Global Online Clothing Rental Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD6761

November 2024

96

About the Report

Global Online Clothing Rental Market Overview

- The USA Online Clothing Rental market is valued at USD 1.5 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for sustainable fashion options, the growing trend of experiential consumption, and the convenience provided by digital rental platforms. With the rise of environmentally conscious consumers and the financial benefits of clothing rentals, more individuals are opting for temporary use of high-end fashion items. This shift is particularly evident in urban centers where access to premium fashion is highly sought after for events and professional engagements.

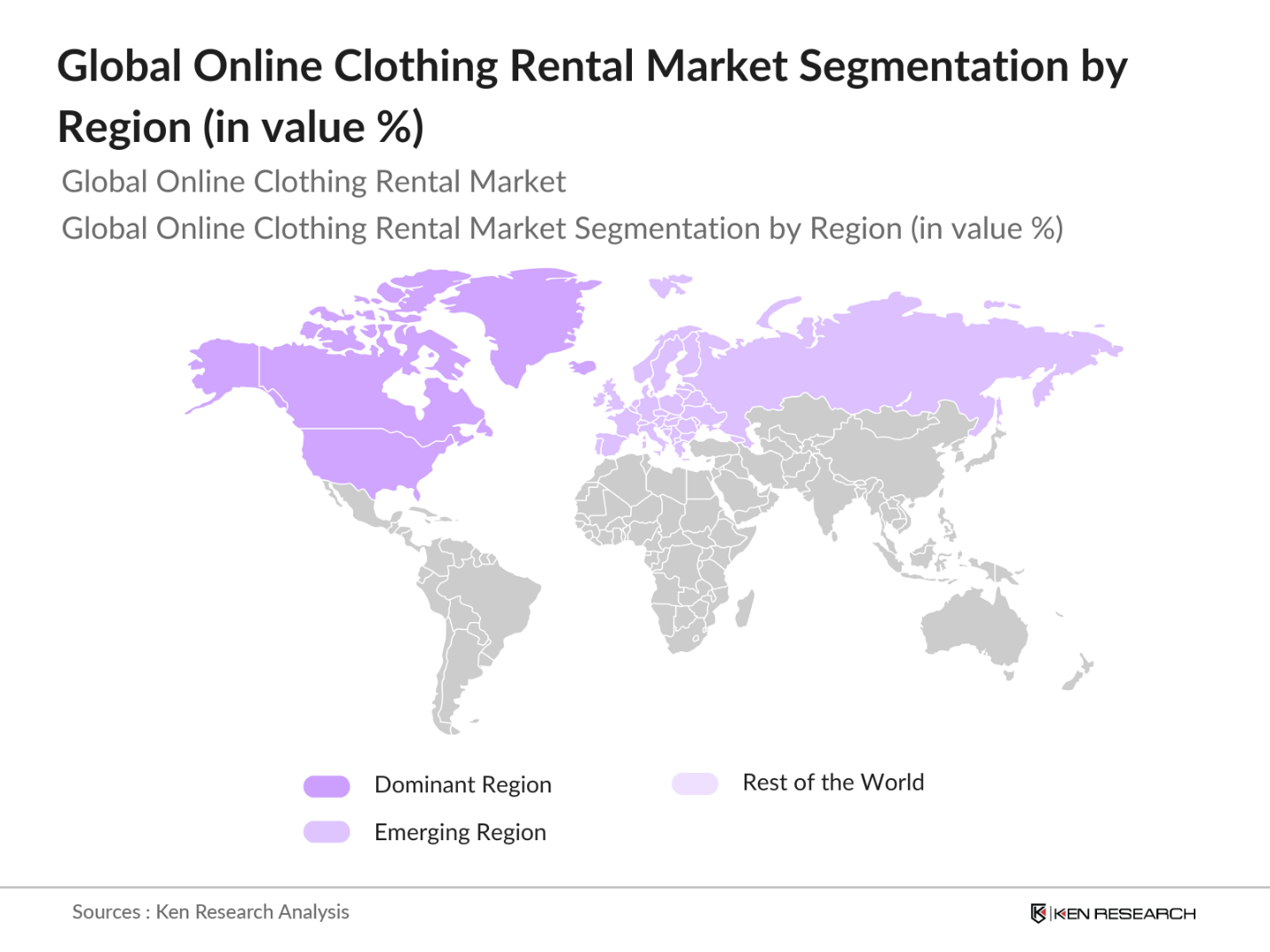

- The global online clothing rental market is dominated by North America and Europe, particularly by cities like New York, Los Angeles, London, and Paris. These regions benefit from a combination of high disposable income, fashion-forward consumers, and strong e-commerce infrastructure. Additionally, the growing popularity of shared economy models in urban areas, where consumers prioritize experiences over ownership, plays a critical role in driving the adoption of clothing rental services in these cities.

