Global Non-Lethal Weapons Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5733

December 2024

86

About the Report

Global Non-Lethal Weapons Market Overview

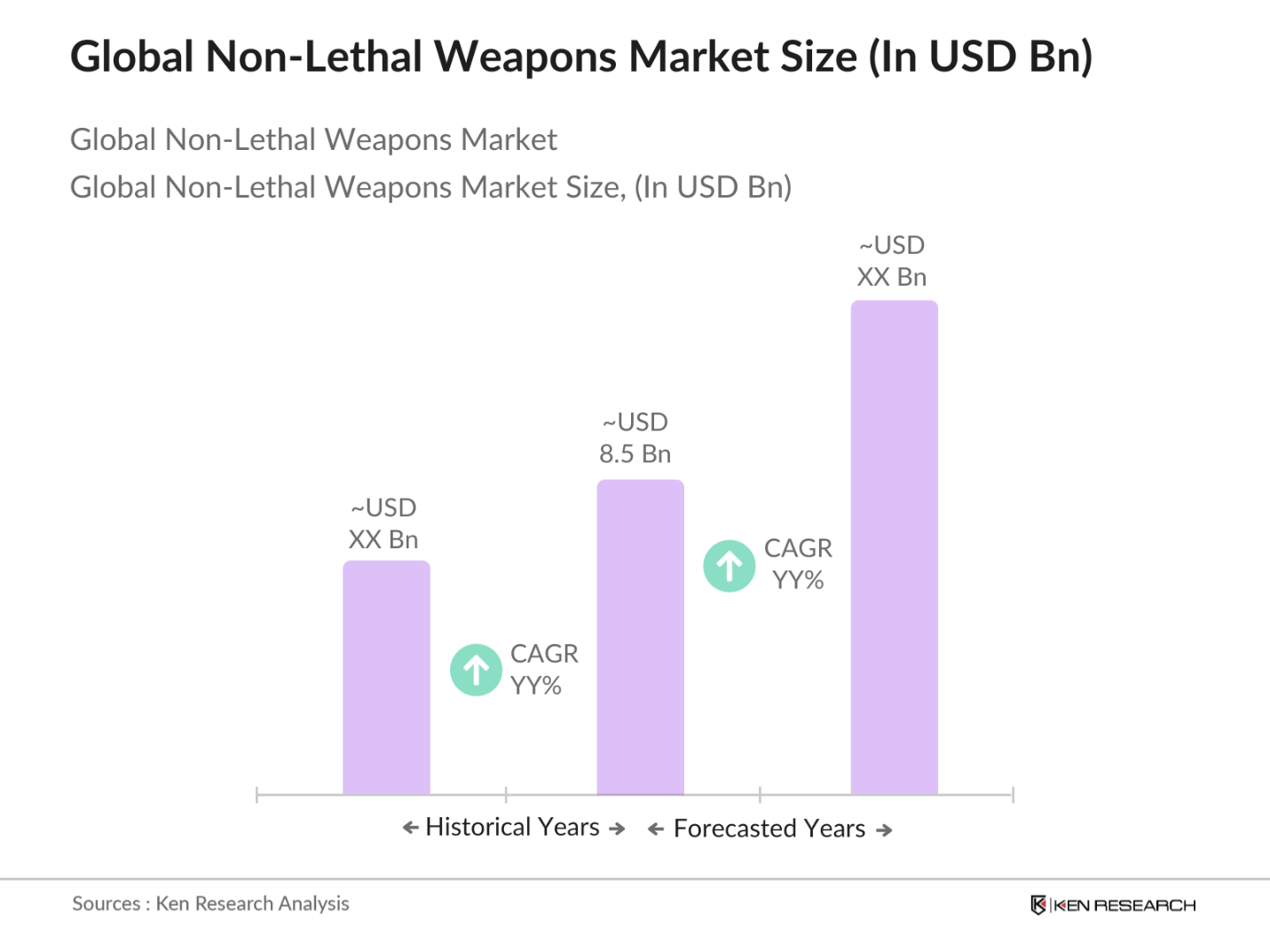

- The global non-lethal weapons market is currently valued at USD 8.5 billion, with significant growth being driven by the increased use of such technologies in law enforcement and military sectors. The market is expanding due to rising demand for crowd control mechanisms and less-lethal solutions, as well as heightened awareness about public safety in conflict zones. Government initiatives to minimize civilian casualties while maintaining public order are further propelling this market forward.

