Global Motorcycle Airbag Market Outlook to 2030

Region:Global

Author(s):Paribhasha Tiwari

Product Code:KROD7337

November 2024

89

About the Report

Global Motorcycle Airbag Market Overview

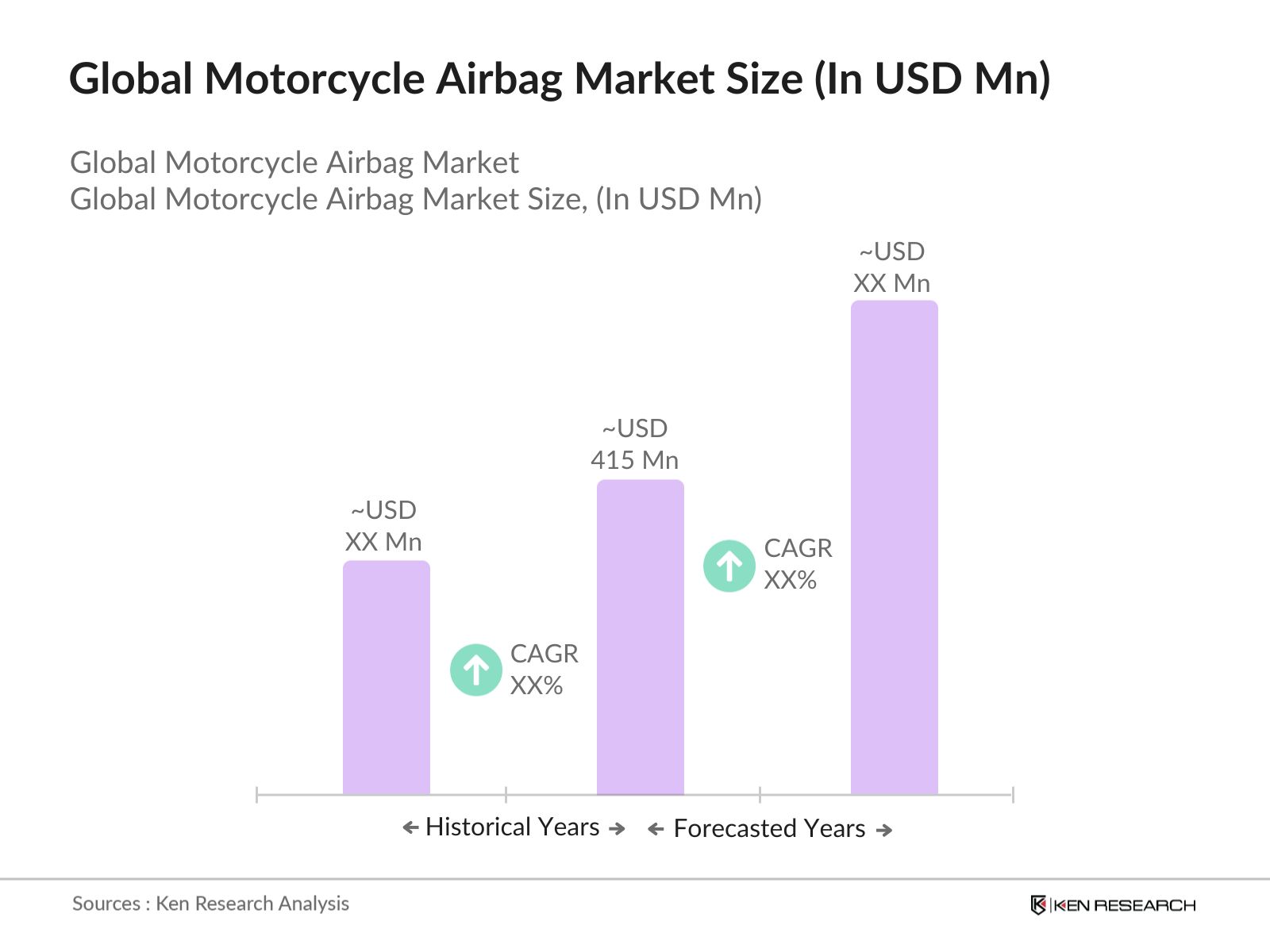

- The global motorcycle airbag market, valued at USD 415 million based on comprehensive data from industry sources, has experienced consistent growth due to increasing focus on rider safety. Motorcycle airbag systems are designed to protect riders in case of accidents, and their adoption has been driven by rising accident rates globally, stricter safety regulations, and growing consumer awareness. Several governments and regulatory bodies are mandating stricter safety protocols for motorcyclists, pushing manufacturers to integrate advanced safety technologies, such as airbag systems, in motorcycles.

