Global Palletizer Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10854

December 2024

114

About the Report

Global Palletizer Market Overview

- The Global Palletizer Market is valued at USD 2.8 billion, propelled by the expanding automation needs in the logistics, food & beverage, and pharmaceutical sectors. Increasing demand for efficient material handling and cost-reduction strategies are primary growth drivers. Furthermore, advancements in robotic technology and the shift towards modular systems contribute to market expansion, emphasizing efficiency in production and supply chain operations.

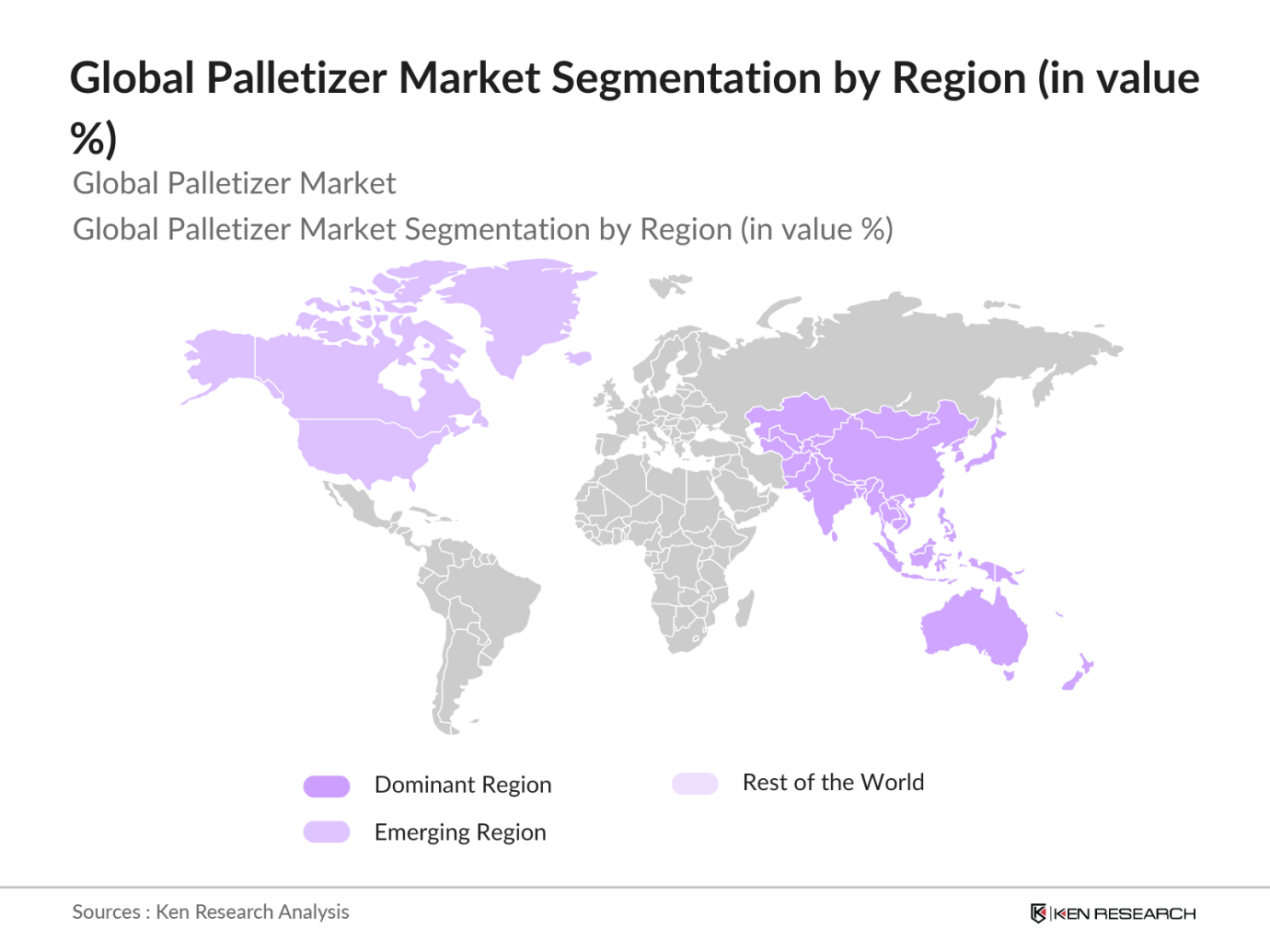

- The Palletizer Market sees significant dominance in regions like North America, led by the U.S., and Asia Pacific, particularly China. The U.S. benefits from well-established industrial automation systems and high demand from manufacturing sectors, while Chinas market dominance stems from its robust manufacturing sector and increasing investment in automation technologies, positioning these countries as leaders in adopting palletizer technology.