- Cities such as Washington, D.C., and countries like the United States and Germany dominate the market due to their high defense budgets and technological advancements. The U.S., in particular, has invested heavily in research and development of non-lethal weapons for crowd control and urban warfare, making it a leading region in the market. Germanys dominance stems from its focus on security technology and its central role in NATO operations.

- The U.S. Department of Defense (DoD) has been heavily investing in the Non-Lethal Weapons Program (NLWP) to enhance the development and deployment of non-lethal technologies. In 2023, the U.S. government allocated over $2.4 billion towards this program to increase the usage of non-lethal weapons in both military and civilian operations. This initiative focuses on equipping the armed forces with advanced non-lethal solutions for crowd control, peacekeeping missions, and disaster relief operations, ensuring minimal casualties while maintaining security. The program's goal is to provide more humane options while adhering to international laws on human rights.

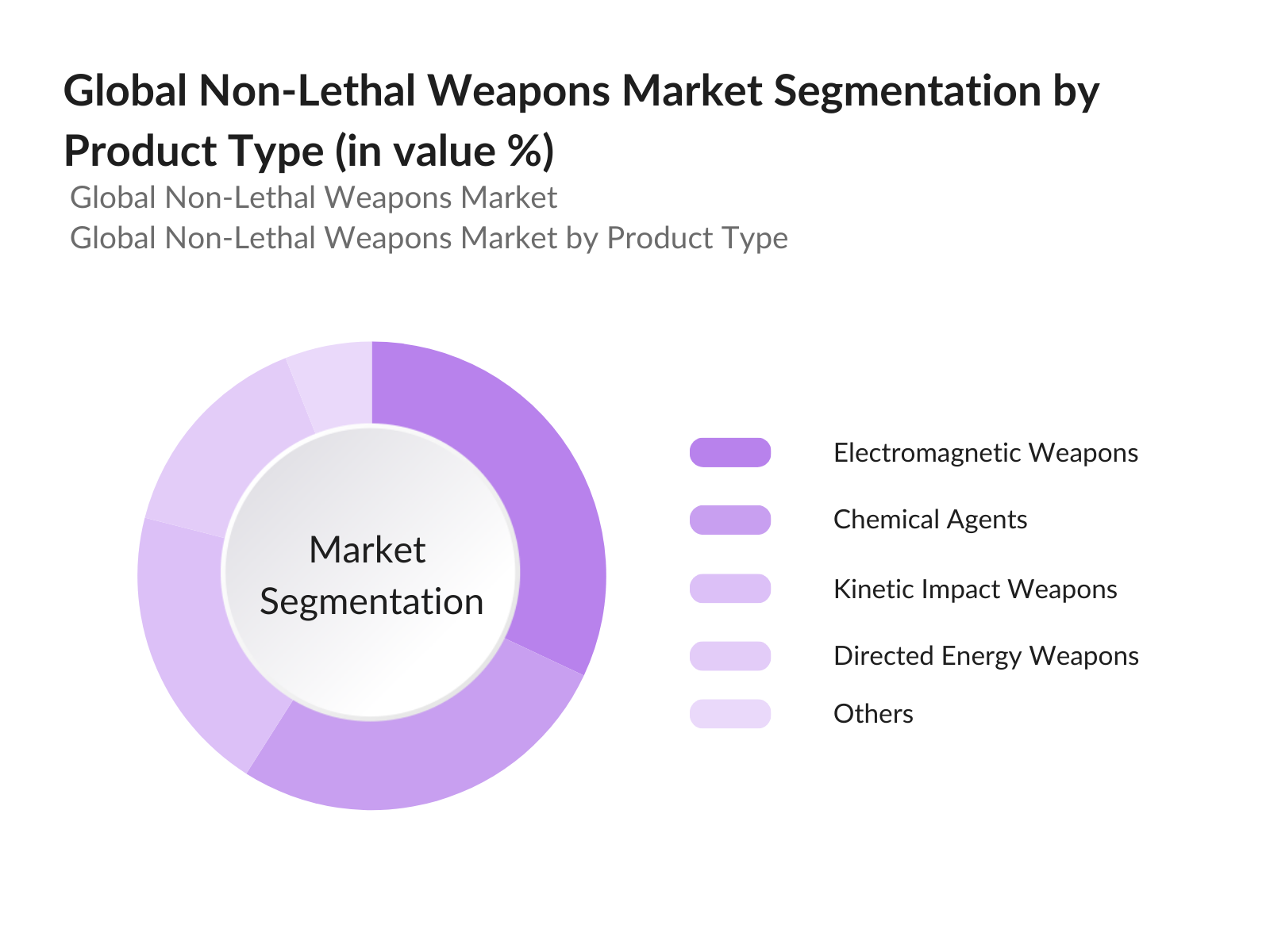

Global Non-Lethal Weapons Market Segmentation

By Product Type: The non-lethal weapons market is segmented by product type into electromagnetic weapons, chemical agents, kinetic impact weapons, directed energy weapons, and others. Recently, electromagnetic weapons have gained dominance due to their versatility in neutralizing threats without causing fatalities. These weapons, such as EMP-based solutions, are preferred for crowd control and law enforcement operations because they disable targets effectively without lasting damage.

