Global Mushroom Protein Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD4353

December 2024

87

About the Report

Global Mushroom Protein Market Overview

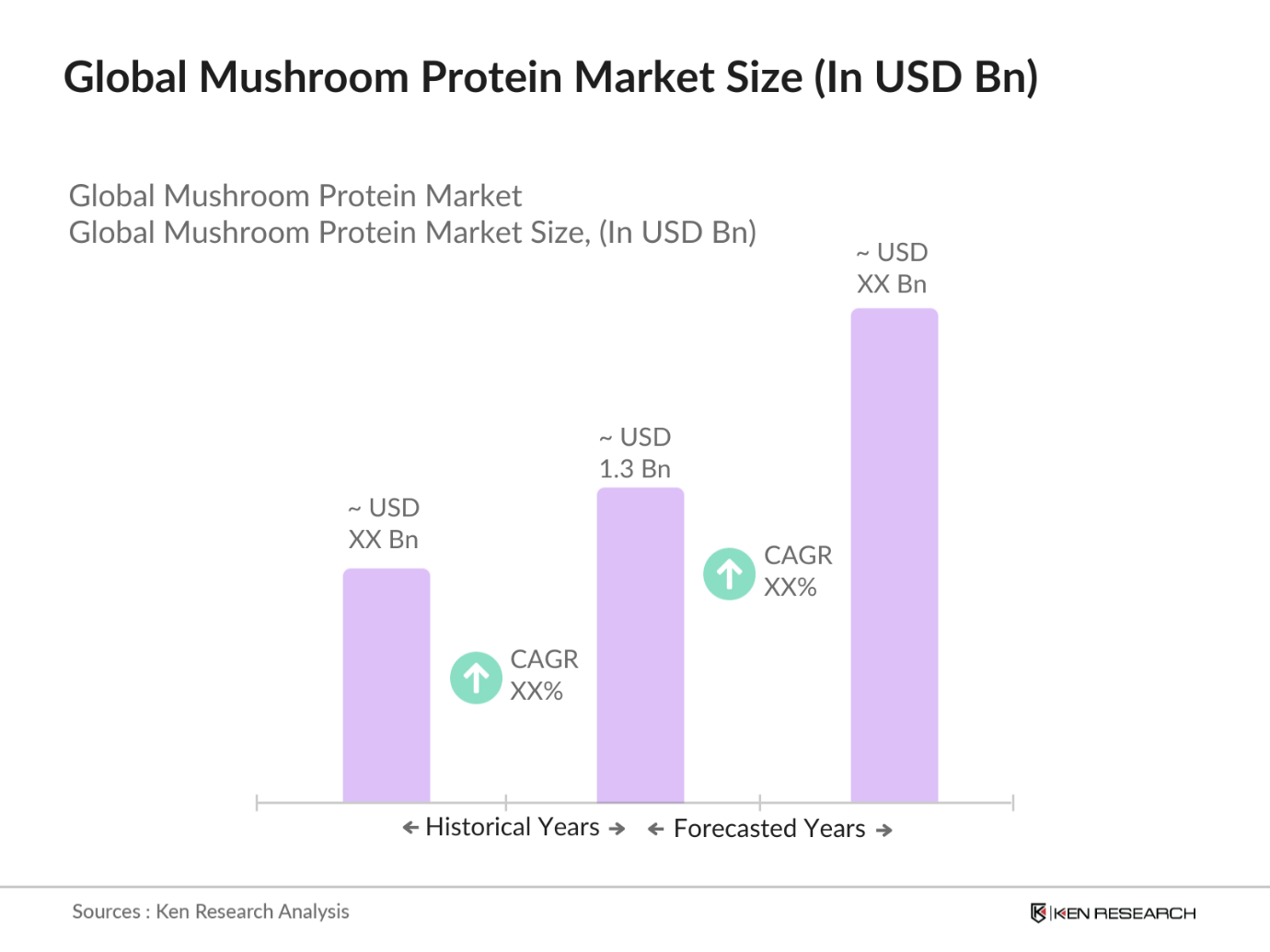

- The global mushroom protein market has grown rapidly and is valued at USD 1.3 billion, driven by increasing consumer demand for plant-based proteins and sustainable food sources. Mushrooms are gaining attention due to their rich nutrient profile, protein content, and minimal environmental impact. A combination of factors such as rising health consciousness, the popularity of vegan diets, and advancements in food technology is propelling market growth. The availability of innovative products such as mushroom-based meat substitutes has also contributed to the growing market size.

