Global Microwave Devices Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD2020

December 2024

95

About the Report

Global Microwave Devices Market Overview

- The global microwave devices market reached USD 8 billion, according to a report by the International Trade Administration. This growth is primarily driven by the increasing demand for advanced communication systems, radar technologies, and satellite communications across various industries such as defense, aerospace, and telecommunications. The significant advancements in 5G infrastructure and the growing adoption of connected devices have accelerated the demand for microwave technologies globally, boosting the market.

- Leading players in this market include Thales Group, Qorvo Inc., Keysight Technologies, L3Harris Technologies, and Analog Devices Inc. These companies are driving innovation and hold a strong market position through diverse product portfolios in sectors like defense, space exploration, and telecommunications. Their extensive research and development initiatives, strategic partnerships, and acquisitions are helping them maintain leadership in this competitive market.

- In July 2023, Thales Group secured a major contract to supply microwave communication systems for a new satellite project launched by the European Space Agency (ESA). The project, aimed at expanding global satellite communication coverage, will leverage Thales' cutting-edge microwave devices to ensure robust data transmission across regions. This development is a significant boost for the microwave device market, expected to impact satellite communications over the next decade.

- Cities like San Jose (USA), Shenzhen (China), and Munich (Germany) dominate the microwave devices market due to their strong technology ecosystems and the presence of major manufacturers. San Jose, with its proximity to Silicon Valley, leads in innovation, while Shenzhen benefits from massive electronics production capabilities. Munich, as a key player in Europe, thrives on strong collaborations between research institutions and the private sector, further driving the regional microwave market growth.

