Global Off-road Vehicle Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10579

November 2024

81

About the Report

Global Off-road Vehicle Market Overview

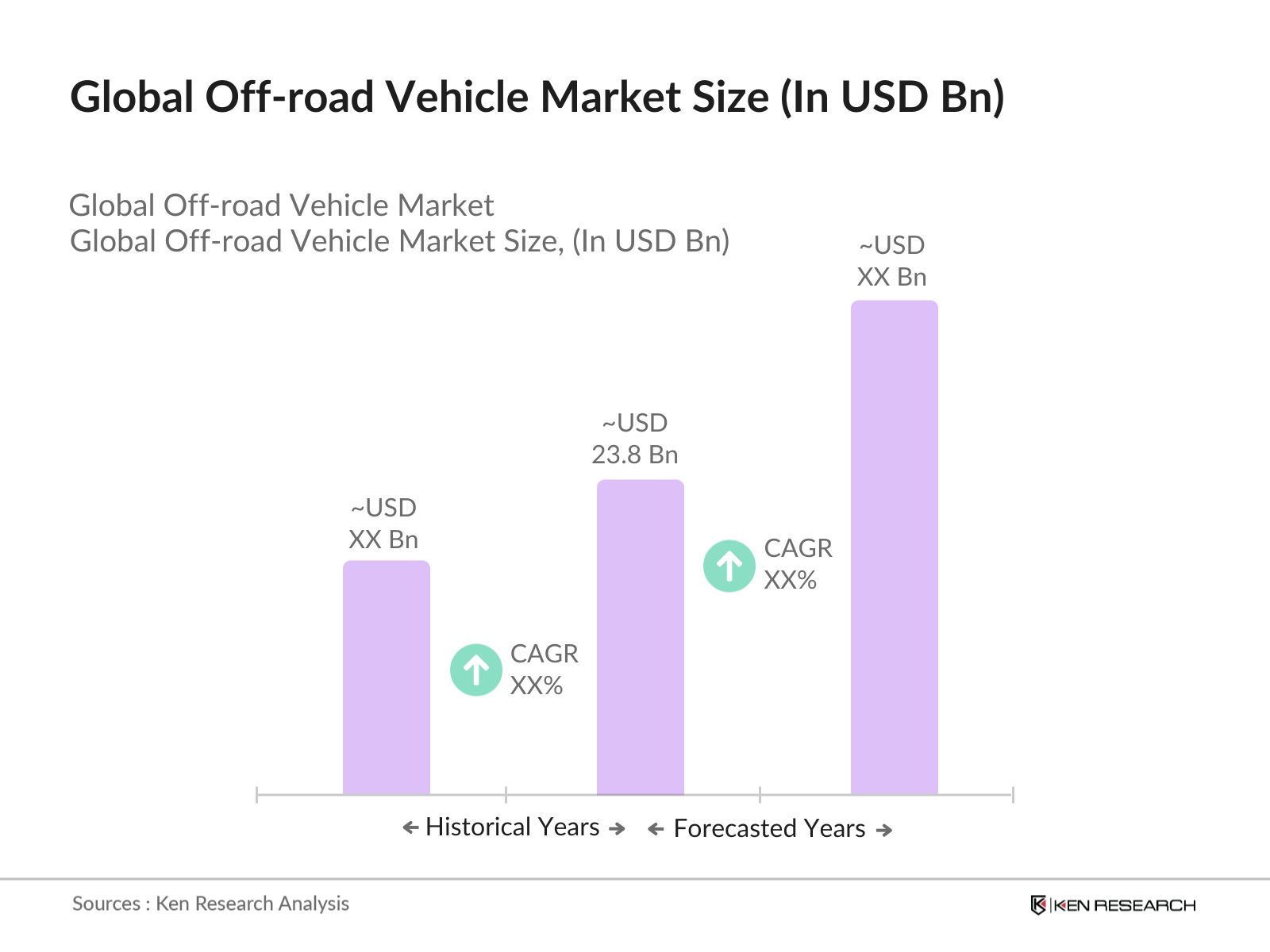

- The global off-road vehicle market is valued at USD 23.8 billion based on a five-year historical analysis, driven by the increasing demand for recreational and utility purposes, advancements in vehicle technology, and expansion in military and agricultural applications. The market has seen significant growth over the past five years due to increased consumer interest in adventure sports, tourism, and expanding industrial utility vehicles. The rise in electric off-road vehicle models, as well as government initiatives promoting eco-friendly alternatives, are key drivers for this market.

