Global Online Racing Games Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD6379

December 2024

94

About the Report

Global Online Racing Games Market Overview

- The Global Online Racing Games Market is valued at USD 8.7 billion, based on detailed historical analysis. This market has experienced consistent growth due to the increasing internet penetration and the rise of cloud-based and mobile gaming platforms. Additionally, advancements in gaming technology, such as the integration of augmented reality (AR) and virtual reality (VR), have fueled demand. The increasing investment in gaming content and the popularity of freemium models, where games are free but generate revenue through in-game purchases, have also contributed to market expansion.

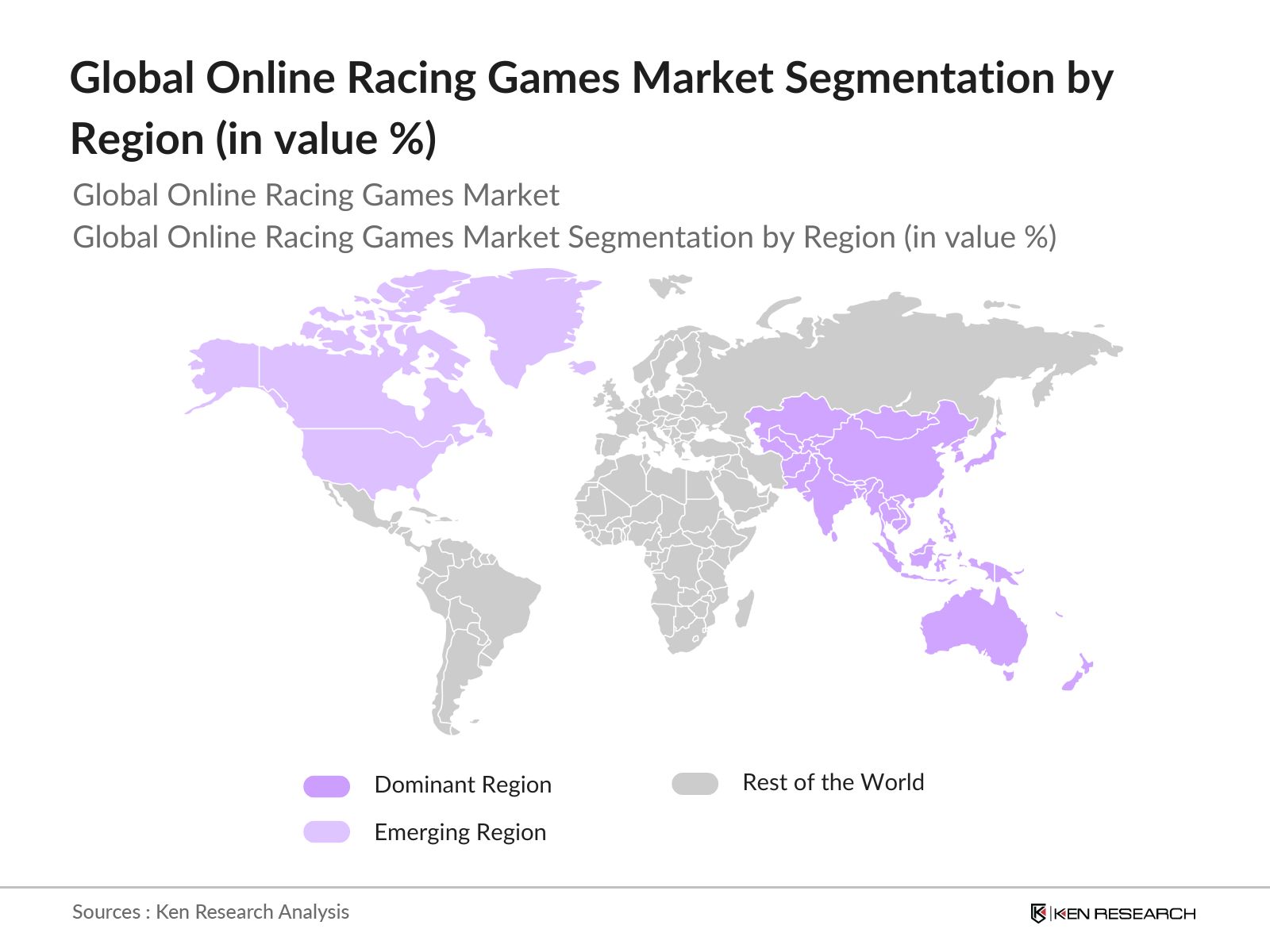

- The key regions dominating the market are North America and Asia Pacific. North America leads due to its established gaming culture, high-speed internet infrastructure, and the presence of key gaming companies such as Microsoft and Electronic Arts. In the Asia Pacific, countries like China, Japan, and South Korea are major players, driven by the vast mobile gaming population and increasing access to affordable internet. The rising popularity of esports in these regions also contributes to their dominance.

- Several governments are recognizing the economic potential of gaming and eSports. For example, the South Korean government is expected to invest over $350 million by 2024 to enhance its eSports infrastructure, including racing game tournaments. This initiative supports the growth of racing games by creating professional leagues, increasing media coverage, and attracting more players to the online racing genre.

Global Online Racing Games Market Segmentation

By Platform: The market is segmented by platform into Console Gaming, PC Gaming, and Mobile Gaming. The mobile gaming segment has shown significant growth in 2023, driven by the increasing use of smartphones and tablets. The freemium model, where games are free to play but offer in-app purchases, has been particularly profitable in emerging markets like Southeast Asia. Console gaming, while still strong, faces increasing competition from mobile platforms due to the latters portability and ease of access.

