Global Organic Snack Food Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD7400

December 2024

85

About the Report

Global Organic Snack Food Market Overview

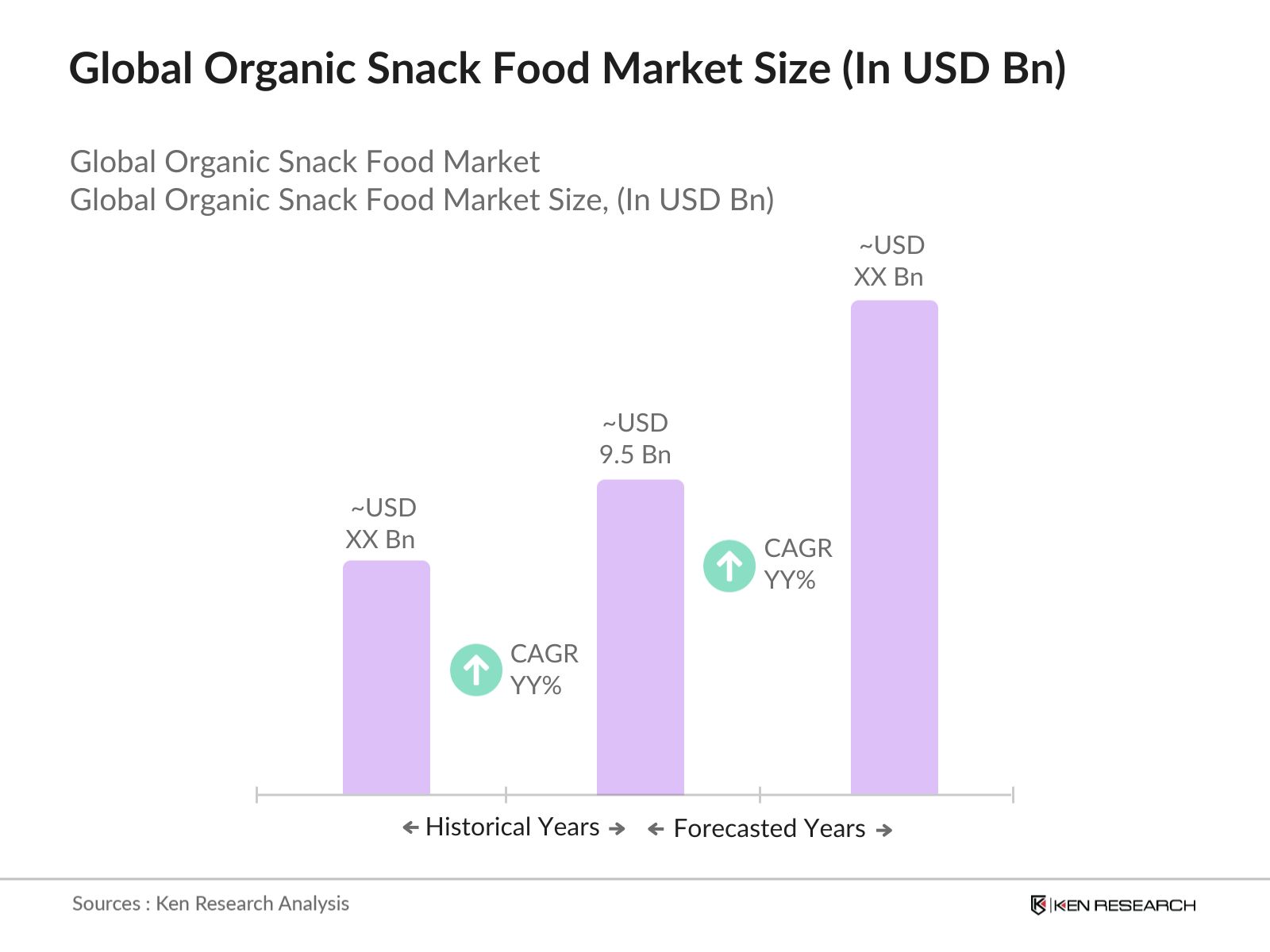

- The Organic Snack Food Market is valued at USD 9.5 billion, based on a five-year historical analysis. The market growth is largely driven by increasing consumer preference for organic, non-GMO foods. Rising health consciousness and demand for minimally processed snack foods contribute significantly, as consumers shift towards sustainable and healthier snack options.

- Countries like the United States and Germany dominate the organic snack market due to well-established retail networks, high disposable incomes, and strong awareness regarding organic products. Additionally, regulatory frameworks supporting organic labeling and certification ensure consumer trust, further propelling market growth in these regions.

