Global Organic Solar Cell Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD7401

December 2024

90

About the Report

Global Organic Solar Cell Market Overview

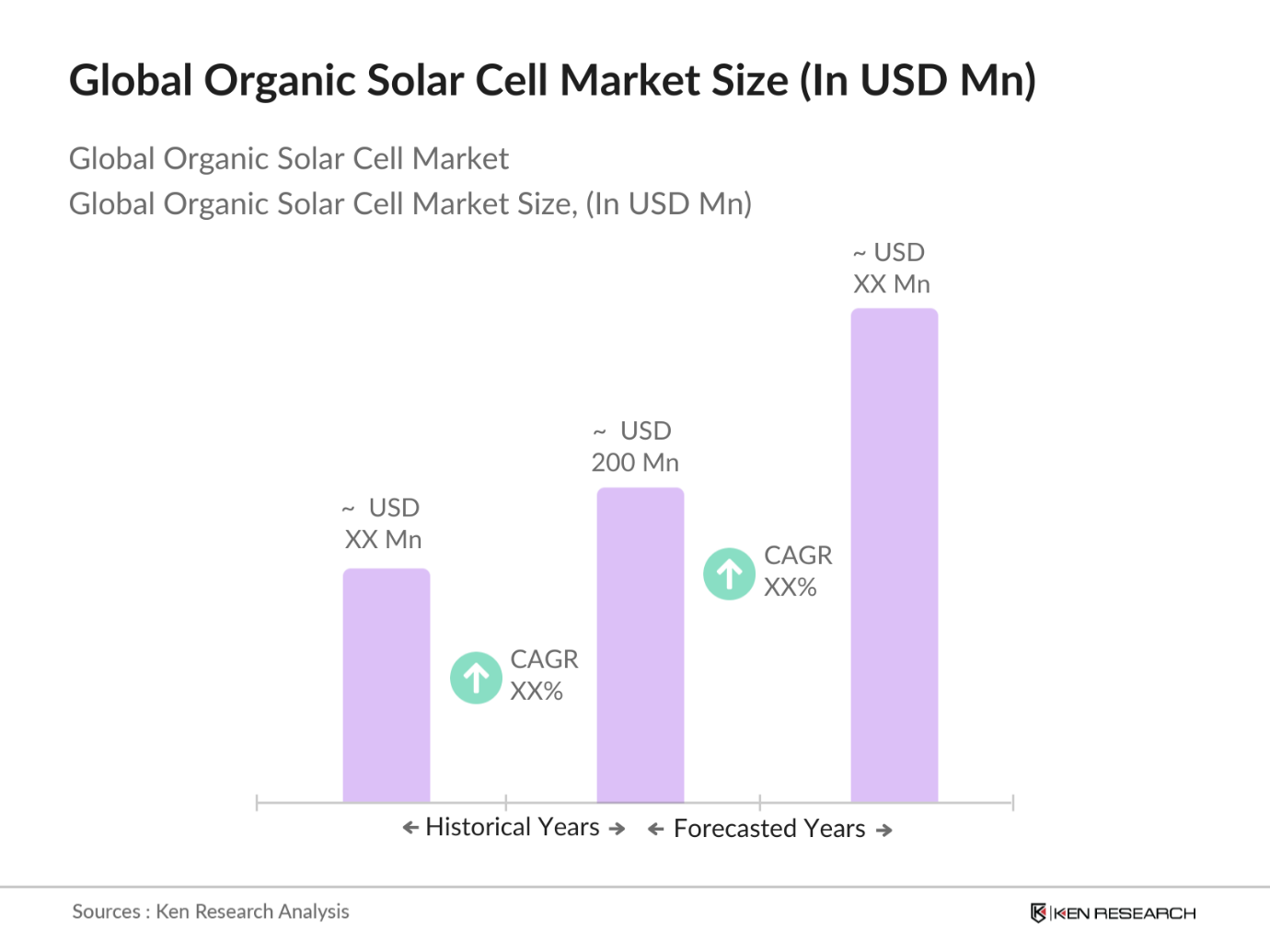

- The global organic solar cell market reached a valuation of USD 200 Mn, with this growth driven by the increasing adoption of renewable energy sources and advancements in organic photovoltaics. This segment has evolved through significant technological improvements, resulting in better flexibility, lighter weights, and ease of integration into diverse applications, from residential buildings to wearable electronics. Countries like Germany, the U.S., and Japan dominate the organic solar cell market due to their strong focus on clean energy adoption and robust investments in research and development.

