Global Microcontrollers Market Outlook to 2030

Region:Global

Author(s):Shivani

Product Code:KROD6349

October 2024

87

About the Report

Global Microcontrollers Market Overview

- The global microcontrollers market is valued at USD 8.52 billion, driven by the expanding adoption of embedded systems across various industries, including automotive, consumer electronics, and industrial automation. The rising demand for smart devices and connected ecosystems, especially with the growing presence of IoT applications, is contributing significantly to the market's growth. The integration of microcontrollers in medical devices and electric vehicles further strengthens the market, positioning it for sustained development.

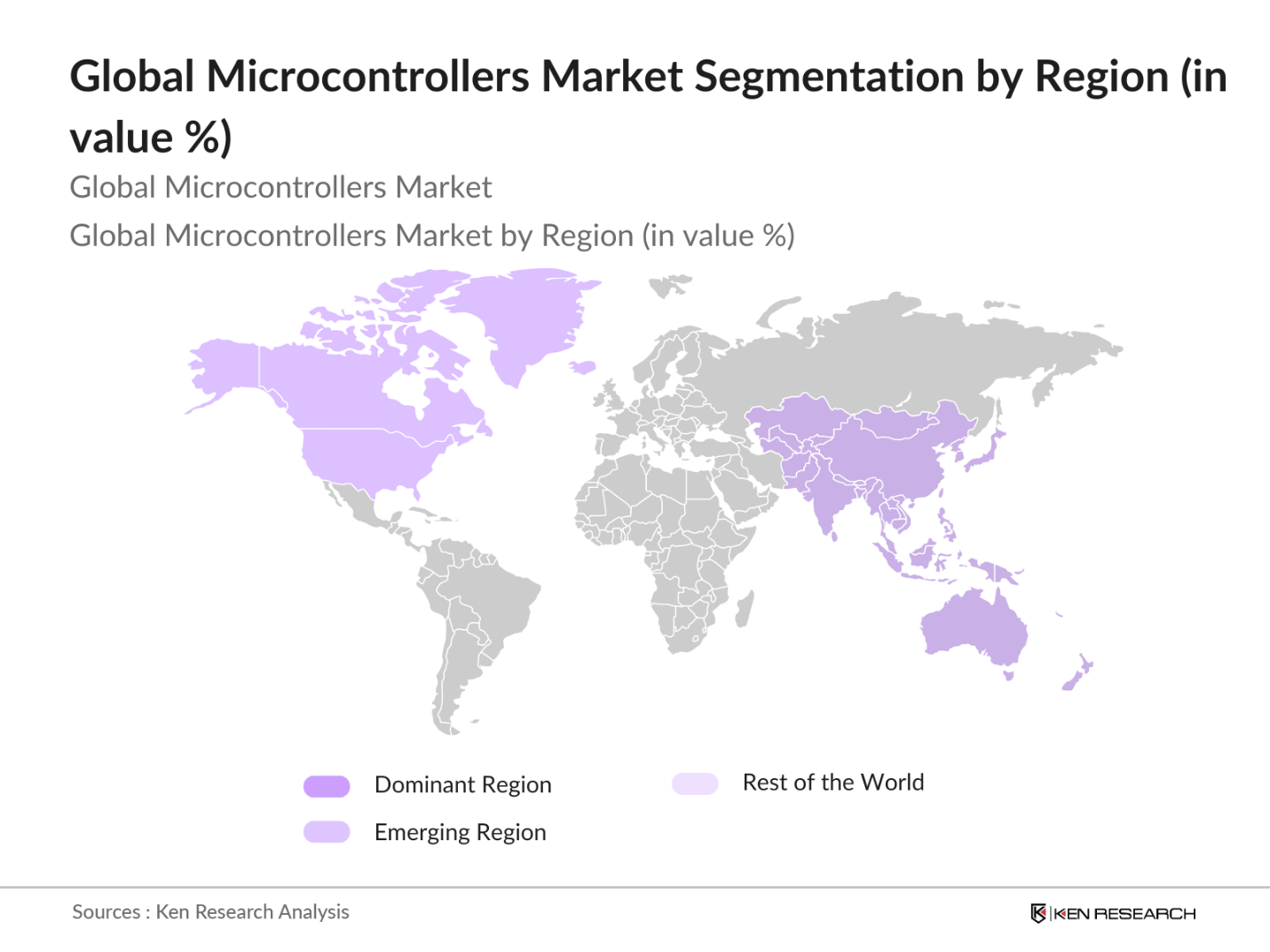

- North America and Asia-Pacific dominate the global microcontrollers market. North America's dominance is attributed to its advanced automotive industry and robust demand for IoT-enabled devices. Meanwhile, Asia-Pacific, particularly countries like China and Japan, leads due to the region's significant manufacturing base and its adoption of 32-bit microcontrollers in consumer electronics and industrial automation. The presence of key semiconductor manufacturers in these regions also contributes to their leading positions in the market.

- Governments globally are implementing national policies to boost microelectronics manufacturing and adoption. In 2023, Chinas National Integrated Circuit Industry Development Guidelines allocated over $150 billion to support local MCU production, reducing dependence on foreign imports. The U.S. CHIPS and Science Act also provided over $52 billion in funding to strengthen domestic semiconductor manufacturing, including microcontrollers. Such policies are driving innovation and competition in MCU development, encouraging the adoption of advanced, energy-efficient microcontrollers for various industries, from automotive to consumer electronics.

