Global Natural Hair Care Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD9081

October 2024

84

About the Report

Global Natural Hair Care Market Overview

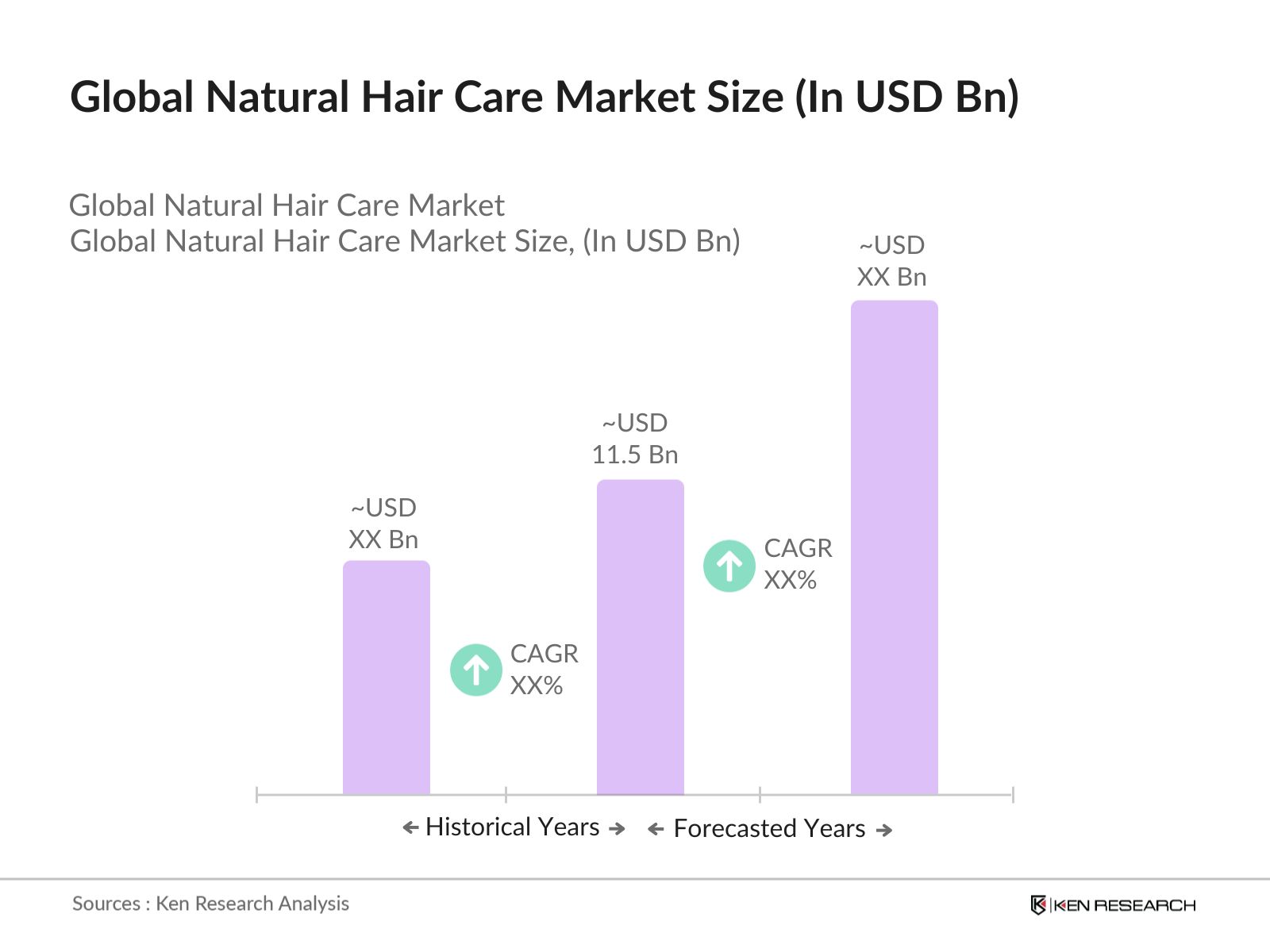

- The Global Natural Hair Care market is valued at USD 11.5 billion based on a five-year historical analysis. The market is primarily driven by the increasing consumer shift toward natural and organic products, growing awareness of the harmful effects of synthetic chemicals, and rising demand for eco-friendly, sustainable beauty solutions. Consumers, particularly in developed regions, are inclined to pay a premium for products that are free from parabens, sulfates, and silicones, leading to steady market growth in this sector.

