Global Mobile Insurance & Plans Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3892

December 2024

86

About the Report

Global Mobile Insurance & Plans Market Overview

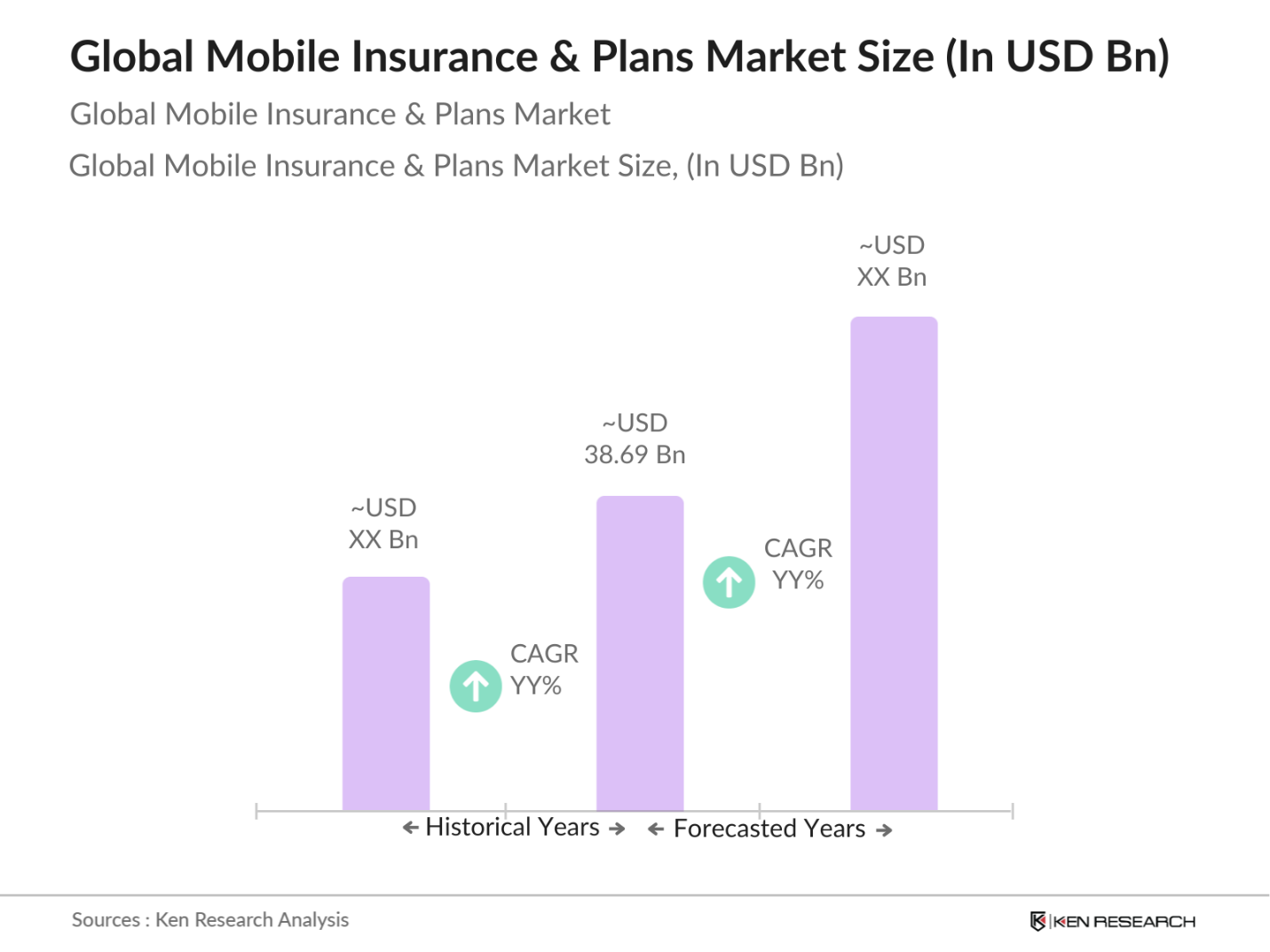

- The Global Mobile Insurance & Plans Market has expanded significantly due to increasing smartphone penetration, high repair costs, and growing awareness of mobile insurance benefits. This market is valued at approximately USD 38.69 billion, driven by consumers seeking financial protection against damages, theft, and loss. Mobile insurance plans have become particularly popular for high-end smartphones, as replacement costs are substantial. Collaborations between mobile carriers, device manufacturers, and insurance providers have made it easier for consumers to access these plans at the time of device purchase.

