Global Pain Patch Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD4842

November 2024

83

About the Report

Global Pain Patch Market Overview

- The Global Pain Patch Market is valued at USD 6 billion and has seen significant growth due to increasing awareness and preference for non-invasive pain relief methods. Key drivers include the rising prevalence of chronic conditions such as arthritis and neuropathic pain, where transdermal patches offer a safer and often more effective alternative to oral medications. Pain patches are also increasingly adopted due to their ability to provide controlled drug release, minimizing side effects associated with oral medications.

- Regions such as North America and Europe dominate the pain patch market due to advanced healthcare infrastructure, strong healthcare spending, and favorable reimbursement policies. North America leads the market, with the U.S. being a significant player, driven by the high incidence of chronic pain conditions and a well-established pharmaceutical industry. Europe follows closely, where aging populations and increased focus on pain management are key contributors to market growth.

- In Europe, the Medical Device Regulation (MDR) implemented in 2021 has significantly impacted the development and approval of medical devices, including pain patches. The MDR requires more extensive clinical evidence and post-market surveillance, which has raised compliance costs for manufacturers. However, this regulation has also ensured that only the safest and most effective products reach the market. In 2023, several companies successfully navigated the MDR process, securing approvals for their pain patches.

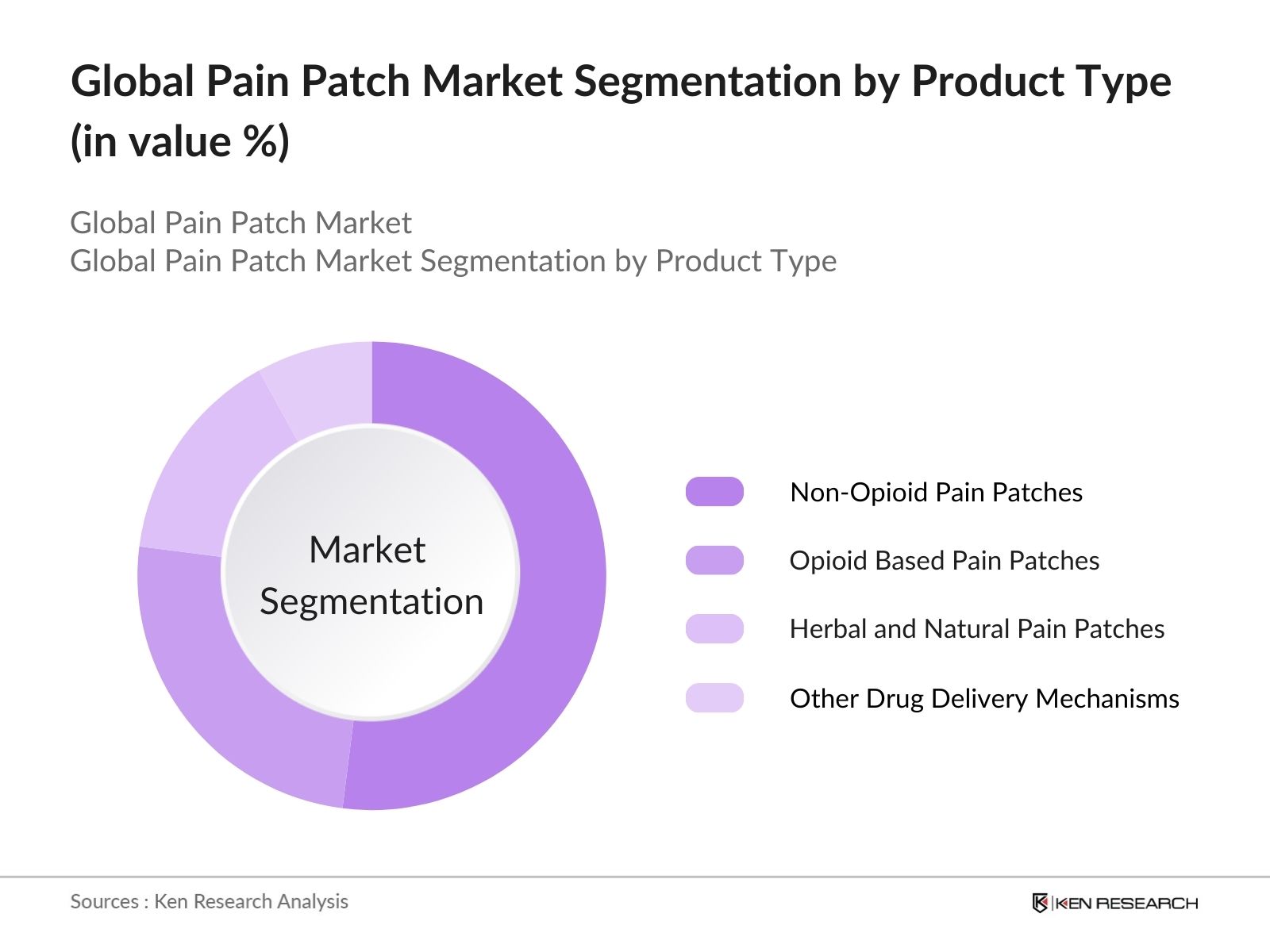

Global Pain Patch Market Segmentation

By Product Type: The Global Pain Patch market is segmented by product type into Non-Opioid Pain Patches, Opioid-Based Pain Patches, Herbal and Natural Pain Patches, and Other Drug Delivery Mechanisms. Recently, Non-Opioid Pain Patches have emerged as the dominant sub-segment within product types. This is primarily due to growing concerns about opioid addiction and the increasing shift towards safer, non-addictive pain management methods. Lidocaine and diclofenac patches are leading the way in this category as they offer effective localized pain relief without the systemic side effects seen with opioids.

By Region: The Global Pain Patch Market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America leads the market, driven by a high prevalence of chronic pain conditions, a well-developed healthcare system, and favorable government policies. In North America, the increasing adoption of non-invasive pain management solutions, coupled with the rising geriatric population, further boosts the demand for pain patches.