Global Microcontrollers Market Segmentation

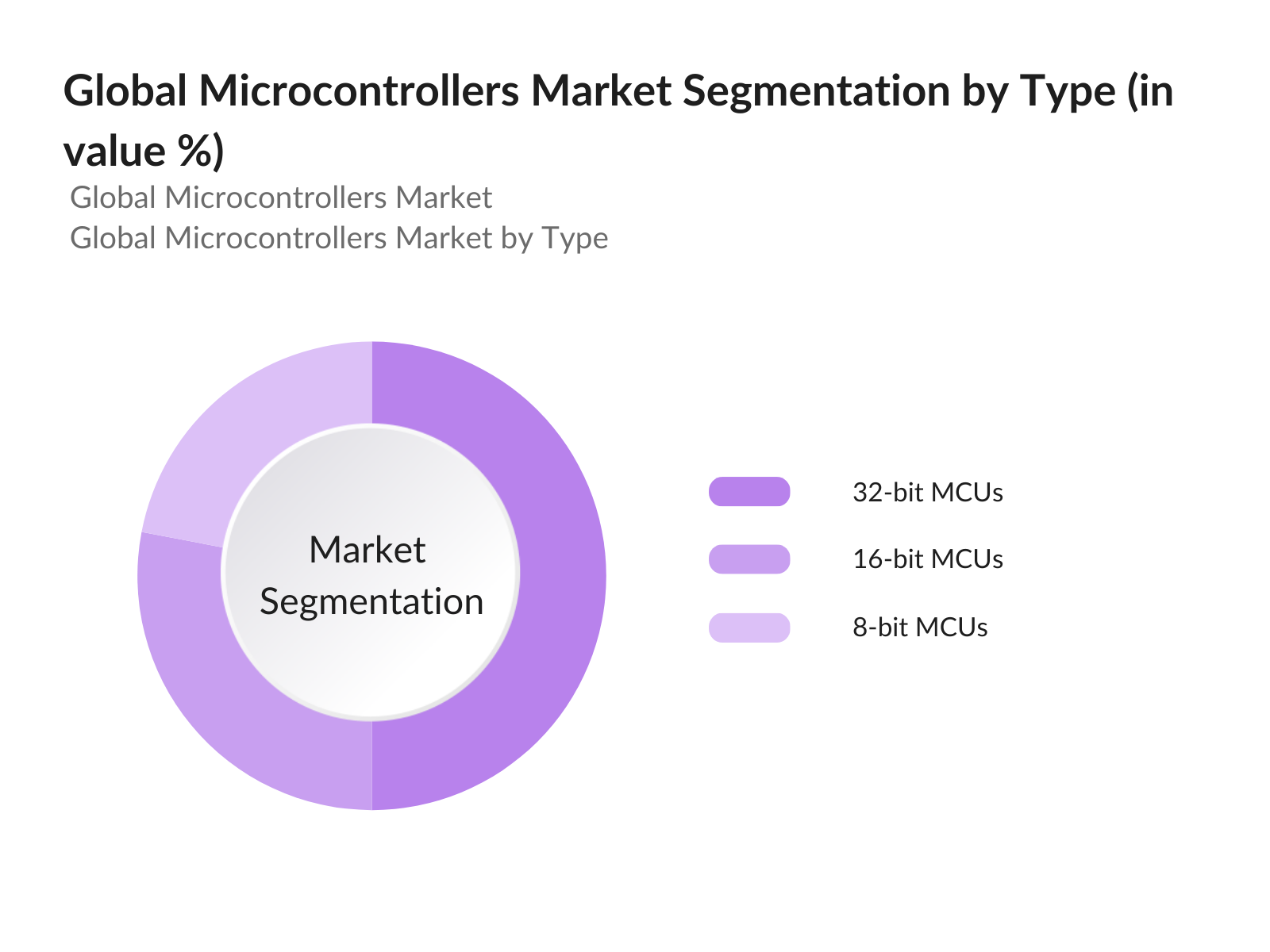

By Type: The global microcontrollers market is segmented by type into 8-bit, 16-bit, and 32-bit microcontrollers. The 32-bit segment holds the dominant share, driven by its superior processing power and efficiency in high-performance applications, such as automotive control systems and smart home devices. With the rising complexity of embedded systems, the demand for 32-bit MCUs continues to increase, particularly in regions where industrial automation and IoT adoption are on the rise.

|

Type |

Market Share (2023) |

|---|---|

|

8-bit MCUs |

22% |

|

16-bit MCUs |

28% |

|

32-bit MCUs |

50% |

By Region: The global microcontrollers market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific holds the largest share, driven by the region's strong electronics manufacturing industry, particularly in China, Japan, and South Korea. The high demand for microcontrollers in consumer electronics and industrial automation in this region has made Asia-Pacific a dominant player in the global market.

|

Region |

Market Share (2023) |

|---|---|

|

North America |

30% |

|

Europe |

20% |

|

Asia-Pacific |

35% |

|

Middle East & Africa |

10% |

|

Latin America |

5% |

Global Microcontrollers Market Competitive Landscape

The global microcontrollers market is dominated by key players that have a significant presence in the semiconductor industry. These companies are known for their continuous innovation, strong product portfolios, and investment in research and development (R&D). The competitive landscape is characterized by intense rivalry among these firms, with a focus on product differentiation, collaborations, and expansion into new markets.

|

Company |

