Global Packaging Tape Market Outlook to 2030

Region:Global

Author(s):Sanjna Verma

Product Code:KROD1253

December 2024

84

About the Report

Global Packaging Tape Market Overview

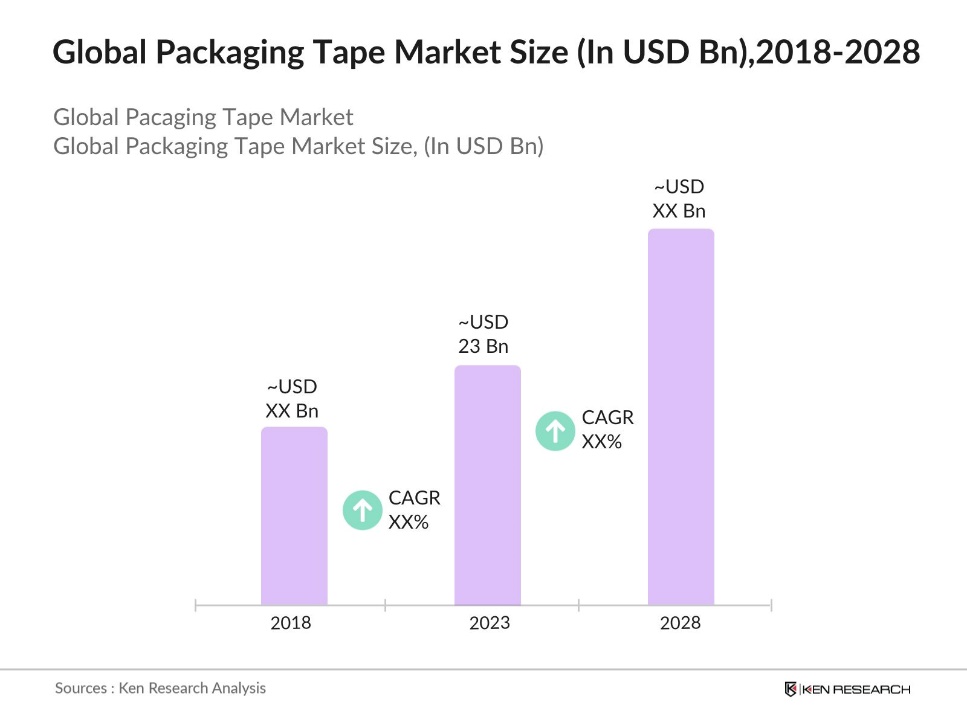

- Global Packaging Tape Market reached a market size of USD 23 billion in 2023. This growth has been driven by the increasing demand for packaging materials across various industries, particularly in e-commerce and logistics, where packaging tape is essential for secure and efficient transportation.

- Key players in the global packaging tape market include 3M Company, Intertape Polymer Group Inc., Tesa SE, Nitto Denko Corporation, and Shurtape Technologies LLC. These companies dominate the market by offering a wide range of packaging tape products and solutions, leveraging their extensive distribution networks and strong brand recognition to maintain market leadership.

- In 2022, 3M introduced the Scotch Cushion Lock Protective Wrap, an eco-friendly packing solution designed to replace traditional plastic wraps. This innovative product offers effective protection for fragile items during shipping and storage while being guilt-free. Made from recyclable materials, it aims to reduce plastic waste without compromising on performance.

- Cities like Shanghai, New York, and London dominate the packaging tape market due to their large manufacturing bases, robust logistics networks, and high concentration of e-commerce activities. Shanghai, being a global trade hub, has seen a surge in packaging material demand, contributing to its dominance in the market.

Global Packaging Tape Market Segmentation

The Global Packaging Tape Market can be segmented based on several factors:

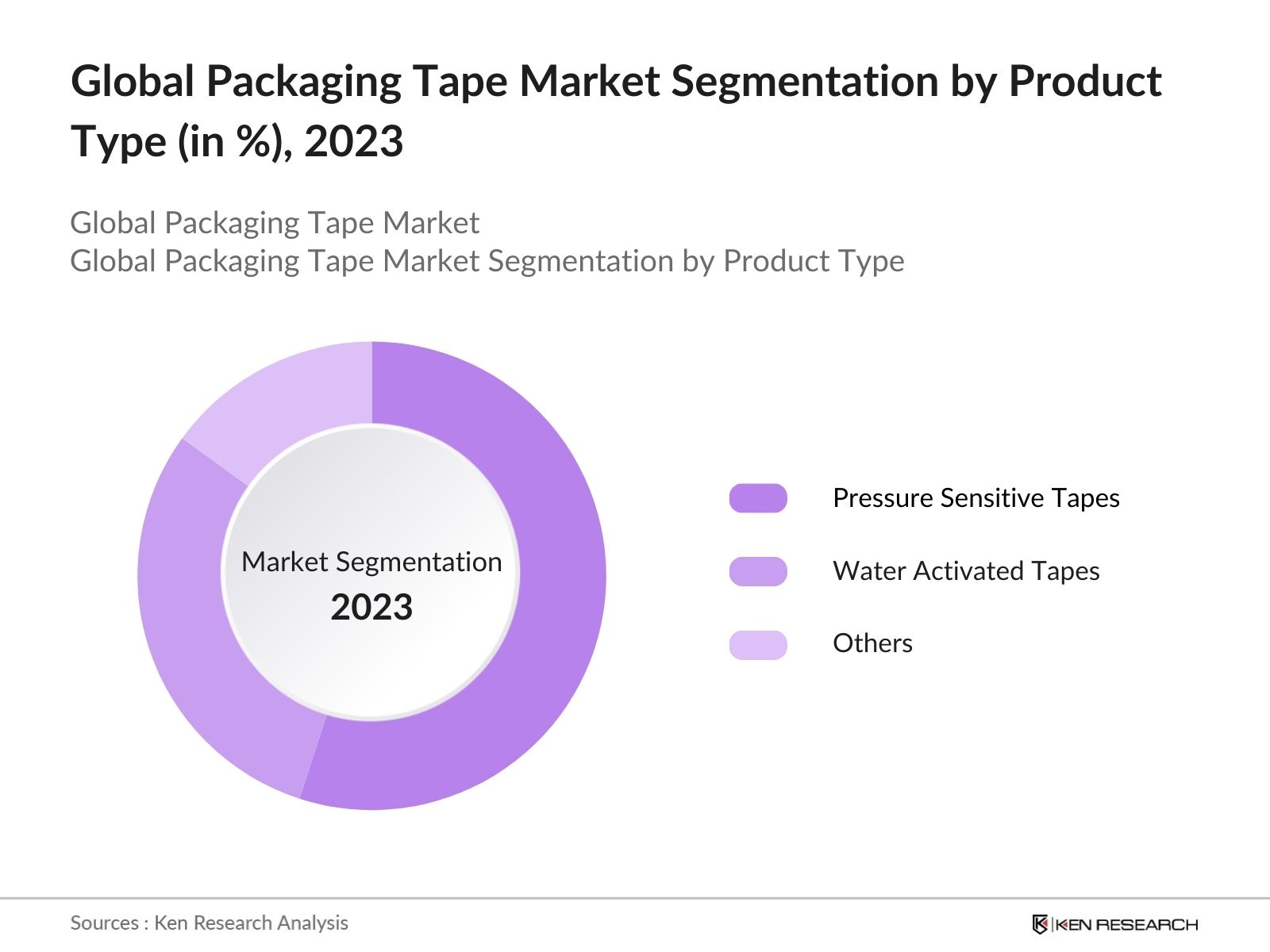

By Product Type: The packaging tape market is segmented by product type into pressure-sensitive tapes, water-activated tapes, and others. In 2023, pressure-sensitive tapes held the dominant market share. This is due to their versatility and ease of use across various applications, including sealing boxes, bundling, and surface protection. The growing demand for durable and high-performance tapes in the e-commerce and logistics industries has bolstered the market for pressure-sensitive tapes.

By Region: The packaging tape market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In 2023, Asia-Pacific held the dominant market share. This region's dominance is driven by rapid industrialization, a booming e-commerce sector, and significant investments in infrastructure development. Countries like China and India are major contributors, with their large manufacturing bases and growing demand for efficient packaging solutions, reinforcing Asia-Pacific's leadership in the market.

By End-User Industry: The market is segmented by end-user industry into e-commerce, food and beverages, consumer goods, and industrial goods. The e-commerce segment dominated the market in 2023. This dominance is attributed to the exponential growth of online shopping and the need for secure packaging solutions to protect goods during transit. The e-commerce sector's reliance on reliable packaging to enhance customer experience and prevent damage during delivery drives the demand for packaging tapes

Global Packaging Tape Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

3M Company |

1902 |

St. Paul, Minnesota, USA |

|

Intertape Polymer Group |

1981 |

Montreal, Quebec, Canada |

|

Tesa SE |

1941 |

Norderstedt, Germany |

|

Nitto Denko Corporation |

1918 |

Osaka, Japan |

|

Shurtape Technologies LLC |

1996 |

Hickory, North Carolina, USA |

- Intertape Polymer Group: In 2024, IPG has launched the IMA Brand E-CO Flex SealMatic, a fully automated case sealer designed for e-commerce. This machine processes FEFCO 201 cases, sealing them with sustainable water-activated tape at speeds of up to 20 boxes per minute without operator intervention. It automatically adjusts to various case sizes and can bypass SIOC cases.