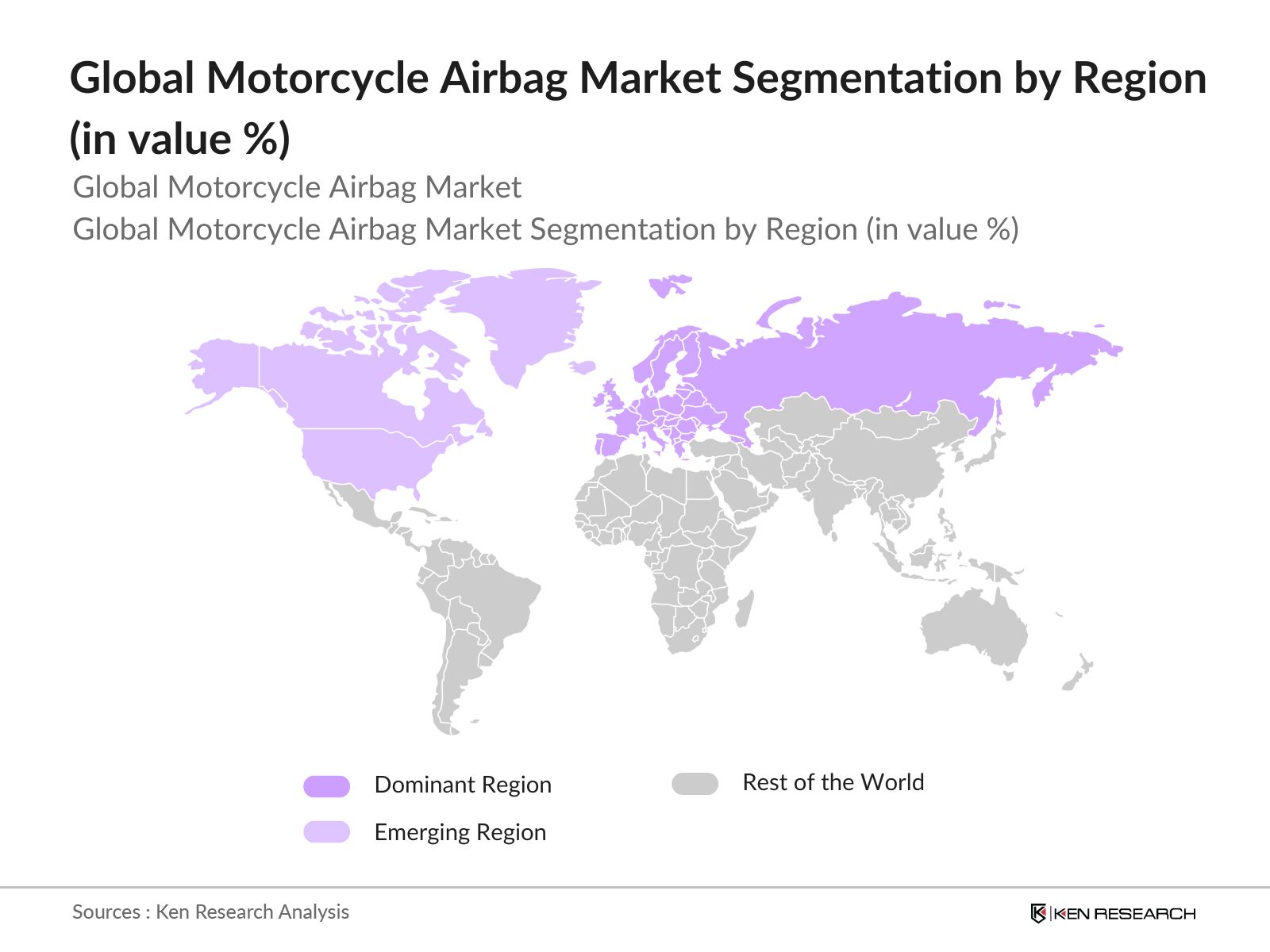

- The dominance of North America and Europe in the global motorcycle airbag market is attributed to their high road safety standards and widespread adoption of protective riding gear. Countries like the United States, Germany, and Italy have stringent road safety regulations and are known for their strong motorcycling culture. Additionally, major manufacturers based in these regions have a high focus on R&D and innovation, which further supports the markets expansion in these areas.

- The European Union has introduced stricter legislation regarding motorcycle safety, which includes mandates for integrating advanced safety systems like airbags. By 2024, new regulations in countries like Germany and France require motorcycle manufacturers to offer airbag options in their high-performance models. Similarly, countries like South Korea have enacted laws making it mandatory for certain classes of motorcycles to be equipped with airbags, contributing to the market's growth by enforcing compliance.

