Global Network-Centric Warfare Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD7359

December 2024

93

About the Report

Global Network-Centric Warfare Market Overview

- The Global Network-Centric Warfare Market is valued at USD 60 billion, driven primarily by increasing defence spending and advancements in digital communication technologies within military operations. This market's growth is underscored by a five-year historical analysis, highlighting significant investment in cybersecurity and integrated military systems. Network-centric capabilities enhance decision-making and response times, especially in operations involving complex data and real-time intelligence.

- The United States, China, and Russia lead the Network-Centric Warfare Market due to substantial government funding, advanced technology infrastructure, and robust defense capabilities. The U.S., with its extensive defense budget and technological prowess, maintains its dominance by continually upgrading its network-centric warfare capabilities. Chinas rapid adoption of digital defense solutions and its commitment to advancing AI in military applications also strengthen its market position. Russia, with a strong focus on electronic warfare and strategic investments in military cyber capabilities, holds a significant market presence driven by its regional influence and technological advancements in defense.

- Governments worldwide have established stringent cybersecurity frameworks to protect military communication networks. The National Institute of Standards and Technology (NIST) in the U.S. launched a revised framework in 2024, focused on securing network-centric systems from cyber threats through mandatory security protocols. Similarly, NATO has introduced cybersecurity standards to protect communication networks within allied forces.

