Global Movies and Entertainment Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD11106

December 2024

118

About the Report

Global Movies and Entertainment Market Overview

- The global movies and entertainment market is valued at USD 100.3 billion, driven primarily by the expansion of digital streaming services and increasing consumer spending on entertainment content. The industry is witnessing robust growth due to the rising popularity of on-demand content and advancements in technology like 4K streaming, virtual reality (VR), and artificial intelligence (AI) in content personalization. The rise of global streaming platforms such as Netflix, Amazon Prime, and Disney+ has also fueled the demand for high-quality, diverse content across genres.

- The U.S. and China lead the global movies and entertainment market due to their established infrastructure, high production value, and strong cultural influence. The U.S. is home to major studios, which dominate international box offices and streaming platforms, while Chinas government-backed cinema industry is rapidly expanding, with a significant domestic viewership base. Additionally, India and Japan are key players in the market, bolstered by strong local film industries and a dedicated audience for both domestic and international content.

- Governments globally have implemented digital content policies to monitor and regulate media. In 2024, the EUs Digital Services Act mandated transparency in content recommendations for digital platforms, a measure aimed at preventing misinformation. Similarly, Indias IT Act amendments require monitoring of online streaming content. These policies increase operational costs for companies as they adapt to regulatory requirements, but they also offer a structured framework for secure content dissemination

