Global Music Production Software Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD5781

December 2024

99

About the Report

Global Music Production Software Market Overview

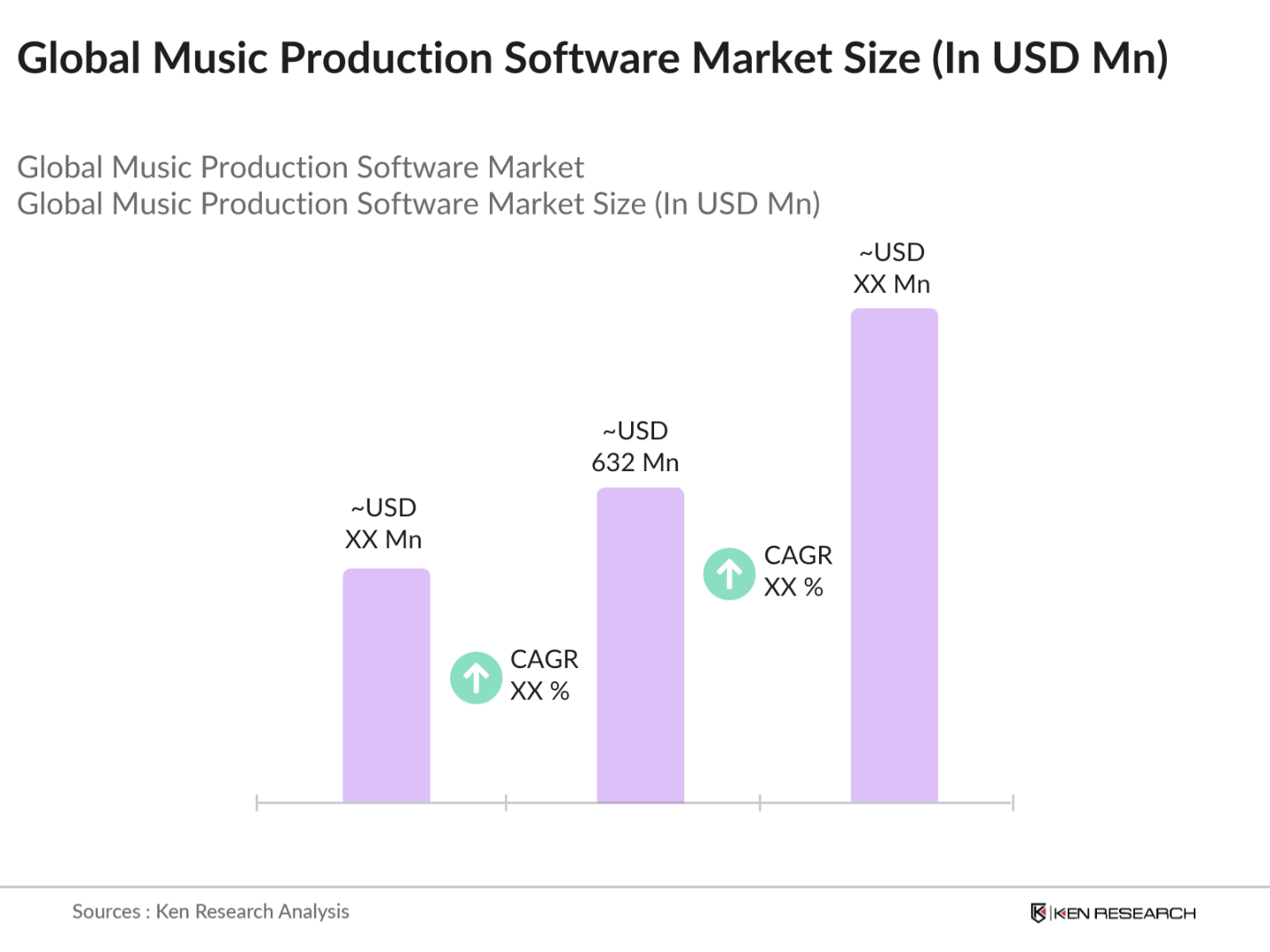

- The Global Music Production Software Market is valued at USD 632 million, based on a five-year historical analysis. This market is driven by the rise of home studios, fueled by affordability and ease of access to production tools. The increasing demand for audio content creation, such as podcasts and streaming music services, is also playing a crucial role in market expansion. Additionally, the integration of artificial intelligence (AI) and machine learning for automated mixing and mastering processes is advancing the industry.