Global Network-Centric Warfare Market Segmentation

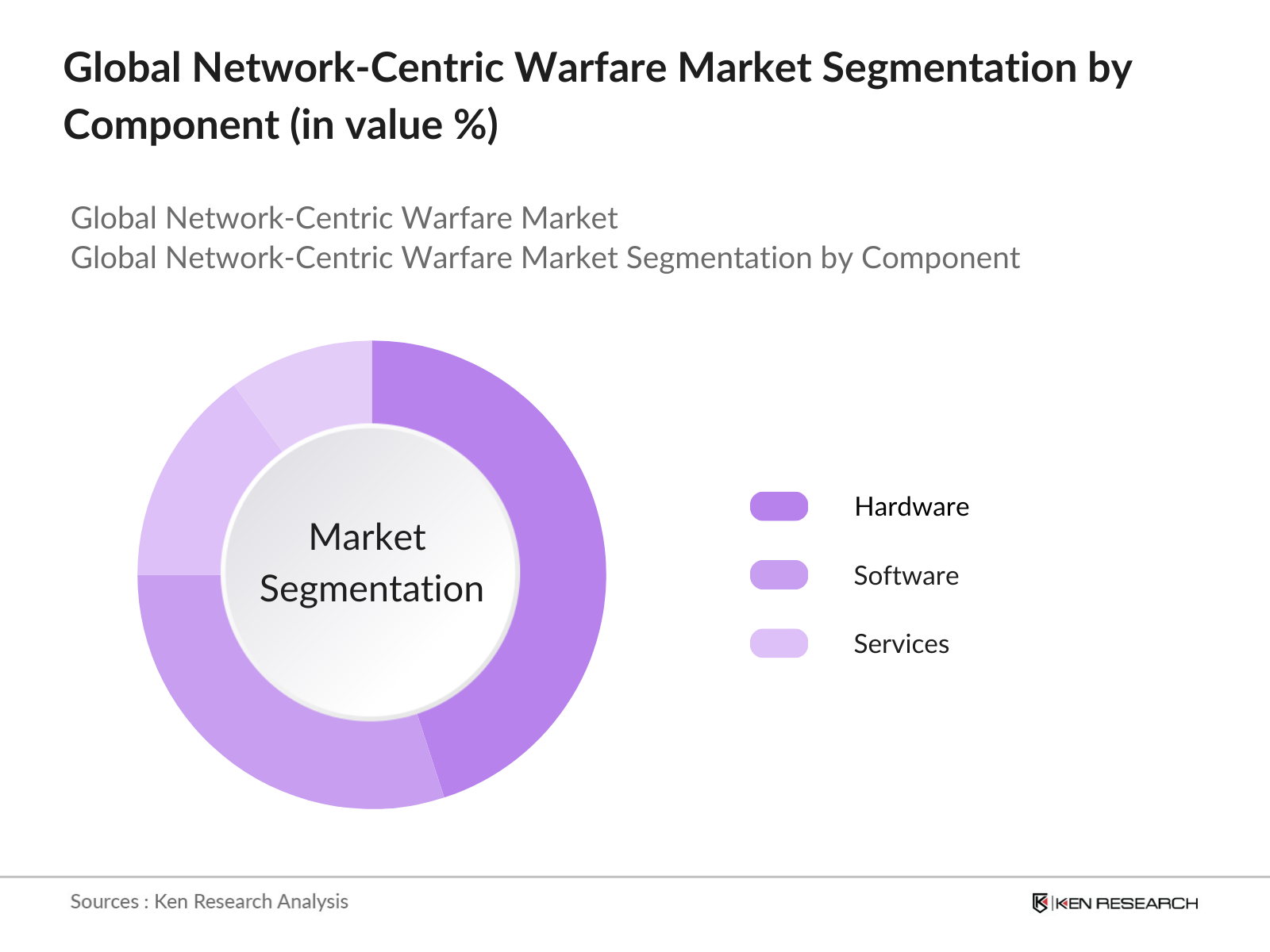

By Component: The Network-Centric Warfare Market is segmented by component into Hardware, Software, and Services. Hardware dominates the market due to its essential role in establishing a robust communication and data transmission infrastructure. Advanced hardware, including servers, satellites, and communication devices, ensures seamless data flow across various military units. High investment in military-grade hardware for resilience and security contributes to this segment's dominance.