- Online clothing rental platforms must comply with e-commerce regulations that protect consumer rights. In 2022, global e-commerce regulations were updated to include stringent consumer protection measures, as reported by the UNCTAD. These regulations ensure transparency in rental agreements, return policies, and consumer privacy, especially in countries with strong digital consumer rights frameworks like the EU. Regulatory compliance remains critical to maintaining consumer trust and mitigating legal risks.

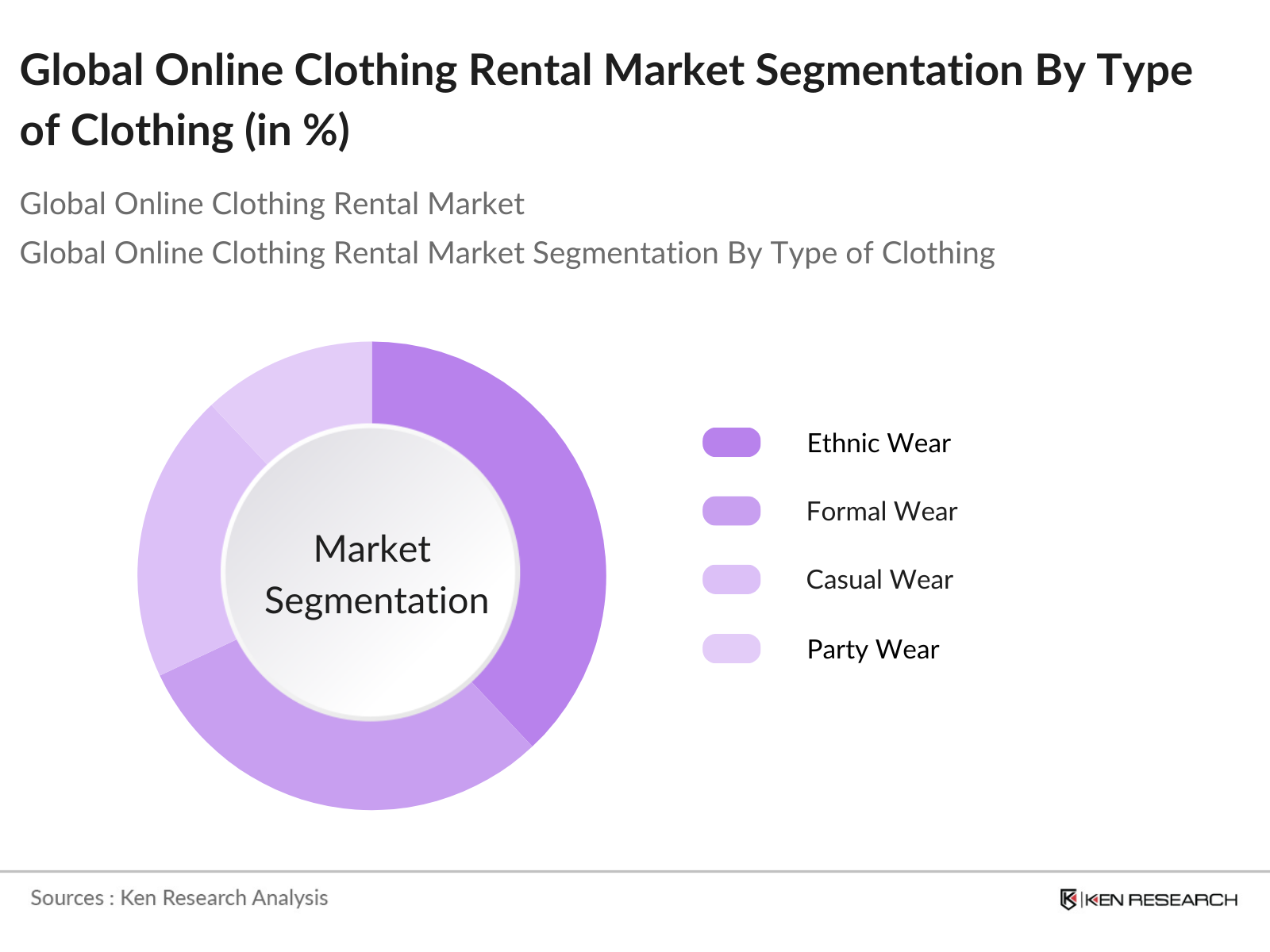

Global Online Clothing Rental Market Segmentation

By Type of Clothing: The global online clothing rental market is segmented by type of clothing into ethnic wear, formal wear, casual wear, and party wear. In 2023, ethnic wear maintained a dominant market share within the clothing rental segment, especially in regions like Asia-Pacific, where traditional attire is frequently worn for weddings and other special occasions.