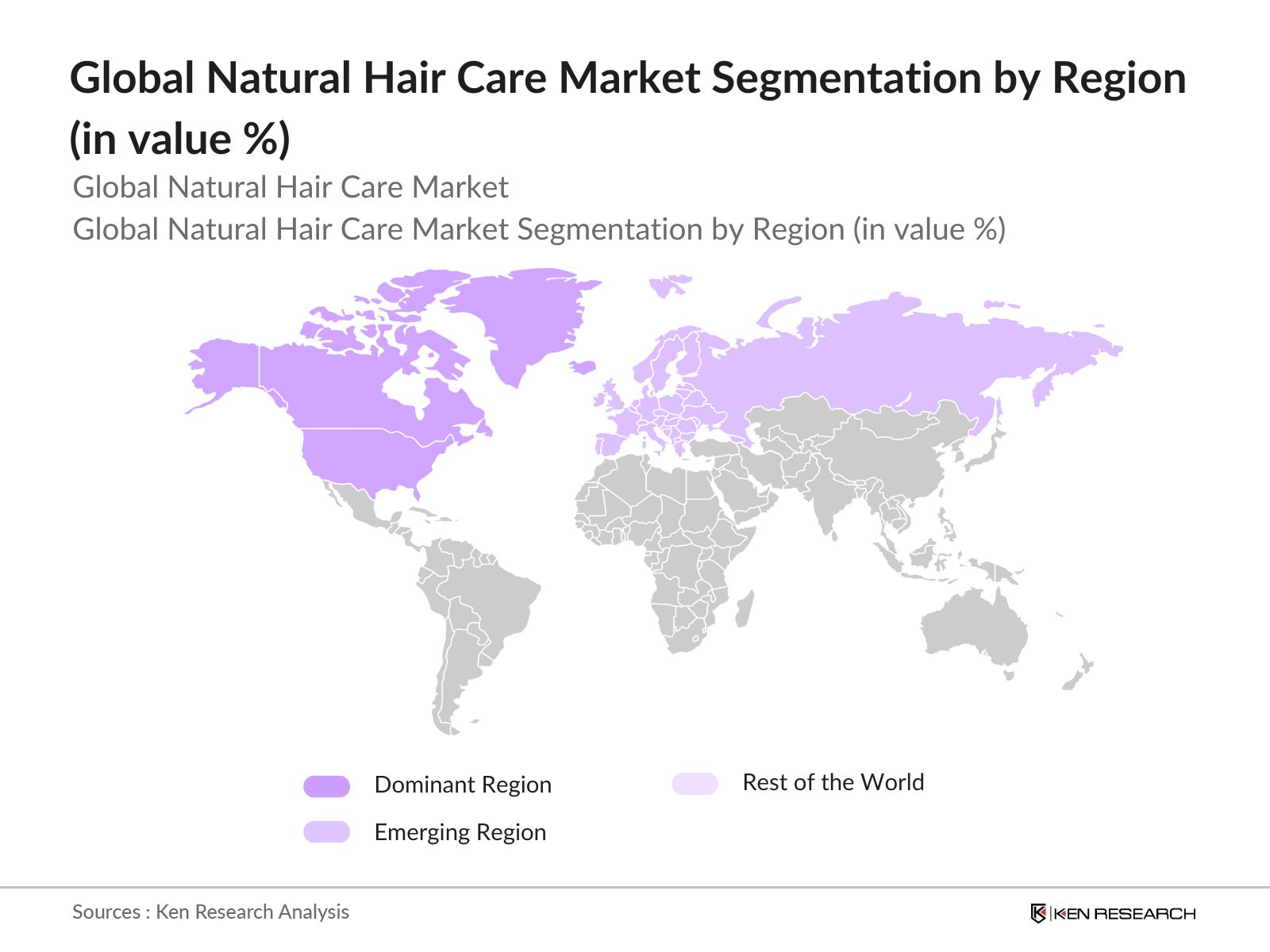

- Countries like the United States, the United Kingdom, and Germany dominate the natural hair care market due to the early adoption of clean beauty trends, higher consumer awareness, and strong demand for premium products. In these regions, consumers are more environmentally conscious, and there is significant demand for vegan and cruelty-free options, which has fueled market expansion. Furthermore, the presence of key brands and increasing e-commerce penetration contribute to the market dominance of these countries.

