Global Offshore Wind Turbine Market Outlook to 2030

Region:Global

Author(s):Sanjeev

Product Code:KROD1857

November 2024

98

About the Report

Global Offshore Wind Turbine Market Overview

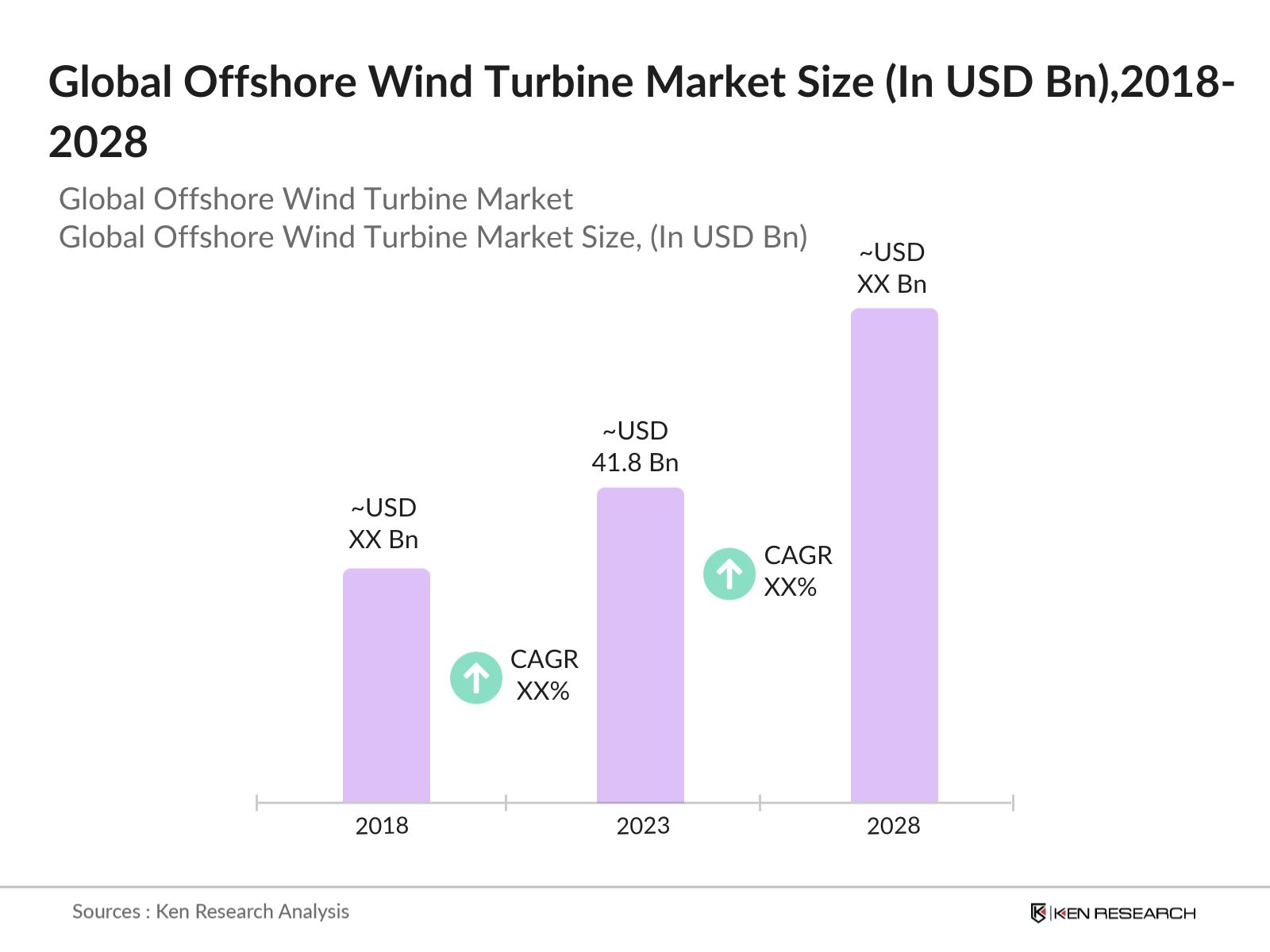

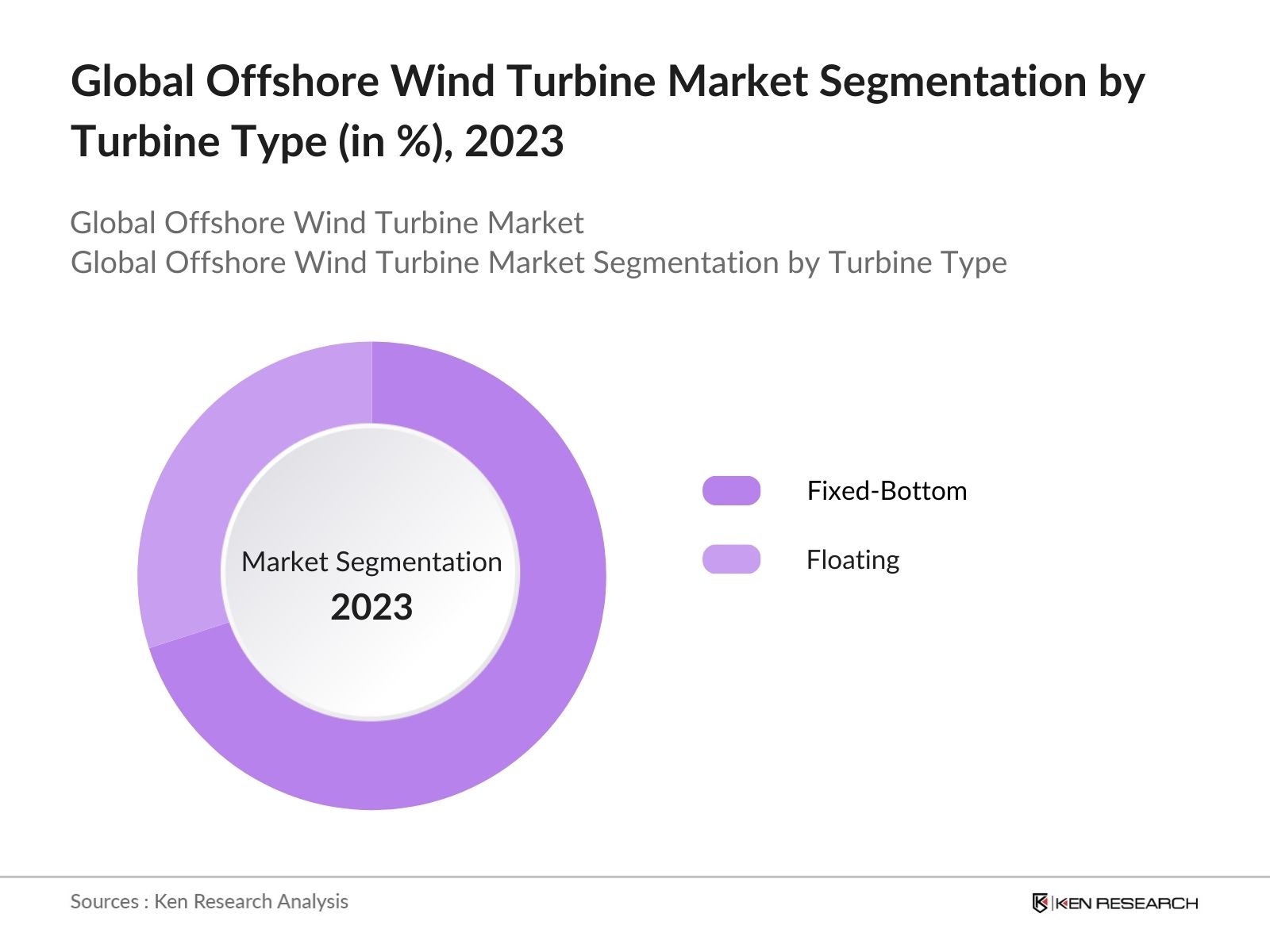

- In 2023, the Global Offshore Wind Turbine Market was valued at USD 41.8 billion, driven by increasing investment in renewable energy sources, technological advancements in turbine design, and growing governmental support for sustainable energy initiatives. The market is segmented into fixed-bottom and floating offshore wind turbines, with fixed-bottom turbines being the most dominant due to their widespread deployment in shallow waters.

