Global Network Security Software Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD1403

December 2024

84

About the Report

Global Network Security Software Market Overview

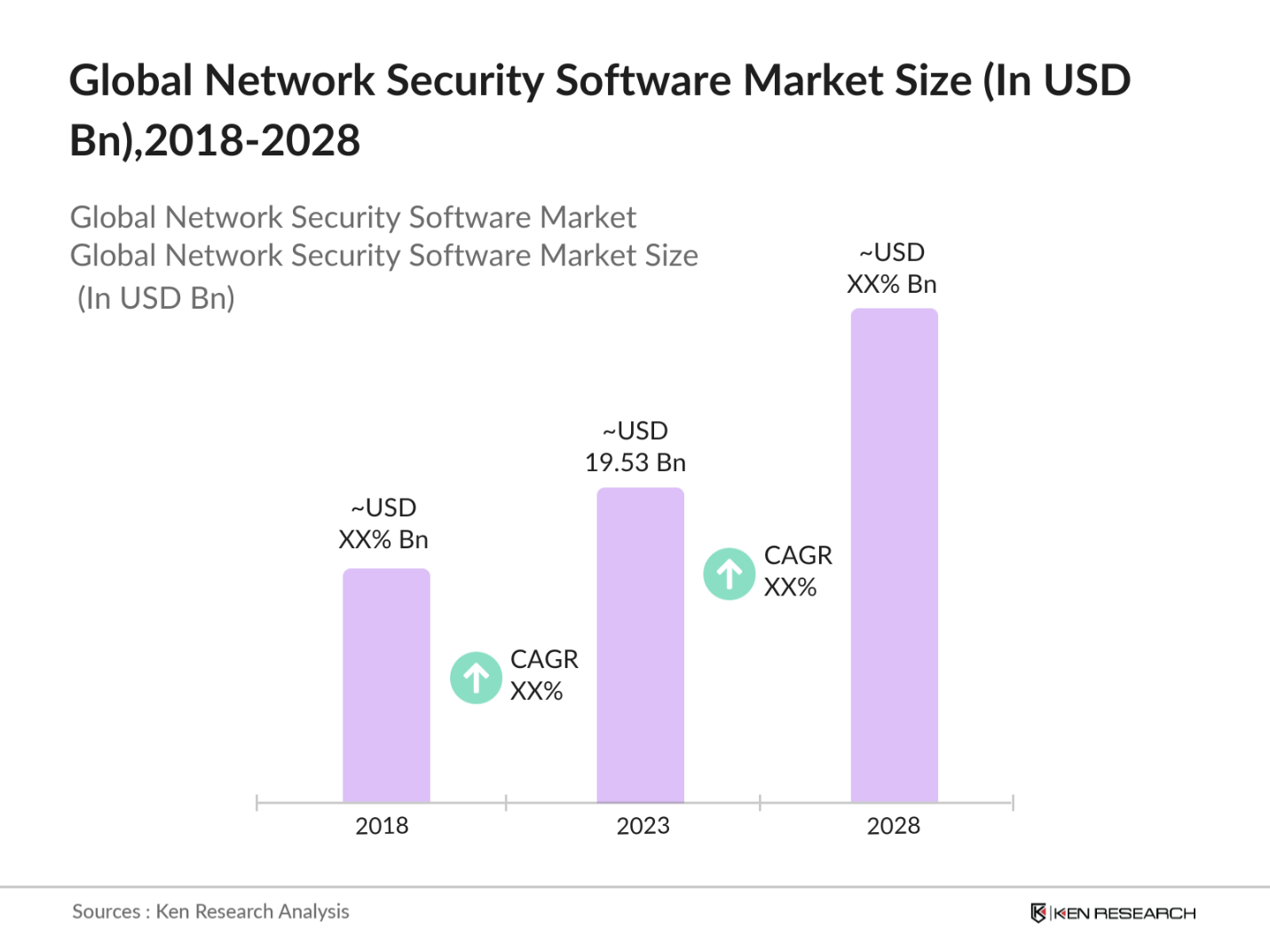

- The global network security software market was valued at USD 19.53 billion. The market has experienced steady growth driven by the rising incidences of cyberattacks, which have compelled organizations to invest heavily in network security. The increasing adoption of cloud-based services and the rise of the Internet of Things (IoT) have further fueled the demand for robust network security solutions. Companies across various sectors are prioritizing investments in network security to safeguard their critical data, making it a key growth area.

