Global Online Trading Platform Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD9115

December 2024

92

About the Report

Global Online Trading Platform Market Overview

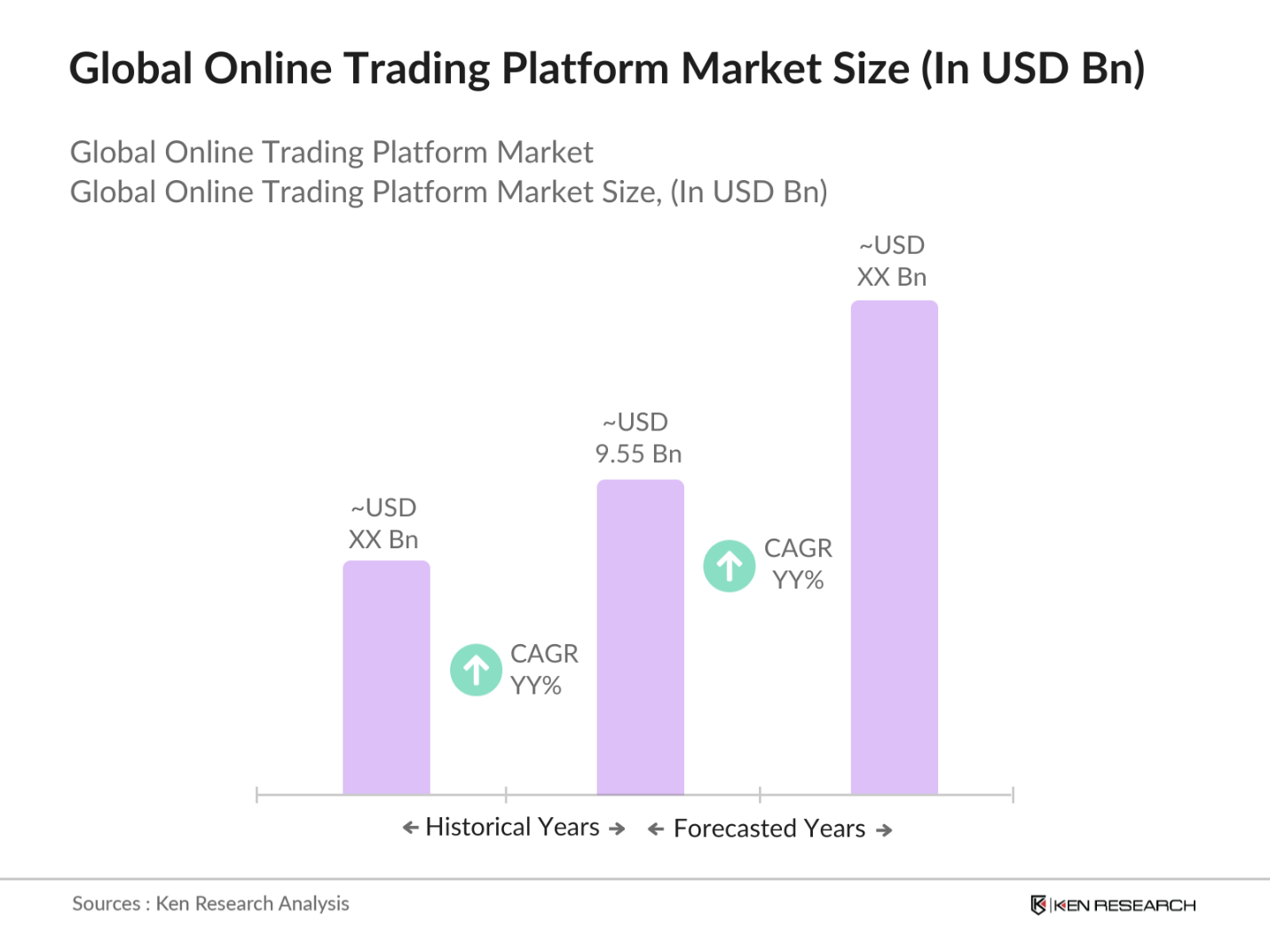

- The global online trading platform market is valued at USD 9.55 billion based on historical analysis of the last five years. This market is driven primarily by increasing internet accessibility, the rise in retail traders globally, and technological advancements such as algorithmic trading and AI-based platforms. Mobile trading applications have further fueled market growth as they make trading more accessible and convenient, leading to a surge in retail participation.