- Countries such as the United States, Germany, and China dominate the mushroom protein market. In the United States, consumer preference for alternative proteins, coupled with a well-established infrastructure for plant-based food production, positions it as a market leader. Germany has a strong focus on sustainable food practices and alternative protein innovations, while Chinas expanding food processing sector and increasing demand for health-centric food products make it a key player. These countries lead due to advanced R&D capabilities, consumer demand, and robust distribution networks.

- Mushroom protein production must comply with stringent food safety standards set by regulatory bodies such as the Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). As of 2024, these regulations require rigorous testing for contaminants, allergens, and microbial safety, ensuring the safe consumption of mushroom protein-based products. In the EU, compliance with the General Food Law has seen a 15% increase in testing requirements for plant-based proteins, including mushrooms.

Global Mushroom Protein Market Segmentation

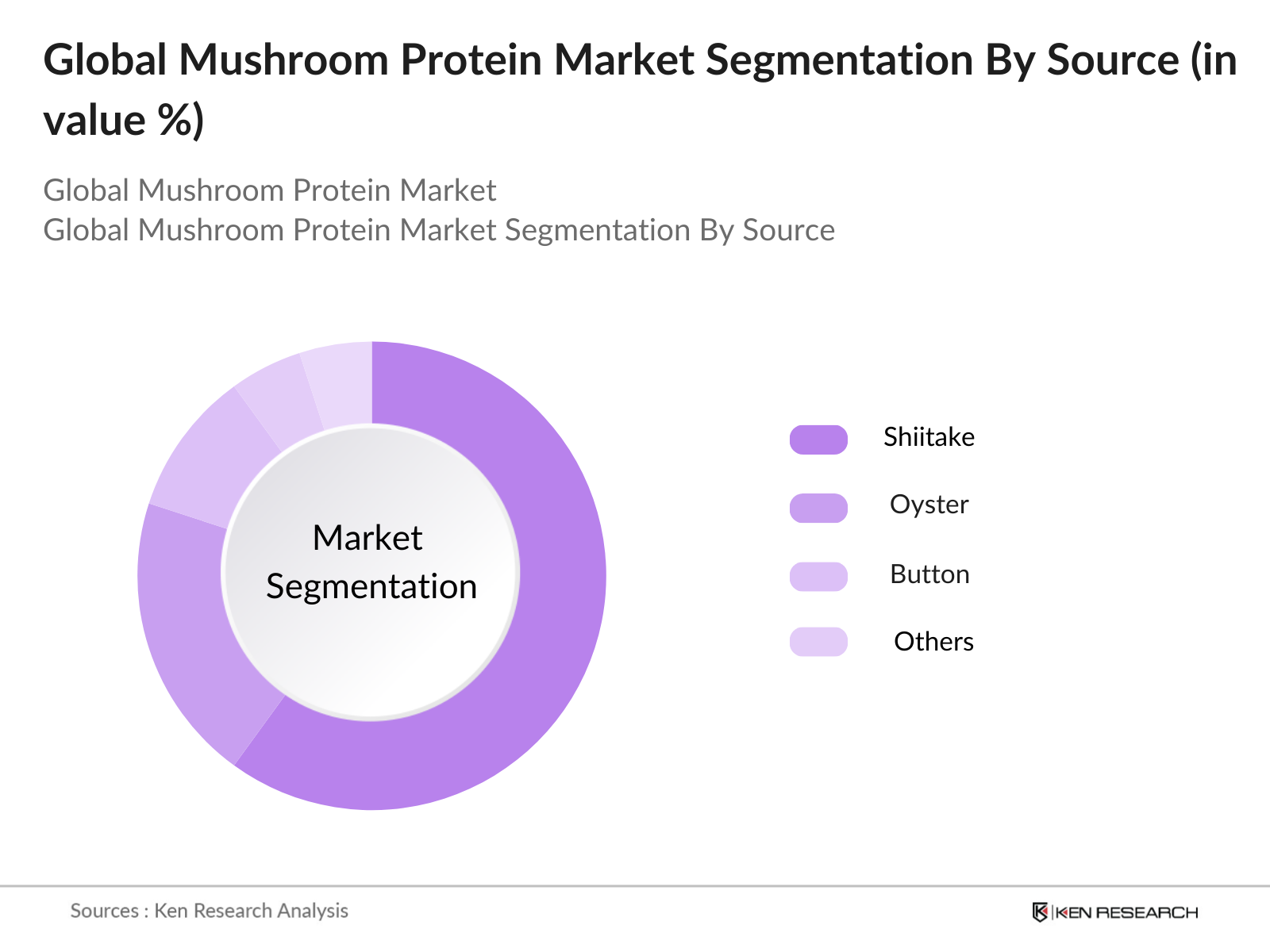

By Source: The global mushroom protein market is segmented by source into shiitake, oyster, button, and others. Button mushrooms dominate the market in this segment due to their widespread availability and versatile applications in food products. Button mushrooms are the most cultivated and consumed variety globally, used in both fresh and processed forms. Their mild flavor and adaptability to various cuisines contribute to their dominant market share. Additionally, their low cost and ability to grow in diverse environments make them a preferred choice for large-scale production.