- Various governments are increasing subsidies to support organic farming. For instance, the U.S. Department of Agriculture allocated $200 million in 2024 to boost organic farming practices, which indirectly benefits organic snack producers by reducing costs associated with raw organic materials. This funding aims to encourage sustainable agricultural practices and expand organic production capacity, offering support to farmers and reducing raw material costs for snack producers.

Global Organic Snack Food Market Segmentation

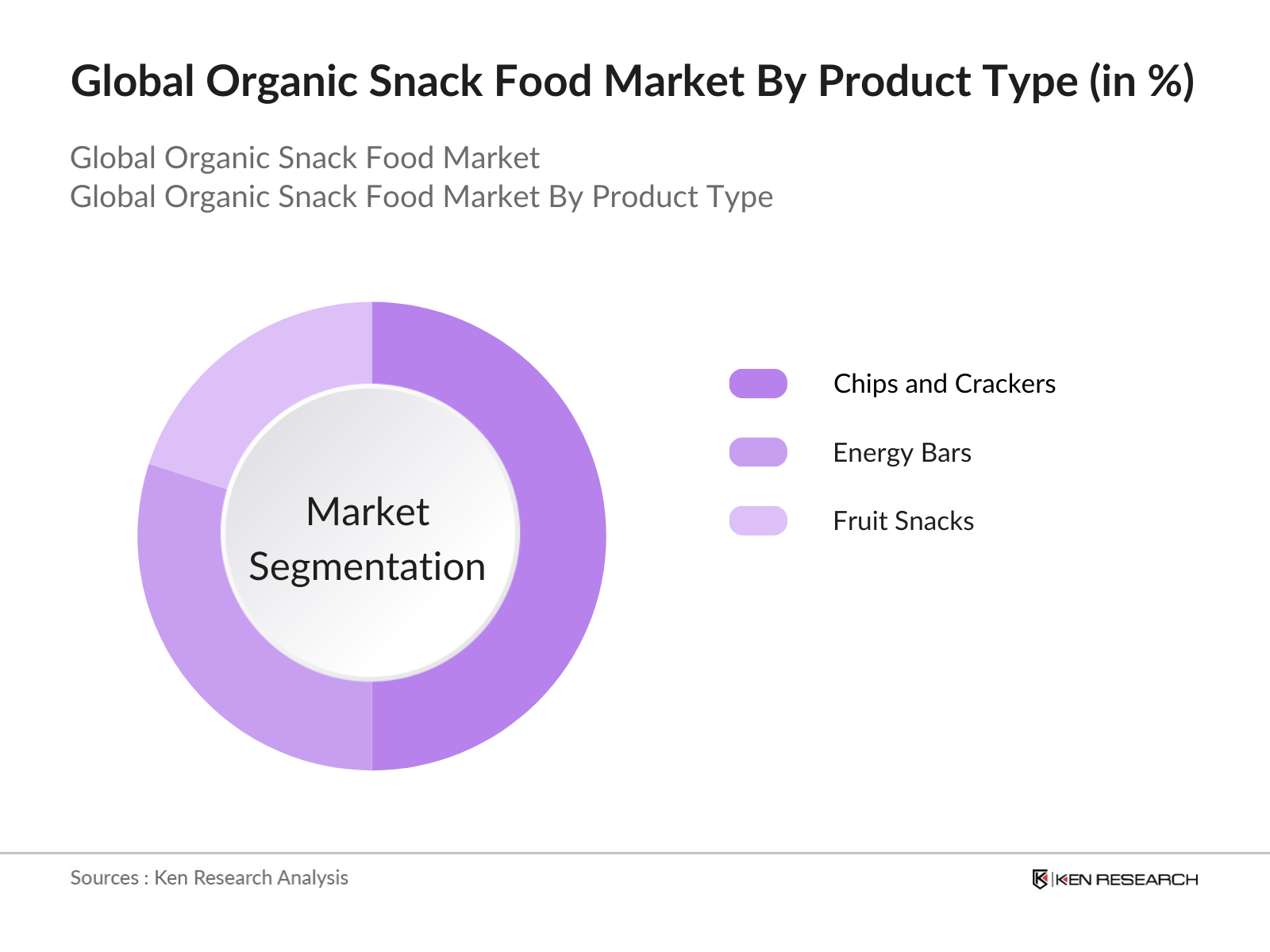

By Product Type: The market is segmented by product type into Chips and Crackers, Energy Bars, and Fruit Snacks. Chips and Crackers hold a dominant share due to their widespread popularity as convenient snack options and their established presence in various retail formats. The growing inclination toward plant-based and gluten-free alternatives in this category also aligns with evolving consumer preferences.