By Distribution Channel: The market is segmented by distribution channel into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. Hospital Pharmacies hold a dominant position in this segmentation due to the rising number of surgeries and post-operative pain treatments, which are often managed directly by healthcare providers. Hospital pharmacies provide immediate access to controlled medications and pain patches, making them the most trusted source for patients in need of pain management solutions.

Global Pain Patch Market Competitive Landscape

The Global Pain Patch Market is characterized by significant consolidation, with major players like Teva Pharmaceuticals, Endo International, and Hisamitsu Pharmaceutical Co. driving innovation through investments in R&D and new product launches. The market also sees strategic mergers and acquisitions as companies aim to expand their global footprint and enhance their product portfolios.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

Revenue (2023) |

R&D Investments |

Market Share (%) |

Patent Strength |

Regional Presence |

Strategic Initiatives |

|

Teva Pharmaceuticals |

1901 |

Israel |

- |

- |

- |

- |

- |

- |

- |

|

Endo International |

1920 |

Ireland |

- |

- |

- |

- |

- |

- |

- |

|

Hisamitsu Pharmaceutical Co. |

1847 |

Japan |

- |

- |

- |

- |

- |

- |

- |

|

Mylan N.V. |

1961 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Grnenthal Group |

1946 |

Germany |

- |

- |

- |

- |

- |

- |

- |

Global Pain Patch Market Analysis

Growth Drivers

- Rising Prevalence of Chronic Pain Conditions: Chronic pain affects approximately 1.5 billion people globally, and this number continues to rise, particularly in developed countries. For instance, in the United States alone, over 100 million people report suffering from chronic pain, with arthritis and lower back pain being the leading causes.. This high burden of pain conditions is driving the demand for non-invasive solutions like pain patches to manage discomfort without resorting to opioids.

- Growing Geriatric Population: The geriatric population is expected to reach 2.1 billion globally by 2050, with significant growth recorded in countries such as Japan and the European Union. In 2024, the number of elderly individuals aged 65 and older is projected to surpass 800 million, particularly in aging economies. Elderly individuals are more susceptible to chronic conditions such as arthritis and neuropathy, leading to a higher demand for pain management solutions like patches, which offer ease of use and fewer side effects compared to oral medications.

- Increasing Preference for Non-Invasive Pain Management Solutions: With rising awareness about the side effects and addiction risks associated with opioid-based medications, more patients and healthcare providers are turning to non-invasive solutions. In 2022, an estimated 9,367,000 U.S. adults needed treatment for OUD, according to the CDC. Pain patches offer a safer, non-addictive alternative for pain relief. This shift in preference is particularly pronounced in the U.S. and parts of Europe, where governments have tightened regulations around opioid prescriptions.

