Global Mining Trucks Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD8335

December 2024

123

About the Report

Global Mining Trucks Market Overview

- The global mining trucks market is valued at USD 22 billion, driven by the increasing demand for minerals, metals, and ores. The industry has seen significant growth over the past five years due to rising global mining activities in coal, iron ore, and copper. Increased automation, demand for fuel-efficient vehicles, and the introduction of electric and autonomous mining trucks have contributed significantly to the market's growth.

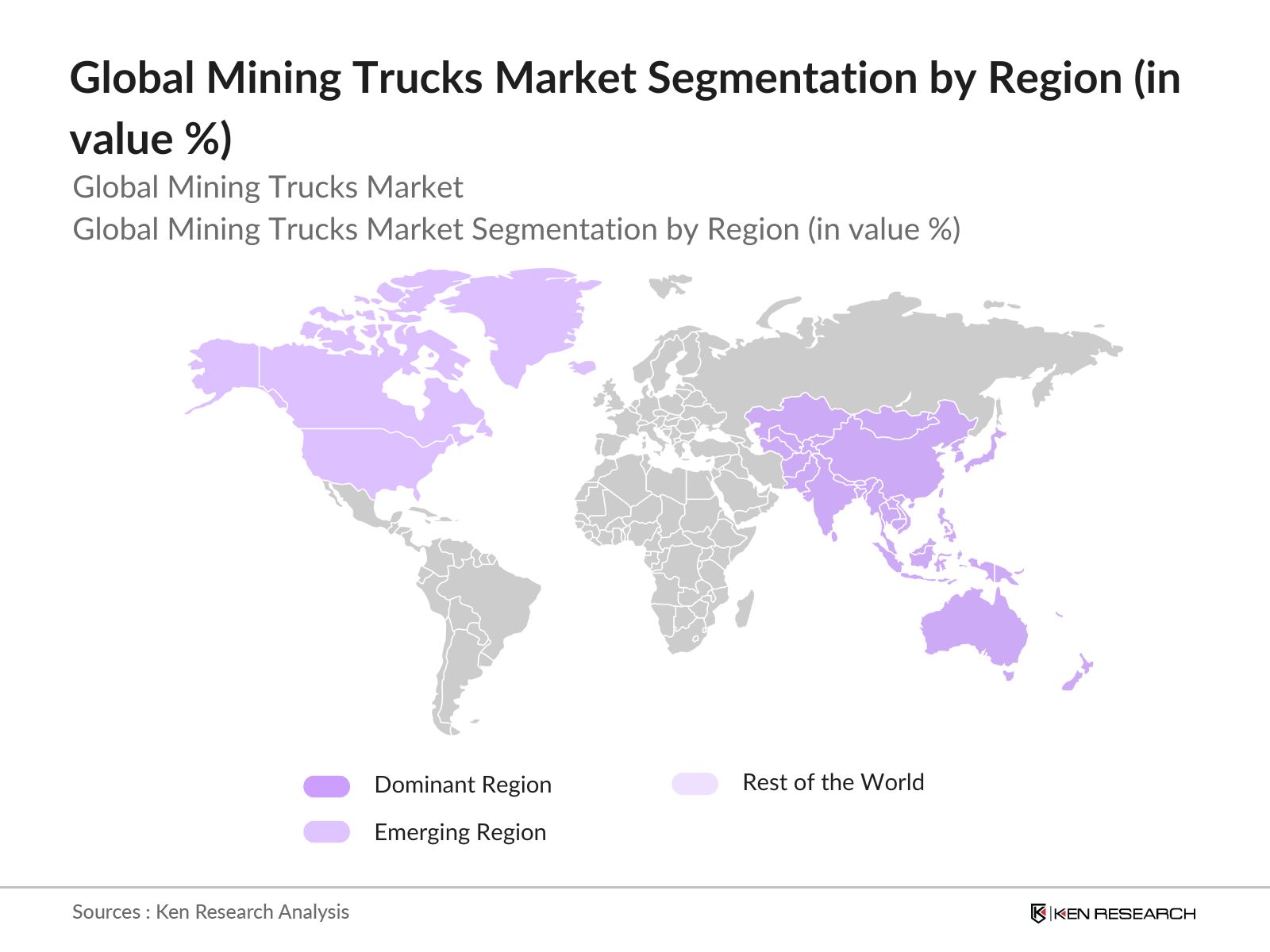

- Dominant regions in the mining truck market include North America, Asia Pacific, and Latin America. North America leads due to advanced mining operations and high investments in technology. The Asia Pacific dominates because of the region's significant mining activities in countries like China and Australia, driven by increasing infrastructure development and industrial demand for metals and minerals. Latin America, particularly Brazil and Chile, plays a significant role due to vast mineral reserves and substantial investments in mining infrastructure.

