Global Non-Fungible Tokens Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD8378

December 2024

94

About the Report

Global Non-Fungible Tokens Market Overview

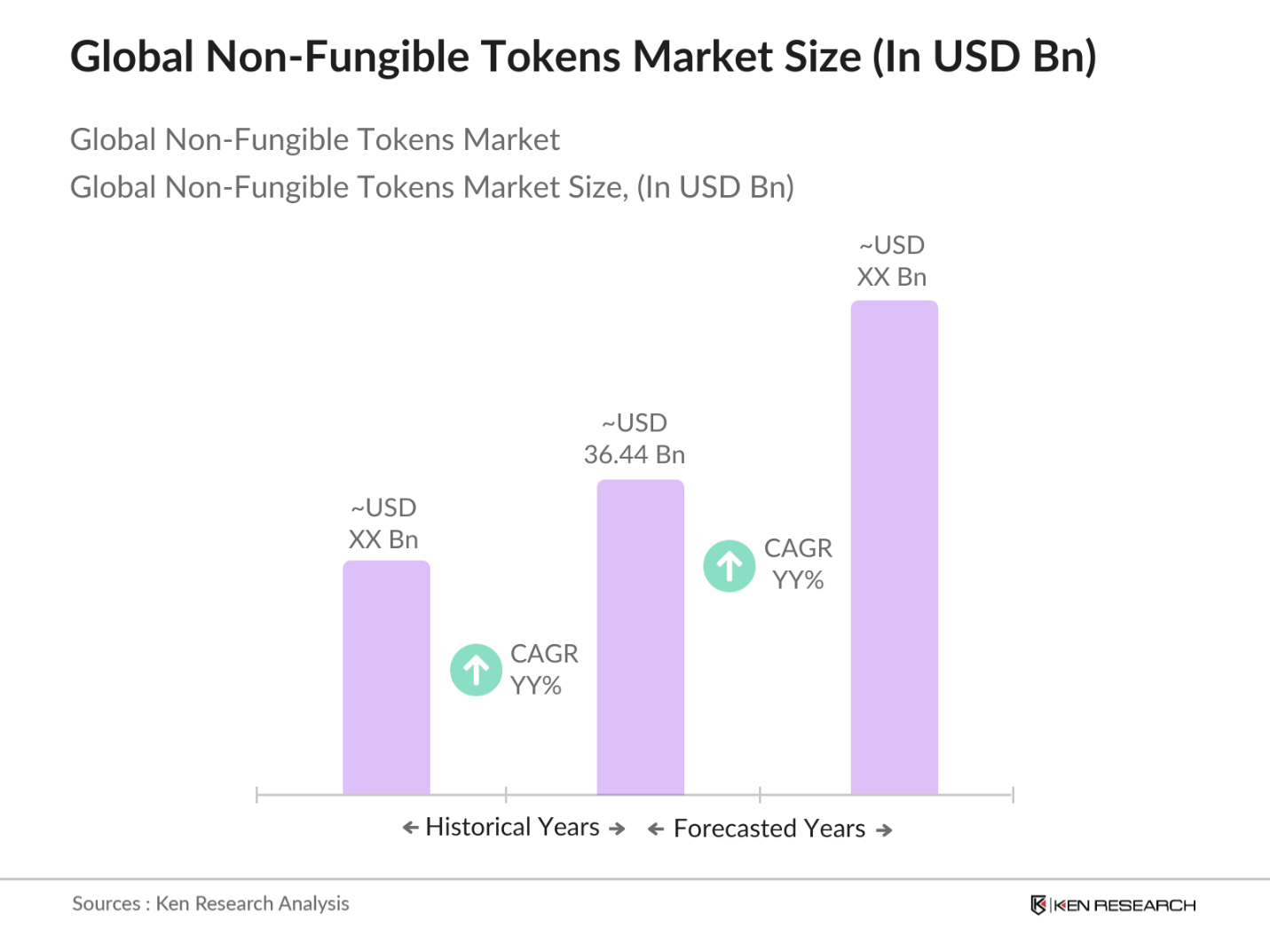

- The global Non-Fungible Tokens (NFT) market is valued at approximately USD 36.44 billion, based on a comprehensive historical analysis. The market is primarily driven by the rising demand for unique digital assets, with artists, gamers, and collectors increasingly investing in NFTs. Furthermore, the growing adoption of blockchain technology across various sectors, coupled with significant investments from institutional players, propels this market forward. This growth trajectory is also supported by a broader understanding of digital ownership and the potential for innovative use cases.

