Global Nanofiltration Market Outlook to 2030

Region:Global

Author(s):Shreya Garg

Product Code:KROD1186

November 2024

81

About the Report

Global Nanofiltration Market Overview

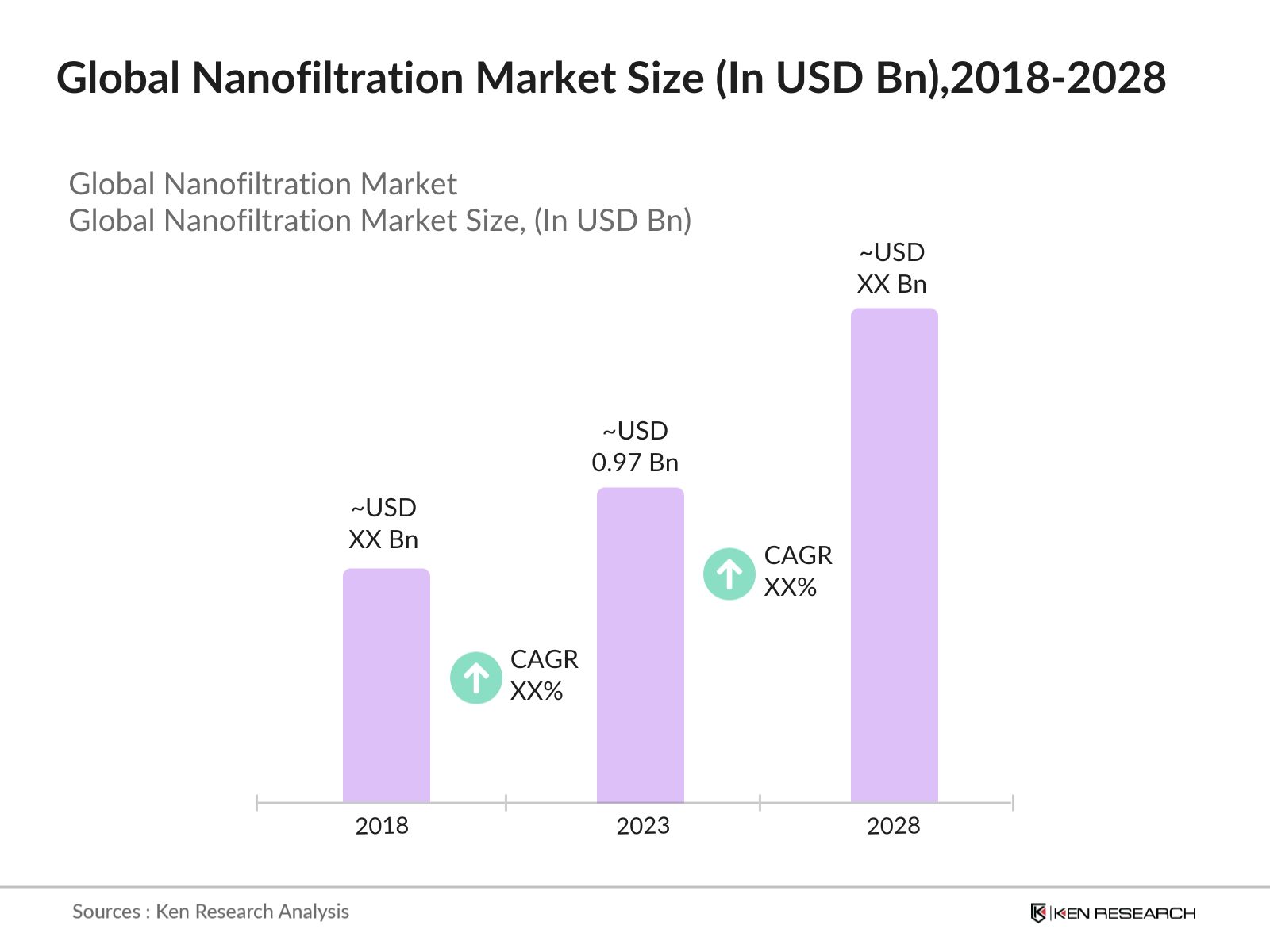

The global nanofiltration market was valued at USD 0.97 Billion in 2023. This growth is driven by the increasing demand for water treatment, particularly in regions facing water scarcity. The market is also being driven by industrial applications such as chemical processing and pharmaceuticals, which rely on nanofiltration membranes to achieve highly specific filtration tasks.

