Global Online Advertising Market Outlook to 2030

Region:Global

Author(s):Rebecca

Product Code:KROD-023

June 2025

80

About the Report

Global Online Advertising Market Overview

- The Global Online Advertising Market was valued at USD 298 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet, the rise of social media platforms, and the growing trend of digital marketing among businesses. The shift from traditional advertising to online channels has significantly contributed to the market's expansion, as companies seek to reach their target audiences more effectively and efficiently.

- The United States, China, and the United Kingdom are dominant players in the online advertising market. The U.S. leads due to its advanced technological infrastructure, high internet penetration, and a large number of digital marketing agencies. China follows closely, driven by its massive population and the rapid growth of e-commerce platforms. The UK benefits from a strong digital economy and a high level of consumer engagement with online content.

- In 2023, the European Union implemented the Digital Services Act, which aims to create a safer digital space by regulating online advertising practices. This legislation requires companies to be more transparent about their advertising algorithms and data usage, ensuring that consumers are better informed about how their data is utilized in targeted advertising campaigns.

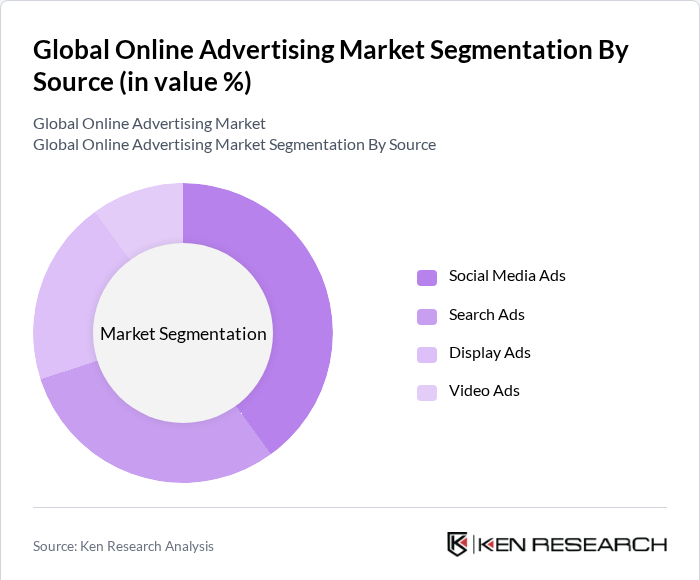

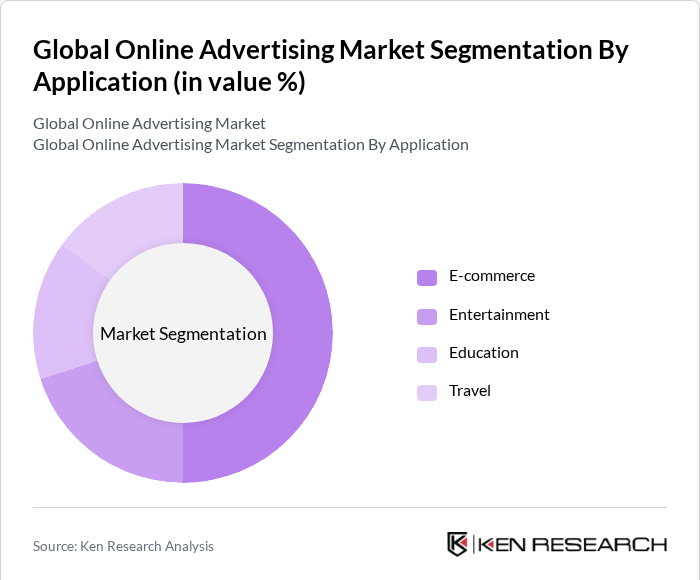

Global Online Advertising Market Segmentation

By Source: The online advertising market is primarily segmented into search ads, display ads, social media ads, and video ads. Among these, social media ads account foor largest market share of total digital ad spend, surpassing previous expectations. This segment benefits from the high intent of users, leading to better conversion rates. Additionally, the growing trend of mobile search has further propelled the demand for search ads, as more consumers rely on their smartphones for information and shopping.