By End-User: The online clothing rental market is further divided into women, men, and children. In 2023, women accounted for the largest market share, owing to their higher demand for occasion-specific clothing like formal dresses and evening gowns. Additionally, womens fashion often demands more variety in styles, colors, and sizes, which fuels the popularity of rental services in this segment.

By Region: The market is divided into five key regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, North America held the largest market share due to a combination of advanced digital infrastructure, a strong base of fashion-conscious consumers, and early adoption of subscription-based clothing rental models.

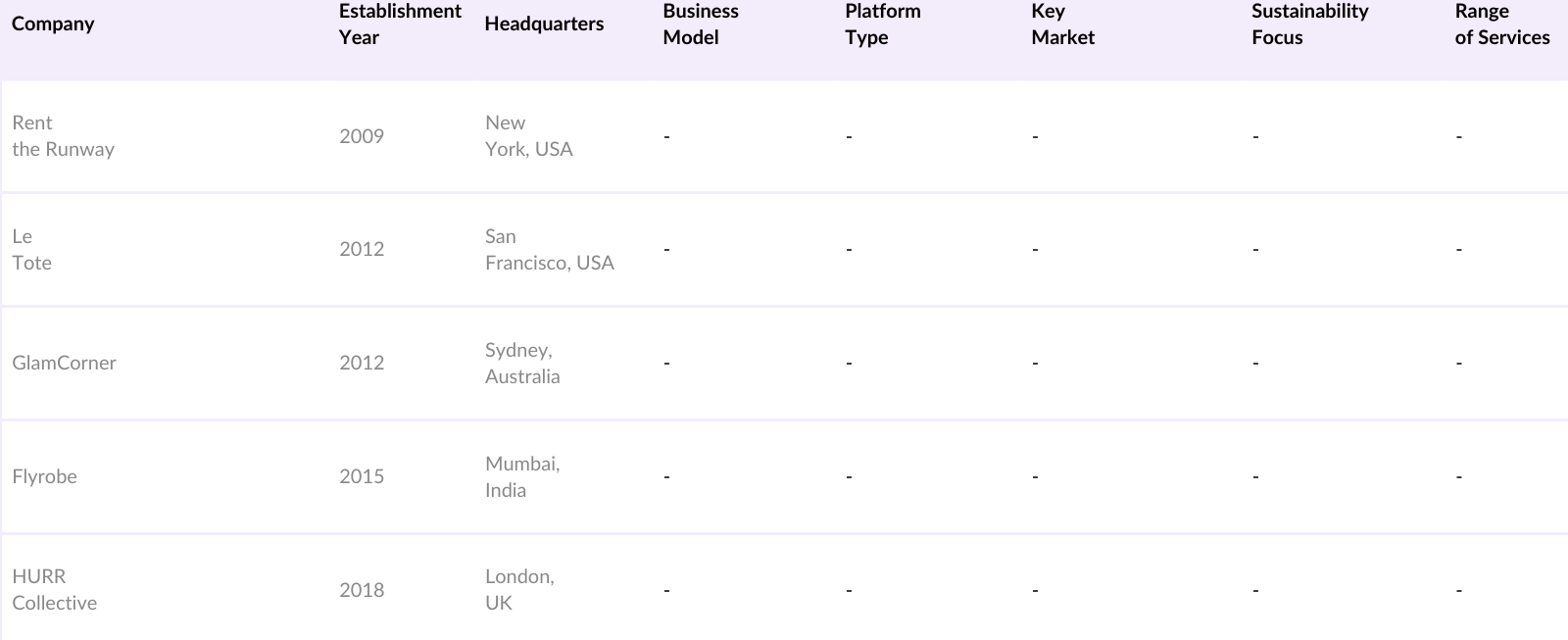

Global Online Clothing Rental Market Competitive Landscape

The global online clothing rental market is dominated by several key players who have established themselves through diverse service offerings, strong customer loyalty, and innovative business models. These players are heavily concentrated in North America and Europe, where consumer demand for fashion rentals is higher due to economic and environmental factors.

