Global Online Insurance Market Outlook to 2030

Region:Global

Author(s):Geetanshi

Product Code:KROD-017

June 2025

90

About the Report

Global Online Insurance Market Overview

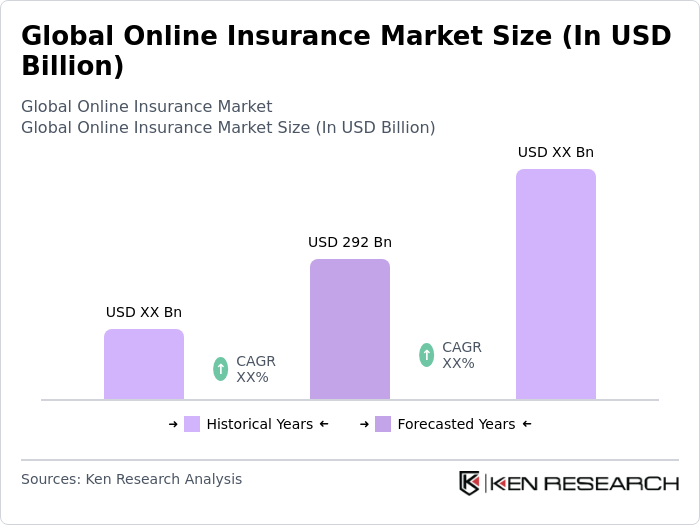

- The Global Online Insurance Market was valued at USD 292 billion, based on a five-year historical analysis. This robust valuation reflects the rapid adoption of digital platforms for insurance services, enhanced customer experience through technology, and the rising demand for personalized insurance products. The acceleration of online channel adoption was notably driven by the COVID-19 pandemic, which increased consumer preference for convenient and accessible insurance solutions.

- Key players in this market include the United States, the United Kingdom, and Germany. These countries maintain dominance due to advanced technological infrastructure, high internet penetration rates, and strong regulatory frameworks that support digital insurance solutions. The presence of major insurance companies and innovative startups in these regions continues to foster competition and drive market growth.

- In 2023, the European Union reinforced consumer protection in the online insurance sector through the Insurance Distribution Directive (IDD). This regulation mandates that insurance providers ensure transparency and provide clear information regarding policy terms and conditions, aiming to build consumer trust and promote fair competition among online insurance providers.