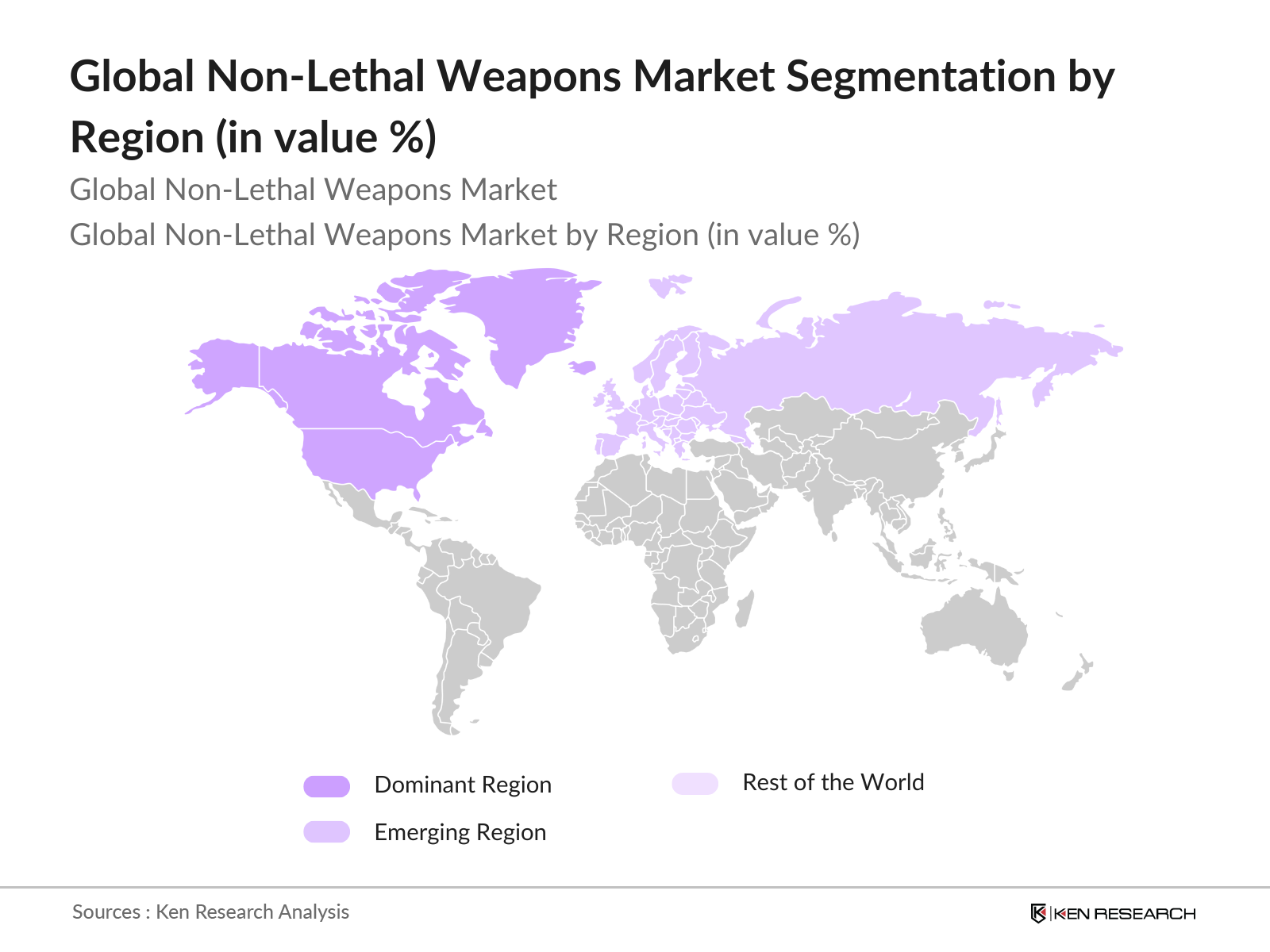

By Region: The non-lethal weapons market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America dominates the market due to its robust defense industry and high defense budget allocation for non-lethal solutions. This region is a leader in non-lethal technology innovation and production, largely because of strong R&D activities and the strategic importance of minimizing casualties in conflict areas.

Global Non-Lethal Weapons Market Competitive Landscape

The global non-lethal weapons market is dominated by a few key players, with significant market influence due to their technological innovations and strategic partnerships. Companies such as Raytheon, BAE Systems, and Axon Enterprise hold prominent positions due to their robust product portfolios and their focus on developing non-lethal solutions that meet military and law enforcement needs globally.

|

Company |

Establishment Year |

Headquarters |

Employees |

Revenue |

Key Product Segment |

Market Reach |

R&D Investment |

Partnerships |

|

Raytheon Company |

1922 |

Waltham, USA |

- |

- |

- |

- |

- |

- |

|

BAE Systems |

1999 |

London, UK |

- |

- |

- |

- |

- |

- |

|

Axon Enterprise, Inc. |

1993 |

Scottsdale, USA |

- |

- |

- |

- |

- |

- |

|

Safariland, LLC |

1964 |

Jacksonville, USA |

- |

- |

- |

- |

- |

- |

|

Rheinmetall AG |

1889 |

Dsseldorf, Germany |

- |

- |

- |

- |

- |

- |

Global Non-Lethal Weapons Market Analysis

Market Growth Analysis