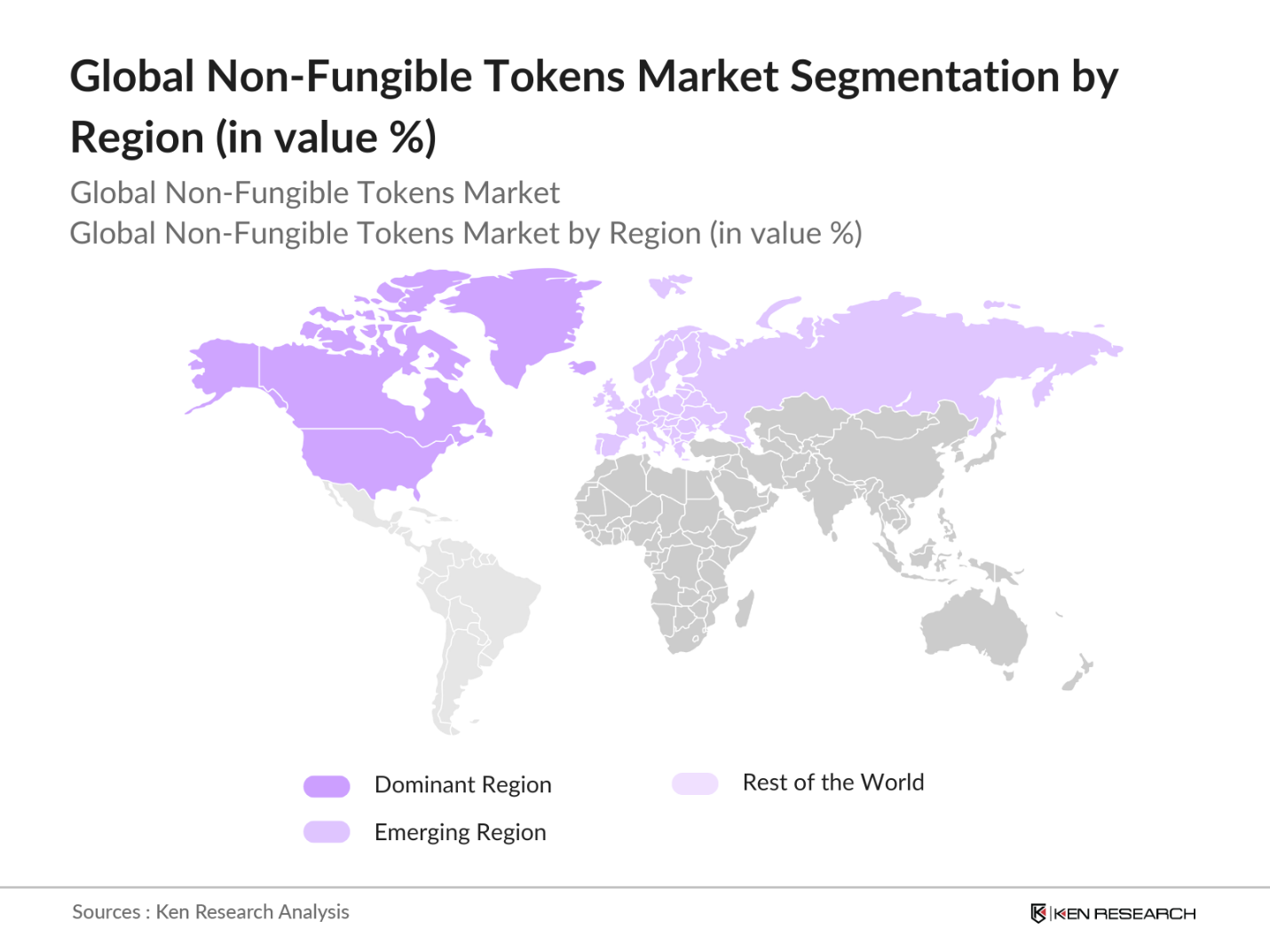

- Leading the NFT market are countries like the United States and the United Kingdom, which are hubs for technology and innovation. The dominance of these nations is attributed to their well-established digital infrastructure, the presence of prominent NFT platforms, and a vibrant creative community that fosters artistic expression. Additionally, regions such as Asia, particularly China and Japan, are emerging as key players due to their significant investments in blockchain technology and a growing base of digital artists and collectors.

- As of 2024, several countries, including the US, Japan, and Switzerland, have introduced frameworks to regulate NFTs and digital assets. According to a 2023 IMF report, these regulations aim to prevent money laundering and ensure transparency in transactions, protecting both creators and consumers. The emergence of these regulations is likely to reduce legal uncertainties and foster broader adoption of NFTs in regulated markets.