- The presence of supportive regulatory policies and major players in these regions has accelerated the commercial deployment of organic solar cells. Germany, with its ambitious renewable energy targets, and Japans focus on energy self-sufficiency, are leading markets for organic solar cell adoption. These countries emphasize energy-efficient solutions, driving demand for advanced solar cell technology.

- Many governments around the world are establishing stringent renewable energy mandates to meet their carbon reduction targets. These policies are driving investment in solar energy, including organic solar technologies. For instance, the European Union aims to source at least 40% of its energy from renewable sources by 2030, creating a supportive environment for organic solar cell adoption. These regulatory frameworks not only encourage investment but also drive research and development, further advancing the market's growth.

Global Organic Solar Cell Market Segmentation

By Material Type: The global organic solar cell market is segmented by material type into polymer-based cells, small molecule organic cells, and hybrid cells. Recently, polymer-based cells have emerged as a leading sub-segment due to their inherent flexibility, lightweight nature, and cost-effectiveness. The increasing use of polymer-based cells in applications requiring flexible modules, such as building-integrated photovoltaics (BIPV), further supports their market position.

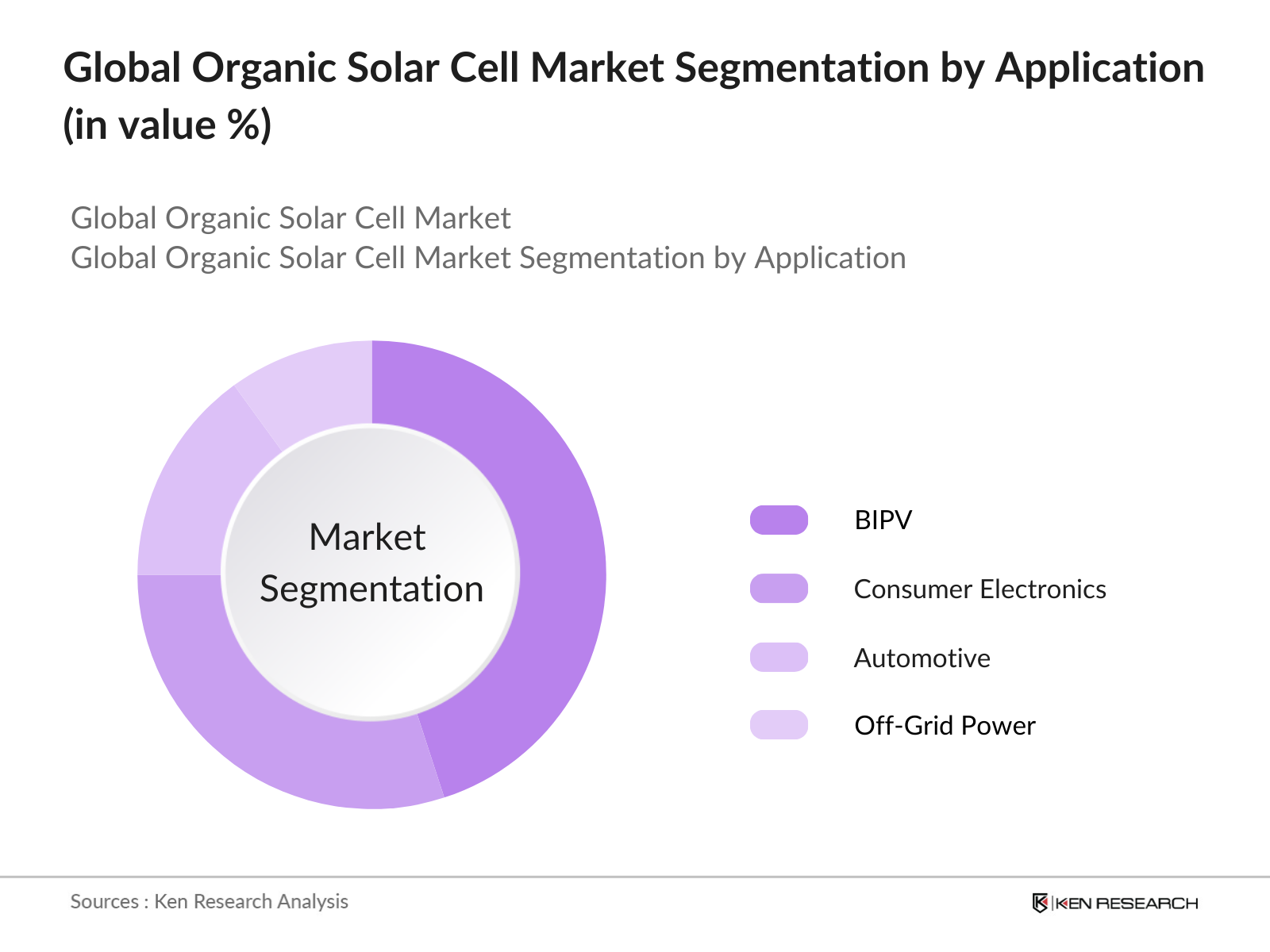

By Application: In terms of applications, the market is divided into BIPV, consumer electronics, automotive, and off-grid power. BIPV holds a dominant market share due to the rising adoption of green building practices and the trend towards integrating energy solutions directly into building materials. This segment benefits from regulatory support and incentives, which have encouraged adoption across commercial and residential structures.

Global Organic Solar Cell Market Competitive Landscape

The global organic solar cell market is dominated by several key players, each bringing unique strengths in R&D, regional presence, and product innovation.