- Increased Use in Law Enforcement: The growing use of non-lethal weapons by law enforcement agencies has been driven by increasing civil unrest globally. In the U.S., there have been over 11,000 instances of protests in 2023 alone, with many of them requiring crowd control interventions. The availability of non-lethal options like rubber bullets and tasers has increased to meet the demand, especially in countries like India, where over 1.4 million police officers are trained annually for crowd management. These tools provide authorities with safer alternatives, mitigating injuries while maintaining order, making non-lethal solutions an essential component of modern policing.

- Rising Focus on Crowd Control: As urban populations continue to grow, the risk of large-scale protests and public disturbances has also increased. The demand for crowd control measures has surged, with nations like Brazil and South Africa recording over 5,000 and 3,000 protests respectively in 2023. Non-lethal weapons are increasingly favored to maintain public safety, aligning with human rights guidelines that discourage excessive force. The growing urbanization trend ensures continuous reliance on non-lethal options, supported by rising government budgets for law enforcement globally.

- Demand from Military and Defense Sectors: Militaries across the world, including the United States, with a defense budget of over $800 billion in 2023, are investing in non-lethal weapons to ensure minimal casualties during peacekeeping operations. Additionally, the EU allocated more than 5 billion for peacekeeping efforts, with significant portions dedicated to non-lethal technology. These tools offer military forces flexible options in conflict zones, enabling strategic responses while avoiding the international scrutiny associated with lethal force. The growing military reliance on such systems, especially for controlling insurgencies, ensures a sustained demand for non-lethal solutions.

