Global Menopause Supplement Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD6501

December 2024

100

About the Report

Global Menopause Supplement Market Overview

- The global menopause supplement market, valued at USD 925 million, is primarily driven by the increasing awareness of womens health and the rising prevalence of menopause symptoms among aging women. The demand for natural and herbal supplements is growing as consumers seek non-hormonal alternatives to manage symptoms such as hot flashes, night sweats, and mood swings. Additionally, the expanding e-commerce platforms have allowed easier access to these products, further driving market growth.

- Countries like the United States, the United Kingdom, and Germany dominate the global menopause supplement market due to their well-established healthcare infrastructure, high consumer awareness, and a large aging female population. In the U.S., for example, the aging population and an increasing preference for herbal remedies play a crucial role in the market's growth. The presence of major supplement manufacturers and innovation in product development also contribute to the dominance of these regions.

- Vegan and non-GMO supplements are becoming increasingly important in the menopause supplement market as consumer preferences shift toward cleaner, more ethical options. The U.S. Food and Drug Administration (FDA) reported in 2024 that 35% of new dietary supplements entering the market are vegan or certified non-GMO. This aligns with the broader health and sustainability trends influencing consumer behavior, particularly in Europe and North America, where there is a growing demand for plant-based, environmentally friendly products.

Global Menopause Supplement Market Segmentation

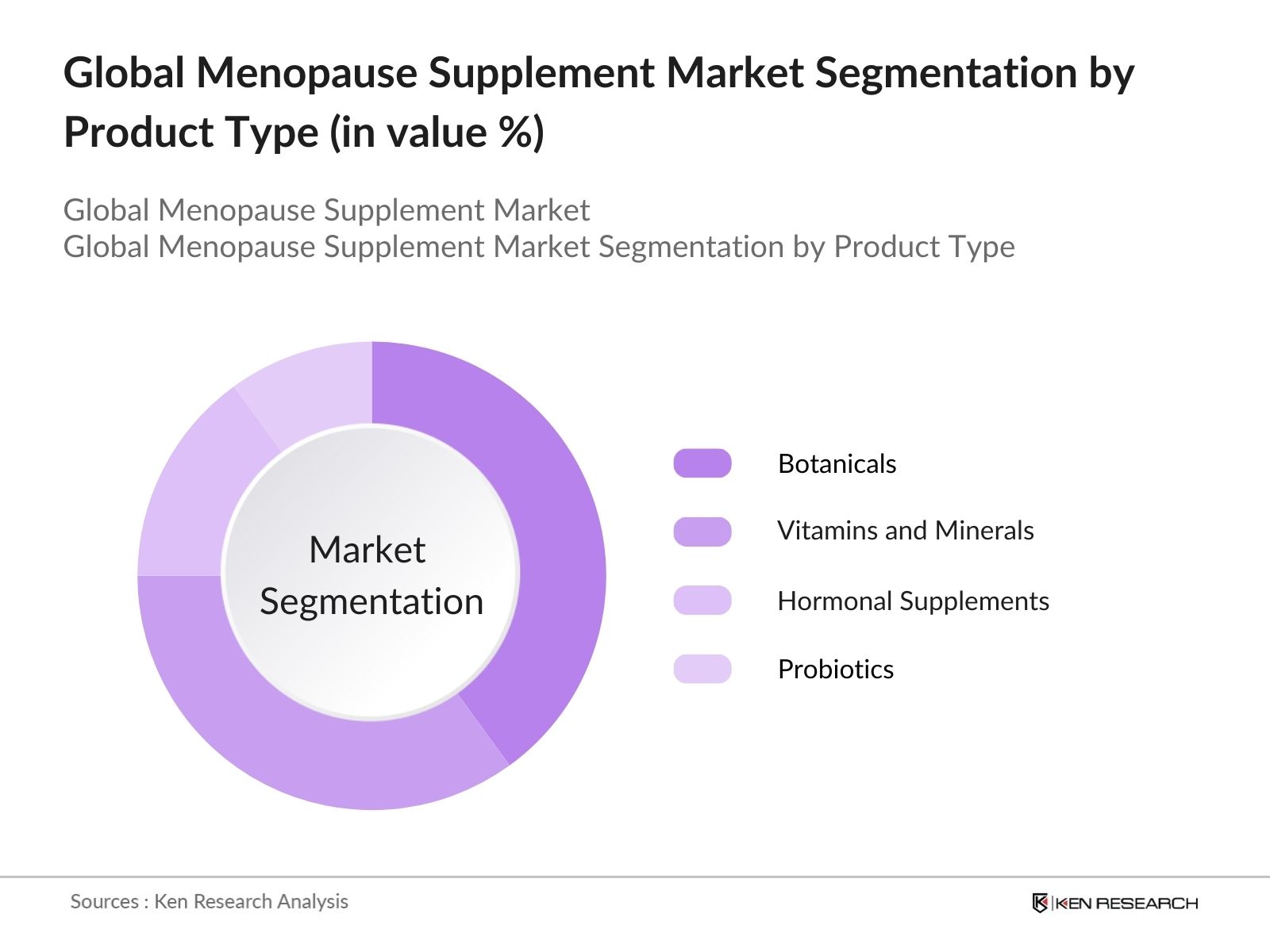

- By Product Type: The menopause supplement market is segmented by product type into vitamins and minerals, botanicals, hormonal supplements, probiotics, and combination supplements.

Recently, botanicals have gained a dominant market share due to their popularity as natural remedies. Consumers are increasingly turning to plant-based supplements such as black cohosh and red clover, which are known to alleviate common menopause symptoms. The demand for these products is further fueled by growing concerns over the side effects associated with hormonal therapies.

- By Region: The menopause supplement market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads the market due to its large aging population and the increasing acceptance of dietary supplements as part of women's healthcare. Europe follows closely behind, driven by significant investments in research and innovation by local manufacturers. Meanwhile, Asia Pacific is showing promising growth due to rising healthcare awareness and the increasing presence of global players entering the market.

