Global Mutual Funds Market Outlook to 2029

Region:Global

Author(s):Dev

Product Code:KROD-043

June 2025

90

About the Report

Global Mutual Funds Market Overview

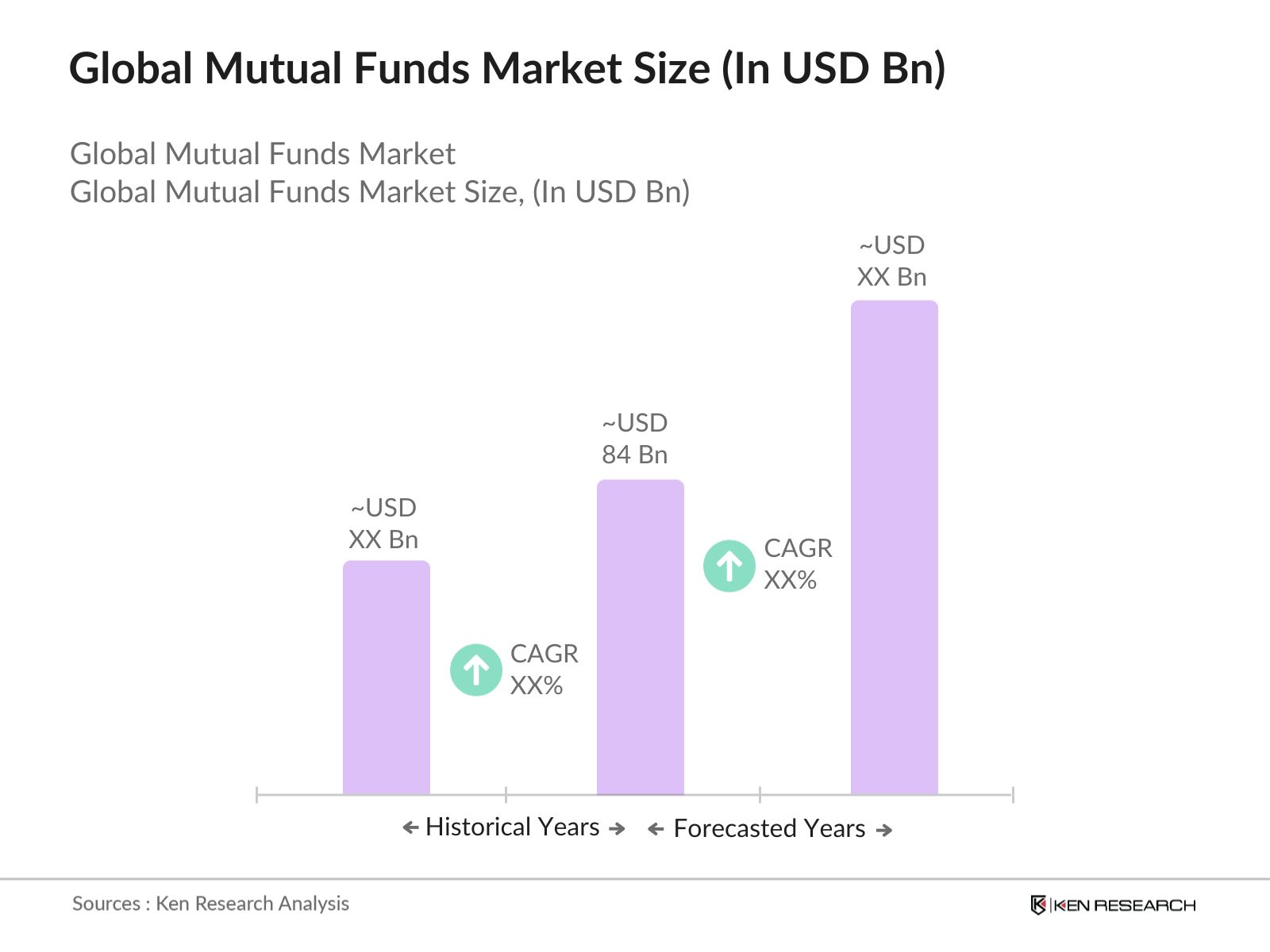

- The Global Mutual Funds Market is valued at USD 84 trillion, based on a five-year historical analysis. This growth is primarily driven by increasing investor interest in diversified investment options, coupled with the rising trend of digital investment platforms that facilitate easier access to mutual funds. The market has seen a significant influx of retail investors, particularly during periods of economic recovery, as individuals seek to grow their wealth through professionally managed portfolios.

