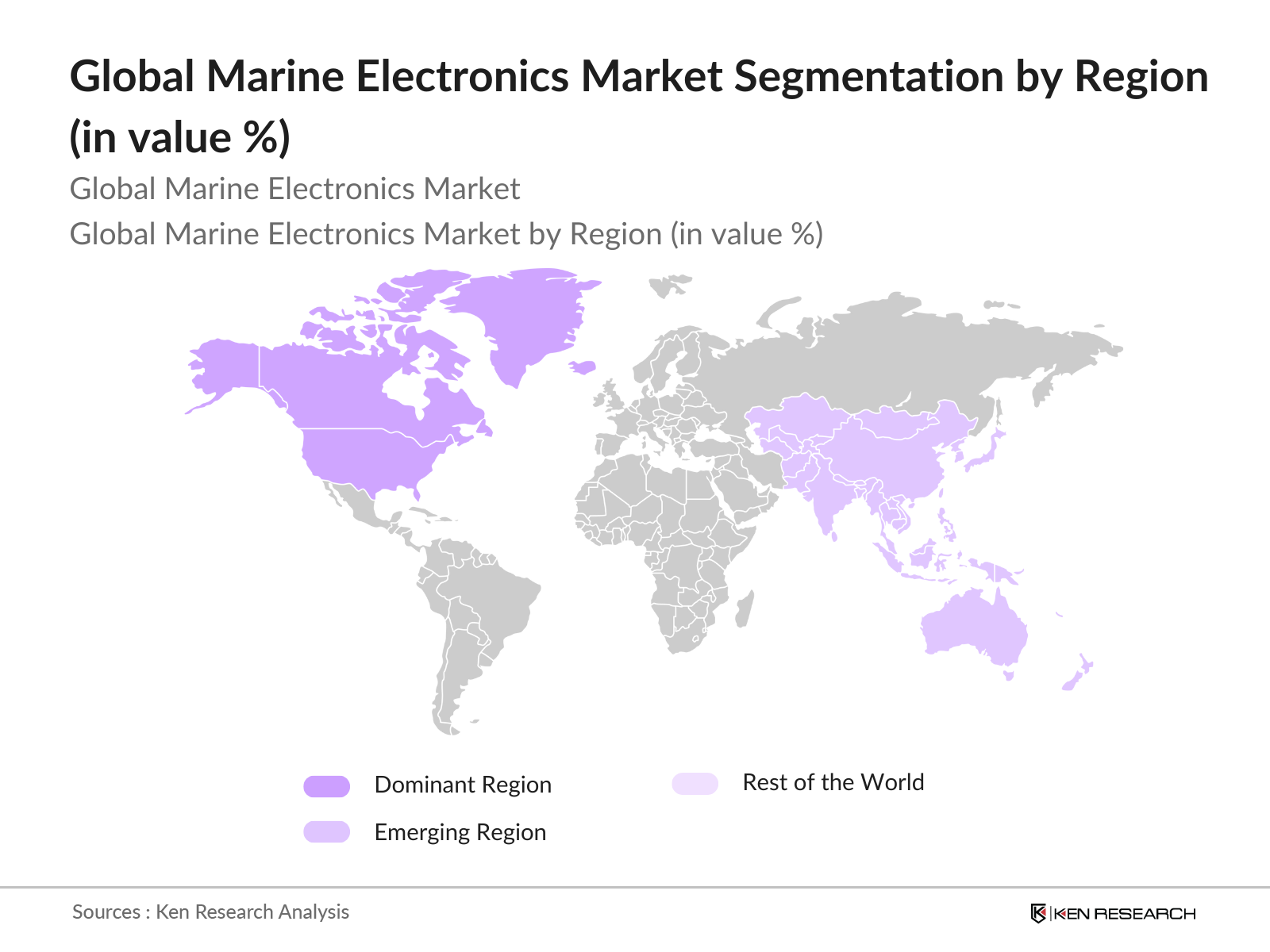

- North America and Asia Pacific hold significant positions in the marine electronics market, with North America leading due to advanced maritime infrastructure and stringent safety regulations. The United States, with its extensive coastline and robust recreational boating sector, benefits from substantial investments in both commercial and leisure marine technologies. Asia Pacific is rapidly growing due to its expanding shipping industry and infrastructure investments, particularly in China and Japan.