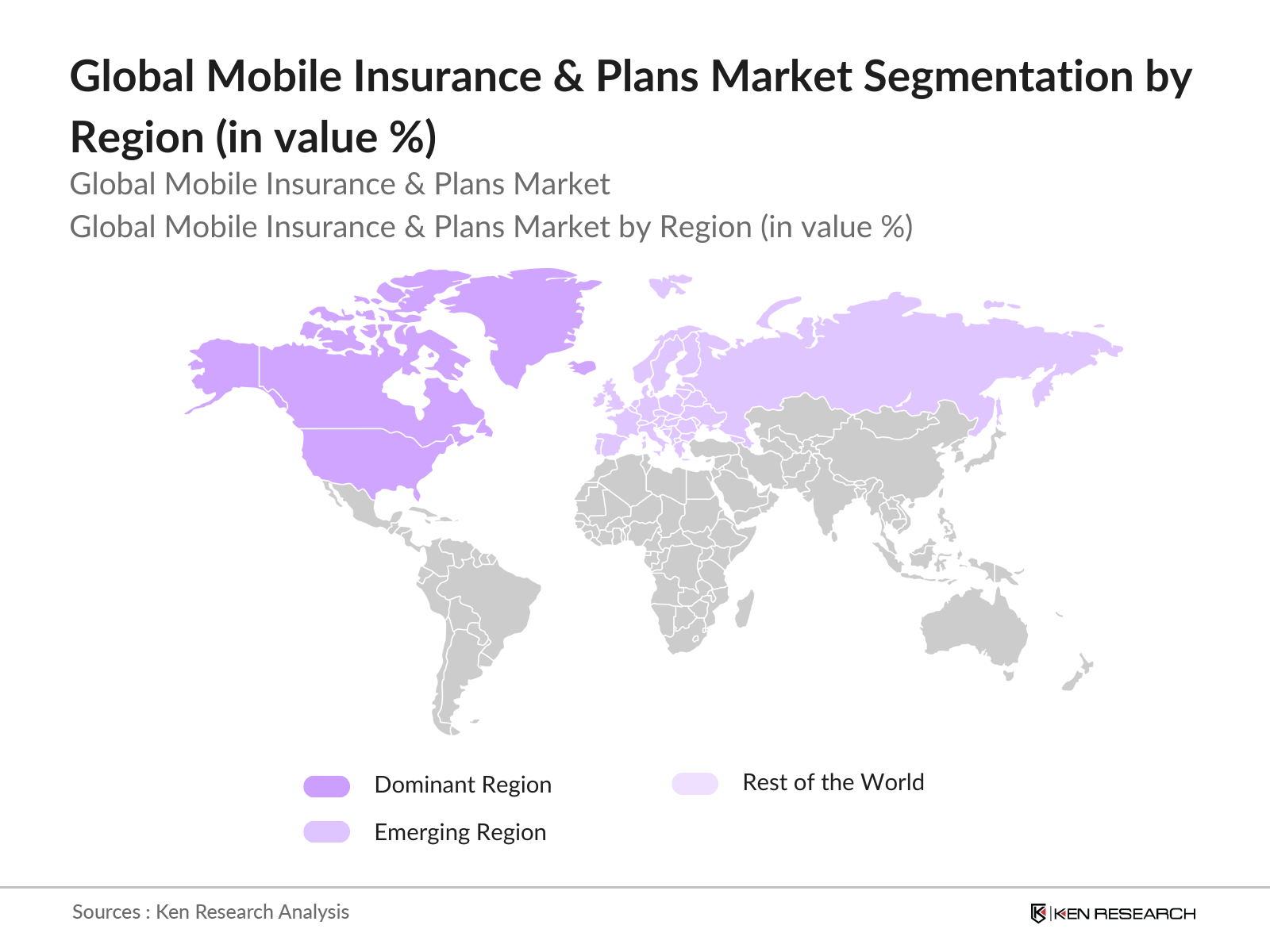

- North America holds the largest market share, driven by the high smartphone penetration rate and strong partnerships among insurers, carriers, and retailers. Europe follows, with consumers increasingly opting for mobile insurance due to the high repair costs associated with premium devices. The Asia-Pacific region is growing rapidly, supported by rising disposable incomes and increasing smartphone usage, particularly in markets like China, India, and Southeast Asia.

- Data privacy regulations impact mobile insurance as companies handle sensitive customer information. Laws like the GDPR mandate strict data protection practices, requiring insurers to secure personal information and prevent unauthorized access. As mobile insurance often involves online account access and digital claims, adherence to data privacy standards is critical to avoid breaches and penalties. Data security is a top priority for insurers, who must implement robust systems to safeguard customer data in compliance with regulatory requirements.

