Global Medical Devices Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10866

December 2024

112

About the Report

Global Medical Devices Market Overview

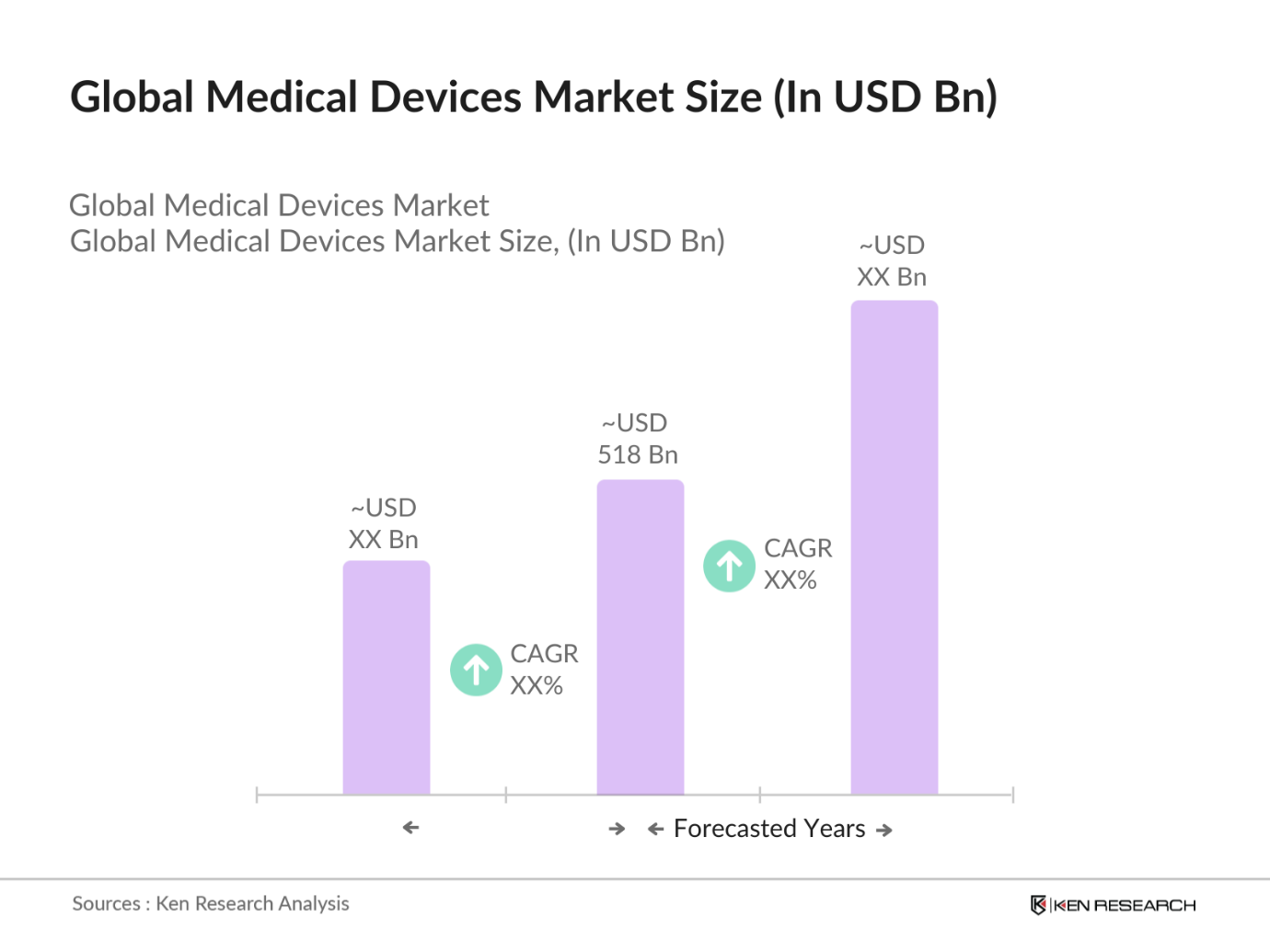

- The Global Medical Devices Market is valued at USD 518 billion, driven by continuous technological advancements and a robust healthcare infrastructure. Key drivers include the increasing prevalence of chronic diseases, an aging population, and the rising demand for portable and minimally invasive devices. Innovations in wearable medical technology and telehealth solutions have further propelled the market's growth, creating avenues for improved patient outcomes and operational efficiency in healthcare systems.