By Application: The applications of online advertising are diverse, including e-commerce, entertainment, education, and travel. The e-commerce segment is the most significant contributor to the market, driven by the increasing number of online shoppers and the growing trend of digital marketing strategies among retailers. The rise of mobile commerce has also played a crucial role in enhancing the effectiveness of online advertising in this sector, as businesses leverage targeted ads to reach potential customers at various stages of the purchasing journey.

Global Online Advertising Market Competitive Landscape

The Global Online Advertising Market is characterized by intense competition among key players such as Google, Facebook, Amazon, and Alibaba. These companies dominate the landscape due to their extensive user bases, advanced advertising technologies, and significant investments in data analytics. The market is also witnessing the emergence of new players leveraging innovative advertising solutions, which adds to the competitive dynamics.

Global Online Advertising Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration: As of 2024, global internet penetration has reached approximately 66%, with over 5.35 billion people online worldwide. This expanding connectivity is a powerful driver for digital businesses, particularly in online advertising, as companies increasingly target this vast and growing audience through digital channels. The surge in smartphone usage—exceeding 4.3 billion subscriptions globally—further amplifies access to online platforms, enabling consumers to engage with content, services, and advertisements anytime and anywhere.

- Shift Towards Digital Marketing: In 2024, there is a clear and accelerating shift from traditional advertising to digital marketing, driven by businesses’ increasing demand for measurable results and higher return on investment (ROI). Companies are leveraging data-driven strategies that utilize advanced analytics, enabling them to precisely target audiences, optimize campaign performance in real-time, and allocate budgets more efficiently. This transition is supported by the widespread adoption of technologies such as programmatic advertising, AI-powered customer segmentation, and personalized content delivery, which enhance engagement and conversion rates.

- Enhanced Targeting Capabilities: The integration of advanced data analytics tools is revolutionizing online advertising by enabling highly precise audience segmentation based on behavior, preferences, and demographics. As of mid-2024, approximately 63% of marketing professionals rated their data-driven strategies as somewhat successful, with another 32% considering them very successful, highlighting the effectiveness of these approaches.

Market Challenges

- Ad Blocker Usage: The growing use of ad blockers is significantly impacting the reach and effectiveness of online advertising campaigns. This trend presents a challenge for advertisers, as it reduces their ability to connect with potential customers. Consumer frustration with intrusive or irrelevant ads is driving this shift, prompting marketers to adopt more engaging, non-disruptive strategies to capture and retain audience attention.

- Privacy Concerns and Regulations: The introduction of stringent data protection regulations, such as GDPR and CCPA, is creating new challenges for online advertisers. Ensuring compliance requires substantial investment in secure data management and transparent privacy practices. Additionally, heightened consumer awareness around data privacy is contributing to increased skepticism toward data collection, potentially undermining the effectiveness of targeted advertising and diminishing overall consumer trust.

Global Online Advertising Market Future Outlook

The future of online advertising is poised for transformative growth, driven by technological advancements and evolving consumer behaviors. As artificial intelligence and machine learning continue to enhance targeting and personalization, advertisers will increasingly leverage these tools to create more engaging content. Additionally, the rise of immersive formats, such as augmented reality ads, is expected to capture consumer interest. With the ongoing expansion of e-commerce, businesses will likely invest more in digital advertising to reach their target audiences effectively, ensuring sustained market growth.

Market Opportunities

- Growth of E-commerce: The e-commerce sector is projected to surpass $6 trillion in sales by 2024, presenting a significant opportunity for online advertisers. As more consumers shift to online shopping, businesses will increasingly invest in targeted advertising to drive traffic and conversions, creating a robust demand for innovative advertising solutions tailored to e-commerce platforms.

- Expansion of Social Media Advertising: With over 5 billion social media users expected in 2024, the potential for social media advertising is immense. Brands are likely to allocate a larger portion of their marketing budgets to social platforms, capitalizing on their ability to reach diverse audiences. This trend will drive the development of new ad formats and strategies, enhancing engagement and brand visibility.

