Global Orthokeratology Lens Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10607

November 2024

84

About the Report

Global Orthokeratology Lens Market Overview

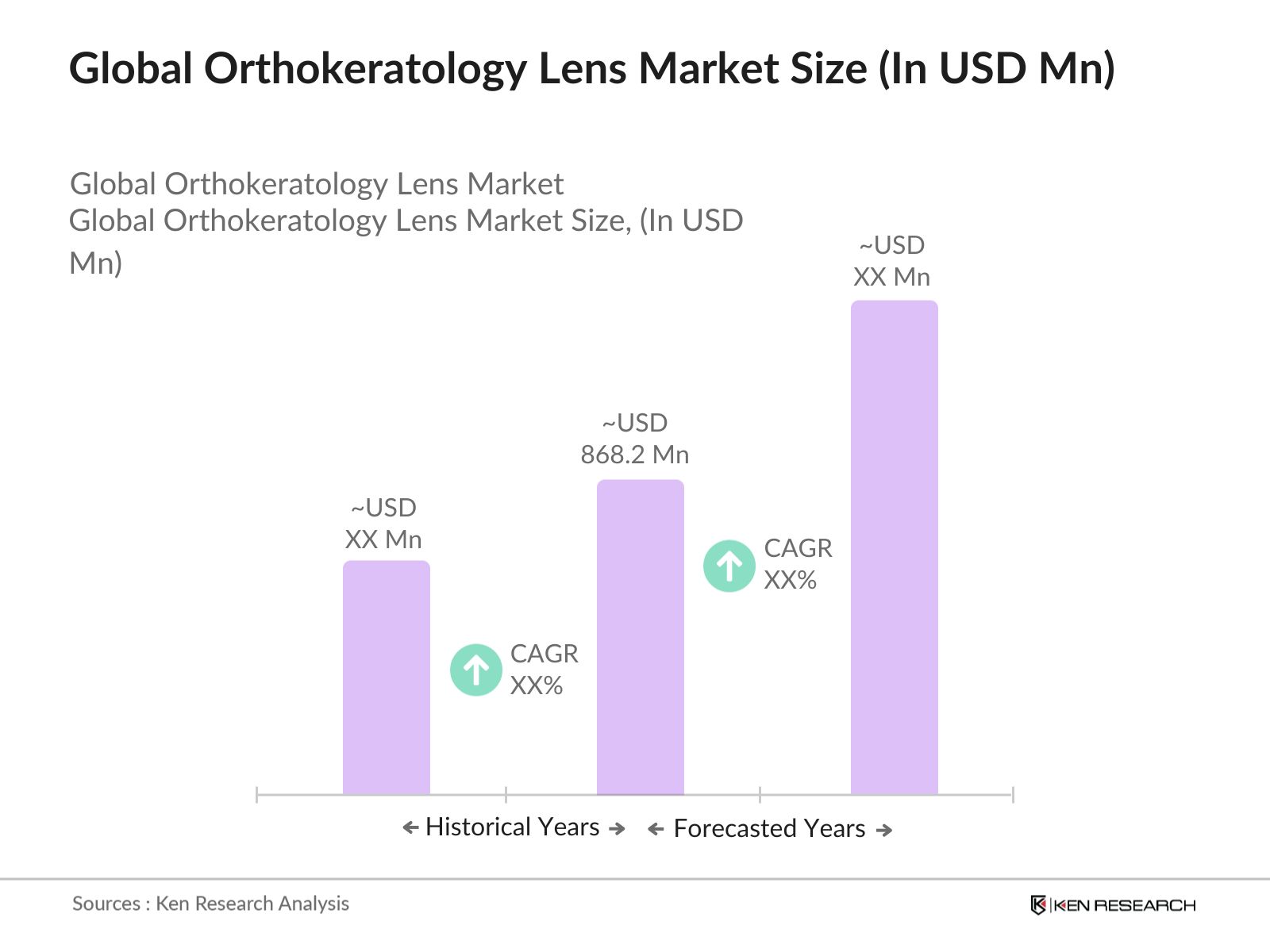

- The orthokeratology lens market is valued at USD 868.2 million based on a five-year historical analysis, driven by the increasing prevalence of myopia and other refractive errors, particularly in children and young adults. The growing demand for non-surgical vision correction, along with advancements in lens design and material technology, further boosts the market. Additionally, the rising awareness of myopia control treatments among eye care professionals and patients contributes to the market's expansion.

