Global Natural Gas Market Outlook to 2029

Region:Global

Author(s):Dev

Product Code:KROD-061

June 2025

80

About the Report

Global Natural Gas Market Overview

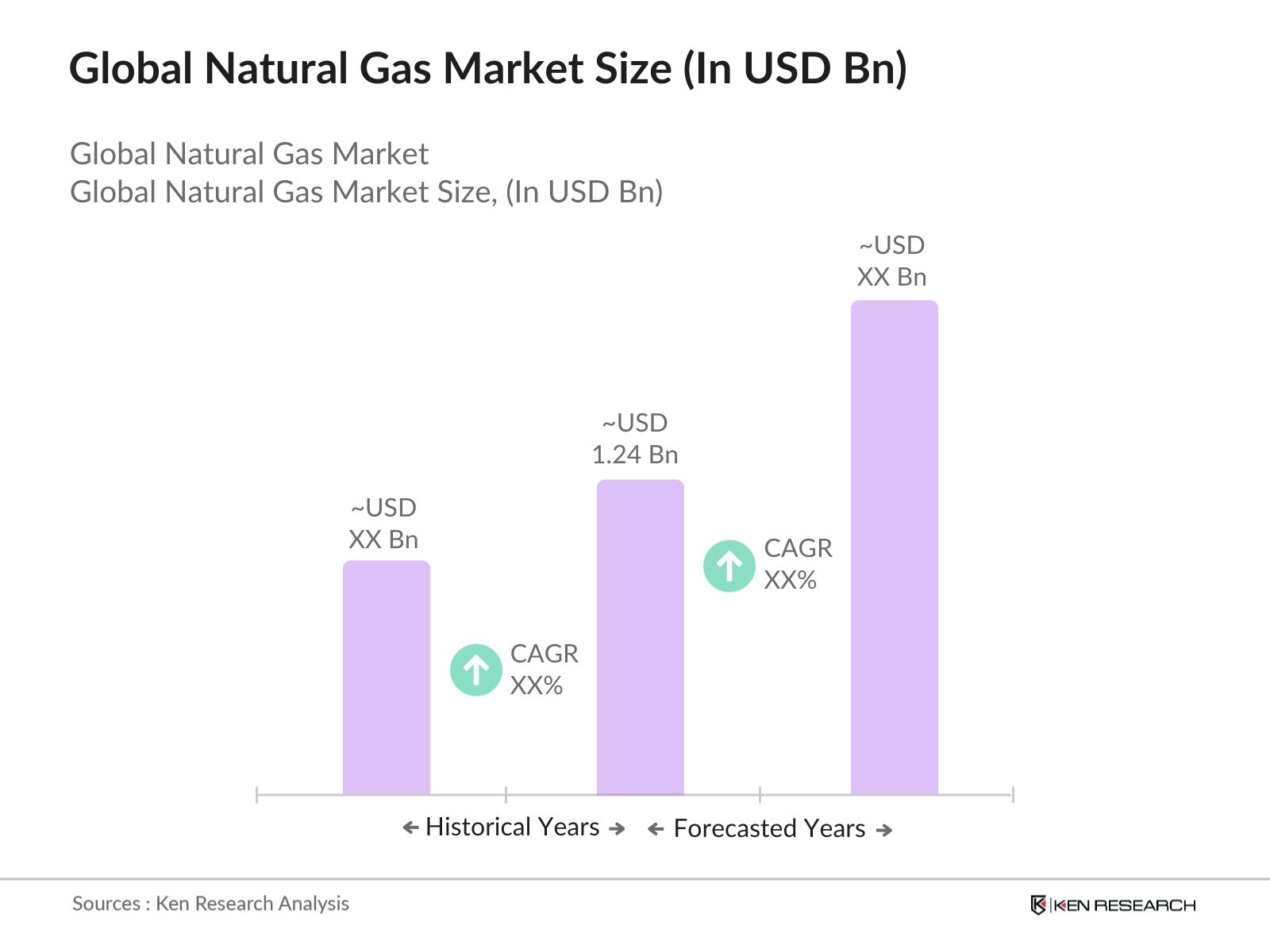

- The Global Natural Gas Market was valued at USD 1.24 Tn, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for cleaner energy sources, industrial growth, and the expansion of natural gas infrastructure worldwide. The shift towards natural gas as a transitional fuel in the energy sector has significantly contributed to the market's expansion.