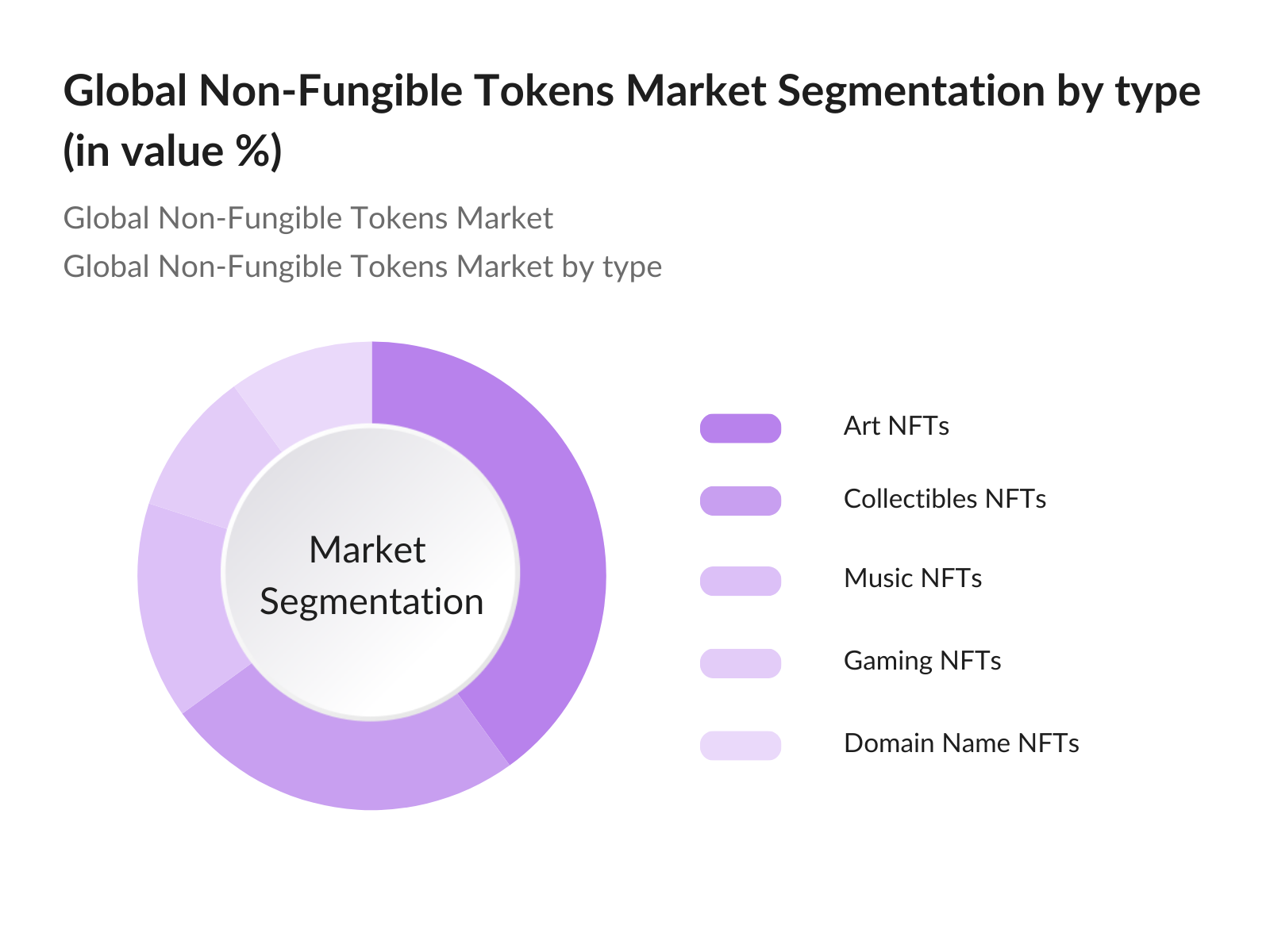

Global Non-Fungible Tokens Market Segmentation

By Type: The global Non-Fungible Tokens market is segmented by type into art NFTs, collectibles NFTs, music NFTs, gaming NFTs, and domain name NFTs. Among these, art NFTs dominate the market due to their significant appeal among collectors and investors. This segment has gained traction as artists leverage NFT platforms to tokenize their artwork, creating unique digital representations that can be bought and sold. The increasing popularity of virtual galleries and online auctions further enhances the demand for art NFTs, establishing them as a central component of the NFT ecosystem.

By Region: The global Non-Fungible Tokens market is segmented by region into North America, Europe, Asia Pacific, and Latin America. North America holds a substantial share of the market, driven by the presence of major NFT platforms and a vibrant tech ecosystem. The region's strong emphasis on innovation and digital entrepreneurship contributes to its leadership in the NFT space. Moreover, the cultural acceptance of digital art and collectibles has fostered a burgeoning market for NFTs, making North America a key player in the global landscape.

Global Non-Fungible Tokens Market Competitive Landscape