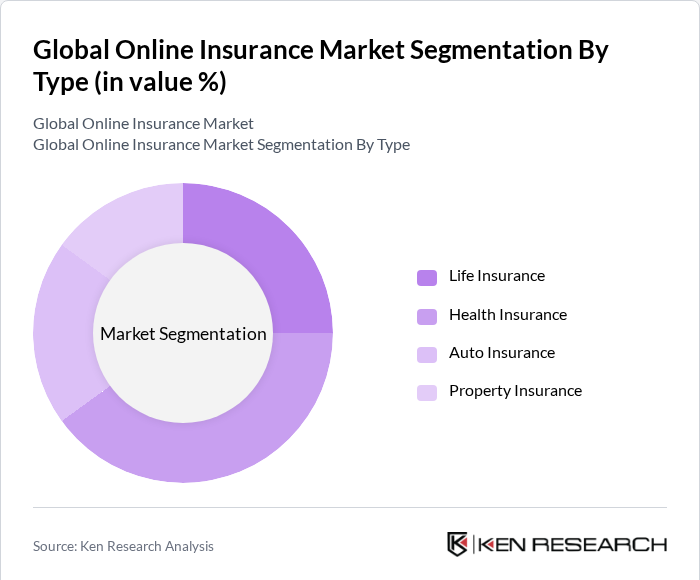

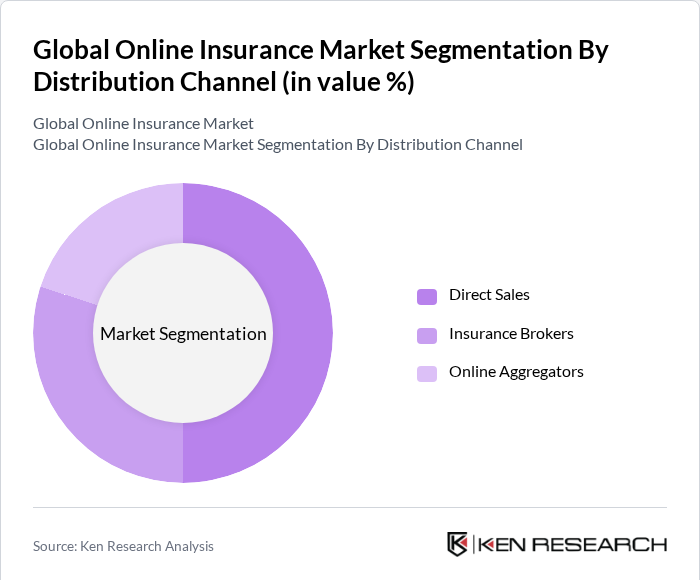

Global Online Insurance Market Segmentation

By Type: The online insurance market is segmented into life insurance and non-life insurance, with further breakdowns commonly including health, auto, and property insurance. Among these, health insurance is the leading sub-segment, driven by heightened awareness of health issues and rising healthcare costs. Consumers increasingly prefer online platforms for purchasing health insurance due to convenience and the ability to compare plans. The demand for personalized health insurance products, especially post-pandemic, continues to fuel this growth.

By Distribution Channel: The market is segmented into direct sales, insurance brokers, and online aggregators. Direct sales remain the leading sub-segment, as consumers increasingly purchase insurance directly from providers’ websites. This is supported by growing trust in online transactions and the ease of accessing information directly from insurers. Online aggregators are also gaining traction, enabling consumers to compare multiple insurance products and prices for a better purchasing experience.

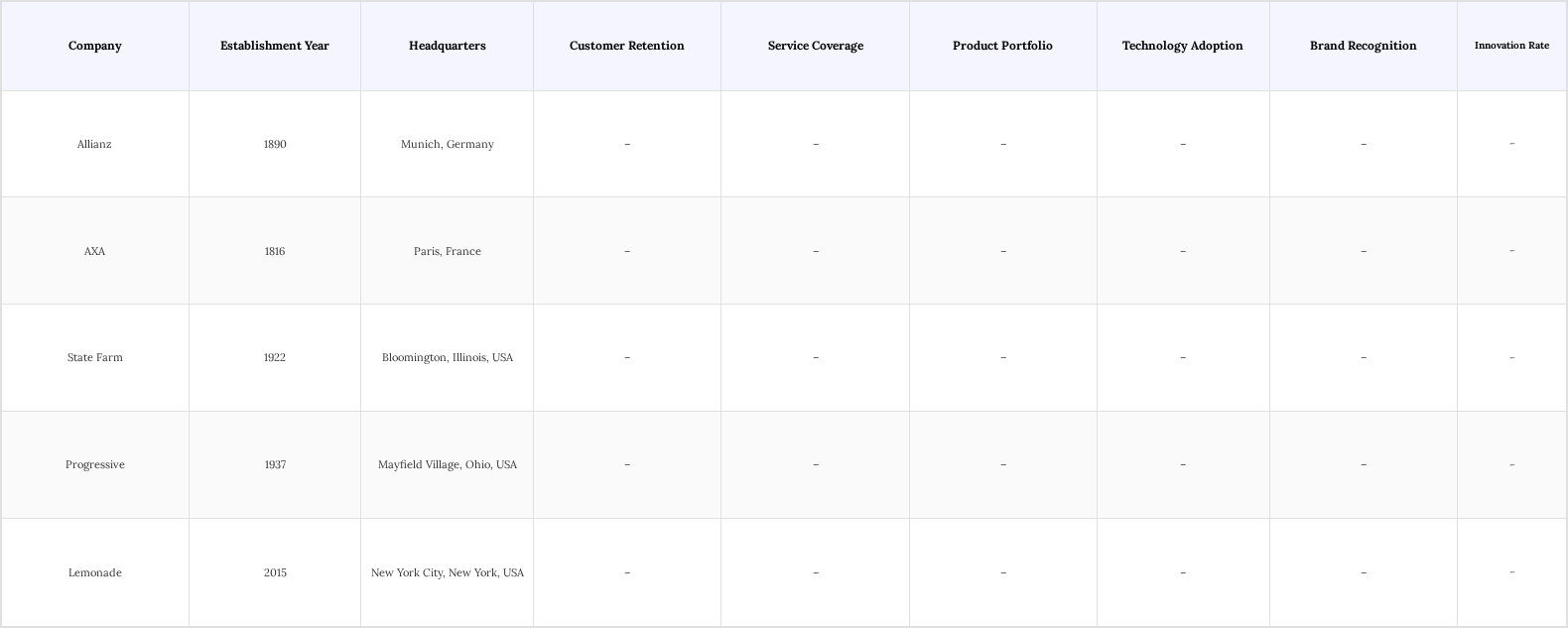

Global Online Insurance Market Competitive Landscape

The Global Online Insurance Market is characterized by a competitive landscape with several key players, including Allianz, AXA, State Farm, Progressive, and Lemonade. These companies leverage technology to enhance customer experience and streamline operations, leading to increased market penetration and customer retention. The market is marked by innovation, with many firms investing in digital platforms and personalized insurance solutions to meet evolving consumer demands.