- Key players in this market include the United States, Russia, and Qatar, which dominate due to their vast natural gas reserves and advanced extraction technologies. The U.S. has become a leader in shale gas production, while Russia's extensive pipeline network and Qatar's liquefied natural gas (LNG) capabilities further solidify their positions in the global market.

-

In 2023, the U.S. Environmental Protection Agency (EPA) finalized new methane emission regulations targeting both new and existing oil and natural gas operations, including natural gas production facilities. These regulations require operators to monitor, detect, and repair methane leaks, impose stricter standards on equipment, and aim to eliminate routine flaring.

Global Natural Gas Market Segmentation

By Source: The natural gas market is primarily segmented into conventional and unconventional sources. Among these, conventional natural gas remains the dominant sub-segment due to its established extraction methods and lower production costs. Conventional sources are widely utilized in power generation and heating applications, making them a preferred choice for many industries. The reliability and efficiency of conventional natural gas extraction techniques have led to sustained demand, despite the growing interest in unconventional sources like shale gas.

By Application: The market is segmented into power generation, residential, commercial, and industrial applications. Power generation is the leading sub-segment, driven by the global shift towards cleaner energy sources. Natural gas is increasingly favored for electricity generation due to its lower carbon emissions compared to coal and oil. The growing number of gas-fired power plants and the need for reliable energy sources in emerging economies further bolster the demand for natural gas in this application.

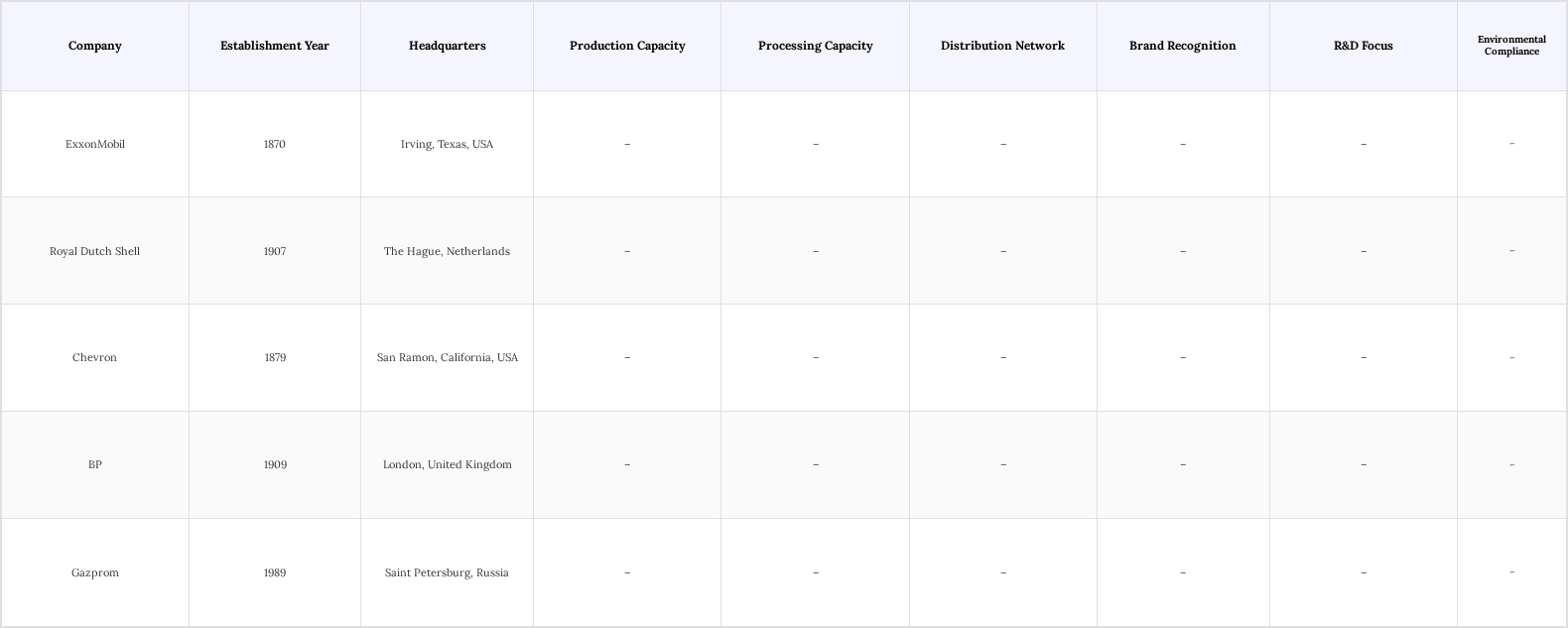

Global Natural Gas Market Competitive Landscape

The Global Natural Gas Market is characterized by intense competition among major players such as ExxonMobil, Royal Dutch Shell, and Chevron. These companies leverage their extensive resources and technological advancements to maintain a competitive edge. The market is also witnessing the entry of new players focusing on innovative extraction and distribution methods, which adds to the competitive dynamics.