- By Dosage Form: The menopause supplement market is segmented by dosage form into tablets, capsules, softgels, powders, and liquids. Capsules hold the largest market share within this segment as they offer ease of consumption and better absorption rates. They are often favored for botanical and probiotic supplements, providing an efficient way to deliver active ingredients. Tablets and softgels are also widely accepted, but capsules continue to dominate due to their consumer-friendly attributes and advancements in encapsulation technologies.

Global Menopause Supplement Market Competitive Landscape

The global menopause supplement market is consolidated, with a few key players dominating the space. These companies lead through robust product portfolios, continuous innovation, and extensive distribution networks. The competitive landscape is shaped by both international and regional players, with some companies focusing on herbal and natural products, while others emphasize scientific formulations and hormonal supplements.

Global Menopause Supplement Industry Analysis

Growth Drivers

- Increasing Awareness of Womens Health: There has been a significant rise in awareness of womens health globally, driving the demand for menopause supplements. According to the World Health Organization (WHO), over 1.1 billion women worldwide are expected to be aged 50 or older in 2024, a key demographic affected by menopause. Public health initiatives, such as the UNs 2022 Global Strategy for Women's, Children's, and Adolescents' Health, emphasize the importance of womens health. This has led to a surge in demand for supplements to alleviate menopausal symptoms, particularly in regions like North America and Europe, where healthcare access is stronger.

- Rising Prevalence of Menopause Symptoms: Menopause symptoms such as hot flashes, night sweats, and mood swings are affecting a growing number of women globally. A 2024 report by the U.S. National Institutes of Health (NIH) stated that nearly 80% of women aged 4555 experience some form of menopause symptoms, leading to increased demand for symptom management solutions like supplements. Countries with aging populations, such as Japan, have seen a sharp increase in supplement consumption due to a higher proportion of older women. This growing need for relief from menopause symptoms is driving demand for supplements aimed at symptom control.

- Growing Adoption of Natural and Herbal Supplements: Natural and herbal supplements have become increasingly popular for managing menopause symptoms due to their perceived safety and efficacy. The U.S. Department of Agriculture (USDA) reports that in 2024, the use of natural supplements, such as those containing black cohosh and soy isoflavones, increased by 22 million adults compared to 2022. Consumers are becoming more health-conscious and looking for natural, hormone-free alternatives, contributing to a broader shift toward plant-based healthcare options. This shift is seen across both developed and emerging markets, where traditional medicine practices are aligning with modern health trends.