- Stringent emission standards are driving mining companies to adopt cleaner technologies. The European Union's Euro VI standards, implemented in 2023, have significantly impacted the mining industry, leading to a shift towards low-emission trucks. According to World Bank data, this regulation increased compliance costs by over USD 2 billion for the European mining sector. These standards are crucial for reducing emissions but represent a financial burden for mining companies.

Global Mining Trucks Market Segmentation

- By Payload Capacity: The global mining truck market is segmented by payload capacity into less than 100 tons, 100-200 tons, and more than 200 tons. Recently, trucks with a payload capacity of more than 200 tons have dominated the market. These heavy-duty trucks are preferred by large-scale mining operators due to their ability to handle massive loads, which reduces the need for multiple trips and increases operational efficiency. Major players like Caterpillar and Komatsu are investing heavily in developing trucks with higher payload capacities to meet the growing demand in the mining industry.

- By Region: The global mining truck market is segmented regionally into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific has the largest share of the market, with countries like China and Australia leading due to their extensive mining activities. In particular, China dominates because of its large demand for minerals to fuel its manufacturing and construction industries. Australia, with its rich mineral reserves, remains a key player in the global mining sector, driving demand for mining trucks.

- By Drive Type: The market is segmented into diesel-powered, electric-powered, and hybrid mining trucks. Diesel-powered trucks currently dominate the market because of their widespread use in mining operations. However, electric-powered trucks are gaining traction, especially in regions like North America and Europe, where stringent emission regulations encourage the adoption of electric vehicles. Electric trucks are becoming popular for their reduced environmental impact and lower operational costs, making them an attractive option for mining companies focusing on sustainability.

Global Mining Trucks Market Competitive Landscape

The global mining trucks market is dominated by key players such as Caterpillar Inc., Komatsu Ltd., and Liebherr Group, among others. These companies hold a significant share due to their technological advancements, extensive distribution networks, and wide range of products. The competitive landscape is also shaped by rising investments in automation and electrification of mining trucks. Smaller players are focusing on innovations to compete with established giants.

|

Company |

Established Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

R&D Investments |

Global Market Presence |

Product Portfolio |

|

Caterpillar Inc. |

1925 |

Illinois, USA |

- |

- |

- |

- |

- |

|

Komatsu Ltd. |

1921 |

Tokyo, Japan |

- |

- |

- |

- |

- |

|

Liebherr Group |

1949 |

Bulle, Switzerland |

- |

- |

- |

- |

- |

|

Hitachi Construction |

1970 |

Tokyo, Japan |

- |

- |

- |

- |

- |

|

Terex Corporation |

1933 |

Connecticut, USA |

- |

- |

- |

- |

- |

Global Mining Trucks Market Analysis

Growth Drivers

- Adoption of Autonomous Trucks: Autonomous mining trucks are seeing increasing adoption, driven by the need for operational efficiency and safety in hazardous environments. As of 2024, major mining companies in regions like Australia and Canada have deployed over 500 autonomous trucks. This rise in autonomous vehicles helps reduce human risk and operational costs, while improving efficiency. Such investments align with the global trend toward automation across industries.

- Rising Demand for Fuel-Efficient Vehicles: With rising fuel prices and the emphasis on reducing carbon footprints, mining companies are shifting toward fuel-efficient mining trucks. Between 2022 and 2024, the global crude oil prices averaged USD 80 per barrel, pushing companies to adopt fuel-saving technologies. This trend is more pronounced in emerging mining economies such as Brazil and South Africa, where mining constitutes a significant share of GDPapproximately USD 500 million in Brazil as per 2023 World Bank data.