Global Natural Gas Market Industry Analysis

Growth Drivers

- Increasing Demand for Cleaner Energy Sources: In 2025, Asia-Pacific’s disposable income per capita is projected at approximately $9,311 (PPP), up from $8,187 in 2022, reflecting an average annual growth rate of 3.3%. Rapid urbanization, digital adoption, and infrastructure development are driving income gains, especially in China and India, where incomes grow even faster. This rising affluence is expanding the middle class, boosting demand for luxury goods like diamonds and supporting sustained market growth.

- Expansion of Natural Gas Infrastructure: Significant investments in natural gas infrastructure are accelerating market accessibility, especially in the Asia-Pacific region. In 2024, LNG investments are expected to reach $42 billion annually, a 20-fold increase from 2020, driven by new pipeline expansions, LNG terminals, and storage facilities. Southeast Asia alone is developing over 100 GW of gas-fired power capacity and nearly 47 million tonnes per annum of LNG import capacity, which could boost natural gas consumption by up to 15% by 2025. These developments support urban demand growth for heating and cooking, enhancing market penetration despite geopolitical and energy transition challenges

- Technological Advancements in Extraction and Processing: Innovations in extraction technologies, such as hydraulic fracturing and horizontal drilling, have significantly increased natural gas production efficiency. In None, production costs have decreased by 18% since 2020 due to these advancements. Additionally, enhanced processing technologies are improving the quality of natural gas, making it more competitive against other energy sources. The U.S. Energy Information Administration (EIA) projects that these technologies will enable a 10% increase in production capacity by 2024, further driving market growth.

Market Challenges

- Price Volatility and Market Fluctuations: The natural gas market is subject to significant price volatility, influenced by geopolitical tensions and supply-demand imbalances. In None, prices fluctuated by over 32% in 2023 due to unexpected supply disruptions. This volatility creates uncertainty for investors and consumers, potentially hindering long-term contracts and investments in infrastructure. The International Gas Union (IGU) highlights that such fluctuations can lead to a 5% reduction in consumption during periods of high prices, impacting overall market stability.

- Environmental Concerns and Regulatory Pressures: Increasing environmental regulations are challenging the natural gas sector. In None, new regulations aimed at reducing methane emissions are expected to impose compliance costs exceeding $1.2 billion by 2024. These regulations may lead to operational adjustments and increased scrutiny from environmental groups, potentially affecting public perception and demand. The World Resources Institute (WRI) indicates that stricter regulations could reduce natural gas consumption by 3% in the region, complicating growth prospects.

Global Natural Gas Market Future Outlook

The future of the natural gas market in None appears promising, driven by ongoing investments in infrastructure and a global shift towards cleaner energy. As countries strive to meet climate goals, natural gas is positioned as a key transitional fuel. The integration of digital technologies in management and operations is expected to enhance efficiency and reduce costs. Furthermore, the increasing adoption of natural gas in transportation and industrial applications will likely bolster demand, ensuring a robust market landscape through 2025 and beyond.

Market Opportunities

- Growth in Emerging Markets: Emerging markets in None present significant opportunities for natural gas expansion. With urbanization rates projected to exceed 65% by 2025, the demand for natural gas in residential and commercial sectors is expected to rise sharply. This growth could lead to an increase in consumption by 22% in these markets, driven by the need for cleaner energy solutions and improved living standards.

- Investment in LNG Export Facilities: The development of LNG export facilities in None is a critical opportunity for market growth. With an estimated investment of $6 billion planned for 2024, these facilities will enhance export capabilities and meet global demand. The potential to export to high-demand regions, such as Asia, could increase revenue streams significantly, with projections indicating a 15% rise in export volumes by 2025.