Key players in the global nanofiltration market include companies such as Dow Chemical Company, Suez Water Technologies, Toray Industries, Alfa Laval, and Pall Corporation. These players dominate the market by offering advanced nanofiltration membrane technologies and investing in research and development to expand their product portfolios. Their strong presence across multiple sectors such as water treatment and chemical manufacturing further reinforces their market positions.

Alfa Laval offers two types of NF spiral membranes, the NF and NF99HF, which utilize thin-film composite membranes. These membranes have a rejection capacity of 99% for magnesium sulfate and operate at pressures up to 50-55 bar, allowing them to retain larger ions and most organic components while permitting small ions to pass through.

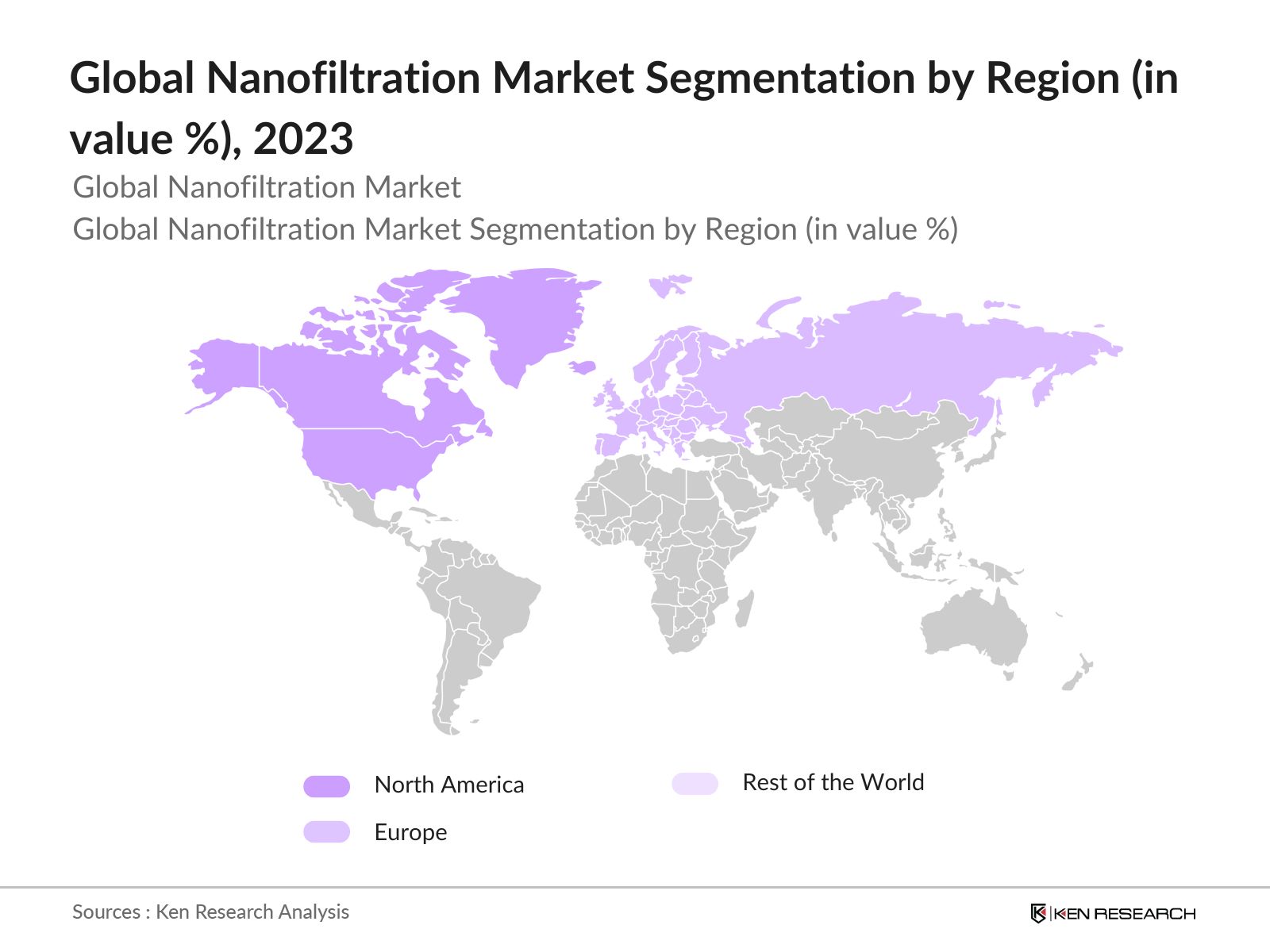

United States, dominated the global nanofiltration industry in 2023. The dominance can be attributed to strict environmental regulations on wastewater treatment, which compel industries to adopt advanced filtration technologies. Additionally, the presence of leading market players and well-established infrastructure further cements North Americas market leadership.