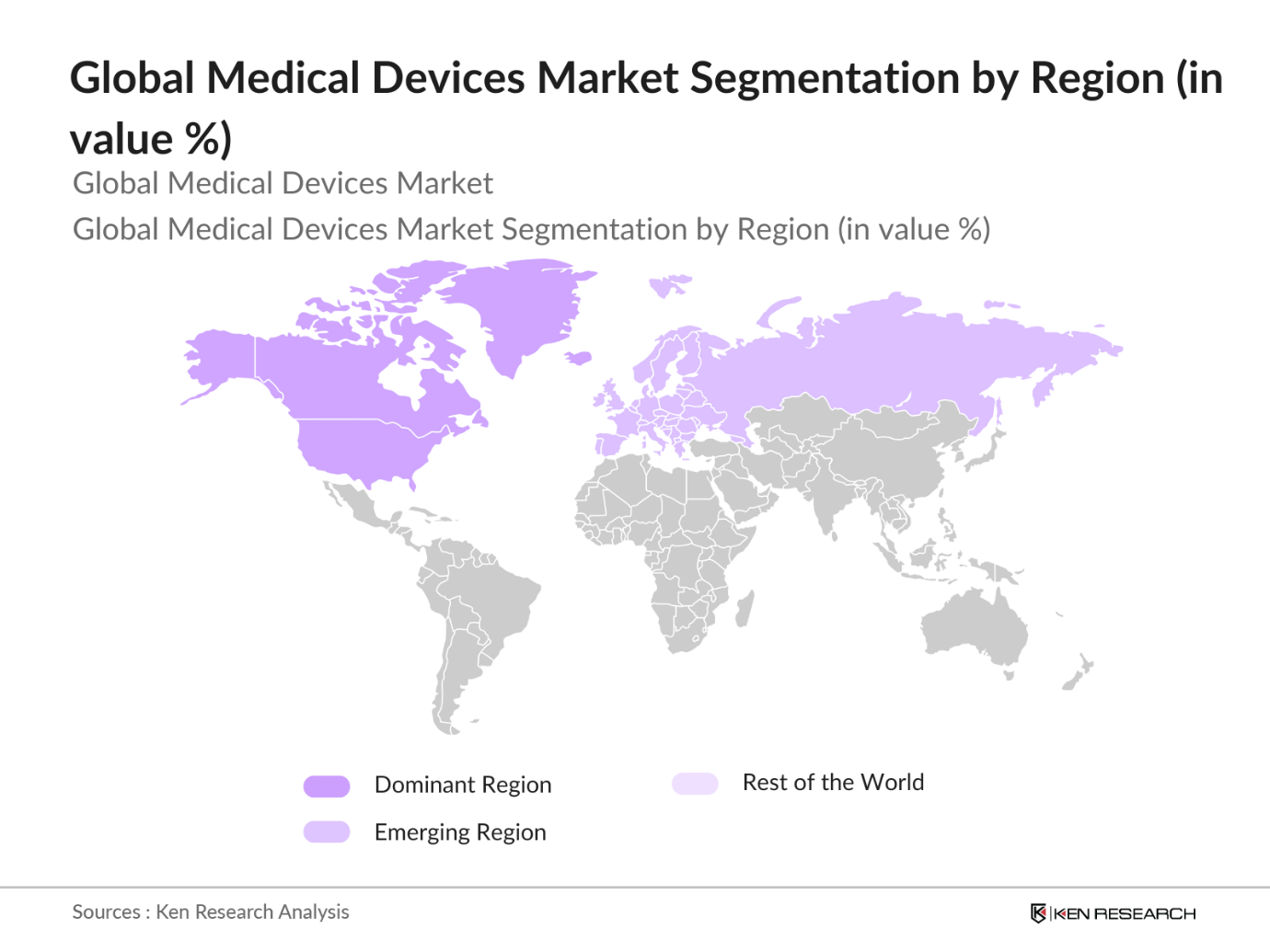

- North America and Europe dominate the medical devices market due to well-established healthcare systems and significant investments in medical research. North America, led by the United States, benefits from high healthcare spending and a strong regulatory environment fostering innovation. In Europe, Germany and the United Kingdom are prominent, driven by advanced healthcare infrastructure, a highly skilled workforce, and favorable government policies promoting R&D within the medical sector.