Global Mobile Insurance & Plans Market Segmentation

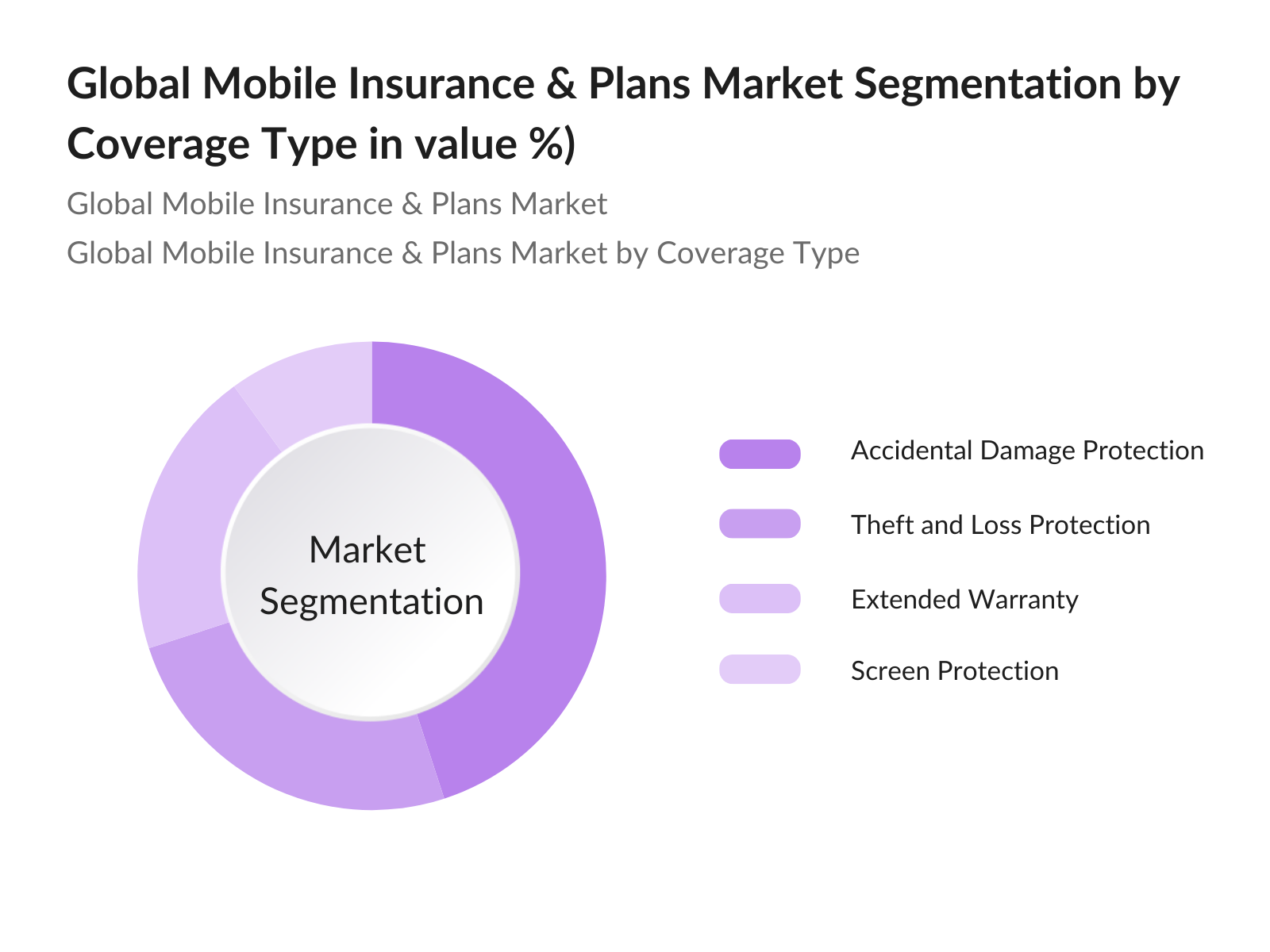

By Coverage Type: The Mobile Insurance & Plans Market is segmented by coverage type into accidental damage protection, theft and loss protection, extended warranty, and screen protection. Accidental damage protection holds the largest share, as it covers the most common types of damage, including drops and spills. Theft and loss protection is also popular, particularly for high-value devices and in regions with high theft rates.

By Region: The Mobile Insurance & Plans Market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads due to high smartphone penetration and strong partnerships in the insurance sector. Europe follows closely with a preference for comprehensive coverage plans, while the Asia-Pacific region shows high growth potential due to rising smartphone adoption and consumer awareness.

Global Mobile Insurance & Plans Market Competitive Landscape

The Global Mobile Insurance & Plans Market is competitive, with major players focusing on comprehensive coverage options, partnerships with mobile carriers, and streamlined claims processes. Leading companies such as AppleCare, Asurion, and SquareTrade offer a range of coverage options and digital claim management solutions to enhance the customer experience. The competitive landscape is shaped by strategic alliances, innovative digital solutions, and customer-centric policies.

|

Company |

Establishment Year |

Headquarters |

Employees |

Revenue |

Coverage Options |

Claims Process |

Partnerships |

|

AppleCare |

1976 |

Cupertino, USA |

|||||

|

Asurion |

1994 |

Nashville, USA |

|||||

|

SquareTrade |

1999 |

San Francisco, USA |

|||||

|

AT&T Mobile Protection |

1983 |

Dallas, USA |

|||||

|

Allianz Insurance |

1890 |

Munich, Germany |

Global Mobile Insurance & Plans Market Analysis

Market Growth Drivers