Global Online Insurance Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration: Global internet penetration reached approximately 68% in 2024, with about 5.5 billion users worldwide, up from 65% the previous year, reflecting a growing digital population. Regions like India and Brazil are experiencing rapid internet growth rates of around 8% and 6% respectively, significantly expanding access to online services. Enhanced internet access enables consumers to easily compare and purchase insurance policies online, driving demand for digital insurance platforms and expanding market reach in previously underserved areas.

- Demand for Convenient Solutions: In 2024, approximately 60% of consumers prefer purchasing insurance online, driven by the convenience and accessibility digital platforms offer. This trend is especially strong in urban areas, where busy lifestyles increase the demand for quick, efficient insurance solutions. The widespread adoption of mobile applications further enhances this preference, enabling users to easily compare policies, purchase coverage, and manage their insurance directly from smartphones.

- InsurTech Innovations: The InsurTech sector is experiencing rapid growth, driven by advanced technologies that enhance customer experience and operational efficiency. In 2024, over 40% of insurance transactions involved some form of automation, including AI-driven chatbots and personalized policy recommendations, which streamline underwriting, claims processing, and customer engagement. Artificial intelligence (AI) and machine learning (ML) are key drivers, enabling faster, more accurate decision-making and fraud detection.

Market Challenges

- Data Privacy and Security Concerns: With the rise of online transactions, data privacy remains a significant challenge for the online insurance market. Increased awareness around data breaches and cyber threats has led to heightened scrutiny from regulatory bodies and consumers alike. Insurers must invest in robust cybersecurity measures to protect sensitive customer data and maintain trust. However, these efforts can place additional strain on resources and impact overall profitability.

- Regulatory Compliance: The online insurance market operates within a complex and evolving regulatory environment that varies across regions. Adhering to frameworks such as GDPR and other local data protection laws can be particularly challenging for smaller firms. Failure to comply can result in severe penalties and reputational harm, making it critical for insurers to remain agile and informed in order to navigate the changing legal landscape effectively.

Global Online Insurance Market Future Outlook

The future of the online insurance market appears promising, driven by technological advancements and evolving consumer preferences. As digital transformation continues, insurers are likely to adopt more sophisticated tools for risk assessment and customer engagement. The integration of AI and machine learning will enhance underwriting processes, while personalized insurance products will cater to diverse consumer needs. Additionally, the expansion into emerging markets presents significant growth potential, as more individuals seek accessible insurance solutions in these regions.

Market Opportunities

- Expansion into Emerging Markets: Emerging markets present a substantial opportunity for online insurance providers. With a growing middle class and increasing internet access, countries like India and Indonesia are expected to see a surge in insurance demand. By 2025, the insurance penetration rate in these regions could increase substantially, offering insurers a chance to tap into a previously underserved customer base and drive revenue growth.

- Development of Personalized Insurance Products: The trend toward personalized insurance is accelerating, with insurers leveraging data analytics and digital platforms to tailor policies to individual customer needs. In 2025, about 20% of new insurance policies are expected to be customized, reflecting rising consumer demand for coverage that aligns with their lifestyles, risk profiles, and budgets.

Scope of the Report

| By Product Type |

Life Insurance Health Insurance Auto Insurance Property Insurance |

| By Distribution Channel |

Direct Sales Insurance Brokers Online Aggregators |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Type |

Individual Customers Corporate Customers |

| By Payment Mode |

Monthly Payment Annual Payment One-time Payment |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Financial Conduct Authority, Insurance Regulatory and Development Authority)

Insurance Companies and Underwriters

Insurance Brokers and Agents

Technology Providers and Insurtech Startups

Reinsurers

Industry Associations and Trade Organizations

Financial Institutions and Banks

Companies

Players Mentioned in the Report:

Allianz

AXA

State Farm

Progressive

Lemonade

InsureTech Innovations

GlobalGuard Insurance

CoverWise Solutions

SafeHaven Online Insurance

ShieldNet Insurance Services

Table of Contents

1. Global Online Insurance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Online Insurance Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Online Insurance Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Internet Penetration and Smartphone Usage