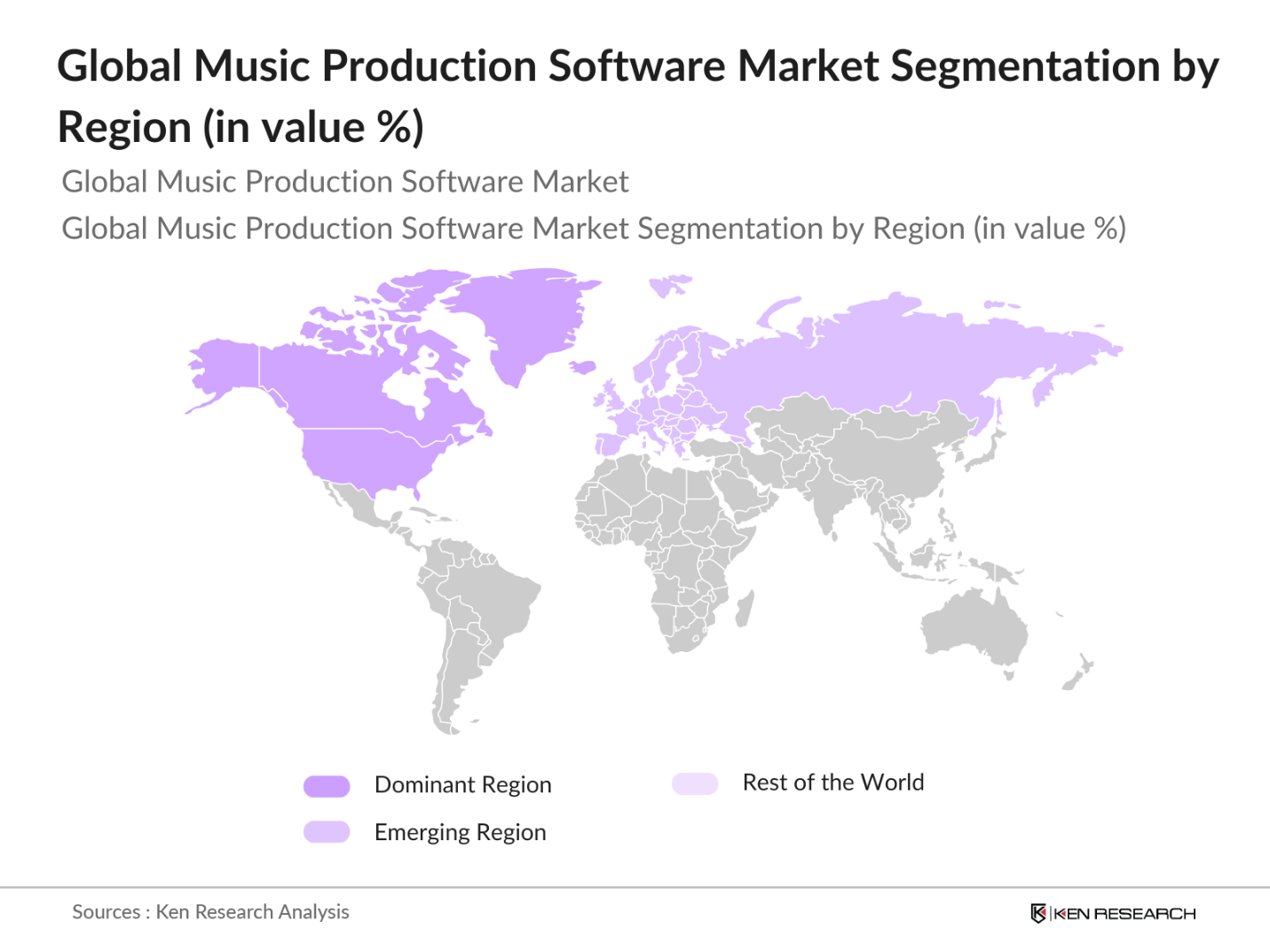

- Countries in North America, particularly the United States, dominate the global music production software market due to the region's established music industry and cutting-edge technological infrastructure. Major cities like Los Angeles and New York house a significant number of professional studios and artists, driving high demand for premium music production tools. Additionally, Europe, with key markets in Germany and the UK, is notable for its focus on innovation in music technology, particularly in cities like Berlin.

- Government regulation plays a critical role in shaping the music production software market. In 2023, increased scrutiny over data security, intellectual property rights, and digital taxation affected software companies operating across borders. The European Unions General Data Protection Regulation (GDPR), for example, requires that music production software companies comply with strict data privacy standards, affecting product design and storage solutions.