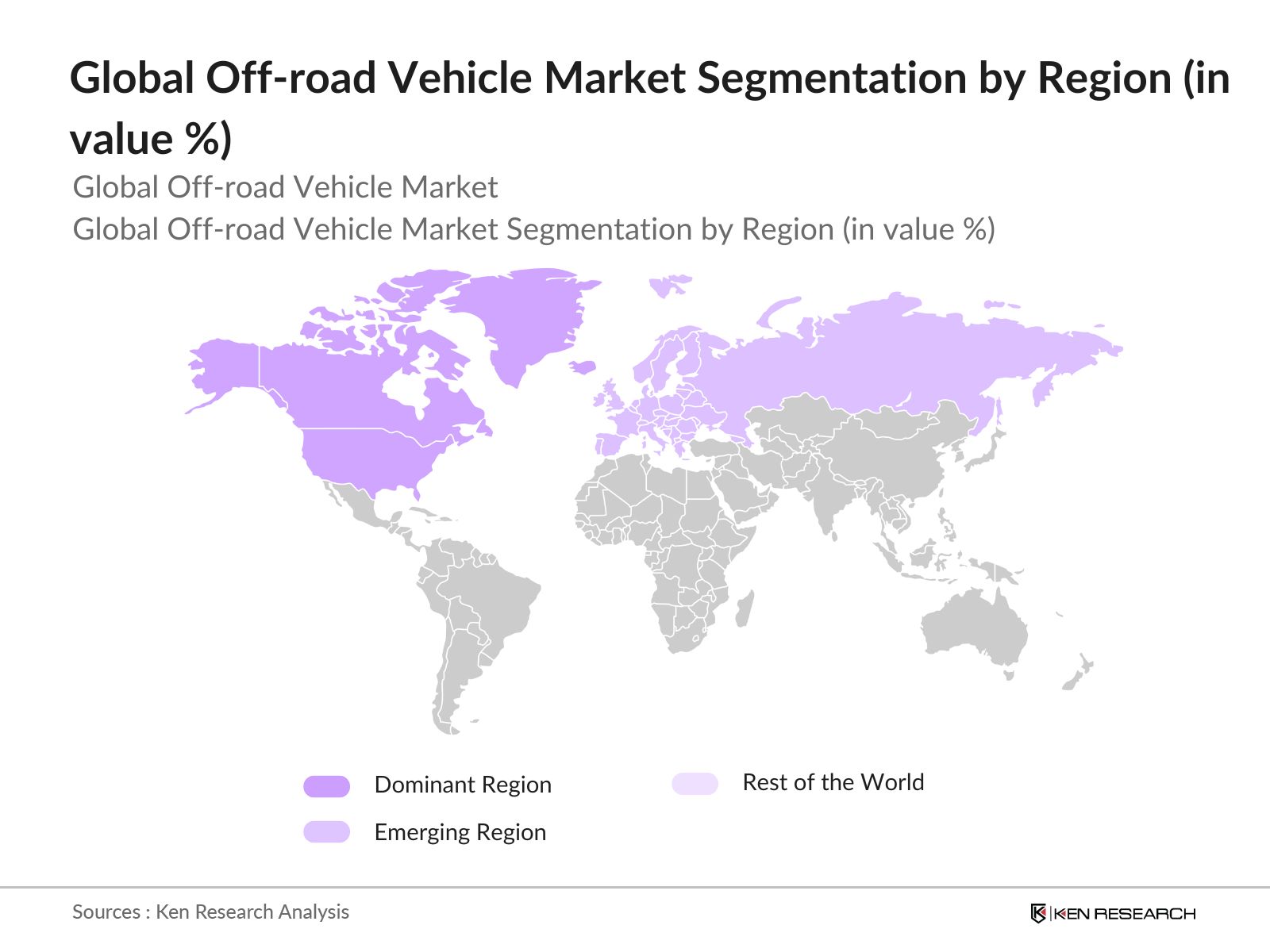

- Countries such as the United States, Canada, and China dominate the global off-road vehicle market due to strong consumer bases, extensive outdoor recreational activities, and established automotive industries. The United States has a well-developed market infrastructure with specialized off-road vehicle trails and parks, driving continuous demand. Meanwhile, Chinas dominance is driven by the growing tourism sector and the expansion of electric off-road vehicle manufacturing capabilities. The combination of high disposable income and a growing culture of outdoor recreation also contribute to the market dominance in these regions.