- Countries like the United States, China, and Japan dominate the orthokeratology lens market due to their high prevalence of myopia and well-established eye care infrastructures. In the U.S., growing investment in healthcare and rising myopia rates in children are major contributors. Meanwhile, China and Japan lead due to their robust technological advancements and strong adoption of orthokeratology as a preventive treatment for myopia, especially among school-aged children.

- In Europe, orthokeratology lenses must meet CE mark requirements before being sold. This certification ensures that the lenses meet EU safety, health, and environmental protection standards. The CE mark process includes compliance with the European Medical Devices Directive, which governs the approval of contact lenses across the European Union. In 2024, regulatory authorities continue to emphasize the importance of stringent safety standards for orthokeratology lenses

Global Orthokeratology Lens Market Segmentation

- By Product Type: The global orthokeratology lens market is segmented by product type into nighttime orthokeratology lenses and daytime orthokeratology lenses. Nighttime lenses hold a dominant market share due to the convenience they offer patients, allowing them to wear lenses overnight and correct their vision for the day without needing contact lenses or glasses. The rising popularity of these lenses among young individuals with progressive myopia has further cemented their dominance in this segment.

- By Region: The orthokeratology market is segmented geographically into North America, Europe, Asia-Pacific, and Rest of the World. Asia-Pacific dominates the market share, driven by the high prevalence of myopia, particularly in countries like China and Japan. The cultural acceptance of vision correction solutions and the early adoption of orthokeratology as a myopia control method have also contributed to the region's lead in this market segment.

- By Material Type: The market is also segmented by material type into fluorosilicone acrylate and silicone hydrogel lenses. Fluorosilicone acrylate lenses hold the largest market share, attributed to their superior permeability to oxygen, which makes them ideal for overnight wear. This material's ability to maintain eye health during extended wear has garnered preference among practitioners and patients alike, reinforcing its dominance in the orthokeratology market.

Global Orthokeratology Lens Market Competitive Landscape

The global orthokeratology lens market is dominated by both global and regional players, with a few key companies driving market innovation and distribution. Leading companies like Paragon Vision Sciences and Bausch & Lomb lead the way in terms of technological advancements and market penetration. These companies benefit from their extensive distribution networks and strong collaborations with eye care professionals. Additionally, local manufacturers in Asia-Pacific, such as Menicon and Brighten Optix, have gained a foothold due to their tailored solutions for the regional market needs.

|

Company |

Year Established |

Headquarters |

Material Technology |

FDA Approval |

Global Presence |

Research Centers |

R&D Investment |

Strategic Partnerships |

|

Paragon Vision Sciences |

1976 |

USA |

||||||

|

Bausch & Lomb Incorporated |

1853 |

USA |

||||||

|

Menicon Co., Ltd. |

1951 |

Japan |

||||||

|

Euclid Systems Corporation |

1993 |

USA |

||||||

|

Brighten Optix |

2007 |

China |

Global Orthokeratology Lens Industry Analysis

Growth Drivers

- Rising Prevalence of Myopia and Other Refractive Errors: The prevalence of myopia is a major factor driving demand for orthokeratology lenses. In 2023, it is estimated that over 2.6 billion people globally are affected by myopia, with Asia accounting for the highest numbers. For instance, in China, more than 600 million people suffer from myopia, particularly among the younger population, according to the National Health Commission. The increasing cases of refractive errors have driven demand for non-surgical interventions like orthokeratology, which offer a solution for managing the condition without permanent surgery.

- Growing Awareness of Non-Surgical Vision Correction: Non-surgical vision correction, such as orthokeratology lenses, has become more widely recognized as an alternative to corrective surgeries like LASIK. The global adoption of orthokeratology lenses has seen a rise due to awareness campaigns by health bodies. According to the World Health Organization, nearly 1 billion people globally had avoidable vision impairment in 2022, many of whom could benefit from non-surgical treatments. This growing awareness is promoting the use of orthokeratology lenses for temporary correction of vision problems.

- Increasing Investment in Healthcare Infrastructure: Global healthcare expenditure has been increasing steadily, particularly in developed regions like North America and Europe, where investment in eye care facilities is growing. The World Bank reports that global health expenditure has grown by $500 billion in 2022, enhancing access to advanced eye care services. These infrastructure investments provide a solid foundation for the expansion of orthokeratology services, making them more accessible to the general public.

Market Restraints

- High Initial Costs of Orthokeratology Treatment: Orthokeratology lenses come with relatively high initial costs, which can be prohibitive for many consumers. On average, orthokeratology lenses can range from $1,000 to $2,000 for fitting and consultation fees, which is significantly higher than traditional corrective lenses. This creates a barrier to widespread adoption, especially in developing markets where healthcare expenditure per capita remains low, according to World Bank data on global healthcare spending.