Global Music Production Software Market Segmentation

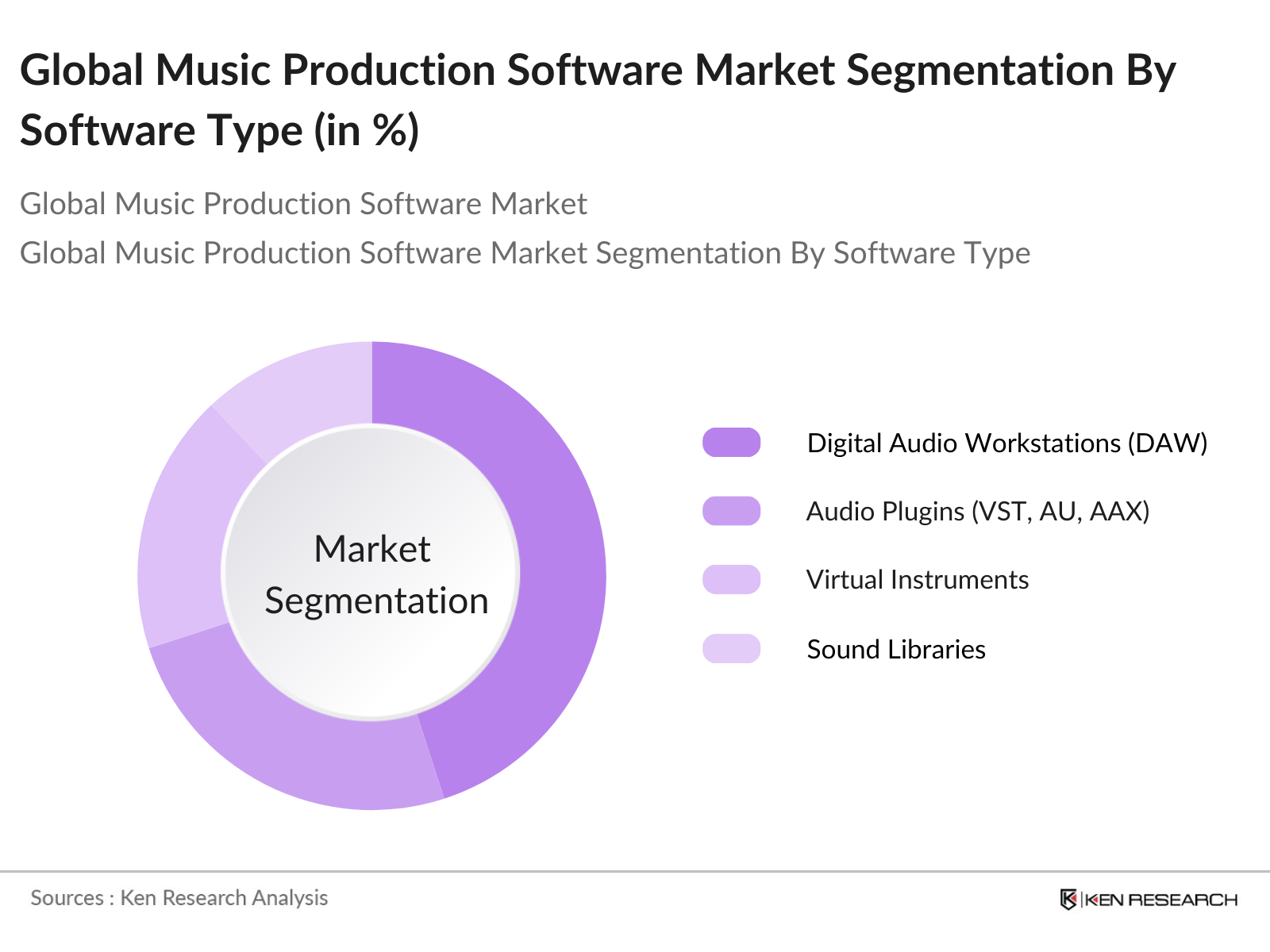

By Software Type: The market is segmented by software type into digital audio workstations (DAW), audio plugins (VST, AU, AAX), virtual instruments, and sound libraries. Among these, digital audio workstations hold a dominant market share due to their versatility and widespread use in music creation. Leading DAW products such as Ableton Live, FL Studio, and Logic Pro X have established a loyal user base, especially in professional and independent music studios, which rely on their comprehensive feature sets and ease of use.

By Deployment Mode: The market is divided into on-premise and cloud-based deployment modes. Cloud-based solutions are gaining popularity, holding a significant market share due to their accessibility and scalability. Producers and sound engineers increasingly prefer cloud-based solutions because they offer collaboration tools, automatic software updates, and seamless access to projects from multiple devices, making the production process more flexible and efficient.

By Region: The market is segmented regionally into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the market with the highest share, driven by the presence of a mature music industry and a large number of professional users. Cities like Los Angeles and New York are hubs for music production, leading to high demand for premium software tools.

Global Music Production Software Market Competitive Landscape

The global music production software market is characterized by the presence of both established companies and emerging players offering innovative solutions. Major industry leaders such as Ableton, Avid Technology, and Apple have a strong hold on the market due to their diverse product portfolios, regular software updates, and widespread user communities. The market also sees significant competition from specialized firms like Image-Line and Native Instruments, which offer unique tools catering to specific user needs.

Global Music Production Software Industry Analysis