- Countries like the United States, China, and the United Kingdom dominate this market. The U.S. remains a leader due to its highly regulated financial ecosystem, institutional investors, and leading technological advancements in fintech. Meanwhile, Chinas rapid digitalization, coupled with high retail participation in financial markets, has positioned it as a dominant player. The U.K. leads in Europe, benefiting from a strong regulatory environment and financial infrastructure.

- Governments worldwide have tightened Anti-Money Laundering (AML) policies. The EU reported seizing over 6.6 billion in illicit assets related to online trading in 2022 . Similarly, countries like Australia have introduced strict AML compliance measures, resulting in over 2,000 online platforms being scrutinized in 2023 . Compliance with such policies is crucial for platform longevity and trustworthiness.

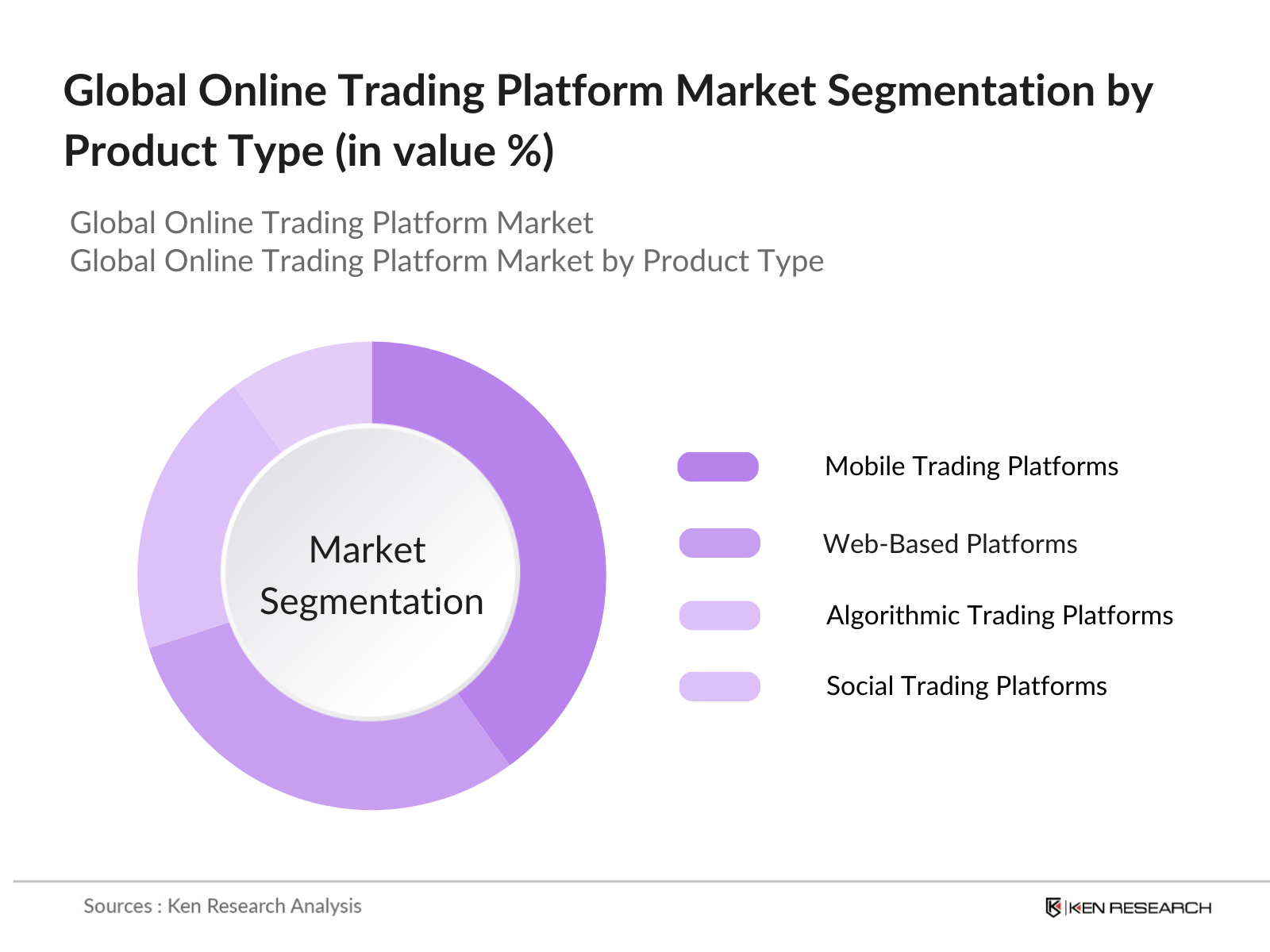

Global Online Trading Platform Market Segmentation

By Product Type: The global online trading platform market is segmented by product type into web-based platforms, mobile trading platforms, algorithmic trading platforms, and social trading platforms. Mobile trading platforms dominate this segment due to their convenience and accessibility, allowing traders to execute trades anytime and anywhere. Additionally, advancements in mobile app technology and user interface design have significantly enhanced the trading experience on mobile platforms, driving user adoption.

By Region: The global online trading platform market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America dominates this segment due to its well-established financial infrastructure and advanced technological landscape, which support high-frequency trading and institutional investments. The U.S., in particular, contributes significantly to this dominance, driven by its robust regulatory frameworks, widespread adoption of trading platforms, and the presence of global financial hubs like New York.

Global Online Trading Platform Market Competitive Landscape