The organic solar cell markets competitive landscape includes both established and emerging companies. Companies like Heliatek GmbH and Mitsubishi Chemical Corporation hold significant positions due to their robust R&D efforts, expansive portfolios, and presence in multiple regions, helping them to secure long-term growth.

Global Organic Solar Cell Market Analysis

Growth Drivers

- Increasing Demand for Renewable Energy Sources:

The global energy consumption is projected to reach approximately 5,000 terawatt-hours (TWh) by 2023, driven by a concerted effort to transition to renewable energy sources. This increase highlights a significant shift towards sustainable practices as countries worldwide aim to reduce their carbon footprints. The urgency to address climate change and enhance energy security has fueled investments in renewable technologies, including organic solar cells, which are seen as a viable solution to meet growing energy demands sustainably. - Technological Advancements in Organic Photovoltaics:

Recent advancements in organic photovoltaics (OPV) have led to an improvement in efficiency rates, with new records reaching around 18% in laboratory settings. This technological progress makes organic solar cells increasingly competitive with traditional silicon-based systems. Additionally, innovations in materials science are paving the way for lower-cost manufacturing processes and enhanced performance under various environmental conditions. As these technologies mature, they are expected to play a crucial role in the global renewable energy mix, contributing to a sustainable energy future. National Renewable Energy Laboratory - Government Incentives for Sustainable Energy Adoption:

Globally, governments are increasingly implementing incentives to promote renewable energy adoption. In the U.S. alone, the federal government has allocated approximately $80 billion for renewable energy initiatives, including solar energy projects. Such funding not only enhances the viability of organic solar cells but also stimulates market growth through subsidies, tax credits, and grants for both consumers and manufacturers. These governmental support mechanisms are essential in accelerating the transition towards renewable energy sources, especially in underdeveloped and developing regions.