Global Online Clothing Rental Industry Analysis

Growth Drivers

- Rising Consumer Demand for Sustainable Fashion: The demand for sustainable fashion is increasing, especially as environmental concerns rise. According to the World Bank, the fashion industry accounts for about 10% of global carbon emissions, driving consumers towards eco-friendly solutions like clothing rental. The UNs Sustainable Development Goals for 2030 emphasize reducing waste and fostering circular economies, pushing the demand for clothing rental services. In 2022, global CO2 emissions from textile production were estimated at 1.2 billion metric tons.

- Increasing Online Shopping Penetration: The rapid expansion of online shopping globally supports the clothing rental industry. With 5.4 billion people using the internet by 2024 (World Bank), the digitalization of the economy has transformed consumer shopping behaviors. In 2023, e-commerce sales contributed to approximately 22% of global retail sales, further propelling rental platforms growth. The World Economic Forum reported that over 2 billion people purchased goods online in 2022, signaling a massive market for rental fashion as convenience and accessibility drive demand.

- Growing Popularity of Sharing Economy: The clothing rental market benefits from the wider adoption of the sharing economy, valued at around USD 1.4 trillion by 2023, as reported by the World Bank. With sectors like transportation and accommodation thriving on the sharing model, apparel rental has followed suit. Global macroeconomic instability and income inequality have influenced consumer decisions to rent rather than own, creating significant momentum for online clothing rentals as part of the global sharing economy movement.

Market Challenges

- High Logistics and Operational Costs: Online clothing rental platforms face significant logistical hurdles, including high transportation and return costs. With fuel prices increasing by nearly 30% from 2021 to 2023 (World Bank), operational costs for rental services have also risen. These expenses, coupled with the need for timely deliveries and product maintenance, place considerable financial strain on businesses. Supply chain disruptions, such as those witnessed during the COVID-19 pandemic, further exacerbate these challenges, affecting profitability and scalability.

- Difficulty in Retaining Customer Loyalty: Retention in the online clothing rental market is tough, given the wide range of options available to consumers. The global churn rate for subscription-based services in 2023 averaged 35%, as per IMF data. The transient nature of fashion, coupled with the competitive landscape, makes it difficult for companies to build long-term customer relationships. Customers often seek novelty, leading to high acquisition costs and low lifetime value for businesses in the rental space.

Global Online Clothing Rental Market Future Outlook

The global online clothing rental market is expected to experience substantial growth over the next five years, driven by the continued rise of e-commerce, technological advancements like virtual try-on solutions, and increasing consumer preference for sustainable fashion choices. The shift towards circular fashion models and reduced clothing waste is also anticipated to boost the market further.

Market Opportunities

- Technological Integration (AI-based Personalization, Virtual Try-On): Advancements in AI technology have revolutionized the clothing rental market. AI-driven personalization enhances the user experience by tailoring recommendations based on individual preferences. In 2023, AI accounted for USD 137 billion in global tech spending, and this is directly benefiting rental platforms by improving customer satisfaction and retention. Virtual try-on tools, powered by AR, are also gaining traction, reducing return rates and enhancing online shopping experiences in the rental sector.

- Expansion in Emerging Markets (Asia-Pacific, Latin America): Emerging markets present a significant opportunity for the clothing rental industry. Asia-Pacific and Latin America are witnessing rising internet penetration, with 3.1 billion internet users in these regions by 2024 (World Bank). This growing digital presence, combined with an increasing middle class and urbanization, supports the adoption of clothing rental services.

Scope of the Report

|

By Type of Clothing |

Ethnic Wear Formal Wear Casual Wear Party Wear |

|

By End-User |

Women Men Children |

|

By Business Model |

Standalone Rental Services Peer-to-Peer Platforms Subscription Models |

|

By Distribution Channel |

Online Platforms Offline Stores |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Online Clothing Rental Platforms

Apparel Manufacturers

E-commerce and Fashion Retailers

Logistics and Delivery Services Providers

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Consumer Protection Agencies, Environmental Regulatory Authorities)

Luxury Fashion Brands

Subscription Model Operators

Companies

Players Mentioned in the Report

Rent the Runway

Le Tote

GlamCorner

Flyrobe

HURR Collective

Style Lend

Dress & Go

YCloset

The Volte

Tulerie

Table of Contents

1. Global Online Clothing Rental Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. Global Online Clothing Rental Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Online Clothing Rental Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Demand for Sustainable Fashion