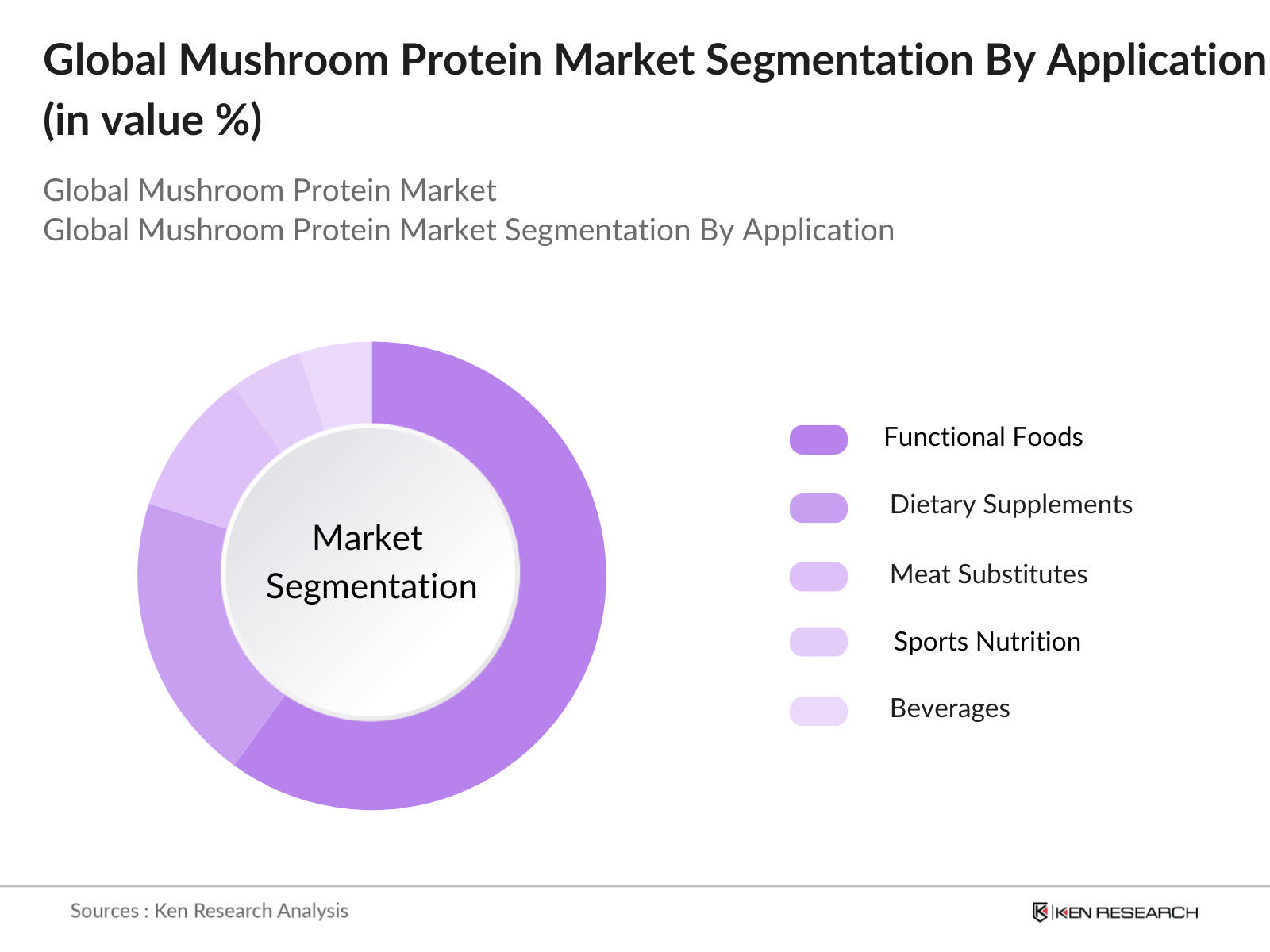

By Application: In terms of application, the mushroom protein market is segmented into functional foods, dietary supplements, meat substitutes, sports nutrition, and beverages. The meat substitutes segment holds the largest market share, driven by the rising demand for plant-based diets and the growing popularity of flexitarian eating habits. Consumers seeking alternatives to animal-based proteins often turn to mushroom protein due to its meaty texture and high protein content. This shift is further supported by the environmental benefits of mushrooms, such as lower carbon emissions and water usage compared to traditional livestock farming.