- The demand for vegan and cruelty-free hair care products is on the rise, with a 25% growth in sales of vegan beauty products globally between 2022 and 2023, according to a 2023 UNEP report. This trend is particularly prominent in North America and Europe, where over 60% of consumers prefer cruelty-free options. As the awareness of animal testing practices grows, natural hair care brands are increasingly adopting cruelty-free certifications, and over 40 countries have already banned animal testing for cosmetics.

Global Natural Hair Care Market Segmentation

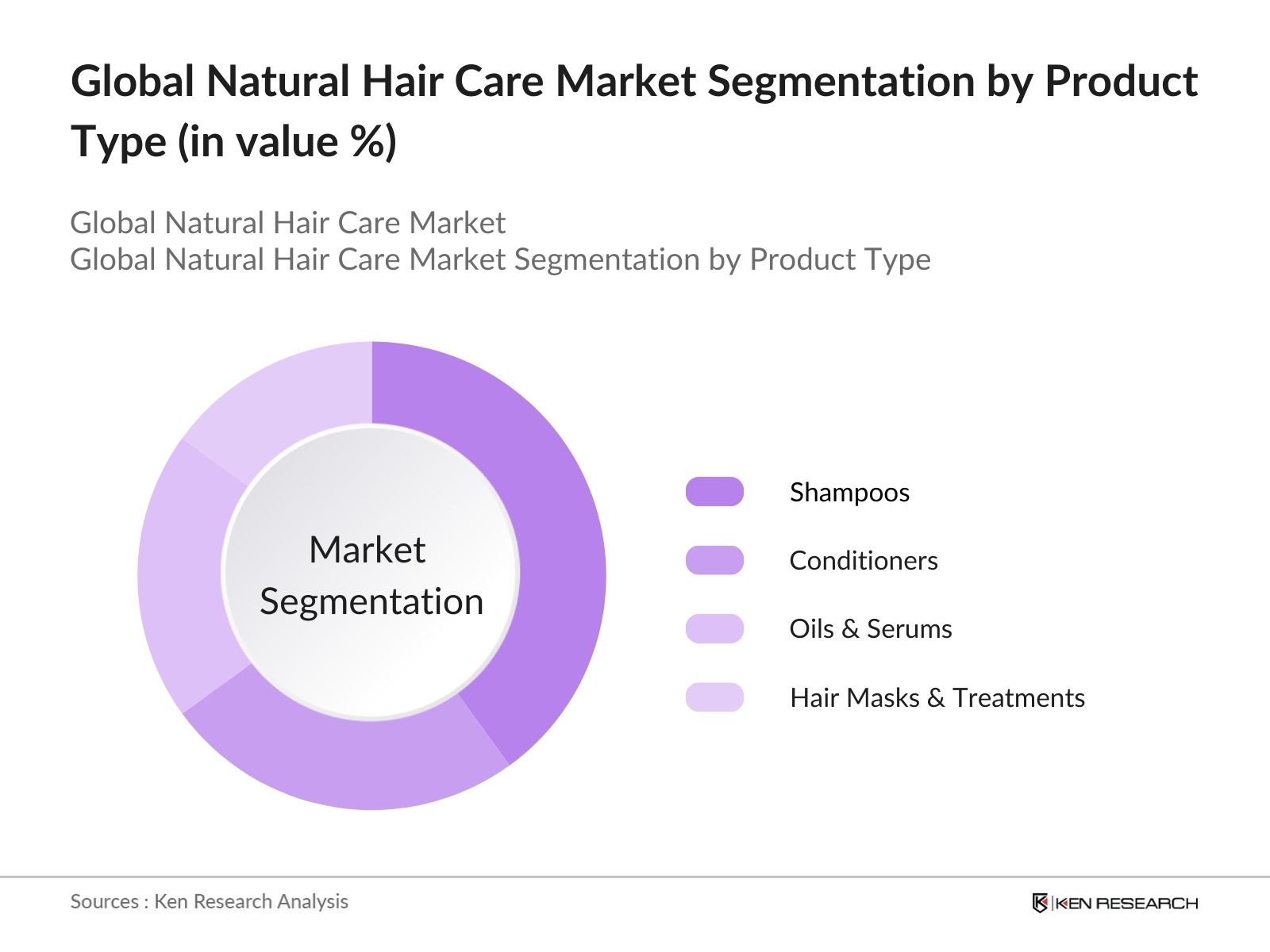

- By Product Type: The Global Natural Hair Care market is segmented by product type into shampoos, conditioners, oils & serums, hair masks & treatments, and styling products. Recently, shampoos hold a dominant market share due to their essential role in daily hair care routines and the increasing preference for sulfate-free, organic alternatives. Brands like SheaMoisture and Briogeo have led this segment, offering consumers plant-based formulations that cater to the demand for chemical-free cleansing products.

- By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the global natural hair care market owing to the region's heightened awareness of natural beauty products and the availability of a wide range of premium brands. Strong consumer preference for organic and sustainable products, coupled with significant investment in R&D by major players, ensures the dominance of this region.

- By Ingredient Type: The market is segmented by ingredient type into plant-based, mineral-based, and animal-based ingredients. Plant-based ingredients hold the largest market share due to growing consumer preference for vegan products, the sustainability factor, and their association with fewer allergic reactions. This segment is dominated by ingredients such as aloe vera, coconut oil, and argan oil, which are known for their nourishing properties and environmentally friendly sourcing.

Global Natural Hair Care Market Competitive Landscape

The global natural hair care market is characterized by the presence of both established brands and emerging players, with companies focusing on innovation, product diversification, and sustainability initiatives. The market is moderately fragmented, with major players holding significant brand loyalty and consumer trust, contributing to their market leadership.

|

Company |

Establishment Year |

Headquarters |