Global Motorcycle Airbag Market Segmentation

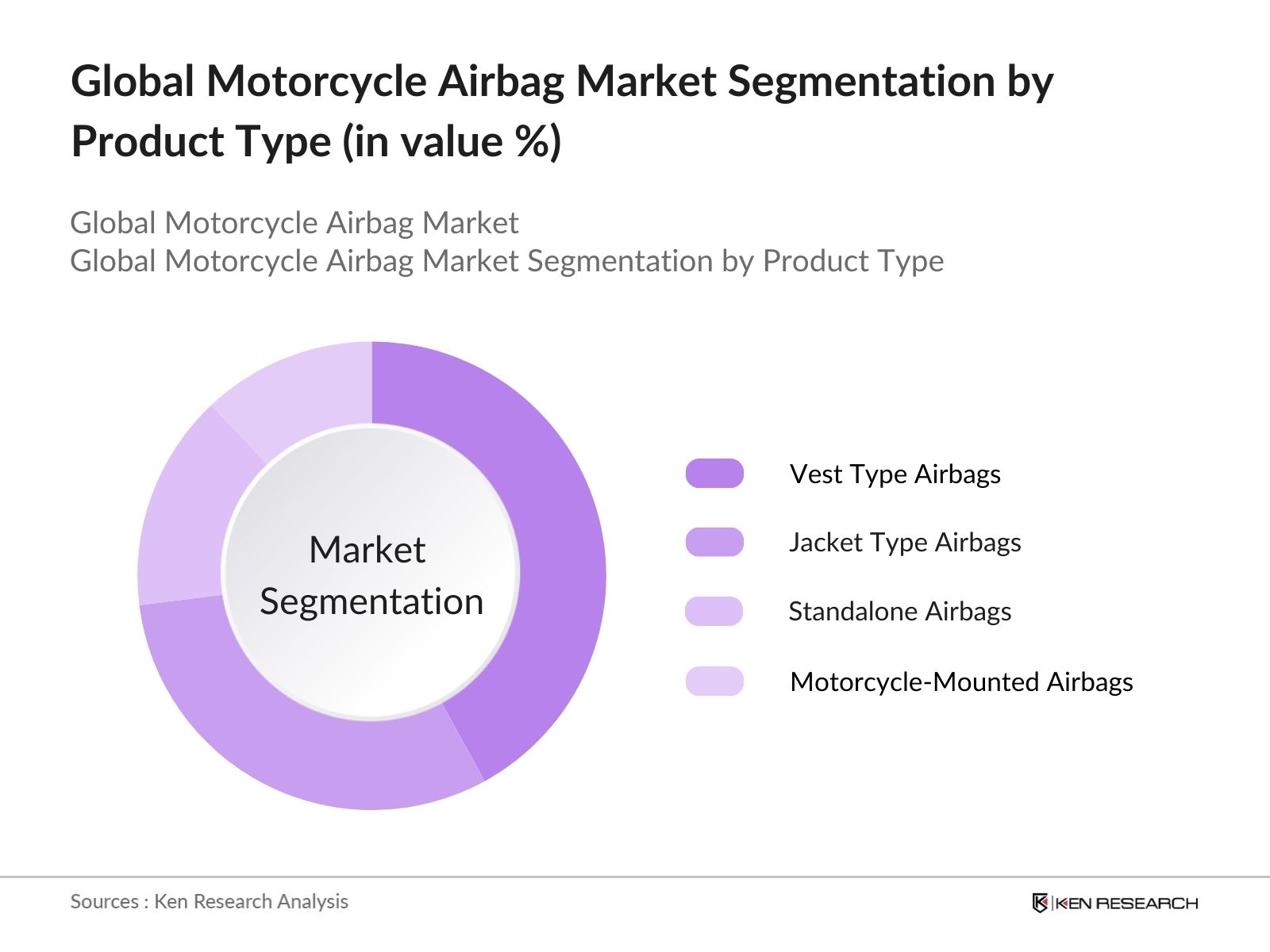

- By Product Type: The global motorcycle airbag market is segmented by product type into vest-type airbags, jacket-type airbags, standalone airbags, and motorcycle-mounted airbags. Vest-type airbags hold the dominant market share in this segment, primarily due to their ease of use, adaptability across different motorcycle models, and higher protection coverage for riders. Riders appreciate the fact that vest-type airbags can be used independently from the motorcycle, providing additional safety in various riding conditions. Vest-type airbags also lead in terms of innovation, with integrated sensors that detect impact more accurately.

- By Region: Regionally, the global motorcycle airbag market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Europe leads the market in terms of both innovation and adoption of motorcycle airbag systems. Countries like Germany, Italy, and France are hubs for motorcycle manufacturing, where advanced safety features are rapidly integrated into new models. Moreover, stringent safety regulations in the region compel riders to invest in superior protective gear, contributing to the high market share.

- By End-User: The global motorcycle airbag market is further segmented by end-users into professional riders, daily commuters, recreational riders, and touring riders. Professional riders dominate the market share in this category due to their increased need for advanced safety equipment in high-speed racing environments. Professional riders, such as those in MotoGP or Superbike racing, rely on cutting-edge airbag systems integrated into their gear to ensure maximum safety during competitions. The high performance of airbag systems under extreme conditions is a key factor contributing to the adoption in this segment.

