Region:Global

Author(s):Geetanshi

Product Code:KRAB0135

Pages:84

Published On:August 2025

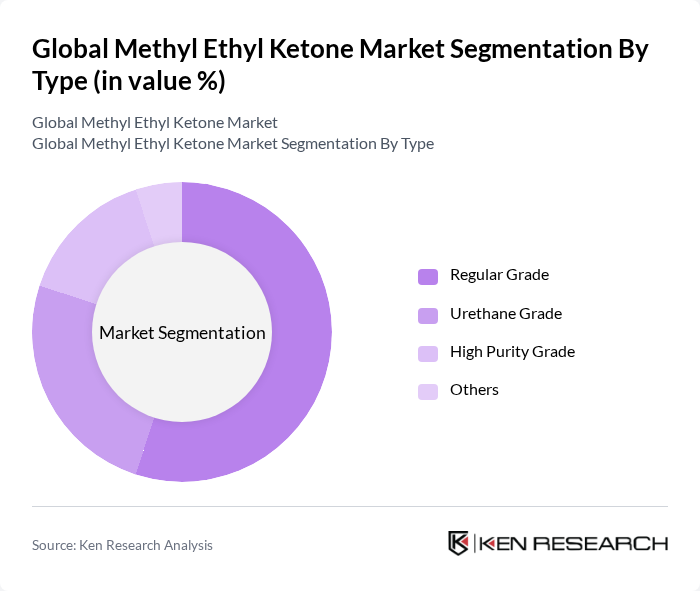

By Type:The market is segmented into Regular Grade, Urethane Grade, High Purity Grade, and Others. Regular Grade is the most widely used due to its cost-effectiveness and versatility across applications such as paints, coatings, and adhesives. Urethane Grade is increasingly adopted in specialized polyurethane applications, while High Purity Grade is preferred in electronics and pharmaceutical industries requiring stringent quality standards. The Others category includes niche formulations for specific industrial requirements .

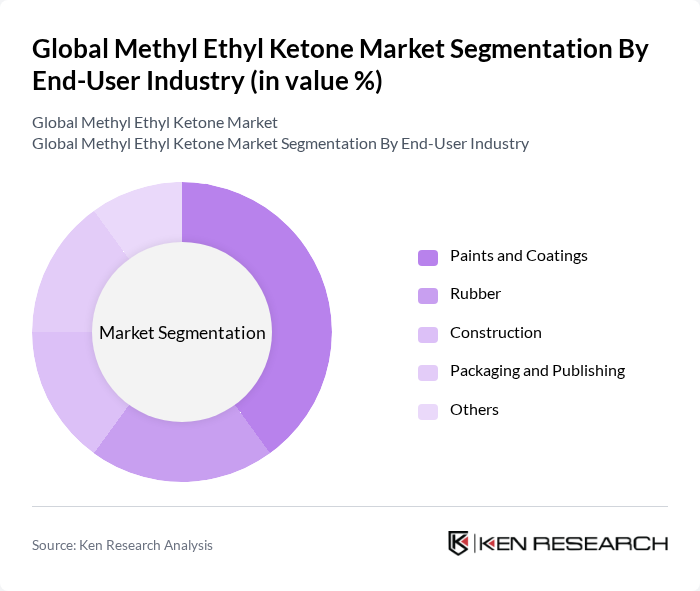

By End-User Industry:The end-user industries for Methyl Ethyl Ketone include Paints and Coatings, Rubber, Construction, Packaging and Publishing, and Others. The Paints and Coatings segment is the largest consumer, driven by demand for high-quality finishes in automotive and architectural applications. The Rubber and Construction sectors also contribute significantly, as MEK is essential for adhesives, sealants, and rubber processing. Packaging and Publishing utilize MEK in printing inks and flexible packaging, while the Others segment includes applications in electronics, pharmaceuticals, and aerospace .

The Global Methyl Ethyl Ketone Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Shell Chemicals, LyondellBasell Industries N.V., Mitsubishi Chemical Corporation, Eastman Chemical Company, BASF SE, INEOS Group Holdings S.A., Arkema S.A., OQ Chemicals, Formosa Plastics Corporation, Taminco (a subsidiary of Eastman Chemical Company), Kraton Corporation, Solvay S.A., Aekyung Petrochemical Co., Ltd., LG Chem Ltd., Sasol Limited, Maruzen Petrochemical Co., Ltd., Zibo Qixiang Tengda Chemical Co., Ltd., Cetex Petrochemicals Limited, and Nouryon Chemicals B.V. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the methyl ethyl ketone market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt bio-based solvents, the demand for eco-friendly MEK alternatives is expected to rise. Additionally, the expansion of e-commerce platforms for chemical distribution will enhance market accessibility, allowing manufacturers to reach a broader customer base. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in various applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Regular Grade Urethane Grade High Purity Grade Others |

| By End-User Industry | Paints and Coatings Rubber Construction Packaging and Publishing Others |

| By Application | Solvent Resin Printing Ink Adhesive Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Drums IBC Totes Bulk Others |

| By Form | Liquid Form Solid Form Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coatings Industry | 60 | Product Managers, R&D Directors |

| Adhesives and Sealants | 50 | Procurement Managers, Technical Sales Representatives |

| Pharmaceuticals | 40 | Formulation Scientists, Quality Control Managers |

| Automotive Sector | 55 | Manufacturing Engineers, Supply Chain Analysts |

| Consumer Goods | 45 | Marketing Managers, Product Development Specialists |

The Global Methyl Ethyl Ketone Market is valued at approximately USD 3.2 billion, driven by increasing demand for high-performance solvents in various industries, including paints, coatings, adhesives, and printing inks.