Global Medical Aesthetics Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5250

December 2024

87

About the Report

Global Medical Aesthetics Market Overview

- The global medical aesthetics market is valued at USD 13.26 billion, driven by the increasing demand for non-invasive and minimally invasive cosmetic procedures. These procedures, including dermal fillers, laser treatments, and body contouring devices, have gained popularity due to shorter recovery times and less pain compared to traditional surgical methods. The adoption of technological innovations, such as energy-based devices and advanced injectables, further fuels the growth of the market.

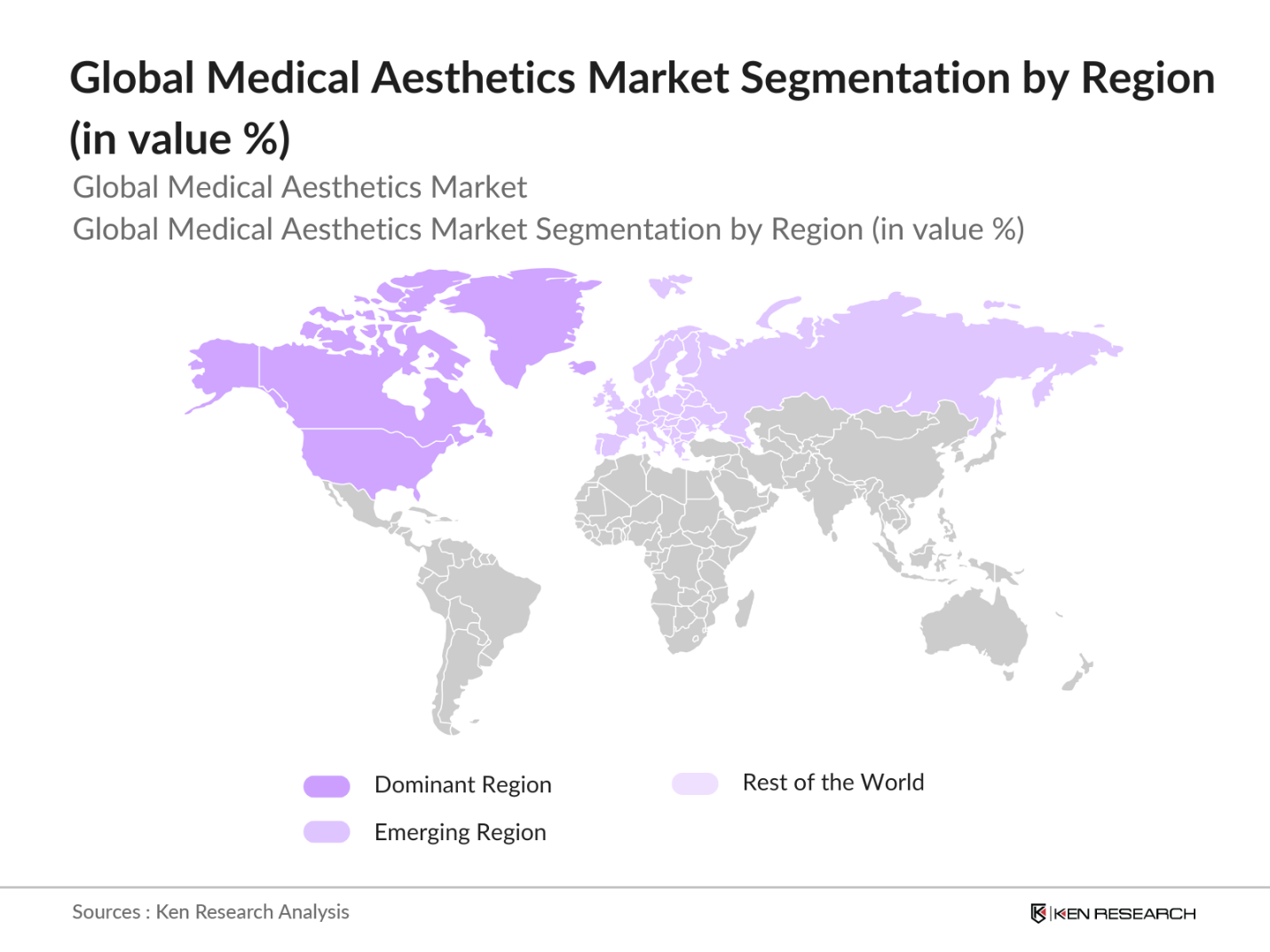

- The dominance of North America and Europe in the medical aesthetics market is primarily attributed to their well-established healthcare infrastructure and high disposable income among consumers. Countries like the United States, Germany, and the United Kingdom lead the market due to the strong presence of key market players and high demand for aesthetic treatments. In the Asia-Pacific region, countries like South Korea and Japan dominate, driven by a strong cultural preference for cosmetic treatments, technological advancements, and an increasing number of medical tourism patients.

- The FDA plays a critical role in regulating medical aesthetic devices and procedures in the US. In 2023, the FDA approved 45 new devices for aesthetic use (FDA.gov). These approvals include innovations such as AI-integrated devices for skin analysis and robotic systems for hair transplants. However, the approval process remains rigorous, with a significant number of devices facing delays due to safety or efficacy concerns. These regulations ensure that only safe and effective products reach the market, but can also slow the introduction of new technologies.