- Key players in the network security software market include companies like Cisco Systems (USA), Palo Alto Networks (USA), Check Point Software Technologies (Israel), Fortinet (USA), and Symantec (a division of Broadcom Inc., USA). These companies have been instrumental in advancing cybersecurity technologies, particularly in areas like firewalls, intrusion prevention systems, and next-generation threat detection. Their strong market presence and continuous innovation in security solutions position them as leaders in the competitive landscape of the network security software market.

- In 2023, Palo Alto Networks acquired Cider Security to enhance its supply chain security capabilities, reflecting the growing focus on securing the software supply chain, which has become a critical concern following recent high-profile breaches. Additionally, Cisco Systems launched its SecureX platform, integrating multiple security products into a unified system to provide enhanced visibility and faster threat response times.

- Cities like New York, San Francisco, and London are dominant in the network security software market due to their concentration of financial institutions, tech companies, and other critical sectors. New York, with its large financial sector, is particularly vulnerable to cyber threats, leading to significant investments in network security. Similarly, San Francisco, home to numerous tech firms and startups, requires advanced security measures to protect sensitive data, further bolstering market growth.

Global Network Security Software Market Segmentation

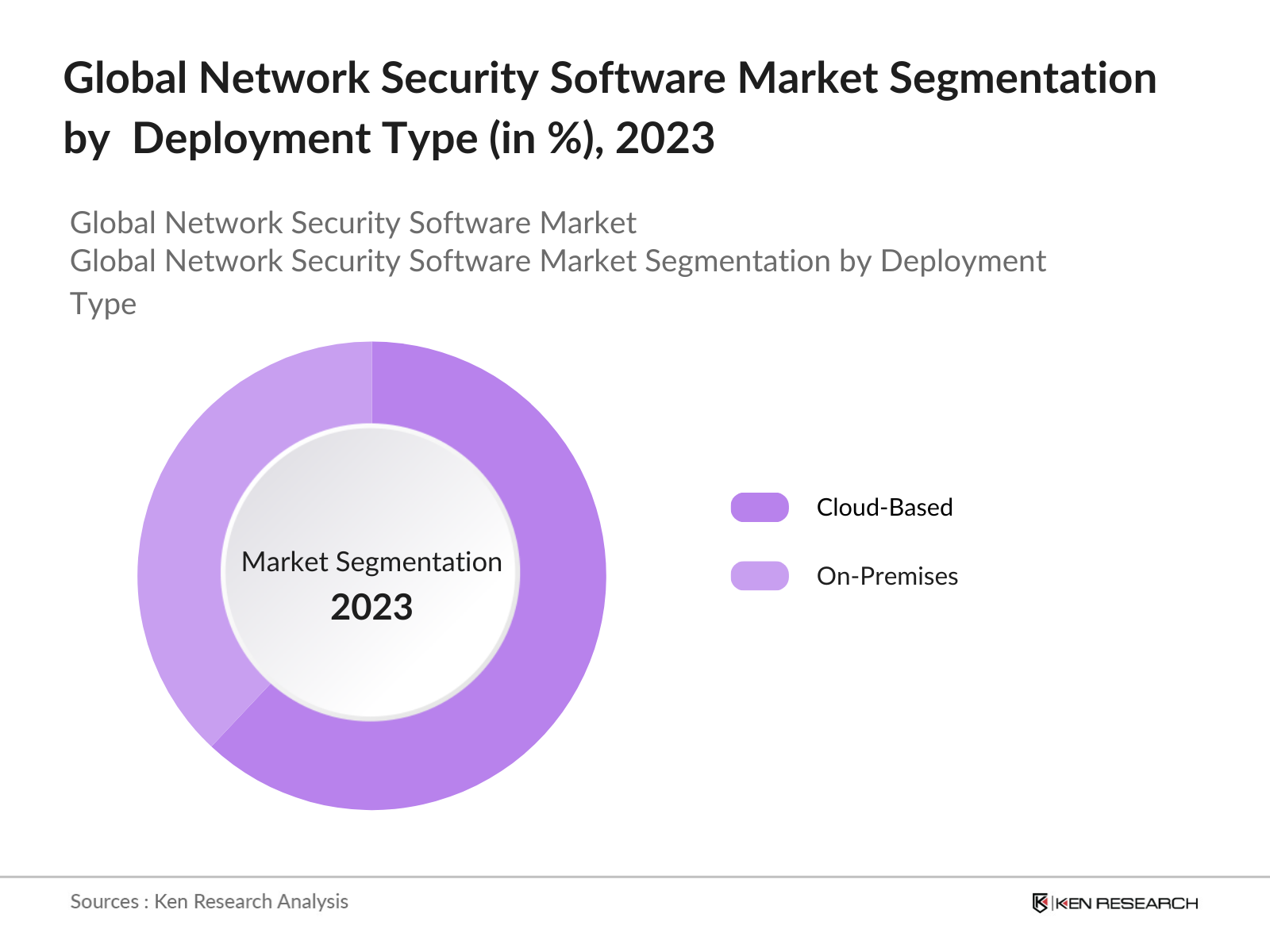

By Deployment Type: The global network security software market is segmented by deployment type into cloud-based and on-premises solutions. In 2023, cloud-based solutions held a dominant market share due to the increasing shift towards cloud computing. Companies prefer cloud-based security solutions because of their scalability, flexibility, and cost-effectiveness. The COVID-19 pandemic accelerated the adoption of remote working, further driving the demand for cloud-based network security software.

By Solution Type: The global network security software market is segmented by solution type into firewalls, antivirus/anti-malware, intrusion detection systems (IDS), intrusion prevention systems (IPS), and others. In 2023, firewalls held the largest market share due to their critical role in monitoring and controlling network traffic. Firewalls are widely adopted for their ability to enforce predetermined security rules, making them a cornerstone of network security strategies across various industries.