Market Challenges

- High Production Costs of Organic Solar Cells:

The production costs of organic solar cells remain a significant challenge, averaging around $250 per kilowatt (KW). This high cost is primarily due to the expensive materials and complex manufacturing processes involved in producing organic photovoltaics. As traditional silicon-based solar cells continue to decrease in price, organic solar cells must find ways to optimize their production methods and reduce material costs to remain competitive in the market. Additionally, scaling up production while maintaining quality poses further challenges for manufacturers, affecting their ability to penetrate broader markets effectively. International Renewable Energy Agency (IRENA) - Limited Efficiency Compared to Traditional Solar Cells:

Currently, organic solar cells exhibit an average efficiency of 10-12%, which is significantly lower than that of traditional silicon-based solar cells, which can achieve efficiencies exceeding 20%. This efficiency gap poses a barrier to widespread adoption, as consumers and businesses typically prefer solutions that maximize energy output. To address this challenge, ongoing research is critical to developing new materials and technologies that can enhance the efficiency of organic solar cells, thereby improving their attractiveness as a viable energy solution. Solar Energy Technologies Office

Global Organic Solar Cell Future Outlook

The global organic solar cell market is anticipated to experience accelerated growth as advancements in organic photovoltaic technologies, government support for clean energy, and demand for efficient, flexible solar solutions continue to expand. With new applications emerging in sectors like consumer electronics and automotive, manufacturers are increasingly investing in research to improve cell efficiency and lifecycle. This trend is likely to support the adoption of organic solar cells in diverse applications, fueling market expansion.

Opportunities

- Expansion of Organic Solar Cell Applications in Urban Environments:

With urban areas increasingly focusing on sustainability, there is a growing opportunity for organic solar cells to be integrated into various urban infrastructure applications, including building-integrated photovoltaics (BIPV). The market for BIPV is projected to expand rapidly as cities aim to meet their renewable energy targets while also addressing issues such as urban heat islands. This trend signifies a shift towards innovative architectural designs that incorporate renewable energy solutions directly into the fabric of buildings, presenting substantial growth prospects for the organic solar cell market. International Energy Agency (IEA) - Investment in Research and Development for New Technologies:

Global research and development expenditures are expected to reach approximately $1.5 trillion, with a significant portion directed towards sustainable technologies. This investment landscape provides a fertile ground for advancements in organic solar cells, where breakthroughs in efficiency, material durability, and manufacturing processes can occur. As R&D initiatives proliferate, they will likely yield innovative solutions that can address current limitations of organic solar technologies, leading to enhanced market acceptance and growth.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Technology Type |

Polymer Solar Cells |

|

Small Molecule Solar Cells |

|

|

By Application |

Residential |

|

Commercial |

|

|

Industrial |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East and Africa |

Products

Key Target Audience

Organic solar cell manufacturers

Renewable energy investors and venture capitalist firms

Building and construction firms specializing in green technology

Government and regulatory bodies (IEA, DOE)

Automotive manufacturers incorporating solar technology

Electronics and appliance manufacturers

BIPV providers

Renewable energy infrastructure companies

Companies

Players mentioned in the report

Heliatek GmbH

Solarmer Energy Inc.

Mitsubishi Chemical Corporation

Armor Group

BELECTRIC OPV GmbH

Disa Solar

Sumitomo Chemical Co., Ltd.

Infinity PV

NanoFlex Power Corporation

Next Energy Technologies Inc.

Polyera Corporation

Ubiquitous Energy Inc.

Raynergy Tek Incorporation

EnSol AS

Fujifilm Holdings Corporation

Table of Contents

1. Global Organic Solar Cell Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Organic Solar Cell Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Organic Solar Cell Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Renewable Energy Sources (Global Energy Consumption: 5,000 MWh in 2023)

3.1.2. Technological Advancements in Organic Photovoltaics (Efficiency Improvement to 18% in 2023)

3.1.3. Government Incentives for Sustainable Energy Adoption (Projected US Investment: $80 billion)

3.1.4. Rising Consumer Awareness of Environmental Impact (80% of Consumers Favor Sustainable Products)

3.2. Market Challenges

3.2.1. High Production Costs of Organic Solar Cells (Material Costs Averaging $250/KW)

3.2.2. Limited Efficiency Compared to Traditional Solar Cells (Current Avg. Efficiency: 10-12%)

3.2.3. Regulatory Barriers in Market Entry (Compliance with International Standards)

3.3. Opportunities

3.3.1. Expansion of Organic Solar Cell Applications in Urban Environments (Potential Growth Areas in Urban Infrastructure)