The global online trading platform market is dominated by major players, including both global and regional companies. This market consolidation highlights the significant influence of a few key players who dominate due to their technological advancements, regulatory compliance, and wide range of product offerings.

|

Company Name |

Year Established |

Headquarters |

No. of Users |

Revenue (USD Bn) |

Trading Instruments |

Platform Features |

Regulatory Compliance |

Mobile App Rating |

Customer Support Options |

|

Charles Schwab |

1971 |

U.S. |

|||||||

|

Interactive Brokers |

1978 |

U.S. |

|||||||

|

E*TRADE |

1982 |

U.S. |

|||||||

|

Fidelity Investments |

1946 |

U.S. |

|||||||

|

Robinhood |

2013 |

U.S. |

Global Online Trading Platform Market Analysis

Market Growth Drivers

- Increasing Retail Participation: In 2023, retail investors accounted for a substantial portion of the total trading volume in global equity markets. Countries like the US saw an influx of retail traders, with over 30 million new trading accounts opened by mid-2022, driven by easy access to online platforms. Financial literacy programs initiated by governments, such as Brazil's 2022 "Investor Education Program," contributed to this trend by onboarding 1.4 million new traders.

- Technological Advancements (AI, Blockchain): The adoption of AI in online trading platforms has enabled better predictive analytics and user experiences. As of 2022, financial services globally have implemented AI-based tools for portfolio management. Additionally, blockchain integration has enhanced transaction transparency, with over 42 million digital wallets supporting trading by 2023. Countries like China have been frontrunners, where the Central Bank has encouraged the blockchain-based digital yuan for online transactions.

- Shift to Mobile-Based Platforms: Mobile trading platforms have witnessed a sharp rise, with over 1.6 billion transactions executed on mobile apps in 2022. Global traders increasingly prefer mobile-based trading platforms for their flexibility and ease of use. Countries like Nigeria have experienced a surge in mobile trading app downloads due to improved smartphone accessibility through government-backed digital infrastructure.