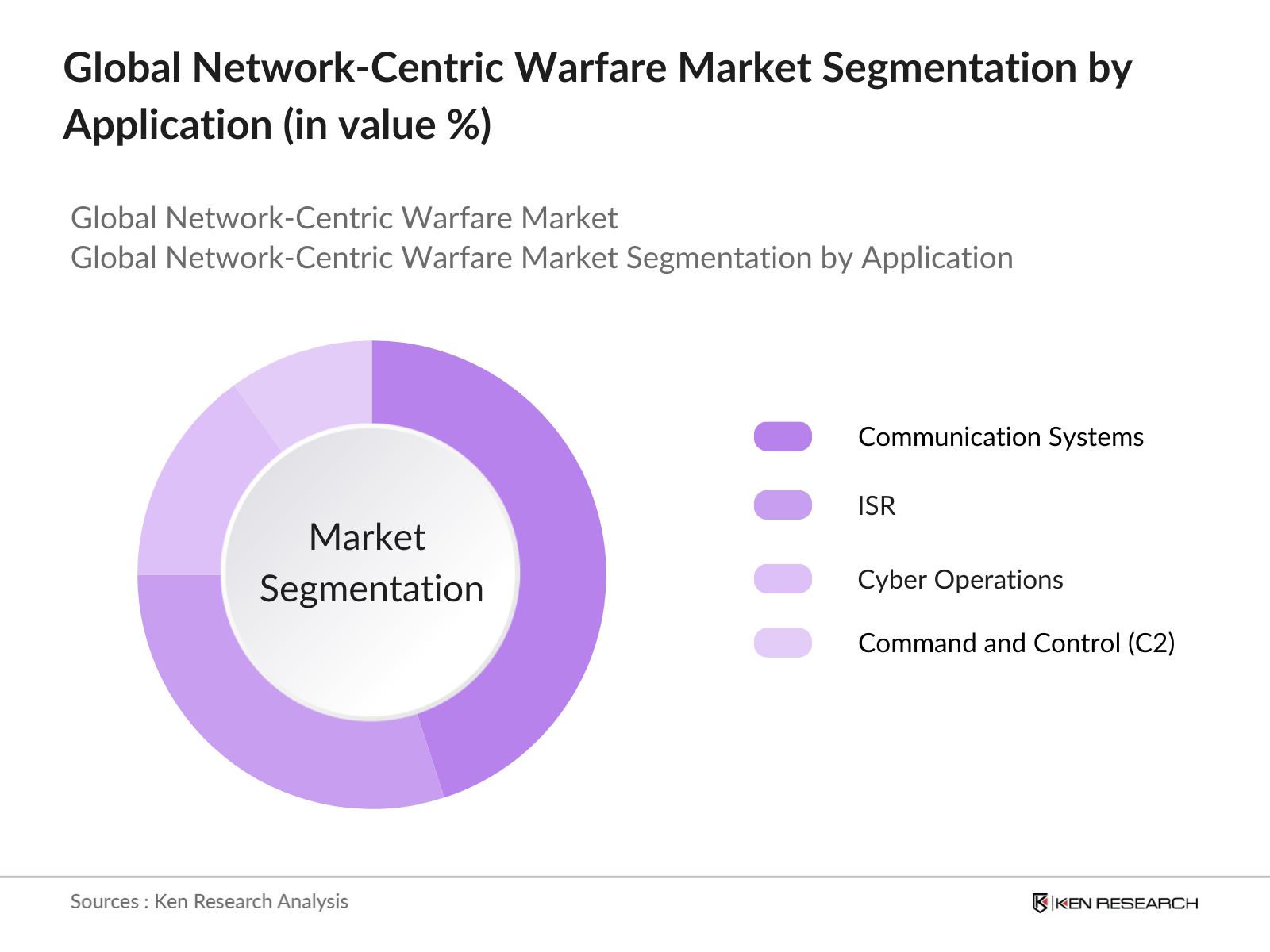

By Application: Network-centric warfare applications include Communication Systems, Intelligence, Surveillance, and Reconnaissance (ISR), Cyber Operations, and Command and Control (C2). ISR leads in application due to the critical need for real-time intelligence in modern warfare. Military forces globally rely on ISR to monitor, assess, and respond to threats, making it essential for both offensive and defensive operations. Investments in advanced sensors and aerial surveillance technologies enhance ISRs effectiveness in combat scenarios.

Global Network-Centric Warfare Market Competitive Landscape

The Global Network-Centric Warfare Market is dominated by a few key players, with established companies like Lockheed Martin, Raytheon Technologies, and Northrop Grumman leading due to extensive R&D investments and high-tech offerings. These firms are known for their cutting-edge technologies, which provide critical communication and surveillance solutions within network-centric frameworks.

Global Network-Centric Warfare Market Analysis

Growth Drivers

- Defense Modernization Programs: Defense modernization remains a top priority globally, with governments like the United States allocating approximately USD 740 billion to the Department of Defense in 2024, focusing on advanced communication technologies, cyber defenses, and AI in warfare. This budget reflects the shift toward network-centric warfare, with funds allocated to enhance connectivity, information sharing, and real-time operational capabilities across various military branches. Additionally, countries such as China and India are significantly ramping up defense spending, totaling USD 224 billion and USD 77 billion, respectively, to bolster technology-driven warfare capabilities. These investments indicate a robust and sustained commitment to evolving network-centric strategies.

- Expanding Military Expenditure: Military expenditures have surged, with the IMF reporting a combined global defense budget of over USD 2.1 trillion in 2023, driven by heightened geopolitical tensions and rapid technological adoption. Leading defense spenders like the U.S., China, and Saudi Arabia have been particularly active in expanding network-centric infrastructure, recognizing the strategic importance of information-driven warfare. China, for example, allocated USD 225 billion towards strengthening its armed forces, including the development of network-centric systems, underscoring the critical role of such technology in maintaining global defense capabilities.

- Advancements in Communication Technology Rapid advancements in communication technologies, such as 5G and satellite communications, are fueling the effectiveness of network-centric warfare. According to the International Telecommunication Union, the global 5G deployment rate reached 42% by 2024, with increased investment from defense sectors to enhance secure and high-speed data transfer on battlefields. This adoption supports the integration of real-time intelligence and seamless interoperability, which are essential for network-centric operations. Nations are leveraging these advancements to improve communication resilience in warfare, particularly through public-private partnerships with telecom providers.

Market Challenges

- High Implementation Costs: The implementation of network-centric warfare systems requires significant investment in infrastructure, which can be a challenge for countries with limited defense budgets. For instance, while the U.S. and NATO allies are dedicating billions to modernize their communication and intelligence systems, emerging economies face constraints. In Africa, average defense spending remains below USD 20 billion per country, as noted by the Stockholm International Peace Research Institute (SIPRI), limiting their ability to adopt high-cost network-centric solutions on a large scale. This disparity highlights the economic challenges smaller nations face in keeping pace with digital warfare advancements.