- The United States, Europe, and Asia-Pacific are the dominant regions in the Global Mutual Funds Market. The U.S. leads due to its well-established financial infrastructure, a large number of investment firms, and a high level of financial literacy among its population. Europe benefits from a strong regulatory framework and a diverse range of fund offerings, while Asia-Pacific is experiencing rapid growth due to increasing disposable incomes and a burgeoning middle class eager to invest.

- In 2023, the U.S. Securities and Exchange Commission (SEC) implemented new regulations aimed at enhancing transparency in mutual fund fees and expenses. This regulation requires fund managers to provide clearer disclosures regarding fees, which is expected to empower investors to make more informed decisions. The initiative aims to foster a more competitive environment by ensuring that investors are fully aware of the costs associated with their investments.

Global Mutual Funds Market Segmentation

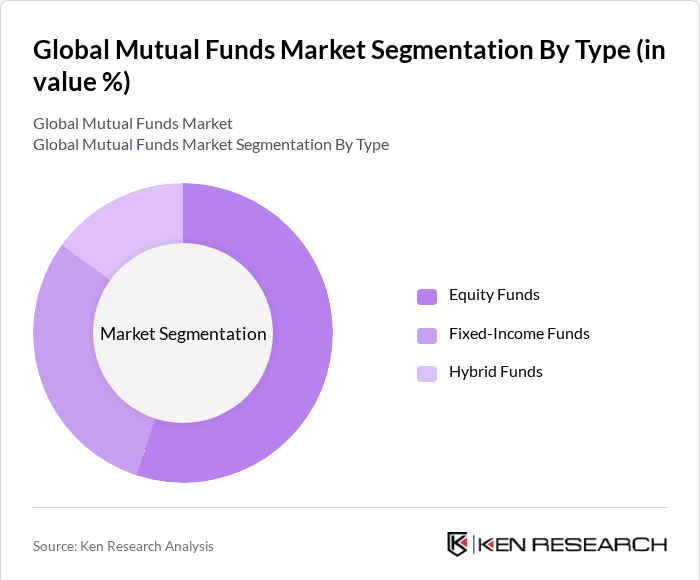

By Type: The Global Mutual Funds Market is primarily segmented into equity funds, fixed-income funds, and hybrid funds. Among these, equity funds dominate the market due to their potential for higher returns, attracting investors looking for capital appreciation. The growing trend of investing in technology and healthcare sectors has further fueled the demand for equity funds. Additionally, the increasing awareness of the benefits of long-term investing has led to a surge in retail participation in equity mutual funds.

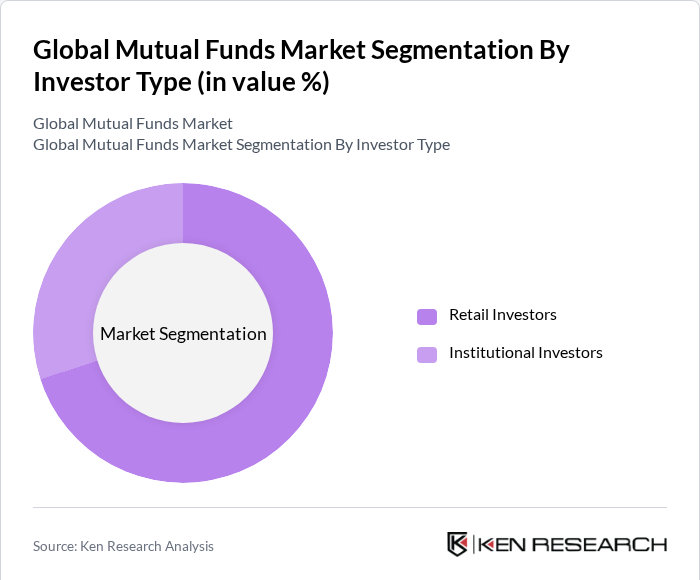

By Investor Type: The market is segmented into retail investors and institutional investors. Retail investors are the dominant segment, driven by the increasing accessibility of mutual funds through online platforms and mobile applications. The rise of robo-advisors and digital wealth management solutions has made it easier for individual investors to participate in the market. Institutional investors, while significant, tend to focus on larger fund sizes and specific investment strategies, which limits their overall market share compared to retail investors.