Growth Drivers

- Proliferation of Home Studios: The rising affordability and availability of personal recording equipment has led to the rapid proliferation of home studios. In 2022, the United States saw an increase in individual musicians producing music from home, contributing significantly to the market demand for music production software. According to the U.S. Bureau of Labor Statistics, there were over 61 million active internet users who engaged in online content creation, including music production, as of 2023.

- Expansion of Streaming Services: The music production industry has benefitted from the expansion of streaming services like Spotify, Apple Music, and YouTube. In 2022, the IFPI reported that streaming contributed $21 billion to the global music market, a key driver for increased demand for production software to cater to the growing number of artists aiming to release content.

- Rising Demand for Audio Content Creation (Podcasts, YouTube): The global rise in audio content creation, including podcasts and YouTube channels, has significantly driven the demand for user-friendly music production software. As of 2023, over 4 million podcasts were active globally, while YouTube reported 2.6 billion monthly active users. The shift towards content monetization models, along with advertisers spending $1.33 billion on podcast advertising in the U.S. in 2022, has spurred professionals and amateurs alike to produce high-quality audio content, requiring advanced tools.

Market Challenges

- High Cost of Professional Software Licenses: One of the major challenges facing the music production software market is the high cost of professional software licenses. In 2022, the average cost of a professional-grade Digital Audio Workstation (DAW) software ranged between $200 and $1000, posing a significant barrier for entry-level users and smaller studios. According to the World Bank, the global median income in 2022 was approximately $13,000, making such investments substantial for emerging market users.