Global Nanofiltration Market Segmentation

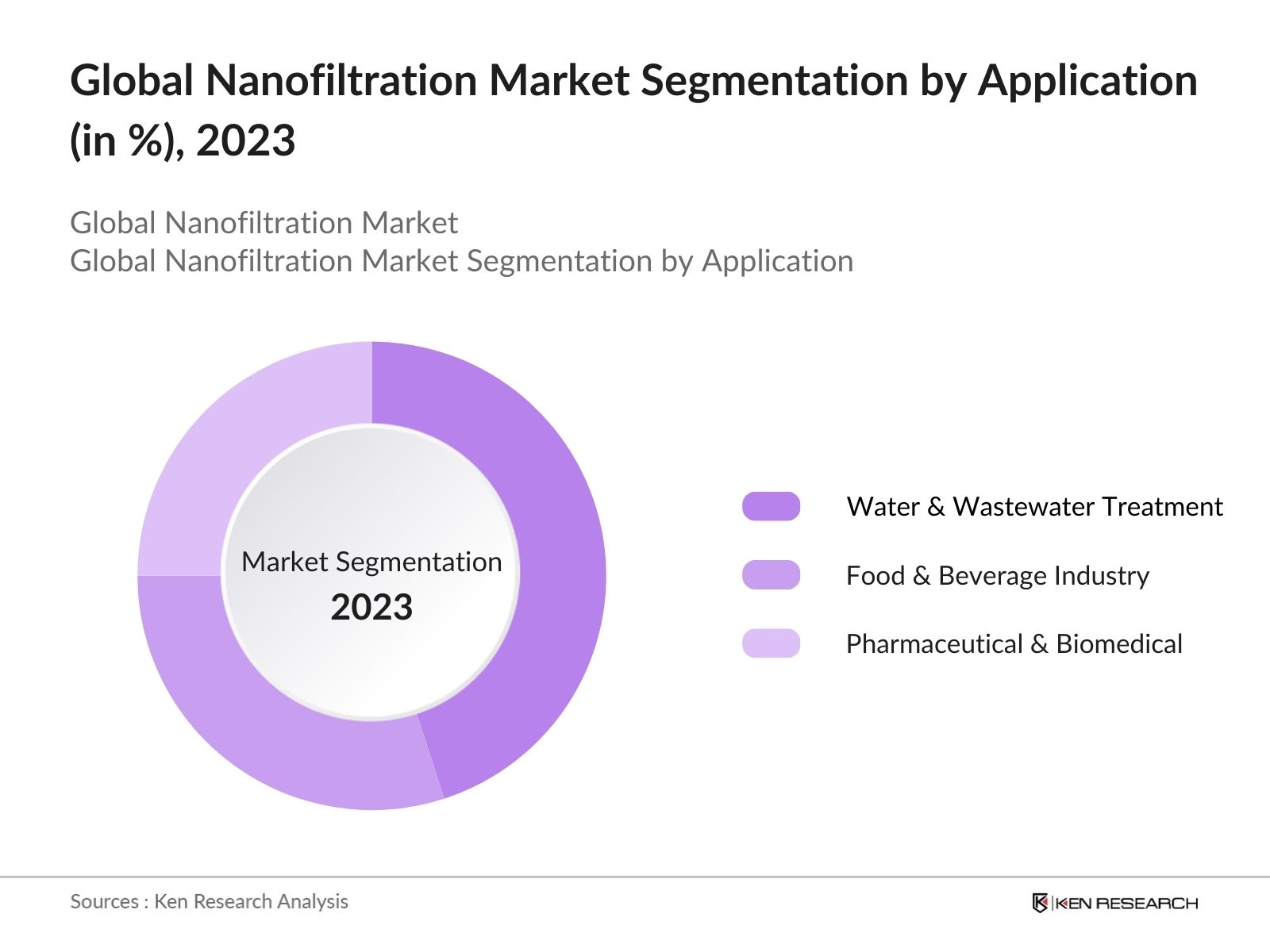

The global nanofiltration market is segmented into various sectors such as application, membrane type, region etc.

By Application: The market is segmented by application into Water & Wastewater Treatment, Food & Beverage Industry, and Pharmaceutical & Biomedical Industry. Recently, Water & Wastewater Treatment dominated the market share. The increasing need for clean water, rising governmental regulations, and growing desalination projects contribute to the dominance of this segment. The use of nanofiltration for removing contaminants and recovering materials makes it a preferred choice in the water sector.

By Membrane Type: The market is segmented by membrane type into Polymeric Membranes, Ceramic Membranes, and Hybrid Membranes. Polymeric segment held more than half of the market share, primarily due to its cost-effectiveness and widespread use in various industries, including water treatment and pharmaceuticals. Their flexibility and compatibility with different filtration systems make them the most popular type of membrane.

By Region: The market is divided into North America, South America, Europe, Asia-Pacific, and Rest of the World. North America led the global nanofiltration market share due to strict regulatory standards on water and wastewater treatment. The presence of key market players also strengthens the region's dominance.

Global Nanofiltration Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Dow Chemical Company |

1897 |

Midland, Michigan, USA |

|

Suez Water Technologies |

2000 |

Paris, France |

|

Toray Industries |

1926 |

Tokyo, Japan |

|

Alfa Laval |

1883 |

Lund, Sweden |

|

Pall Corporation |

1946 |

New York, USA |

- Suez Water Technologies Achievement: Suez participated in the Global Water Summit 2024, with sessions on financing water security, delivering global targets for water reuse, and accelerating the transition to a zero-carbon water sector. Suez was named Water Company of the Year in 2024 for its achievements in industrial desalination in China, where it is constructing its largest ever industrial desalination project to serve a chemical complex and save 36 million m3/year of fresh water.

- Toray Industries Acquisition: This company has been active in expanding its filtration and water treatment capabilities, including acquiring companies related to water treatment technologies, such as Hanmee Entec Co., Ltd. in 2023, which focuses on sewage and wastewater treatment.Additionally, Toray has been developing new filtration technologies, including reverse osmosis membranes, indicating a broader strategy in enhancing its water treatment offerings.