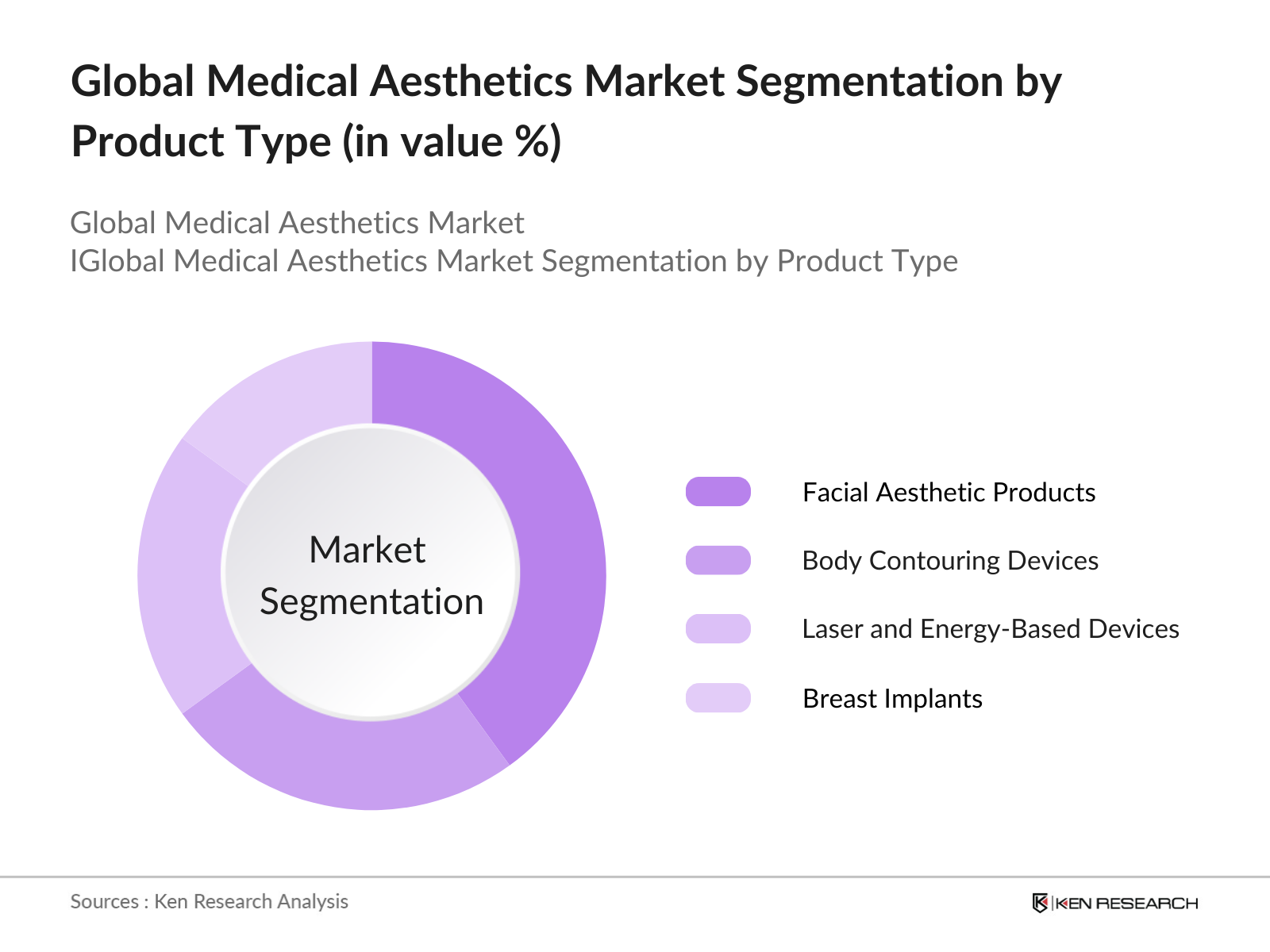

Global Medical Aesthetics Market Segmentation

By Product Type: The global medical aesthetics market is segmented by product type into facial aesthetic products, body contouring devices, laser and energy-based devices, and breast implants. Facial aesthetic products, including dermal fillers and botulinum toxin, hold the dominant market share due to their widespread use in non-surgical procedures for wrinkle reduction and volume restoration. The non-invasive nature of these treatments and the growing demand for anti-aging solutions contribute to the significant market share of facial aesthetic products. In addition, increasing awareness about facial rejuvenation options has driven the demand for these products globally.

By Region: The global medical aesthetics market is segmented by region into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America holds the largest market share due to the high disposable income, increasing acceptance of aesthetic procedures, and the presence of leading market players. The strong regulatory framework in the U.S. and Canada also supports the growth of this segment. In the Asia-Pacific region, South Korea is a major hub for cosmetic treatments, driven by the popularity of beauty standards and a booming medical tourism industry.

Global Medical Aesthetics Market Competitive Landscape

The global medical aesthetics market is dominated by a few key players who have established strong product portfolios and innovation pipelines. Companies are focusing on mergers and acquisitions, product launches, and partnerships to maintain a competitive edge. The market's competitive landscape features both global giants and specialized companies. Companies such as Allergan and Galderma lead in facial aesthetic products, while Cynosure and Lumenis dominate in laser-based devices. This consolidation of power in the hands of a few players is due to their ability to innovate and meet the growing demand for non-invasive procedures.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Number of Employees |

Products Offered |

Technological Specialization |

R&D Investments |

Geographical Reach |

Recent Developments |

|

Allergan |