- Industry 4.0 standards, particularly in developed economies, are pushing manufacturers to adopt advanced automation technologies, including palletizing systems with integrated data-sharing capabilities. In 2023, over 40% of palletizers sold in North America and Europe featured Industry 4.0 capabilities, facilitating seamless integration with broader factory automation systems. Compliance with these standards is essential to ensure competitiveness in a digitally connected industrial landscape.

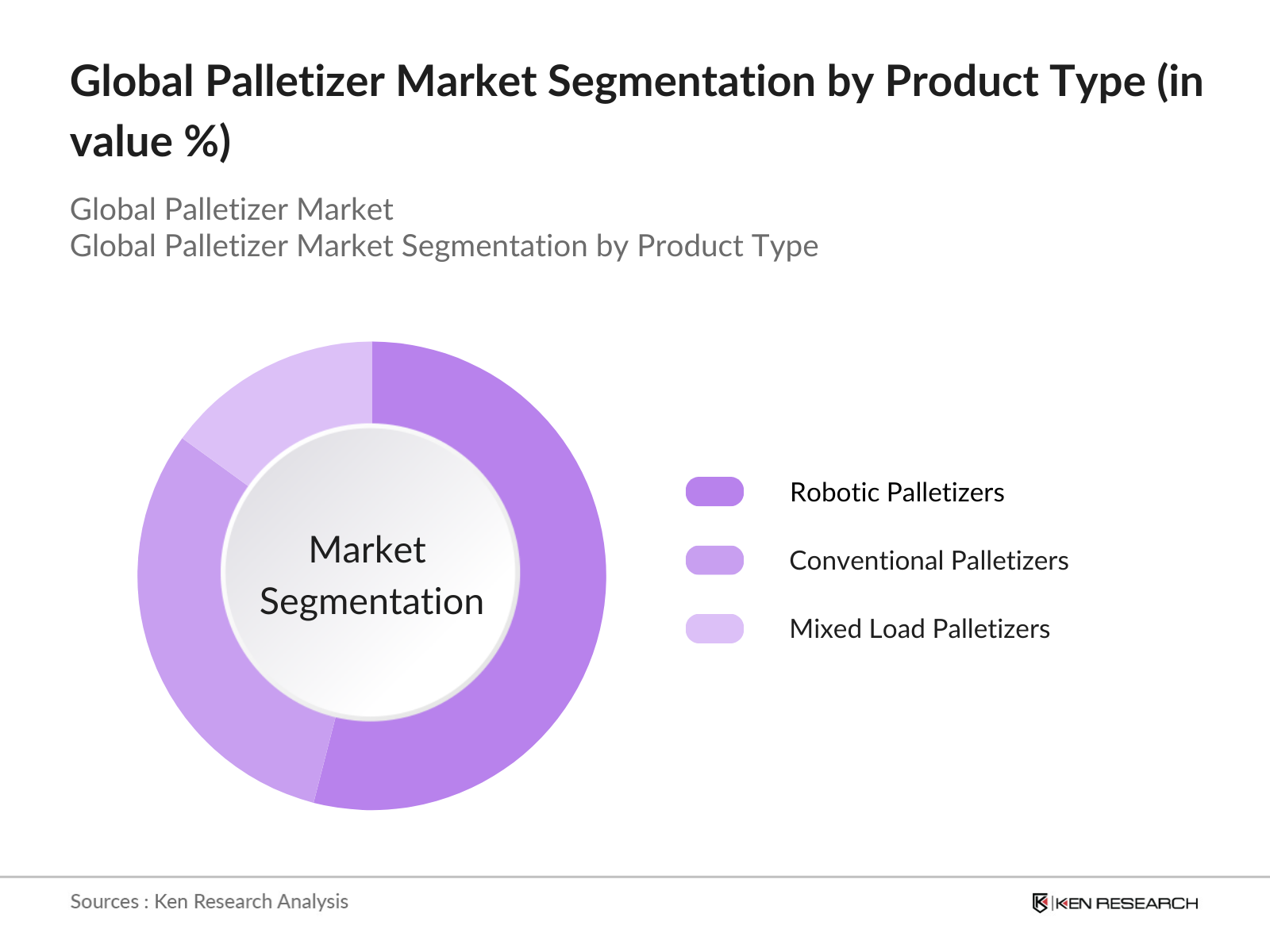

Global Palletizer Market Segmentation

- By Product Type: The palletizer market is segmented by product type into robotic palletizers, conventional palletizers, and mixed load palletizers. Robotic palletizers dominate the market due to their versatility, precision, and ability to handle a wide range of products across different industries. This type is favored especially in food & beverage and pharmaceutical sectors where speed and customization are key, driving its demand as companies look for high-speed, low-labor solutions.

