Global Mobile Commerce Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD9048

December 2024

88

About the Report

Global Mobile Commerce Market Overview

- The Global Mobile Commerce (mCommerce) market is valued at USD 1.25 trillion, based on an analysis over the past five years. This market is primarily driven by the widespread adoption of smartphones and the increasing penetration of high-speed internet in developing and developed regions. Additionally, the rise in mobile payment options, spurred by digital wallet adoption, has enabled users to complete transactions conveniently. This ease of transaction has encouraged more consumers to engage in mCommerce, contributing significantly to the market's valuation.

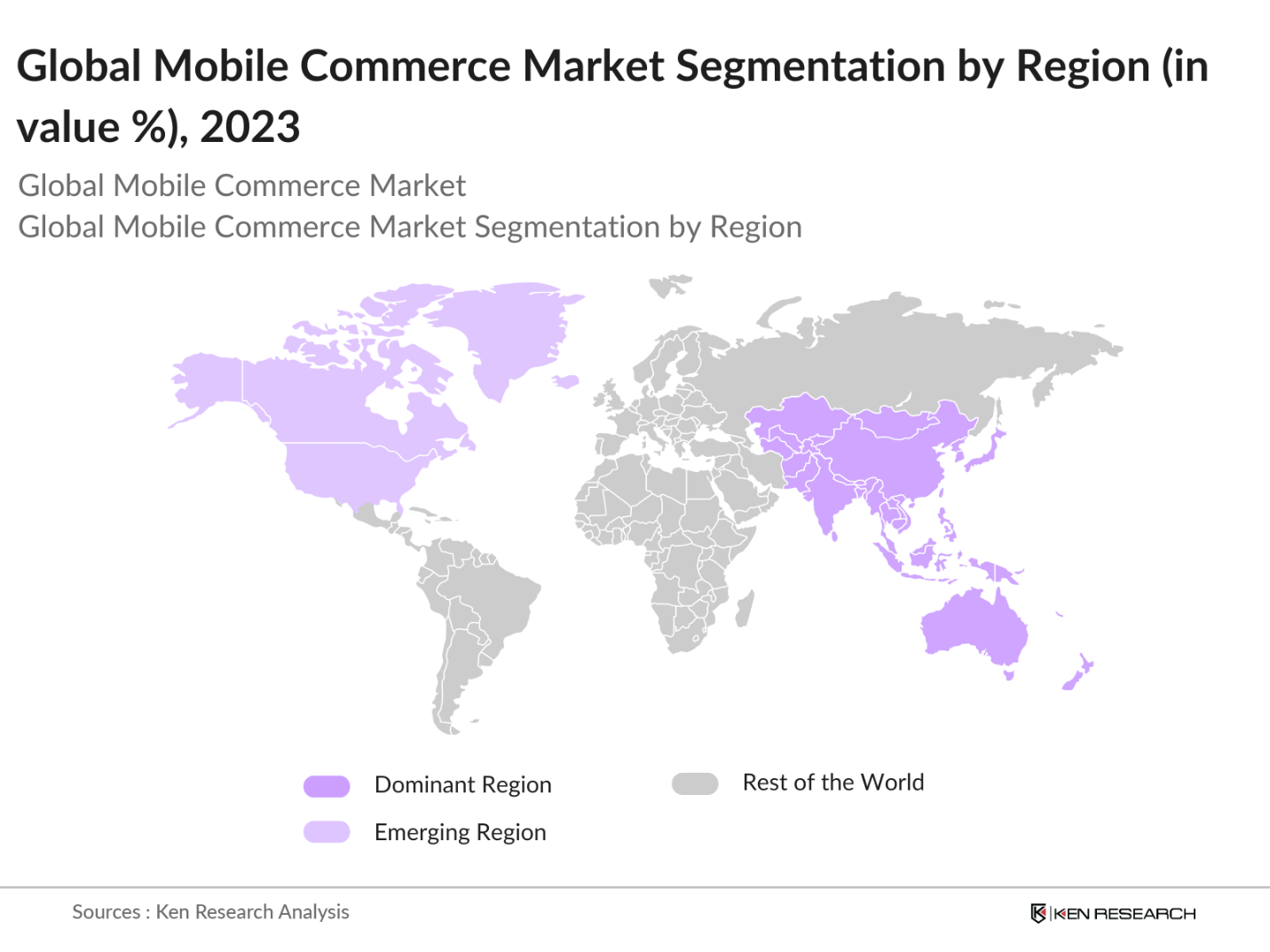

- North America and Asia-Pacific dominate the mobile commerce market due to their advanced technological infrastructure, high smartphone penetration, and digital literacy. Countries like the United States and China lead due to their large, tech-savvy populations and the presence of eCommerce giants like Amazon and Alibaba, which heavily invest in mobile shopping platforms. These regions have also witnessed significant government support for digital payments, which strengthens their dominance in mCommerce.

- Data privacy policies are integral to mobile commerce, with governments enforcing stricter regulations to protect consumer information. The EUs General Data Protection Regulation (GDPR) serves as a benchmark, influencing privacy policies globally. Countries like Japan and Brazil have adopted similar policies, requiring businesses to adhere to local standards for data management and security.

