Global NSAIDs Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD4178

December 2024

91

About the Report

Global NSAIDs Market Outlook 2028

Global NSAIDs Market Overview

- The USA Volumetric Display market is valued at USD 21.7 billion, based on a five-year historical analysis. This market is primarily driven by advancements in augmented reality (AR) and virtual reality (VR) technologies, along with the increasing demand for enhanced 3D visualization in industries such as healthcare, defense, and entertainment. With the growing focus on interactive display technologies, volumetric displays are becoming a key solution for real-time data visualization and immersive experiences, especially in sectors like medical imaging and automotive design.

- Countries like the United States, Germany, and Japan dominate the NSAIDs market. These countries have well-established healthcare systems and high levels of consumer awareness regarding pain management products. Additionally, the robust pharmaceutical infrastructure in these regions ensures a steady supply of high-quality NSAIDs, supported by strong research and development activities from pharmaceutical giants. The dominance of these regions can be attributed to their extensive use of both prescription and non-prescription NSAIDs, coupled with favorable reimbursement policies that make NSAID treatment accessible to larger populations.

- In 2023, the United States expanded its Prescription Drug Monitoring Programs (PDMPs) to include NSAIDs, primarily focusing on preventing misuse and over-prescription. These monitoring programs now require healthcare providers to report the dispensing of prescription NSAIDs in an effort to track potential misuse. This initiative, in conjunction with stricter regulations on opioid prescriptions, has elevated NSAIDs as a safer alternative for chronic pain management.