- By Region: The regional segmentation of the palletizer market includes North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific leads due to extensive manufacturing activity in China and India, coupled with increasing automation adoption. North America follows, with the U.S. and Canada benefitting from robust technological adoption in the automation and logistics sectors.

- By End-Use Industry: The palletizer market is segmented by end-use industry into food & beverage, pharmaceuticals, electronics, chemicals, and logistics & warehousing. Food & beverage dominates this segment due to the high demand for efficient packaging and handling of products. Companies in this industry require fast and reliable automation solutions to manage large volumes, particularly in bottling, canning, and packaging lines.

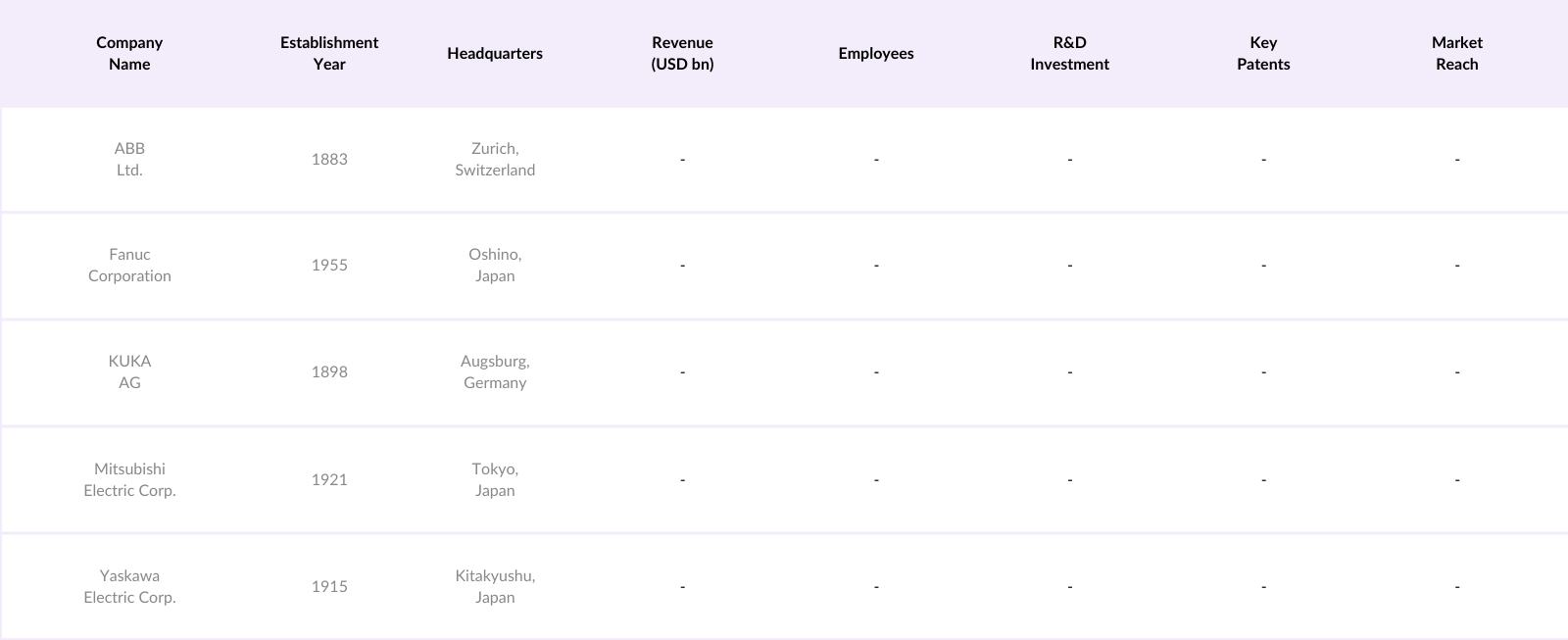

Global Palletizer Market Competitive Landscape

The global palletizer market is dominated by key players who drive industry advancements through technology, innovation, and extensive distribution networks. These companies leverage automated systems and technological upgrades to enhance productivity and maintain their competitive edge.