- Increased Smartphone Ownership Worldwide: The rise in global smartphone ownership is a key driver for mobile insurance demand, as over 6.8 billion people now use mobile phones, with approximately 4.6 billion owning smartphones. In high-usage regions like North America and Europe, of the population owns a smartphone, highlighting a vast base of potential customers for mobile insurance. As smartphones become central to daily life and work, consumers seek protection plans to safeguard these essential devices from damage and theft, supporting insurance adoption globally.

- High Cost of Smartphone Repairs Driving Demand for Insurance: With the average smartphone repair cost exceeding $300 for high-end devices, insurance coverage is increasingly sought to offset these expenses. Repair costs for popular models with advanced technology, such as 5G and OLED screens, make repairs costly, particularly in regions with high labor costs like the U.S. and Europe. This cost burden drives consumers to adopt mobile insurance plans, ensuring financial protection against accidental damage and component failures.

- Partnerships with Telecom Providers to Facilitate Mobile Insurance: Insurance companies increasingly partner with telecom providers to offer mobile insurance at the point of sale, facilitating easy access for consumers. Major telecom providers in regions like North America and Asia have introduced bundled packages, making mobile insurance a default option for new device purchases. These partnerships streamline the purchasing process, allowing customers to enroll in protection plans during device acquisition, thereby driving higher adoption rates and expanding the reach of mobile insurance.

Market Challenges:

- High Premiums Relative to Device Value: The high premiums for mobile insurance plans can be a deterrent for consumers, particularly when premiums approach the cost of device repair or replacement. For example, annual premiums for flagship smartphone models can exceed $150, which may seem excessive for users with mid-range or older devices. This pricing structure challenges insurers to balance premium costs with value, as high premiums may dissuade customers from opting for coverage, especially for less expensive devices.