Global Motorcycle Airbag Market Competitive Landscape

The global motorcycle airbag market is dominated by both longstanding manufacturers and new entrants offering innovative technologies. Leading companies invest heavily in R&D to enhance safety standards and meet the demands of professional riders and safety-conscious consumers. The competition is largely driven by technological advancements and partnerships between airbag manufacturers and motorcycle brands.

|

Company Name |

Establishment Year |

Headquarters |

Number of Employees |

Product Range |

R&D Investments (USD Mn) |

Partnerships |

Safety Patents |

Revenue (USD Bn) |

Global Reach |

|

Alpinestars S.p.A. |

1963 |

Asolo, Italy |

|||||||

|

Dainese S.p.A. |

1972 |

Vicenza, Italy |

|||||||

|

Honda Motor Co., Ltd. |

1948 |

Tokyo, Japan |

|||||||

|

Hit-Air (Mugen Denko Co., Ltd.) |

1999 |

Tokyo, Japan |

|||||||

|

Helite |

2002 |

Dijon, France |

Global Motorcycle Airbag Market Analysis

Market Growth Drivers

- Increasing Motorcycle Sales (Global Motorcycle Registrations, Road Safety Awareness): Global motorcycle registrations are on the rise, especially in countries like India, China, and Brazil, where the total number of registered motorcycles surpassed 200 million units by 2024. The growing demand for two-wheelers in developing countries is primarily driven by traffic congestion and the need for economical transportation. Simultaneously, increased awareness around road safety has prompted a surge in the demand for advanced safety features, including airbags. This growth is further supported by the steady rise in motorcycle production in countries like India, which manufactured over 21 million two-wheelers in 2023, driving the adoption of safety technologies such as airbags to meet increasing safety expectations.