Market Challenges:

- Ethical Concerns and Public Backlash: Despite the growing adoption of non-lethal weapons, there are ethical concerns over their misuse. In 2023, Amnesty International recorded over 1,500 cases of misuse globally, leading to severe injuries, particularly in nations like Venezuela and Hong Kong. Public backlash against the use of these tools has led to lawsuits and demands for better oversight, with over 200 complaints filed in the U.S. alone. Ensuring compliance with international human rights standards remains a major hurdle, as the risk of misuse tarnishes the reputation of non-lethal solutions.

- High R&D Costs: The development of non-lethal weapons involves significant research and development expenditures. For instance, in 2023, global R&D spending for military and law enforcement equipment reached $40 billion, with non-lethal technologies accounting for nearly $3 billion of this. Countries like Israel and the U.S. are leading in R&D investments, but smaller nations find it challenging to allocate similar funds. This creates a financial barrier to entry for many manufacturers, slowing the global expansion of non-lethal weapon technologies.

Global Non-Lethal Weapons Market Future Outlook

Over the next five years, the global non-lethal weapons market is expected to experience steady growth, driven by continuous technological advancements and increasing government support for non-lethal security solutions. The demand for less-lethal systems for both law enforcement and defense applications will propel the market forward. Emerging trends such as the integration of AI and smart technologies into non-lethal weaponry are expected to further enhance the market's capabilities.

Market Opportunities:

- Adoption of Laser-Based and Directed Energy Solutions: Laser-based and directed energy non-lethal solutions are gaining prominence due to their precision and reduced risk of injury. In 2022, the U.S. military allocated over $500 million to develop laser-based non-lethal technologies, while European nations invested heavily in similar innovations for riot control. These technologies are particularly useful in minimizing physical contact during protests, with reports from Canada and Israel indicating successful trials of directed energy solutions. As more countries adopt these advanced systems, they are expected to become a standard tool in non-lethal arsenals.

- Rise of Portable and Wearable Non-Lethal Solutions: The rise of portable and wearable non-lethal devices is making these technologies more accessible. In 2023, law enforcement agencies in Japan deployed over 10,000 wearable non-lethal units, providing officers with lightweight, easily accessible tools for de-escalation. Similarly, the U.K. distributed over 8,000 portable non-lethal weapons to its officers, allowing for quick deployment in urban environments. These developments reflect a shift toward user-friendly, easily deployable technologies in crowded or high-tension situations.

Scope of the Report

|

By Product Type |

Electromagnetic Weapons Chemical Agents Kinetic Impact Weapons Directed Energy Weapons Others |

|

By Application |

Military and Defense Law Enforcement Civilian Security Private Security Firms |

|

By Technology |

Electroshock Impact Technology Chemical-based Acoustic Technology |

|

By Range |

Short Range Medium Range Long Range |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Military and Defense Organizations

Law Enforcement Agencies (Department of Homeland Security, Europol)

Private Security Firms

Civilian Security Agencies

Government and Regulatory Bodies (United Nations, NATO)

Technology Innovators and Developers

Investment and Venture Capitalist Firms

Public Safety and Riot Control Suppliers

Companies

Players Mention in the Report

Raytheon Company

BAE Systems

Axon Enterprise, Inc.

Safariland, LLC

Rheinmetall AG

Leonardo S.p.A

TASER International

The Boeing Company

General Dynamics Corporation

Heckler & Koch GmbH

FN Herstal

Lamperd Less Lethal, Inc.

Combined Systems, Inc.

NonLethal Technologies, Inc.

United Tactical Systems

Table of Contents

01. Global Non-Lethal Weapons Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Non-Lethal Weapons Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Non-Lethal Weapons Market Analysis

3.1. Growth Drivers

3.1.1. Increased Use in Law Enforcement

3.1.2. Rising Focus on Crowd Control

3.1.3. Demand from Military and Defense Sectors

3.1.4. Growing Public Pressure for Non-Lethal Solutions

3.2. Market Challenges

3.2.1. Ethical Concerns and Public Backlash

3.2.2. Technological Limitations in Non-Lethal Weapon Efficiency

3.2.3. High R&D Costs

3.3. Opportunities

3.3.1. Advancements in Smart Non-Lethal Technologies

3.3.2. Increasing Adoption by Civilian Agencies

3.3.3. Strategic Partnerships Between Private and Government Entities

3.4. Trends

3.4.1. Integration of AI and IoT in Non-Lethal Systems

3.4.2. Adoption of Laser-Based and Directed Energy Solutions

3.4.3. Rise of Portable and Wearable Non-Lethal Solutions

3.5. Government Regulations

3.5.1. International Human Rights Guidelines

3.5.2. Arms Control Laws and Treaties

3.5.3. National Security and Law Enforcement Directives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Government Agencies, Distributors)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

