Global Motorcycle Helmet Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10061

December 2024

128

About the Report

Global Motorcycle Helmet Market Overview

- The Global Motorcycle Helmet Market is valued at USD 2.5 billion, based on a five-year historical analysis. This market is driven by increasing road safety awareness, government regulations mandating helmet use, and rising demand for helmets with advanced safety features. Growing urbanization and two-wheeler ownership in emerging economies such as India, Brazil, and Southeast Asia are further fueling the demand. Additionally, consumers preferences for helmets with aesthetic and customizable features have contributed to the markets growth. Data from the World Bank and regional safety initiatives support this upward trend.

- The market is dominated by countries like the United States, China, and India due to their high motorcycle usage and strict safety regulations. The United States has seen significant demand for high-end helmets, driven by increasing interest in biking as a leisure activity. Chinas dominance is due to its large population and growing urbanization, while Indias market thrives due to the growing two-wheeler segment and strict government policies enforcing helmet usage. These regions continue to lead the market due to economic factors and regulatory environments supporting helmet adoption.

- Different regions enforce varying helmet safety standards, such as ECE in Europe, DOT in the U.S., and ISI in India. In 2024, over 45 countries adhere to the ECE standard, which mandates rigorous testing for impact resistance and durability. The U.S. requires DOT certification, and in 2023, over 18 million helmets were sold in compliance with these standards. Indias ISI standard ensures that all helmets meet safety requirements, with over 10 million helmets certified under ISI sold last year. These regulations ensure riders safety and drive the demand for compliant products globally.

Global Motorcycle Helmet Market Segmentation

- By Product Type: The global motorcycle helmet market is segmented by product type into full-face helmets, open-face helmets, half-helmets, modular helmets, and off-road helmets. Recently, full-face helmets have taken a dominant share in the market due to their superior safety features and growing consumer demand for maximum protection. These helmets offer the highest level of safety and are increasingly favored by both daily commuters and professional riders, especially in regions with strict road safety enforcement. As road safety campaigns continue to grow, the demand for full-face helmets is expected to remain strong.

- By Distribution Channel: The market is also segmented by distribution channel into offline retail (stores and dealerships) and online retail. Offline retail holds a dominant position in the market, accounting for the majority of helmet sales. This is largely due to consumer preference for physically inspecting helmets before purchase to assess comfort, size, and fit. Additionally, brick-and-mortar stores offer immediate availability and allow for product trials, which remains a significant factor for consumers in developing markets where online infrastructure is still evolving.