Market Challenges

- Security Concerns and Cybersecurity Threats: The rise in online trading activity has led to increasing cyber threats. In 2022, over $6.9 billion was lost globally to financial fraud and cyber attacks targeting trading platforms . Countries like the UK reported a 33% increase in cyberattacks on financial platforms, prompting government action in strengthening cybersecurity frameworks . The introduction of AI-driven security measures has become crucial to addressing these concerns.

- Regulatory Compliance Complexities: Navigating global regulations remains a significant challenge for online trading platforms. The European Unions Markets in Financial Instruments Directive II (MiFID II) saw an increase in compliance costs to over $2 billion annually by 2023, as firms needed to meet stringent requirements . In Asia, regulations like Singapore's Financial Advisors Act introduced in 2022 have led to more complex approval processes, delaying platform expansions.

Global Online Trading Platform Market Future Outlook

The global online trading platform market is expected to experience significant growth over the coming years, driven by technological advancements, increased retail investor participation, and enhanced regulatory frameworks. As platforms continue to innovate with AI-driven trading strategies, improved user experience, and integration of cryptocurrencies, the market is likely to evolve further. Continuous improvements in mobile technology and digital infrastructure will also play a critical role in expanding the market to emerging economies and untapped retail segments.

Market Opportunities:

- Rise of Algorithmic Trading: Algorithmic trading is becoming mainstream, with over of global trading volume in 2023 being conducted via algorithms. The US leads this trend, with $14 trillion in assets managed through algorithmic strategies by 2022. This shift is also growing in developing markets like India, where algorithmic trading volume grew by 25% in 2022, due to new government policies supporting fintech innovations.

- Blockchain Integration and Digital Asset Trading: Blockchain integration has facilitated the rise of digital asset trading, with over 25 million new digital wallets created in 2023 . As of 2022, over $1 trillion worth of digital assets were traded globally, driven by countries like the UAE, where government regulations now support blockchain-backed securities . Blockchain is increasingly being integrated into traditional trading platforms, offering transparency and enhanced security.

Scope of the Report

|

By Product Type |

Web-Based Platforms Mobile Trading Platforms Algorithmic Trading Platforms Social Trading Platforms |

|

By Application |

Retail Trading Institutional Trading High-Frequency Trading (HFT) |

|

By Asset Class |

Equities Forex Commodities Cryptocurrencies |

|

By Deployment Model |

On-Premise Cloud-Based |

|

By Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Online Trading Platform Providers

Financial Institutions

Government and Regulatory Bodies (SEC, FINRA)

Retail Investors

Institutional Investors

Algorithmic Trading Firms

Investments and Venture Capitalist Firms

Technology Providers

Companies

Players Mention in the Report

Charles Schwab

Interactive Brokers

E*TRADE

Fidelity Investments

Robinhood

IG Group

Plus500

Saxo Bank

OANDA

TD Ameritrade

CMC Markets

AvaTrade

eToro

XTB

Pepperstone

Table of Contents

1. Global Online Trading Platform Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Evolution of Online Trading Platforms

1.4. Market Segmentation Overview

2. Global Online Trading Platform Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Online Trading Platform Market Analysis

3.1. Growth Drivers

3.1.1. Rising Internet Penetration

3.1.2. Increasing Retail Participation

3.1.3. Technological Advancements (AI, Blockchain)

3.1.4. Shift to Mobile-Based Platforms

3.2. Market Challenges

3.2.1. Security Concerns and Cybersecurity Threats

3.2.2. Regulatory Compliance Complexities

3.2.3. Market Saturation and Competition

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Customization of User Experience