- The adoption of digital health platforms and telemedicine continues to expand globally, with over 1 billion telemedicine visits conducted in 2024, primarily in urban areas. The global shift to digital health is bolstered by healthcare provider shortages and increased patient demand for remote care options. For instance, telemedicine use in India has surged, supported by government initiatives and private investments. This digital transformation is reducing pressure on healthcare facilities, enhancing patient access to specialist consultations, and improving continuity of care across regions

Global Medical Devices Market Segmentation

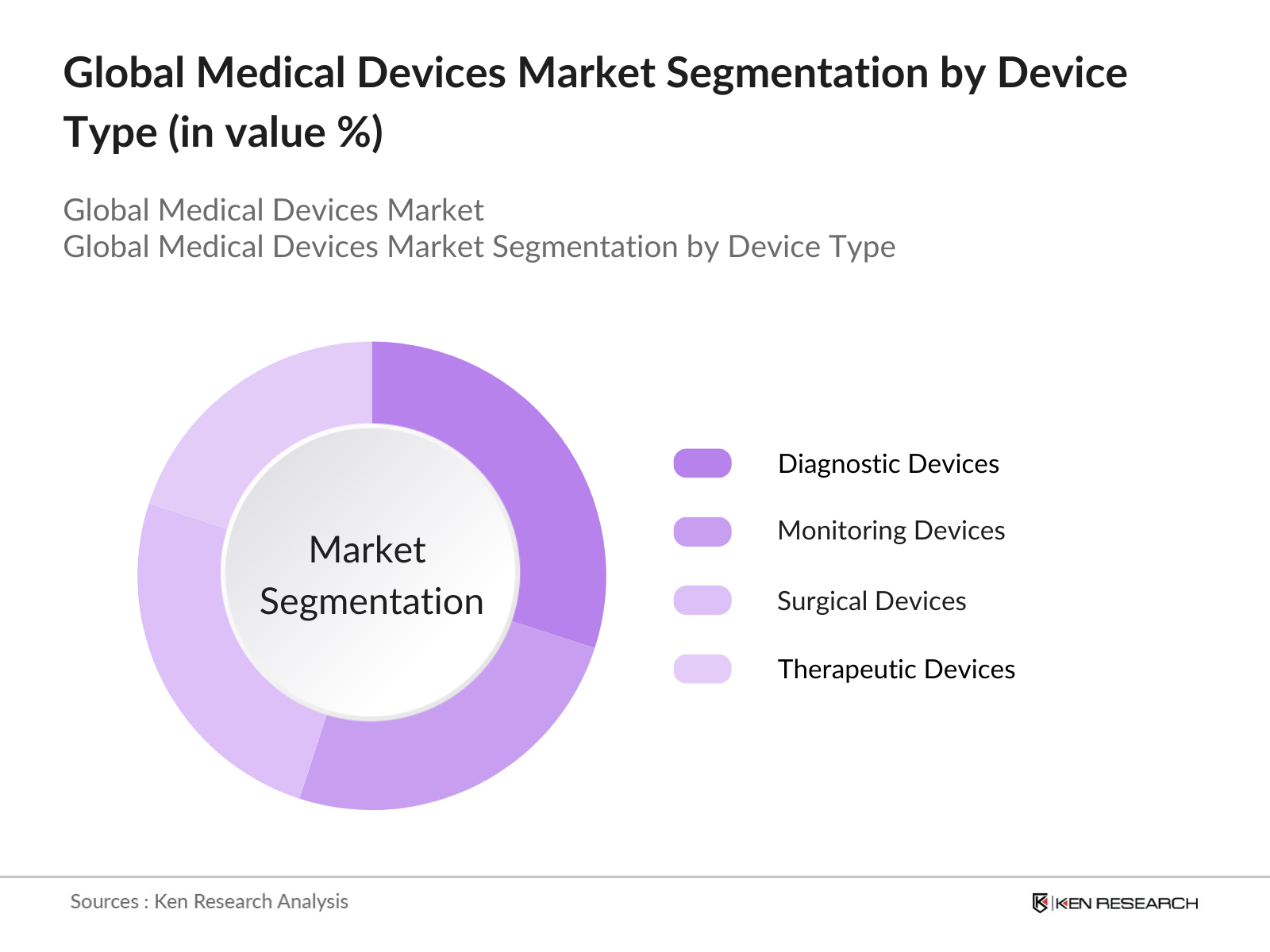

- By Device Type: The global medical devices market is segmented by device type into diagnostic devices, monitoring devices, therapeutic devices, and surgical devices. Among these, diagnostic devices hold a dominant market share due to the increasing need for early and accurate disease detection. Advancements in diagnostic technology, including portable imaging devices and molecular diagnostic equipment, have streamlined diagnosis, contributing to the dominance of this segment. Companies like Siemens Healthineers and Philips Healthcare continue to invest heavily in R&D to maintain leadership in this area.

- By Region: Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share due to advanced healthcare infrastructure and a high demand for technologically advanced medical devices. The region benefits from established market players and innovation-friendly regulations, making it a key center for medical technology development. In Asia-Pacific, rapid economic growth and improving healthcare facilities have positioned the region as a rising market, with China and Japan being prominent due to supportive policies and an aging population.

- By Application: The market is segmented by application into cardiovascular, orthopedic, neurology, respiratory, and other specialized applications. Cardiovascular applications lead the market due to the high prevalence of heart-related ailments worldwide. This dominance is supported by the increasing adoption of minimally invasive procedures and innovative cardiovascular devices that reduce recovery times and improve patient comfort. Major players like Medtronic and Abbott are at the forefront, with a focus on developing next-generation heart monitoring and treatment solutions.

Global Medical Devices Market Competitive Landscape