- Rising Focus on Rider Safety (Accident Data, Safety Regulations): With over millions of road fatalities globally in 2024, motorcycles account for a disproportionately large number of these accidents, especially in low- and middle-income countries. Governments and safety bodies across regions like North America and Europe have implemented stricter regulations, pushing for mandatory rider safety measures. For instance, Europe has enacted laws that encourage the use of airbag jackets, and in countries like Japan, new crash data showed that airbag systems could reduce fatalities by over 20%, leading to more regulations around mandatory airbag use for high-performance motorcycles.

- Government Initiatives and Safety Regulations (Legislation, Mandates, Subsidies): Government interventions aimed at enhancing rider safety have been pivotal in the growth of the motorcycle airbag market. In countries like the U.S., federal programs encourage the integration of safety devices like airbags through safety mandates tied to production incentives. Furthermore, by 2024, the EU introduced subsidies for manufacturers developing cutting-edge airbag technologies, leading to a sharp increase in R&D investment from companies looking to improve their safety standards. These government-backed programs aim to bring down the cost of airbag systems, making them more accessible to a wider audience.

Market Challenges

- High Costs of Airbag Integration (Product Costs, Manufacturing Challenges): Motorcycle airbags are complex systems requiring precise engineering, which significantly increases the cost of production. The average cost of installing an airbag in a motorcycle range from $400 to $1,500, depending on the model and features. High-end motorcycles integrated with advanced airbag systems have seen slower adoption in price-sensitive markets like Southeast Asia and Africa. Additionally, manufacturers face challenges in scaling production due to the need for specialized materials and sensors, adding to the overall production cost and making it less feasible for low-cost motorcycle manufacturers to integrate such systems.

- Lack of Standardization Across Regions (Varying Safety Standards, Certification Issues): The motorcycle airbag market faces significant barriers due to the lack of international safety standards. Countries such as the U.S., Japan, and Brazil follow differing guidelines for motorcycle safety, making it difficult for manufacturers to develop airbags that meet universal regulatory standards. By 2024, over 60 countries had varying requirements for motorcycle airbag certifications, leading to delays in the production process as manufacturers struggle to meet each region's specific safety criteria. This lack of standardization hampers the seamless rollout of airbag systems, especially for global manufacturers.

Global Motorcycle Airbag Market Future Outlook

Over the next five years, the global motorcycle airbag market is expected to experience strong growth, driven by increased motorcycle sales and rising awareness about rider safety. Governments in various regions are pushing for the adoption of advanced safety systems, which will further drive demand for motorcycle airbags. The rise of electric motorcycles, coupled with technological advancements in airbag systems, such as smart airbags and sensor integration, will open up new avenues for innovation and market expansion. As more motorcycle manufacturers seek to integrate airbags as a standard safety feature, the market is poised for sustained growth.

Makret Opportunities

- Rising Demand in Emerging Markets (Increase in Motorcycle Ownership, Safety Initiatives): The growing middle class in emerging markets such as Southeast Asia and Latin America has led to an increase in motorcycle ownership, creating an opportunity for motorcycle airbag manufacturers. For instance, motorcycle registrations in Indonesia surpassed 120 million in 2024, representing a significant target market for airbag producers. Additionally, government-led safety initiatives in countries like Brazil and Thailand have raised awareness about motorcycle safety, fostering greater demand for protective gear such as airbags. As these markets continue to expand, airbag systems will see increasing adoption.

- Collaborations Between Manufacturers and Safety Bodies (Partnerships, Joint Ventures): In 2024, multiple collaborations between motorcycle manufacturers and safety regulatory bodies created opportunities for the development of enhanced airbag technologies. Partnerships between organizations such as the European Safety Authority and major motorcycle manufacturers have led to the creation of specialized safety programs. These collaborations are designed to increase rider safety through the integration of airbag systems in premium motorcycles. Joint ventures have also been established to lower production costs, creating a platform for wider airbag integration across different models and price segments.