- Government Support for Sustainable Mining: Governments globally are pushing for sustainable mining practices. For example, the U.S. government, under its Clean Air Act, has committed over USD 1.2 billion in incentives for cleaner technologies in mining vehicles by 2023. Similar measures in the European Union aim at reducing emissions and promoting the electrification of mining trucks. As of 2024, government-backed initiatives have reduced emissions in the mining sector by 15%, as indicated by IMF-backed data.

Challenges

- High Operational and Maintenance Costs: Mining trucks come with high operational and maintenance costs, often exceeding USD 200,000 annually per vehicle. These costs cover fuel, repairs, and regular maintenance. Data from the IMF reveals that labor and parts costs have risen by 15% from 2022 to 2024 due to inflation and supply chain disruptions. Such high costs are a barrier for small and medium-sized mining operators, particularly in developing economies.

- Stringent Government Regulations on Emissions: Governments worldwide are implementing stringent emission norms for mining vehicles. For instance, the European Union has enforced Euro VI standards for heavy vehicles, which mining trucks must comply with. The enforcement of these standards has added significant compliance costs, with companies in Europe reporting increased operational costs by USD 50,000 per vehicle, as per World Bank data. These regulations aim to curb emissions but have proven to be a challenge for mining companies.

Global Mining Market Future Outlook

Global mining trucks market is expected to witness significant growth due to the adoption of electric and autonomous mining trucks, particularly in developed regions. Mining companies are increasingly focusing on sustainability and efficiency, driving the demand for technologically advanced trucks that reduce fuel consumption and lower emissions. Government regulations and environmental policies will further encourage companies to adopt eco-friendly trucks, especially in North America and Europe.

Market Opportunities

- Expansion of Autonomous Mining Equipment: Autonomous mining trucks represent a major growth opportunity in the mining trucks market. By 2023, over 30% of large-scale mining operations in countries like Australia and Canada had adopted autonomous mining technologies. This trend is driven by a need to increase operational efficiency and reduce labor costs. World Bank data confirms that mining companies saved approximately USD 5 million annually by deploying autonomous vehicles across multiple sites.

- Rising Investments in Mining Technologies: The mining sector is witnessing a surge in investments focused on innovation and technology. According to IMF data, global investment in mining technologies reached USD 10 billion in 2023, with a significant portion allocated to automated trucks and electric vehicles. Countries like China and India, where mining contributes significantly to the economy, are leading in technological investments aimed at enhancing productivity and sustainability.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Hex Head Structural Screws |

|

Flat Head Structural Screws |

|

|

Wafer Head Structural Screws |

|

|

By Application |

Residential Construction |

|

Commercial Construction |

|

|

Industrial Construction |

|

|

By Material |

Steel |

|

Stainless Steel |

|

|

Galvanized Steel |

|

|

By Diameter |

Small Diameter Screws (<6mm) |

|

Medium Diameter Screws (6-10mm) |

|

|

Large Diameter Screws (>10mm) |

|

|

By Region |

North America |

|

Europe |

|

|

Asia Pacific |

|

|

Latin America |

|

|

Middle East & Africa |

Products

Key Target Audience

Mining Companies

Original Equipment Manufacturers (OEMs)

Mining Equipment Distributors

Mining Consultants and Engineers

Technology Providers for Autonomous Vehicles

Mining Fleet Management Companies

Government and Regulatory Bodies (e.g., U.S. Environmental Protection Agency, European Commission)

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Caterpillar Inc.

Komatsu Ltd.

Liebherr Group

Hitachi Construction Machinery Co., Ltd.

Volvo Construction Equipment

Terex Corporation

SANY Group

BelAZ

XCMG Group

Doosan Infracore Co., Ltd.