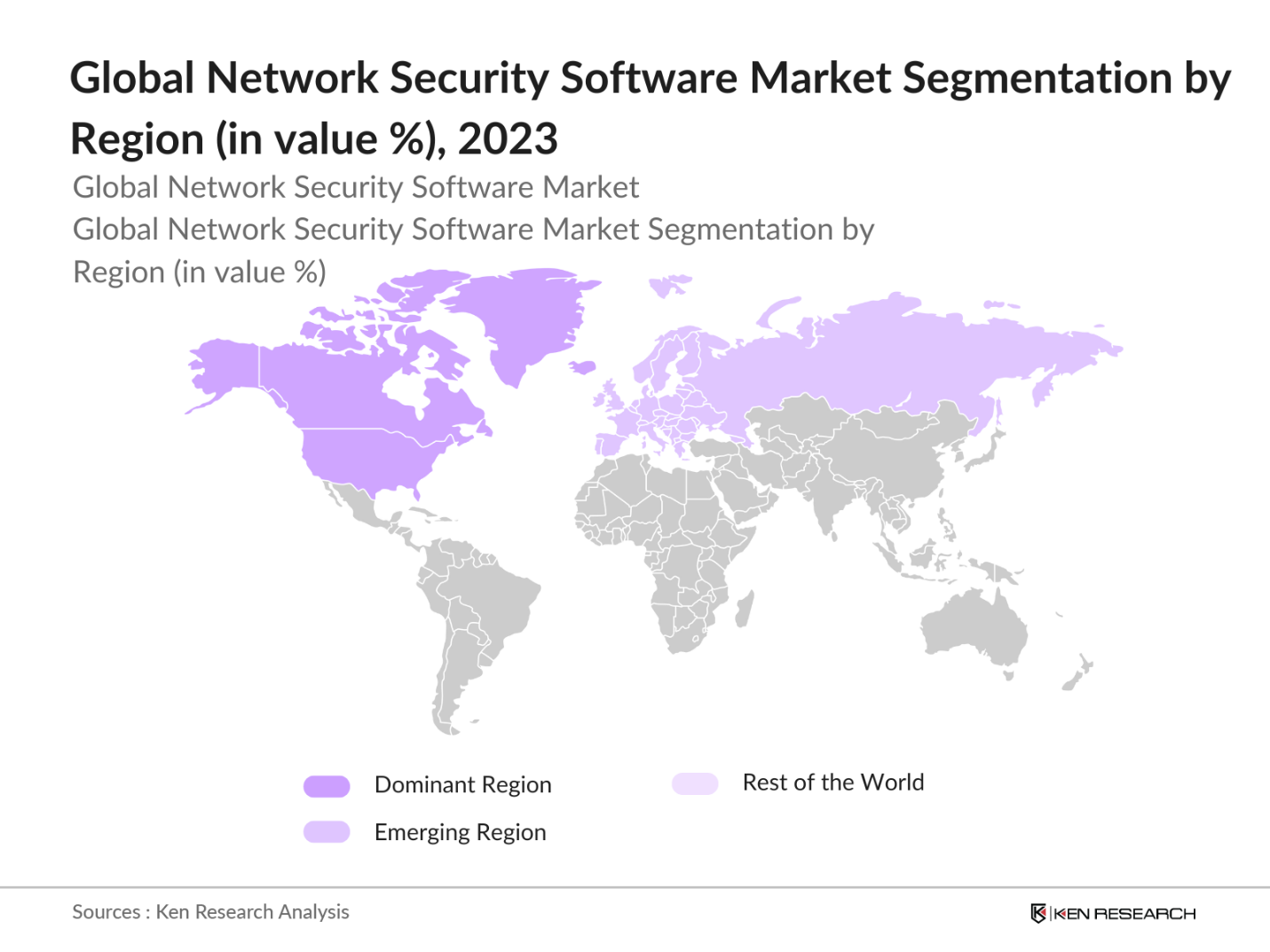

By Region: The network security software market is segmented geographically into North America, Europe, Asia-Pacific (APAC), Latin America, and the Middle East and Africa (MEA). In 2023, North America held a dominant market share, largely due to the presence of major network security providers and a high level of cybersecurity awareness. Significant investments by the U.S. government in cybersecurity, coupled with the region's advanced technological infrastructure, have further contributed to North America's leadership position in the market.

Global Network Security Software Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Cisco Systems |

1984 |

San Jose, USA |

|

Palo Alto Networks |

2005 |

Santa Clara, USA |

|

Check Point Software |

1993 |

Tel Aviv, Israel |

|

Fortinet |

2000 |

Sunnyvale, USA |

|

Symantec (Broadcom Inc.) |

1982 |

Mountain View, USA |

- Palo Alto Networks: In November 2022, Palo Alto Networks announced the acquisition of Cider Security, a pioneer in application security (AppSec) and software supply chain security.The deal was valued at approximately $195 million in cash, excluding the value of replacement equity awards.

- Fortinet: In August 2024, Fortinet announced the acquisition of Next DLP, a data security startup focused on insider risk and data protection. The deal aims to enhance Fortinet's Unified SASE platform and improve its position in the standalone enterprise data loss prevention market. Terms of the acquisition were not disclosed, but it follows Fortinet's recent acquisition of Lacework, a cloud-native application protection platform, which was estimated to be valued between $200 million and $230 million.

Global Network Security Software Market Analysis

Global Network Security Software Market Growth Drivers

- Increased Government Spending on Cybersecurity: Governments across major economies, including the United States and the European Union, have significantly increased their cybersecurity budgets to combat rising cyber threats. This influx of government spending is driving the demand for advanced network security software, as organizations are required to comply with stringent security regulations and safeguard national interests.

- Proliferation of IoT Devices and Connected Infrastructure: The global network of Internet of Things (IoT) devices is expected to reach over 50 billion by 2024, according to the International Telecommunication Union (ITU). This rapid expansion has created complex and interconnected networks that are increasingly vulnerable to cyberattacks. As more devices are integrated into business operations, the need for robust network security solutions becomes critical.

- Rising Incidences of Cyberattacks and Data Breaches: In 2023, there were over 5,000 significant data breaches reported globally, affecting millions of individuals and organizations. High-profile cases, such as the ransomware attack on the Colonial Pipeline in the U.S., have highlighted the critical importance of network security. The financial and reputational damage caused by such breaches has compelled organizations to invest heavily in network security software to protect their data and ensure business continuity.