The Global Medical Devices Market is led by a few dominant players that leverage innovation and strong distribution networks to maintain their market positions. Notable companies include Medtronic, Johnson & Johnson, and Philips Healthcare. These firms invest significantly in R&D and expand through strategic partnerships and acquisitions to increase market presence.

Global Medical Devices Industry Analysis

Growth Drivers

- Aging Population and Chronic Diseases: The global population of individuals aged 65 and older is projected to reach 761 million by 2024, driving demand for medical devices catering to chronic disease management. As life expectancy rises, healthcare systems are increasingly challenged by age-related diseases like cardiovascular ailments, diabetes, and arthritis. Chronic conditions now affect over 1 billion people worldwide, spurring the need for diagnostic equipment and home healthcare solutions. For example, chronic respiratory disease impacts 262 million people globally, with growing healthcare demand in mature economies like Japan and Europe, where over 25% of the population is over 65.

- Technological Advancements: Technological innovations in medical devices have enabled improved diagnostic precision and minimally invasive treatments. For instance, robotic-assisted surgery is rapidly expanding, with the International Federation of Robotics reporting 73,000 surgical robots installed globally by 2024. In imaging, innovations such as high-definition MRI scanners allow detailed diagnosis, enhancing patient outcomes and reducing recovery times. Furthermore, wearables for continuous health monitoring have proliferated, supported by 700 million global users in 2023. These advancements align with healthcare providers' push for digital health solutions, driving sectoral growth.

- Rising Healthcare Expenditure: Global healthcare spending is anticipated to surpass $9 trillion in 2024, driven by expanding healthcare needs and aging populations. Governments in high-income countries, including the United States, which invested $4.3 trillion in healthcare in 2023, allocate substantial budgets to medical infrastructure. Increased spending supports equipment upgrades in public hospitals and strengthens demand for technologically advanced medical devices in emerging economies like India, where healthcare spending has risen by nearly 2% since 2023. This rising expenditure across developed and developing countries promotes market growth.