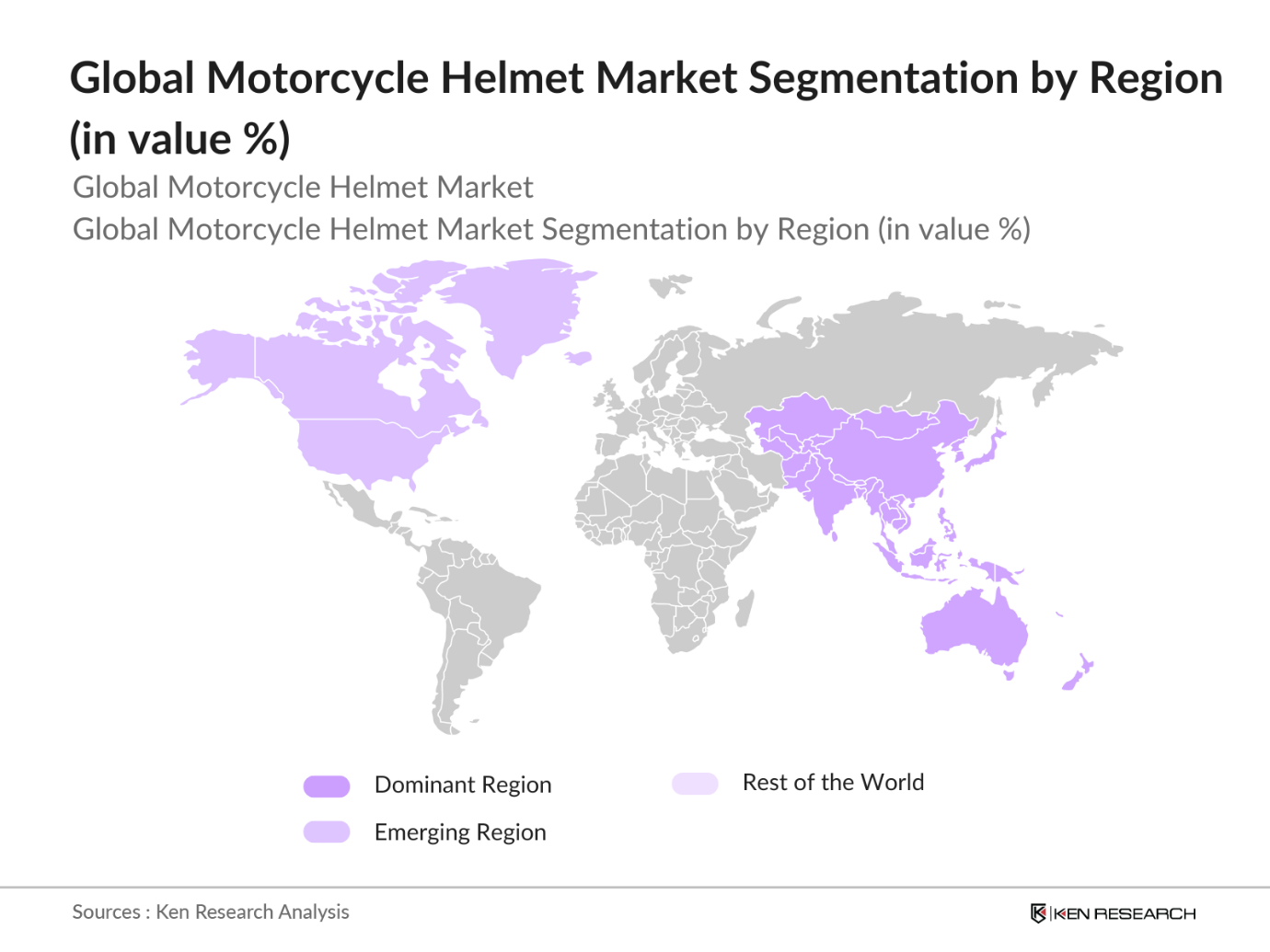

- By Region: Regionally, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region dominates the global market, driven by increasing two-wheeler ownership in countries such as India, China, and Indonesia. The rapid urbanization, coupled with the enforcement of road safety laws and helmet usage mandates, makes this region the fastest-growing market. The rising middle class in these countries also fuels demand for premium helmets, contributing to regional growth.

Global Motorcycle Helmet Market Competitive Landscape

The global motorcycle helmet market is characterized by a few key players dominating the market. The competition is primarily driven by product innovations, safety certifications, and strategic partnerships with motorcycle manufacturers. Companies like Shoei, AGV, and Arai have a strong foothold in the market due to their reputation for producing high-quality helmets, whereas newer entrants are focusing on smart helmet technology integration.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Annual Revenue (USD) |

Certification |

R&D Investment (USD) |

Product Range |

Regional Presence |

|

Arai Helmet Ltd. |

1926 |

Japan |

- |

- |

- |

- |

- |

- |

|

Shoei Co., Ltd. |

1958 |

Japan |

- |

- |

- |

- |

- |

- |

|

AGV |

1947 |

Italy |

- |

- |

- |

- |

- |

- |

|

HJC Helmets |

1971 |

South Korea |

- |

- |

- |

- |

- |

- |

|

Nolan Helmets |

1972 |

Italy |

- |

- |

- |

- |

- |

- |

Global Motorcycle Helmet Industry Analysis

Growth Drivers

- Rising Road Safety Awareness: In 2024, road safety has become a top priority in many countries, leading to an increase in helmet adoption. According to the World Health Organization, over 1.35 million people die annually from road accidents, with many fatalities involving two-wheeler riders. In countries like India, where motorcycle accidents contribute significantly to fatalities, awareness campaigns and governmental initiatives have resulted in increased helmet usage. In Brazil, for example, road safety awareness programs resulted in a 30% increase in helmet sales in urban areas in 2023, promoting the need for helmets as a mandatory safety accessory.

- Government Regulations on Helmet Usage: Government regulations mandating helmet usage have been crucial for market growth. In 2024, 89 countries have implemented helmet usage laws. In India, the Ministry of Road Transport mandated helmet use for all motorized two-wheeler riders, resulting in substantial fines for non-compliance. The Motor Vehicles Act, 2019, in India has led to a 45% increase in helmet sales in 2023 as people adhere to the law to avoid penalties. The European Union also enforces strict regulations, leading to the adoption of ECE-compliant helmets, with over 20 million helmets sold across the region annually.