04. Global Non-Lethal Weapons Market Segmentation

4.1. By Product Type (In Value %) [Type of Non-Lethal Weapons]

4.1.1. Electromagnetic Weapons

4.1.2. Chemical Agents (Tear Gas, Pepper Spray)

4.1.3. Kinetic Impact Weapons (Rubber Bullets, Bean Bags)

4.1.4. Directed Energy Weapons

4.1.5. Others (Acoustic Weapons, Dazzlers)

4.2. By Application (In Value %) [End-Use Applications]

4.2.1. Military and Defense

4.2.2. Law Enforcement

4.2.3. Civilian Security

4.2.4. Private Security Firms

4.3. By Technology (In Value %) [Technology Type]

4.3.1. Electroshock

4.3.2. Impact Technology

4.3.3. Chemical-based

4.3.4. Acoustic Technology

4.4. By Range (In Value %) [Range of Weapons]

4.4.1. Short Range

4.4.2. Medium Range

4.4.3. Long Range

4.5. By Region (In Value %) [Geographical Segmentation]

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global Non-Lethal Weapons Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Raytheon Company

5.1.2. BAE Systems

5.1.3. Rheinmetall AG

5.1.4. Axon Enterprise, Inc.

5.1.5. Safariland, LLC

5.1.6. General Dynamics Corporation

5.1.7. The Boeing Company

5.1.8. Leonardo S.p.A

5.1.9. TASER International

5.1.10. Heckler & Koch GmbH

5.1.11. FN Herstal

5.1.12. Combined Systems, Inc.

5.1.13. Lamperd Less Lethal, Inc.

5.1.14. United Tactical Systems

5.1.15. NonLethal Technologies, Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Innovation, Strategic Partnerships, Patents Filed, Geographical Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global Non-Lethal Weapons Market Regulatory Framework

6.1. International Human Rights Guidelines

6.2. Arms Control and Disarmament Treaties

6.3. National Security Regulations and Compliance

07. Global Non-Lethal Weapons Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Non-Lethal Weapons Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Range (In Value %)

8.5. By Region (In Value %)

09. Global Non-Lethal Weapons Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the first phase, an ecosystem map is constructed that identifies all major stakeholders in the global non-lethal weapons market. Desk research and secondary data sources are used to gather information on market dynamics and the critical variables that impact this market.

Step 2: Market Analysis and Construction

In this step, historical market data is compiled and analyzed. This includes penetration levels of non-lethal technologies in defense and law enforcement sectors. Statistical evaluations and revenue data are assessed to construct a reliable market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed from initial research are validated through interviews with key industry experts. These consultations provide deeper insights into market trends, emerging technologies, and operational challenges faced by stakeholders.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the research findings into a coherent market report. Primary data from manufacturers and secondary data from trusted industry sources are combined to ensure accuracy and completeness of the analysis.

Frequently Asked Questions

01. How big is the Global Non-Lethal Weapons Market?

The global non-lethal weapons market is valued at USD 8.5 billion, driven by demand from military, law enforcement, and civilian sectors seeking effective solutions for crowd control and security operations.

02. What are the challenges in the Global Non-Lethal Weapons Market?

Key challenges include ethical concerns over the use of non-lethal force, technological limitations, and high research and development costs, which hinder the widespread adoption of non-lethal weapons.

03. Who are the major players in the Global Non-Lethal Weapons Market?

Major players include Raytheon Company, BAE Systems, Axon Enterprise, Safariland LLC, and Rheinmetall AG, all of which have a strong market presence due to their advanced non-lethal solutions.

04. What are the growth drivers of the Global Non-Lethal Weapons Market?

Growth is driven by the increasing need for crowd control in urban settings, military peacekeeping missions, and the development of advanced technologies like electromagnetic and directed energy weapons.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.