Global Movies and Entertainment Market Segmentation

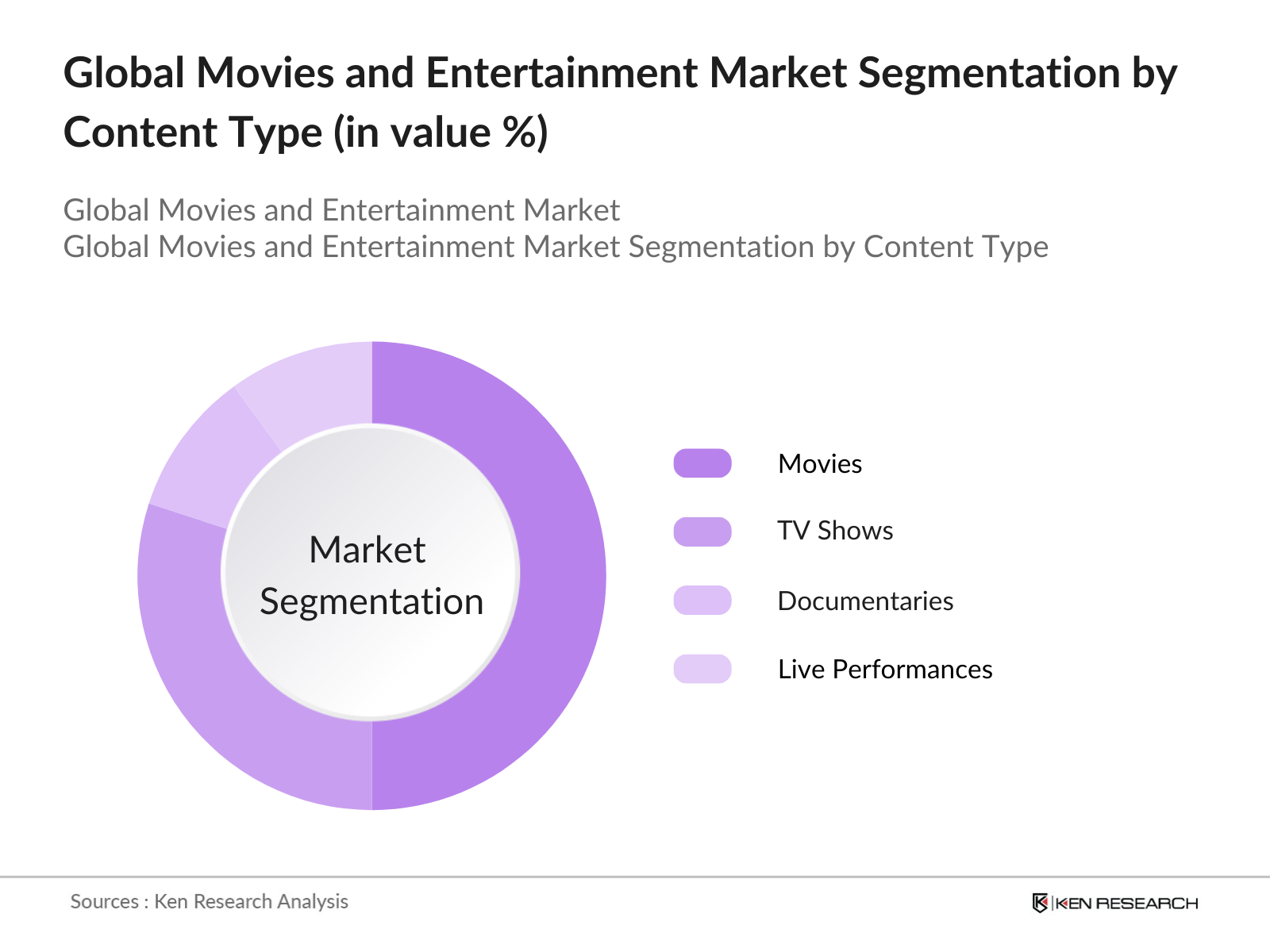

- By Content Type: The global movies and entertainment market is segmented by content type into movies, TV shows, documentaries, live performances, and music and audio content. Recently, movies hold a dominant market share in this segment, attributed to their substantial global audience and the growth of streaming platforms. Hollywood studios have extensive budgets and global distribution channels, enabling films to reach international markets rapidly. Movies are also culturally impactful and offer diverse genre appeal, ensuring strong audience engagement.