Global Mutual Funds Market Competitive Landscape

The Global Mutual Funds Market is characterized by a competitive landscape with several key players, including Vanguard Group, BlackRock, Fidelity Investments, Charles Schwab, and State Street Global Advisors. These companies dominate the market due to their extensive product offerings, strong brand recognition, and innovative investment strategies. The market is also witnessing increased competition from fintech companies that are disrupting traditional models with technology-driven solutions.

Global Mutual Funds Market Industry Analysis

Growth Drivers

- Increasing Investor Awareness and Financial Literacy: Increasing investor awareness and financial literacy is gradually supporting mutual fund growth in India. With overall literacy exceeding 77%, around 23-35% of adults are financially literate, understanding key concepts like inflation and risk diversification. This gap is narrowing due to government initiatives and digital platforms providing accessible financial education. As awareness improves, more individuals are expected to invest in mutual funds, driving greater participation and fostering the sector’s expansion.

- Technological Advancements in Investment Platforms: Technological advancements have revolutionized mutual fund investing in India, with over 90% of transactions occurring through digital channels by 2024, driven by widespread adoption of platforms like UPI and mobile apps. Mobile app usage for investments has surged, enabling real-time trading and portfolio management. This digital shift enhances accessibility and convenience, especially attracting younger investors and expanding participation from smaller towns and rural areas, thereby significantly boosting mutual fund market growth.

- Rise in Disposable Income and Wealth Accumulation: The rise in disposable income is a significant driver for mutual fund investments in India. In 2024, the average per capita disposable income is projected to reach approximately ?2.14 lakh (around $2,600), reflecting an 8% increase from the previous year. This growth enables more individuals to allocate funds toward investments, including mutual funds, supporting greater participation and diversification as investors seek to enhance their financial security.

Market Challenges

- Market Volatility and Economic Uncertainty: Market volatility remains a key challenge for mutual fund investments in None. Economic uncertainty can prompt investors to adopt a more cautious approach, often reducing their exposure to mutual funds in favor of cash holdings or safer investment avenues. This shift in sentiment can affect fund inflows and overall market stability, especially during periods of macroeconomic stress.

- Regulatory Compliance and Legal Challenges: The regulatory environment for mutual funds in None is becoming increasingly complex. New compliance requirements are adding to operational burdens, particularly for smaller fund managers who may struggle with rising costs and administrative demands. Additionally, legal issues related to fund disclosures and transparency can further erode investor trust, posing risks to fund performance and long-term growth.

Global Mutual Funds Market Future Outlook

The future of the mutual funds market in None appears promising, driven by technological advancements and increasing investor engagement. As digital platforms continue to evolve, they will facilitate greater access to investment opportunities, particularly among younger demographics. Furthermore, the growing emphasis on sustainable investing is likely to shape fund offerings, with more investors seeking environmentally responsible options. Overall, the market is poised for growth, supported by a favorable economic environment and a shift towards innovative investment strategies.

Market Opportunities

- Expansion into Emerging Markets: There is a significant opportunity for mutual funds to expand into emerging markets within None. With a projected increase in middle-class households by 17% in 2024, fund managers can tap into a growing investor base eager for diversified investment options. This expansion could lead to an estimated $12 billion increase in assets under management as these markets mature and investors seek professional management of their wealth.

- Development of Sustainable and ESG Funds: The demand for sustainable and ESG (Environmental, Social, and Governance) funds is rapidly increasing. In 2024, it is anticipated that ESG investments will account for majority of total mutual fund assets in None, reflecting a growing awareness of social responsibility among investors. This trend presents a lucrative opportunity for fund managers to develop innovative products that align with these values.

Scope of the Report

| By Product Type |

Equity Funds Fixed-Income Funds Hybrid Funds |

| By Investor Type |

Retail Investors Institutional Investors |

| By Geography |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Strategy |

Active Management Passive Management Index Funds |

| By Fund Size |

Small Cap Funds Mid Cap Funds Large Cap Funds |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Securities and Exchange Commission, Financial Industry Regulatory Authority)

Asset Management Companies

Wealth Management Firms

Pension Funds and Retirement Plans

Insurance Companies

Family Offices

Financial Advisors and Planners

Companies

Players Mentioned in the Report:

Vanguard Group

BlackRock

Fidelity Investments

Charles Schwab

State Street Global Advisors

Apex Capital Management

Horizon Wealth Partners

Summit Investment Strategies

Evergreen Asset Management

Nexus Fund Advisors

Table of Contents

1. Global Mutual Funds Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Mutual Funds Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Mutual Funds Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Investor Awareness and Financial Literacy