- Major players in the Global Offshore Wind Turbine Market include Siemens Gamesa, Vestas, GE Renewable Energy, rsted, and MHI Vestas Offshore Wind. These companies are recognized for their advanced turbine technologies and strong project portfolios. Siemens Gamesa leads the market with its innovative Direct Drive turbines, known for their efficiency and reliability in offshore environments.

- In Europe, countries like the United Kingdom, Germany, and Denmark are prominent markets, driven by favorable government policies and high investment in offshore wind energy projects. These countries are characterized by well-established offshore wind infrastructure and ambitious renewable energy targets.

- In 2023, rsted launched a new offshore wind farm project in the North Sea, featuring the latest generation of Siemens Gamesa turbines. This project underscores the ongoing expansion of offshore wind capacity in Europe and reflects broader trends in the global shift towards renewable energy sources.

Global Offshore Wind Turbine Market Segmentation

The Global Offshore Wind Turbine Market can be segmented by turbine type, water depth, and region:

- By Turbine Type: The market is segmented into fixed-bottom and floating offshore wind turbines. In 2023, fixed-bottom turbines remain the most dominant type due to their established presence in shallow waters, where they are more cost-effective to install. However, floating turbines are gaining popularity due to their ability to be deployed in deeper waters, unlocking new areas for wind energy development.