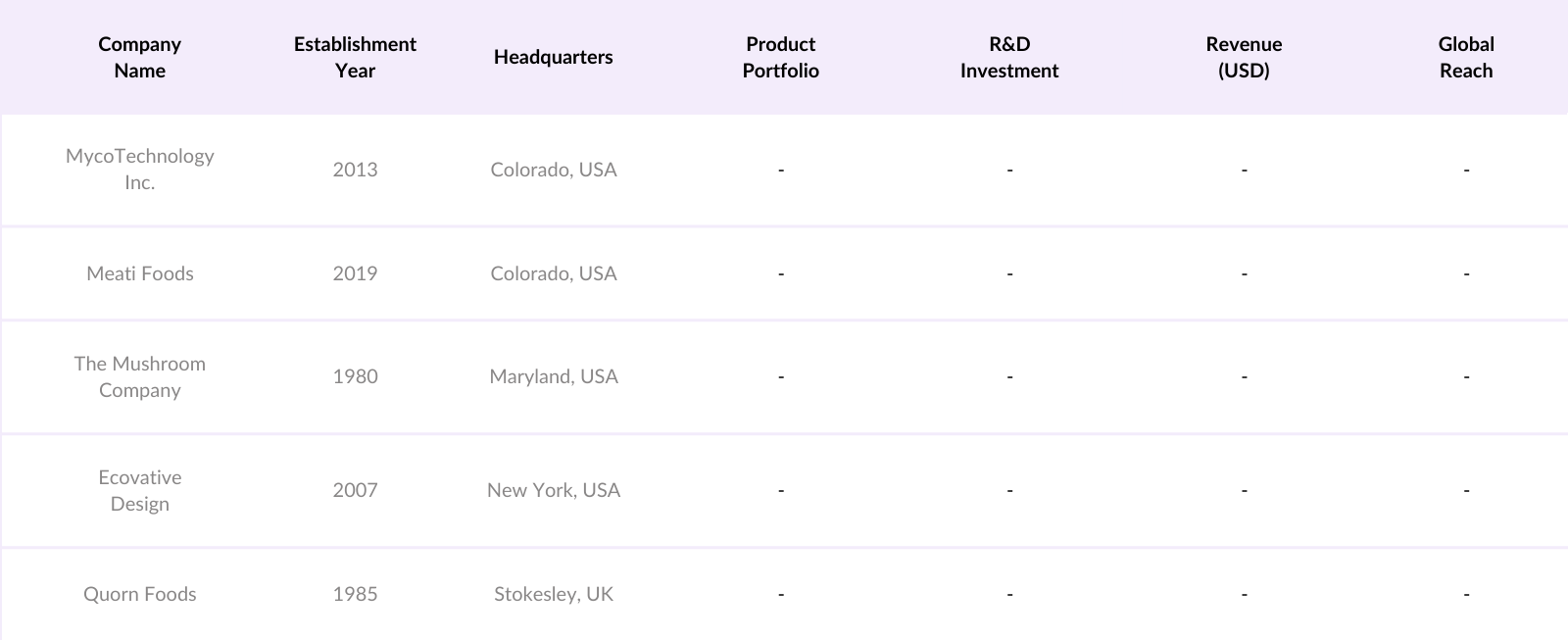

Global Mushroom Protein Market Competitive Landscape

The global mushroom protein market is competitive, with several prominent players dominating the landscape. These companies focus on innovation, sustainability, and expanding their product offerings to cater to the growing consumer demand for plant-based proteins.

The mushroom protein market is dominated by these players, who focus on both product innovation and sustainability initiatives. Companies such as MycoTechnology Inc. and Quorn Foods are investing heavily in R&D to stay ahead of the competition and meet the growing demand for plant-based proteins. Additionally, mergers and acquisitions (M&A) activity in this market highlights the ongoing consolidation trend as larger players seek to expand their market presence and strengthen their product portfolios.

Global Mushroom Protein Market Analysis

Growth Drivers

- Consumer Preference for Plant-Based Proteins: With the global population shifting towards healthier dietary choices, the demand for plant-based proteins has surged. As of 2024, the global population is witnessing a significant rise in the adoption of plant-based diets, with nearly 79 million individuals identifying as vegan or vegetarian, according to global dietary trends by the World Health Organization (WHO). Mushroom protein, known for its rich amino acid profile, has emerged as a top choice due to its minimal environmental impact. Additionally, the average daily protein consumption per person in high-income countries is 85 grams, a large portion of which is now derived from plant sources.

- Rising Demand for Alternative Proteins: The demand for alternative proteins continues to rise as global concerns about climate change and food security grow. According to the Food and Agriculture Organization (FAO), protein consumption from non-animal sources, including mushrooms, increased by 15% between 2022 and 2024. Additionally, mushroom protein is emerging as a key component due to its high digestibility and low carbon footprint, as global greenhouse gas emissions from agriculture are expected to decrease by 5 metric tons due to shifts in protein consumption patterns in developed countries.