Global NSAIDs Market Segmentation

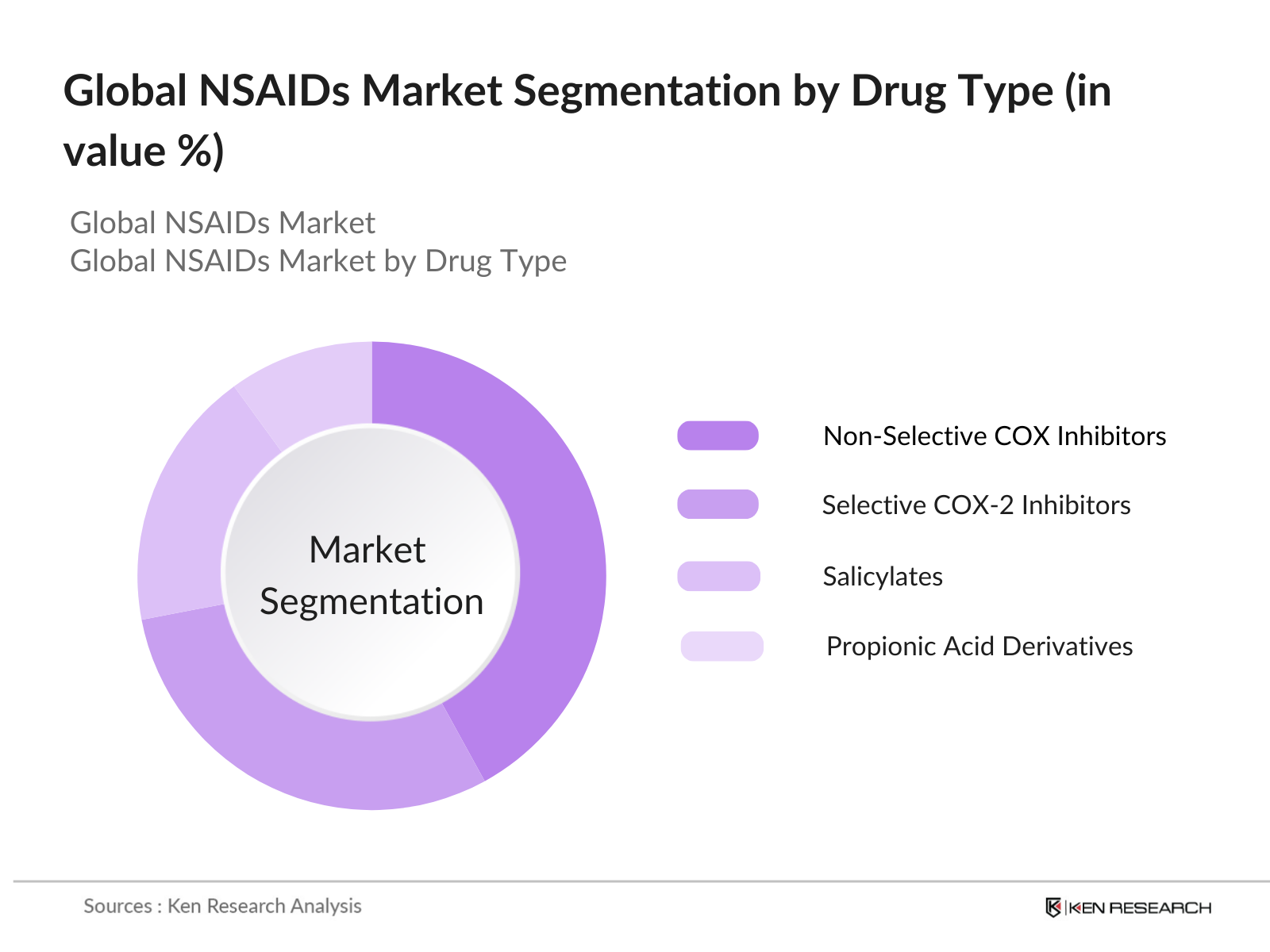

By Drug Type: The Global NSAIDs market is segmented by drug type into non-selective COX inhibitors, selective COX-2 inhibitors, salicylates, and propionic acid derivatives. In 2023, non-selective COX inhibitors like ibuprofen and aspirin lead the market due to their efficacy in treating both pain and inflammation in a variety of conditions. These drugs are favored for their wide availability as over-the-counter medications, cost-effectiveness, and their established safety profile. Their extensive use in both developed and developing countries supports their strong presence in the market.

By Region: The Global NSAIDs market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, North America leads the market, driven by a well-established healthcare infrastructure, widespread awareness of NSAID products, and favorable healthcare reimbursement systems. The increasing elderly population and the growing prevalence of chronic diseases such as arthritis and cardiovascular disorders in the U.S. further fuel NSAID demand in the region. Additionally, key pharmaceutical companies conducting robust research and development activities in North America strengthen the region's dominant position in the global market.

Global NSAIDs Market Competitive Landscape

The global NSAIDs market is characterized by a mix of large multinational corporations and regional players. The markets competitive landscape is marked by both innovation in drug formulations and strategic partnerships for distribution and marketing. Major players are focusing on enhancing their product portfolios with the development of new formulations that offer fewer side effects, particularly gastrointestinal issues commonly associated with long-term NSAID use.

|

Company |

Establishment Year |

Headquarters |

Market Presence |

R&D Investment |

Product Portfolio |

Global Reach |

Revenue (2023) |

|

Pfizer Inc. |

1849 |

New York, USA |

|||||

|

Novartis AG |

1996 |

Basel, Switzerland |

|||||

|

Bayer AG |

1863 |

Leverkusen, Germany |

|||||

|

Johnson & Johnson |

1886 |

New Brunswick, USA |

|||||

|

Sanofi |

1973 |

Paris, France |

Global NSAIDs Market Analysis

Market Growth Drivers

- Rising Prevalence of Musculoskeletal Disorders (Chronic Pain Cases): The increasing incidence of musculoskeletal disorders such as osteoarthritis, rheumatoid arthritis, and chronic back pain significantly drives the demand for NSAIDs. According to the World Health Organization, musculoskeletal conditions are the leading cause of disability worldwide, affecting 1.71 billion individuals globally in 2023. Of these, lower back pain affects 568 million people, while osteoarthritis impacts 528 million. This immense patient base necessitates pain management, primarily through NSAIDs, fostering substantial market demand.

- Government Policies on Pain Management (Health Ministry Guidelines): Various governments have issued guidelines to improve pain management strategies, enhancing the accessibility of NSAIDs. In the United States, the Department of Health and Human Services published updated pain management guidelines in 2023, emphasizing non-opioid treatments like NSAIDs for chronic pain. In the European Union, new pain management frameworks were adopted in 2022, encouraging healthcare providers to prioritize NSAID usage due to their lower risk profile compared to opioids.

- Expanding Access to Over-the-Counter (OTC) Medications: Increased availability of NSAIDs as over-the-counter (OTC) medications has broadened market access for these drugs. In 2023, global sales of OTC pain relief medications, including NSAIDs, reached a substantial number, with governments in developing nations like India and Brazil expanding drug access in rural areas through health initiatives. Regulatory bodies such as the FDA in the U.S. and MHRA in the U.K. continue to streamline approval for OTC NSAIDs, facilitating greater adoption by consumers.

Market Challenges

- Side Effects and Associated Risks (Gastrointestinal and Cardiovascular Issues): The NSAIDs market faces significant challenges due to well-documented side effects, including gastrointestinal bleeding and cardiovascular risks. In 2022, the U.S. FDA issued safety warnings, linking long-term NSAID usage to over 100,000 hospitalizations due to gastrointestinal complications annually. Cardiovascular risks have also been reported, with an estimated 16,500 NSAID-related cardiovascular deaths each year, increasing concerns among healthcare providers and consumers alike.