- Complexity of Integration: Integrating network-centric capabilities across various military branches presents technical and operational challenges. The World Economic Forum notes that over 60% of military organizations globally have reported issues in synchronizing legacy systems with new technologies, resulting in operational inefficiencies. For instance, the integration of autonomous systems, AI-driven analytics, and real-time data exchange in coalition operations often results in communication mismatches due to incompatible standards and protocols, increasing the risk of delayed responses and reduced coordination

Global Network-Centric Warfare Market Future Outlook

The Global Network-Centric Warfare Market is poised for substantial growth, driven by continuous advancements in communication technologies, AI integration, and increased global defense budgets. Countries worldwide are enhancing their military capabilities with network-centric solutions to meet rising cybersecurity threats and complex modern warfare requirements. Enhanced interoperability and real-time data processing capabilities will likely shape the sectors development, as military forces seek to maximize decision-making speed and efficiency on the battlefield.

- Development of Artificial Intelligence (AI) in Warfare: The adoption of AI in military operations has created new opportunities within network-centric warfare. As of 2024, the U.S. Department of Defense is allocating approximately USD 1.7 billion annually to AI development, aimed at enhancing autonomous operations, data analytics, and decision-making capabilities. Countries like China and the U.K. are also integrating AI-driven technologies for predictive analytics and battlefield assessments, creating a transformative effect in real-time intelligence gathering and threat identification, thus advancing the capabilities of network-centric warfare systems.

- Increased Government Defense Budgets: Governments globally are prioritizing defense budget increases to enhance network-centric warfare capabilities. In 2024, Europes defense expenditure crossed USD 440 billion, largely aimed at fortifying networked defense capabilities against geopolitical tensions. The European Defence Agency reports significant investments in collaborative defense technologies, aimed at developing interoperable communication and intelligence systems across NATO allies, providing robust support to network-centric warfare advancements. This budget prioritization indicates a strong foundation for network-centric capabilities.

Scope of the Report

|

Segment |

Sub-Segments |

|

Platform |

- Land-Based |

|

Application |

- Intelligence, Surveillance, and Reconnaissance (ISR) |

|

Architecture |

- Hardware |

|

Communication Network |

- Wired |

|

Mission Type |

- Tactical |

|

Region |

- North America |

Products

Key Target Audience

Defense Ministries (U.S. Department of Defense, Chinas Ministry of National Defense)

Armed Forces Procurement Agencies

Cybersecurity Providers for Defense

Communication Systems Providers

Defense R&D Institutions

Private Defense Contractors and Suppliers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (NATO, European Defence Agency)

Companies

Players mentioned in the report

Lockheed Martin Corporation

Raytheon Technologies

Northrop Grumman Corporation

Boeing Defense, Space & Security

BAE Systems plc

General Dynamics Information Technology

L3Harris Technologies, Inc.

Thales Group

Leonardo S.p.A.

Rheinmetall AG

CACI International Inc

Elbit Systems Ltd.

SAIC (Science Applications International Corporation)

Honeywell International Inc.

Collins Aerospace

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Market Size (USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Technological Advancements in Defense Systems