Year Established |

Headquarters |

No. of Employees |

Annual Revenue (USD) |

Key Products |

R&D Investment |

Global Presence |

|

Microchip Technology Inc. |

1989 |

Chandler, Arizona, USA |

|||||

|

NXP Semiconductors |

2006 |

Eindhoven, Netherlands |

|||||

|

Renesas Electronics Corp. |

2010 |

Tokyo, Japan |

|||||

|

Texas Instruments |

1930 |

Dallas, Texas, USA |

|||||

|

STMicroelectronics |

1987 |

Geneva, Switzerland |

Global Microcontrollers Market Analysis

Market Growth Drivers

- Rising Demand for Consumer Electronics: The demand for microcontroller units (MCUs) is surging due to the increased production of consumer electronics like smartphones, smart home devices, and wearables. According to World Bank data, global electronic manufacturing rose by over 7 million units between 2022, driven by growing technological consumption in Asia-Pacific and North America. For instance, in 2023, over 1.5 billion smartphones were shipped globally, each incorporating several MCUs for functionalities like power management and connectivity. The expansion of 5G networks further supports the adoption of more advanced MCUs with faster data processing capabilities.

- Increased Automation in Industrial Applications: The automation industry is rapidly growing, with industrial robots reaching over 3 million units globally by 2023. Embedded systems, powered by microcontrollers, are crucial for automation in sectors like automotive and manufacturing. For example, the automotive industry alone uses about 30 MCUs per vehicle for applications ranging from power control to safety mechanisms. Government initiatives like "Industry 4.0" in Europe and "Made in China 2025" are accelerating the adoption of MCUs to automate processes, ensuring precision and efficiency.