- Lack of Expertise Among Eye Care Practitioners: Orthokeratology treatment requires specialized expertise, and there is a shortage of trained practitioners capable of providing this service. In 2023, fewer than 10% of optometrists in emerging markets like Southeast Asia have received formal training in orthokeratology, according to regional health associations. This lack of expertise limits the availability of orthokeratology lenses, particularly in rural and underserved areas.

Global Orthokeratology Lens Market Future Outlook

Over the next few years, the orthokeratology lens market is expected to experience notable growth due to increasing myopia prevalence, particularly in the Asia-Pacific region, and ongoing technological advancements in lens design and material. The rising adoption of myopia control methods, particularly among children, and expanding healthcare infrastructure will continue to drive market demand. Regulatory approvals and reimbursement policies will also play a key role in shaping the future market landscape, enabling greater adoption of orthokeratology lenses worldwide.

Market Opportunities

- Increasing Use of Orthokeratology for Pediatric Myopia Control: There is a growing trend of orthokeratology being used to control myopia in children. According to the American Academy of Ophthalmology, pediatric myopia management has become a key focus due to rising cases of myopia among children, with over 50 million children affected globally as of 2022. Orthokeratology has proven effective in slowing the progression of myopia in children, offering a significant opportunity for growth in this market.

- Advancements in Lens Materials and Design: Technological advancements in lens materials and design are creating new opportunities in the orthokeratology market. In 2024, the use of advanced polymers in lens manufacturing has improved both comfort and oxygen permeability, key factors in ensuring long-term use without compromising eye health. These innovations, supported by research from global organizations like the National Eye Institute, enhance the effectiveness of orthokeratology lenses, further driving adoption.

Scope of the Report

|

Product Type |

Nighttime Orthokeratology Lenses |

|

Daytime Orthokeratology Lenses |

|

|

Material Type |

Fluorosilicone Acrylate |

|

Silicone Hydrogel |

|

|

Application |

Myopia Management |

|

Hyperopia Correction |

|

|

Presbyopia Treatment |

|

|

Age Group |

Pediatrics |

|

Adults |

|

|

Distribution Channel |

Hospitals and Clinics |

|

Online Retailers |

|

|

Optical Stores |

Products

Key Target Audience

Eye Care Practitioners

Hospitals and Clinics

Lens Manufacturers

Regulatory Bodies (FDA, CE Authorities)

Venture Capital Firms

Medical Research Institutions

Retail Optical Stores

Government Health Agencies (NIH, CDC)

Companies

Players Mentioned in the Report:

Paragon Vision Sciences

Bausch & Lomb Incorporated

Euclid Systems Corporation

CooperVision Inc.

Menicon Co., Ltd.

TruForm Optics

Contex Inc.

Procornea Nederland B.V.

Brighten Optix

Alpha Corporation

No7 Contact Lenses Ltd

Visioneering Technologies

EyeDream Ortho-K Lenses

Seefree Lens Co., Ltd.

BostonSight

Table of Contents

1. Global Orthokeratology Lens Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Orthokeratology Lens Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Orthokeratology Lens Market Analysis

3.1. Growth Drivers (myopia management demand, aging population, increasing healthcare expenditure)

3.1.1. Rising Prevalence of Myopia and Other Refractive Errors

3.1.2. Growing Awareness of Non-Surgical Vision Correction

3.1.3. Increasing Investment in Healthcare Infrastructure

3.2. Market Challenges (high costs, technical expertise requirement, regulatory hurdles)

3.2.1. High Initial Costs of Orthokeratology Treatment

3.2.2. Lack of Expertise Among Eye Care Practitioners

3.2.3. Regulatory Constraints in Emerging Markets

3.3. Opportunities (expansion in pediatric applications, technological advancements)

3.3.1. Increasing Use of Orthokeratology for Pediatric Myopia Control

3.3.2. Advancements in Lens Materials and Design

3.3.3. Expansion of Orthokeratology Clinics in Emerging Markets

3.4. Trends (digitization of eye care, personalized lenses, AI integration)

3.4.1. Integration of Artificial Intelligence in Eye Care Diagnostics

3.4.2. Development of Custom-Made Orthokeratology Lenses

3.4.3. Adoption of Digital Eye Care Monitoring Tools

3.5. Government Regulation (FDA approvals, CE mark, healthcare reimbursement policies)

3.5.1. FDA Approval Process for Orthokeratology Lenses

3.5.2. CE Mark Requirements for Market Entry in Europe

3.5.3. Reimbursement Policies for Orthokeratology in Different Markets

3.6. SWOT Analysis (strengths, weaknesses, opportunities, threats specific to the orthokeratology market)

3.7. Stakeholder Ecosystem (key players, suppliers, distributors, clinics, regulatory bodies)

3.8. Porters Five Forces Analysis (competitive rivalry, bargaining power of suppliers and buyers, threat of new entrants, and substitutes specific to orthokeratology lenses)