- Emergence of Alternative Therapies (Opioid Crisis Influence): The opioid crisis, particularly in the U.S. and Europe, has led to an increased focus on non-opioid pain management alternatives. However, the emergence of alternative therapies, such as biologics and cannabinoid-based treatments, presents a competitive challenge to the NSAIDs market. In 2023, global sales of biologic therapies for pain management were valued at billions, indicating a shift toward these newer modalities. The reduced side effect profile of biologics has attracted patients who are increasingly cautious about NSAIDs long-term risks.

Global NSAIDs Market Future Outlook

Over the next five years, the Global NSAIDs market is poised for steady growth, driven by a combination of factors such as the increasing prevalence of chronic diseases, advancements in drug delivery technologies, and the rising geriatric population. With more countries prioritizing healthcare access and expanding their healthcare infrastructure, the market is expected to witness sustained demand for both prescription and over-the-counter NSAIDs.

Market Opportunities:

- Increasing Focus on COX-2 Selective NSAIDs: COX-2 selective NSAIDs have gained attention due to their reduced gastrointestinal side effects. In 2023, COX-2 inhibitors accounted for a substantial portion of total NSAID sales globally, especially in developed markets like North America and Europe. Research conducted by the European Medicines Agency in 2022 confirmed that COX-2 inhibitors present a lower risk for gastrointestinal complications compared to traditional NSAIDs, making them a preferred choice for patients and healthcare providers.

- Shift Toward Personalized Medicine (Pharmacogenomics Data): Pharmacogenomics, the study of how genes affect a person's response to drugs, is becoming increasingly relevant in the NSAIDs market. In 2023, a study published by the NIH demonstrated that certain genetic markers could predict patients' responses to specific NSAIDs, allowing for more personalized pain management strategies. This trend toward personalized medicine is expected to revolutionize NSAID prescriptions, minimizing side effects while maximizing therapeutic efficacy.

Scope of the Report

|

By Drug Type |

Non-selective COX Inhibitors Selective COX-2 Inhibitors Salicylates Propionic Acid Derivatives |

|

By Route of Administration |

Oral Topical Injectable |

|

By Distribution Channel |

Hospital Pharmacies Retail Pharmacies E-Pharmacies |

|

By Therapeutic Application |

Pain Relief (Acute and Chronic) Osteoarthritis and Rheumatoid Arthritis Cardiovascular Applications (Low-Dose Aspirin) |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Pharmaceutical Manufacturers

Government and Regulatory Bodies (FDA, EMA, WHO)

Healthcare Providers and Hospitals

Retail Pharmacies and Drug Stores

E-Pharmacies

Contract Manufacturing Organizations (CMOs)

Investment and Venture Capitalist Firms

Research and Development Institutes

Companies

Players Mention in the Report

Pfizer Inc.

Novartis AG

Bayer AG

Johnson & Johnson

Sanofi

Merck & Co.

GlaxoSmithKline Plc

AstraZeneca

Roche Holding AG

Eli Lilly and Company

Boehringer Ingelheim

Mylan N.V.

Teva Pharmaceutical Industries

Takeda Pharmaceutical Co.

Abbott Laboratories

Table of Contents

01. Global NSAIDs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Market Growth Rate in mg/Dose Units)

1.4. Market Segmentation Overview

02. Global NSAIDs Market Size (in USD Mn)

2.1. Historical Market Size (In Value, Units Sold)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Patent Expirations, New Approvals)