The global Non-Fungible Tokens market is characterized by a competitive landscape dominated by a few key players, including OpenSea, Rarible, Foundation, Nifty Gateway, and NBA Top Shot. These companies have established themselves through innovative platforms that facilitate the buying, selling, and trading of NFTs. Their strong brand presence and user-friendly interfaces attract a large base of creators and collectors, enhancing their market positioning.

|

Major Players |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Blockchain Used |

Key Offerings |

Partnerships |

|

OpenSea |

2017 |

New York, USA |

100+ |

||||

|

Rarible |

2020 |

San Francisco, USA |

50+ |

||||

|

Foundation |

2020 |

San Francisco, USA |

30+ |

||||

|

Nifty Gateway |

2018 |

Boston, USA |

40+ |

||||

|

NBA Top Shot |

2020 |

Vancouver, Canada |

60+ |

Global Non-Fungible Tokens Market Analysis

Market Growth Drivers

- Rise in Digital Ownership: Digital ownership has surged globally, with blockchain technology enabling the secure transfer of NFTs. In 2023, the global digital economys value was reported at over USD 4.2 trillion, with emerging markets like the US, South Korea, and Japan leading the adoption of digital assets like NFTs. The rapid expansion of blockchain-based platforms supports this trend, as data from the IMF confirms that blockchain-based digital assets have become increasingly integral to financial ecosystems. This rise is facilitated by growing interest in decentralized ownership and the increased value attributed to unique digital tokens.