- Increased Focus on Sustainable Food Sources: Sustainability remains a central focus for consumers in 2024, with mushroom protein seen as an eco-friendly alternative to traditional sources. Mushrooms have one of the lowest water and land footprints among protein sources. The Food and Water Watch report shows that mushroom production requires only 1.8 liters of water per kilogram, compared to 15 liters for beef. With climate concerns increasing, the sustainability aspect of mushroom protein is driving its appeal. Countries like the United States have set sustainability targets, with a 12% increase in plant-based protein consumption being linked to meeting environmental goals.

Market Challenges

- Limited Awareness in Certain Regions: Despite the rising global popularity of mushroom protein, consumer awareness remains limited in emerging markets. Data from the United Nations Development Programme (UNDP) shows that in regions like Sub-Saharan Africa and parts of Southeast Asia, less than 25% of the population has access to plant-based protein sources such as mushroom protein, compared to 78% in North America. This discrepancy highlights a significant challenge for market penetration in developing regions.

- High Production Costs: While technological advances are improving production, the cost of producing mushroom protein remains higher compared to other plant-based proteins. A 2024 report from the United Nations Food and Agriculture Organization (FAO) reveals that the cost per kilogram of mushroom protein is approximately 1.5 times higher than soy protein, largely due to the specialized cultivation and extraction processes required. This cost disparity poses a challenge for mainstream adoption, particularly in cost-sensitive markets.

Global Mushroom Protein Market Future Outlook

The global mushroom protein market is expected to see continued growth driven by the increasing shift towards plant-based diets, the rising demand for sustainable food solutions, and ongoing innovations in food technology. The focus on reducing the environmental impact of food production is pushing both consumers and manufacturers to explore alternative protein sources like mushrooms. The versatility of mushroom protein in various food applications, from meat substitutes to functional foods, ensures its growing importance in the global food landscape.