- Governments worldwide are introducing subsidies to encourage the adoption of eco-friendly marine electronics, such as solar-powered systems and hybrid battery solutions. For instance, the European Union allocated 30 million in 2023 to support shipowners upgrading their navigation and communication systems with energy-efficient technologies. This subsidy is part of the EUs broader maritime environmental program, aiming to reduce carbon emissions and promote sustainability in the maritime industry.

Global Marine Electronics Market Segmentation

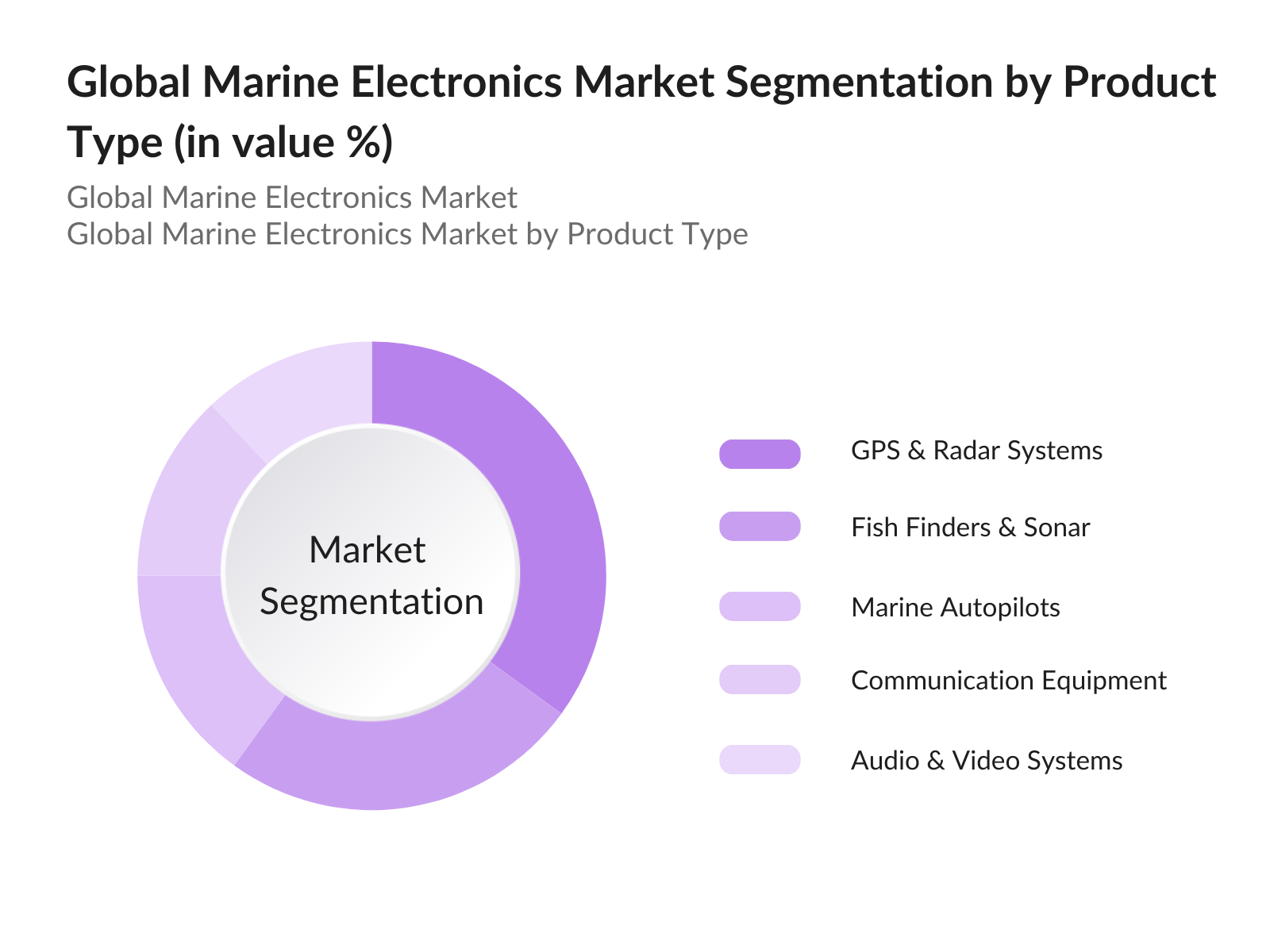

By Product Type: The marine electronics market is segmented by product type into GPS & Radar Systems, Fish Finders & Sonar, Marine Autopilots, Communication Equipment, and Audio & Video Systems. Currently, GPS & Radar Systems dominate, especially in commercial and military segments, due to their critical role in safety and route optimization. The continuous advancements in GPS technology enable more precise navigation, which is essential in busy marine routes and hazardous waters, further bolstering demand.