1950 |

Ireland |

|||||||

|

Galderma |

1981 |

Switzerland |

|||||||

|

Cynosure |

1991 |

USA |

|||||||

|

Lumenis |

1966 |

Israel |

|||||||

|

Johnson & Johnson |

1886 |

USA |

Global Medical Aesthetics Market Analysis

Global Medical Aesthetics Market Growth Drivers

- Aging Population: The global population aged 60 years and older reached 1.05 billion in 2023, according to the United Nations, and is expected to increase further in the coming years. This demographic shift is driving demand for medical aesthetics as older individuals seek non-invasive procedures to address age-related skin concerns such as wrinkles and sagging. In the US alone, approximately 16 million minimally invasive cosmetic procedures were performed on adults aged 55 and older in 2022 (American Society of Plastic Surgeons). This trend highlights the significant role of the aging population in driving the medical aesthetics market.

- Rising Demand for Minimally Invasive Procedures: Minimally invasive procedures, such as Botox injections and laser treatments, were among the most performed aesthetic procedures globally in 2023, according to the World Health Organization (WHO). These treatments have gained popularity due to their reduced recovery times and lower risks compared to surgical interventions. With more individuals opting for these procedures, the demand for medical aesthetics continues to grow, driven by innovations that offer better outcomes with minimal discomfort. Data from the WHO further supports the increasing preference for these treatments.

- Technological Advancements: Technological innovation is a major growth driver in the medical aesthetics market. the integration of AI and robotics into aesthetic treatments, including robotic hair transplants and AI-based skin analysis tools, has revolutionized the field. These advancements have enhanced precision, patient outcomes, and overall satisfaction. According to a report by the International Medical Device Regulators Forum (IMDRF), over 300 new medical aesthetic devices incorporating AI were approved for clinical use in 2023 alone. This innovation pipeline continues to fuel market growth by offering cutting-edge solutions to consumers.