- Tesa SE: In 2023, tesa SE, a leading manufacturer of technical adhesive tapes and self-adhesive system solutions, acquired Lohmann GmbH & Co. KG, another prominent player in the adhesive tape market. This strategic move is expected to significantly strengthen tesa's position in the global adhesive tape industry. Through this acquisition, tesa will be able to expand its product offerings by incorporating Lohmann's expertise in manufacturing double-sided adhesive tapes, transfer films, and adhesive systems.

Global Packaging Tape Industry Analysis

Growth Drivers:

- Rising E-commerce Industry: The global e-commerce market is a major growth driver for the packaging tape market. As of 2024, there are approximately 273.49 million online shoppers in the United States, reflecting a 5.6% increase from the previous year. The exponential rise in online shopping has significantly increased the demand for packaging materials to ensure safe and efficient delivery of goods, driving further growth in the packaging tape market.

- Expansion in the Logistics Sector: The global logistics sector, encompassing freight transport and warehousing, has experienced significant growth, fueled by a 1% rise in global goods trade and 1.5% growth in services in Q1 2024. Major economies like China (9% export increase), India (7%), and the United States (3%) have driven this resurgence. Packaging tapes play a vital role in securing packages, highlighting their importance in this expanding industry.

- Growing Demand for Sustainable Packaging: Global demand for sustainable packaging materials, such as biodegradable and recyclable tapes, is rising. In 2021, the U.S. produced around 40 million tons of plastic waste, with only 5% to 6% recycled, underscoring the need for sustainable alternatives. This shift is driven by consumer awareness and regulatory pressures, with entities like the U.S. Environmental Protection Agency promoting eco-friendly packaging, increasing the use of sustainable packaging tapes.

Market Challenges:

- Stringent Environmental Regulations: The packaging tape market faces challenges due to increasing environmental regulations aimed at reducing plastic waste. Companies are now required to comply with rigorous standards for recycling and waste management, adding to operational costs and complexity. Non-compliance can result in hefty fines and damage to brand reputation, making it a significant hurdle for the market.

- Supply Chain Disruptions: The global supply chain has faced numerous disruptions in recent years, impacting the availability of raw materials and finished products in the packaging tape market. In 2021, the blockage of the Suez Canal caused a delay in the shipment worth $9.6 billion during that period, affecting the supply of packaging materials, including tapes. These disruptions have led to increased lead times and costs, challenging manufacturers to maintain inventory levels and meet customer demand.

Government Initiatives:

- European Union Circular Economy Action Plan: The European Union's Circular Economy Action Plan (CEAP), part of the Green Deal, aims to shift from a linear to a circular economy focused on sustainability. Updated in 2020, CEAP promotes resource efficiency and waste reduction. In March 2022, the European Commission proposed the Ecodesign for Sustainable Products Regulation (ESPR) to make products more durable, reusable, repairable, recyclable, and energy-efficient, extending beyond the current Ecodesign Directive.

- Chinas Green Packaging Initiative: Launched in July 2019, this initiative aims to reduce environmental impact through a waste sorting program and promote recyclable, biodegradable packaging in the express delivery sector. The State Post Bureau of China targets 95% of packages using electronic waybills to cut paper waste. These green packaging efforts are expected to save around 207 million disposable plastic bags annually.

Global Packaging Tape Future Market Outlook

Global Packaging Tape Market is projected to experience significant growth over the next five years, driven by the increasing demand for packaging solutions across various industries. The market is expected to benefit from advancements in sustainable packaging materials, catering to the growing consumer preference for eco-friendly products.

Future Market Trends

- Innovation in Sustainable Materials: The packaging tape market is likely to see a surge in the development of sustainable materials. Manufacturers will focus on creating biodegradable and recyclable tapes to meet the rising demand for eco-friendly packaging solutions. This trend will be driven by stringent environmental regulations and consumer preference for sustainable products, encouraging companies to innovate and reduce their carbon footprint.