R&D Expenditure |

Revenue (USD Bn) |

No. of Employees |

Market Share |

Product Portfolio |

Key Innovations |

|

Aveda Corporation |

1978 |

United States |

||||||

|

SheaMoisture |

1991 |

United States |

||||||

|

John Masters Organics |

1994 |

United States |

||||||

|

Briogeo Hair Care |

2013 |

United States |

||||||

|

The Body Shop |

1976 |

United Kingdom |

Global Natural Hair Care Industry Analysis

Growth Drivers

- Increasing Consumer Awareness for Natural Ingredients: As of 2023, a growing number of consumers are becoming more health-conscious, particularly regarding the ingredients in personal care products. According to the World Bank, in 2022, global spending on health-related consumer goods increased by 8% compared to 2021, reflecting an increased demand for natural and organic ingredients in hair care products. In the U.S. and EU, nearly 65% of consumers actively seek natural or plant-based ingredients. This shift is driven by rising awareness of the harmful effects of synthetic chemicals. The natural hair care market benefits from this trend, as consumers prioritize health and eco-friendliness .

- Shift Towards Sustainable and Organic Products: In 2023, the World Bank reported that 55% of global consumers are concerned about sustainability, contributing to the demand for sustainable and organic hair care products. This trend is most prominent in developed economies, where organic certifications and eco-friendly packaging play a significant role in consumer decision-making. Organic hair care products, free from sulfates, parabens, and synthetic fragrances, appeal to environmentally conscious buyers. The increasing availability of certified organic products from emerging markets is expected to further boost the global adoption of sustainable hair care products .

- Rise in Dermatological Recommendations: With an increasing number of dermatologists recommending natural hair care products, especially for individuals with sensitive skin, the demand for chemical-free formulations is on the rise. As of 2023, dermatological organizations in Europe and North America reported a 20% increase in consultations relating to skin sensitivities triggered by synthetic chemicals. Governments are also emphasizing consumer safety by promoting natural alternatives, creating a supportive environment for the natural hair care industry. This shift is significant for consumers seeking dermatologist-approved products .