Global Medical Aesthetics Market Challenges

- High Costs: Medical aesthetic procedures are often expensive, with the average cost of popular treatments such as laser skin resurfacing or non-surgical fat reduction ranging between $2,000 and $5,000 in 2023 (WHO data). Despite the rising demand for these services, high costs remain a significant barrier to market growth, particularly in regions where disposable income is lower. According to data from the International Monetary Fund (IMF), countries with lower GDP per capita, such as India and Brazil, experience slower uptake of aesthetic procedures compared to developed nations, where such services are more affordable and accessible.

- Lack of Skilled Professionals: There is a notable lack of trained professionals in medical aesthetics, particularly in emerging markets. The International Labor Organization (ILO) reported that as of 2023, there were approximately 500,000 qualified cosmetic surgeons and dermatologists worldwide, with a significant concentration in North America and Europe. This uneven distribution means that many regions, especially developing ones, face challenges in meeting the rising demand for aesthetic procedures.

Global Medical Aesthetics Market Future Outlook

Over the next five years, the global medical aesthetics market is expected to witness significant growth, driven by advancements in non-invasive technologies, increasing consumer demand for anti-aging solutions, and a growing awareness of aesthetic treatments. The expansion into emerging markets, along with the introduction of more sophisticated and user-friendly devices, is set to bolster market growth. Furthermore, the rise in medical tourism, especially in countries like South Korea, Thailand, and Mexico, will present lucrative opportunities for key players to expand their market presence.

Market Opportunities:

- Integration of AI in Aesthetic Procedures: The use of AI in aesthetic procedures has grown significantly in recent years. In 2023, a number of aesthetic clinics worldwide integrated AI-powered diagnostic tools into their practices (IMDRF). These tools, such as AI-based skin analysis systems, provide clinicians with real-time insights into patient conditions, enabling more personalized and accurate treatment plans. AI is also being used to predict patient outcomes, streamline administrative tasks, and enhance the overall patient experience. The adoption of AI in the industry is expected to accelerate as technological capabilities continue to expand.

- Increasing Male Participation in Aesthetic Treatments: Male participation in aesthetic treatments has increased substantially in recent years. Popular treatments among men include hair transplants, Botox, and body contouring procedures. This shift reflects changing societal norms around male grooming and self-care, along with the growing availability of treatments specifically designed for men. The trend is expected to expand further as more men become aware of the benefits of aesthetic treatments, contributing to the growth of the medical aesthetics market.

Scope of the Report

|

By Product Type |

Facial Aesthetic Products Body Contouring Devices Laser and Energy-Based Devices Breast Implants Others (Hair Restoration, Vaginal Rejuvenation) |

|

By End-User |

Hospitals Dermatology Clinics Medical Spas Home Use |

|

By Application |

Skin Resurfacing and Tightening Hair Removal Fat Reduction and Body Contouring Tattoo Removal Others |

|

By Technology |

Laser-based Radiofrequency-based Ultrasound-based Injectable-based |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Hospitals and Dermatology Clinics

Medical Device Manufacturers

Aesthetic Service Providers

Cosmetic Surgery Centers

Medical Spas

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, European Medicines Agency)

Medical Aesthetic Training Institutes

Companies

Players Mention in the Report

Allergan

Galderma

Merz Pharmaceuticals

Syneron Candela

Hologic Inc. (Cynosure)

Johnson & Johnson

Lumenis

Solta Medical

Cutera Inc.

Alma Lasers

Sientra

Revance Therapeutics

Venus Concept

Sciton Inc.