By Region: In terms of geographical segmentation, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share, benefiting from its substantial investments in maritime infrastructure, especially within the U.S. commercial and recreational boating sectors. These regions exhibit high adoption rates of marine electronics due to the focus on safety and operational efficiency.

Global Marine Electronics Market Competitive Landscape

The Global Marine Electronics market is characterized by the presence of key players who drive technological innovation, product differentiation, and strategic partnerships to capture market share.

|

Company |

Establishment Year |

Headquarters |

Key Products |

Technology Focus |

Market Presence |

Strategic Initiatives |

Key Partnerships |

Product Innovation |

Regional Focus |

|

Garmin Ltd. |

1989 |

Schaffhausen, CH |

GPS, Radar Systems |

- |

- |

- |

- |

- |

- |

|

Furuno Electric Co., Ltd. |

1938 |

Nishinomiya, JP |

Communication Equip. |

- |

- |

- |

- |

- |

- |

|

Kongsberg Maritime |

1814 |

Kongsberg, NO |

Navigation Systems |

- |

- |

- |

- |

- |

- |

|

Teledyne FLIR LLC |

1978 |

Wilsonville, US |

Thermal Imaging |

- |

- |

- |

- |

- |

- |

|

Northrop Grumman |

1939 |

Falls Church, US |

Defense Electronics |

- |

- |

- |

- |

- |

- |

Global Marine Electronics Market Analysis

Market Growth Drivers

- Rising Demand for GPS and Radar (Safety, Navigation Precision): The integration of GPS and radar systems into marine electronics has become crucial for safety and precision in navigation. According to the International Maritime Organization (IMO), there are over 50,000 merchant ships globally, each requiring reliable navigation systems to ensure safer operations in crowded waters. GPS technology provides positioning accuracy within 10 meters, which is essential for collision avoidance and precise route mapping. The U.S. Coast Guard highlights radar usage as a significant factor in reducing marine incidents, showcasing the strong demand for these systems in both commercial and military vessels

- Technological Innovations (Marine Autopilots, Sonar Systems): Technological advancements in marine electronics, such as marine autopilots and sonar systems, have enhanced operational efficiencies, saving fuel and reducing crew workload. In 2023, the International Energy Agency (IEA) noted that 12,000 vessels adopted marine autopilot systems that streamline navigation over extended routes, optimizing fuel consumption and reducing crew intervention. Innovations in sonar systems, providing detection ranges up to 10 km for submarines and other marine entities, have also bolstered operational safety. As of 2024, these systems are particularly in demand in military and commercial sectors due to increased focus on secure navigation.

- Increased Adoption in Military Applications (Passive Radar Systems, Advanced Monitoring): The adoption of advanced marine electronics in military applications has surged, with passive radar systems playing a critical role in undetectable monitoring and secure maritime operations. In 2023, NATO reported that 1,200 vessels across allied nations deployed passive radar systems, enabling them to operate without emitting detectable signals, ensuring covert surveillance. Advanced monitoring systems now cover over 4,000 nautical miles, enhancing situational awareness in sensitive regions. This shift reflects a strategic investment by military bodies in enhancing naval capabilities while ensuring stealth operations.

Market Challenges:

- High Costs of Advanced Sonar Systems (Research & Development Constraints): The high costs associated with advanced sonar systems remain a considerable challenge in the marine electronics market. These systems, which require extensive R&D and specialized materials, can cost over $500,000 per unit, limiting their accessibility for smaller operators. According to the World Trade Organization (WTO), maritime operators can afford to integrate these advanced sonar systems due to financial constraints, highlighting the significant barrier to widespread adoption. The high costs continue to restrict technological penetration, especially in non-military segments.

- Regulatory Standards and Compliance (Global and Regional Requirements): Global and regional regulatory standards for marine electronics are stringent, adding complexity and costs to product deployment. The International Maritime Organization (IMO) has enforced regulations mandating that electronic systems meet strict emissions and safety standards, impacting over 100,000 vessels worldwide. These regulations require manufacturers to invest in rigorous certification and testing processes, which significantly increase production costs. Additionally, regional variations in compliance standards demand tailored solutions, further complicating product development for manufacturers seeking to cater to global markets.