Global Nanofiltration Industry Analysis

Growth Drivers

- Increased Water Treatment Demand in Scarcity Regions: Countries like Saudi Arabia are investing heavily in water treatment infrastructure, with commitments of up to USD 5 billion by 2025 to enhance their water management systems, necessitating efficient filtration systems like nanofiltration. This demand is supported by data from the International Water Association, which projects a consistent rise in desalination and wastewater treatment requirements globally.

- Expanding Chemical Industry Adoption: The chemical processing industry has increasingly adopted nanofiltration technology to achieve precise separation processes, leading to a surge in demand. In 2023, the chemical industry invested heavily in upgrading filtration technologies to meet stringent environmental regulations, driven by increasing regulations on emissions and hazardous waste, creating a direct growth avenue for nanofiltration systems in chemical manufacturing and processing.

- Pharmaceutical Industry's Need for High Purity Solutions: The pharmaceutical sector is expected to consume 40 million liters of purified water daily, necessitating advanced filtration systems to meet quality standards. Leading manufacturers are expected to allocate USD 150 million toward improving filtration technologies in their manufacturing plants over the next year, significantly boosting demand for nanofiltration solutions.

Challenges

- Complexity in Membrane Fouling and Replacement: Nanofiltration membranes are prone to fouling, which reduces their efficiency and lifespan. Replacing membranes frequently adds to operational costs depending on the industry and application. In regions like Asia-Pacific, where industrial applications are growing rapidly, the cost of maintaining these systems is expected to hinder widespread adoption, especially in sectors like food and beverage processing, where frequent maintenance is necessary.

- Limited Adoption in Developing Countries: The high cost and lack of technical expertise have slowed the adoption of nanofiltration technologies in developing countries. Water treatment plants in Africa and Southeast Asia will implement nanofiltration technologies due to financial constraints and lack of skilled technicians. The cost of training personnel and ensuring proper system upkeep adds frequent amount annually in per plant, further complicating adoption in these regions.

Government Initiatives

- Indian Government's Clean Ganga Project: The initiative is indeed an investment, with the Indian government unveiling a plan that includes over USD 4 billion aimed at cleaning the Ganga. This funding is directed towards various projects like implementing advanced filtration technologies, including nanofiltration systems. This large-scale government initiative presents significant growth potential for the nanofiltration market in India.

- China's 2024 Water Conservation Projects: On March 20, 2024, China announced its first national-level regulations on water conservation, which will take effect on May 1, 2024. These regulations include setting water use quotas for various sectors, controlling water use amounts, and restricting water-intensive projects in areas facing severe shortages. This massive push for water sustainability is expected to provide lucrative opportunities for nanofiltration technology providers.

Global Nanofiltration Market Future Outlook

The global nanofiltration market is expected to grow exponentially. The growth will be driven by stringent government regulations on wastewater treatment, the rise of industries in developing nations, and technological advancements in membrane efficiency. Increased investment in desalination projects and pharmaceutical applications will also play a significant role in expanding market demand.

Future Trends

- Rising Investment in Industrial Water Treatment: Over the next five years, the global industrial water treatment sector will see a surge in investment, with over USD 25 billion expected to be spent by 2028. Nanofiltration technologies will play a critical role in meeting industry-specific water treatment needs, especially in the food, beverage, and pharmaceutical industries. These sectors are projected to invest USD 6 billion in nanofiltration technologies between 2024 and 2028, as regulatory pressures and operational efficiency become increasingly important.

- Desalination Projects to Boost Demand: By 2028, the global desalination market is expected to grow significantly, with an additional 2 billion cubic meters of desalinated water projected to be produced annually. Nanofiltration systems will be integral to many of these projects, particularly in the Middle East and North Africa, where governments are investing heavily in desalination technologies to combat water scarcity. By 2028, USD 10 billion will be allocated globally to desalination projects, driving the nanofiltration market in these regions.