Global Microwave Devices Market Segmentation

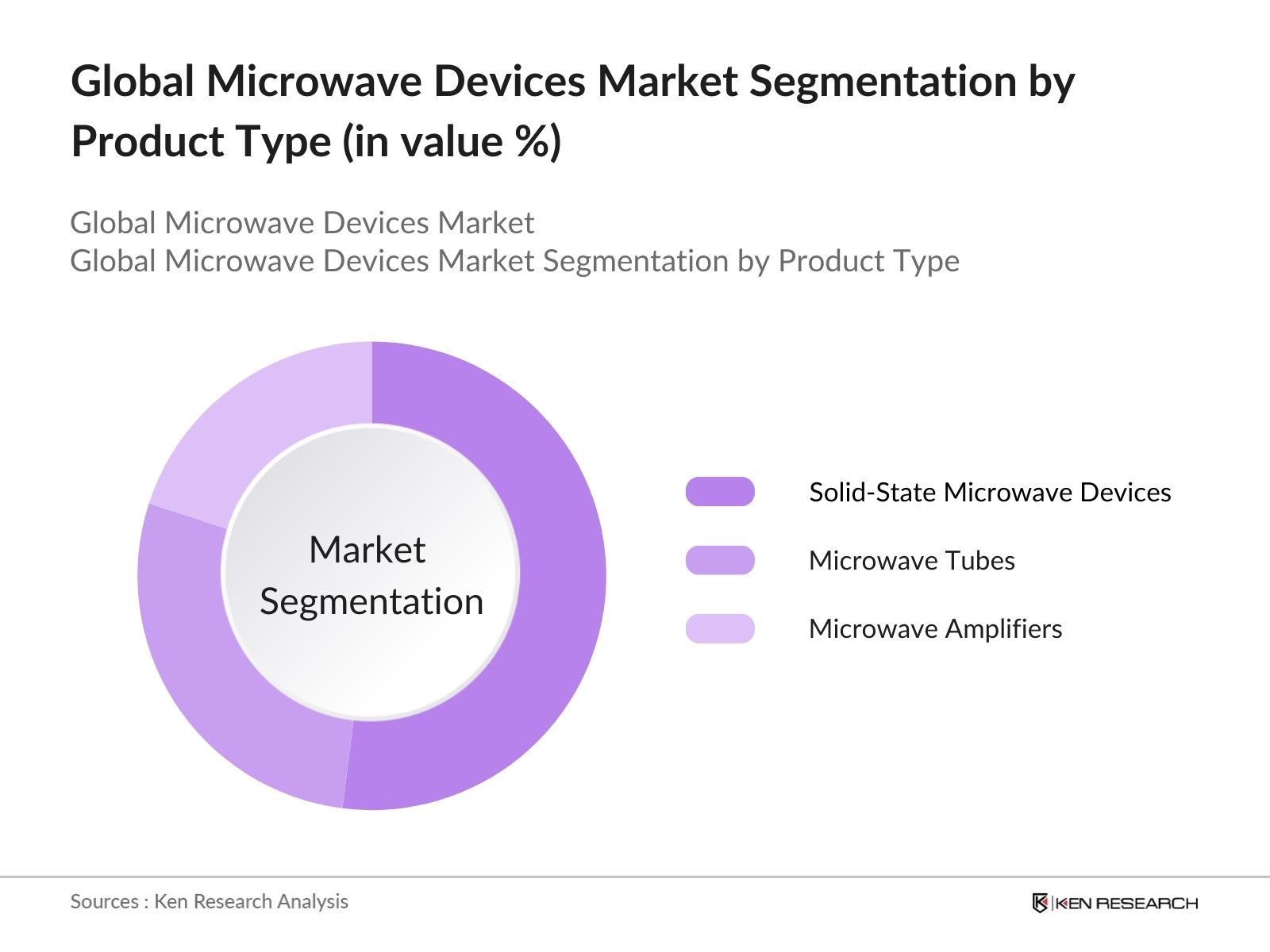

By Product Type: The global microwave devices market is segmented by product type into microwave tubes, solid-state microwave devices, and microwave amplifiers. In 2023, solid-state microwave devices dominated the market due to their higher efficiency, reliability, and compact design compared to vacuum tube technology. The rapid adoption of solid-state devices in telecommunications and defense applications has contributed significantly to this segments market dominance.

|

Product Type |

Market Share (2023) |

|

Solid-State Microwave Devices |

52% |

|

Microwave Tubes |

28% |

|

Microwave Amplifiers |

20% |

By Application: The market is also segmented by application into defense, telecommunications, and medical. In 2023, the defense segment held the largest market share, as microwave devices are essential for radar, communication, and electronic warfare systems. The growing demand for advanced military communication systems and radar technology globally has been a significant driver for the dominance of this segment.

|

Application |

Market Share (2023) |

|

Defense |

45% |

|

Telecommunications |

35% |

|

Medical |

20% |

By Region - The global microwave devices market is segmented by region into North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America. In 2023, North America dominated the market primarily due to high defense spending in the U.S. and the rapid deployment of 5G infrastructure. The U.S. government allocated USD 700 million toward advanced microwave-based communication systems in 2023, supporting this regions market leadership.

|

Region |

Market Share (2023) |

|

North America |

40% |

|

Europe |

25% |

|

Asia-Pacific (APAC) |

20% |

|

Middle East & Africa (MEA) |

10% |

|

Latin America |

5% |

Global Microwave Devices Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Thales Group |

2000 |

France |

|

Qorvo Inc. |

2015 |

USA |

|

Keysight Technologies |

2014 |

USA |

|

L3Harris Technologies |

2019 |

USA |

|

Analog Devices Inc. |

1965 |

USA |

- Thales Group (2023 Update): In 2023, Thales Group expanded its microwave technology portfolio by acquiring a 40% stake in a U.S.-based radar systems company for USD 250 million. This acquisition is aligned with Thales' strategy to strengthen its position in the defense and space sectors. The investment is expected to enhance its microwave device offerings, focusing on cutting-edge radar communication technologies.

- Qorvo Inc. (2023 Development): In August 2023, Qorvo announced the opening of a new R&D center in San Diego, USA, dedicated to advancing microwave technology for 5G applications. The center will focus on developing more efficient microwave amplifiers and communication devices to meet the rising demand in telecommunications. This move is a significant step for Qorvo in bolstering its technological leadership in the microwave devices market.

Global Microwave Devices Market Analysis

Growth Drivers

- Rising Defense Expenditure and Focus on Electronic Warfare: Global military spending reached a record high of USD 2.24 trillion in 2022, driven by increased investments in modernizing military communication and radar systems that rely heavily on microwave technologies. Countries like the U.S., China, and India are heavily investing in advanced radar and satellite communication systems to strengthen their defense capabilities. The U.S. Department of Defense allocated USD 700 million in 2023 to develop next-generation microwave communication systems, contributing significantly to the growth of the microwave devices market.