Global Marine Electronics Market Future Outlook

The marine electronics market is expected to continue its growth trajectory over the next five years, driven by the increasing need for safety, efficiency, and environmental sustainability across maritime sectors. Advancements in navigation, coupled with rising investments in marine infrastructure, especially in emerging economies, will contribute to market expansion. The market will also benefit from ongoing technological developments in autonomous marine systems, particularly in GPS, radar, and underwater sonar applications, which will be critical for various commercial and defense uses.

Market Opportunities:

- Integration of AI for Autonomous Navigation: The adoption of artificial intelligence in marine electronics is enabling more autonomous vessel operations. AI-driven navigation systems analyze environmental data, vessel positioning, and other factors in real-time, optimizing routes and enhancing safety. In 2023, over 1,000 vessels globally have integrated autonomous navigation solutions, according to the International Maritime Research Institute. This technology is increasingly valuable for commercial shipping companies aiming to reduce crew-related costs and improve operational efficiency.

- Growing Implementation of IoT for Predictive Maintenance: The Internet of Things (IoT) is revolutionizing maintenance practices in the marine sector by enabling predictive maintenance for electronics and machinery. IoT sensors monitor engine performance, fuel consumption, and electronic health in real-time, alerting operators to potential issues before they escalate. In 2023, the International Association of Classification Societies reported that IoT-based maintenance solutions were implemented across over 2,500 vessels globally, significantly reducing downtime and maintenance costs by enabling preemptive repairs.

Scope of the Report

|

By Product Type |

GPS & Radar Systems Fish Finders & Sonar Marine Autopilots Communication Equipment Audio & Video Systems |

|

By Application |

Merchant Marine Fishing Vessels Yachts/Recreation Military Underwater Exploration Drones |

|

By Vessel Type |

Commercial Vessels Defense & Naval Ships Leisure Boats |

|

By End-User |

Analog Digital Hybrid Systems |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Maritime Shipping Companies

Defense and Military Procurement Departments

Port Authorities and Maritime Infrastructure Regulators

Fishing Industry Associations

Recreational Boat Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Coast Guard, International Maritime Organization)

Marine Technology Innovators and Startups

Companies

Players Mention in the Report

Garmin Ltd.

Furuno Electric Co., Ltd.

Kongsberg Maritime

Teledyne FLIR LLC

Northrop Grumman

Wrtsil Corporation

Thales Group

Tokyo Keiki Inc.

Navico Group

L3Harris Technologies, Inc.

Japan Radio Co., Ltd.

ATLAS ELEKTRONIK GmbH

Kraken Robotics Inc.

Neptune Sonar Ltd.

Sound Metrics Corp.