In the coming years, the mushroom protein market is likely to witness greater integration into mainstream food products, an increase in production efficiencies, and further investments in research and development. Market players will also focus on expanding their geographical presence and tapping into emerging markets where plant-based diets are gaining traction.

Market Opportunities

- Integration in Functional Foods & Beverages: The mushroom protein market is expanding beyond traditional food products and entering the functional foods and beverages sector. As of 2024, the functional food market is valued at over $250 billion, with mushroom protein increasingly used in products aimed at health-conscious consumers, particularly those seeking immune-boosting and anti-inflammatory benefits. Mushroom proteins high beta-glucan content, which supports immune health, makes it an ideal ingredient for fortified foods and beverages.

- Expanding Applications in Dietary Supplements: In 2024, mushroom protein is becoming a sought-after ingredient in the dietary supplements industry due to its nutrient density and digestibility. The supplement industry, valued at over $150 billion globally, has seen a growing inclusion of mushroom protein in protein powders and meal replacement products. According to the U.S. Department of Agriculture (USDA), mushrooms contain a range of bioactive compounds, including antioxidants and fiber, that enhance their appeal as a nutritional supplement.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Source |

Shiitake, Oyster, Button, Others |

|

By Application |

Functional Foods, Dietary Supplements, Meat Substitutes, Sports Nutrition, Beverages |

|

By Product Form |

Powder, Liquid, Capsule, Tablets |

|

By Distribution Channel |

Offline (Supermarkets, Specialty Stores, Health Food Stores), Online (E-Commerce Platforms, Company Websites) |

|

By Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Food & Beverage Manufacturers

Dietary Supplement Producers

Meat Substitute Manufacturers

Functional Foods Manufacturers

Government and Regulatory Bodies (e.g., USDA, EFSA)

Investor and Venture Capitalist Firms

Research and Development Firms

Organic and Sustainable Food Retailers

Companies

Players mentioned in the Market

MycoTechnology Inc.

Meati Foods

The Mushroom Company

Ecovative Design

Quorn Foods

Bolt Threads

Perfect Day

Gaia Herbs

Mushlabs GmbH

M2 Ingredients

Fungi Perfecti

Shandong Qihe Biotechnology Co., Ltd.

Grow Mushrooms Ltd.

Monterey Mushrooms Inc.