3.1.2. Increasing Online Shopping Penetration

3.1.3. Growing Popularity of Sharing Economy

3.1.4. Shifting Consumer Preferences Towards Affordability and Variety

3.2. Market Challenges

3.2.1. Concerns over Hygiene and Wearability

3.2.2. High Logistics and Operational Costs

3.2.3. Difficulty in Retaining Customer Loyalty

3.3. Opportunities

3.3.1. Technological Integration (AI-based personalization, Virtual Try-On)

3.3.2. Expansion in Emerging Markets (Asia-Pacific, Latin America)

3.3.3. Increasing Collaborations with Luxury Brands

3.4. Trends

3.4.1. Rising Demand for Gender-Neutral Fashion

3.4.2. Subscription-Based Rental Models

3.4.3. Integration of Circular Fashion in Rental Services

3.4.4. Adoption of Blockchain for Clothing Ownership Verification

3.5. Regulatory Landscape

3.5.1. E-commerce and Consumer Protection Regulations

3.5.2. Environmental Impact and Sustainability Standards

3.5.3. Intellectual Property Concerns in Fashion Rentals

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Online Clothing Rental Market Segmentation

4.1. By Type of Clothing (In Value %)

4.1.1. Ethnic Wear

4.1.2. Formal Wear

4.1.3. Casual Wear

4.1.4. Party Wear

4.2. By End-User (In Value %)

4.2.1. Women

4.2.2. Men

4.2.3. Children

4.3. By Business Model (In Value %)

4.3.1. Standalone Rental Services

4.3.2. Peer-to-Peer Platforms

4.3.3. Subscription Models

4.4. By Distribution Channel (In Value %)

4.4.1. Online Platforms

4.4.2. Offline Stores

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Online Clothing Rental Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Rent the Runway

5.1.2. Le Tote

5.1.3. GlamCorner

5.1.4. HURR Collective

5.1.5. Style Lend

5.1.6. Flyrobe

5.1.7. Dress & Go

5.1.8. YCloset

5.1.9. The Volte

5.1.10. Tulerie

5.1.11. Armoire

5.1.12. MyWardrobeHQ

5.1.13. Bag Borrow or Steal

5.1.14. Covetella

5.1.15. RentMyWardrobe

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Platform Type, Business Model, Market Presence, Service Range)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Global Online Clothing Rental Market Regulatory Framework

6.1. E-commerce Standards and Regulations

6.2. Consumer Protection Laws

6.3. Environmental Sustainability Compliance

6.4. Industry-Specific Certifications

7. Global Online Clothing Rental Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Online Clothing Rental Future Market Segmentation

8.1. By Type of Clothing (In Value %)

8.2. By End-User (In Value %)

8.3. By Business Model (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Online Clothing Rental Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavioral Analysis

9.3. Marketing and Branding Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping the key variables driving the online clothing rental market, including consumer preferences, sustainability factors, and technological advancements. Data was gathered from a combination of proprietary databases and secondary sources such as industry reports and government publications.

Step 2: Market Analysis and Construction

A comprehensive analysis of the historical data for the market was carried out to assess the trends, growth rate, and revenue generation. The data was cross-referenced with market penetration statistics and financial reports from leading companies in the industry.

Step 3: Hypothesis Validation and Expert Consultation

Interviews were conducted with market experts, including executives from clothing rental platforms and industry analysts. These consultations helped refine our understanding of the market dynamics, particularly around consumer behavior and pricing strategies.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing all the gathered data into a cohesive market analysis. Additional insights from peer-to-peer rental platforms and customer feedback were included to enhance the depth and reliability of the report.

Frequently Asked Questions

01. How big is the Global Online Clothing Rental Market?

The USA Online Clothing Rental market is valued at USD 1.5 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for sustainable fashion options, the growing trend of experiential consumption, and the convenience provided by digital rental platforms.

02. What are the key challenges in the Global Online Clothing Rental Market?

Key challenges include high logistics and operational costs, concerns over hygiene and garment quality, and consumer hesitance towards renting clothing. Additionally, retaining customer loyalty in a highly competitive market remains a major hurdle.

03. Who are the major players in the Global Online Clothing Rental Market?

The major players include Rent the Runway, Le Tote, GlamCorner, Flyrobe, and HURR Collective. These companies dominate the market due to their strong service offerings, customer loyalty, and innovative business models.

04. What are the growth drivers of the Global Online Clothing Rental Market?

The growth of the market is driven by consumer demand for variety in clothing without ownership costs, the rise of the shared economy, and increasing environmental awareness. Technological advancements in e-commerce platforms also support market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.