- Expansion of 5G Networks and Satellite Communication: As of 2023, over 70 countries have rolled out 5G networks, significantly increasing the demand for microwave devices that support high-frequency communication infrastructure. According to a report by the International Telecommunication Union (ITU), 5G networks will require an estimated 150,000 new base stations globally by the end of 2024, many of which will rely on microwave technology for efficient data transmission. This surge in the telecom sector is a primary driver for the increased demand for microwave devices in the telecommunications industry.

- Aerospace and Space Exploration Investments: The space exploration sector has seen a remarkable increase in investments, especially in satellite communications, which depend on microwave devices. According to NASA's 2024 budget report, the U.S. allocated USD 2.4 billion for satellite communication systems incorporating microwave technology. Similarly, in 2023, the European Space Agency (ESA) approved a USD 1.5 billion budget for the development of microwave-based satellite communication systems.

Challenges

- Stringent Regulatory Requirements: The microwave devices market faces stringent regulatory requirements concerning frequency allocation and electromagnetic radiation standards. In 2023, the Federal Communications Commission (FCC) introduced new regulations limiting the use of specific frequency bands for commercial and defense applications, creating compliance challenges for manufacturers. Adherence to these regulations increases development times and costs, which can delay the deployment of microwave devices in key markets such as defense and telecommunications.

- Supply Chain Disruptions in Semiconductor Industry: The ongoing semiconductor shortage, exacerbated by geopolitical tensions between major producers like the U.S. and China, has caused delays in the production of microwave devices. In 2023, the shortage of semiconductor materials used in microwave components led to a drop in the global supply of these devices. This shortage has impacted industries such as aerospace and defense, where the timely availability of high-performance microwave devices is critical for radar systems and communication infrastructure.

Government Initiatives

- U.S. Next-Generation Radar Development Program (2023): In 2023, the U.S. government launched the "Next-Generation Radar Development Program," with a budget of USD 150 million. The program focuses on upgrading existing radar systems to include advanced microwave technology, essential for improving the accuracy and range of military communication and surveillance systems. This initiative is expected to drive demand for microwave devices, particularly in defense applications, as the program progresses through 2024.

- European Space Agencys Satellite Communication Initiative (2023): In 2023, the European Space Agency (ESA) launched a USD 1.5 billion initiative aimed at improving satellite communication capabilities across Europe. The program involves deploying satellite communication systems that rely on microwave technology for data transmission. By 2024, the ESA plans to launch additional satellites equipped with advanced microwave communication devices to expand its satellite network.

Global Microwave Devices Market Outlook

The global microwave devices market is expected to grow steadily, driven by increasing demand for advanced communication systems, radar technologies, and medical equipment. Key sectors include aerospace, defense, telecommunications, and healthcare. The rise of 5G technology and innovations in satellite communication systems are also major growth factors. North America and Asia-Pacific are projected to dominate the market due to technological advancements and industrial demand.

Future Trends

- Increased Adoption of Microwave Devices in 6G Networks: By 2028, the global microwave devices market will witness significant growth driven by the development and deployment of 6G networks. According to the International Telecommunication Union (ITU), 6G is expected to offer data transmission speeds 100 times faster than 5G, necessitating the use of advanced microwave devices. Governments and telecom companies are likely to invest heavily in microwave technology to meet the high-frequency demands of 6G, making this a key trend for the next five years.

- Growing Use of Microwave Technology in Quantum Computing: Microwave devices are expected to play a crucial role in quantum computing by 2028, particularly in enabling quantum communication and data transfer. As quantum computing moves from research labs to commercial applications, the demand for microwave devices will surge. Companies like IBM and Google have already started investing in microwave technologies for quantum computers, indicating that the market will see increased demand in this sector over the next five years.

Scope of the Report

|

By Product Type |

Solid-State Microwave Devices Microwave Tubes Microwave Amplifiers |

|

By Application |

Defense Telecommunications Medical |

|

By Region |

North America Europe Asia-Pacific (APAC) Middle East & Africa (MEA) Latin America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecommunications Companies

Defense and Military Organizations

Aerospace and Satellite Manufacturers

Electronics and Semiconductor Manufacturers

Automotive Manufacturers

Consumer Electronics Companies

Energy and Utility Companies

Investors and Venture Capital Firms

Regulatory Bodies and Standards Organizations (eg. FCC, ITU etc.)