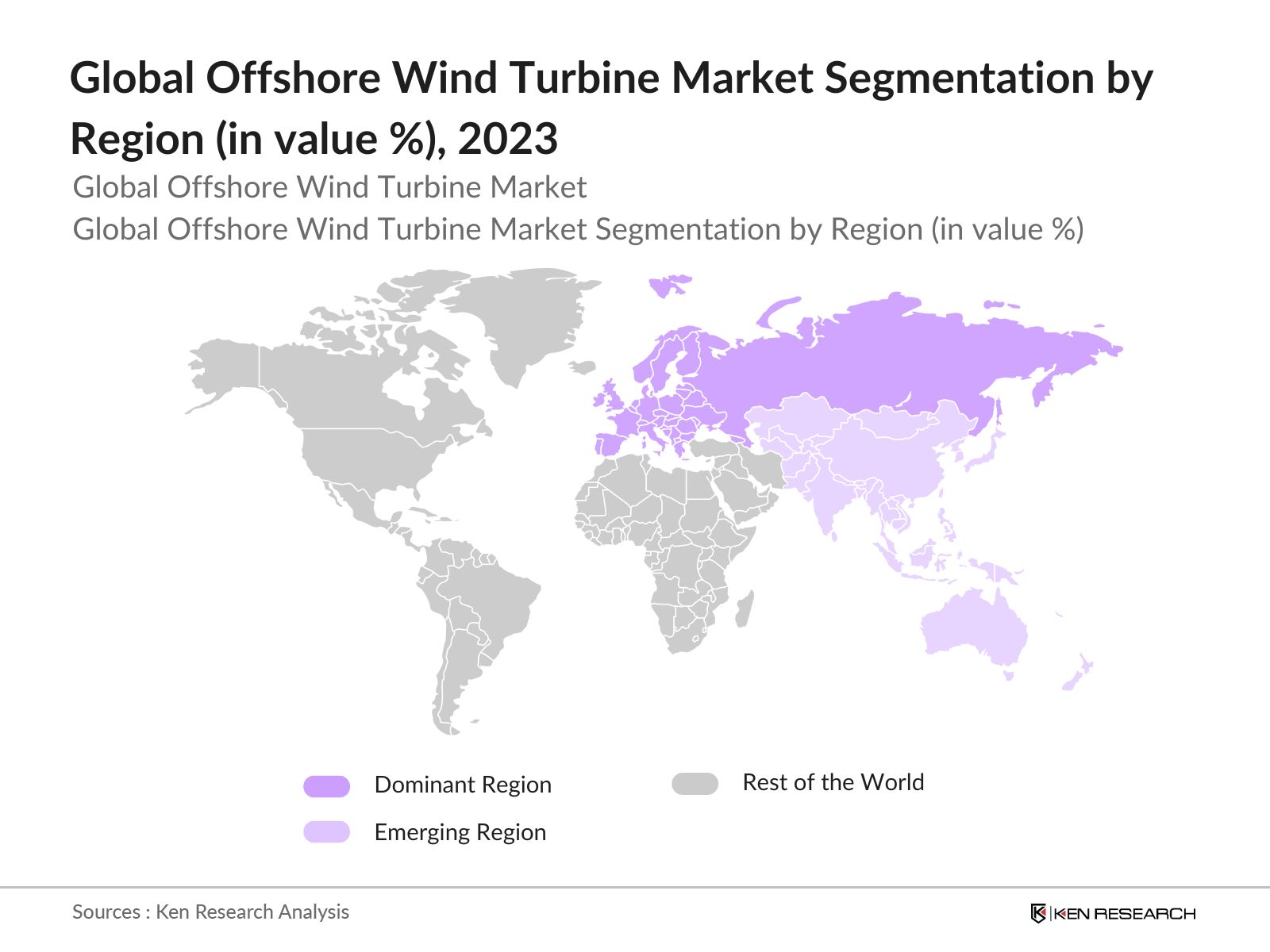

- By Region: The market is segmented regionally into Europe, Asia Pacific, North America, Latin America and Middle East & Africa. In 2023, Europe leads the market due to its strong commitment to renewable energy and substantial investments in offshore wind projects. Asia Pacific is also a market, driven by the increasing energy demands of countries like China and Japan and their strategic moves towards renewable energy.

- By Water Depth: The market is segmented by water depth into shallow water (up to 30m), transitional water (30-60m), and deep water (more than 60m). In 2023, shallow water installations dominate the market due to lower installation costs and easier maintenance. However, there is a growing interest in transitional and deep-water projects as technology improves and the demand for renewable energy increases.

Global Offshore Wind Turbine Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Siemens Gamesa |

1976 |

Zamudio, Spain |

|

Vestas |

1945 |

Aarhus, Denmark |

|

GE Renewable Energy |

2002 |

Paris, France |

|

rsted |

1972 |

Fredericia, Denmark |

|

MHI Vestas Offshore Wind |

2014 |

Aarhus, Denmark |

- Siemens Gamesa: In 2023, Siemens Gamesa introduced its SG 14-222 DD turbine, the largest and most powerful offshore wind turbine to date, catering to the growing demand for high-capacity turbines in large-scale offshore wind farms. This launch is aimed at strengthening the company's position as a leader in offshore wind technology and addressing the increasing need for renewable energy solutions.

- Vestas: In 2024, Vestas expanded its product line with the launch of the V236-15.0 MW turbine, designed to maximize energy output and efficiency in offshore environments. This new turbine emphasizes Vestas's commitment to innovation and sustainability, positioning the company to capture a significant share of the growing offshore wind market.

Global Offshore Wind Turbine Market Analysis

Market Growth Drivers:

- Increasing Investment in Renewable Energy: The growing global commitment to reducing carbon emissions and combating climate change is driving substantial investment in renewable energy sources, particularly offshore wind. In 2023, global investments in renewable energy reached USD 500 billion, with offshore wind energy accounting for about USD 50 billion. This investment growth is bolstered by ambitious government targets, such as the European Unions aim for 60 GW of offshore wind capacity by 2030 and 300 GW by 2050, and the United States plan to install 30 GW of offshore wind capacity by 2030.

- Technological Advancements: The average capacity of offshore wind turbines has significantly increased, with recent models reaching up to 14 MW. Additionally, innovations such as floating turbines are expanding opportunities by enabling deployment in deeper waters, with floating wind projects expected to grow substantially, reaching 3 GW of capacity by 2030.