- Increasing Two-Wheeler Ownership (Urban and Rural): Two-wheeler ownership is increasing rapidly, particularly in emerging markets like India and Southeast Asia. In India, two-wheelers constitute 75% of total vehicle registrations, with over 21 million two-wheelers sold in 2023 alone. This rise has directly boosted the demand for helmets as riders seek to comply with local safety laws. In rural regions, two-wheeler ownership has risen as incomes grow, contributing to helmet sales. In Indonesia, over 9 million motorcycles were sold in 2023, which further emphasized the need for helmets, especially with government campaigns targeting rural safety.

Market Restraints

- Pricing Constraints for Developing Economies: The cost of helmets remains a major challenge in developing economies, where affordability often dictates purchasing decisions. In countries like Nigeria and Bangladesh, where the per capita income remains below $2,500, the average price of a quality helmet can be prohibitive, leading to lower helmet sales. In Nigeria, where over 60% of the population lives on less than $3.20 a day, cheaper, non-standard helmets are commonly used, negatively impacting the market for quality helmets and increasing safety risks.

- Lack of Standardization in Safety Regulations: Safety regulation inconsistencies across regions are a significant challenge. In 2024, different countries continue to adopt varying safety standards, such as ECE in Europe, DOT in the U.S., and ISI in India. This lack of uniformity hinders global helmet manufacturers from producing a single model that complies with all safety standards, thus increasing production costs. For example, in 2023, nearly 20% of helmets imported into India did not meet the ISI standard, leading to increased costs due to the need for region-specific manufacturing.

Global Motorcycle Helmet Market Future Outlook

Over the next five years, the global motorcycle helmet market is expected to see significant growth driven by continuous advancements in safety technologies, the rise of smart helmets, and increasing consumer demand for high-performance gear. Governments around the world continue to introduce stringent helmet laws, particularly in regions like Asia and Latin America, to curb traffic fatalities. As disposable incomes increase and the trend of motorcycling as a hobby grows, particularly in developed nations, the demand for premium and customizable helmets will further fuel market expansion.

Market Opportunities

- Rising Demand for Smart Helmets (Smart Technology, Connectivity Features): Smart helmets, which integrate advanced features such as Bluetooth connectivity, GPS, and safety sensors, are experiencing strong demand in 2024. In the U.S., over 500,000 smart helmets were sold in 2023, showing a shift toward enhanced riding experiences. These helmets, equipped with integrated communication systems and navigation tools, are particularly popular among urban motorcyclists. With the global push towards the Internet of Things (IoT), the adoption of smart helmets is expected to grow further, backed by strong sales in tech-savvy markets like Japan, which saw a 20% rise in sales in 2023.

- Growth in E-Commerce Platforms: E-commerce platforms have become a significant driver for helmet sales, with over 50% of global helmet purchases made online in 2024. In India, leading e-commerce platforms reported a 30% increase in helmet sales in 2023, particularly in rural and semi-urban areas where access to retail outlets is limited. This trend is mirrored in Southeast Asia, where digital adoption is rapidly growing, supported by the increasing penetration of mobile phones and affordable internet access. The rise of online platforms is creating opportunities for brands to reach wider audiences without the need for a physical presence.

Scope of the Report

|

Product Type |

Full-Face Helmets Open-Face Helmets Half-Helmets Modular Helmets Off-Road Helmets |

|

End-User |

Commuters Professional Riders Enthusiasts |

|

Distribution Channel |

Offline Retail Online Retail |

|

Material Type |

Polycarbonate Fiberglass Composite Carbon Fiber Kevlar |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Motorcycle Manufacturers

Helmet Distributors and Retailers

Helmet Component Suppliers

Safety and Certification Bodies

Government and Regulatory Bodies (DOT, ECE, SNELL)

Investors and Venture Capitalist Firms

Insurance Companies

E-commerce Platforms

Companies

Players Mentioned in the Report:

Arai Helmet Ltd.

Shoei Co., Ltd.

AGV

HJC Helmets

Nolan Helmets

Bell Helmets

Schuberth GmbH

LS2 Helmets

Shark Helmets

Caberg Helmets

Studds Accessories Ltd.

MT Helmets

Royal Enfield

Vega Helmets

TORC Helmets

Table of Contents

1. Global Motorcycle Helmet Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics (Growth Drivers, Challenges, Opportunities)