Challenges

- High Cost of Specialty Pain Patches: Specialty pain patches, particularly those that incorporate advanced technologies such as heat-activated or microneedle-based delivery systems, can be significantly more expensive compared to traditional medications. In 2022, the per capita health expenditure in the United States was reported to be approximately$12,555. These costs make access to such patches more challenging for low-income individuals, especially in regions where public healthcare does not cover specialty medical devices.

- Stringent Regulatory Requirements: The regulatory pathway for pain patches is highly stringent, as these are classified as combination products involving both medical devices and pharmaceuticals. In 2023, the U.S. Food and Drug Administration (FDA) tightened regulations on transdermal drug delivery systems, requiring more robust clinical data to demonstrate efficacy and safety, which has made the approval process more rigorous and costly, slowing down the entry of new products.

Global Pain Patch Future Market Outlook

The Global Pain Patch Market is set to experience robust growth in the coming years, fueled by the increasing prevalence of chronic pain conditions, growing demand for non-invasive therapies, and technological advancements in drug delivery systems. As healthcare providers seek alternatives to opioid-based pain management, the demand for non-opioid patches is expected to rise. Emerging markets like Asia-Pacific and Latin America are also forecast to contribute significantly to market growth due to expanding healthcare infrastructures and rising disposable incomes.

Market Opportunities

- Development of Next-Gen Pain Patches: The development of next-generation pain patches, such as those utilizing biodegradable materials or enhanced drug formulations, presents a significant growth opportunity. In 2023, researchers at the University of California developed a biodegradable microneedle pain patch that could reduce disposal issues and improve drug delivery efficiency. Such innovations will likely gain regulatory approval and contribute to the expansion of this market segment.

- Growing Demand for Opioid Alternatives: The opioid crisis has led to a surge in demand for non-opioid pain management alternatives. According to the Centers for Disease Control and Prevention (CDC), there were approximately81,083 opioid-related overdose deathsin 2023. This shift is also being supported by healthcare payers, who are increasingly covering non-opioid therapies in response to the crisis.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Non-Opioid Pain Patches |

|

Opioid-Based Pain Patches |

|

|

Herbal and Natural Pain Patches |

|

|

Other Drug Delivery Mechanisms |

|

|

By Distribution Channel |

Hospital Pharmacies |

|

Retail Pharmacies |

|

|

Online Pharmacies |

|

|

By Application |

Neuropathic Pain |

|

Musculoskeletal Pain |

|

|

Cancer Pain |

|

|

Post-Surgical Pain |

|

|

Other Types of Chronic Pain |

|

|

By Technology |

Matrix-Based Patches |

|

Reservoir-Based Patches |

|

|

Micro-Needle Patches |

|

|

Hydrogel-Based Patches |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East & Africa |

Products

Key Target Audience

Pharmaceutical Manufacturers

Healthcare Providers (Hospitals, Clinics, Pain Management Centers)

Biotechnology Firms

Wellness and Alternative Medicine Companies

Insurance Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EMA)

Companies

Major Players in the Global Pain Patch Market

Teva Pharmaceuticals

Endo International

Hisamitsu Pharmaceutical Co.

Mylan N.V.

Grnenthal Group

3M Healthcare

Purdue Pharma

Johnson & Johnson

Sanofi S.A.

Acorda Therapeutics

Novartis AG

Actavis (Allergan)

Nipro Corporation

Pfizer Inc.

Abbott Laboratories

Table of Contents

1. Global Pain Patch Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Pain Patch Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Pain Patch Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Chronic Pain Conditions (e.g., arthritis, lower back pain)

3.1.2. Growing Geriatric Population

3.1.3. Increasing Preference for Non-Invasive Pain Management Solutions

3.1.4. Advancements in Drug Delivery Systems

3.2. Market Challenges

3.2.1. High Cost of Specialty Pain Patches

3.2.2. Stringent Regulatory Requirements (FDA, EMA)

3.2.3. Risk of Skin Irritation and Side Effects

3.3. Opportunities

3.3.1. Development of Next-Gen Pain Patches (transdermal innovations, novel formulations)

3.3.2. Increasing Adoption in Emerging Markets (Asia-Pacific, LATAM)

3.3.3. Growing Demand for Opioid Alternatives

3.4. Trends

3.4.1. Adoption of Biodegradable Materials for Patches

3.4.2. Integration with Wearable Devices for Continuous Monitoring

3.4.3. Personalized Pain Management Approaches (tailored treatments)

3.5. Regulatory Landscape

3.5.1. FDA Approvals and Clinical Trials

3.5.2. EU Medical Device Regulations (MDR)

3.5.3. Patent Expirations and Generic Market Entry

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Manufacturers (patch producers, contract manufacturers)