Scope of the Report

|

By Product Type |

Vest-Type Airbags Jacket-Type Airbags Standalone Airbags Motorcycle-Mounted Airbags |

|

By End-User |

Professional Riders Daily Commuters Recreational Riders Touring Riders |

|

By Sales Channel |

OEMs, Aftermarket Online Platforms Specialty Stores |

|

By Deployment Type |

Mechanical Airbags Electronic Airbags |

|

By Motorcycle Type |

Standard Motorcycles Cruiser Motorcycles Touring Motorcycles Sports Motorcycles |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Motorcycle Manufacturers

Motorcycle Gear Manufacturers

Insurance Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (UNECE, NHTSA)

Motorcycle Racing Associations (MotoGP, Superbike Racing)

Dealership Networks

Safety Equipment Distributors

Companies

Major Players

Alpinestars S.p.A.

Dainese S.p.A.

Honda Motor Co., Ltd.

Hit-Air (Mugen Denko Co., Ltd.)

Helite

BMW Motorrad

Suzuki Motor Corporation

Yamaha Motor Co., Ltd.

Rev'It!

Triumph Motorcycles

Table of Contents

1. Global Motorcycle Airbag Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Motorcycle Airbag Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Motorcycle Airbag Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Motorcycle Sales (Global Motorcycle Registrations, Road Safety Awareness)