Market Restraints

- High Product Costs (Price Sensitivity in Developing Economies): Natural hair care products, especially those with certified organic ingredients, are often priced higher than their synthetic counterparts. In emerging economies like India and Brazil, the per capita income in 2023 stood at USD 2,200 and USD 9,000, respectively, according to the World Bank. High costs for organic hair care products in these regions make them less accessible to the mass market. Price sensitivity is a significant barrier for growth in developing economies, where consumers are more focused on affordability .

- Short Shelf Life of Organic Ingredients: Natural hair care products typically have a shorter shelf life due to the absence of synthetic preservatives, which can deter consumers from purchasing them. Organic products usually last only 6-12 months, compared to synthetic alternatives that can last up to 24 months. The United States Department of Agriculture (USDA) noted in 2023 that this challenge has affected the export of organic products, as maintaining quality during transportation over long distances is difficult. This is particularly concerning for emerging markets with less developed supply chain infrastructure.

Global Natural Hair Care Market Future Outlook

Over the next five years, the global natural hair care market is expected to show significant growth, driven by increasing consumer awareness of product ingredients, rising demand for organic and plant-based hair care solutions, and the expanding influence of eco-friendly and sustainable beauty products. The growth is further fueled by the rise of direct-to-consumer channels, technological innovations in product formulations, and the growing prevalence of conscious consumerism across key markets.

Market Opportunities

- Growing Demand in Emerging Markets (APAC, LATAM): The Asia-Pacific and Latin American regions represent significant growth potential for natural hair care products. According to the World Bank, APAC's consumer expenditure on personal care products grew by 12% in 2023, while LATAM's grew by 9%. In countries like Brazil and India, rising disposable incomes, urbanization, and increasing health awareness are driving demand for organic and natural products. The APAC region, with its growing middle class and rapid economic development, presents a particularly lucrative opportunity for global natural hair care brands .

- Expansion of E-Commerce Channels for Direct-to-Consumer Sales: With the rise of digitalization, e-commerce has become a critical sales channel for natural hair care products. In 2023, the global e-commerce market reached USD 4.2 trillion in total retail sales, as reported by the International Trade Centre. Direct-to-consumer (DTC) brands in the natural hair care space have particularly benefited from the low barriers to market entry and direct communication with consumers. The adoption of online retail channels in emerging markets like India and China further expands access to these products, bypassing traditional brick-and-mortar limitations .

Scope of the Report

|

By Product Type |

Shampoos, Conditioners, Oils & Serums, Hair Masks & Treatments, Styling Products |

|

By Ingredient Type |

Plant-based, Mineral-based, Animal-based |

|

By Sales Channel |

Supermarkets & Hypermarkets, Specialty Stores, Online Retail, Pharmacies & Drugstores |

|

By Gender |

Men, Women, Unisex |

|

By Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Hair Care Manufacturers

Raw Material Suppliers

Retailers and Distributors

E-commerce Platforms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA Organic)

Sustainability and Ethical Sourcing Organizations

Packaging and Labeling Solution Providers

Companies

Players Mentioned in the Report:

Aveda Corporation

The Body Shop

John Masters Organics

SheaMoisture

Kiehls

Lush Cosmetics

Avalon Organics

Briogeo Hair Care

True Botanicals

Rahua

Alaffia

Jason Natural Products

Faith In Nature

Dr. Bronner's

Acure Organics

Table of Contents

1. Global Natural Hair Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Natural Hair Care Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Natural Hair Care Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Awareness for Natural Ingredients

3.1.2. Shift Towards Sustainable and Organic Products

3.1.3. Rise in Dermatological Recommendations

3.1.4. Global Trend for Clean Beauty Products

3.2. Market Challenges

3.2.1. High Product Costs (Price Sensitivity in Developing Economies)

3.2.2. Short Shelf Life of Organic Ingredients

3.2.3. Regulatory Compliance Issues (Different Certification Standards Across Regions)

3.2.4. Competition from Synthetic Hair Care Products

3.3. Opportunities

3.3.1. Growing Demand in Emerging Markets (APAC, LATAM)

3.3.2. Expansion of E-Commerce Channels for Direct-to-Consumer Sales

3.3.3. Technological Innovations in Product Formulation (Microencapsulation, Bio-based Ingredients)

3.3.4. Rise of Customizable and Personalized Hair Care Solutions

3.4. Trends

3.4.1. Vegan and Cruelty-Free Product Demand

3.4.2. Eco-friendly Packaging Initiatives

3.4.3. Gender-neutral Hair Care Products

3.4.4. Integration of AI and Machine Learning for Personalized Hair Care

3.5. Government Regulations

3.5.1. Global Standards on Natural and Organic Certifications

3.5.2. Product Labeling Requirements (INCI Standards)

3.5.3. Ban on Harmful Chemicals (Parabens, Sulfates)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Ingredient Suppliers, Manufacturers, Distributors, Retailers)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Market Fragmentation and Brand Loyalty)

