Global Next Generation Firewall (NGFW) Market Outlook to 2030

Region:Global

Author(s):Sanjana

Product Code:KROD514

October 2024

81

About the Report

Global Next Generation Firewall (NGFW) Market Overview

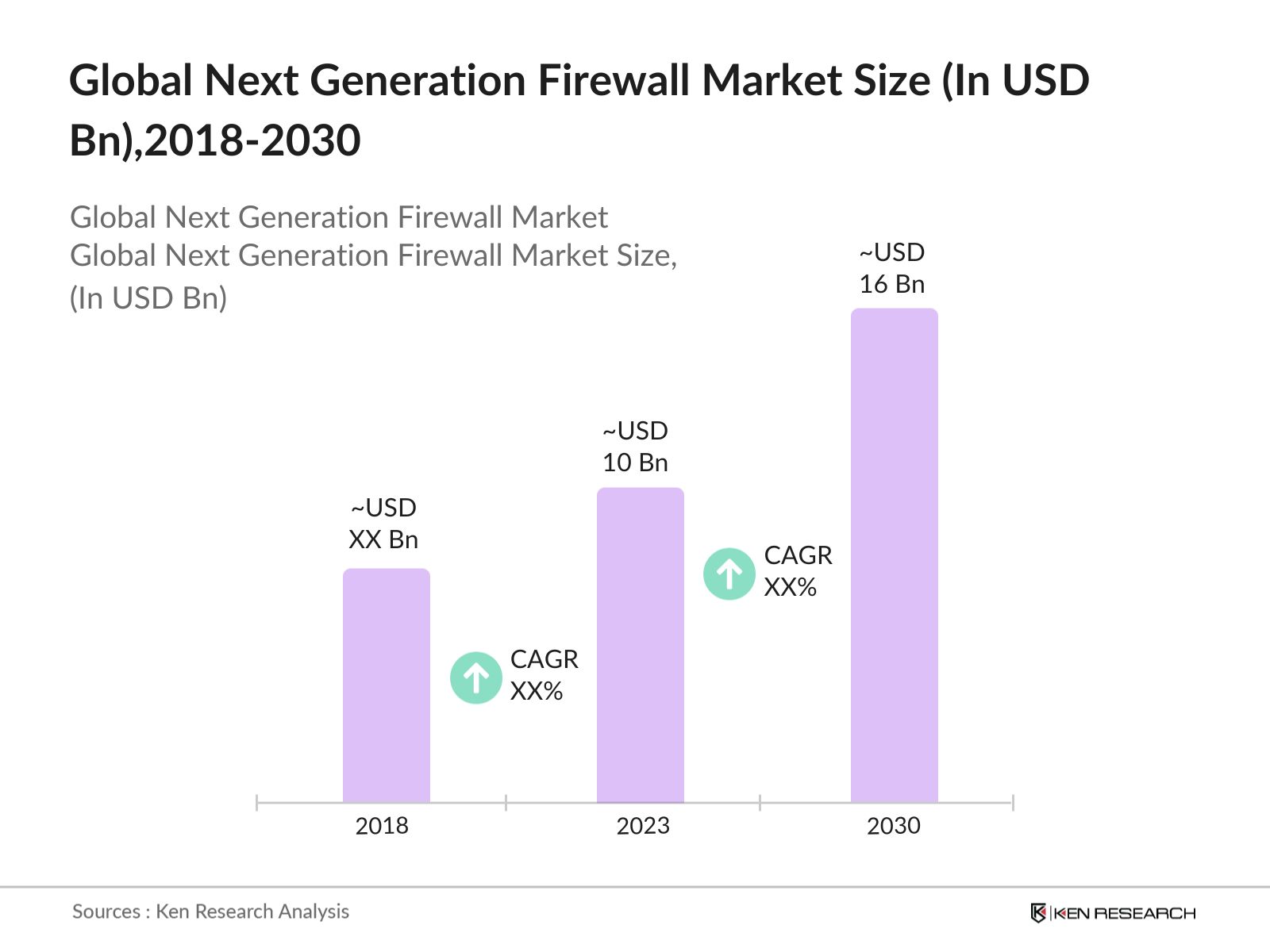

- The Global Next Generation Firewall (NGFW) Market was valued at USD 10 Bn in 2023, driven by the growing demand for advanced security solutions due to increasing cyber threats and data breaches. The rapid adoption of cloud-based services and the proliferation of connected devices have also necessitated robust security measures, thus fueling the demand for NGFWs.