3.1.2. Growing Demand for Convenient and Accessible Insurance Solutions

3.1.3. Rise of InsurTech Innovations Enhancing Customer Experience

3.2. Market Challenges

3.2.1. Data Privacy and Security Concerns

3.2.2. Regulatory Compliance and Legal Frameworks

3.2.3. High Competition Among Online Insurance Providers

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Development of Personalized Insurance Products

3.3.3. Integration of AI and Machine Learning for Risk Assessment

3.4. Trends

3.4.1. Shift Towards Digital-First Insurance Models

3.4.2. Increased Use of Big Data Analytics in Underwriting

3.4.3. Growing Popularity of Peer-to-Peer Insurance Models

3.5. Government Regulation

3.5.1. Overview of Regulatory Bodies Governing Online Insurance

3.5.2. Impact of GDPR on Data Handling Practices

3.5.3. Licensing Requirements for Online Insurance Providers

3.5.4. Consumer Protection Laws Affecting Online Transactions

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Online Insurance Market Segmentation

4.1. By Product Type

4.1.1. Life Insurance

4.1.2. Health Insurance

4.1.3. Auto Insurance

4.1.4. Property Insurance

4.2. By Distribution Channel

4.2.1. Direct Sales

4.2.2. Insurance Brokers

4.2.3. Online Aggregators

4.3. By Region

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

4.4. By Customer Type

4.4.1. Individual Customers

4.4.2. Corporate Customers

4.5. By Payment Mode

4.5.1. Monthly Payment

4.5.2. Annual Payment

4.5.3. One-time Payment

5. Global Online Insurance Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Allianz

5.1.2. AXA

5.1.3. State Farm

5.1.4. Progressive

5.1.5. Lemonade

5.1.6. InsureTech Innovations

5.1.7. GlobalGuard Insurance

5.1.8. CoverWise Solutions

5.1.9. SafeHaven Online Insurance

5.1.10. ShieldNet Insurance Services

5.2. Cross Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Customer Satisfaction Ratings

5.2.3. Average Policy Premiums

5.2.4. Claims Settlement Ratio

5.2.5. Digital Engagement Metrics

5.2.6. Product Diversification Index

5.2.7. Innovation Index

5.2.8. Brand Recognition Score

6. Global Online Insurance Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Online Insurance Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Online Insurance Market Future Market Segmentation

8.1. By Product Type

8.1.1. Life Insurance

8.1.2. Health Insurance

8.1.3. Auto Insurance

8.1.4. Property Insurance

8.2. By Distribution Channel

8.2.1. Direct Sales

8.2.2. Insurance Brokers

8.2.3. Online Aggregators

8.3. By Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia-Pacific

8.3.4. Latin America

8.3.5. Middle East & Africa

8.4. By Customer Type

8.4.1. Individual Customers

8.4.2. Corporate Customers

8.5. By Payment Mode

8.5.1. Monthly Payment

8.5.2. Annual Payment

8.5.3. One-time Payment

9. Global Online Insurance Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key components and stakeholders within the Global Online Insurance Market. This step relies on thorough desk research, utilizing secondary data sources and proprietary databases to gather relevant industry insights. The primary aim is to pinpoint and define the essential variables that drive market behavior and trends.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical data related to the Global Online Insurance Market. This includes evaluating market penetration rates, the balance between online platforms and traditional service providers, and the resulting revenue streams. Additionally, we will assess service quality metrics to ensure the accuracy and reliability of our revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

We will formulate market hypotheses and validate them through structured interviews with industry experts from various sectors. These consultations will provide critical operational and financial insights, helping to refine and substantiate the market data. Engaging with practitioners will enhance the credibility of our findings and support our analytical framework.

Step 4: Research Synthesis and Final Output

The concluding phase involves direct discussions with multiple stakeholders to gather in-depth insights into product categories, sales trends, consumer behavior, and other relevant factors. This engagement will help to corroborate and enrich the data obtained through previous methodologies, ensuring a thorough and validated analysis of the Global Online Insurance Market.

Frequently Asked Questions

01. How big is the Global Online Insurance Market?

The Global Online Insurance Market is valued at USD 292 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Online Insurance Market?

Key challenges in the Global Online Insurance Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Online Insurance Market?

Major players in the Global Online Insurance Market include Allianz, AXA, State Farm, Progressive, Lemonade, among others.

04. What are the growth drivers for the Global Online Insurance Market?

The primary growth drivers for the Global Online Insurance Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.