By Game Type: The market can be categorized by game type into Car Racing Games, Motorcycle Racing Games, and Fantasy Racing Games. Car racing games dominate due to the established fan base and the popularity of real-world racing simulations. Games like Need for Speed and Gran Turismo continue to attract both casual gamers and hardcore racing enthusiasts. Motorcycle and fantasy racing games cater to niche audiences but have also gained traction with new gameplay modes and immersive environments.

By Region: Regionally, North America and Asia Pacific lead the market, with the APAC region accounting for over 50% of the global market share in 2023. In North America, console-based racing games have a share, whereas the Asia Pacific's growth is propelled by the booming mobile gaming segment. The adoption of 5G networks and government initiatives to improve internet infrastructure in APAC are key factors boosting the regions dominance.

Global Online Racing Games Market Competitive Landscape

The market is highly competitive, with a mix of established gaming giants and newer developers. Companies like Microsoft and Electronic Arts have a strong foothold due to their popular racing franchises and investments in game development and esports.

Global Online Racing Games Market Analysis

Market Growth Drivers

- Increased Digital Engagement from Global Audiences: The rising global internet penetration, especially in regions like Asia-Pacific, is driving the demand for online racing games. As of 2024, over 4.9 billion people worldwide are expected to have internet access, creating a larger pool of potential gamers. This growth in internet accessibility is enabling racing game companies to reach more consumers.

- Increasing eSports Popularity Leading to Higher Game Engagement: The global eSports industry continues to experience strong growth, and online racing games are becoming a popular category within competitive gaming. By 2024, the global eSports audience is projected to exceed 640 million, many of whom follow racing titles such as F1 Esports Series and Gran Turismo Sport.

- Gaming Subscriptions Driving Adoption: Subscription-based gaming services such as Xbox Game Pass, PlayStation Plus, and cloud gaming platforms are expected to grow significantly in 2024. According to macroeconomic indicators, digital spending on entertainment is forecast to reach $275 billion in 2024, and online racing games are among the most popular categories.