4. Global Natural Hair Care Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Shampoos

4.1.2. Conditioners

4.1.3. Oils & Serums

4.1.4. Hair Masks & Treatments

4.1.5. Styling Products

4.2. By Ingredient Type (In Value %)

4.2.1. Plant-based

4.2.2. Mineral-based

4.2.3. Animal-based

4.3. By Sales Channel (In Value %)

4.3.1. Supermarkets & Hypermarkets

4.3.2. Specialty Stores

4.3.3. Online Retail

4.3.4. Pharmacies & Drugstores

4.4. By Gender (In Value %)

4.4.1. Men

4.4.2. Women

4.4.3. Unisex

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Natural Hair Care Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Aveda Corporation

5.1.2. The Body Shop

5.1.3. John Masters Organics

5.1.4. SheaMoisture

5.1.5. Kiehls

5.1.6. Lush Cosmetics

5.1.7. Avalon Organics

5.1.8. Briogeo Hair Care

5.1.9. True Botanicals

5.1.10. Rahua

5.1.11. Alaffia

5.1.12. Jason Natural Products

5.1.13. Faith In Nature

5.1.14. Dr. Bronner's

5.1.15. Acure Organics

5.2. Cross Comparison Parameters (Brand Popularity, Product Diversification, Sustainability Initiatives, Consumer Trust, R&D Focus, Revenue Growth, Geographic Presence, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Global Natural Hair Care Market Regulatory Framework

6.1. Natural Product Certifications (ECOCERT, USDA Organic, COSMOS)

6.2. Compliance with Global Environmental Standards

6.3. Import/Export Tariffs for Natural Ingredients

7. Global Natural Hair Care Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Natural Hair Care Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredient Type (In Value %)

8.3. By Sales Channel (In Value %)

8.4. By Gender (In Value %)

8.5. By Region (In Value %)

9. Global Natural Hair Care Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Demographics and Psychographics Analysis

9.3. Marketing Strategies for Brand Differentiation

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first phase, we constructed an ecosystem map of the global natural hair care market. This involved secondary research using a combination of proprietary databases and publicly available resources to gather critical industry-level data on product categories, ingredient trends, and key market drivers.

Step 2: Market Analysis and Construction

During this phase, historical data on the global natural hair care market was compiled and analyzed. This included evaluating market penetration of natural hair care products across different regions, the impact of consumer preferences on market dynamics, and the role of technological innovation in product development.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on the historical analysis and were validated through consultations with industry experts, including product managers, brand owners, and market analysts. These insights were used to refine and corroborate the data collected in the earlier stages of research.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the data from all stages of research into a comprehensive report. This included analyzing consumer behavior patterns, competitor strategies, and growth opportunities for the global natural hair care market, culminating in a validated and robust market analysis.

Frequently Asked Questions

01. How big is the Global Natural Hair Care Market?

The global natural hair care market is valued at USD 11.5 billion, driven by rising consumer demand for organic and chemical-free products, growing environmental awareness, and advancements in product formulations.

02. What are the challenges in the Global Natural Hair Care Market?

Challenges include the high cost of natural ingredients, short shelf life of organic products, and the complexity of meeting various certification requirements in different regions. Additionally, competition from synthetic hair care products remains strong.

03. Who are the major players in the Global Natural Hair Care Market?

Key players include Aveda Corporation, SheaMoisture, The Body Shop, John Masters Organics, and Briogeo Hair Care. These companies have built consumer trust and dominate the market with their strong brand presence and innovative product lines.

04. What are the growth drivers of the Global Natural Hair Care Market?

The market is driven by increasing consumer awareness of harmful chemicals in hair care products, the rise of eco-friendly and sustainable beauty trends, and the growing demand for cruelty-free and vegan hair care products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.