Table of Contents

1. Global Structural Wood Screws Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Structural Wood Screws Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Structural Wood Screws Market Analysis

3.1 Growth Drivers (Material Durability, Sustainable Wood Usage)

3.1.1 Rising Demand for Sustainable Construction

3.1.2 Preference for Wood-Based Structures

3.1.3 Advanced Manufacturing Technologies

3.1.4 Increasing Adoption in Prefabricated Buildings

3.2 Market Challenges (Supply Chain, Sourcing Issues)

3.2.1 Fluctuating Raw Material Prices

3.2.2 Competition from Alternative Fasteners

3.2.3 Regulatory Requirements for Sustainability Certifications

3.3 Opportunities (Construction Industry Expansion)

3.3.1 Expanding Green Building Initiatives

3.3.2 Urbanization and Rural Development Projects

3.3.3 Rising Investments in Infrastructure

3.4 Trends (Technological Innovations)

3.4.1 Growing Use of High-Tensile Steel Screws

3.4.2 Integration of Anti-Corrosive Coatings

3.4.3 Adoption of Automated Screw Driving Systems

3.5 Government Regulations (Environmental Standards and Trade Policies)

3.5.1 Construction Material Regulations

3.5.2 Trade Policies and Import Tariffs on Fasteners

3.5.3 Energy Efficiency and Green Certifications

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Global Structural Wood Screws Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Hex Head Structural Screws

4.1.2 Flat Head Structural Screws

4.1.3 Wafer Head Structural Screws

4.2 By Application (In Value %)

4.2.1 Residential Construction

4.2.2 Commercial Construction

4.2.3 Industrial Construction

4.3 By Material (In Value %)

4.3.1 Steel

4.3.2 Stainless Steel

4.3.3 Galvanized Steel

4.4 By Diameter (In Value %)

4.4.1 Small Diameter Screws (<6mm)

4.4.2 Medium Diameter Screws (6-10mm)

4.4.3 Large Diameter Screws (>10mm)

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Structural Wood Screws Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Simpson Strong-Tie

5.1.2 Spax International

5.1.3 FastenMaster

5.1.4 GRK Fasteners

5.1.5 ITW Construction Products

5.1.6 SFS Group

5.1.7 Wrth Group

5.1.8 Heco-Schrauben GmbH & Co KG

5.1.9 Fischer Group

5.1.10 EJOT Holding GmbH & Co KG

5.2 Cross Comparison Parameters (Market Capitalization, Revenue, Global Reach, Manufacturing Units, Product Range, Innovation Index, Market Share, Sustainability Initiatives)

5.3 Market Share Analysis (In Value %)

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Structural Wood Screws Market Regulatory Framework

6.1 Environmental Standards and Sustainability Mandates

6.2 Compliance Requirements for Fasteners in Structural Applications

6.3 Certification Processes for Eco-Friendly Products

7. Global Structural Wood Screws Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Structural Wood Screws Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Material (In Value %)

8.4 By Diameter (In Value %)

8.5 By Region (In Value %)

9. Global Structural Wood Screws Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping all major stakeholders in the global mining trucks market. Desk research was conducted using secondary databases to gather information on the key variables, such as technological advancements and payload capacities.

Step 2: Market Analysis and Construction

The historical data for market penetration, mining activities, and truck adoption was analyzed. Factors such as cost, safety regulations, and emissions standards were considered to provide a holistic understanding of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through interviews with industry experts from mining companies and truck manufacturers. These consultations provided insights into market trends and company-specific strategies.

Step 4: Research Synthesis and Final Output

The data was synthesized into actionable insights, ensuring that the report captures a comprehensive view of the market. Manufacturer insights were integrated into the market segmentation and future outlook sections

Frequently Asked Questions

01. How big is the global mining trucks market?

The global mining trucks market is valued at USD 22 billion, driven by the increasing demand for minerals and metals worldwide, coupled with advancements in truck technology.

02. What are the challenges in the global mining trucks market?

The global mining trucks market faces challenges such as high capital investment, operational costs, and stringent emissions regulations. Additionally, the shortage of skilled operators for advanced trucks poses a significant barrier.

03. Who are the major players in the global mining trucks market?

Major players in global mining trucks market include Caterpillar Inc., Komatsu Ltd., Liebherr Group, Hitachi Construction Machinery Co., Ltd., and Volvo Construction Equipment. These companies dominate due to their technological advancements and global reach.

04. What are the growth drivers of the global mining trucks market?

Key growth drivers in global mining trucks market include increasing demand for minerals, adoption of electric and autonomous trucks, and rising environmental regulations that push companies towards sustainable practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.