- Major players in the NGFW market include Palo Alto Networks, Fortinet, Cisco Systems, Check Point Software Technologies, and Juniper Networks. These companies have a significant market share due to their strong product portfolios and extensive customer base. Palo Alto Networks, in particular, dominates with its innovative features and extensive global presence.

- Check Point introduced several new products in 2023, including enhancements to its Quantum SD-WAN and the Horizon XDR platform. These innovations aim to provide comprehensive security solutions that integrate connectivity and threat prevention across various environments, reinforcing Check Point's commitment to cybersecurity excellence.

- Major cities like San Francisco, New York, and London dominate the NGFW market due to their concentration of large enterprises and tech startups, which are primary consumers of advanced cybersecurity solutions. San Francisco, being a hub for technology companies, has a high demand for NGFWs to protect against sophisticated cyber threats.

Global Next Generation Firewall (NGFW) Market Segmentation

The Global Next Generation Firewall (NGFW) Market can be segmented based on several factors:

By Deployment Type: The market is segmented by deployment type into On-Premise, Cloud-based & Hybrid. In 2023, On-Premise accounts for the largest value share. This dominance is attributed to the preference of large enterprises and government organizations for maintaining control over their security infrastructure. On-premises NGFWs are favored due to their ability to provide high levels of customization and integration with existing network systems.

By Industry Vertical: The market is segmented by industry verticals into BFSI, Healthcare, IT & Telecom, Retail & Government. In 2023, BFSI dominates the market due to the industry's stringent regulatory requirements and the critical need for protecting sensitive financial data from cyber-attacks. The BFSI sector's ongoing digital transformation and increasing adoption of cloud services further necessitate advanced NGFW solutions to safeguard against potential security breaches.

By Industry Vertical: The market is segmented by industry verticals into BFSI, Healthcare, IT & Telecom, Retail & Government. In 2023, BFSI dominates the market due to the industry's stringent regulatory requirements and the critical need for protecting sensitive financial data from cyber-attacks. The BFSI sector's ongoing digital transformation and increasing adoption of cloud services further necessitate advanced NGFW solutions to safeguard against potential security breaches.