- Government Support for IoT Infrastructure: Governments worldwide are investing heavily in IoT infrastructure to enable smart cities and smart grids. By 2024, the global IoT devices count is expected to surpass 50 billion, requiring billions of MCUs to operate. For instance, the European Union's Horizon 2024 plan allocates over $20 billion for IoT and connected infrastructure development. In the U.S., the government is funding over $1 billion for smart grid projects, driving the demand for low-power and secure MCUs to manage interconnected systems effectively. These initiatives bolster the need for scalable MCU production.

Market Challenges:

- High Development Costs for Embedded Systems: Developing high-performance MCUs is becoming increasingly costly due to rising material and research costs. According to the World Bank, global R&D expenditure for semiconductor technology reached $630 billion in 2023, with a significant portion allocated to MCU development. Furthermore, advanced semiconductor materials like gallium nitride, used in modern MCUs, are 3x more expensive than traditional silicon. This cost structure affects companies' ability to mass-produce MCUs at competitive prices, limiting their accessibility in emerging markets.

- Complex Design Processes: The complexity of designing MCUs for modern applications, particularly in industries like automotive and healthcare, is increasing. According to data from the U.S. Department of Commerce, the time required to design an advanced MCU has risen by 30% over the last five years. This complexity stems from the need to integrate security features, energy efficiency, and connectivity within smaller chips. As a result, companies face delays in bringing new MCU models to market, hindering innovation cycles and potentially losing market share to competitors.

Global Microcontrollers Market Future Outlook

The global microcontrollers market is expected to witness significant growth in the coming years. Advancements in IoT, 5G, and AI will further fuel the demand for microcontrollers in smart devices and connected ecosystems. The automotive industrys shift towards electric and autonomous vehicles will remain a key driver, pushing for more powerful and efficient MCUs. Additionally, the growing importance of low-power consumption MCUs for wearable devices and medical applications will present new opportunities for market expansion.

Market Opportunities:

- Rise of 32-bit Microcontrollers: 32-bit MCUs are gaining traction across various sectors due to their superior performance in handling complex tasks, such as real-time processing in AI and IoT applications. According to the U.S. Semiconductor Industry Association, shipments of 32-bit MCUs grew by 12 million units in 2023 alone. These MCUs are increasingly preferred in industries like automotive and healthcare for their ability to process large datasets while ensuring energy efficiency and reliability.

- Adoption of Edge Computing: Edge computing, where data is processed closer to the source, is driving the adoption of MCUs that can handle local data processing with minimal latency. In 2023, a significant number of IoT solutions implemented edge computing in sectors such as healthcare, industrial automation, and smart cities, according to a report by the World Economic Forum. The capability of MCUs to perform real-time data analytics at the edge allows companies to improve operational efficiency, speed up decision-making processes, and reduce dependence on cloud infrastructure, enabling faster response times and enhanced reliability for critical applications.

Scope of the Report

|

By Type |

8-bit Microcontrollers 16-bit Microcontrollers 32-bit Microcontrollers |

|

By Application |

Automotive Consumer Electronics Industrial Automation Medical Devices |

|

By Technology |

Embedded Microcontrollers External Microcontrollers |

|

By Architecture |

Harvard Architecture Von Neumann Architecture |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Automotive Manufacturers

Consumer Electronics Companies

Industrial Automation Providers

Medical Device Manufacturers

Telecommunications Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FCC, ITU, NHTSA)

IoT Solution Providers

Companies

Major Players

-

Microchip Technology Inc.

NXP Semiconductors

Renesas Electronics Corporation

Texas Instruments

STMicroelectronics

Infineon Technologies

Analog Devices, Inc.