Sinclair Pharma

Table of Contents

01. Global Medical Aesthetics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02. Global Medical Aesthetics Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

03. Global Medical Aesthetics Market Analysis

3.1 Growth Drivers (Aging Population, Rising Demand for Minimally Invasive Procedures, Increased Awareness of Aesthetic Procedures, Technological Advancements)

3.2 Market Challenges (High Costs, Regulatory Hurdles, Lack of Skilled Professionals)

3.3 Opportunities (Expansion into Emerging Markets, Product Innovations, Partnerships with Dermatology Clinics)

3.4 Trends (Integration of AI in Aesthetic Procedures, Popularity of Non-Invasive Treatments, Increasing Male Participation in Aesthetic Treatments)

3.5 Government Regulations (FDA Approvals, Medical Device Compliance, Regional Regulatory Standards)

3.6 SWOT Analysis

3.7 Value Chain Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

04. Global Medical Aesthetics Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Facial Aesthetic Products (Dermal Fillers, Botulinum Toxin, Chemical Peels)

4.1.2 Body Contouring Devices (Cryolipolysis, Liposuction Devices)

4.1.3 Laser and Energy-Based Devices (Laser Hair Removal, Skin Resurfacing, Tattoo Removal)

4.1.4 Breast Implants

4.1.5 Others (Hair Restoration, Vaginal Rejuvenation)

4.2 By End-User (In Value %)

4.2.1 Hospitals

4.2.2 Dermatology Clinics

4.2.3 Medical Spas

4.2.4 Home Use

4.3 By Application (In Value %)

4.3.1 Skin Resurfacing and Tightening

4.3.2 Hair Removal

4.3.3 Fat Reduction and Body Contouring

4.3.4 Tattoo Removal

4.3.5 Others

4.4 By Technology (In Value %)

4.4.1 Laser-based

4.4.2 Radiofrequency-based

4.4.3 Ultrasound-based

4.4.4 Injectable-based

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

05. Global Medical Aesthetics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Allergan

5.1.2 Galderma

5.1.3 Merz Pharmaceuticals

5.1.4 Syneron Candela

5.1.5 Hologic Inc. (Cynosure)

5.1.6 Johnson & Johnson

5.1.7 Lumenis

5.1.8 Solta Medical

5.1.9 Cutera Inc.

5.1.10 Alma Lasers

5.1.11 Sientra

5.1.12 Revance Therapeutics

5.1.13 Venus Concept

5.1.14 Sciton Inc.

5.1.15 Sinclair Pharma

5.2 Cross Comparison Parameters (Revenue, Number of Aesthetic Products, Geographical Reach, R&D Investments, Employee Strength, Technology Specialization, Key Innovations, Acquisition Activity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

06. Global Medical Aesthetics Market Regulatory Framework

6.1 Medical Device Regulations

6.2 Compliance Requirements for Aesthetic Devices

6.3 Certification and Quality Standards

07. Global Medical Aesthetics Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08. Global Medical Aesthetics Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By End-User (In Value %)

8.3 By Application (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

09. Global Medical Aesthetics Market Analysts Recommendations

9.1 Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This stage involves mapping out the key stakeholders in the global medical aesthetics market. Through extensive desk research and secondary data from proprietary databases, we establish the ecosystem dynamics, identifying critical variables such as consumer trends, technological advancements, and regulatory influences.

Step 2: Market Analysis and Data Compilation

We analyze historical data to assess market penetration and revenue generation for various medical aesthetic products and services. This phase includes evaluating the adoption rate of minimally invasive procedures and consumer preferences for non-surgical treatments.

Step 3: Hypothesis Validation and Expert Consultation

Industry-specific hypotheses are validated through direct consultations with experts in the medical aesthetics field. These consultations, conducted via structured interviews, provide critical insights into market trends, growth drivers, and challenges.

Step 4: Research Synthesis and Final Output

We synthesize data collected from both primary and secondary research, incorporating the feedback from industry experts. This ensures that the final report is comprehensive and provides accurate, data-backed insights into the market landscape.

Frequently Asked Questions

01. How big is the global medical aesthetics market?

The global medical aesthetics market is valued at USD 13.26 billion, driven by increasing demand for non-invasive treatments and the rising aging population.

02. What are the challenges in the medical aesthetics market?

Challenges include the high cost of aesthetic treatments, regulatory hurdles, and the need for highly skilled professionals to perform these procedures.

03. Who are the major players in the global medical aesthetics market?

Key players include Allergan, Galderma, Merz Pharmaceuticals, Syneron Candela, and Hologic Inc. (Cynosure), among others, dominating due to their advanced products and strong global presence.

04. What are the growth drivers of the global medical aesthetics market?

Growth is driven by advancements in non-invasive technologies, increasing consumer awareness about aesthetic treatments, and the rise in medical tourism, particularly in Asia-Pacific.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.