Global Palletizer Industry Analysis

Growth Drivers

- Automation and Labor Optimization: The demand for automation in palletizing processes is largely driven by the need to reduce dependency on manual labor, with global labor shortages affecting sectors from manufacturing to logistics. According to the International Labour Organization (ILO), automation reduces operational risks associated with labor-intensive tasks by 20-30%, enhancing productivity and safety. The International Federation of Robotics (IFR) reports a 15% increase in the deployment of robotic palletizers across manufacturing sectors in 2023, attributed to their ability to operate continuously and optimize labor allocation. This shift enables better labor cost management and improves operational efficiency.

- Increased Demand in Manufacturing Sectors: Manufacturing output is rising globally, with the World Bank noting a 4.5% increase in industrial production in emerging markets during 2023. This growth has spurred demand for palletizing systems in automotive, food and beverage, and consumer goods sectors to accommodate increased output levels. For instance, the food and beverage sector, responsible for over $8 trillion in global revenue, heavily invests in palletizing solutions to support expanding distribution networks and fulfill large-scale orders efficiently. Such demand reinforces the adoption of advanced palletizing systems across multiple verticals.

- Advancements in Robotic Palletizing Technology: Technological advancements in robotic palletizing, including machine vision and AI-enhanced robotics, have increased accuracy and reduced error rates in palletizing applications. The IFR reports that adoption of such robotic systems rose by 12% in 2023, especially in regions like North America and Europe, where labor costs are higher. Additionally, advanced software algorithms integrated into palletizing robots have improved stacking speed by 20%, optimizing warehouse operations. These innovations directly cater to the market's need for precision and efficiency, especially in sectors handling fragile or high-volume products.

Market Restraints

- High Initial Investment Costs: Palletizing systems, especially robotic and AI-integrated models, entail high initial investments, often over $200,000 per unit. For smaller businesses, this upfront cost is prohibitive, creating a barrier to entry for adopting advanced palletizers. According to the U.S. Bureau of Economic Analysis, equipment and machinery investments are a substantial financial strain on SMEs, as such outlays represent 40-50% of total capital expenditure. High equipment costs, therefore, slow the growth rate of adoption, impacting smaller players across sectors.

- Technical Complexity and Integration Issues: Integration of palletizing systems into existing operational flows is complex, with 20-30% of installations requiring customization, as noted by the IFR in 2023. Furthermore, 15% of companies report technical issues when retrofitting palletizers into legacy production lines, citing challenges in achieving compatibility with existing control systems. Such complexities add to installation time and cost, making integration a significant barrier, particularly for businesses with outdated infrastructure.

Global Palletizer Market Future Outlook

Over the next few years, the Global Palletizer Market is projected to grow significantly, fueled by continuous advancements in robotic and AI technologies, the rise of modular and flexible palletizing systems, and increasing applications in warehousing and logistics. The growth in e-commerce and the global emphasis on automation in supply chains are further anticipated to propel market demand as companies seek more efficient handling solutions.

Market Opportunities

- Integration with AI and IoT Technologies: AI and IoT integration in palletizing systems enables predictive maintenance and enhances productivity by 15-20%, according to McKinseys 2023 report on industrial IoT. AI-driven analytics aid in real-time monitoring of machine performance, reducing downtime significantly. Additionally, IoT-enhanced sensors optimize robotic accuracy, improving stacking precision by 30% in complex logistics operations. The shift towards AI and IoT-integrated systems represents a robust opportunity to optimize the palletizing process and enhance system reliability in high-demand sectors.

- Expanding Application in Emerging Economies: Emerging economies are witnessing rapid industrialization, with India and Brazil reporting manufacturing sector growth of 5% and 4.2%, respectively, in 2023 (World Bank). This growth has spurred the demand for automated solutions like palletizers to support large-scale production and exports. Palletizer adoption in these regions is further incentivized by government initiatives aimed at modernizing infrastructure, such as Indias Make in India program, which provides financial incentives for automation. This trend underlines significant growth potential for the palletizer market in emerging markets.

Scope of the Report

|

Product Type |

Robotic Palletizers Conventional Palletizers Mixed Load Palletizers |

|

End-Use Industry |

Food and Beverage Pharmaceuticals Electronics Chemicals Logistics and Warehousing |

|

Payload Capacity |

Low Capacity (Up to 100 kg) Medium Capacity (100500 kg) High Capacity (Above 500 kg) |

|

Automation Level |

Fully Automated Semi-Automated |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Manufacturing Facilities

Logistics and Warehousing Providers

Investment and Venture Capitalist Firms

Food and Beverage Companies

Pharmaceutical Manufacturers

Electronics and Consumer Goods Manufacturers

Government and Regulatory Bodies (e.g., U.S. Department of Commerce, European Commission)

Industrial Automation Solution Providers

Companies

Players Mentioned in the Report:

ABB Ltd.