Global Mobile Commerce Market Segmentation

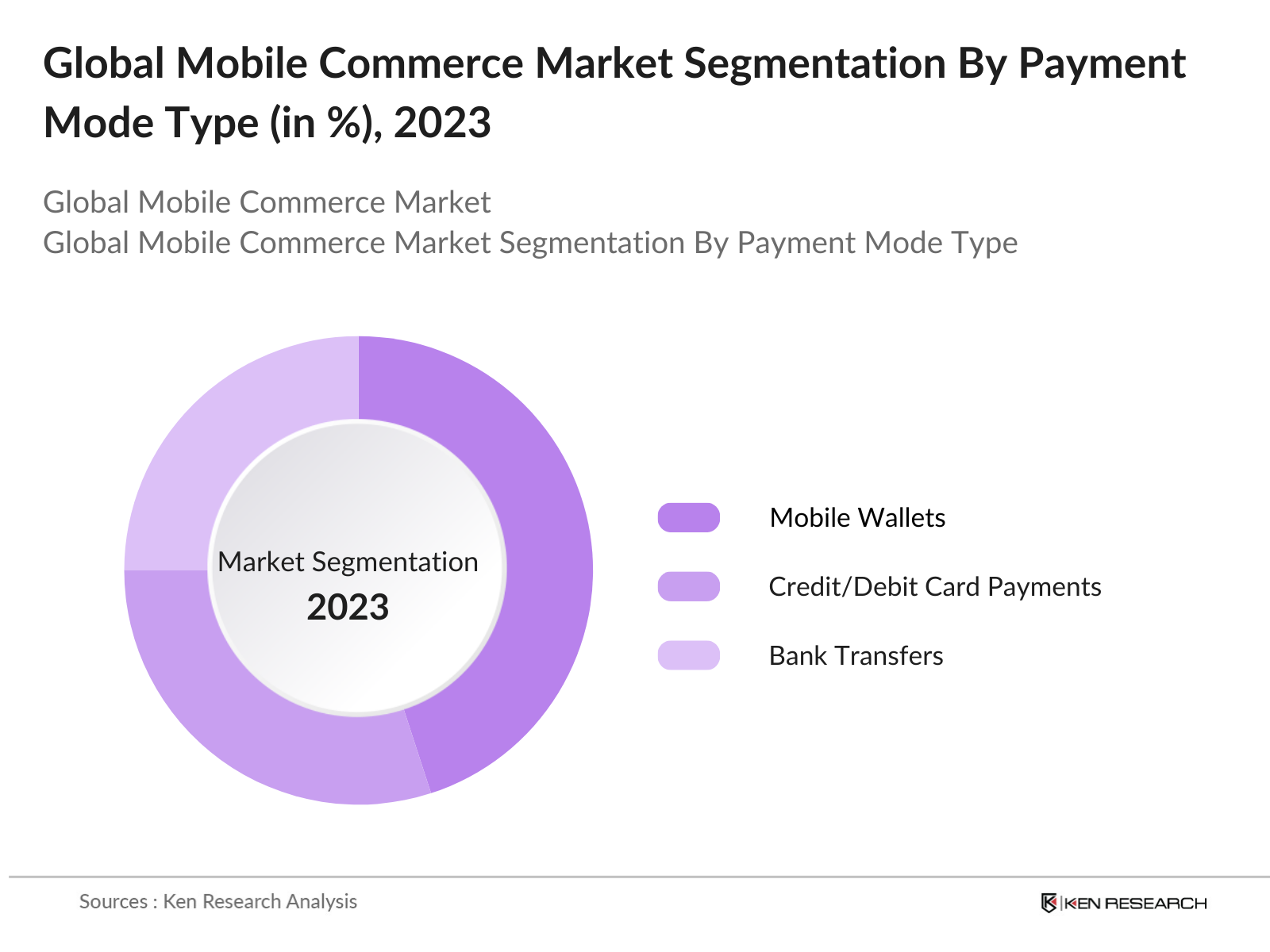

By Payment Mode: The Global Mobile Commerce market is segmented by payment mode into mobile wallets, credit/debit card payments, and bank transfers. Mobile wallets dominate this segment due to their convenience and security features, with popular apps like Apple Pay, Google Pay, and Alipay gaining massive user adoption globally. As consumers increasingly favor secure, one-tap transactions, the mobile wallet sub-segment continues to expand and hold the largest market share.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific holds a dominant position due to the rapid adoption of mobile payments in China and India. These countries benefit from a high smartphone user base and government support for digital payments, making Asia-Pacific the leading region in the mCommerce sector.

By Transaction Type: The mobile commerce market is segmented by transaction type into peer-to-peer transfers, bill payments, and online shopping. Online shopping dominates this segment, driven by the shift of traditional retail to digital platforms. The convenience of mobile-based shopping apps, along with exclusive app discounts and personalized offers, has accelerated the growth of this segment. Online shopping remains the most significant contributor to mCommerce revenue.

Global Mobile Commerce Market Competitive Landscape

The global mobile commerce market is dominated by major players who invest heavily in technological innovation and user experience. These companies include both global giants and emerging regional leaders in mobile payments and eCommerce. Their influence highlights the competitive and highly consolidated nature of the market.