- Piracy and Software Cracking: Piracy remains a critical issue in the music production software market. A 2022 report by the Business Software Alliance (BSA) indicated that approximately 37% of software installations globally were unlicensed. This rampant piracy affects legitimate software providers' revenue and undermines market growth, particularly in regions like Southeast Asia, where software piracy rates exceed 60%.

Global Music Production Software Market Future Outlook

Over the next five years, the global music production software market is expected to experience significant growth driven by continuous technological advancements, increasing penetration of cloud-based solutions, and rising demand for music production across all genres. The market will continue to see new innovations, particularly in artificial intelligence (AI)-driven software that assists with composing, mixing, and mastering.

Market Opportunities

- Expansion of Subscription-Based Models: The shift toward subscription-based models offers a significant growth opportunity for music production software companies. In 2023, over 50% of software users opted for monthly or annual subscriptions rather than purchasing one-time licenses. This business model has proven effective in emerging markets where upfront software costs are prohibitive. The World Bank estimates that approximately 70% of individuals in low- and middle-income countries have access to mobile payments, facilitating easier access to subscription-based services.

- Integration of AI-Assisted Production Tools: The increasing integration of AI-assisted tools in music production software presents vast opportunities for both amateur and professional users. AI tools have improved significantly, with over $200 billion invested globally in AI technology by 2023. Companies offering AI-enhanced features such as automated mastering, predictive audio editing, and AI-driven composition tools are seeing increased adoption.

Scope of the Report

|

Software Type |

Digital Audio Workstations (DAW) Audio Plugins (VST, AU, AAX) Virtual Instruments Sound Libraries |

|

Deployment Mode |

On-Premise Cloud-Based |

|

End Users |

Professional Music Studios Independent Producers Educational Institutions Hobbyists & Freelancers |

|

Distribution Channel |

Direct Sales Third-Party Resellers Online Marketplaces |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Professional Music Studios

Independent Producers

Audio Software Developers

Music Distribution Platforms

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Copyright Agencies, FCC)

Streaming Platforms

Musical Equipment Manufacturers

Companies

Players Mentioned in the Report

Ableton AG

Avid Technology, Inc.

Image-Line Software

Steinberg Media Technologies GmbH

PreSonus Audio Electronics, Inc.

Apple Inc. (Logic Pro)

Cockos Incorporated (Reaper)

Native Instruments GmbH

Propellerhead Software

MAGIX Software GmbH

Table of Contents

1. Global Music Production Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Revenue Growth %, Installed Base)

1.4. Market Segmentation Overview (Software Type, Deployment Mode, End Users, Distribution Channel, Region)

2. Global Music Production Software Market Size (In USD Bn)

2.1. Historical Market Size (Market Penetration Rate, Growth % YoY)

2.2. Year-On-Year Growth Analysis (Volume and Value)

2.3. Key Market Developments and Milestones (Product Launches, Platform Innovations, Licensing Agreements)

3. Global Music Production Software Market Analysis

3.1. Growth Drivers

3.1.1. Proliferation of Home Studios

3.1.2. Expansion of Streaming Services

3.1.3. Rising Demand for Audio Content Creation (Podcasts, YouTube)

3.1.4. Growth in Music Technology Integration (AI, Machine Learning in Production) 3.2. Market Challenges

3.2.1. High Cost of Professional Software Licenses

3.2.2. Piracy and Software Cracking

3.2.3. Complex Learning Curve for Users

3.3. Opportunities

3.3.1. Expansion of Subscription-Based Models

3.3.2. Integration of AI-Assisted Production Tools

3.3.3. Increased Demand in Emerging Markets

3.3.4. Collaborations with Online Learning Platforms

3.4. Trends

3.4.1. Growth in Mobile Music Production Apps

3.4.2. Increased Integration of Cloud-Based Software Solutions

3.4.3. Collaboration Tools for Remote Production

3.5. Government Regulation (Taxation, Data Security, Licensing)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Developers, Music Producers, Distribution Platforms)