Time-Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Thales Group

L3 Technologies

Teledyne Technologies

Analog Devices

Qorvo

CPI International

General Dynamics

Toshiba Electron Tubes & Devices

Macom

Kratos Defense & Security Solutions

Microsemi

API Technologies

TMD Technologies

RFMD (RF Micro Devices)

E2V Technologies

Table of Contents

1. Global Microwave Devices Market Overview

1.1. Market Definition and Scope

1.2. Market Size and Growth

1.3. Key Market Drivers

1.4. Overview of Market Segmentation

2. Global Microwave Devices Market Size and Analysis

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Microwave Devices Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Defense Expenditure and Electronic Warfare Focus

3.1.2. Expansion of 5G Networks and Satellite Communication

3.1.3. Aerospace and Space Exploration Investments

3.2. Market Challenges

3.2.1. High Costs of Microwave Technologies

3.2.2. Stringent Regulatory Requirements

3.2.3. Supply Chain Disruptions in Semiconductor Industry

3.3. Market Opportunities

3.3.1. Advancements in Microwave Technologies for Defense

3.3.2. Increasing Demand for High-Frequency Communication Devices

3.4. Current Market Trends

3.4.1. Adoption of GaN-Based Microwave Devices

3.4.2. Microwave Devices in Autonomous Vehicles

3.4.3. Microwave Devices in 5G Millimeter-Wave Applications

4. Global Microwave Devices Market Segmentation, 2023

4.1. By Product Type (Value %)

4.1.1. Solid-State Microwave Devices

4.1.2. Microwave Tubes

4.1.3. Microwave Amplifiers

4.2. By Application (Value %)

4.2.1. Defense

4.2.2. Telecommunications

4.2.3. Medical

4.3. By Region (Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. APAC

4.3.4. Middle East and Africa (MEA)

4.3.5. Latin America

5. Global Microwave Devices Market Competitive Landscape

5.1. Key Players and Market Share Analysis

5.2. Strategic Initiatives and Developments

5.3. Mergers, Acquisitions, and Investments

5.4. Company Profiles

5.4.1. Thales Group

5.4.2. Qorvo Inc.

5.4.3. Keysight Technologies

5.4.4. L3Harris Technologies

5.4.5. Analog Devices Inc.

6. Global Microwave Devices Market Regulatory and Legal Framework

6.1. Frequency Allocation Regulations

6.2. Electromagnetic Radiation Standards and Compliance

7. Global Microwave Devices Market Forecast, 2023-2028

7.1. Future Market Size Projections

7.2. Factors Influencing Future Market Growth

8. Future Market Segmentation, 2028

8.1. By Product Type (Value %)

8.2. By Application (Value %)

8.3. By Region (Value %)

9. Analyst Recommendations and Strategic Insights

9.1. Total Addressable Market (TAM) Analysis

9.2. Customer and Market Potential Analysis

9.3. Key Strategic Initiatives for Market Penetration

10. Global Microwave Devices Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step 2: Market Building

Collating statistics on the Global Microwave Devices Market over the years, analyzing the penetration of Global Microwave Devices technologies, and computing the revenue generated for the market. This step also involves reviewing technology adoption rates and application effectiveness to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple Global Microwave Devices companies to understand the nature of technology segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these Global Microwave Devices companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01. How big is the global microwave devices market?

The global microwave devices market was valued at USD 8 billion in 2023, driven by increased demand in sectors such as defense, telecommunications, and aerospace, particularly for radar and satellite communication systems.

02. What are the challenges in the global microwave devices market?

Challenges include high production costs for microwave technologies, stringent regulatory requirements for frequency allocation, and supply chain disruptions affecting semiconductor materials crucial for microwave device manufacturing.

03. Who are the major players in the global microwave devices market?

Key players in the market include Thales Group, Qorvo Inc., Keysight Technologies, L3Harris Technologies, and Analog Devices Inc. These companies lead through strong innovation, product portfolios, and strategic partnerships in defense and telecommunications sectors.

04. What are the growth drivers of the global microwave devices market?

The market is propelled by rising defense expenditure globally, the rapid expansion of 5G networks, and growing investments in space exploration, all of which require advanced microwave devices for communication and radar applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.