3.1.2. Rise in Disposable Income and Wealth Accumulation

3.1.3. Technological Advancements in Investment Platforms

3.2. Market Challenges

3.2.1. Market Volatility and Economic Uncertainty

3.2.2. Regulatory Compliance and Legal Challenges

3.2.3. Competition from Alternative Investment Vehicles

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Development of Sustainable and ESG Funds

3.3.3. Growth of Robo-Advisory Services

3.4. Trends

3.4.1. Increasing Popularity of Passive Investment Strategies

3.4.2. Integration of Artificial Intelligence in Fund Management

3.4.3. Shift Towards Digital and Mobile Investment Solutions

3.5. Government Regulation

3.5.1. Overview of Regulatory Bodies and Their Roles

3.5.2. Impact of Regulations on Fund Operations

3.5.3. Compliance with International Financial Reporting Standards

3.5.4. Recent Regulatory Changes Affecting the Market

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Mutual Funds Market Segmentation

4.1. By Product Type

4.1.1. Equity Funds

4.1.2. Fixed-Income Funds

4.1.3. Hybrid Funds

4.2. By Investor Type

4.2.1. Retail Investors

4.2.2. Institutional Investors

4.3. By Geography

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

4.4. By Investment Strategy

4.4.1. Active Management

4.4.2. Passive Management

4.4.3. Index Funds

4.5. By Fund Size

4.5.1. Small Cap Funds

4.5.2. Mid Cap Funds

4.5.3. Large Cap Funds

5. Global Mutual Funds Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Vanguard Group

5.1.2. BlackRock

5.1.3. Fidelity Investments

5.1.4. Charles Schwab

5.1.5. State Street Global Advisors

5.1.6. Apex Capital Management

5.1.7. Horizon Wealth Partners

5.1.8. Summit Investment Strategies

5.1.9. Evergreen Asset Management

5.1.10. Nexus Fund Advisors

5.2. Cross Comparison Parameters

5.2.1. Total Assets Under Management (AUM)

5.2.2. Fund Performance Metrics

5.2.3. Fee Structures and Expense Ratios

5.2.4. Customer Satisfaction Ratings

5.2.5. Market Share Analysis

5.2.6. Investment Strategy Diversification

5.2.7. Geographic Reach and Distribution Channels

5.2.8. Innovation in Fund Offerings

6. Global Mutual Funds Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Mutual Funds Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Mutual Funds Market Future Market Segmentation

8.1. By Product Type

8.1.1. Equity Funds

8.1.2. Fixed-Income Funds

8.1.3. Hybrid Funds

8.2. By Investor Type

8.2.1. Retail Investors

8.2.2. Institutional Investors

8.3. By Geography

8.3.1. North America

8.3.2. Europe

8.3.3. Asia-Pacific

8.3.4. Latin America

8.3.5. Middle East & Africa

8.4. By Investment Strategy

8.4.1. Active Management

8.4.2. Passive Management

8.4.3. Index Funds

8.5. By Fund Size

8.5.1. Small Cap Funds

8.5.2. Mid Cap Funds

8.5.3. Large Cap Funds

9. Global Mutual Funds Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key components and stakeholders within the Global Mutual Funds Market. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather relevant industry information. The primary goal is to pinpoint and define the essential variables that drive market behavior and trends.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical data related to the Global Mutual Funds Market. This includes evaluating market size, growth rates, and the competitive landscape. Additionally, we will assess various performance metrics to ensure the accuracy and reliability of the market estimates and projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts and stakeholders. These consultations will provide critical insights into market trends, challenges, and opportunities, helping to refine the initial hypotheses and enhance the overall understanding of the market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and insights to produce a comprehensive report on the Global Mutual Funds Market. This includes cross-referencing findings from various sources and validating them through direct engagement with market participants, ensuring a robust and accurate representation of the market landscape.

Frequently Asked Questions

01. How big is the Global Mutual Funds Market?

The Global Mutual Funds Market is valued at USD 84 trillion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Mutual Funds Market?

Key challenges in the Global Mutual Funds Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Mutual Funds Market?

Major players in the Global Mutual Funds Market include Vanguard Group, BlackRock, Fidelity Investments, Charles Schwab, State Street Global Advisors, among others.

04. What are the growth drivers for the Global Mutual Funds Market?

The primary growth drivers for the Global Mutual Funds Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.