Global Masterbatch Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD5036

December 2024

93

About the Report

Global Masterbatch Market Overview

- The global masterbatch market is valued at USD 12.9 billion, based on a five-year historical analysis. This market's growth is primarily driven by the increased demand for plastic products across various industries such as packaging, automotive, consumer goods, and agriculture. Masterbatch, as an additive used to impart colour or enhance properties of plastics, is essential in these sectors. Additionally, environmental regulations promoting sustainable and biodegradable plastics have led to a rise in demand for specialized masterbatch formulations.

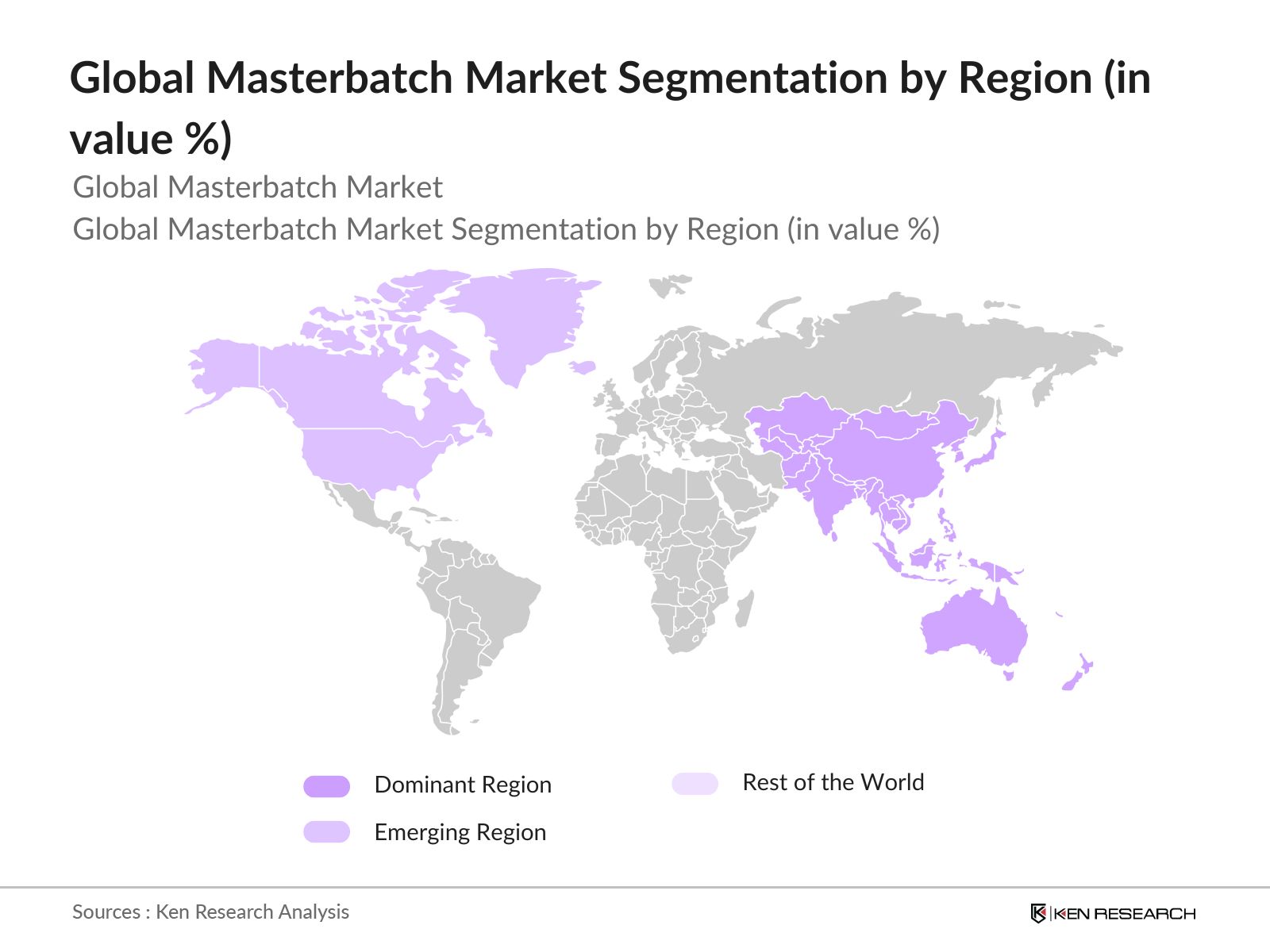

- Countries like China, the United States, and Germany dominate the global masterbatch market due to their large manufacturing bases and high consumption in end-user industries. Chinas dominance is primarily because of its massive plastic production capacity, while the United States and Germany benefit from their advanced automotive and packaging industries. These regions are also at the forefront of research and development in creating innovative and sustainable masterbatch solutions.