3.3.2. Investment in Research and Development for New Technologies (Global R&D Expenditure: $1.5 trillion)

3.3.3. Collaborations Between Industry and Academia (Increasing Partnerships for Innovation)

3.4. Trends

3.4.1. Integration of Organic Solar Cells in Building Materials (Market for BIPV Expected to Grow Significantly)

3.4.2. Adoption of Hybrid Solar Technologies (Combining Organic and Inorganic Cells)

3.4.3. Focus on Sustainability and Circular Economy in Production Processes

3.5. Government Regulation

3.5.1. Renewable Energy Mandates and Policies (Commitments from Various Nations)

3.5.2. Tax Incentives for Organic Solar Projects (Federal Tax Credits for Solar Investments)

3.5.3. Standards and Certification Processes for Organic Solar Cells (Regulatory Compliance Frameworks)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Organic Solar Cell Market Segmentation

4.1. By Technology Type (In Value %)

4.1.1. Polymer Solar Cells

4.1.2. Small Molecule Solar Cells

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Region (In Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East and Africa

5. Global Organic Solar Cell Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Solar Frontier

5.1.2. 3M Company

5.1.3. Konarka Technologies

5.1.4. Heliatek

5.1.5. Dyesol

5.1.6. Oxford PV

5.1.7. Ascent Solar Technologies

5.1.8. First Solar

5.1.9. SunPower Corporation

5.1.10. Panasonic Corporation

5.1.11. Canadian Solar

5.1.12. JinkoSolar

5.1.13. Trina Solar

5.1.14. LONGi Green Energy

5.1.15. REC Group

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Organic Solar Cell Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Organic Solar Cell Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Organic Solar Cell Market Future Segmentation

8.1. By Technology Type (In Value %)

8.2. By Application (In Value %)

8.3. By Region (In Value %)

8.4. By Material Type (In Value %)

8.5. By End-User Segment (In Value %)

9. Global Organic Solar Cell Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase includes an in-depth mapping of the organic solar cell market landscape, identifying critical stakeholders and variables influencing growth, such as adoption rates, technology advancements, and government support.

Step 2: Market Analysis and Construction

This stage focuses on the analysis of historical data and trends, assessing the distribution of organic solar cells across different regions and applications, including BIPV and automotive sectors. The findings are cross-referenced with available industry reports to ensure accurate insights.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, consultations with industry experts through computer-assisted telephone interviews (CATIs) are conducted. These interviews provide firsthand data on operational dynamics, technological developments, and barriers.

Step 4: Research Synthesis and Final Output

In the last phase, we synthesize insights from various manufacturers and end-users, verifying the data against findings from primary and secondary research. This ensures a holistic and accurate market view.

Frequently Asked Questions

01. How big is the Global Organic Solar Cell Market?

The global organic solar cell market is valued at approximately USD 200 Mn, with a strong growth trajectory propelled by advancements in solar technology and government incentives for renewable energy.

02. What are the challenges in the Global Organic Solar Cell Market?

The market faces challenges like shorter lifespan compared to inorganic cells, higher sensitivity to environmental factors, and higher initial costs, which impact widespread adoption.

03. Who are the major players in the Global Organic Solar Cell Market?

Key players include Heliatek GmbH, Solarmer Energy Inc., Mitsubishi Chemical Corporation, and BELECTRIC OPV GmbH, who dominate due to their technological advancements and global reach.

04. What are the growth drivers of the Global Organic Solar Cell Market?

Growth drivers include increased renewable energy adoption, demand for flexible solar solutions, and technological innovations that improve cell efficiency and reduce production costs.

05. Which regions dominate the Global Organic Solar Cell Market?

Dominant regions include North America, Europe, and Asia-Pacific, driven by supportive government policies, high investment in green technology, and well-established market players.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.