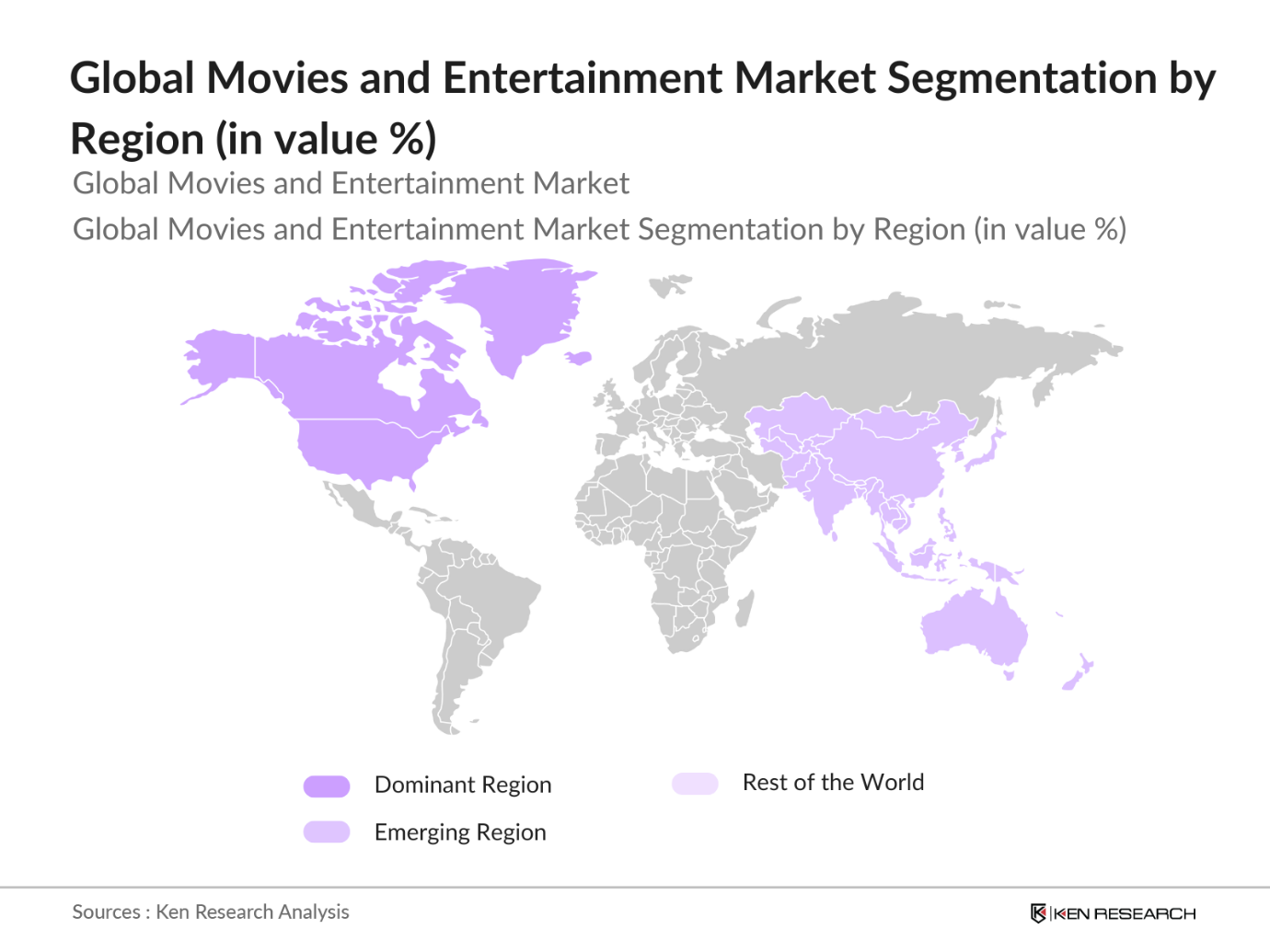

- By Region: The global movies and entertainment market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America dominates due to its historical foundation in the film industry, hosting the headquarters of top studios and streaming platforms. The regions high disposable income and strong demand for diverse content across genres also contribute to its leading position. Asia-Pacific follows closely, with countries like China and India experiencing rapid market growth, fueled by increasing investments and a growing population of streaming subscribers.

- By Distribution Channel: The distribution channels in the global movies and entertainment market include theatrical releases, digital/streaming platforms, cable and satellite, physical sales, and licensing and merchandising. Streaming platforms lead this segment due to their flexibility and accessibility. Digital streamings rise is driven by changing consumer preferences toward on-demand content and the ability to consume content across devices. Platforms like Netflix and Disney+ leverage data analytics to offer personalized recommendations, enhancing user experience and retention.