3.8. Porters Five Forces

3.8.1. Threat of New Entrants

3.8.2. Bargaining Power of Suppliers

3.8.3. Bargaining Power of Buyers

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Global Music Production Software Market Segmentation

4.1. By Software Type (In Value %)

4.1.1. Digital Audio Workstations (DAW)

4.1.2. Audio Plugins (VST, AU, AAX)

4.1.3. Virtual Instruments

4.1.4. Sound Libraries

4.2. By Deployment Mode (In Value %)

4.2.1. On-Premise

4.2.2. Cloud-Based

4.3. By End Users (In Value %)

4.3.1. Professional Music Studios

4.3.2. Independent Producers

4.3.3. Educational Institutions

4.3.4. Hobbyists & Freelancers

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Third-Party Resellers

4.4.3. Online Marketplaces

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Music Production Software Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ableton AG

5.1.2. Avid Technology, Inc.

5.1.3. Image-Line Software

5.1.4. Steinberg Media Technologies GmbH

5.1.5. PreSonus Audio Electronics, Inc.

5.1.6. Apple Inc. (Logic Pro)

5.1.7. Cockos Incorporated (Reaper)

5.1.8. Native Instruments GmbH

5.1.9. Propellerhead Software

5.1.10. MAGIX Software GmbH

5.1.11. Bitwig GmbH

5.1.12. Roland Corporation

5.1.13. Serato Audio Research

5.1.14. Reason Studios

5.1.15. BandLab Technologies

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Software Updates, Global Presence, Customer Base, Pricing Strategy, Market Share, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Development, Collaborations, Marketing Strategies)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Music Production Software Market Regulatory Framework

6.1. Software Licensing and Copyright Regulations

6.2. Compliance Requirements (Regional Music Licensing Laws)

6.3. Data Security Standards (GDPR, CCPA)

6.4. Certification Processes (Software Standards for Security and Performance)

7. Global Music Production Software Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Expansion of AI Tools, Cloud Adoption, Emerging Markets)

8. Global Music Production Software Future Market Segmentation

8.1. By Software Type (In Value %)

8.2. By Deployment Mode (In Value %)

8.3. By End Users (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Music Production Software Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis (Unexplored Segments, Niche Markets)

Research Methodology

Step 1: Identification of Key Variables

This initial phase involved mapping the music production ecosystem, identifying all key stakeholders, including music software developers, end-users, and distributors. Secondary research from proprietary databases was used to define the critical variables affecting market dynamics, such as software adoption rates and technological advancements.

Step 2: Market Analysis and Construction

Historical data for the global music production software market was compiled to assess market penetration and revenue generation. Service quality statistics, market share by key players, and the impact of software piracy were analyzed to ensure the accuracy of the estimates.

Step 3: Hypothesis Validation and Expert Consultation

The third phase focused on validating market hypotheses through interviews with industry experts from leading music production software companies. These consultations provided insights into product performance, customer preferences, and the challenges faced by companies.

Step 4: Research Synthesis and Final Output

The final step involved direct interaction with major music production software developers to refine data on software segment performance and market forecasts. This bottom-up approach ensured the reliability of the analysis and projections for future market growth.

Frequently Asked Questions

1. How big is the Global Music Production Software Market?

The Global Music Production Software Market is valued at USD 632 billion, based on a five-year historical analysis. This market is driven by the rise of home studios, fueled by affordability and ease of access to production tools.

2. What are the challenges in the Global Music Production Software Market?

Challenges include high licensing costs for professional software, widespread piracy, and the steep learning curve associated with mastering advanced music production software tools.

3. Who are the major players in the Global Music Production Software Market?

Major players include Ableton, Avid Technology, Apple (Logic Pro), Image-Line Software, and Steinberg Media Technologies GmbH. These companies dominate due to their innovative product offerings, strong brand presence, and large user communities.

4. What are the growth drivers of the Global Music Production Software Market?

Growth drivers include the rise of home studios, the increasing use of AI and machine learning in music production, and the growing demand for audio content in new media formats like podcasts and streaming platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.