- Technological Advancements in Packaging Solutions: The future of the packaging tape market will be shaped by technological advancements that enhance product performance and efficiency. Innovations such as smart tapes with integrated RFID technology for tracking and temperature-sensitive tapes for cold chain logistics will become more prevalent. These advancements will provide added value to customers, improving supply chain management and product security.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Product Type |

Pressure-Sensitive Tapes Water-Activated Tapes Others |

|

By Application |

E-commerce Food and Beverages Industrial Goods |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Packaging Manufacturers

E-commerce Companies

Logistics and Transportation Companies

Food and Beverage Companies

Industrial Goods Manufacturers

Investment & Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Environment, Forest and Climate Change, India)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

3M Company

Intertape Polymer Group Inc.

Tesa SE

Nitto Denko Corporation

Shurtape Technologies LLC

Avery Dennison Corporation

Berry Global Inc.

Scapa Group PLC

Vibac Group S.p.A

Lintec Corporation

Pro Tapes & Specialties, Inc.

Loytape Industries Sdn Bhd

PPM Industries S.p.A

Advance Tapes International

Saint-Gobain Performance Plastics

Table of Contents

1. Global Packaging Tape Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Packaging Tape Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Packaging Tape Market Analysis

3.1. Growth Drivers

3.1.1. Rising E-commerce Industry

3.1.2. Expansion in the Logistics Sector

3.1.3. Growing Demand for Sustainable Packaging

3.1.4. Innovation in Packaging Materials

3.2. Restraints

3.2.1. Stringent Environmental Regulations

3.2.2. Supply Chain Disruptions

3.3.3 Expanding Raw Material Costs

3.3. Opportunities

3.3.1. Technological Advancements in Packaging Solutions

3.3.2. Expansion in Emerging Markets

3.3.3. Development of Eco-Friendly Products

3.4. Trends

3.4.1. Innovation in Sustainable Materials

3.4.2. Technological Advancements in Packaging Solutions

3.5. Government Regulation

3.5.1. European Union Circular Economy Action Plan

3.5.2. Chinas Green Packaging Initiative

3.5.3. United States Sustainable Packaging Act

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Packaging Tape Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Pressure-Sensitive Tapes

4.1.2. Water-Activated Tapes

4.1.3. Others

4.2. By Material Type (in Value %)

4.2.1. Polypropylene

4.2.2. Polyvinyl Chloride

4.2.3. Others

4.3. By End-User Industry (in Value %)

4.3.1. E-commerce

4.3.2. Food and Beverages

4.3.3. Consumer Goods

4.3.4. Industrial Goods

4.4. By Application (in Value %)

4.4.1. Sealing

4.4.2. Bundling

4.4.3. Surface Protection

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Packaging Tape Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. 3M Company

5.1.2. Intertape Polymer Group

5.1.3. Tesa SE

5.1.4. Nitto Denko Corporation

5.1.5. Shurtape Technologies LLC

5.1.6 Avery Dennison Corporation

5.1.7 Berry Global Inc.

5.1.8 Scapa Group PLC

5.1.9 Vibac Group S.p.A

5.1.10 Lintec Corporation

5.1.11 Pro Tapes & Specialties, Inc.

5.1.12 Loytape Industries Sdn Bhd

5.1.13 PPM Industries S.p.A

5.1.14 Advance Tapes International

5.1.15 Saint-Gobain Performance Plastics

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Packaging Tape Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Packaging Tape Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Packaging Tape Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Packaging Tape Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Material Type (in Value %)

9.3. By End-User Industry (in Value %)

9.4. By Application (in Value %)

9.5. By Region (in Value %)

10. Global Packaging Tape Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on packaging tape market over the years, penetration of marketplaces and service providers ratio to compute revenue generated next generation firewall market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple next generation packaging tape companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from packaging tape companies.

Frequently Asked Questions

01. How big is Global Packaging Tape Market?

Global Packaging Tape Market reached a market size of USD 23 billion in 2023. This growth has been driven by the increasing demand for packaging materials across various industries, particularly in e-commerce and logistics, where packaging tape is essential for secure and efficient transportation.

02. What are the challenges in Global Packaging Tape Market?

Challenges in the Global Packaging Tape Market include fluctuating raw material prices, stringent environmental regulations, and supply chain disruptions. These factors can increase costs and impact the availability of packaging tapes in the market.

03. Who are the major players in Global Packaging Tape Market?

Major players in the Global Packaging Tape Market include 3M Company, Intertape Polymer Group Inc., Tesa SE, Nitto Denko Corporation, and Shurtape Technologies LLC. These companies lead the market due to their innovative product offerings and strong distribution networks.

04 What are the growth drivers of the Global Packaging Tape Market?

Growth drivers of the Global Packaging Tape Market include the rapid expansion of the e-commerce sector, increasing demand for secure packaging solutions in logistics, and a shift towards sustainable packaging materials. These factors are boosting the adoption of packaging tapes across various industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.