Global Movies and Entertainment Market Competitive Landscape

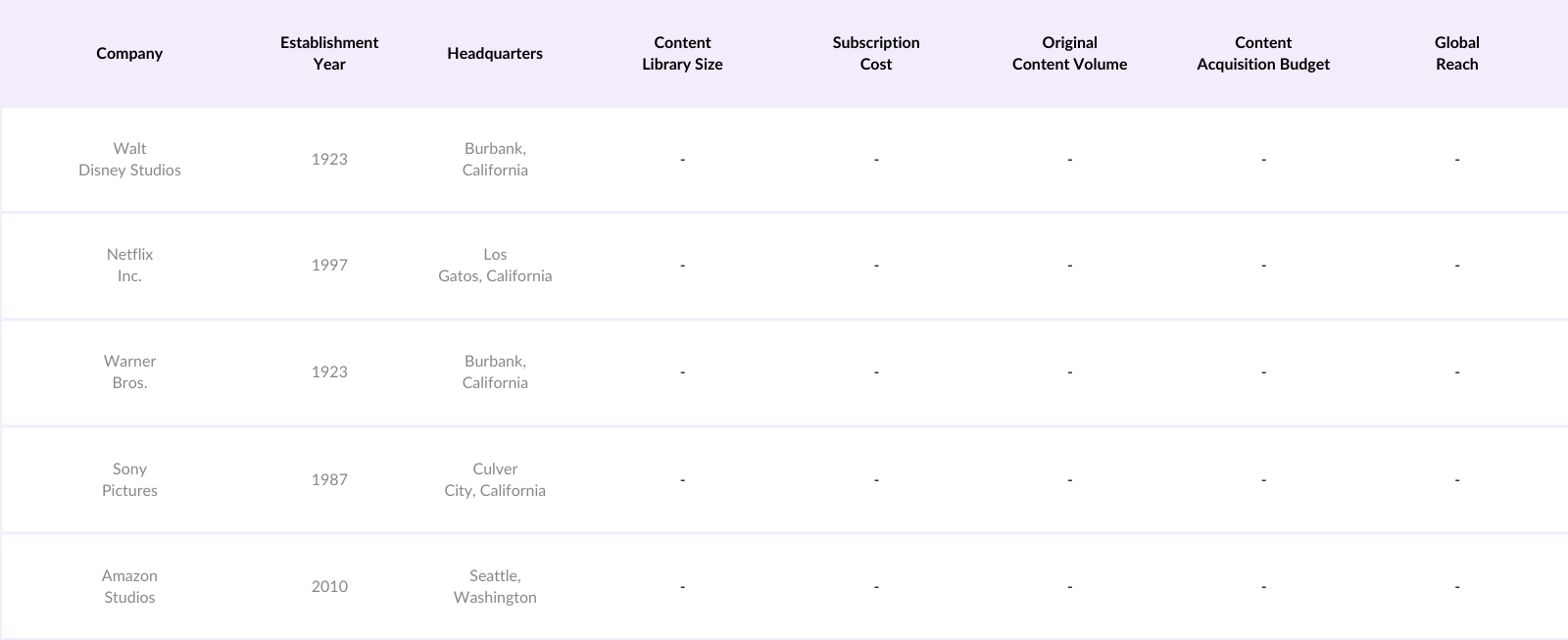

The global movies and entertainment market is consolidated, with a few key players controlling a significant portion of market share. Major companies like Walt Disney Studios and Netflix lead in revenue and content production, leveraging extensive distribution networks. The market remains competitive with constant innovation in content types, partnerships, and regional expansions.

Global Movies and Entertainment Industry Analysis

Growth Drivers

- Increasing Digital Consumption: The global increase in internet access, with 5.16 billion users online in 2024, drives significant growth in digital media consumption, including movies and entertainment content. Countries with rapid internet expansion, such as India with over 840 million users, reflect this trend, with 90% consuming video content online. The digital media market benefits from high smartphone penetrationaround 6.8 billion globally, fueling direct-to-consumer content delivery. The shift in entertainment patterns, supported by enhanced internet connectivity in rural areas globally, facilitates wider access to digital content and promotes growth for digital platforms in various economies.

- Expanding Streaming Platforms: In 2024, streaming services reach over 3 billion subscriptions worldwide, with growth driven by major players entering emerging markets. For instance, Indias subscriber base rose by approximately 11% in the last two years, reflecting increased local content offerings. Latin America also experiences an uptick in subscribers, where affordable streaming plans are made available to capture lower-income segments. The market shows a strong digital transformation, with over 68% of new internet subscribers in Asia and Africa engaging in streaming activities as platforms expand their reach.

- Technological Advancements (AR, VR, AI in Content) : Technologies like AR, VR, and AI enhance content consumption and engagement in the entertainment industry. In 2024, VR headset shipments reached 8.5 million units globally, supported by an influx of immersive movie experiences. AI tools also optimize content recommendation systems, with platforms like Netflix implementing AI-driven personalization, impacting the viewing habits of its 231 million users globally. This growth is backed by government support, with countries like the U.S. investing $400 million in AI and AR research to boost digital entertainment technologies, as seen through recent Department of Commerce allocations.

Market Restraints

- Piracy Concerns: Piracy remains a major challenge for the global entertainment industry, with losses reaching approximately $29 billion annually due to illegal downloads. This is especially significant in emerging markets where enforcement of copyright laws is limited. In countries like India and Brazil, where digital piracy rates exceed 50%, the financial impact constrains industry growth. Governments such as the U.S. have responded with the introduction of policies like the 2024 Digital Millennium Copyright Act amendments to curb piracy. However, piracy remains prevalent, impacting revenue streams worldwide.