- Government bans on single-use plastics are accelerating the adoption of sustainable masterbatch solutions. As of 2024, over 50 countries, including India, the EU, and Canada, have implemented strict bans on single-use plastic products, pushing manufacturers to develop alternatives. The Indian government, for instance, has mandated a complete ban on single-use plastics by 2025, affecting nearly 200,000 small and medium enterprises involved in plastic production. This has prompted a surge in demand for biodegradable masterbatch formulations to comply with regulatory frameworks.

Global Masterbatch Market Segmentation

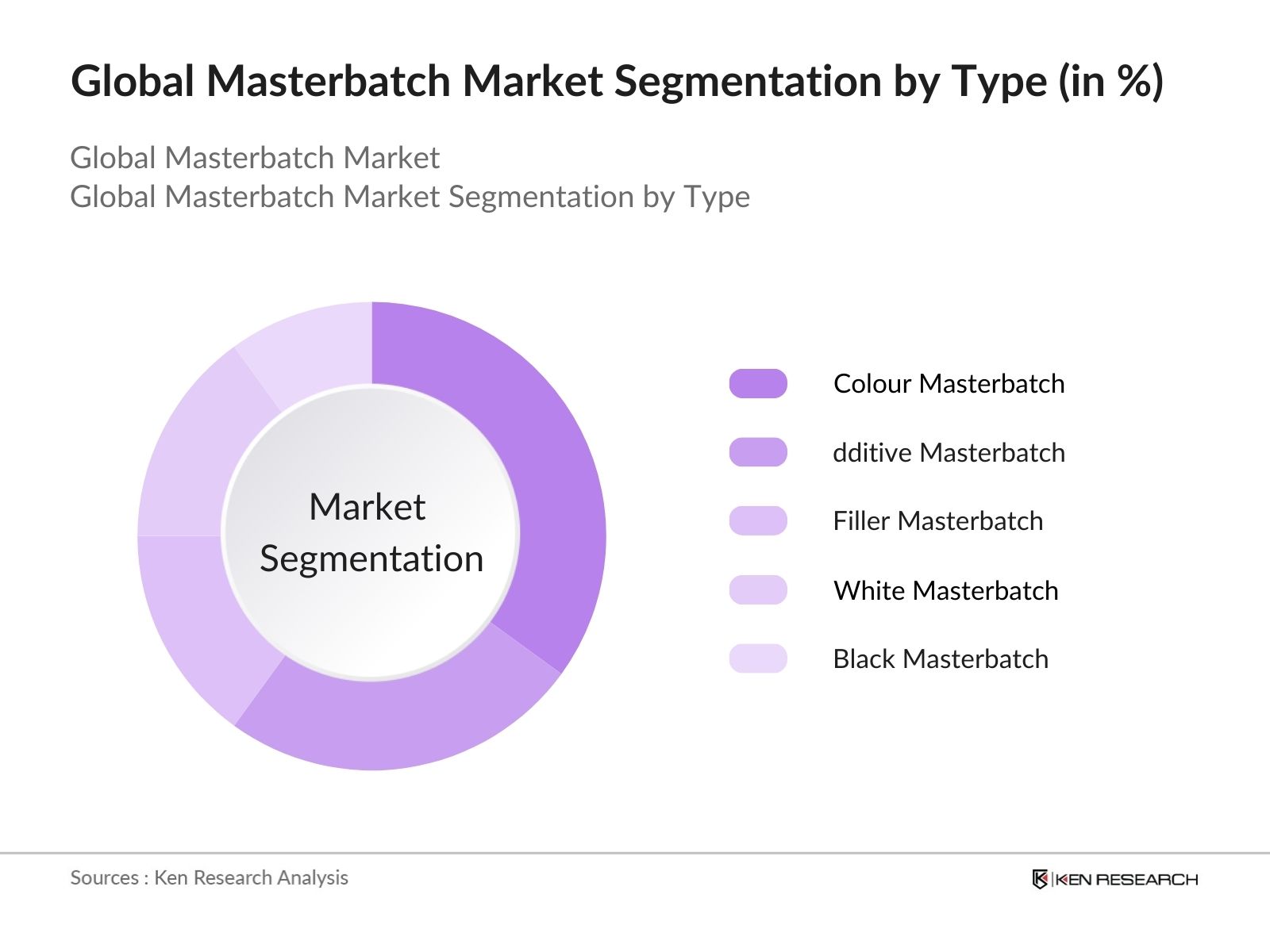

- By Type: The global masterbatch market is segmented by type into colour masterbatch, additive masterbatch, filler masterbatch, white masterbatch, and black masterbatch. Among these, colour masterbatch holds a dominant market share due to its widespread application in packaging, consumer goods, and automotive industries. The ability to customize colours for specific branding needs and the demand for high-quality aesthetics in plastic products contribute to the dominance of this segment.

- By Polymer: The market is segmented by polymer into polyethylene (PE), polypropylene (PP), polystyrene (PS), polyvinyl chloride (PVC), and polyethylene terephthalate (PET). Polyethylene holds the largest market share due to its versatile properties, making it a preferred choice in packaging and consumer goods. Its high usage in the production of plastic bags, containers, and other flexible packaging materials supports its dominance.

- By Region: The global masterbatch market is geographically segmented into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. Asia-Pacific leads the market, driven by the robust plastic production capacities in China and India. The regions dominance is further supported by increasing industrialization, urbanization, and a strong demand for packaging and automotive applications.

Global Masterbatch Market Competitive Landscape

The global masterbatch market is dominated by several key players that have established their presence through innovations, mergers, and product portfolio expansions. Companies like Clariant AG, PolyOne Corporation, and Ampacet Corporation have strengthened their positions through continuous R&D and strategic collaborations. These players have an extensive distribution network and provide customized solutions to meet specific client needs.

|

Company Name |

Establishment Year |

Headquarters |

R&D Expenditure |

Manufacturing Facilities |

Product Range |

Sustainability Initiatives |

Market Presence |

Number of Patents |