Table of Contents

01. Global Marine Electronics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics and Growth Rate

1.4 Market Segmentation Overview

02. Global Marine Electronics Market Size (in USD Billion)

2.1 Historical Market Size Analysis

2.2 Year-On-Year Growth Trends

2.3 Key Market Milestones and Developments

03. Global Marine Electronics Market Drivers and Challenges

3.1 Market Growth Drivers

3.1.1 Rising Demand for GPS and Radar (Safety, Navigation Precision)

3.1.2 Technological Innovations (Marine Autopilots, Sonar Systems)

3.1.3 Increased Adoption in Military Applications (Passive Radar Systems, Advanced Monitoring)

3.1.4 Demand for Onboard Entertainment Systems (Enhanced Passenger Experience)

3.2 Market Challenges

3.2.1 High Costs of Advanced Sonar Systems (Research & Development Constraints)

3.2.2 Environmental Factors (Waterproofing, Corrosion Resistance)

3.2.3 Regulatory Standards and Compliance (Global and Regional Requirements)

04. Key Opportunities and Emerging Trends in the Marine Electronics Market

4.1 Opportunities

4.1.1 Integration of AI in Navigation Systems

4.1.2 Expansion in Emerging Markets (APAC, Latin America)

4.1.3 Hybrid Power Systems for Environmental Efficiency

4.2 Emerging Trends

4.2.1 Passive Radar for Military and Commercial Use

4.2.2 Advanced Thermal Imaging (Night and Fog Navigation)

4.2.3 IoT-Enabled Predictive Maintenance (Operational Efficiency)

05. Marine Electronics Market Segmentation

5.1 By Product Type

5.1.1 GPS & Radar Systems

5.1.2 Fish Finders & Sonar

5.1.3 Marine Autopilots

5.1.4 Communication Equipment

5.1.5 Audio & Video Systems

5.2 By Application

5.2.1 Merchant Marine

5.2.2 Fishing Vessels

5.2.3 Yachts/Recreation

5.2.4 Military Applications

5.2.5 Underwater Exploration Drones

5.3 By Vessel Type

5.3.1 Commercial Vessels

5.3.2 Defense & Naval Ships

5.3.3 Leisure Boats

5.4 By Technology

5.4.1 Analog

5.4.2 Digital

5.4.3 Hybrid Systems

5.5 By Region

5.5.1 North America

5.5.2 Europe

5.5.3 Asia Pacific

5.5.4 Latin America

5.5.5 Middle East & Africa

06. Competitive Landscape and Market Share Analysis

6.1 Major Competitors in Marine Electronics Market

6.1.1 Garmin Ltd.

6.1.2 Furuno Electric Co., Ltd.

6.1.3 Kongsberg Maritime

6.1.4 Navico Group

6.1.5 Wrtsil Corporation

6.1.6 Northrop Grumman Corporation

6.1.7 Thales Group

6.1.8 Tokyo Keiki Inc.

6.1.9 L3Harris Technologies, Inc.

6.1.10 Japan Radio Co., Ltd.

6.1.11 Teledyne FLIR LLC

6.1.12 ATLAS ELEKTRONIK GmbH

6.1.13 Johnson Outdoors Inc.

6.1.14 Neptune Sonar Ltd.

6.1.15 Sound Metrics Corp.

6.2 Cross Comparison Parameters (Revenue, Technology Focus, Geographic Presence, Innovation Rate, Product Portfolio Depth, Strategic Partnerships, Market Share, R&D Expenditure)

6.3 Market Share Analysis

6.4 Strategic Developments and Initiatives

6.5 Mergers and Acquisitions

6.6 Venture Capital Investments and Funding

07. Global Marine Electronics Market Supply Chain Analysis

7.1 Key Suppliers and Raw Material Analysis

7.2 Key Distribution Channels

7.3 Key Consumers and Demand Centers

7.4 Value Chain Optimization Opportunities

08. Regional Analysis and Forecast by Region

8.1 North America

8.2 Europe

8.3 Asia Pacific

8.4 Latin America

8.5 Middle East & Africa

09. Future Market Size Projections (in USD Billion)

9.1 Projections by Region

9.2 Key Growth Drivers and Restraints for Future Market

10. Analysts' Recommendations

10.1 Strategic Positioning and Investment Opportunities

10.2 Customer Analysis (Cohorts and Behavior Insights)

10.3 White Space Analysis in Product and Regional Markets

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the ecosystem of stakeholders within the Global Marine Electronics Market, utilizing secondary databases to capture extensive market-level information. This phase identified variables like product demand, regulatory influences, and supply chain dynamics.

Step 2: Market Analysis and Construction

This phase analyzed historical data covering market penetration, customer segmentation, and technological innovation rates. Data from 2018-2023 was used to build an accurate picture of market trends and drivers, such as the rise in demand for safety and navigation technology.

Step 3: Hypothesis Validation and Expert Consultation

Through structured consultations with marine technology professionals, market assumptions were verified and refined. These interviews provided critical insights into operational and financial dynamics, bolstering the reliability of data estimates.

Step 4: Research Synthesis and Final Output

The synthesis stage involved direct feedback from manufacturers, covering sales performance, consumer preferences, and product technology. This collaborative input verified the data, enhancing the credibility and depth of the analysis.

Frequently Asked Questions

01. How big is the Global Marine Electronics Market?

The global marine electronics market is valued at approximately USD 6.34 billion, driven by advancements in navigation systems and increasing adoption in commercial shipping and defense sectors.

02. What are the challenges in the Global Marine Electronics Market?

Challenges include high costs associated with advanced sonar systems and the need for compliance with strict environmental and safety regulations.

03. Who are the major players in the Global Marine Electronics Market?

Key players include Garmin Ltd., Furuno Electric Co., Ltd., Kongsberg Maritime, Teledyne FLIR LLC, and Northrop Grumman, each focusing on specific innovations in navigation and communication technologies.

04. What are the growth drivers of the Global Marine Electronics Market?

The market is propelled by the growing importance of safety and precision in maritime navigation, particularly in GPS, radar, and thermal imaging technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.