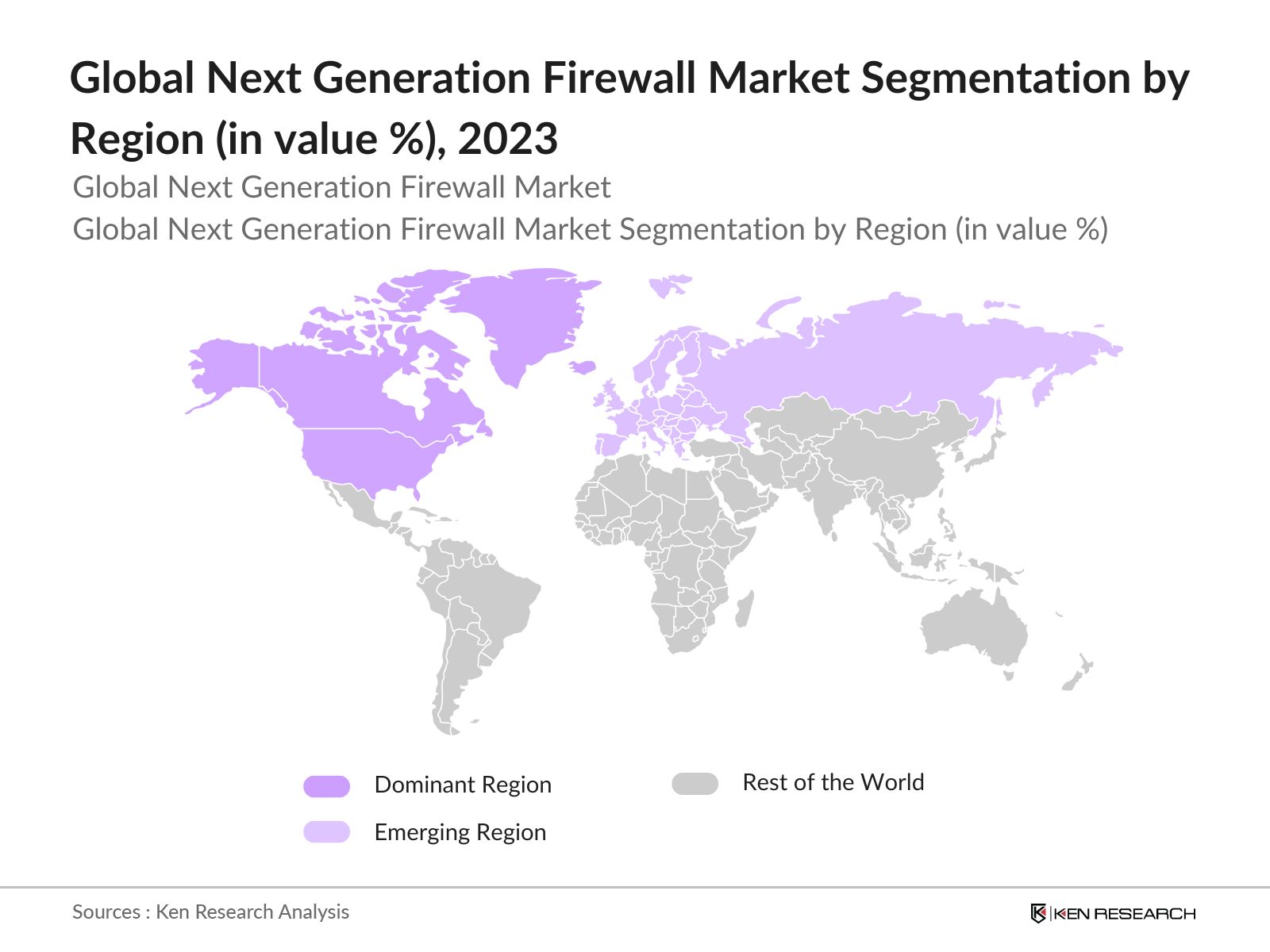

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, LAMEA and Middle East & Africa (MEA). In 2023, North America dominates the Global Next Generation Firewall (NGFW) market due to the presence of key NGFW vendors, a high level of cybersecurity awareness, and significant investments in network security infrastructure. The increasing frequency of cyberattacks on critical infrastructure and enterprises has led to heightened demand for NGFWs in the USA, making it the largest market globally.

Global Next Generation Firewall (NGFW) Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Palo Alto Networks |

2005 |

Santa Clara, USA |

|

Fortinet |

2000 |

Sunnyvale, USA |

|

Cisco Systems |

1984 |

San Jose, USA |

|

Check Point Software |

1993 |

Tel Aviv, Israel |

|

Juniper Networks |

1996 |

Sunnyvale, USA |

- Palo Alto Network: In 2024, Palo Alto Networks introduced new security solutions powered by Precision AI. The company is emphasizing the importance of integrated capabilities to streamline security operations and improve efficiency in response to the growing volume of cyber threats, which includes an average of 2.3 million new threats daily.

- Cisco & Tech Mahindra Partnership: In 2024, Tech Mahindra has expanded its collaboration with Cisco to deliver an AI-powered NGFW modernization solution for their global customers. This initiative enhances traditional firewall capabilities by integrating advanced features such as unified policy management across both on-premises and cloud environments, as well as incorporating Cisco's Talos threat intelligence for comprehensive malware defense.

Global Next Generation Firewall (NGFW) Industry Analysis

Growth Drivers:

- Rising Cybersecurity Threats: The increasing frequency and sophistication of cyber-attacks globally are driving the demand for Next Generation Firewalls (NGFW). In 2023, Internet Crime Complaint Centre received 880,418 complaints with potential losses exceeding $12.5 billion. This surge has led organizations to invest heavily in advanced NGFW solutions to protect sensitive data and ensure compliance with regulatory frameworks.

- Expansion of Cloud-Based Services: Organisations are migrating to cloud environments require advanced firewalls that can offer real-time protection and scalability. AWS alone offers over 200 distinct cloud services, while Azure and GCP provide similar offerings across various models like Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). NGFWs are particularly critical in hybrid cloud environments where traditional firewalls fall short.

- Regulatory Compliance Requirements: Governments worldwide are imposing stringent regulations to protect data and ensure cybersecurity resilience. The European Unions General Data Protection Regulation (GDPR) has imposed heavy fines for data breaches, incentivizing organizations to adopt robust security measures like NGFWs. In 2023 fines related to GDPR violations amounted to 1.2 billion on Meta, pushing them to enhance their security infrastructures.

Challenges:

- Complexity in Integration: Integrating NGFWs into existing IT infrastructure can be a complex process, particularly for organizations with legacy systems. This complexity often necessitates additional investments in IT staff training and system upgrades, further complicating the adoption process and delaying the realization of security benefits.

- Evolving Cyber Threat Landscape: The constantly evolving nature of cyber threats poses a significant challenge to the effectiveness of NGFWs. This rapid evolution of threats requires continuous updates and enhancements to NGFW technologies, putting pressure on vendors to innovate at a fast pace. Failure to keep up with these advancements can render NGFWs ineffective, leading to potential breaches and loss of customer trust.