Scope of the Report

| By Source |

Search Ads Display Ads Social Media Ads Video Ads |

| By Application |

E-commerce Entertainment Education Travel |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Advertising Format |

Text Ads Image Ads Rich Media Ads Native Ads |

| By Targeting Method |

Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Trade Commission, European Commission)

Advertising Agencies

Media Buying Firms

Digital Marketing Platforms

Brand Managers and Marketing Executives

Data Analytics Companies

Telecommunications Companies

Companies

Players Mentioned in the Report:

Google

Facebook

Amazon

Alibaba

Twitter

AdSphere

ClickWave

PromoPulse

MarketMingle

AdVantage Solutions

Table of Contents

1. Global Online Advertising Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Online Advertising Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Online Advertising Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Internet Penetration and Smartphone Usage

3.1.2. Shift Towards Digital Marketing Strategies by Businesses

3.1.3. Enhanced Targeting Capabilities through Data Analytics

3.2. Market Challenges

3.2.1. Ad Blocker Usage Among Consumers

3.2.2. Privacy Concerns and Data Protection Regulations

3.2.3. Intense Competition Among Advertising Platforms

3.3. Opportunities

3.3.1. Growth of E-commerce and Online Retail

3.3.2. Expansion of Social Media Advertising

3.3.3. Innovations in Ad Formats and Technologies

3.4. Trends

3.4.1. Rise of Video Advertising and Live Streaming

3.4.2. Increased Focus on Personalization and User Experience

3.4.3. Integration of Artificial Intelligence in Ad Campaigns

3.5. Government Regulation

3.5.1. Compliance with GDPR and CCPA Regulations

3.5.2. Advertising Standards and Guidelines by Regulatory Bodies

3.5.3. Restrictions on Data Collection and Usage

3.5.4. Impact of Taxation Policies on Digital Advertising

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Online Advertising Market Segmentation

4.1. By Source

4.1.1. Search Ads

4.1.2. Display Ads

4.1.3. Social Media Ads

4.1.4. Video Ads

4.2. By Application

4.2.1. E-commerce

4.2.2. Entertainment

4.2.3. Education

4.2.4. Travel

4.3. By Region

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

4.4. By Advertising Format

4.4.1. Text Ads

4.4.2. Image Ads

4.4.3. Rich Media Ads

4.4.4. Native Ads

4.5. By Targeting Method

4.5.1. Demographic Targeting

4.5.2. Behavioral Targeting

4.5.3. Contextual Targeting

4.5.4. Retargeting

5. Global Online Advertising Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Google

5.1.2. Facebook

5.1.3. Amazon

5.1.4. Alibaba

5.1.5. Twitter

5.1.6. AdSphere

5.1.7. ClickWave

5.1.8. PromoPulse

5.1.9. MarketMingle

5.1.10. AdVantage Solutions

5.2. Cross Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Revenue Growth Rate

5.2.3. Customer Acquisition Cost

5.2.4. Return on Advertising Spend (ROAS)

5.2.5. Click-Through Rate (CTR)

5.2.6. Conversion Rate

5.2.7. Customer Lifetime Value (CLV)

5.2.8. Average Order Value (AOV)

5.2.9. Engagement Rate

5.2.10. Brand Awareness Metrics

6. Global Online Advertising Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Online Advertising Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Online Advertising Market Future Market Segmentation

8.1. By Source

8.1.1. Search Ads

8.1.2. Display Ads

8.1.3. Social Media Ads

8.1.4. Video Ads

8.2. By Application

8.2.1. E-commerce

8.2.2. Entertainment

8.2.3. Education

8.2.4. Travel

8.3. By Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia-Pacific

8.3.4. Latin America

8.3.5. Middle East & Africa

8.4. By Advertising Format

8.4.1. Text Ads

8.4.2. Image Ads

8.4.3. Rich Media Ads

8.4.4. Native Ads

8.5. By Targeting Method

8.5.1. Demographic Targeting

8.5.2. Behavioral Targeting

8.5.3. Contextual Targeting

8.5.4. Retargeting

9. Global Online Advertising Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Online Advertising Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Online Advertising Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Online Advertising Market.

Frequently Asked Questions

01. How big is the Global Online Advertising Market?

The Global Online Advertising Market is valued at USD 298 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Online Advertising Market?

Key challenges in the Global Online Advertising Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Online Advertising Market?

Major players in the Global Online Advertising Market include Google, Facebook, Amazon, Alibaba, Twitter, among others.

04. What are the growth drivers for the Global Online Advertising Market?

The primary growth drivers for the Global Online Advertising Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.