- Government Support and Policy Initiatives: The United Kingdoms Contracts for Difference scheme allocates significant funds annually to offshore wind projects, reducing costs for developers. In the United States, the Offshore Wind Executive Order aims to double the country's offshore wind capacity by 2030, while China's 14th Five-Year Plan targets 30 GW of offshore wind capacity by 2025 with substantial financial support for project construction. These initiatives are creating a favorable environment for market expansion and encouraging investments in new projects.

Market Challenges:

- High Installation and Maintenance Costs: The high costs associated with the installation and maintenance of offshore wind turbines pose significant challenges. The harsh marine environment requires specialized equipment and expertise, which can increase operational expenses.

- Grid Integration Issues: Integrating offshore wind energy into existing power grids can be complex and costly, particularly in regions with outdated infrastructure. Grid stability and the need for energy storage solutions are ongoing challenges that must be addressed to support market growth.

Government Initiatives:

- European Unions Offshore Renewable Energy Strategy: The European Union's Offshore Renewable Energy Strategy, part of the European Green Deal, aims to increase offshore wind capacity to 300 GW by 2050. This strategy includes initiatives to streamline permitting processes, enhance grid infrastructure, and promote cross-border cooperation, providing significant support for the offshore wind turbine market.

- Chinas 14th Five-Year Plan for Renewable Energy: China's 14th Five-Year Plan for Renewable Energy includes ambitious targets for offshore wind development, aiming to reach 30 GW of installed capacity by 2025. The plan outlines policies and incentives to encourage investment in offshore wind projects, reflecting China's commitment to renewable energy growth.

Global Offshore Wind Turbine Market Future Market Outlook

The Global Offshore Wind Turbine Market is expected to continue its robust growth, driven by increasing demand for renewable energy, advancements in turbine technology, and supportive government policies.

Future Market Trends:

- Expansion of Floating Wind Farms: Floating wind farms are expected to gain traction as technology matures and costs decrease. These farms enable the exploitation of wind resources in deeper waters, expanding the market's geographical scope and potential.

- Integration of Hybrid Energy Systems: There is likely to be an increased focus on integrating offshore wind with other renewable energy sources, such as solar or hydrogen production, to create hybrid energy systems. These systems can enhance grid stability and optimize energy output, providing a more comprehensive renewable energy solution.

Scope of the Report

|

By Region |

Europe Asia Pacific North America South America Middle East & Africa |

|

By Water Depth |

Shallow Water Transitional Water Deep Water |

|

By Turbine Type |

Fixed-Bottom Turbines Floating Turbines |

|

By Capacity |

Up to 3 MW 3 MW to 5 MW Above 5 MW |

|

By Application |

Commercial Power Generation Utility Power Generation Industrial Power Generation |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Banks and Financial Institutions

Venture Capitalists

Government and Regulatory Bodies (EU, NDRC, DOE)

Wind Turbine Manufacturers

Renewable Energy Developers

Offshore Engineering Firms

Energy Storage Companies

Environmental and Marine Agencies

Academic and Research Institutions

Energy Policy Advisors

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Siemens Gamesa

Vestas

GE Renewable Energy

rsted

MHI Vestas Offshore Wind

Senvion

Goldwind

MingYang Smart Energy

Shanghai Electric Wind Power

Hitachi Offshore Wind

Envision Energy

Nordex Group

Suzlon Energy

Doosan Heavy Industries & Construction

Sinovel Wind Group Co., Ltd.

Table of Contents

Global Offshore Wind Turbine Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Global Offshore Wind Turbine Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

Global Offshore Wind Turbine Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Investment in Renewable Energy