Government Initiatives:

- European Union Cybersecurity Resilience Act: The European Union introduced the Cybersecurity Resilience Act in 2024, aimed at strengthening the cybersecurity posture of critical infrastructure operators across member states. Security incidents and vulnerabilities must be reported to ENISA, the EU's cybersecurity agency, within 21-36 months. This legislative push is expected to significantly boost the NGFW market in Europe.

- Indias National Cybersecurity Strategy (2021-2024): India's National Cybersecurity Strategy aims to ensure a safe, secure, trusted, resilient, and vibrant cyberspace for the country. India witnessed a 218% increase in ransomware attacks in 2021, making it the 10th most targeted country globally and 2nd in the Asia-Pacific region after Australia. The strategy also includes provisions for training and capacity building to ensure the effective deployment and management of NGFWs, thereby supporting market growth.

Global Next Generation Firewall (NGFW) Future Market Outlook

The market is expected to reach USD 16 Bn by 2030 driven by the increasing demand for advanced cybersecurity solutions in the face of evolving cyber threats. The integration of machine learning and AI into NGFWs will enable organizations to proactively defend against sophisticated attacks, reducing response times and improving overall network security.

Future Market Trends

- AI and Machine Learning Integration: Over the next five years, the integration of AI and machine learning into NGFWs will become a standard feature, enabling firewalls to autonomously detect and respond to emerging threats. These technologies will allow NGFWs to adapt to new attack vectors in real-time, reducing the need for manual intervention and enhancing overall security effectiveness.

- Cloud-Native Security Solutions: As organizations continue to migrate to cloud environments, the demand for cloud-native NGFW solutions will increase. Future NGFWs will be designed to seamlessly integrate with cloud platforms, offering unified security management across hybrid and multi-cloud deployments. This trend will be driven by the need for scalable security solutions that can protect dynamic cloud workloads.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Component |

Solutions Services |

|

By Deployment Type |

On-premise Cloud Hybrid |

|

By Industry |

BFSI Healthcare IT & Telecom Retail Government |

|

By Organization Size |

Large Organization Small & Medium Enterprises (SMEs) |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

CIOs and CTOs of Large Enterprises

Cybersecurity Solution Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Homeland Security, European Union Agency for Cybersecurity)