Market Restraints

- Regulatory Approvals and Compliance (FDA, EMA): The regulatory landscape for menopause supplements remains stringent, particularly in regions like the U.S. and Europe. The U.S. Food and Drug Administration (FDA) requires that dietary supplements adhere to strict guidelines, but as of 2024, only 35% of supplements marketed for menopause in the U.S. had received full approval. Similarly, the European Medicines Agency (EMA) reports that 29% of natural menopause products face delays due to labeling and ingredient compliance. These regulatory hurdles are slowing market entry for new products, especially for those with herbal or natural ingredients that require thorough validation.

- Product Efficacy and Consumer Trust: Consumer trust remains a significant challenge in the menopause supplement market. A study by the U.K.s National Health Service (NHS) in 2023 revealed that 47% of consumers question the efficacy of menopause supplements due to inconsistent results and a lack of clinical trials. Many supplements claim to alleviate symptoms, but without FDA or EMA backing, consumer skepticism remains high. Manufacturers face the challenge of building trust through transparent ingredient sourcing, rigorous clinical testing, and proper labeling, especially in markets where consumers are highly informed and cautious about healthcare products.

Global Menopause Supplement Market Future Outlook

Over the next five years, the menopause supplement market is expected to witness considerable growth, driven by increasing consumer awareness, advancements in botanical and non-hormonal formulations, and the expansion of e-commerce platforms. Companies are focusing on innovation in personalized nutrition, adapting their products to meet the unique needs of individual consumers. In addition, emerging markets in the Asia Pacific and Latin America present new growth opportunities as consumer demand for preventive healthcare rises.

Market Opportunities

- Innovation in Formulation (Botanicals, Hormone-Free): There is significant room for innovation in the formulation of menopause supplements. According to the U.S. National Center for Biotechnology Information (NCBI), botanicals and hormone-free options are becoming increasingly popular, with more than 50% of new supplements launched in 2024 including adaptogens and botanicals like ashwagandha and maca root. This innovation aligns with the growing demand for natural alternatives, driven by safety concerns associated with hormone-based treatments. Formulations that incorporate scientifically backed ingredients offer a substantial opportunity for growth in this sector.

- Untapped Emerging Markets: Emerging markets offer substantial opportunities for menopause supplements due to rising middle-class populations and increased internet access. The World Bank reported that in 2024, more than 430 million women aged 40-60 live in emerging economies like India and Brazil, presenting a significant demand for healthcare solutions. Internet penetration in these countries now exceeds 60%, providing a growing platform for e-commerce sales of health supplements. Manufacturers targeting these markets with affordable and culturally relevant products stand to benefit from untapped consumer bases.

Scope of the Report

|

By Product Type |

Vitamins and Minerals Botanicals Hormonal Supplements Probiotics Combination Supplements |

|

By Dosage Form |

Tablets Capsules Softgels Powders Liquids |

|

By Distribution Channel |

Pharmacies and Drug Stores Supermarkets and Hypermarkets E-commerce Specialty Stores |

|

By Ingredients |

Black Cohosh Soy Isoflavones Red Clover Flaxseed Evening Primrose Oil |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Manufacturers of Dietary Supplements

Womens Healthcare Providers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. FDA, European Food Safety Authority)

Pharmaceutical Companies

E-commerce Platforms

Herbal and Natural Product Companies

Retail Pharmacies

Companies

Players Mentioned in the Report:

Amway

Blackmores

Herbalife Nutrition

Pfizer Inc.

GNC Holdings, Inc.

NOW Foods

Natures Way Products

Jarrow Formulas

The Honest Company

Rainbow Light

Swisse Wellness

Estroven

Life Extension

MegaFood

Pure Encapsulations

Table of Contents

1. Global Menopause Supplement Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Menopause Supplement Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Menopause Supplement Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Awareness of Women's Health