3.1.2 Rising Focus on Rider Safety (Accident Data, Safety Regulations)

3.1.3 Government Initiatives and Safety Regulations (Legislation, Mandates, Subsidies)

3.1.4 Advances in Airbag Technology (Sensor Accuracy, Deployment Speed)

3.2 Market Challenges

3.2.1 High Costs of Airbag Integration (Product Costs, Manufacturing Challenges)

3.2.2 Lack of Standardization Across Regions (Varying Safety Standards, Certification Issues)

3.2.3 Resistance from Riders (Comfort Concerns, Reluctance to Adopt New Safety Gear)

3.2.4 Limited Awareness in Developing Countries (Low Adoption Rates, Safety Perception)

3.3 Opportunities

3.3.1 Rising Demand in Emerging Markets (Increase in Motorcycle Ownership, Safety Initiatives)

3.3.2 Collaborations Between Manufacturers and Safety Bodies (Partnerships, Joint Ventures)

3.3.3 Introduction of Smart Airbag Systems (Connected Devices, IOT Integration)

3.3.4 Expansion in Aftermarket Segment (Airbag Retrofitting, Customization)

3.4 Trends

3.4.1 Integration of Airbags in Protective Clothing (Wearable Airbags, Airbag Jackets)

3.4.2 Shift Toward Modular Airbag Systems (Replaceable Airbags, Flexible Design)

3.4.3 Increased Focus on Lightweight Materials (Enhanced Mobility, Comfort Improvements)

3.4.4 Airbags for Electric Motorcycles (New Designs for EVs, Battery Protection)

3.5 Government Regulation

3.5.1 International Safety Standards (UNECE Regulations, ISO Standards)

3.5.2 Regional Safety Mandates (NHTSA Guidelines, Euro 5 Regulations)

3.5.3 Subsidies for Safety Equipment (Government Grants, Incentives for Safety Gear)

3.5.4 Public Awareness Campaigns (Government-Led Safety Campaigns, Awareness Drives)

3.6 SWOT Analysis

3.6.1 Strengths

3.6.2 Weaknesses

3.6.3 Opportunities

3.6.4 Threats

3.7 Stake Ecosystem

3.7.1 Motorcycle Manufacturers (OEM Partnerships, Tier 1 Suppliers)

3.7.2 Airbag Technology Providers (Technology Innovations, Major Providers)

3.7.3 Insurance Companies (Impact on Premiums, Liability Regulations)

3.8 Porters Five Forces

3.8.1 Threat of New Entrants

3.8.2 Bargaining Power of Suppliers

3.8.3 Bargaining Power of Buyers

3.8.4 Threat of Substitutes

3.8.5 Industry Rivalry

3.9 Competition Ecosystem

3.9.1 Key Motorcycle Airbag Providers (Competitive Landscape, Airbag Products)

4. Global Motorcycle Airbag Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Vest-Type Airbags

4.1.2 Jacket-Type Airbags

4.1.3 Standalone Airbags

4.1.4 Motorcycle-Mounted Airbags

4.2 By End-User (In Value %)

4.2.1 Professional Riders (MotoGP, Superbike Racing)

4.2.2 Daily Commuters

4.2.3 Recreational Riders

4.2.4 Touring Riders

4.3 By Sales Channel (In Value %)

4.3.1 OEMs

4.3.2 Aftermarket

4.3.3 Online Platforms

4.3.4 Specialty Stores

4.4 By Deployment Type (In Value %)

4.4.1 Mechanical Airbags

4.4.2 Electronic Airbags

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Motorcycle Airbag Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Alpinestars S.p.A.

5.1.2. Dainese S.p.A.

5.1.3. Honda Motor Co., Ltd.

5.1.4. Hit-Air (Mugen Denko Co., Ltd.)

5.1.5. Helite

5.1.6. Spidi Sport S.r.l.

5.1.7. BMW Motorrad

5.1.8. Ducati Motor Holding S.p.A.

5.1.9. Rev'It!

5.1.10. Tech-Air by Alpinestars

5.1.11. Klim

5.1.12. RST Moto

5.1.13. Yamaha Motor Co., Ltd.

5.1.14. Suzuki Motor Corporation

5.1.15. Triumph Motorcycles

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Product Range, Technology Patents, Regional Reach, Safety Features, Pricing)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Motorcycle Airbag Market Regulatory Framework

6.1 International Safety Regulations

6.2 Certification Processes

6.3 Compliance Requirements

6.4 Environmental Regulations for Materials

7. Global Motorcycle Airbag Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Motorcycle Airbag Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By End-User (In Value %)

8.3 By Sales Channel (In Value %)

8.4 By Deployment Type (In Value %)

8.5 By Region (In Value %)

9. Global Motorcycle Airbag Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior Analysis

9.3 Marketing Strategy Insights

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first phase, we mapped the entire ecosystem of the global motorcycle airbag market. This was done using desk research and analyzing secondary data sources, including industry reports, government publications, and safety guidelines. Our objective was to identify all critical variables influencing the market, including regulations, product innovations, and rider demographics.

Step 2: Market Analysis and Construction

We collected and analyzed historical data on motorcycle sales, adoption rates of safety gear, and airbag deployment. The construction of market dynamics was backed by data on safety equipment adoption, regulations, and technological advancements in motorcycle airbag systems. Revenue estimates were cross-checked using market performance indicators across different regions.

Step 3: Hypothesis Validation and Expert Consultation

Key industry experts from top motorcycle brands and safety gear manufacturers were consulted to validate our hypotheses. Interviews were conducted through computer-assisted telephone interviews (CATIs) to gain insights into product performance, pricing, and consumer preferences. This validation process was critical in fine-tuning the market analysis.

Step 4: Research Synthesis and Final Output

In the final phase, data was synthesized, incorporating the insights gathered from industry practitioners. Our research included a bottom-up approach for data verification, focusing on key product segments and technological innovations. The final output reflects a comprehensive, validated view of the global motorcycle airbag market.

Frequently Asked Questions

01. How big is the Global Motorcycle Airbag Market?

The global motorcycle airbag market is valued at USD 415 million. The market has been steadily growing due to increased motorcycle sales and rising focus on rider safety.

02. What are the challenges in the Global Motorcycle Airbag Market?

Challenges in the global motorcycle airbag market include high costs associated with airbag integration, lack of standardization in different regions, and limited awareness about airbag technology, especially in developing markets.

03. Who are the major players in the Global Motorcycle Airbag Market?

Major players in the global motorcycle airbag market include Alpinestars, Dainese, Honda Motor Co., Ltd., Hit-Air, and Helite. These companies dominate the market due to their extensive focus on safety innovations and partnerships with motorcycle manufacturers.

04. What are the growth drivers of the Global Motorcycle Airbag Market?

The market is propelled by government initiatives for rider safety, rising motorcycle ownership, and advancements in airbag technology, such as faster deployment systems and sensor accuracy.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.