Scope of the Report

| By Source |

Conventional Unconventional |

| By Application |

Power Generation Residential Commercial Industrial |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By End-User |

Power Plants Manufacturing Transportation Residential Heating |

| By Distribution Channel |

Pipeline Liquefied Natural Gas (LNG) Compressed Natural Gas (CNG) |

| By Pricing Type |

Spot Pricing Contract Pricing |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Energy, International Energy Agency)

Natural Gas Producers and Exploration Companies

Pipeline and Infrastructure Operators

Energy Trading Firms

Environmental Agencies (e.g., Environmental Protection Agency)

Utility Companies and Energy Suppliers

International Organizations (e.g., Organization of the Petroleum Exporting Countries)

Companies

Players Mentioned in the Report:

ExxonMobil

Royal Dutch Shell

Chevron

BP

Gazprom

TotalEnergies

Equinor

ConocoPhillips

Enbridge

Sempra Energy

Table of Contents

1. Global Natural Gas Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Natural Gas Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Natural Gas Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Cleaner Energy Sources

3.1.2. Expansion of Natural Gas Infrastructure

3.1.3. Technological Advancements in Extraction and Processing

3.2. Market Challenges

3.2.1. Price Volatility and Market Fluctuations

3.2.2. Environmental Concerns and Regulatory Pressures

3.2.3. Competition from Renewable Energy Sources

3.3. Opportunities

3.3.1. Growth in Emerging Markets

3.3.2. Investment in LNG Export Facilities

3.3.3. Development of Natural Gas as a Transportation Fuel

3.4. Trends

3.4.1. Shift Towards Decarbonization Initiatives

3.4.2. Increasing Role of Natural Gas in Power Generation

3.4.3. Rise of Digital Technologies in Natural Gas Management

3.5. Government Regulation

3.5.1. Emission Standards and Compliance Regulations

3.5.2. Policies Promoting Natural Gas Usage

3.5.3. Safety Regulations in Extraction and Transportation

3.5.4. International Trade Agreements Affecting Natural Gas Markets

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Natural Gas Market Segmentation

4.1. By Source

4.1.1. Conventional

4.1.2. Unconventional

4.2. By Application

4.2.1. Power Generation

4.2.2. Residential

4.2.3. Commercial

4.2.4. Industrial

4.3. By Region

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

4.4. By End-User

4.4.1. Power Plants

4.4.2. Manufacturing

4.4.3. Transportation

4.4.4. Residential Heating

4.5. By Distribution Channel

4.5.1. Pipeline

4.5.2. Liquefied Natural Gas (LNG)

4.5.3. Compressed Natural Gas (CNG)

4.6. By Pricing Type

4.6.1. Spot Pricing

4.6.2. Contract Pricing

5. Global Natural Gas Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ExxonMobil

5.1.2. Royal Dutch Shell

5.1.3. Chevron

5.1.4. BP

5.1.5. Gazprom

5.1.6. TotalEnergies

5.1.7. Equinor

5.1.8. ConocoPhillips

5.1.9. Enbridge

5.1.10. Sempra Energy

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Geographic Presence

5.2.4. Product Portfolio Diversification

5.2.5. R&D Investment

5.2.6. Customer Base Size

5.2.7. Sustainability Initiatives

5.2.8. Strategic Partnerships and Alliances

6. Global Natural Gas Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Natural Gas Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Natural Gas Market Future Market Segmentation

8.1. By Source

8.1.1. Conventional

8.1.2. Unconventional

8.2. By Application

8.2.1. Power Generation

8.2.2. Residential

8.2.3. Commercial

8.2.4. Industrial

8.3. By Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia-Pacific

8.3.4. Latin America

8.3.5. Middle East & Africa

8.4. By End-User

8.4.1. Power Plants

8.4.2. Manufacturing

8.4.3. Transportation

8.4.4. Residential Heating

8.5. By Distribution Channel

8.5.1. Pipeline

8.5.2. Liquefied Natural Gas (LNG)

8.5.3. Compressed Natural Gas (CNG)

8.6. By Pricing Type

8.6.1. Spot Pricing

8.6.2. Contract Pricing

9. Global Natural Gas Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Natural Gas Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Natural Gas Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Natural Gas Market.

Frequently Asked Questions

01. How big is the Global Natural Gas Market?

The Global Natural Gas Market is valued at USD 1.24 Tn, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Natural Gas Market?

Key challenges in the Global Natural Gas Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Natural Gas Market?

Major players in the Global Natural Gas Market include ExxonMobil, Royal Dutch Shell, Chevron, BP, Gazprom, among others.

04. What are the growth drivers for the Global Natural Gas Market?

The primary growth drivers for the Global Natural Gas Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.