- Content Censorship and Regulation: Content censorship varies globally, with stringent regulations in markets like China, where foreign movies are limited to 34 annually. Middle Eastern countries impose similar restrictions, affecting the profitability of content from global studios. Regulations in India and Southeast Asia mandate content review processes, leading to delays in releases. The influence of local governments, such as the Chinese government's strict monitoring of digital media, adds a layer of complexity to market operations, challenging the global distribution and consumption of diverse content.

Global Movies and Entertainment Market Future Outlook

Over the next five years, the global movies and entertainment market is anticipated to experience growth driven by the continued expansion of streaming services, technological advancements, and rising consumer demand for personalized and diverse content. Industry players are likely to invest in immersive technologies, such as augmented and virtual reality, to enhance the user experience and create more interactive content.

Market Opportunities

- New Revenue Streams through NFTs: NFTs provide new revenue opportunities, allowing creators to monetize digital collectibles. In 2024, NFT sales in the entertainment industry reached $4.7 billion, with companies like Warner Music experimenting with NFT merchandise. NFTs provide direct engagement opportunities, especially in markets like the U.S., where over 2 million consumers actively purchase digital assets. Governments in countries like Japan have also taken steps to regulate NFT sales, enhancing legitimacy in the market, which promotes industry adoption of NFTs.

- Cross-Platform Content Integration: With over 74% of consumers preferring cross-platform viewing options, platforms are capitalizing on integrated media experiences. This trend sees content designed for television, streaming, and gaming, where companies like Disney are integrating Marvel and Star Wars franchises across these media. Such strategies expand reach, especially in the U.K., where regulations now encourage integrated content under the Digital Services Act, aiming to provide consumers with diversified content options. This trend aligns with consumer preferences for versatile entertainment options, enhancing market growth.

Scope of the Report

|

Content Type |

Movies TV Shows and Series Documentaries Live Performances Music/Audio |

|

Distribution Channel |

Theatrical Releases Streaming Platforms Cable and Satellite Physical Sales |

|

Genre |

Action Drama Comedy Thriller Animation |

|

Revenue Model |

Subscription-Based Pay-Per-View Advertising-Based Freemium |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Streaming Platforms

Theatrical Distributors

Production Companies

Advertising Agencies

Investor and Venture Capitalist Firms

Telecommunication Providers

Government and Regulatory Bodies (Federal Communications Commission (FCC), National Film Development Corporation)

Media and Entertainment Service Providers

Companies

Players Mentioned in the Report:

Walt Disney Studios

Netflix Inc.

Warner Bros.

Universal Pictures

Sony Pictures Entertainment

Paramount Pictures

Lionsgate Films

Amazon Studios

Apple TV+

ViacomCBS

NBCUniversal Media

DreamWorks Animation

Metro-Goldwyn-Mayer (MGM)

Hulu LLC

HBO Max

Table of Contents

1. Global Movies and Entertainment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Movies and Entertainment Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Movies and Entertainment Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Digital Consumption