3.9. Competition Ecosystem

4. Global Orthokeratology Lens Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Nighttime Orthokeratology Lenses

4.1.2. Daytime Orthokeratology Lenses

4.2. By Material Type (In Value %)

4.2.1. Fluorosilicone Acrylate

4.2.2. Silicone Hydrogel

4.3. By Application (In Value %)

4.3.1. Myopia Management

4.3.2. Hyperopia Correction

4.3.3. Presbyopia Treatment

4.4. By Age Group (In Value %)

4.4.1. Pediatrics

4.4.2. Adults

4.5. By Distribution Channel (In Value %)

4.5.1. Hospitals and Clinics

4.5.2. Online Retailers

4.5.3. Optical Stores

5. Global Orthokeratology Lens Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bausch & Lomb Incorporated

5.1.2. Euclid Systems Corporation

5.1.3. Paragon Vision Sciences

5.1.4. CooperVision Inc.

5.1.5. Menicon Co., Ltd.

5.1.6. TruForm Optics

5.1.7. Contex Inc.

5.1.8. Procornea Nederland B.V.

5.1.9. Brighten Optix

5.1.10. Alpha Corporation

5.1.11. No7 Contact Lenses Ltd

5.1.12. Visioneering Technologies

5.1.13. EyeDream Ortho-K Lenses

5.1.14. Seefree Lens Co., Ltd.

5.1.15. BostonSight

5.2. Cross Comparison Parameters (Revenue, Product Range, Regional Presence, FDA Approvals, Material Type, Patient Outcomes, Production Volume, Clinical Trials)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Orthokeratology Lens Market Regulatory Framework

6.1. Certification Requirements

6.2. Compliance with Regional Safety Standards

6.3. Clinical Study Requirements for FDA/CE Approval

7. Global Orthokeratology Lens Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Orthokeratology Lens Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Application (In Value %)

8.4. By Age Group (In Value %)

8.5. By Distribution Channel (In Value %)

9. Global Orthokeratology Lens Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying essential market parameters by mapping the ecosystem of orthokeratology lens stakeholders. This is achieved through extensive secondary research and access to proprietary databases, capturing industry data such as myopia rates, healthcare spending, and lens adoption.

Step 2: Market Analysis and Construction

This phase involves gathering and analyzing historical data on the orthokeratology lens market, including market penetration, the number of practicing professionals, and lens sales. Insights into regional differences and technology advancements are incorporated to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts, conducted through structured interviews, allow for the validation of market hypotheses and provide deeper insights into market trends and challenges. This step helps refine market data and ensure it aligns with industry practices.

Step 4: Research Synthesis and Final Output

In the final step, data from industry leaders, including lens manufacturers and eye care practitioners, is compiled to produce a final, validated analysis. This includes a comprehensive breakdown of market trends, competitive landscape, and future opportunities, ensuring an accurate representation of the orthokeratology market.

Frequently Asked Questions

01. How big is the Global Orthokeratology Lens Market?

The global orthokeratology lens market is valued at USD 868.2 million, with growth driven by increasing awareness of non-surgical myopia control and advancements in lens technology.

02. What are the challenges in the Orthokeratology Lens Market?

Challenges in the market include high costs associated with orthokeratology treatment, a shortage of skilled practitioners, and regulatory hurdles in certain regions. The market also faces stiff competition from other vision correction methods, such as LASIK.

03. Who are the major players in the Orthokeratology Lens Market?

Key players in the market include Paragon Vision Sciences, Bausch & Lomb Incorporated, Euclid Systems Corporation, Menicon Co., Ltd., and CooperVision Inc. These companies dominate due to their innovative product offerings, strong distribution networks, and established partnerships with healthcare providers.

04. What are the growth drivers of the Orthokeratology Lens Market?

The market is primarily driven by the rising prevalence of myopia, particularly in Asia-Pacific, where the condition is widespread. The convenience of non-surgical treatments and advancements in lens materials are also boosting the market's growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.