Region:Global

Author(s):Shubham

Product Code:KRAC0842

Pages:86

Published On:August 2025

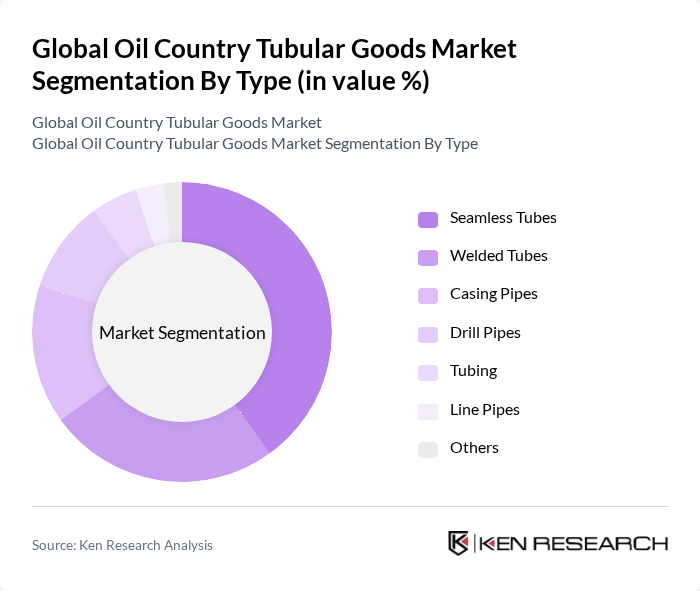

By Type:The market is segmented into seamless tubes, welded tubes, casing pipes, drill pipes, tubing, line pipes, and others.Seamless tubescontinue to gain traction due to their superior strength and reliability, making them ideal for high-pressure and critical well environments. Welded tubes are preferred in lower-pressure applications for their cost-effectiveness. Casing pipes are essential for well integrity and zonal isolation, while drill pipes are critical for transmitting drilling torque and fluid. Tubing and line pipes facilitate the safe transport of oil and gas, and the 'others' segment includes specialty products such as premium connections and corrosion-resistant alloys.

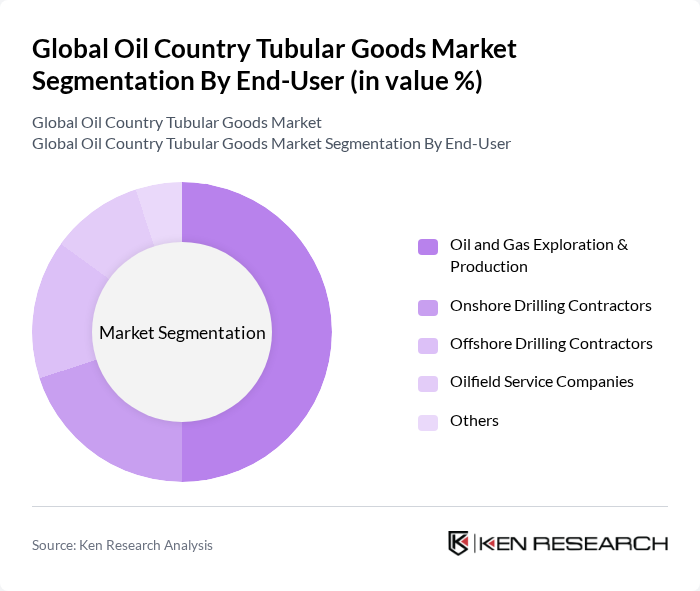

By End-User:The end-user segmentation includes oil and gas exploration & production, onshore drilling contractors, offshore drilling contractors, oilfield service companies, and others.Oil and gas exploration & productionis the largest segment, driven by global energy demand and ongoing investments in both conventional and unconventional reserves. Onshore and offshore drilling contractors are significant consumers of OCTG, supporting increased rig counts and deeper drilling activities. Oilfield service companies utilize tubular goods for well maintenance and intervention, while the 'others' category covers niche applications such as geothermal and carbon capture projects.

The Global Oil Country Tubular Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tenaris S.A., Vallourec S.A., National Oilwell Varco, Inc., United States Steel Corporation, TMK Group, JFE Steel Corporation, ArcelorMittal S.A., Sumitomo Corporation, Nippon Steel Corporation, Hunting PLC, ChelPipe Group, SeAH Steel Holdings, Tata Steel Limited, Benteler International AG, Sandvik AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the OCTG market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt digital solutions and advanced manufacturing techniques, operational efficiencies are expected to improve. Additionally, the integration of IoT in supply chain management will enhance transparency and reduce costs. These trends, coupled with a focus on safety and quality standards, will likely shape the market landscape, fostering innovation and resilience in the face of challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Seamless Tubes Welded Tubes Casing Pipes Drill Pipes Tubing Line Pipes Others |

| By End-User | Oil and Gas Exploration & Production Onshore Drilling Contractors Offshore Drilling Contractors Oilfield Service Companies Others |

| By Application | Drilling Production Transportation Well Completion Others |

| By Process | Seamless Electric Resistance Welded (ERW) Others |

| By Grade | API Grade Premium Grade Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 100 | Drilling Engineers, Project Managers |

| Manufacturers of Tubular Goods | 80 | Production Managers, Sales Directors |

| Oilfield Service Providers | 70 | Operations Managers, Technical Specialists |

| Regulatory Bodies | 40 | Policy Analysts, Compliance Officers |

| Industry Associations | 50 | Research Analysts, Advocacy Directors |

The Global Oil Country Tubular Goods Market is valued at approximately USD 35 billion, driven by increasing energy demand in emerging economies and advancements in drilling technologies that enhance the efficiency and reliability of tubular goods.