- Complexity and Delays in the Claims Process: The claims process for mobile insurance is often complex and time-consuming, leading to customer dissatisfaction. In many cases, claims require extensive documentation, proof of purchase, and detailed damage assessment, which can delay the process by several weeks. This complexity discourages some consumers from utilizing mobile insurance, as they may find the claims process burdensome. Improving claim efficiency is essential for insurers to enhance customer experience and retain policyholders.

Global Mobile Insurance & Plans Market Future Outlook

Over the next five years, the Mobile Insurance & Plans Market is expected to grow due to increasing smartphone adoption, rising repair costs, and demand for digital insurance solutions. Innovations in digital claims management and seamless integration with mobile financing are expected to drive growth. The market will see a shift toward more comprehensive plans that include theft, accidental damage, and extended warranties as consumers seek full protection for high-value devices.

Market Opportunities:

- Expansion in High-Growth Emerging Markets: Emerging markets in Asia, Africa, and Latin America present high-growth opportunities for mobile insurance due to rising smartphone adoption. In countries like India and Nigeria, smartphone penetration is rapidly increasing, with millions entering the market annually. As disposable incomes grow, consumers are more inclined to protect their investments, creating demand for affordable insurance plans. Targeted expansion into these markets allows insurers to capitalize on rising smartphone ownership and address protection needs in underinsured regions.

- Integration of Insurance with Mobile Financing Options: Integrating mobile insurance with device financing options offers consumers a convenient way to bundle payments, increasing insurance adoption. Mobile financing is popular in markets like Southeast Asia, where monthly installment plans make smartphones more accessible. By incorporating insurance within financing packages, consumers are encouraged to add protection at minimal additional cost, making insurance more accessible and appealing. This integration offers insurers a way to reach budget-conscious customers who prefer bundled solutions.

Scope of the Report

|

By Coverage Type |

Accidental Damage Protection Theft and Loss Protection Extended Warranty Screen Protection |

|

By Distribution Channel |

Mobile Carriers Device Manufacturers Online Insurance Providers Retail Stores |

|

By Device Type |

Smartphones Tablets |

|

By End-User |

Individual Consumers |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Individual Smartphone Users

Corporate IT Departments for Employee Devices

Mobile Carriers and Service Providers

Government and Regulatory Bodies (e.g., Insurance Regulatory Authorities)

Investments and Venture Capitalist Firms

Retail Electronics Stores

E-commerce Platforms

Mobile Manufacturers and OEMs

Companies

Players Mention in the Reports

AppleCare

Asurion

AT&T Mobile Protection

SquareTrade

T-Mobile Protection

Allianz Insurance

AmTrust International

Brightstar Corp.

Telefnica Insurance

Orange Care

Verizon Mobile Protection

Chubb Limited

AIG Mobile Insurance

Samsung Care+

AXA Assistance

Table of Contents

01. Global Mobile Insurance & Plans Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

02. Global Mobile Insurance & Plans Market Size (In USD Billion)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

03. Global Mobile Insurance & Plans Market Analysis

Growth Drivers (Rising Smartphone Penetration, High Repair Costs, Consumer Awareness of Protection Plans)

Increased Smartphone Ownership Worldwide

High Cost of Smartphone Repairs Driving Demand for Insurance

Growing Awareness and Adoption of Protection Plans

Partnerships with Telecom Providers to Facilitate Mobile Insurance

Market Challenges (High Premium Costs, Complexity of Claims, Device Depreciation)

High Premiums Relative to Device Value

Complexity and Delays in the Claims Process

Depreciation of Device Value Over Time

Opportunities (Expansion in Emerging Markets, Integration with Mobile Financing, Growing Demand for Premium Devices)

Expansion in High-Growth Emerging Markets

Integration of Insurance with Mobile Financing Options

Demand for Premium Smartphones Driving Insurance Uptake

Trends (Digital Claim Management, Inclusion of Theft Protection, Bundling with Device Plans)