- Regulatory bodies are enforcing stricter safety standards for off-road vehicles to ensure their safe operation in hazardous environments. In 2023, the National Highway Traffic Safety Administration (NHTSA) updated its safety protocols for off-road vehicles, mandating advanced driver-assistance systems (ADAS) in certain models. The European Commission also proposed new safety measures under the Vehicle General Safety Regulation, which is expected to increase vehicle costs but improve safety outcomes. These regulations are influencing manufacturers to adopt new technologies that meet evolving safety standards.

Global Off-road Vehicle Market Segmentation

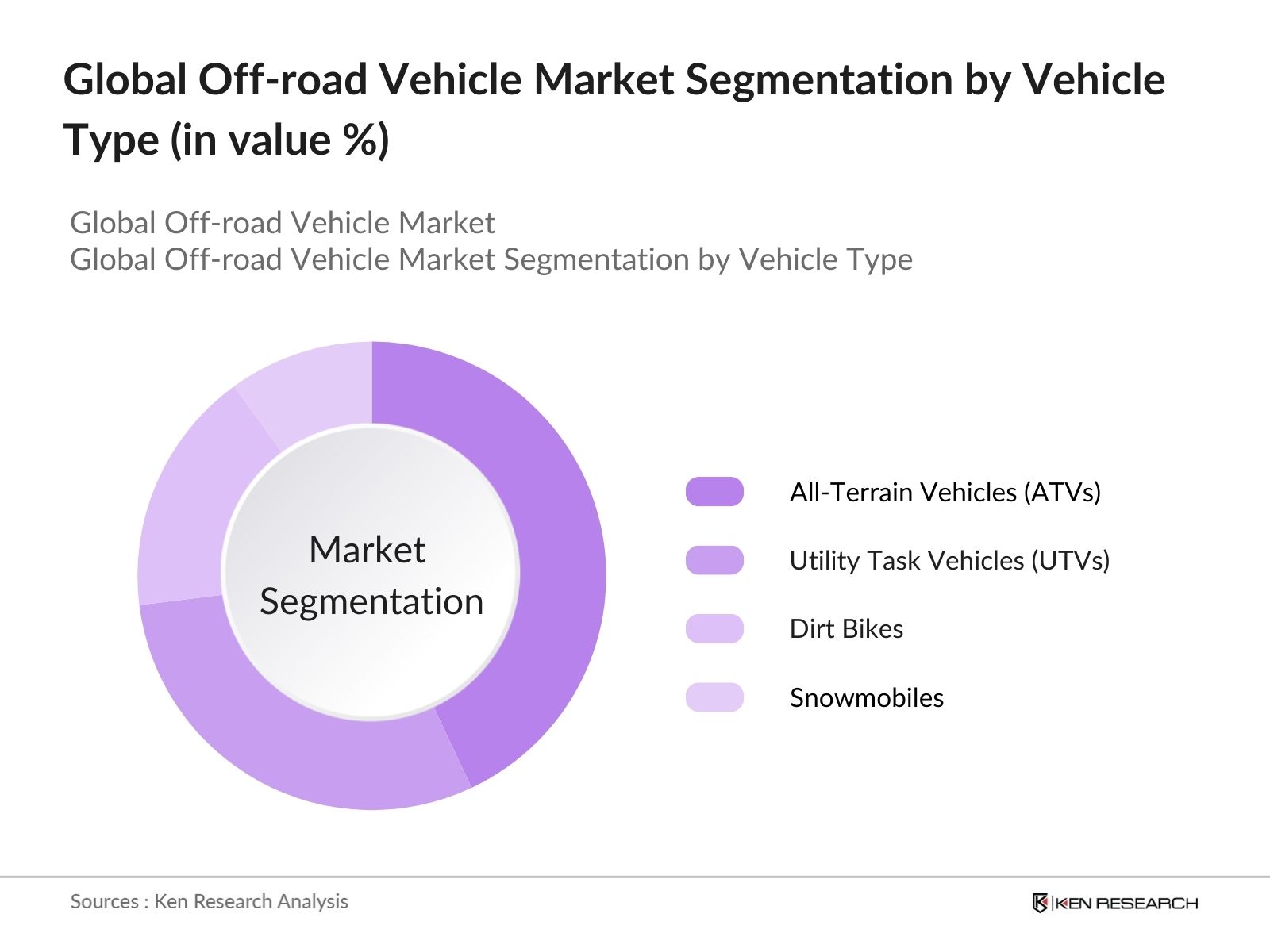

- By Vehicle Type: The global off-road vehicle market is segmented by vehicle type into all-terrain vehicles (ATVs), utility task vehicles (UTVs), dirt bikes, snowmobiles, and amphibious vehicles. ATVs dominate the market share due to their versatility, allowing them to be used in diverse applications ranging from recreation to agricultural tasks. Their popularity is supported by a strong presence in North America, where the consumer base highly values the multi-functionality of these vehicles, further driving market demand.