Global Mobile Commerce Industry Analysis

Growth Drivers

- Mobile Device Penetration: The global penetration of mobile devices has increased significantly, with over 7.1 billion mobile devices in use worldwide as of 2024. This widespread access to mobile phones facilitates an expansive reach for mobile commerce, making it a viable channel for various consumer segments. In several emerging markets, the rapid increase in affordable smartphones has been key to driving mobile commerce adoption. According to the International Telecommunication Union (ITU), approximately 96% of the global population has access to mobile networks, creating a robust foundation for the growth of mobile commerce.

- Increase in Internet Connectivity: With over 5.4 billion people connected to the internet globally, mobile commerce growth is supported by an expanding base of internet users. The World Bank reports that mobile internet penetration has surged due to infrastructure investments, especially in Asia-Pacific and Sub-Saharan Africa, where governments are focused on increasing digital inclusion. By connecting new users to the internet, these initiatives are driving mobile commerce adoption as more consumers access online platforms via mobile devices.

- Rise of Digital Payments: The rise in digital payment adoption has significantly boosted mobile commerce, with the number of global digital wallet users surpassing 1.5 billion. The IMF highlights that digital payment infrastructure, particularly in emerging economies, is expanding as governments and private firms support cashless economies. This trend encourages consumers to make purchases directly through mobile platforms, as mobile wallets and digital payment options enhance convenience and security.

