Region:Global

Author(s):Geetanshi

Product Code:KRAA1305

Pages:98

Published On:August 2025

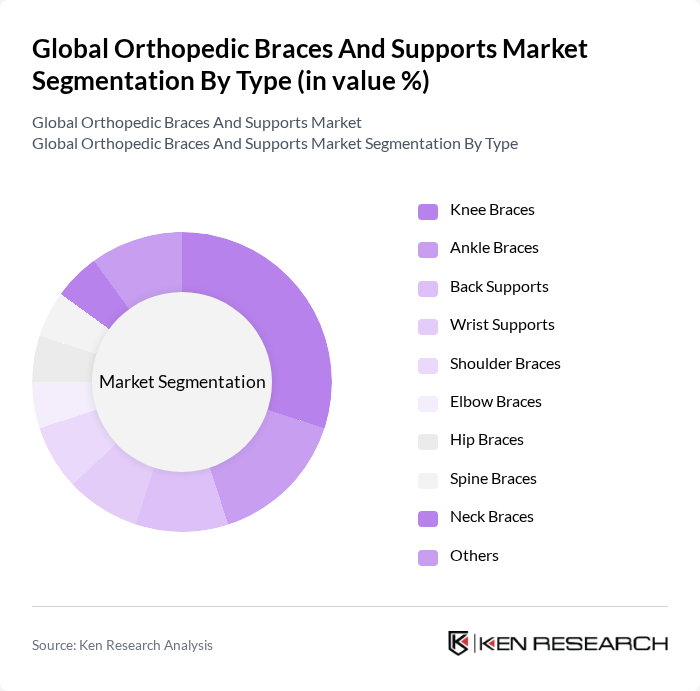

By Type:The orthopedic braces and supports market is segmented into knee braces, ankle braces, back supports, wrist supports, shoulder braces, elbow braces, hip braces, spine braces, neck braces, and others. Among these,knee bracesremain the most dominant segment due to the high incidence of knee injuries, osteoarthritis, and ligament injuries. The increasing participation in sports and physical activities, combined with a preference for non-invasive treatment options, has further fueled demand for knee braces for both preventive and therapeutic applications .

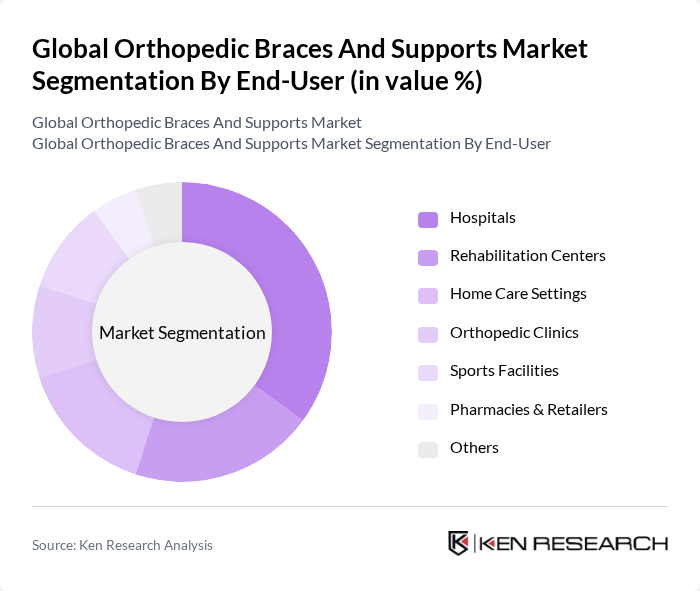

By End-User:The market is segmented by end-users including hospitals, rehabilitation centers, home care settings, orthopedic clinics, sports facilities, pharmacies & retailers, and others.Hospitalsare the leading end-user segment, driven by the increasing number of orthopedic surgeries, the need for post-operative care, and the adoption of advanced orthopedic devices. The growing trend of outpatient surgeries and rehabilitation services has further enhanced demand for orthopedic braces and supports in hospital settings. Home care and sports facilities are also experiencing increased adoption due to the convenience and preventive benefits offered by modern braces .

The Global Orthopedic Braces and Supports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Össur hf, DJO Global, Inc., Breg, Inc., medi GmbH & Co. KG, Zimmer Biomet Holdings, Inc., Stryker Corporation, DeRoyal Industries, Inc., Hanger, Inc., BSN medical GmbH, Tynor Orthotics Pvt. Ltd., Bauerfeind AG, Ottobock SE & Co. KGaA, Fillauer LLC, Frank Stubbs Company, Inc., McDavid, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the orthopedic braces and supports market appears promising, driven by technological advancements and demographic shifts. As the geriatric population grows and awareness of orthopedic health increases, demand for innovative solutions will rise. Additionally, the integration of telehealth services and smart technologies will enhance patient engagement and adherence to treatment plans. Companies that focus on developing cost-effective, customizable solutions will likely capture significant market share, addressing both patient needs and healthcare provider demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Knee Braces Ankle Braces Back Supports Wrist Supports Shoulder Braces Elbow Braces Hip Braces Spine Braces Neck Braces Others |

| By End-User | Hospitals Rehabilitation Centers Home Care Settings Orthopedic Clinics Sports Facilities Pharmacies & Retailers Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Retail Direct Sales Distributors Others |

| By Material | Fabric Plastic Metal Composite Materials Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Premium Price Range |

| By Application | Injury Recovery Post-Surgery Support Preventive Care Osteoarthritis Management Ligament Injury (ACL, LCL, etc.) Sports Performance Enhancement Others |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 60 | Orthopedic Specialists, Sports Medicine Physicians |

| Healthcare Distributors | 50 | Supply Chain Managers, Product Managers |

| Retailers of Orthopedic Products | 40 | Store Managers, Purchasing Agents |

| Patients Using Braces | 70 | Individuals with Injuries, Post-Surgery Patients |

| Physical Therapists | 45 | Rehabilitation Specialists, Clinic Directors |

The Global Orthopedic Braces and Supports Market is valued at approximately USD 4.7 billion, reflecting a significant growth trend driven by increasing musculoskeletal disorders, a rising geriatric population, and greater awareness of preventive care and rehabilitation.