- Increased Investment from Institutional Players: Institutional investors are increasingly viewing NFTs as a valuable addition to their portfolios, with significant capital inflows. In 2023, investments in blockchain-related assets, including NFTs, reached USD 95 billion. Financial institutions like hedge funds and venture capitalists are recognizing the long-term value in NFTs and decentralized platforms. driven by innovation in blockchain and smart contracts.

- Expansion of the Metaverse: The integration of NFTs within the metaverse is gaining traction as companies like Meta (Facebook) and Roblox increasingly embrace these digital assets. According to the IMF, the global value of the metaverse market is currently estimated at USD 1.6 trillion, with NFTs playing a crucial role in enabling ownership and transactions of digital goods. The intersection between NFTs and the metaverse is likely to foster increased demand for digital collectibles, real estate, and avatars as users seek personalized digital experiences.

Market Challenges:

- Regulatory Uncertainties: Regulatory frameworks for NFTs are still evolving globally, leading to uncertainties for market participants. As of 2024, only 22 countries have developed regulations that address digital assets like NFTs, creating operational risks for NFT platforms and investors. A 2023 World Bank report highlights that while blockchain regulations are becoming more widespread, inconsistent regulatory environments hinder cross-border transactions and the broader adoption of NFTs.

- Environmental Concerns of Blockchain Technology: The energy consumption of blockchain networks, especially those supporting NFTs, remains a significant environmental challenge. Data from the World Bank shows that Ethereum, one of the largest blockchain networks for NFTs, consumed approximately 70 terawatt-hours (TWh) of energy in 2022. With growing global focus on sustainability, the environmental impact of blockchain operations is under scrutiny, driving discussions around adopting more energy-efficient consensus mechanisms.

Global Non-Fungible Tokens Market Future Outlook

Over the next five years, the global Non-Fungible Tokens market is expected to show significant growth driven by the continuous expansion of digital asset ownership, advancements in blockchain technology, and increasing consumer demand for unique and verified digital items. The convergence of the metaverse and NFTs is poised to create new opportunities for creators and brands alike, leading to further innovations in the NFT landscape. Furthermore, as more sectors recognize the potential of NFTs, from gaming to real estate, the market is set to diversify and expand.

Market Opportunities:

- Partnerships with Artists and Creators: Partnerships between NFT platforms and established artists or content creators are opening new revenue streams. In 2023, over 12,000 artists globally launched NFT collections, generating millions in sales. According to the World Bank, such partnerships foster direct relationships between creators and consumers, eliminating intermediaries and boosting revenue for artists. Blockchains transparent ledger ensures creators receive royalties with each secondary sale, enhancing long-term income potential.

- Expansion into New Industries (Gaming, Art, Music): NFTs are expanding into industries beyond art, including gaming, music, and sports. In 2023, the global gaming industry, valued at USD 267 billion, has seen significant NFT integration, with in-game assets tokenized and traded across decentralized platforms. The rise of "play-to-earn" games has transformed gaming economies, as noted by the IMF, indicating a growing intersection between blockchain technologies and various entertainment sectors.

Scope of the Report

|

By Type |

Art NFTs Collectibles NFTs Music NFTs Gaming NFTs Domain Names NFTs |

|

By Blockchain Technology |

Ethereum Binance Smart Chain Flow Tezos |

|

By End User |

Individual Artists and Creators Corporations and Brands Gamers |

|

By Payment Method |

Cryptocurrency Fiat Currency |

|

By Region |

North America Europe Asia Pacific Latin America |

Products

Key Target Audience

Digital Artists

Gamers

Collectors

Corporations and Brands

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., SEC, CFTC)