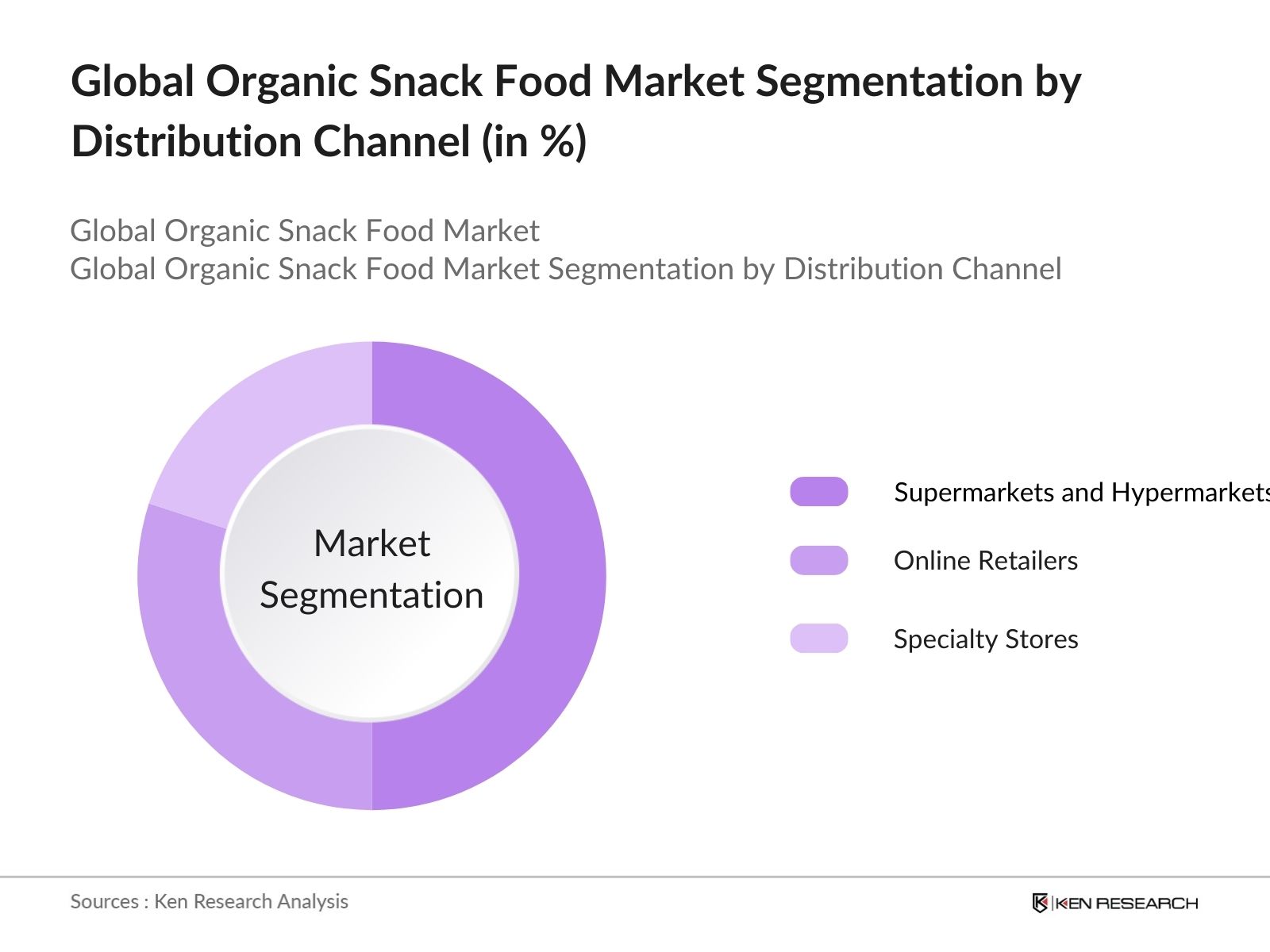

By Distribution Channel: Distribution channels in the organic snack market include Supermarkets and Hypermarkets, Online Retailers, and Specialty Stores. Supermarkets and Hypermarkets dominate the distribution landscape, as they offer diverse organic snack options in a single location, catering to consumer demand for accessibility and variety.

By Region: The market's regional segmentation includes North America, Europe, and Asia-Pacific. North America leads due to well-established organic food regulations, high consumer awareness, and a strong focus on wellness. Growing investments in organic farming further boost the supply chain, allowing for consistent product availability.