Telecommunications Companies

Cloud Service Providers

Banking, Financial Services, and Insurance (BFSI) Companies

Healthcare Companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2030

Table of Contents

1. Global Next Generation Firewall (NGFW) Market Overview

1.1 Definition and Scope

1.1. Market Definition

1.2. Market Scope and Boundaries

2. Market Taxonomy

3. Market Growth Rate

3.1. Historical CAGR (2018-2023)

3.2. Projected CAGR (2023-2030)

4. Global Next Generation Firewall (NGFW) Market Size (in USD Bn), 2018-2023

4.1 Historical Market Size

4.2 Year-on-Year Growth Analysis

4.3 Key Market Developments and Milestones

5. Global Next Generation Firewall (NGFW) Market Analysis

5.1 Growth Drivers

5.1.1. Rising Cybersecurity Threats

5.1.2. Regulatory Compliance and Standards

5.1.3. Adoption of Cloud-Based Services

5.2 Restraints

5.2.1. High Implementation Costs

5.2.2. Complexity of Integration with Existing Systems

5.2.3. Evolving Cyber Threats

5.4 Opportunities

5.4.1. Growth in AI and Machine Learning Integration

5.4.2. Increasing Demand for Managed Security Services

5.4.3. Expansion into Emerging Markets

5.5 Trends

5.5.1. Shift towards Zero Trust Architecture

5.5.2. Adoption of Cloud-Native Security Solutions

5.5.3. Integration with IoT and Smart Devices

5.6 Government Regulations

5.6.1 U.S. Cybersecurity Modernization Initiative (2023)

5.2. European Union Cybersecurity Resilience Act (2024)

5.3. National Cybersecurity Policies in Emerging Markets

5.7 SWOT Analysis

5.7.1. Strengths

5.7.2. Weaknesses

5.7.3. Opportunities

5.7.4. Threats

5.8 Stakeholder Ecosystem

5.8.1. Key Stakeholders

5.8.2. Role of Value Chain Participants

5.9 Competition Ecosystem

5.9.1. Competitive Landscape Overview

5.9.2. Market Positioning of Key Players

6. Global Next Generation Firewall (NGFW) Market Segmentation, 2023

6.1 By Deployment Type (in Value %)

6.1.1. On-Premises

6.1.2. Cloud-Based

6.1.3. Hybrid

6.2 By Industry Vertical (in Value %)

6.2.1. BFSI

6.2.2. Healthcare

6.2.3. IT & Telecom

6.2.4. Government

6.2.5. Retail

6.3 By Technology (in Value %)

6.3.1. Deep Packet Inspection (DPI)

6.3.2. Application Control

6.3.3. User Identity Management

6.4 By Region (in Value %)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia-Pacific

6.4.4. Latin America

6.4.5. Middle East & Africa

7. Global Next Generation Firewall (NGFW) Market Cross Comparison

7.1 Detailed Profiles of Major Companies

7.1.1. Palo Alto Networks

7.1.2. Fortinet

7.1.3. Cisco Systems

7.1.4. Check Point Software Technologies

7.1.5. Juniper Networks

7.1.6 Barracuda Networks

7.1.7 SonicWall

7.1.8 Forcepoint

7.1.9 WatchGuard Technologies

7.1.10 Sophos Group

7.1.11 Hillstone Networks

7.1.12 Huawei Technologies Co., Ltd.

7.1.13 Zscaler

7.1.14 AhnLab

7.1.15 Sangfor Technologies

7.2 Cross Comparison Parameters

7.2.1. No. of Employees

7.2.2. Headquarters

7.2.3. Inception Year

7.2.4. Revenue

8. Global Next Generation Firewall (NGFW) Market Competitive Landscape

8.1 Market Share Analysis

8.1.1. Market Share by Key Players

8.1.2. Regional Market Share

8.2 Strategic Initiatives

8.2.1. Product Launches and Innovations

8.2.2. Strategic Partnerships and Collaborations

8.2.3. Geographical Expansions

8.3 Mergers and Acquisitions

8.3.1. Recent M&A Deals

8.3.2. Impact on Market Dynamics

9. Global Next Generation Firewall (NGFW) Market Regulatory Framework

9.1 Cybersecurity Standards and Compliance

9.1.1. National and International Standards

9.1.2. Industry-Specific Compliance Requirements

9.2 Certification Processes

9.2.1. Certification Bodies

9.2.2. Certification Requirements and Procedures

9.3 Impact of Regulatory Changes

9.3.1. Impact on Product Development

9.3.2. Impact on Market Entry and Expansion

10. Global Next Generation Firewall (NGFW) Future Market Size (in USD Bn), 2023-2030

10.1 Future Market Size Projections

10.1.1. Market Size by Year (2023-2028)

10.1.2. Market Size by Key Segments

10.2 Key Factors Driving Future Market Growth

10.2.1. Technological Advancements

10.2.2. Increased Regulatory Focus on Cybersecurity

10.2.3. Growth in Cloud Computing and IoT

11. Global Next Generation Firewall (NGFW) Future Market Segmentation, 2030

11.1 By Deployment Type (in Value %)

11.2 By Industry Vertical (in Value %)

11.3 By Technology (in Value %)

11.4 By Region (in Value %)

12. Global Next Generation Firewall (NGFW) Market Analysts Recommendations

12.1 TAM/SAM/SOM Analysis

12.2 Customer Cohort Analysis

12.3 Marketing Initiatives

12.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on next generation firewall market over the years, penetration of marketplaces and service providers ratio to compute revenue generated next generation firewall market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple next generation firewall companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from next generation firewall companies.

Frequently Asked Questions

01. How big is Global Next Generation Firewall (NGFW) Market?

In 2023, the Global Next Generation Firewall (NGFW) Market was valued at USD 10 Bn driven by the growing demand for advanced security solutions due to increasing cyber threats and data breaches.

02. What are the challenges in Global Next Generation Firewall (NGFW) Market?

Challenges in the Global Next Generation Firewall (NGFW) market include high implementation costs, complexity in integration and evolving cyber threat landscape. Integrating NGFWs into existing IT infrastructure can be a complex process, particularly for organizations with legacy systems.

03. Who are the major players in Global Next Generation Firewall (NGFW) Market?

Major players in the NGFW market include Palo Alto Networks, Fortinet, Cisco Systems, Check Point Software Technologies, and Juniper Networks. These companies have a significant market share due to their strong product portfolios and extensive customer base.

04 What are the growth drivers of the Global Next Generation Firewall (NGFW) Market?

The market is propelled by the rise in cloud computing adoption, cybersecurity threats & strict regulatory requirements. The increasing frequency and sophistication of cyber-attacks globally are driving the demand for Next Generation Firewalls (NGFW).

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.