Scope of the Report

|

By Application |

Water & Wastewater Treatment Food & Beverage Industry Pharmaceutical & Biomedical Industry |

|

By Membrane Type |

Polymeric Membranes Ceramic Membranes Hybrid Membranes |

|

By Region |

North America South America Europe APAC MEA |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors and VC Firms

Banks and Financial Institutions

Government Water Authorities

Wastewater Treatment Companies

Water Utility Providers

Industrial Water Treatment Companies

Food and Beverage Manufacturers

Chemical Manufacturers

Desalination Plant Operators

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Dow Chemical Company

Suez Water Technologies

Toray Industries

Alfa Laval

Pall Corporation

Hydranautics

Koch Membrane Systems

Lenntech

GEA Group

Veolia Water Technologies

Synder Filtration

Merck Millipore

GE Healthcare

Evoqua Water Technologies

Nitto Denko

Table of Contents

1. Global Nanofiltration Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Nanofiltration Market Size (in USD), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Nanofiltration Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Water Treatment Demand

3.1.2. Pharmaceutical Sector Expansion

3.1.3. Chemical Processing Industry Demand

3.1.4. Government Infrastructure Investments

3.2. Restraints

3.2.1. High Installation Costs

3.2.2. Membrane Fouling and Replacement Costs

3.2.3. Limited Adoption in Developing Economies

3.3. Opportunities

3.3.1. Technological Advancements in Membranes

3.3.2. Increasing Adoption in Emerging Markets

3.3.3. Expansion of Desalination Projects

3.4. Trends

3.4.1. Rise in Industrial Water Reuse

3.4.2. Focus on Sustainability and Efficiency

3.4.3. Development of Hybrid Membranes

3.5. Government Regulation

3.5.1. Water Treatment Standards

3.5.2. Pharmaceutical and Industrial Filtration Compliance

3.5.3. Public-Private Partnerships in Desalination Projects

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global Nanofiltration Market Segmentation, 2023

4.1. By Application (in Value %)

4.1.1. Water & Wastewater Treatment

4.1.2. Food & Beverage Industry

4.1.3. Pharmaceutical & Biomedical Industry

4.2. By Membrane Type (in Value %)

4.2.1. Polymeric Membranes

4.2.2. Ceramic Membranes

4.2.3. Hybrid Membranes

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Rest of the World

5. Global Nanofiltration Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Dow Chemical Company

5.1.2. Suez Water Technologies

5.1.3. Toray Industries

5.1.4. Alfa Laval

5.1.5. Pall Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Nanofiltration Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Nanofiltration Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Nanofiltration Market Future Size (in USD), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Nanofiltration Market Future Segmentation, 2028

9.1. By Application (in Value %)

9.2. By Membrane Type (in Value %)

9.3. By Region (in Value %)

10. Global Nanofiltration Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global Nanofiltration industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different Nanofiltration companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple nanofiltration companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such Nanofiltration companies.

Frequently Asked Questions

01 How big is the Global Nanofiltration Market?

The global nanofiltration market was valued at USD 1.2 billion in 2023, driven by the growing demand for advanced water treatment systems, industrial filtration, and pharmaceutical applications.

02 What are the challenges in the Global Nanofiltration Market?

Challenges in the global nanofiltration market include high installation and maintenance costs, membrane fouling issues, limited adoption in developing countries, and regulatory barriers in emerging markets, which hinder widespread adoption of nanofiltration systems.

03 Who are the major players in the Global Nanofiltration Market?

Key players in the global nanofiltration market include Dow Chemical Company, Suez Water Technologies, Toray Industries, Alfa Laval, and Pall Corporation. These companies dominate the market due to their advanced technologies, extensive R&D investments, and strong market presence.

04 What are the growth drivers of the Global Nanofiltration Market?

The global nanofiltration market is propelled by the increasing need for water treatment in regions with water scarcity, expanding chemical industry applications, growing pharmaceutical sector demand for high-purity filtration, and government investment in desalination projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.