3.1.2. Rising Prevalence of Menopause Symptoms

3.1.3. Growing Adoption of Natural and Herbal Supplements

3.1.4. Expansion of E-commerce Platforms

3.2. Market Challenges

3.2.1. Regulatory Approvals and Compliance (FDA, EMA)

3.2.2. Product Efficacy and Consumer Trust

3.2.3. High Competition from Conventional Pharmaceuticals

3.3. Opportunities

3.3.1. Innovation in Formulation (Botanicals, Hormone-Free)

3.3.2. Untapped Emerging Markets

3.3.3. Increasing Focus on Preventative Healthcare

3.4. Trends

3.4.1. Personalized Nutrition Solutions

3.4.2. Functional Beverages with Menopause Benefits

3.4.3. Incorporation of Probiotics and Adaptogens

3.4.4. Growth in Vegan and Non-GMO Supplements

3.5. Regulatory Landscape

3.5.1. U.S. FDA Guidelines for Dietary Supplements

3.5.2. European Food Safety Authority (EFSA) Regulations

3.5.3. Labeling and Health Claims Restrictions

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Global Menopause Supplement Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Vitamins and Minerals

4.1.2. Botanicals

4.1.3. Hormonal Supplements (Non-Prescription)

4.1.4. Probiotics

4.1.5. Combination Supplements

4.2. By Dosage Form (In Value %)

4.2.1. Tablets

4.2.2. Capsules

4.2.3. Softgels

4.2.4. Powders

4.2.5. Liquids

4.3. By Distribution Channel (In Value %)

4.3.1. Pharmacies and Drug Stores

4.3.2. Supermarkets and Hypermarkets

4.3.3. E-commerce

4.3.4. Specialty Stores

4.4. By Ingredients (In Value %)

4.4.1. Black Cohosh

4.4.2. Soy Isoflavones

4.4.3. Red Clover

4.4.4. Flaxseed

4.4.5. Evening Primrose Oil

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Menopause Supplement Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amway

5.1.2. Blackmores

5.1.3. Herbalife Nutrition

5.1.4. Pfizer Inc.

5.1.5. GNC Holdings, Inc.

5.1.6. NOW Foods

5.1.7. Nature's Way Products

5.1.8. Jarrow Formulas

5.1.9. The Honest Company

5.1.10. Rainbow Light

5.1.11. Swisse Wellness

5.1.12. Estroven

5.1.13. Life Extension

5.1.14. MegaFood

5.1.15. Pure Encapsulations

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Reach, R&D Investment, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Menopause Supplement Market Regulatory Framework

6.1. Regional Regulatory Standards (North America, Europe, APAC)

6.2. Ingredient Safety and Testing Requirements

6.3. Certification Processes (Non-GMO, Organic, Vegan Certifications)

7. Global Menopause Supplement Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Menopause Supplement Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Dosage Form (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Ingredients (In Value %)

8.5. By Region (In Value %)

9. Global Menopause Supplement Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved identifying key variables affecting the global menopause supplement market, including consumer preferences, regulatory impacts, and technological advancements. This step leveraged extensive desk research and proprietary industry databases to outline major stakeholders.

Step 2: Market Analysis and Construction

Historical data was compiled to analyze market trends, growth drivers, and challenges. This analysis also included detailed market segmentation and revenue estimations, focusing on the leading product types, dosage forms, and regional markets.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts were consulted to validate market hypotheses and gather operational insights. This process involved interviews with professionals from key companies in the dietary supplement industry to ensure accuracy and relevance in the analysis.

Step 4: Research Synthesis and Final Output

The final phase synthesized all collected data to produce a comprehensive and validated market analysis. Cross-referencing with multiple industry sources helped ensure that the data presented is reliable and actionable for stakeholders in the menopause supplement market.

Frequently Asked Questions

01. How big is the Global Menopause Supplement Market?

The global menopause supplement market, valued at USD 925 million, is growing due to increasing awareness of menopause-related health issues and the rising demand for natural and herbal supplements.

02. What are the challenges in the Global Menopause Supplement Market?

The market faces challenges such as stringent regulatory approvals, product efficacy concerns, and competition from pharmaceutical alternatives. High consumer skepticism regarding the effectiveness of supplements also impacts growth.

03. Who are the major players in the Global Menopause Supplement Market?

Major players include Amway, Blackmores, Herbalife Nutrition, Pfizer Inc., and GNC Holdings. These companies dominate due to their extensive product portfolios, strong distribution networks, and continuous investment in R&D.

04. What are the growth drivers of the Global Menopause Supplement Market?

Key drivers include the rising prevalence of menopause symptoms, increasing consumer demand for natural remedies, and growing awareness of womens health. Additionally, the expansion of online retail channels boosts accessibility to these products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.