Global Organic Snack Food Maret Competitive Landscape

The market is consolidated, with a few key players dominating due to their broad product ranges and well-established distribution networks. These companies emphasize innovation, including new flavor offerings and sustainable packaging solutions.

Global Organic Snack Food Market Analysis

Market Growth Drivers

- Increasing Demand for Healthy Alternatives: In 2024, consumer demand for healthier food options has surged, with an estimated 17 million households in the U.S. actively choosing organic over conventional snack foods. This shift is largely attributed to rising health consciousness among consumers, especially among families and younger demographics who prioritize organic and clean-label products for better health outcomes.

- Expanding Distribution Channels in the E-Commerce Sector: E-commerce platforms and online grocery services have recorded substantial growth, with organic snack foods seeing nearly 25,000 units sold monthly through top online retailers in North America. This uptick aligns with the digitalization of shopping habits, which allows brands to reach a broader audience at competitive prices.

- Rising Adoption of Plant-Based Ingredients in Organic Snacks: The global market has seen a noteworthy increase in plant-based ingredients used in organic snack foods, with over 12,000 tons of organic legumes, seeds, and grains incorporated in 2024 alone. The health benefits associated with plant-based ingredients, alongside consumer concerns about allergies and environmental impact, are fueling this demand.

Market Challenges

- High Production Costs Due to Strict Organic Standards: Adhering to organic certification standards has resulted in an average production cost increase of nearly $150 per metric ton for organic snack producers in 2024. Compliance with organic labeling and sourcing requirements involves costly inputs and practices, which limits profit margins and increases the end cost to consumers.

- Supply Chain Constraints in Sourcing Organic Ingredients: A shortage of organic raw materials has impacted the industry, with organic ingredient suppliers reporting a gap of 5,000 tons in 2024 due to limited agricultural land and longer crop rotation times required for organic certification. This supply shortfall not only affects production schedules but also contributes to price volatility in the organic snack market.

Global Organic Snack Food Market Future Outlook

Over the next five years, the Organic Snack Food industry is expected to expand, propelled by rising consumer demand for plant-based and nutrient-dense snacks. The continued development of sustainable and eco-friendly packaging, along with increased accessibility through online channels, will further support market growth.

Future Market Opportunities

- Expansion of Organic Snack Offerings to Meet Specialized Diets: Over the next five years, the organic snack market is expected to witness a expansion in product offerings tailored to specialized diets. Organic keto, paleo, and allergen-free snack lines will likely increase by an estimated 50,000 SKUs by 2029, driven by growing consumer interest in personalized nutrition. Major brands are anticipated to lead this trend, with new product launches focused on organic, health-specific snacks.

- Increased Investment in Sustainable Agriculture for Organic Ingredient Sourcing: Investment in sustainable farming practices is projected to increase, with industry funding reaching around $1 billion by 2029. This funding will facilitate improved crop yield methods that cater to organic certification, enabling a more reliable supply of organic raw materials. Enhanced agricultural sustainability is expected to help mitigate price fluctuations and stabilize supply chains for organic snack manufacturers.

Scope of the Report

|

Product Type |

Chips and Crackers |

|

Distribution Channel |

Supermarkets and Hypermarkets |

|

Ingredient |

Fruits and Nuts |

|

Consumer Demographics |

Millennials |

|

Region |

North America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Organic Product Manufacturers

Banks and Financial Institution

Private Equity Firms

Health-Conscious Consumer Groups

Online Retail Platforms

Food and Beverage Packaging Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (USDA, EU Organic Certification Bodies)

Companies

Players Mentioned in the Report:

Annie's Homegrown

General Mills

Danone

PepsiCo

The Hain Celestial Group

Navitas Organics

Made in Nature

Organic Valley

Pure Organic

Rhythm Superfoods

Table of Contents

1. Organic Snack Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. Organic Snack Food Market Size (In USD Bn)

2.1. Historical Market Size (Growth Trends, Consumption Patterns)

2.2. Year-on-Year Growth Analysis (Revenue Growth, Volume Analysis)

2.3. Key Market Developments and Milestones (New Product Launches, Regulatory Milestones)

3. Organic Snack Food Market Analysis

3.1. Growth Drivers

3.1.1. Consumer Shift Toward Healthier Eating

3.1.2. Rise in Vegan and Gluten-Free Diets

3.1.3. Increasing Disposable Income for Premium Products

3.1.4. Growth in E-commerce and Online Distribution Channels

3.2. Market Challenges

3.2.1. High Price Sensitivity Among Consumers

3.2.2. Supply Chain Complexity for Organic Ingredients

3.2.3. Regulatory Compliance and Organic Certifications

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Increasing Demand for Plant-Based Proteins