Global Network Security Software Market Challenges

- Complexity of Security Integration Across Multiple Platforms: As businesses adopt a multi-cloud strategy and integrate various third-party applications, the complexity of managing network security across different platforms has increased. This complexity not only increases the risk of vulnerabilities but also raises operational costs, making it a significant challenge for the network security software market.

- High Costs of Advanced Security Solutions: The cost of implementing and maintaining advanced network security solutions remains a significant challenge for small and medium-sized enterprises (SMEs). These high costs can be prohibitive for smaller companies, leading to underinvestment in critical security infrastructure and exposing them to potential cyber threats. This challenge continues to affect the overall adoption rate of network security solutions.

Global Network Security Software Market Government Initiatives

- National Cybersecurity Strategy2023 Launched: TheU.S. governmenthas officiallylaunched itsNational Cybersecurity Strategy, which aims toenhance the protectionof critical infrastructureand bolster nationalcybersecurityresilience. Thisinitiative emphasizesthe importanceof public-private partnershipsto innovate anddevelop advancedsecurity technologies, thereby fosteringgrowth in thecybersecuritysector.

- Indias National Cyber Coordination Centre (NCCC) Expansion: The Indian government has taken significant steps to expand the National Cyber Coordination Centre (NCCC) in response to increasing cyber threats. This expansion is part of a broader strategy to enhance cybersecurity capabilities across critical sectors, driving investments in network security software as organizations align with government directives to strengthen their cybersecurity frameworks.

Global Network Security Software Market Outlook

The global network security software market continues to evolve, several key trends are expected to shape its trajectory leading up to 2028. Driven by the rapid advancement of technologies such as quantum computing, the expansion of 5G networks, and growing concerns over data privacy, the market is poised for significant transformation.

Future Trends:

- Rise of Quantum-Resistant Encryption Technologies: As quantum computing advances, it poses a significant threat to current encryption standards. By 2028, the network security software market is expected to see widespread adoption of quantum-resistant encryption technologies. Governments and corporations are likely to invest heavily in developing and deploying these new encryption methods to protect sensitive data from future quantum attacks. This shift will drive demand for next-generation security solutions capable of withstanding the computing power of quantum machines.

- Growth in Privacy-Enhancing Technologies (PETs): With data privacy concerns on the rise, the market for Privacy-Enhancing Technologies (PETs) is set to grow significantly over the next five years. By 2028, PETs, including advanced encryption, differential privacy, and secure multi-party computation, will become integral components of network security software. These technologies will help organizations comply with stringent data protection regulations and ensure that personal and sensitive data is handled securely, driving the future growth of the network security market.

Scope of the Report

|

By Deployment Type |

Cloud-based On-premises solutions |

|

By Solution Type |

Firewalls Antivirus/anti-malware Intrusion detection systems (IDS) Intrusion prevention systems (IPS) others |

|

By Region |

North America Europe, Asia-Pacific (APAC) Latin America Middle East & Africa (MEA) |

|

By Company Size |

Small and Medium Enterprises (SMEs) Large Enterprises |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (NIST)

IT and Telecommunications Companies

Cloud Service Providers

Healthcare Organizations

Manufacturing Firms

Energy and Utility Companies

Insurance Companies

Investments and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Cisco Systems

Palo Alto Networks

Check Point Software Technologies

Fortinet

Symantec (Broadcom Inc.)

Trend Micro

IBM Corporation

McAfee (part of Intel Security)

Juniper Networks

FireEye, Inc.

Sophos Group plc

F5 Networks

Kaspersky Lab

CrowdStrike Holdings, Inc.