|

Clariant AG |

1995 |

Switzerland |

- |

- |

- |

- |

- |

- |

|

PolyOne Corporation |

2000 |

USA |

- |

- |

- |

- |

- |

- |

|

Ampacet Corporation |

1937 |

USA |

- |

- |

- |

- |

- |

- |

|

A. Schulman, Inc. |

1928 |

USA |

- |

- |

- |

- |

- |

- |

|

Cabot Corporation |

1882 |

USA |

- |

- |

- |

- |

- |

- |

Global Masterbatch Market Analysis

Global Masterbatch Market Growth Drivers

- Increasing Demand for Plastic Products: The growing demand for plastic products is driven by their versatile applications in packaging, automotive, and consumer goods. As of 2024, global plastic production exceeds 380 million tons annually, according to the World Bank, fueled by rapid industrialization in developing countries like India and China. These economies are expanding their manufacturing sectors, contributing to higher demand for plastic products. Additionally, the packaging industry continues to expand, supporting demand for plastic-based materials due to their lightweight and cost-effective properties. The global trade volume of plastic products also reflects a steady increase, valued at $1.2 trillion in 2023.

- Stringent Environmental Regulations: The imposition of stringent environmental regulations has impacted the masterbatch market, especially in developed regions like the EU. By 2024, more than 50 countries globally, including key markets such as France and Germany, have implemented strict policies on plastic production and recycling to reduce environmental damage. These regulations push manufacturers to adopt eco-friendly masterbatch formulations. According to the IMF, industrial production in these countries is undergoing major shifts towards greener alternatives, with governments also offering incentives for sustainable materials. The European Green Deal targets plastic waste reductions of up to 2 million tons annually by 2025.

- Growth in Automotive, Packaging, and Consumer Goods Sectors: Masterbatch demand is closely tied to the growth of end-user industries such as automotive, packaging, and consumer goods. The automotive industry alone, which produces over 90 million vehicles annually, increasingly requires lightweight plastic components for fuel efficiency. Similarly, the global packaging industry, valued at $917 billion, continues to expand, particularly in e-commerce and food sectors, further boosting demand for innovative masterbatch solutions. Consumer goods, such as electronics, are also driving demand, with over 20 billion units of electronic devices produced globally in 2024, requiring specialized plastic formulations for durability and aesthetics.