3.1.2. Technological Advancements

3.1.3. Government Support and Policy Initiatives

3.2. Restraints

3.2.1. High Installation and Maintenance Costs

3.2.2. Grid Integration Issues

3.2.3. Environmental and Regulatory Constraints

3.3. Opportunities

3.3.1. Expansion into New Markets

3.3.2. Technological Innovations

3.3.3. Growing Demand for Clean Energy

3.4. Trends

3.4.1. Expansion of Floating Wind Farms

3.4.2. Integration of Hybrid Energy Systems

3.4.3. Development of Smart Turbines

3.5. Government Regulation

3.5.1. European Unions Offshore Renewable Energy Strategy

3.5.2. Chinas 14th Five-Year Plan for Renewable Energy

3.5.3. U.S. Offshore Wind Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

Global Offshore Wind Turbine Market Segmentation, 2023

4.1. By Turbine Type (in Value %)

4.1.1. Fixed-Bottom Turbines

4.1.2. Floating Turbines

4.2. By Water Depth (in Value %)

4.2.1. Shallow Water

4.2.2. Transitional Water

4.2.3. Deep Water

4.3. By Region (in Value %)

4.3.1. Europe

4.3.2. Asia Pacific

4.3.3. North America

4.3.4. South America

4.3.5. Middle East & Africa

4.4. By Capacity (in Value %)

4.4.1. Up to 3 MW

4.4.2. 3 MW to 5 MW

4.4.3. Above 5 MW

4.5. By Application (in Value %)

4.5.1. Commercial Power Generation

4.5.2. Utility Power Generation

4.5.3. Industrial Power Generation

Global Offshore Wind Turbine Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens Gamesa

5.1.2. Vestas

5.1.3. GE Renewable Energy

5.1.4. rsted

5.1.5. MHI Vestas Offshore Wind

5.1.6. Senvion

5.1.7. Goldwind

5.1.8. MingYang Smart Energy

5.1.9. Shanghai Electric Wind Power

5.1.10. Hitachi Offshore Wind

5.1.11. Envision Energy

5.1.12. Nordex Group

5.1.13. Suzlon Energy

5.1.14. Doosan Heavy Industries & Construction

5.1.15. Sinovel Wind Group Co., Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

Global Offshore Wind Turbine Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

Global Offshore Wind Turbine Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

Global Offshore Wind Turbine Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

Global Offshore Wind Turbine Future Market Segmentation, 2028

9.1. By Turbine Type (in Value %)

9.2. By Water Depth (in Value %)

9.3. By Region (in Value %)

9.4. By Capacity (in Value %)

9.5. By Application (in Value %)

Global Offshore Wind Turbine Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, technological advancements, and policy impacts. We also assess regional developments and market dynamics specific to the offshore wind turbine market.

Step 2: Market Building

We collect historical data on market size, growth rates, turbine type segmentation (fixed-bottom and floating turbines), and the distribution of water depths (shallow, transitional, and deep waters). We also analyze market share and revenue generated by leading companies, emerging trends in turbine technology, and regional developments to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading wind turbine manufacturers, project developers, and energy policy advisors. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as project financing, installation challenges, and regulatory compliance.

Step 4: Research Output

Our team interacts with wind turbine manufacturers, renewable energy developers, environmental agencies, and market analysts to understand the dynamics of market segments, evolving technologies, and regulatory trends. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

How large is the Global Offshore Wind Turbine Market?

In 2023, the Global Offshore Wind Turbine Market was valued at USD 41.8 billion. The market's growth is driven by increasing investment in renewable energy, technological advancements in turbine design, and strong government support for sustainable energy initiatives.

What are the challenges in the Global Offshore Wind Turbine Market?

Challenges in the Global Offshore Wind Turbine Market include high installation and maintenance costs, grid integration issues, and stringent environmental and regulatory constraints. Additionally, the need for technological advancements to improve turbine efficiency and durability in harsh offshore environments presents ongoing challenges.

Who are the major players in the Global Offshore Wind Turbine Market?

Major players in the Global Offshore Wind Turbine Market include Siemens Gamesa, Vestas, GE Renewable Energy, rsted, and MHI Vestas Offshore Wind. These companies lead the market with advanced turbine technologies, strong project portfolios, and continuous innovation in offshore wind solutions.

What are the growth drivers of the Global Offshore Wind Turbine Market?

Key growth drivers include increasing investment in renewable energy to combat climate change, technological advancements in turbine design, and supportive government policies promoting offshore wind development. The expansion of offshore wind capacity and the growing adoption of floating turbines also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.