3.1.2 Increasing Defense Budgets Globally

3.1.3 Rising Geopolitical Tensions

3.1.4 Integration of AI and Machine Learning in Warfare

3.2 Market Challenges

3.2.1 High Implementation Costs

3.2.2 Cybersecurity Threats

3.2.3 Interoperability Issues Among Defense Systems

3.3 Opportunities

3.3.1 Development of Unmanned Platforms

3.3.2 Expansion into Emerging Markets

3.3.3 Collaboration Between Defense Contractors and Tech Firms

3.4 Trends

3.4.1 Adoption of Cloud-Based Solutions

3.4.2 Emphasis on Cyber Defense Capabilities

3.4.3 Shift Towards Multi-Domain Operations

3.5 Government Regulations

3.5.1 Defense Acquisition Policies

3.5.2 International Arms Trade Agreements

3.5.3 Data Protection and Privacy Laws

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Market Segmentation

4.1 By Platform (Value %)

4.1.1 Land-Based

4.1.2 Naval-Based

4.1.3 Air-Based

4.1.4 Unmanned Systems

4.2 By Application (Value %)

4.2.1 Intelligence, Surveillance, and Reconnaissance (ISR)

4.2.2 Communications

4.2.3 Command and Control

4.2.4 Computers

4.2.5 Cyber Operations

4.2.6 Electronic Warfare

4.3 By Architecture (Value %)

4.3.1 Hardware

4.3.2 Software

4.4 By Communication Network (Value %)

4.4.1 Wired

4.4.2 Wireless

4.5 By Mission Type (Value %)

4.5.1 Tactical

4.5.2 Strategic

4.6 By Region (Value %)

4.6.1 North America

4.6.2 Europe

4.6.3 Asia-Pacific

4.6.4 Middle East and Africa

4.6.5 Latin America

5. Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Lockheed Martin Corporation

5.1.2 Northrop Grumman Corporation

5.1.3 Raytheon Technologies Corporation

5.1.4 BAE Systems plc

5.1.5 Thales Group

5.1.6 General Dynamics Corporation

5.1.7 L3Harris Technologies, Inc.

5.1.8 Elbit Systems Ltd.

5.1.9 Leonardo S.p.A.

5.1.10 Saab AB

5.1.11 Airbus SE

5.1.12 Boeing Defense, Space & Security

5.1.13 CACI International Inc.

5.1.14 Booz Allen Hamilton Holding Corporation

5.1.15 Leidos Holdings, Inc.

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, R&D Expenditure, Market Share, Key Contracts, Technological Capabilities)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Regulatory Framework

6.1 Defense Procurement Regulations

6.2 Compliance Requirements

6.3 Certification Processes

7. Future Market Size (USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Platform (Value %)

8.2 By Application (Value %)

8.3 By Architecture (Value %)

8.4 By Communication Network (Value %)

8.5 By Mission Type (Value %)

8.6 By Region (Value %)

9. Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial stage involves mapping out the ecosystem of stakeholders in the Global Network-Centric Warfare Market. Through desk research using proprietary and secondary sources, we identify and categorize variables such as technology adoption rates, military spending trends, and defense capabilities to establish a baseline for analysis.

Step 2: Market Analysis and Construction

Here, historical data is analyzed, focusing on factors influencing market dynamics like service quality, revenue generation, and adoption rates. This stage leverages the detailed breakdown of segment contributions, compiling data to construct a clear market representation.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are established based on the preliminary findings, which are then validated through consultations with industry experts and stakeholders. These interactions provide crucial insights into operational and financial aspects, adding depth to the data analysis.

Step 4: Research Synthesis and Final Output

In this final phase, the insights gathered from various sources are synthesized into a comprehensive, validated report. The bottom-up approach ensures data reliability, and cross-referencing findings with industry standards strengthens the overall analysis.

Frequently Asked Questions

01. How big is the Global Network-Centric Warfare Market?

The Global Network-Centric Warfare Market is valued at USD 60 billion, driven by an increase in military spending and the demand for integrated, high-speed communication solutions.

02. What are the main challenges in the Global Network-Centric Warfare Market?

Key challenges include high initial investment costs, integration complexities, and data security concerns, which can hinder seamless deployment and scalability.

03. Who are the major players in the Global Network-Centric Warfare Market?

Prominent companies include Lockheed Martin, Raytheon Technologies, Northrop Grumman, Boeing Defense, and BAE Systems. These firms dominate due to their extensive experience, technological innovation, and government contracts.

04. What drives the Global Network-Centric Warfare Market?

The market is propelled by rising cyber threats, the need for real-time data processing, and increasing defense budgets worldwide, which together support the adoption of network-centric warfare capabilities.

05. What segments dominate the Global Network-Centric Warfare Market?

ISR (Intelligence, Surveillance, and Reconnaissance) and Hardware components lead in market dominance due to their critical roles in gathering intelligence and enabling communication infrastructure.

06. What is the future outlook for the Global Network-Centric Warfare Market?

Future growth is expected due to advancements in AI, increased government spending on cybersecurity, and the global trend toward modernization of military communication systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.