Market Challenges

- Piracy and Cybersecurity Threats Impacting Revenue: Online piracy remains a challenge in the gaming industry. In 2024, it is estimated that piracy will lead to losses exceeding $29 billion for digital content providers, including gaming companies. This illegal distribution of online racing games hampers revenue generation and undermines efforts by developers to monetize their games through legitimate channels such as in-game purchases and subscription models.

- Player Retention in a Saturated Market: The growing number of online racing games has led to intense competition, making player retention challenging. Gamers are frequently switching between titles, especially with new game launches and updates in other genres. In 2024, more than 30,000 new gaming apps are expected to be launched globally. With so many options available, retaining a loyal player base is increasingly difficult, forcing companies to spend heavily on marketing and frequent content updates to keep users engaged.

Global Online Racing Games Market Future Outlook

Over the next five years, the global online racing games industry is expected to witness robust growth driven by advancements in mobile gaming, the widespread adoption of VR/AR technologies, and the expanding esports ecosystem.

Future Market Opportunities

- Growth in Cloud-Based Gaming for Racing Titles: By 2029, cloud-based gaming services are expected to host a large portion of online racing games. As cloud gaming services such as Google Stadia and Nvidia GeForce Now become more widespread, the barrier to entry for high-performance gaming will lower, allowing more players to access racing games without needing expensive hardware.

- Rise of Racing Game Franchises in eSports: In the next five years, racing games are anticipated to become even more integral to the eSports ecosystem. By 2029, online racing tournaments are expected to generate millions in prize pools and attract global audiences, with new competitive leagues forming around popular racing titles. The projected audience for eSports racing events will surpass 100 million by 2026, driven by high-profile games like F1 2025 and Forza Horizon.

Scope of the Report

|

Platform |

Console Gaming PC Gaming Mobile Gaming |

|

Game Type |

Car Racing Games Motorcycle Racing Games Fantasy Racing Games |

|

Monetization Model |

Freemium Paid Games Subscription-based Models |

|

Audience |

Casual Gamers Hardcore Gamers Esports Enthusiasts |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institution

Private Equity Firms

Mobile and Console Manufacturers

Automotive Companies (for branding and collaboration)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FCC, CRTC)

Internet Service Providers

Companies

Players Mentioned in the Report:

Microsoft

Electronic Arts Inc.

Codemasters

Tencent Holdings Ltd.

Ubisoft

THQ Nordic

Gameloft

Aquiris Game Studio

Activision Blizzard

NaturalMotion

Table of Contents

1. Global Online Racing Games Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics

Market Growth Rate

Key Influencers (Technological Advancements, Changing Consumer Preferences, Internet Penetration)

1.4 Market Segmentation Overview

2. Global Online Racing Games Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Online Racing Games Market Analysis

3.1 Growth Drivers

Rise of Cloud Gaming and VR Adoption

Expanding Mobile Gaming Accessibility

Increased Internet Connectivity

Continuous Content Updates and Engagement Strategies

3.2 Market Challenges

High Development Costs

Increasing Competition Among Developers

Device Fragmentation and Compatibility Issues

Piracy and Copyright Infringements

3.3 Opportunities

Integration of Virtual and Augmented Reality

Expansion into Emerging Markets (Latin America, Southeast Asia)

Collaboration with Automotive Brands

Esports and Competitive Gaming

3.4 Market Trends

Growth in In-App Purchases (Freemium Model)

Increasing Adoption of Simulation-Style Racing Games

Cross-Platform Gaming Demand

Emergence of Subscription-based Models

3.5 Government Regulations

Data Privacy Regulations

Consumer Protection in Digital Gaming

Anti-piracy Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

Bargaining Power of Suppliers

Bargaining Power of Buyers

Threat of Substitutes

Threat of New Entrants

Competitive Rivalry

4. Global Online Racing Games Market Segmentation

4.1 By Platform (In Value %)

Console Gaming (PlayStation, Xbox, Nintendo)

PC Gaming (Desktop, Laptop)