03. Global NSAIDs Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Musculoskeletal Disorders (Chronic Pain Cases)

3.1.2. Increasing Geriatric Population (Aging Population Data)

3.1.3. Government Policies on Pain Management (Health Ministry Guidelines)

3.1.4. Expanding Access to Over-the-Counter (OTC) Medications

3.2. Market Challenges

3.2.1. Side Effects and Associated Risks (Gastrointestinal and Cardiovascular Issues)

3.2.2. Emergence of Alternative Therapies (Opioid Crisis Influence)

3.2.3. Stringent Regulatory Approval Processes (FDA and EMA Guidelines)

3.3. Opportunities

3.3.1. Innovation in Drug Delivery Mechanisms (Topical, Injectable Forms)

3.3.2. Rising Demand in Emerging Markets (BRICS Nations Data)

3.3.3. Strategic Collaborations between Pharmaceuticals and Biotech Firms

3.4. Trends

3.4.1. Increasing Focus on COX-2 Selective NSAIDs

3.4.2. Shift Toward Personalized Medicine (Pharmacogenomics Data)

3.4.3. Growth of E-Pharmacy Channels (Online Drug Sales Data)

3.5. Government Regulations

3.5.1. FDA Black Box Warnings and Labeling Changes

3.5.2. Reimbursement Policies for Prescription NSAIDs

3.5.3. Prescription Drug Monitoring Programs (PDMPs)

3.5.4. EU Pharmacovigilance Regulations (ADR Reporting Guidelines)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

04. Global NSAIDs Market Segmentation

4.1. By Drug Type (in Value %)

4.1.1. Non-selective COX Inhibitors

4.1.2. Selective COX-2 Inhibitors

4.1.3. Salicylates

4.1.4. Propionic Acid Derivatives

4.2. By Route of Administration (in Value %)

4.2.1. Oral

4.2.2. Topical

4.2.3. Injectable

4.3. By Distribution Channel (in Value %)

4.3.1. Hospital Pharmacies

4.3.2. Retail Pharmacies

4.3.3. E-Pharmacies

4.4. By Therapeutic Application (in Value %)

4.4.1. Pain Relief (Acute and Chronic)

4.4.2. Osteoarthritis and Rheumatoid Arthritis

4.4.3. Cardiovascular Applications (Low-Dose Aspirin)

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global NSAIDs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Pfizer Inc.

5.1.2. Novartis AG

5.1.3. Bayer AG

5.1.4. GlaxoSmithKline Plc

5.1.5. Johnson & Johnson

5.1.6. Merck & Co.

5.1.7. Sanofi

5.1.8. Boehringer Ingelheim

5.1.9. Abbott Laboratories

5.1.10. Mylan N.V.

5.1.11. Eli Lilly and Company

5.1.12. Roche Holding AG

5.1.13. Takeda Pharmaceutical Co.

5.1.14. AstraZeneca

5.1.15. Teva Pharmaceutical Industries

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Market Cap, R&D Investment, Global Reach, Product Portfolio, Regulatory Compliance, Distribution Networks)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Partnerships, Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Funding

5.8. Government Grants and Subsidies

06. Global NSAIDs Market Regulatory Framework

6.1. Global Regulatory Bodies (FDA, EMA, WHO)

6.2. Compliance Requirements

6.3. Certification Processes (cGMP, ISO Certifications)

07. Global NSAIDs Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global NSAIDs Future Market Segmentation

8.1. By Drug Type (in Value %)

8.2. By Route of Administration (in Value %)

8.3. By Distribution Channel (in Value %)

8.4. By Therapeutic Application (in Value %)

8.5. By Region (in Value %)

09. Global NSAIDs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives

9.3. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research begins by constructing a detailed ecosystem map of the Global NSAIDs Market. This involves gathering insights from secondary databases such as proprietary research platforms, government publications, and financial reports to identify key market drivers, inhibitors, and influencers. The goal is to create a foundational understanding of the markets operational landscape.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled to analyze past market trends in the Global NSAIDs Market. This involves studying data related to product demand, regional penetration, and pharmaceutical manufacturing output. The analysis also includes mapping revenue streams from major segments such as non-selective and selective NSAIDs.

Step 3: Hypothesis Validation and Expert Consultation

Initial market hypotheses are developed and validated through expert consultations. Industry stakeholders, including pharmaceutical executives and healthcare professionals, are engaged in structured interviews to refine key assumptions and market estimates. These insights help in confirming market growth trajectories and industry challenges.

Step 4: Research Synthesis and Final Output

The final step integrates both primary and secondary data sources to produce a validated and comprehensive market analysis. The synthesized data is cross-referenced with market insights derived from both top-down and bottom-up approaches to ensure the accuracy of market size, trends, and growth projections.

Frequently Asked Questions

01. How big is the Global NSAIDs Market?

The Global NSAIDs market is valued at USD 21.7 billion, driven by the increasing demand for pain management solutions, particularly in regions with a high prevalence of chronic diseases.

02. What are the challenges in the Global NSAIDs Market?

Key challenges include side effects such as gastrointestinal and cardiovascular risks associated with long-term NSAID use, as well as the availability of alternative treatments such as biologics and opioids.

03. Who are the major players in the Global NSAIDs Market?

Major players include Pfizer, Novartis, Bayer, Johnson & Johnson, and Sanofi, which dominate the market through their extensive product portfolios and global distribution networks.

04. What are the growth drivers of the Global NSAIDs Market?

The market is driven by the increasing incidence of chronic diseases, an aging population, and the widespread availability of both prescription and over-the-counter NSAIDs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.