Adoption of Digital Platforms for Claims Management

Inclusion of Theft and Loss Protection in Mobile Insurance Plans

Bundling of Insurance Plans with Telecom and Device Purchase Plans

Government Regulations (Consumer Protection, Data Privacy, Standardization of Plans)

Consumer Protection Laws Affecting Mobile Insurance Terms

Data Privacy and Security Regulations in Insurance

Standardization of Mobile Insurance Terms and Conditions

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competition Ecosystem

04. Global Mobile Insurance & Plans Market Segmentation

By Coverage Type (In Value %)

Accidental Damage Protection

Theft and Loss Protection

Extended Warranty

Screen Protection

By Distribution Channel (In Value %)

Mobile Carriers

Device Manufacturers

Online Insurance Providers

Retail Stores

By Device Type (In Value %)

Smartphones

Tablets

By End-User (In Value %)

Individual Consumers

Corporate Users

By Region (In Value %)

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

05. Global Mobile Insurance & Plans Market Competitive Analysis

Detailed Profiles of Major Companies

AppleCare

Asurion

AT&T Mobile Protection

SquareTrade

T-Mobile Protection

Allianz Insurance

AmTrust International

Brightstar Corp.

Telefnica Insurance

Orange Care

Verizon Mobile Protection

Chubb Limited

AIG Mobile Insurance

Samsung Care+

AXA Assistance

Cross Comparison Parameters (Headquarters, Inception Year, Revenue, Coverage Options, Claims Process, Partnerships, Customer Satisfaction Ratings, Global Presence)

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital in Mobile Insurance Startups

Private Equity Investments in Insurance Technology

Government Grants Supporting Digital Insurance Solutions

06. Global Mobile Insurance & Plans Market Regulatory Framework

Consumer Protection Standards

Data Privacy Regulations Impacting Mobile Insurance

Standardization of Insurance Terms Across Markets

07. Global Mobile Insurance & Plans Market Future Size (In USD Billion)

Future Market Size Projections

Key Factors Driving Future Market Growth

08. Global Mobile Insurance & Plans Market Future Segmentation

By Coverage Type (In Value %)

By Distribution Channel (In Value %)

By Device Type (In Value %)

By End-User (In Value %)

By Region (In Value %)

09. Global Mobile Insurance & Plans Market Analysts Recommendations

TAM/SAM/SOM Analysis

Customer Cohort Analysis

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research started by identifying the key drivers in the Mobile Insurance & Plans Market, including smartphone penetration, repair costs, and consumer behavior. Data was collected from proprietary databases, government publications, and industry reports.

Step 2: Market Analysis and Construction

Historical data on mobile insurance adoption, market segmentation, and trends by region and distribution channel were analyzed. This phase also involved examining the growth in mobile insurance uptake in emerging markets.

Step 3: Hypothesis Validation and Expert Consultation

Key assumptions were validated through expert consultations with mobile insurance providers, device manufacturers, and retail channel representatives. Their insights helped align the reports projections with industry realities.

Step 4: Research Synthesis and Final Output

The final synthesis integrated qualitative insights and quantitative data, presenting a comprehensive analysis of the Mobile Insurance & Plans Market, including growth drivers, challenges, opportunities, and market projections.

Frequently Asked Questions

01. How big is the Global Mobile Insurance & Plans Market?

The global mobile insurance and plans market is valued at approximately USD 38.69billion, driven by the rising cost of smartphone repairs, increased device ownership, and demand for protection plans.

02. What are the challenges in the Global Mobile Insurance & Plans Market?

Challenges include high premiums relative to device value, complexity in the claims process, and depreciation of device value over time, which affects insurance payouts.

03. Who are the major players in the Global Mobile Insurance & Plans Market?

Key players include AppleCare, Asurion, SquareTrade, Allianz Insurance, and AT&T Mobile Protection, recognized for their extensive coverage options and partnerships.

04. What are the growth drivers of the Global Mobile Insurance & Plans Market?

Growth drivers include rising smartphone penetration, the high cost of repairs, consumer awareness of protection plans, and partnerships with telecom providers for bundled insurance options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.