Market Restraints

- High R&D Costs: Research and development (R&D) in the medical devices sector requires substantial investment, with average development costs for new devices reaching $94 million in 2023. This financial strain often limits innovation, especially among smaller players, as it requires prolonged clinical trials, regulatory approvals, and advanced manufacturing processes. In regions like Europe, R&D funding challenges are significant, as compliance with new regulations has increased development timelines by up to 30%. High R&D costs thus constrain product pipelines and delay time-to-market for advanced devices.

- Regulatory Compliance: Strict regulations in the medical device industry create complexities, particularly in multinational market expansions. For instance, the European Unions MDR increases regulatory compliance costs, raising expenses by up to 10% annually for manufacturers seeking to launch devices in Europe. Moreover, in the U.S., FDA requirements mandate rigorous testing, adding time and significant costs. For emerging markets, the regulatory landscape is fragmented, challenging manufacturers to meet varying requirements across countries. These compliance hurdles restrict companies agility in entering or expanding within regulated market.

Global Medical Devices Market Future Outlook

The Global Medical Devices Market is expected to experience substantial growth over the next five years, driven by advancements in medical technology, increasing demand for portable and minimally invasive devices, and a rise in home healthcare services. Growing investments in wearable technology and artificial intelligence applications are anticipated to fuel market expansion, providing better diagnostics, treatment monitoring, and patient outcomes. Furthermore, emerging markets like Asia-Pacific present lucrative opportunities for growth due to rising healthcare expenditures and improved access to healthcare.

Market Opportunities

- Emerging Markets: Emerging markets present substantial growth potential for medical device companies due to expanding healthcare infrastructures and an increasing middle-class population. Countries like India and Brazil experienced a 15% increase in medical device imports in 2023, driven by a surge in non-communicable diseases and improved healthcare access. Moreover, government spending on healthcare in these regions is on the rise, as demonstrated by Indias budget increase of 25% in 2024 for public health programs, stimulating demand for diagnostic and therapeutic devices.

- Increasing Demand for Home Healthcare: Home healthcare is becoming a major opportunity for the medical device market, with over 50 million patients globally utilizing home-based medical devices in 2024. This trend is supported by aging populations and the rising prevalence of chronic conditions. For instance, portable oxygen concentrators are now widely adopted in North America, where 40 million people live with chronic respiratory conditions. Additionally, diabetes monitoring devices for home use are witnessing increased adoption, supported by improvements in digital health solutions and government programs promoting at-home care alternatives.

Scope of the Report

|

Device Type |

Diagnostic Devices Monitoring Devices Therapeutic Devices Surgical Devices Others |

|

Application |

Cardiovascular Orthopedic Neurology Respiratory Others |

|

End User |

Hospitals and Clinics Home Healthcare Ambulatory Surgical Centers |

|

Technology |

Portable Medical Devices Implantable Medical Devices Wearable Medical Devices |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Medical Device Manufacturers

Healthcare Providers and Hospital Chains

Government Regulatory Bodies (e.g., FDA, EMA)

Insurance Providers and Healthcare Payers

Healthcare Equipment Distributors

Research Institutions and Biomedical Labs

Investor and Venture Capitalist Firms

Health and Technology Startups

Companies

Players Mentioned in the Report:

Medtronic

Johnson & Johnson

Philips Healthcare

GE Healthcare

Abbott Laboratories

Boston Scientific

Stryker Corporation

Siemens Healthineers

B. Braun Melsungen

Olympus Corporation

Smith & Nephew

Terumo Corporation

Baxter International

3M Healthcare

Zimmer Biomet

Table of Contents

1. Global Medical Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. Global Medical Devices Market Size (In USD Million)