RSA Security LLC

Table of Contents

1. Global Network Security Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Network Security Software Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Network Security Software Market Analysis

3.1. Growth Drivers

3.1.1. Increased Government Spending on Cybersecurity

3.1.2. Proliferation of IoT Devices and Connected Infrastructure

3.1.3. Rising Incidences of Cyberattacks and Data Breaches

3.2. Challenges

3.2.1. Complexity of Security Integration Across Multiple Platforms

3.2.2. Shortage of Skilled Cybersecurity Professionals

3.2.3. High Costs of Advanced Security Solutions

3.3. Government Initiatives

3.3.1. National Cybersecurity Strategy 2023 (USA)

3.3.2. European Union Cybersecurity Act 2024

3.3.3. Indias National Cyber Coordination Centre (NCCC) Expansion

3.4. Recent Trends

3.4.1. Adoption of Zero Trust Security Architecture

3.4.2. Integration of Artificial Intelligence (AI) in Network Security

3.4.3. Growth of Managed Security Service Providers (MSSPs)

4. Global Network Security Software Market Segmentation, 2023

4.1. By Deployment Type (in Value %)

4.1.1. Cloud-Based

4.1.2. On-Premises

4.2. By Solution Type (in Value %)

4.2.1. Firewalls

4.2.2. Antivirus/Anti-Malware

4.2.3. IDS/IPS

4.2.4. Others

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific (APAC)

4.3.4. Latin America

4.3.5. Middle East & Africa (MEA)

4.4. By End-User Industry (in Value %)

4.4.1. BFSI

4.4.2. Healthcare

4.4.3. IT & Telecom

4.4.4. Retail

4.4.5. Government & Defense

4.5. By Organization Size (in Value %)

4.5.1. Large Enterprises

4.5.2. Medium Enterprises

4.5.3. Small Enterprises

4.6. By Service Type (in Value %)

4.6.1. Managed Security Services

4.6.2. Professional Services

4.6.3. Training & Education Services

5. Global Network Security Software Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Cisco Systems

5.1.2. Palo Alto Networks

5.1.3. Check Point Software Technologies

5.1.4. Fortinet

5.1.5. Symantec (Broadcom Inc.)

5.1.6. Trend Micro

5.1.7. IBM Corporation

5.1.8. McAfee (part of Intel Security)

5.1.9. Juniper Networks

5.1.10. FireEye, Inc.

5.1.11. Sophos Group plc

5.1.12. F5 Networks

5.1.13. Kaspersky Lab

5.1.14. CrowdStrike Holdings, Inc.

5.1.15. RSA Security LLC

5.2. Recent Developments

5.2.1. IBMs Launch of Cloud Pak for Security (2023)

5.2.2. Ciscos Acquisition of Kenna Security (2023)

5.2.3. Fortinets Partnership with Google Cloud (2024)

6. Global Network Security Software Market Future Trends (Market Outlook 2028)

6.1. Rise of Quantum-Resistant Encryption Technologies

6.2. Expansion of 5G-Enabled Security Solutions

6.3. Growth in Privacy-Enhancing Technologies (PETs)

7. Global Network Security Software Market Future Market Size (in USD Bn), 2023-2028

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Network Security Software Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

9. Global Network Security Software Market Regulatory Framework

9.1. Environmental Standards

9.2. Compliance Requirements

9.3. Certification Processes

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Global Network Security Software Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global Network Security Software Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Network Security Software and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Network Security Software.

Frequently Asked Questions

01. How big is the Global Network Security Software Market?

The global network security software market was valued at USD 19.53 billion in 2023, driven by the growing need for cybersecurity solutions across various sectors, increasing government spending on cybersecurity, and the proliferation of connected devices.

02. What are the challenges in the Global Network Security Software Market?

Challenges in the global network security software market include the complexity of integrating security solutions across multiple platforms, the shortage of skilled cybersecurity professionals, and the high costs associated with deploying advanced security solutions, particularly for small and medium-sized enterprises.

03. Who are the major players in the Global Network Security Software Market?

Key players in the global network security software market include Cisco Systems, Palo Alto Networks, Check Point Software Technologies, Fortinet, and Symantec (Broadcom Inc.). These companies lead the market due to their extensive product portfolios, strong customer base, and continuous innovation in security technologies.

04. What are the growth drivers of the Global Network Security Software Market?

The global network security software market is propelled by factors such as increased government spending on cybersecurity, the rapid proliferation of IoT devices, and the rising incidences of cyberattacks and data breaches. These drivers are leading organizations to invest heavily in robust network security solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.