3.3.3. Integration of AI and Machine Learning

3.4. Trends

3.4.1. Rise of Algorithmic Trading

3.4.2. Increased Focus on User Education (Democratization of Trading)

3.4.3. Blockchain Integration and Digital Asset Trading

3.5. Government Regulation

3.5.1. AML (Anti-Money Laundering) Policies

3.5.2. Know Your Customer (KYC) Requirements

3.5.3. Global Regulatory Frameworks for Online Trading

3.5.4. Data Privacy Regulations (GDPR, CCPA)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Financial Institutions

3.7.2. Technology Providers

3.7.3. Retail and Institutional Traders

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Global Online Trading Platform Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Web-Based Platforms

4.1.2. Mobile Trading Platforms

4.1.3. Algorithmic Trading Platforms

4.1.4. Social Trading Platforms

4.2. By Application (In Value %)

4.2.1. Retail Trading

4.2.2. Institutional Trading

4.2.3. High-Frequency Trading (HFT)

4.3. By Asset Class (In Value %)

4.3.1. Equities

4.3.2. Forex

4.3.3. Commodities

4.3.4. Cryptocurrencies

4.4. By Deployment Model (In Value %)

4.4.1. On-Premise

4.4.2. Cloud-Based

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Online Trading Platform Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Charles Schwab

5.1.2. Interactive Brokers

5.1.3. E*TRADE

5.1.4. Fidelity Investments

5.1.5. Robinhood

5.1.6. TD Ameritrade

5.1.7. IG Group

5.1.8. Plus500

5.1.9. AvaTrade

5.1.10. OANDA

5.1.11. Saxo Bank

5.1.12. XTB

5.1.13. CMC Markets

5.1.14. eToro

5.1.15. Pepperstone

5.2. Cross Comparison Parameters (No. of Users, Headquarters, Revenue, Commission Structure, Platforms Supported, Mobile App Rating, Customer Support, No. of Available Assets)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Online Trading Platform Market Regulatory Framework

6.1. Global Regulatory Bodies and Standards

6.2. Compliance Requirements for Online Trading

6.3. Certification Processes for Platforms

7. Global Online Trading Platform Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Online Trading Platform Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Asset Class (In Value %)

8.4. By Deployment Model (In Value %)

8.5. By Region (In Value %)

9. Global Online Trading Platform Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Strategic Marketing Initiatives

Research Methodology

Step 1: Identification of Key Variables

In this phase, a comprehensive map of stakeholders involved in the global online trading platform market is created. Data from proprietary databases, industry journals, and regulatory reports are collected to outline the key factors influencing the market, including user trends, technology adoption, and regulatory impacts.

Step 2: Market Analysis and Construction

Historical data is analyzed to assess the markets performance over the last five years, focusing on revenue growth, platform adoption, and user retention rates. Service providers and customer satisfaction metrics are also evaluated to refine market estimates and projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on the initial data analysis and validated through expert interviews with industry veterans and key platform providers. These discussions offer deeper insights into trading patterns, emerging technologies, and challenges faced by online trading platforms.

Step 4: Research Synthesis and Final Output

The final step involves integrating all findings from primary and secondary research to produce a cohesive and detailed market analysis. Quantitative data is corroborated with industry experts to ensure accuracy and reliability.

Frequently Asked Questions

01. How big is the Global Online Trading Platform Market?

The global online trading platform market is valued at USD 9.55 billion, driven by increased mobile adoption, technological advancements in algorithmic trading, and the growing retail investor base.

02. What are the challenges in the Global Online Trading Platform Market?

Challenges include data privacy concerns, cybersecurity threats, and increased regulatory scrutiny. Additionally, the saturation of trading platforms creates a highly competitive environment.

03. Who are the major players in the Global Online Trading Platform Market?

Key players include Charles Schwab, Interactive Brokers, E*TRADE, Fidelity Investments, and Robinhood. These companies lead due to their strong market presence, technological offerings, and compliance with financial regulations.

04. What are the growth drivers of the Global Online Trading Platform Market?

The market is propelled by factors such as rising retail investor participation, technological innovations in trading platforms, and the expansion of mobile and web-based trading solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.