Market Challenges

- Cybersecurity Risks: Cybersecurity remains a major concern in the mobile commerce market, with the World Economic Forum reporting over 2,200 cyber-attacks occurring every day on mobile platforms globally. These threats pose significant risks to both consumers and businesses, with financial losses from cybercrime estimated to reach over $8 trillion by 2024, according to the World Bank. As mobile commerce expands, implementing strong cybersecurity measures is essential to safeguard user data and secure transactions.

- Mobile Platform Compatibility: One challenge for mobile commerce providers is ensuring compatibility across diverse mobile platforms. According to GSMA, around 75% of users worldwide use Android, while a smaller but significant portion uses iOS, creating difficulties in optimizing app performance universally. These differences lead to issues in application development and user experience, especially as fragmented operating systems and varied device specifications can result in inconsistent user experiences.

Global Mobile Commerce Market Future Outlook

Over the next five years, the Global Mobile Commerce market is projected to experience significant expansion driven by technological advancements, increased security measures, and the growth of mobile payment options. With governments worldwide supporting cashless economies, the demand for mobile commerce solutions is expected to surge. Key drivers include increased smartphone penetration, enhanced connectivity, and AI-driven personalization in mobile shopping experiences.

Opportunities

- Expansion into Emerging Markets: Emerging markets present significant opportunities for mobile commerce growth, as smartphone adoption rates continue to rise rapidly. According to the World Bank, smartphone adoption in Sub-Saharan Africa is increasing by approximately 15 million users annually, creating a new consumer base for mobile commerce. In addition, governments are investing in mobile infrastructure to promote digital trade, providing favorable conditions for mobile commerce expansion.

- Integration of AI & ML in Mobile Shopping: The integration of artificial intelligence (AI) and machine learning (ML) in mobile commerce enables retailers to offer personalized recommendations and predictive analysis, enhancing user engagement. According to the International Data Corporation (IDC), investments in AI for mobile applications are projected to reach significant levels, making it an area of rapid development. Retailers using AI for tailored shopping experiences report higher engagement rates, presenting substantial growth potential for mobile commerce.

Scope of the Report

|

Payment Mode |

Mobile Wallets Credit/Debit Card Payments Bank Transfers |

|

Transaction Type |

Peer-to-Peer Transfers Bill Payments Online Shopping |

|

End-User |

Retail Banking and Finance Travel & Hospitality |

|

Device Type |

Smartphones Tablets Wearable Devices |

|

Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

E-commerce and Online Retail Companies

Mobile Payment Solution Provider Companies

Telecommunication Service Provider Companies

Banks and Financial Institutions

Investors and Venture Capitalist Firms

Mobile Application Development Companies

Government and Regulatory Bodies (e.g., Federal Trade Commission, European Central Bank)

Retail and Consumer Goods Companies

Companies

Players Mentioned in the Report

Alibaba Group

Amazon

Apple Inc.

Google LLC

Tencent Holdings Ltd.

PayPal Holdings, Inc.

Samsung Electronics

Visa Inc.

Walmart

Stripe

Table of Contents

1. Global Mobile Commerce Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Mobile Commerce Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Mobile Commerce Market Analysis

3.1. Growth Drivers

3.1.1. Mobile Device Penetration

3.1.2. Increase in Internet Connectivity

3.1.3. Rise of Digital Payments

3.1.4. Evolving Consumer Buying Behavior

3.2. Market Challenges

3.2.1. Cybersecurity Risks

3.2.2. Mobile Platform Compatibility

3.2.3. Regulatory Compliance in Cross-Border Transactions

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Integration of AI & ML in Mobile Shopping

