Region:Global

Author(s):Geetanshi

Product Code:KRAB0140

Pages:81

Published On:August 2025

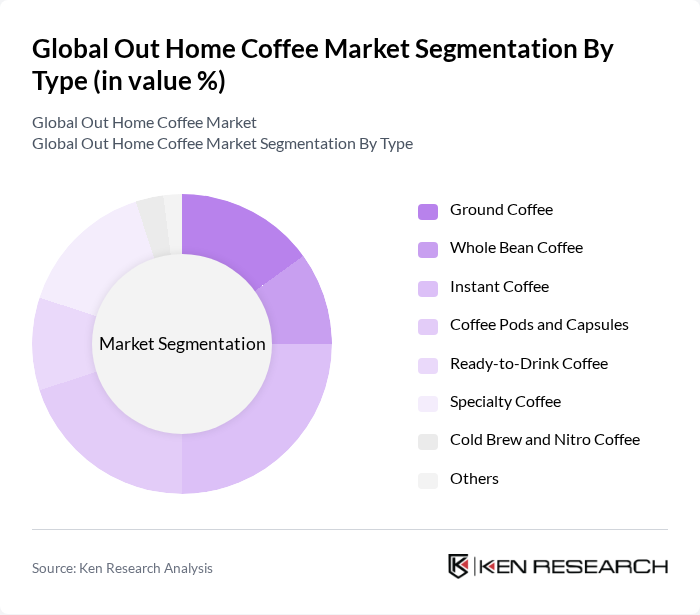

By Type:The market is segmented into various types of coffee products, including Ground Coffee, Whole Bean Coffee, Instant Coffee, Coffee Pods and Capsules, Ready-to-Drink Coffee, Specialty Coffee, Cold Brew and Nitro Coffee, and Others. Among these, Instant Coffee and Coffee Pods and Capsules are gaining significant traction due to their convenience and ease of preparation, appealing to busy consumers seeking quick solutions. The trend towards specialty coffee is also notable, as consumers increasingly seek unique flavors, artisanal brewing methods, and high-quality brews. Health-oriented and plant-based coffee options are also emerging as key trends in response to evolving dietary preferences .

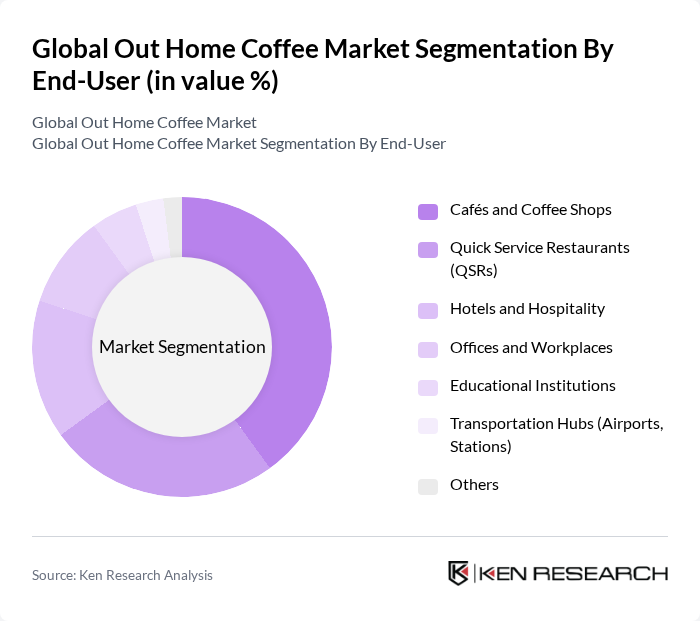

By End-User:The end-user segmentation includes Cafés and Coffee Shops, Quick Service Restaurants (QSRs), Hotels and Hospitality, Offices and Workplaces, Educational Institutions, Transportation Hubs (Airports, Stations), and Others. Cafés and Coffee Shops are the leading segment, driven by the growing coffee culture and consumer preference for socializing in coffee establishments. Quick Service Restaurants are also significant, as they increasingly offer coffee as part of their menu to attract customers. Offices and workplaces are seeing renewed demand as employees return to physical workspaces, and transportation hubs are expanding premium coffee offerings to cater to travelers .

The Global Out Home Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Starbucks Corporation, Nestlé S.A., The J.M. Smucker Company, Keurig Dr Pepper Inc., Dunkin' Brands Group, Inc., Luigi Lavazza S.p.A., Peet's Coffee, Inc., Illycaffè S.p.A., Tchibo GmbH, Costa Coffee (The Coca-Cola Company), Blue Bottle Coffee, Inc., Tim Hortons Inc., Caribou Coffee Company, Inc., Stumptown Coffee Roasters, Gloria Jean's Coffees contribute to innovation, geographic expansion, and service delivery in this space.

The out home coffee market is poised for significant evolution, driven by changing consumer preferences and technological advancements. As the demand for sustainable and ethically sourced coffee grows, brands will need to adapt their sourcing strategies to meet consumer expectations. Additionally, the integration of technology in coffee preparation, such as smart coffee machines, is expected to enhance the consumer experience. These trends indicate a dynamic market landscape that will require continuous innovation and responsiveness to consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Ground Coffee Whole Bean Coffee Instant Coffee Coffee Pods and Capsules Ready-to-Drink Coffee Specialty Coffee Cold Brew and Nitro Coffee Others |

| By End-User | Cafés and Coffee Shops Quick Service Restaurants (QSRs) Hotels and Hospitality Offices and Workplaces Educational Institutions Transportation Hubs (Airports, Stations) Others |

| By Distribution Channel | Coffee Shop Chains Independent Cafés Foodservice Providers Vending Machines Online Platforms Others |

| By Packaging Type | Bags Cans Bottles Pods and Capsules Cartons |

| By Flavor | Original Flavored Decaffeinated Functional/Health-Oriented |

| By Price Range | Premium Mid-Range Economy |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Occasional Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Café Owners and Managers | 120 | Café Owners, Operations Managers |

| Restaurant Beverage Managers | 80 | Beverage Managers, Purchasing Managers |

| Consumer Focus Groups | 60 | Regular Coffee Consumers, Specialty Coffee Enthusiasts |

| Distributors and Wholesalers | 50 | Sales Managers, Distribution Coordinators |

| Market Analysts and Experts | 40 | Industry Analysts, Market Researchers |

The Global Out Home Coffee Market is valued at approximately USD 25 billion, driven by increasing demand for coffee in cafés, restaurants, and offices, as well as the rising trend of coffee culture globally.