2.1. Historical Market Size (In USD Billion)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Milestones

2.4. Market Size Breakdown by Device Category

3. Global Medical Devices Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population and Chronic Diseases

3.1.2. Technological Advancements

3.1.3. Rising Healthcare Expenditure

3.1.4. Favorable Government Regulations

3.2. Market Challenges

3.2.1. High R&D Costs

3.2.2. Regulatory Compliance

3.2.3. Complex Reimbursement Policies

3.3. Opportunities

3.3.1. Emerging Markets

3.3.2. Increasing Demand for Home Healthcare

3.3.3. Expansion in Minimally Invasive Technologies

3.4. Trends

3.4.1. Internet of Medical Things (IoMT)

3.4.2. AI Integration

3.4.3. Digital Health and Telemedicine

3.5. Regulatory Landscape

3.5.1. FDA Regulations

3.5.2. European CE Marking

3.5.3. China's NMPA Standards

3.6. Stakeholder Ecosystem

3.7. Porters Five Forces Analysis

3.8. Competitive Landscape Overview

4. Global Medical Devices Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Diagnostic Devices

4.1.2. Monitoring Devices

4.1.3. Therapeutic Devices

4.1.4. Surgical Devices

4.1.5. Others

4.2. By Application (In Value %)

4.2.1. Cardiovascular

4.2.2. Orthopedic

4.2.3. Neurology

4.2.4. Respiratory

4.2.5. Others

4.3. By End User (In Value %)

4.3.1. Hospitals and Clinics

4.3.2. Home Healthcare

4.3.3. Ambulatory Surgical Centers

4.4. By Technology (In Value %)

4.4.1. Portable Medical Devices

4.4.2. Implantable Medical Devices

4.4.3. Wearable Medical Devices

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Medical Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Medtronic

5.1.2. Johnson & Johnson

5.1.3. Philips Healthcare

5.1.4. GE Healthcare

5.1.5. Siemens Healthineers

5.1.6. Abbott Laboratories

5.1.7. Stryker Corporation

5.1.8. Boston Scientific

5.1.9. Baxter International

5.1.10. B. Braun Melsungen

5.1.11. Olympus Corporation

5.1.12. Zimmer Biomet

5.1.13. Terumo Corporation

5.1.14. Smith & Nephew

5.1.15. 3M Healthcare

5.2. Cross Comparison Parameters (Number of Patents, Headquarters, Revenue, R&D Investments, Product Launch Frequency, Market Presence, Innovation Index, M&A Activity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Partnerships and Collaborations

5.6. Venture Capital Funding Analysis

6. Global Medical Devices Market Regulatory Framework

6.1. Key Compliance Standards

6.2. Certification Processes

6.3. Global Harmonization Efforts

7. Global Medical Devices Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Drivers for Future Growth

8. Global Medical Devices Market Analysts Recommendations

8.1. Investment and R&D Prioritization

8.2. Entry Strategy for Emerging Markets

8.3. Key Target Segment Recommendations

8.4. Risk Mitigation in Regulatory Compliance

9. Disclaimer

10. Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map for stakeholders in the Global Medical Devices Market. This includes extensive desk research and use of secondary and proprietary databases to capture industry-level insights. Key variables affecting market dynamics are identified.

Step 2: Market Analysis and Construction

This step includes data compilation from historical records, assessing market penetration and device usage trends. An analysis of revenue generation from major sub-segments is conducted to ensure accuracy in estimating market size and growth.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed for market trends and growth projections are validated through expert consultations, including interviews with representatives from leading device manufacturers and industry analysts. This step ensures reliable and nuanced market insights.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with medical device manufacturers provides insights into product segmentations, sales performance, and consumer preferences. This enhances the accuracy and validity of market statistics and trends.

Frequently Asked Questions

01. How big is the Global Medical Devices Market?

The Global Medical Devices Market is valued at USD 518 billion, driven by rapid technological advancements and increasing demand for efficient healthcare solutions worldwide.

02. What are the challenges in the Global Medical Devices Market?

Challenges include high R&D costs, stringent regulatory compliance requirements, and complex reimbursement processes, which can hinder market growth and innovation.

03. Who are the major players in the Global Medical Devices Market?

Key players include Medtronic, Johnson & Johnson, Philips Healthcare, GE Healthcare, and Abbott Laboratories, all of which have a strong global presence and broad product portfolios.

04. What factors drive growth in the Global Medical Devices Market?

The market's growth is driven by an aging global population, increased prevalence of chronic diseases, technological innovations, and a demand for minimally invasive devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.