- By Region: The global off-road vehicle market is regionally segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America leads the market due to the well-established infrastructure for off-road recreational activities and high consumer purchasing power. The U.S. and Canada have numerous off-road trails, parks, and a strong culture surrounding off-roading events. Additionally, these regions have experienced a rise in the demand for utility vehicles in agriculture, supporting their leading position in the market.

- By Application: The global off-road vehicle market is segmented by application into agriculture, military, sports & recreation, and tourism. The sports and recreation segment holds the dominant market share. The growing interest in off-roading and adventure tourism has made this segment highly lucrative. Countries like the U.S., Canada, and Australia have seen a rise in consumer spending on outdoor activities, driving the sales of off-road vehicles for recreational purposes. The increasing trend of off-road vehicle tours and events also boosts demand in this segment.

Global Off-road Vehicle Market Competitive Landscape

The global off-road vehicle market is dominated by a few major players, which include Polaris Industries Inc., Honda Motor Co., Ltd., and Yamaha Motor Co., Ltd., along with others. These companies lead the market through continuous innovation, advanced manufacturing capabilities, and extensive distribution networks. Additionally, the competition is driven by investments in electric off-road vehicles and autonomous technology, which is setting the tone for future industry growth.

|

Company Name |

Establishment Year |

Headquarters |

Annual Revenue (USD) |

Global Reach |

Product Portfolio |

R&D Investment |

Technology Adoption |

Strategic Partnerships |

Employee Base |

|

Polaris Industries Inc. |

1954 |

Medina, Minnesota, USA |

|||||||

|

Honda Motor Co., Ltd. |

1948 |

Tokyo, Japan |

|||||||

|

Yamaha Motor Co., Ltd. |

1955 |

Iwata, Japan |

|||||||

|

Arctic Cat Inc. |

1960 |

Thief River Falls, USA |

|||||||

|

BRP Inc. |

2003 |

Valcourt, Canada |

Global Off-road Vehicle Industry Analysis

Growth Drivers

- Growing Demand for All-Terrain Utility (Increased Consumer Preference): The demand for off-road vehicles is rising due to their diverse applications in agriculture, military, and recreational activities. According to the World Bank, global rural population stood at 3.4 billion in 2022, leading to increasing agricultural mechanization. Off-road vehicles (ORVs) provide essential utility in areas with challenging terrains. In the US, the Bureau of Economic Analysis reported consumer spending on recreational goods and vehicles rose by $145 billion in 2023, reflecting the rising popularity of all-terrain and off-road vehicles for both utility and adventure.

- Expanding Recreational Activities (Adventurous Sports and Tourism): Off-road vehicles are increasingly popular for recreational purposes, especially in countries with expansive natural landscapes. Data from the World Travel & Tourism Council reveals that adventure tourism contributed over $412 billion to the global economy in 2023, driven by activities like dune bashing, trail riding, and desert safaris. This growing trend of adventure tourism directly boosts the demand for off-road vehicles. In Australia, over 900,000 off-road recreational vehicles were registered by 2023, illustrating the strong link between tourism and vehicle demand.

- Rise in Agricultural Mechanization (Utility in Farm Operations): Agricultural mechanization is driving the adoption of off-road vehicles, especially in developing nations. According to the FAO, 52% of agricultural land globally is now mechanized, and off-road utility vehicles are an integral part of operations on farms, particularly in uneven terrains. In India alone, the Ministry of Agriculture reported a surge in farm machinery imports, including off-road vehicles, as the agricultural sector strives to modernize. The global expansion of farmland, which grew to 4.9 billion hectares by 2023 (World Bank), further indicates increasing use of ORVs in farming.