Creative Agencies

Blockchain Developers

Companies

Players Mention in the Report

OpenSea

Rarible

Foundation

Nifty Gateway

NBA Top Shot

Axie Infinity

Sorare

Cryptokitties

Decentraland

Enjin

VIV3

Zora

Mintable

Bakkt

Immutable X

Table of Contents

1. Global Non-Fungible Tokens Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Non-Fungible Tokens Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Non-Fungible Tokens Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Digital Ownership

3.1.2. Increased Investment from Institutional Players

3.1.3. Expansion of the Metaverse

3.1.4. Consumer Demand for Unique Digital Assets

3.2. Market Challenges

3.2.1. Regulatory Uncertainties

3.2.2. Environmental Concerns of Blockchain Technology

3.2.3. Market Volatility

3.3. Opportunities

3.3.1. Partnerships with Artists and Creators

3.3.2. Expansion into New Industries (Gaming, Art, Music)

3.3.3. Innovations in Blockchain Technology

3.4. Trends

3.4.1. Gamification of NFTs

3.4.2. Rise of Fractionalized Ownership

3.4.3. Integration with Augmented Reality (AR)

3.5. Regulatory Landscape

3.5.1. Emerging Global Regulations

3.5.2. Standards for NFT Platforms

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Non-Fungible Tokens Market Segmentation

4.1. By Type (In Value %)

4.1.1. Art NFTs

4.1.2. Collectibles NFTs

4.1.3. Music NFTs

4.1.4. Gaming NFTs

4.1.5. Domain Names NFTs

4.2. By Blockchain Technology (In Value %)

4.2.1. Ethereum

4.2.2. Binance Smart Chain

4.2.3. Flow

4.2.4. Tezos

4.3. By End User (In Value %)

4.3.1. Individual Artists and Creators

4.3.2. Corporations and Brands

4.3.3. Gamers

4.4. By Region (In Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Latin America

4.5. By Payment Method (In Value %)

4.5.1. Cryptocurrency

4.5.2. Fiat Currency

5. Global Non-Fungible Tokens Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. OpenSea

5.1.2. Rarible

5.1.3. Foundation

5.1.4. SuperRare

5.1.5. Nifty Gateway

5.1.6. NBA Top Shot

5.1.7. Decentraland

5.1.8. Cryptokitties

5.1.9. Axie Infinity

5.1.10. Sorare

5.1.11. Enjin

5.1.12. Zora

5.1.13. VIV3

5.1.14. Mintable

5.1.15. Bakkt

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Major Partnerships, Recent Innovations, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Non-Fungible Tokens Market Regulatory Framework

6.1. Compliance Requirements

6.2. Intellectual Property Rights

6.3. Tax Implications for NFT Transactions

7. Global Non-Fungible Tokens Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Non-Fungible Tokens Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Blockchain Technology (In Value %)

8.3. By End User (In Value %)

8.4. By Region (In Value %)

8.5. By Payment Method (In Value %)

9. Global Non-Fungible Tokens Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global Non-Fungible Tokens market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the global Non-Fungible Tokens market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple NFT platforms to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the global Non-Fungible Tokens market.

Frequently Asked Questions

01. How big is the global Non-Fungible Tokens market?

The global Non-Fungible Tokens market is valued at USD 36.44 billion, driven by increasing demand for unique digital assets and significant investments from institutional players.

02. What are the challenges in the global Non-Fungible Tokens market?

Challenges include regulatory uncertainties, environmental concerns surrounding blockchain technology, and market volatility, which can hinder widespread adoption and investment.

03. Who are the major players in the global Non-Fungible Tokens market?

Key players in the market include OpenSea, Rarible, Foundation, and NBA Top Shot, which dominate due to their innovative platforms and strong brand presence.

04. What are the growth drivers of the global Non-Fungible Tokens market?

The market is propelled by factors such as the rise of digital ownership, advancements in blockchain technology, and the increasing acceptance of NFTs across various industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.