Cypress Semiconductor (Infineon)

Silicon Labs

Toshiba Corporation

Nordic Semiconductor

Maxim Integrated

Atmel Corporation (Microchip)

ON Semiconductor

Espressif Systems

Table of Contents

1. Global Microcontrollers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Microcontrollers Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Microcontrollers Market Analysis

3.1. Growth Drivers (Microcontroller Unit Sales, Embedded Systems Adoption, Technological Advancements)

3.1.1. Rising Demand for Consumer Electronics

3.1.2. Increased Automation in Industrial Applications

3.1.3. Government Support for IoT Infrastructure

3.2. Market Challenges (Cost of High-Performance MCUs, Scalability Issues)

3.2.1. High Development Costs for Embedded Systems

3.2.2. Complex Design Processes

3.2.3. Security Vulnerabilities

3.3. Opportunities (Advancements in AI, IoT-Enabled Devices)

3.3.1. Smart Home Applications

3.3.2. Expansion in Automotive Sector

3.3.3. Emerging Markets Expansion

3.4. Trends (Integration of AI, Energy Efficiency in MCUs)

3.4.1. Rise of 32-bit Microcontrollers

3.4.2. Growing Demand for Low-Power MCUs

3.4.3. Adoption of Edge Computing

3.5. Government Regulations (Compliance with Environmental Standards)

3.5.1. National Microelectronics Policies

3.5.2. IoT Security Frameworks

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Microcontrollers Market Segmentation

4.1. By Type (In Value %)

4.1.1. 8-bit Microcontrollers

4.1.2. 16-bit Microcontrollers

4.1.3. 32-bit Microcontrollers

4.2. By Application (In Value %)

4.2.1. Automotive

4.2.2. Consumer Electronics

4.2.3. Industrial Automation

4.2.4. Medical Devices

4.3. By Technology (In Value %)

4.3.1. Embedded Microcontrollers

4.3.2. External Microcontrollers

4.4. By Architecture (In Value %)

4.4.1. Harvard Architecture

4.4.2. Von Neumann Architecture

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Microcontrollers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Microchip Technology Inc.

5.1.2. NXP Semiconductors

5.1.3. Renesas Electronics Corporation

5.1.4. Texas Instruments

5.1.5. STMicroelectronics

5.1.6. Infineon Technologies

5.1.7. Analog Devices, Inc.

5.1.8. Cypress Semiconductor (Infineon)

5.1.9. Silicon Labs

5.1.10. Toshiba Corporation

5.1.11. Nordic Semiconductor

5.1.12. Maxim Integrated

5.1.13. Atmel Corporation (Microchip)

5.1.14. ON Semiconductor

5.1.15. Espressif Systems

5.2. Cross-Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Range, R&D Investment, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Microcontrollers Market Regulatory Framework

6.1. IoT Device Certification

6.2. Microcontroller Standards and Protocols

6.3. Environmental and Energy-Efficiency Regulations

7. Global Microcontrollers Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Microcontrollers Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Architecture (In Value %)

8.5. By Region (In Value %)

9. Global Microcontrollers Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this initial step, we map the microcontrollers market's ecosystem, identifying major stakeholders, including semiconductor manufacturers, automotive companies, and consumer electronics producers. Extensive desk research and data from proprietary databases are used to identify the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This step involves analyzing historical data on market trends, penetration rates, and revenue generation in the microcontrollers market. Various factors such as market maturity, technological advancements, and market penetration are evaluated to construct reliable revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about the market's growth drivers and challenges are validated through consultations with industry experts. These interviews provide insights into the operational and financial aspects of the market, complementing secondary research data.

Step 4: Research Synthesis and Final Output

Finally, a synthesis of all research inputs is conducted, including direct engagement with key manufacturers to gather data on product segments, sales performance, and consumer preferences. This ensures the final output is accurate and reflective of current market conditions.

Frequently Asked Questions

1 How big is the global microcontrollers market?

The global microcontrollers market is valued at USD 8.52 billion, driven by the rising adoption of embedded systems across industries such as automotive, consumer electronics, and industrial automation.

2 What are the challenges in the microcontrollers market?

Challenges include the high cost of developing advanced MCUs, security vulnerabilities in IoT applications, and the complexity of designing microcontroller-based systems.

3 Who are the major players in the global microcontrollers market?

Key players include Microchip Technology Inc., NXP Semiconductors, Renesas Electronics Corporation, Texas Instruments, and STMicroelectronics, among others.

4 What are the growth drivers for the microcontrollers market?

The market is driven by the rising demand for smart devices, connected ecosystems, and advanced automotive technologies like electric and autonomous vehicles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.