Market Restraints

- High Vehicle Costs (Premium Pricing for Advanced Vehicles): Off-road vehicles often come with high production and maintenance costs due to specialized design and advanced technology integration. Data from the European Automobile Manufacturers' Association (ACEA) shows that vehicle manufacturing costs have risen by 12% in 2023, driven by inflation, increased material costs, and labor shortages. In particular, the cost of steel and aluminum (key components in ORVs) rose by 15% in 2023, leading to higher retail prices. As a result, ORVs remain out of reach for many cost-conscious consumers in emerging markets.

- Environmental Regulations (Emission Standards and Penalties): Governments worldwide are imposing stringent regulations on emissions, affecting the off-road vehicle market. In 2023, the European Union tightened its emissions standards under Euro 7, compelling manufacturers to reduce vehicle emissions. Similar moves were made in the US with the implementation of Tier 4 emission standards for non-road engines. The International Energy Agency reported that by 2023, carbon emissions from the transport sector reached 8.4 billion metric tons, leading to penalties for high-emission vehicles and challenging the adoption of conventional ORVs.

Global Off-road Vehicle Market Future Outlook

Over the next five years, the global off-road vehicle market is expected to show significant growth, driven by continuous technological advancements, increased consumer demand for electric and hybrid models, and the expansion of recreational tourism activities worldwide. Additionally, increasing investments in research and development, coupled with supportive government policies promoting eco-friendly vehicles, are anticipated to fuel market growth further.

Market Opportunities

- Technological Advancements (Electric Off-Road Vehicles): The rise of electric vehicles has also penetrated the off-road market, with manufacturers investing heavily in electric ORVs. As of 2023, over 12 million electric vehicles were on roads globally (IEA), and this trend is expanding into off-road applications. The US government passed a $7.5 billion infrastructure bill in 2022 aimed at supporting EV adoption, including funding for electric off-road charging infrastructure. Electric ORVs, with zero emissions and lower running costs, present an opportunity to align with environmental goals while expanding their market share.

- Emerging Markets (Latin America and Asia-Pacific Expansion): Emerging markets present significant opportunities for growth in the off-road vehicle sector. The IMF reported that Latin Americas GDP grew by 2.9% in 2023, with expanding middle-class populations driving demand for leisure and recreational vehicles. Similarly, Asia-Pacifics agricultural sector saw a 10% rise in mechanization in 2023 (Asian Development Bank), creating a large market for utility-focused off-road vehicles. Brazil and India, in particular, are expected to be key players, with their vast agricultural landscapes and growing investment in mechanization infrastructure.

Scope of the Report

|

Vehicle Type |

All-Terrain Vehicles (ATVs) |

|

Utility Task Vehicles (UTVs) |

|

|

Dirt Bikes |

|

|

Snowmobiles |

|

|

Amphibious Vehicles |

|

|

Application |

Agriculture |

|

Military |

|

|

Sports & Recreation |

|

|

Tourism |

|

|

Engine Type |

Internal Combustion Engine (ICE) |

|

Electric-Powered |

|

|

Hybrid |

|

|

Propulsion Type |

2-Wheel Drive |

|

4-Wheel Drive |

|

|

All-Wheel Drive |

|

|

Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East & Africa |

Products

Key Target Audience

Off-road vehicle manufacturers

Automotive component suppliers

Recreational tourism companies

Defense contractors

Agricultural machinery distributors

Investors and venture capitalist firms

Government and regulatory bodies (U.S. Department of Transportation, European Commission)

Electric vehicle infrastructure providers

Companies

Players Mentioned in the Report:

Polaris Industries Inc.

Honda Motor Co., Ltd.

Yamaha Motor Co., Ltd.

Kawasaki Motors Corp.

Arctic Cat Inc.

BRP Inc. (Bombardier Recreational Products)

John Deere

Textron Inc.

Suzuki Motor Corporation

CF Moto

Mahindra & Mahindra Ltd.

TGB Motor Co., Ltd.

KTM AG

Benelli QJ

Segway Technology Co., Ltd.