3.3.3. Personalization and Customer Experience Enhancements

3.4. Trends

3.4.1. Adoption of Augmented Reality (AR) for Shopping

3.4.2. Growth of Mobile Wallets

3.4.3. Integration of Social Commerce Channels

3.5. Government Regulations

3.5.1. Data Privacy Policies

3.5.2. Consumer Protection Laws

3.5.3. Financial Transaction Compliance

3.5.4. Anti-Fraud Measures

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Mobile Commerce Market Segmentation

4.1. By Payment Mode (In Value %)

4.1.1. Mobile Wallets

4.1.2. Credit/Debit Card Payments

4.1.3. Bank Transfers

4.2. By Transaction Type (In Value %)

4.2.1. Peer-to-Peer Transfers

4.2.2. Bill Payments

4.2.3. Online Shopping

4.3. By End-User (In Value %)

4.3.1. Retail

4.3.2. Banking and Finance

4.3.3. Travel & Hospitality

4.4. By Device Type (In Value %)

4.4.1. Smartphones

4.4.2. Tablets

4.4.3. Wearable Devices

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Mobile Commerce Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Alibaba Group

5.1.2. Amazon

5.1.3. Apple Inc.

5.1.4. eBay Inc.

5.1.5. Google LLC

5.1.6. MasterCard

5.1.7. PayPal Holdings, Inc.

5.1.8. Samsung Electronics

5.1.9. Square Inc.

5.1.10. Tencent Holdings Ltd.

5.1.11. Visa Inc.

5.1.12. Walmart

5.1.13. Rakuten, Inc.

5.1.14. JD.com

5.1.15. Stripe

5.2 Cross-Comparison Parameters (Revenue, Market Share, User Base, Mobile App Rating, Transaction Volume, Number of Active Users, Customer Satisfaction, Security Features)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Mobile Commerce Market Regulatory Framework

6.1. Data Protection and Privacy Regulations

6.2. Financial Compliance Requirements

6.3. Cybersecurity Standards

6.4. International Trade Regulations

7. Global Mobile Commerce Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Mobile Commerce Future Market Segmentation

8.1. By Payment Mode (In Value %)

8.2. By Transaction Type (In Value %)

8.3. By End-User (In Value %)

8.4. By Device Type (In Value %)

8.5. By Region (In Value %)

9. Global Mobile Commerce Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research initiates with mapping the ecosystem of the Global Mobile Commerce Market, which includes identifying major stakeholders. This stage relies on comprehensive desk research using secondary and proprietary sources to define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase includes the analysis of historical data, examining the adoption rates of mobile payment solutions, transaction types, and regional preferences. Data are gathered on consumer preferences and transaction volumes to ensure an accurate estimation of revenue distribution.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market behavior and growth projections are validated through consultations with industry experts. These discussions provide insights into operational challenges, technological adoption rates, and strategic initiatives shaping the market.

Step 4: Research Synthesis and Final Output

The final phase synthesizes primary data from industry players and secondary data sources. This integrated approach verifies the reliability of findings, yielding a comprehensive and validated analysis of the Global Mobile Commerce Market.

Frequently Asked Questions

01. How big is the Global Mobile Commerce Market?

The Global Mobile Commerce market is valued at USD 1.25 trillion, driven by increasing smartphone penetration, digital payment adoption, and seamless online shopping experiences.

02. What are the challenges in the Global Mobile Commerce Market?

Key challenges include cybersecurity risks, data privacy concerns, and cross-border transaction regulations, which can hinder smooth operation across international markets.

03. Who are the major players in the Global Mobile Commerce Market?

Major players include Alibaba Group, Amazon, Apple Inc., Google LLC, and Tencent Holdings Ltd., all of which have established strongholds in mobile payment and eCommerce.

04. What are the growth drivers of the Global Mobile Commerce Market?

Growth is fueled by rising smartphone adoption, digital wallet popularity, and AI-driven mobile shopping personalization, enhancing user engagement in mobile commerce.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.