1.4. Market Segmentation Overview

2. Global Motorcycle Helmet Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Motorcycle Helmet Market Analysis

3.1. Growth Drivers

3.1.1. Rising Road Safety Awareness

3.1.2. Government Regulations on Helmet Usage

3.1.3. Increasing Two-Wheeler Ownership (Urban and Rural)

3.1.4. Consumer Preferences for Premium Safety Features

3.2. Market Challenges

3.2.1. Pricing Constraints for Developing Economies

3.2.2. Lack of Standardization in Safety Regulations

3.2.3. Counterfeit Helmet Market

3.3. Opportunities

3.3.1. Rising Demand for Smart Helmets (Smart Technology, Connectivity Features)

3.3.2. Growth in E-Commerce Platforms

3.3.3. Entry into Emerging Markets (India, Southeast Asia, Africa)

3.4. Trends

3.4.1. Lightweight Helmets with Advanced Materials (Carbon Fiber, Kevlar)

3.4.2. Integration of Advanced Ventilation Systems

3.4.3. Customizable and Stylish Helmet Designs

3.5. Government Regulations

3.5.1. Helmet Safety Standards by Region (ECE, DOT, ISI)

3.5.2. Enforcement of Penalties for Non-Compliance

3.6. Stakeholder Ecosystem

3.7. Porters Five Forces Analysis

3.8. Competitive Landscape

4. Global Motorcycle Helmet Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Full-Face Helmets

4.1.2. Open-Face Helmets

4.1.3. Half-Helmets

4.1.4. Modular Helmets

4.1.5. Off-Road Helmets

4.2. By End-User (In Value %)

4.2.1. Commuters

4.2.2. Professional Riders

4.2.3. Enthusiasts

4.3. By Distribution Channel (In Value %)

4.3.1. Offline Retail (Stores, Dealerships)

4.3.2. Online Retail

4.4. By Material Type (In Value %)

4.4.1. Polycarbonate

4.4.2. Fiberglass Composite

4.4.3. Carbon Fiber

4.4.4. Kevlar

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Motorcycle Helmet Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Arai Helmet Ltd.

5.1.2. Bell Helmets

5.1.3. Shoei Co., Ltd.

5.1.4. HJC Helmets

5.1.5. AGV (Amsafe Bridport)

5.1.6. Schuberth GmbH

5.1.7. Nolan Helmets

5.1.8. LS2 Helmets

5.1.9. Shark Helmets

5.1.10. Caberg Helmets

5.1.11. Studds Accessories Ltd.

5.1.12. MT Helmets

5.1.13. Royal Enfield (Eicher Motors)

5.1.14. Vega Helmets

5.1.15. TORC Helmets

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Helmet Range, Safety Certification, Price Range, Technology Integration, Manufacturing Locations, Geographic Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

6. Global Motorcycle Helmet Market Regulatory Framework

6.1. Regional Helmet Certification Requirements (ECE, DOT, SNELL)

6.2. Compliance with Environmental Regulations (Sustainable Materials)

6.3. Enforcement of Safety Mandates for Helmet Usage

7. Global Motorcycle Helmet Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Motorcycle Helmet Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. Global Motorcycle Helmet Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segment Analysis

9.3. Product Diversification Strategy

9.4. Market Penetration Tactics for Emerging Economies

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders in the global motorcycle helmet market. Desk research is conducted using secondary data sources, including industry reports, government publications, and proprietary databases, to identify critical factors such as safety regulations, consumer preferences, and distribution channels influencing market dynamics.

Step 2: Market Analysis and Construction

This phase involves collecting historical data on the global motorcycle helmet market, including production volumes, revenue generation, and distribution patterns. Additionally, we analyze helmet usage statistics, certification processes, and the ratio of offline to online sales to accurately estimate the market size for 2023.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are developed and validated through consultations with market experts and stakeholders, including manufacturers, retailers, and regulatory bodies. These consultations provide insights into market trends, safety standard certifications, and emerging technologies such as smart helmets.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing primary and secondary research findings to create a comprehensive report. This includes verifying the data from the bottom-up approach and confirming industry trends with manufacturers, ensuring a well-rounded view of the motorcycle helmet market.

Frequently Asked Questions

01. How big is the Global Motorcycle Helmet Market?

The global motorcycle helmet market is valued at USD 2.5 billion, driven by the increasing awareness of road safety and government regulations mandating helmet use in emerging markets.

02. What are the challenges in the Global Motorcycle Helmet Market?

The challenges include counterfeit helmet production, lack of standardization in safety certifications, and pricing constraints in developing economies, which hamper market penetration.

03. Who are the major players in the Global Motorcycle Helmet Market?

Key players in the market include Arai Helmet Ltd., Shoei Co., Ltd., AGV, HJC Helmets, and Nolan Helmets. These companies have a global presence and dominate due to their strong safety certifications and innovative product lines.

04. What are the growth drivers of the Global Motorcycle Helmet Market?

Growth is driven by rising two-wheeler ownership, increasing consumer demand for premium helmets with advanced safety features, and strict government regulations enforcing helmet use across regions like Asia and Latin America.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.