3.1.2 Expanding Streaming Platforms

3.1.3 Technological Advancements (AR, VR, AI in Content)

3.1.4 Global Expansion of Content Production

3.2 Market Challenges

3.2.1 Piracy Concerns

3.2.2 Content Censorship and Regulation

3.2.3 High Production Costs

3.2.4 Market Saturation in Developed Economies

3.3 Opportunities

3.3.1 New Revenue Streams through NFTs

3.3.2 Cross-Platform Content Integration

3.3.3 Growth in Emerging Markets

3.3.4 Collaborations with Telecom Operators

3.4 Trends

3.4.1 Rise of On-Demand Content

3.4.2 Interactive and Personalized Viewing Experiences

3.4.3 Expansion of Multilingual Content

3.4.4 Growth of Independent Filmmakers and Studios

3.5 Government Regulations

3.5.1 Digital Content Regulation Policies

3.5.2 Subsidies for Local Production

3.5.3 Export Regulations for Content

3.5.4 Intellectual Property (IP) Protections

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porter's Five Forces

3.9 Competitive Ecosystem

4. Global Movies and Entertainment Market Segmentation

4.1 By Content Type (in Value %)

4.1.1 Movies

4.1.2 TV Shows and Series

4.1.3 Documentaries

4.1.4 Live Performances and Events

4.1.5 Music and Audio Content

4.2 By Distribution Channel (in Value %)

4.2.1 Theatrical Releases

4.2.2 Digital/Streaming Platforms

4.2.3 Cable and Satellite

4.2.4 Physical Sales (DVDs, Blu-ray)

4.2.5 Licensing and Merchandising

4.3 By Genre (in Value %)

4.3.1 Action

4.3.2 Drama

4.3.3 Comedy

4.3.4 Thriller and Horror

4.3.5 Animation

4.4 By Revenue Model (in Value %)

4.4.1 Subscription-Based

4.4.2 Pay-Per-View

4.4.3 Advertising-Based

4.4.4 Freemium

4.5 By Region (in Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Movies and Entertainment Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Walt Disney Studios

5.1.2 Netflix Inc.

5.1.3 Warner Bros. Entertainment

5.1.4 Universal Pictures

5.1.5 Sony Pictures Entertainment

5.1.6 Paramount Pictures

5.1.7 Lionsgate Films

5.1.8 Amazon Studios

5.1.9 Apple TV+

5.1.10 ViacomCBS

5.1.11 NBCUniversal Media

5.1.12 DreamWorks Animation

5.1.13 Metro-Goldwyn-Mayer (MGM)

5.1.14 Hulu LLC

5.1.15 HBO Max

5.2 Cross Comparison Parameters (Revenue, Content Library Size, Subscription Cost, Original Content Volume, Content Acquisition Budget, Global Reach, Genre Diversity, Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures and Collaborations

5.8 Technological Innovations

5.9 Content Licensing and Syndication Agreements

6. Global Movies and Entertainment Market Regulatory Framework

6.1 Content Licensing Standards

6.2 Data Protection and Privacy Laws

6.3 Copyright and Anti-Piracy Regulations

6.4 Content Classification Standards

7. Global Movies and Entertainment Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Movies and Entertainment Future Market Segmentation

8.1 By Content Type (in Value %)

8.2 By Distribution Channel (in Value %)

8.3 By Genre (in Value %)

8.4 By Revenue Model (in Value %)

8.5 By Region (in Value %)

9. Global Movies and Entertainment Market Analysts Recommendations

9.1 Market Penetration Strategies

9.2 Consumer Cohort Analysis

9.3 Targeted Advertising Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved identifying all relevant stakeholders within the global movies and entertainment market. Extensive desk research was conducted using secondary databases to define critical variables influencing market performance.

Step 2: Market Analysis and Construction

In this stage, historical data for the movies and entertainment market was collected, with a focus on market penetration, subscription rates, and revenue generated. This also included quality assessments for market segment accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through expert interviews, providing insights into industry challenges, trends, and projections. Consultations were instrumental in validating the accuracy of the dataset.

Step 4: Research Synthesis and Final Output

The final synthesis stage included cross-verifying data with top industry players to acquire insights on market trends and segmentation. This ensured a comprehensive and validated analysis of the global movies and entertainment market.

Frequently Asked Questions

1. How big is the global movies and entertainment market?

The global movies and entertainment market is valued at USD 100.3 billion, propelled by the expansion of digital platforms and increased consumer spending on on-demand content.

2. What are the challenges in the global movies and entertainment market?

Challenges include piracy, regulatory restrictions, high production costs, and market saturation in established economies. These factors can impact profitability and market expansion.

3. Who are the major players in the global movies and entertainment market?

Key players include Walt Disney Studios, Netflix, Warner Bros., Universal Pictures, and Amazon Studios, dominating due to their strong distribution channels and extensive content libraries.

4. What are the growth drivers of the global movies and entertainment market?

Key growth drivers include technological advancements, increasing digital consumption, and rising investments in streaming platforms, enhancing the consumer experience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.