3.7.2. Suppliers (raw materials, adhesives, drug substances)

3.7.3. Distributors (pharmacy chains, hospitals, e-commerce)

3.7.4. End-Users (patients, healthcare professionals, caregivers)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Pain Patch Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Non-Opioid Pain Patches (lidocaine, diclofenac)

4.1.2. Opioid-Based Pain Patches (fentanyl, buprenorphine)

4.1.3. Herbal and Natural Pain Patches

4.1.4. Other Drug Delivery Mechanisms

4.2. By Distribution Channel (In Value %)

4.2.1. Hospital Pharmacies

4.2.2. Retail Pharmacies

4.2.3. Online Pharmacies

4.3. By Application (In Value %)

4.3.1. Neuropathic Pain

4.3.2. Musculoskeletal Pain

4.3.3. Cancer Pain

4.3.4. Post-Surgical Pain

4.3.5. Other Types of Chronic Pain

4.4. By Technology (In Value %)

4.4.1. Matrix-Based Patches

4.4.2. Reservoir-Based Patches

4.4.3. Micro-Needle Patches

4.4.4. Hydrogel-Based Patches

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Pain Patch Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Teva Pharmaceuticals

5.1.2. Endo International

5.1.3. Hisamitsu Pharmaceutical Co.

5.1.4. Mylan N.V.

5.1.5. Grnenthal Group

5.1.6. 3M Healthcare

5.1.7. Purdue Pharma

5.1.8. Johnson & Johnson

5.1.9. Sanofi S.A.

5.1.10. Acorda Therapeutics

5.1.11. Novartis AG

5.1.12. Actavis (Allergan)

5.1.13. Nipro Corporation

5.1.14. Pfizer Inc.

5.1.15. Abbott Laboratories

5.2. Cross Comparison Parameters (Revenue, R&D Investments, Product Portfolio, Regulatory Approvals, Market Penetration, Patent Strength, Market Share, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Pain Patch Market Regulatory Framework

6.1. FDA Guidelines for Transdermal Patches

6.2. Clinical Trial Requirements

6.3. Labeling Standards

6.4. EU MDR Compliance

7. Global Pain Patch Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Pain Patch Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Application (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Global Pain Patch Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step in our research methodology is the identification of key variables that influence the Global Pain Patch Market. This involves mapping out major stakeholders and collecting data through extensive desk research, including secondary databases and proprietary industry reports, to ensure a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

We then analyze historical market data to assess the penetration of pain patches across different regions, technologies, and applications. This includes evaluating healthcare spending, regulatory approvals, and trends in chronic pain management to create accurate revenue forecasts.

Step 3: Hypothesis Validation and Expert Consultation

In this step, market hypotheses are validated through direct consultations with industry experts, including pain management specialists, pharmaceutical companies, and regulatory authorities. Their insights ensure the reliability and precision of our market estimates.

Step 4: Research Synthesis and Final Output

The final step consolidates all research findings and expert opinions to create a comprehensive market analysis. This includes validating data using both top-down and bottom-up approaches to ensure an accurate reflection of the market landscape and future growth potential.

Frequently Asked Questions

1. How big is the Global Pain Patch Market?

The Global Pain Patch Market is valued at USD 6 billion, driven by increasing demand for non-invasive pain management solutions and advancements in transdermal drug delivery systems.

2. What are the challenges in the Global Pain Patch Market?

Challenges include the high cost of specialty pain patches, stringent regulatory approvals (FDA, EMA), and concerns over skin irritation or allergic reactions associated with prolonged use.

3. Who are the major players in the Global Pain Patch Market?

Key players include Teva Pharmaceuticals, Endo International, Hisamitsu Pharmaceutical Co., and Mylan N.V., dominating the market due to their robust product portfolios and strong global distribution networks.

4. What are the growth drivers of the Global Pain Patch Market?

The market is propelled by the rising incidence of chronic pain conditions, increased healthcare expenditure in emerging markets, and growing preference for non-invasive pain management therapies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.