Protein Reimagine Foods

Table of Contents

1. Global Mushroom Protein Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Revenue Growth %, Volume Growth %)

1.4. Market Segmentation Overview

2. Global Mushroom Protein Market Size (In USD Million)

2.1. Historical Market Size (In Volume & Value)

2.2. Year-On-Year Growth Analysis (By Value %, By Volume %)

2.3. Key Market Developments and Milestones

3. Global Mushroom Protein Market Analysis

3.1. Growth Drivers (Market-Specific Drivers e.g., Increasing Vegan Population, Health Benefits, Sustainability)

3.1.1. Consumer Preference for Plant-Based Proteins

3.1.2. Rising Demand for Alternative Proteins

3.1.3. Increased Focus on Sustainable Food Sources

3.1.4. Technological Advancements in Protein Extraction

3.2. Market Challenges (Specific to the Mushroom Protein Market)

3.2.1. Limited Awareness in Certain Regions

3.2.2. High Production Costs

3.2.3. Supply Chain Issues

3.2.4. Competition with Established Plant-Based Protein Sources (Soy, Pea Protein)

3.3. Opportunities (Mushroom Protein Industry-Specific)

3.3.1. Integration in Functional Foods & Beverages

3.3.2. Expanding Applications in Dietary Supplements

3.3.3. Partnerships with Food Tech Startups

3.3.4. Growing Investments in Research & Development

3.4. Trends (In Product Innovation, Market Consumption Patterns)

3.4.1. Increased Focus on Clean Label Products

3.4.2. Consumer Demand for Non-GMO and Organic Products

3.4.3. Use of Mushroom Protein in Meat Alternatives

3.5. Government Regulations (Related to Mushroom Protein Production and Marketing)

3.5.1. Food Safety Standards

3.5.2. Labeling Requirements

3.5.3. Regulations for Organic Certification

3.5.4. Import and Export Restrictions

3.6. SWOT Analysis

3.7. Stake Ecosystem (Suppliers, Manufacturers, Distributors, Retailers)

3.8. Porters Five Forces

3.9. Competition Ecosystem (In Mushroom Protein)

4. Global Mushroom Protein Market Segmentation

4.1. By Source (In Value %)

4.1.1. Shiitake

4.1.2. Oyster

4.1.3. Button

4.1.4. Others

4.2. By Application (In Value %)

4.2.1. Functional Foods

4.2.2. Dietary Supplements

4.2.3. Meat Substitutes

4.2.4. Sports Nutrition

4.2.5. Beverages

4.3. By Product Form (In Value %)

4.3.1. Powder

4.3.2. Liquid

4.3.3. Capsule

4.3.4. Tablets

4.4. By Distribution Channel (In Value %)

4.4.1. Offline (Supermarkets, Specialty Stores, Health Food Stores)

4.4.2. Online (E-Commerce Platforms, Company Websites)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Mushroom Protein Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. MycoTechnology Inc.

5.1.2. Meati Foods

5.1.3. The Mushroom Company

5.1.4. Ecovative Design

5.1.5. Quorn Foods

5.1.6. Perfect Day

5.1.7. Bolt Threads

5.1.8. Shandong Qihe Biotechnology Co., Ltd.

5.1.9. Monterey Mushrooms Inc.

5.1.10. Grow Mushrooms Ltd.

5.1.11. Mushlabs GmbH

5.1.12. Protein Reimagine Foods

5.1.13. Fungi Perfecti

5.1.14. Gaia Herbs

5.1.15. M2 Ingredients

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Sustainability Initiatives, Global Reach, Product Portfolio, R&D Investment, Certification Status, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Mushroom Protein Market Regulatory Framework

6.1. Food Safety Standards (FDA, EFSA)

6.2. Compliance Requirements (Labeling, Product Claims)

6.3. Certification Processes (Non-GMO, Organic, Vegan)

7. Global Mushroom Protein Future Market Size (In USD Million)

7.1. Future Market Size Projections (Top-Down Approach)

7.2. Key Factors Driving Future Market Growth

8. Global Mushroom Protein Future Market Segmentation

8.1. By Source (In Value %)

8.2. By Application (In Value %)

8.3. By Product Form (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Mushroom Protein Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives

9.3. White Space Opportunity Analysis

9.4. Market Penetration Strategies

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

This stage involves mapping the entire mushroom protein ecosystem, identifying major stakeholders, such as producers, manufacturers, and suppliers. Extensive desk research using proprietary databases and secondary resources is conducted to gather market intelligence. The aim is to recognize and define the factors that influence the mushroom protein market.

Step 2: Market Analysis and Construction

In this phase, we analyze historical market data to identify growth patterns and trends. This involves examining production volumes, revenue growth, and demand fluctuations in key regions. Additionally, an evaluation of product quality statistics and consumer behavior is conducted to ensure the reliability of market projections.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses are validated through consultations with industry experts and company representatives via structured interviews. This step includes computer-assisted telephone interviews (CATIs) to gather in-depth operational and strategic insights that validate and refine the collected data.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the research findings through direct engagement with key players in the mushroom protein market. This allows us to confirm sales performance, consumer preferences, and emerging market opportunities. The final output is a comprehensive and validated market analysis that provides accurate insights into the global mushroom protein market.

Frequently Asked Questions

01. How big is the global mushroom protein market?

The global mushroom protein market is valued at USD 1.3 billion, driven by the increasing demand for plant-based proteins and sustainable food production.

02. What are the challenges in the global mushroom protein market?

Challenges include high production costs, limited consumer awareness in some regions, and competition from other alternative proteins like soy and pea protein.

03. Who are the major players in the mushroom protein market?

Key players include MycoTechnology Inc., Meati Foods, The Mushroom Company, Quorn Foods, and Ecovative Design, who dominate the market due to their innovative product offerings and sustainability initiatives.

04. What are the growth drivers of the mushroom protein market?

The market is driven by factors such as the rising health consciousness among consumers, increasing adoption of plant-based diets, and advancements in food technology that make mushroom protein a viable alternative to animal-based proteins.

05. What are the future prospects of the mushroom protein market?

The market is expected to continue growing due to its environmental benefits, versatility in food applications, and rising consumer interest in sustainable food solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.