Table of Contents

1. Global Off-Road Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Off-Road Vehicle Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Off-Road Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Growing demand for all-terrain utility (Increased consumer preference)

3.1.2. Expanding recreational activities (Adventurous sports and tourism)

3.1.3. Rise in agricultural mechanization (Utility in farm operations)

3.1.4. Military adoption of off-road vehicles (Defense sector demand)

3.2. Market Challenges

3.2.1. High vehicle costs (Premium pricing for advanced vehicles)

3.2.2. Environmental regulations (Emission standards and penalties)

3.2.3. Lack of infrastructure (Limited off-road tracks in urban areas)

3.3. Opportunities

3.3.1. Technological advancements (Electric off-road vehicles)

3.3.2. Emerging markets (Latin America and Asia-Pacific expansion)

3.3.3. Aftermarket services (Customization and maintenance services)

3.4. Trends

3.4.1. Electric and hybrid off-road vehicles (Sustainability focus)

3.4.2. Autonomous off-road vehicles (AI integration and safety features)

3.4.3. Lightweight materials (Enhancing fuel efficiency and performance)

3.5. Government Regulations

3.5.1. Emission norms (Environmental restrictions for off-road vehicles)

3.5.2. Import/export tariffs (Impact on vehicle costs and availability)

3.5.3. Safety standards (Industry-specific safety regulations)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Off-Road Vehicle Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. All-Terrain Vehicles (ATVs)

4.1.2. Utility Task Vehicles (UTVs)

4.1.3. Dirt Bikes

4.1.4. Snowmobiles

4.1.5. Amphibious Vehicles

4.2. By Application (In Value %)

4.2.1. Agriculture

4.2.2. Military

4.2.3. Sports & Recreation

4.2.4. Tourism

4.3. By Engine Type (In Value %)

4.3.1. Internal Combustion Engine (ICE)

4.3.2. Electric-Powered

4.3.3. Hybrid

4.4. By Propulsion Type (In Value %)

4.4.1. 2-Wheel Drive

4.4.2. 4-Wheel Drive

4.4.3. All-Wheel Drive

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Off-Road Vehicle Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Polaris Industries Inc.

5.1.2. Honda Motor Co., Ltd.

5.1.3. Yamaha Motor Co., Ltd.

5.1.4. Kawasaki Motors Corp.

5.1.5. Arctic Cat Inc.

5.1.6. BRP Inc. (Bombardier Recreational Products)

5.1.7. John Deere

5.1.8. Textron Inc.

5.1.9. Suzuki Motor Corporation

5.1.10. CF Moto

5.1.11. Mahindra & Mahindra Ltd.

5.1.12. TGB Motor Co., Ltd.

5.1.13. KTM AG

5.1.14. Benelli QJ

5.1.15. Segway Technology Co., Ltd.

5.2. Cross Comparison Parameters (Annual Revenue, Headquarters, Global Reach, Product Portfolio, R&D Investment, Technology Adoption, Strategic Partnerships, Employee Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Off-Road Vehicle Market Regulatory Framework

6.1. Emission Norms

6.2. Safety & Certification Standards

6.3. Compliance Requirements

7. Global Off-Road Vehicle Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Off-Road Vehicle Market Future Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Application (In Value %)

8.3. By Engine Type (In Value %)

8.4. By Propulsion Type (In Value %)

8.5. By Region (In Value %)

9. Global Off-Road Vehicle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the off-road vehicle market ecosystem by identifying major stakeholders, including manufacturers, distributors, and end-users. Comprehensive desk research is conducted, drawing on secondary and proprietary databases to collect market data and trends.

Step 2: Market Analysis and Construction

In this phase, historical data regarding off-road vehicle sales, usage rates, and consumer preferences is compiled and analyzed. Market size estimates and growth projections are developed based on these findings.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts from off-road vehicle manufacturers and key stakeholders. These discussions offer critical insights into market trends, product innovations, and strategic initiatives.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all research findings, including competitive landscape analysis and regional segmentation data, to provide a comprehensive and validated market report.

Frequently Asked Questions

01. How big is the global off-road vehicle market?

The global off-road vehicle market is valued at USD 23.8 billion based on a five-year historical analysis, driven by advancements in vehicle technology, increased recreational activities, and rising demand for utility vehicles in agriculture and military sectors.

02. What are the challenges in the global off-road vehicle market?

The market faces challenges such as high vehicle costs, stringent environmental regulations, and limited infrastructure for off-road activities in urban areas, which restrict broader adoption.

03. Who are the major players in the global off-road vehicle market?

Key players in the market include Polaris Industries Inc., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., and Arctic Cat Inc. These companies dominate due to their strong product portfolios, global reach, and technological advancements.

04. What are the growth drivers of the global off-road vehicle market?

Growth drivers include the increasing popularity of recreational off-roading, the rise in agricultural mechanization, military adoption of off-road vehicles, and advancements in electric vehicle technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.