Fanuc Corporation

KUKA AG

Mitsubishi Electric Corporation

Yaskawa Electric Corporation

Columbia/Okura LLC

Schneider Electric SE

Kion Group AG

Honeywell International Inc.

FlexLink Systems Inc.

Premier Tech Chronos

BEUMER Group GmbH

Intelligrated Inc.

Kawasaki Heavy Industries Ltd.

Fuji Yusoki Kogyo Co., Ltd.

Table of Contents

1. Global Palletizer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Palletizer Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Palletizer Market Analysis

3.1. Growth Drivers

Automation and Labor Optimization

Increased Demand in Manufacturing Sectors

Advancements in Robotic Palletizing Technology

Cost Efficiency in Logistics

3.2. Market Challenges

High Initial Investment Costs

Technical Complexity and Integration Issues

Operational Skill Gap

3.3. Opportunities

Integration with AI and IoT Technologies

Expanding Application in Emerging Economies

Growth of E-commerce and Warehousing Automation

3.4. Trends

Adoption of Collaborative Palletizing Robots

Modular and Flexible Palletizing Systems

Increased Focus on Energy-Efficient Solutions

3.5. Regulatory Landscape

Safety Standards and Regulations

Environmental Compliance

Industry 4.0 Integration Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

4. Global Palletizer Market Segmentation

4.1. By Product Type (In Value %)

Robotic Palletizers

Conventional Palletizers

Mixed Load Palletizers

4.2. By End-Use Industry (In Value %)

Food and Beverage

Pharmaceuticals

Electronics

Chemicals

Logistics and Warehousing

4.3. By Payload Capacity (In Value %)

Low Capacity (Up to 100 kg)

Medium Capacity (100–500 kg)

High Capacity (Above 500 kg)

4.4. By Automation Level (In Value %)

Fully Automated

Semi-Automated

4.5. By Region (In Value %)

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

5. Global Palletizer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

ABB Ltd.

Fanuc Corporation

KUKA AG

Mitsubishi Electric Corporation

Yaskawa Electric Corporation

Fuji Yusoki Kogyo Co., Ltd.

Columbia/Okura LLC

Schneider Electric SE

Kion Group AG

Honeywell International Inc.

FlexLink Systems Inc.

Premier Tech Chronos

BEUMER Group GmbH

Intelligrated Inc.

Kawasaki Heavy Industries Ltd.

5.2. Cross Comparison Parameters

Number of Employees

Headquarters Location

Inception Year

Revenue

Market Share

R&D Spending

Key Patents Held

Geographical Presence

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Funding

5.8. Government Incentives and Grants

6. Global Palletizer Market Regulatory Framework

6.1. Safety and Compliance Standards

6.2. Environmental Regulations

6.3. Certification and Licensing Requirements

7. Global Palletizer Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Global Palletizer Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Payload Capacity (In Value %)

8.4. By Automation Level (In Value %)

8.5. By Region (In Value %)

9. Global Palletizer Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Strategic Initiatives

9.4. White Space Opportunity Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with a mapping of key stakeholders and market components across the Global Palletizer Market. Secondary research draws on proprietary databases, reports, and publications, focusing on defining critical market variables.

Step 2: Market Analysis and Construction

In this phase, historical data on market penetration and segment-specific adoption is analyzed. The synthesis of data includes an assessment of revenue generation trends across sectors, ensuring a balanced representation of historical growth.

Step 3: Hypothesis Validation and Expert Consultation

Market insights and assumptions are further validated via CATI interviews with industry experts and representatives of leading palletizer companies. Insights from these interviews guide data validation.

Step 4: Research Synthesis and Final Output

This final phase consolidates data from primary and secondary sources to create a comprehensive market report. Data validation is conducted through follow-up engagement with key companies, ensuring the accuracy of projections.

Frequently Asked Questions

01 How big is the Global Palletizer Market?

The Global Palletizer Market is valued at USD 2.8 billion, primarily driven by increased automation needs in warehousing and manufacturing.

02 What are the challenges in the Global Palletizer Market?

Key challenges include high initial costs, technical complexity in integration, and a skill gap in operating advanced palletizing systems.

03 Who are the major players in the Global Palletizer Market?

Major players include ABB Ltd., Fanuc Corporation, KUKA AG, Mitsubishi Electric Corp., and Yaskawa Electric Corporation.

04 What factors drive growth in the Global Palletizer Market?

Growth drivers include advancements in robotic technology, the rise of modular systems, and the expansion of logistics and warehousing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.