Global Masterbatch Market Challenges

- Fluctuating Raw Material Prices: One of the primary challenges in the masterbatch market is the fluctuating prices of raw materials, especially petrochemicals. Crude oil, which remains the principal raw material source, saw price volatility between $80 to $120 per barrel from 2022 to 2024. This has directly impacted production costs for masterbatch manufacturers. Furthermore, disruptions in global supply chains due to geopolitical tensions in major oil-producing regions have exacerbated these fluctuations, causing uncertainties for manufacturers dependent on stable raw material availability.

- Rising Environmental Concerns: Environmental concerns surrounding plastic waste management and pollution have led to declining demand in regions with strict regulations. The World Bank estimates that over 300 million tons of plastic waste are generated annually, with only about 20% effectively recycled. Countries like Japan and Germany have introduced extensive recycling policies to manage this, reducing demand for conventional masterbatch and increasing the focus on biodegradable alternatives. Moreover, public awareness and consumer preferences for eco-friendly products are pushing companies to rethink their use of traditional plastics, affecting the demand dynamics for masterbatch.

Global Masterbatch Market Future Outlook

Over the next five years, the global masterbatch market is expected to experience growth driven by the increasing adoption of sustainable plastics, innovations in polymer technologies, and the rising demand for aesthetically appealing plastic products. Additionally, the growing emphasis on biodegradable and eco-friendly masterbatch formulations will further boost market expansion. The automotive and packaging industries, in particular, are expected to be key contributors to this growth, alongside emerging applications in healthcare and 3D printing.

Global Masterbatch Market Opportunities

- Development of Biodegradable Masterbatch: There is an increasing opportunity for the development of biodegradable masterbatch, as global plastic waste remains a major environmental issue. According to the World Bank, biodegradable plastics currently account for less than 2% of the total plastics market, but this segment is growing as governments push for sustainable alternatives. Countries like Italy and France have introduced subsidies for the use of biodegradable plastics in packaging. With more than 300 million tons of plastic waste generated globally each year, biodegradable masterbatch formulations present a strong growth avenue for manufacturers focused on sustainability.

- Adoption of Circular Economy Practices: The adoption of circular economy practices is driving the masterbatch market towards recyclability and reuse. As per the World Bank, 80% of global trade regulations in 2024 now focus on reducing plastic waste through recycling initiatives. Major economies such as the EU and Japan are spearheading efforts to ensure plastics remain in circulation longer, reducing the demand for virgin materials. This creates opportunities for masterbatch manufacturers to develop products specifically designed for recycled plastics, enhancing their performance and aesthetic appeal, thus aligning with global sustainability goals.

Scope of the Report

|

By Type |

Colour Masterbatch Additive Masterbatch Filler Masterbatch White Masterbatch Black Masterbatch |

|

By Polymer |

Polyethylene (PE) Polypropylene (PP) Polystyrene (PS) Polyvinyl Chloride (PVC) Polyethylene Terephthalate (PET) |

|

By Application |

Packaging Automotive Consumer Goods Construction Agriculture |

|

By End-Use Industry |

Food and Beverage Healthcare Industrial Applications Retail and E-commerce |

|

By Region |

North America Europe Asia-Pacific Middle East and Africa Latin America |

Products

Key Target Audience

Polymer Manufacturers

Automotive Manufacturers

Packaging Industry Leaders

Masterbatch Suppliers

Banks and Financial Institutions

Government and Regulatory Bodies (U.S. EPA, European Chemicals Agency)

Plastic Product Manufacturers

Investor and Venture Capitalist Firms

Additive Technology Providers

Companies

Global Masterbatch Market Major Players

Clariant AG

PolyOne Corporation

Ampacet Corporation

A. Schulman, Inc.

Cabot Corporation

Plastiblends India Ltd.

Tosaf Group

Hubron International

Plastika Kritis S.A.

Penn Color, Inc.

RTP Company

GCR Group

DOW Chemical Company

Sukano AG

Prayag Polytech Pvt. Ltd.