3.3.3. Innovations in Packaging for Shelf-Life Extension

3.4. Trends

3.4.1. Demand for Clean Label and Minimal Processing

3.4.2. Rise of Functional Snacks with Added Nutrients

3.4.3. Growth of Snacks Catering to Special Diets (Keto, Paleo)

3.5. Regulatory Environment

3.5.1. USDA and FDA Regulations on Organic Labeling

3.5.2. Compliance with International Organic Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Producers, Distributors, Retailers, End-Consumers)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

4. Organic Snack Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Chips and Crackers

4.1.2. Energy Bars

4.1.3. Fruit Snacks

4.1.4. Meat Snacks

4.1.5. Other Snacks

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retailers

4.2.4. Specialty Stores

4.3. By Ingredient (In Value %)

4.3.1. Fruits and Nuts

4.3.2. Grains and Cereals

4.3.3. Vegetables

4.3.4. Dairy

4.4. By Consumer Demographics (In Value %)

4.4.1. Millennials

4.4.2. Gen Z

4.4.3. Baby Boomers

4.4.4. Health-Conscious Consumers

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Organic Snack Food Market Competitive Analysis

5.1. Profiles of Major Companies

5.1.1. Annie's Homegrown, Inc.

5.1.2. General Mills, Inc.

5.1.3. Danone S.A.

5.1.4. PepsiCo, Inc.

5.1.5. The Hain Celestial Group, Inc.

5.1.6. Navitas Organics

5.1.7. Made in Nature

5.1.8. Organic Valley

5.1.9. Pure Organic

5.1.10. Rhythm Superfoods

5.1.11. Clif Bar & Company

5.1.12. Kashi Company

5.1.13. SunOpta Inc.

5.1.14. Alter Eco

5.1.15. Simple Mills

5.2. Cross Comparison Parameters (Product Range, Certifications, Market Share, Sales Network, Product Innovation, Target Consumer, Online Presence, Financial Performance)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Expansion, Partnerships, Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Strategic Partnerships and Collaborations

5.8. Venture Capital and Private Equity Investments

6. Organic Snack Food Market Regulatory Framework

6.1. Organic Certification Standards

6.2. Labeling and Packaging Regulations

6.3. Food Safety Standards

6.4. Import and Export Policies

6.5. Compliance Monitoring Programs

7. Organic Snack Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Changing Consumer Preferences, Innovation in Flavor Profiles, Expansion in Emerging Economies)

8. Organic Snack Food Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient (In Value %)

8.4. By Consumer Demographics (In Value %)

8.5. By Region (In Value %)

9. Organic Snack Food Market Analyst Recommendations

9.1. Total Addressable Market (TAM), Serviceable Addressable Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Consumer Behavior Insights and Trends

9.3. Strategic Marketing Initiatives

9.4. Product and Market Expansion Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

A foundational analysis was conducted, mapping the organic snack ecosystem, identifying primary stakeholders, and sourcing data through proprietary and secondary sources. Key variables such as product demand, pricing trends, and distribution patterns were identified for market structuring.

Step 2: Market Analysis and Construction

Historical data and trends in organic snack sales and market share by segment were analyzed. Data aggregation was conducted to build a segmented overview, ensuring that estimates are aligned with market realities.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts were consulted through telephonic interviews to validate demand forecasts and obtain insights into consumer behavior. These consultations reinforced accuracy in sales trends and market sizing.

Step 4: Research Synthesis and Final Output

The final analysis incorporated feedback from organic snack manufacturers, verifying statistics through a bottom-up approach. This ensures a robust, reliable report tailored to the Organic Snack Food Market.

Frequently Asked Questions

1. How big is the Organic Snack Food Market?

The Organic Snack Food Market, valued at USD 9.5 billion, is driven by consumer interest in health and sustainability, with substantial growth projected in the coming years.

2. What challenges does the Organic Snack Food Market face?

Key challenges in the Organic Snack Food Market include high product costs, limited raw material availability, and stringent organic certification processes, affecting profitability and market penetration.

3. Who are the major players in the Organic Snack Food Market?

Major players in the Organic Snack Food Market include Annie's Homegrown, Danone, PepsiCo, and others, which have established brand loyalty and robust distribution networks globally.

4. What drives growth in the Organic Snack Food Market?

Growth in the Organic Snack Food Market is fueled by rising health consciousness, demand for clean-label products, and increased retail availability, supported by sustainable farming initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.