Mobile Gaming (Smartphones, Tablets)

4.2 By Game Type (In Value %)

Car Racing Games

Motorcycle Racing Games

Fantasy Racing Games

4.3 By Monetization Model (In Value %)

Freemium (In-app purchases, Ads)

Paid Games

Subscription-based Models

4.4 By Audience (In Value %)

Casual Gamers

Hardcore Gamers

Esports Enthusiasts

4.5 By Region (In Value %)

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

5. Global Online Racing Games Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Microsoft

5.1.2 Electronic Arts Inc.

5.1.3 Ubisoft

5.1.4 Codemasters (Acquired by EA)

5.1.5 Activision Blizzard

5.1.6 THQ Nordic

5.1.7 Gameloft

5.1.8 Tencent Holdings Ltd.

5.1.9 Nintendo

5.1.10 Sony Interactive Entertainment

5.1.11 Aquiris Game Studio

5.1.12 NaturalMotion

5.1.13 Nexon Korea Corporation

5.1.14 Boss Alien Ltd.

5.1.15 Criterion Games

5.2 Cross Comparison Parameters (Revenue, Player Base, Regions Operated, Key Titles, R&D Investments, Number of Active Users, Game Monetization Models, Esports Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Game Releases, Acquisitions, Partnerships)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Online Racing Games Market Regulatory Framework

6.1 Regional Regulations Impacting Gaming Content

6.2 Compliance with Data Privacy Laws

6.3 Game Certification Requirements

7. Global Online Racing Games Future Market Size (In USD Bn)

7.1 Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Online Racing Games Future Market Segmentation

8.1 By Platform (In Value %)

8.2 By Game Type (In Value %)

8.3 By Monetization Model (In Value %)

8.4 By Audience (In Value %)

8.5 By Region (In Value %)

9. Global Online Racing Games Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 White Space Opportunity Analysis

9.4 Marketing Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved identifying critical factors influencing the global online racing games market. This was done through comprehensive desk research, including analysis of industry reports, company financials, and relevant proprietary databases to gather market intelligence.

Step 2: Market Analysis and Construction

Historical market data was compiled and analyzed to evaluate trends in player engagement, game downloads, in-app purchases, and game monetization models. This step included an in-depth review of revenue generation from various platforms such as mobile, PC, and consoles.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were developed and validated through interviews with industry experts, including game developers, platform operators, and analysts. Insights from these consultations provided clarity on market challenges and opportunities.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the collected data and refining the results to provide a validated market report. The final output offers comprehensive insights into the online racing games market, its key segments, and future outlook.

Frequently Asked Questions

01. How big is the Global Online Racing Games Market?

The global online racing games market is valued at USD 8.7 billion, driven by increasing internet accessibility, the rise of cloud gaming, and the growing mobile gaming population worldwide.

02. What are the challenges in the Global Online Racing Games Market?

Key challenges in the global online racing games market include high development costs, competition among developers, and issues related to piracy. Additionally, device fragmentation and the need for consistent internet access limit the gaming experience in some regions.

03. Who are the major players in the Global Online Racing Games Market?

Major players in the global online racing games market include Microsoft, Electronic Arts, Tencent, Ubisoft, and Codemasters. These companies dominate the market due to their strong gaming franchises, technological innovations, and wide-ranging distribution networks.

04. What are the growth drivers of the Global Online Racing Games Market?

The global online racing games market is driven by the widespread adoption of mobile gaming, the integration of VR/AR technologies, and increasing demand for multiplayer and esports racing experiences. The availability of high-speed internet and 5G networks further supports growth.

05. What are the future trends in the Global Online Racing Games Market?

Future trends in the global online racing games market include the expansion of esports, the integration of AR/VR for more immersive gaming experiences, and the rise of cross-platform gaming. Strategic partnerships with automotive companies for branding opportunities in games will also shape the future market landscape.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.