Table of Contents

1. Global Masterbatch Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Masterbatch Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Masterbatch Market Analysis

3.1. Growth Drivers (Regulations, End-User Industries, Demand for Plastics)

3.1.1. Increasing Demand for Plastic Products

3.1.2. Stringent Environmental Regulations

3.1.3. Growth in Automotive, Packaging, and Consumer Goods Sectors

3.2. Market Challenges (Cost, Raw Material Availability, Regulatory Compliance)

3.2.1. Fluctuating Raw Material Prices

3.2.2. Rising Environmental Concerns

3.2.3. Limited Skilled Workforce for Innovative Masterbatch Formulations

3.3. Opportunities (Recyclability, Biodegradable Masterbatch)

3.3.1. Development of Biodegradable Masterbatch

3.3.2. Adoption of Circular Economy Practices

3.3.3. Expanding Applications in Medical and 3D Printing

3.4. Trends (Color Innovation, Customization, Sustainability)

3.4.1. Shift Towards Sustainable and Biodegradable Masterbatch

3.4.2. Increased Use of Color Innovation and Customization

3.4.3. Integration of Additive Masterbatch for Enhanced Product Performance

3.5. Government Regulation (Environmental Regulations, Plastic Use Policies)

3.5.1. Governmental Bans on Single-Use Plastics

3.5.2. Incentives for Sustainable and Recyclable Materials

3.5.3. Regulatory Push for Plastic Recycling

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Global Masterbatch Market Segmentation

4.1. By Type (In Value %)

4.1.1. Colour Masterbatch

4.1.2. Additive Masterbatch

4.1.3. Filler Masterbatch

4.1.4. White Masterbatch

4.1.5. Black Masterbatch

4.2. By Polymer (In Value %)

4.2.1. Polyethylene (PE)

4.2.2. Polypropylene (PP)

4.2.3. Polystyrene (PS)

4.2.4. Polyvinyl Chloride (PVC)

4.2.5. Polyethylene Terephthalate (PET)

4.3. By Application (In Value %)

4.3.1. Packaging

4.3.2. Automotive

4.3.3. Consumer Goods

4.3.4. Construction

4.3.5. Agriculture

4.4. By End-Use Industry (In Value %)

4.4.1. Food and Beverage

4.4.2. Healthcare

4.4.3. Industrial Applications

4.4.4. Retail and E-commerce

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East and Africa

4.5.5. Latin America

5. Global Masterbatch Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Clariant AG

5.1.2. PolyOne Corporation

5.1.3. Ampacet Corporation

5.1.4. A. Schulman, Inc.

5.1.5. Cabot Corporation

5.1.6. Plastiblends India Ltd.

5.1.7. Tosaf Group

5.1.8. Hubron International

5.1.9. Plastika Kritis S.A.

5.1.10. Penn Color, Inc.

5.1.11. RTP Company

5.1.12. GCR Group

5.1.13. DOW Chemical Company

5.1.14. Sukano AG

5.1.15. Prayag Polytech Pvt. Ltd.

5.2 Cross Comparison Parameters (Revenue, R&D Expenditure, Sustainability Initiatives, Regional Presence, Manufacturing Capacity, Product Diversification, Technological Innovation, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. Global Masterbatch Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Masterbatch Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Masterbatch Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Polymer (In Value %)

8.3. By Application (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. Global Masterbatch Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves identifying major stakeholders across the global masterbatch market. Extensive desk research from secondary sources like government reports, industry databases, and proprietary research tools helps define key market variables, including growth drivers and challenges.

Step 2: Market Analysis and Construction

In this step, historical data on masterbatch market size, product types, and application penetration are compiled and analyzed. Key factors like production volumes and regional market trends are used to build a comprehensive market outlook.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry professionals from leading masterbatch producers and polymer manufacturers validate the market hypotheses. Their insights provide valuable operational and financial information that is integrated into the analysis.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all collected data to generate a detailed market report, validated through a combination of bottom-up and top-down approaches, ensuring an accurate representation of the market.

Frequently Asked Questions

1. How big is the Global Masterbatch Market?

The global masterbatch market was valued at USD 12.9 billion, driven by the demand for high-performance plastic products in key industries such as packaging, automotive, and consumer goods.

2. What are the key challenges in the Global Masterbatch Market?

Challenges in the global masterbatch market include fluctuating raw material prices, stringent environmental regulations, and increasing competition from regional manufacturers offering low-cost alternatives.

3. Who are the major players in the Global Masterbatch Market?

Key players in the global masterbatch market include Clariant AG, PolyOne Corporation, Ampacet Corporation, A. Schulman, Inc., and Cabot Corporation. These companies dominate the market due to their extensive product portfolios, global presence, and continuous innovation.

4. What are the growth drivers of the Global Masterbatch Market?

Growth drivers in the global masterbatch market include the rising demand for plastic products, advancements in polymer technology, and the increased adoption of sustainable and biodegradable materials in various end-use industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.