Global Passenger Car Accessories Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD11133

December 2024

86

About the Report

Global Passenger Car Accessories Market Overview

- The Global Passenger Car Accessories Market is valued at USD 189 billion, reflecting a robust demand driven by increased consumer spending on personalization and functionality enhancements. The market's steady expansion is fueled by technological advancements, such as integration with smart car systems, which appeal to the growing trend of in-vehicle connectivity and entertainment.

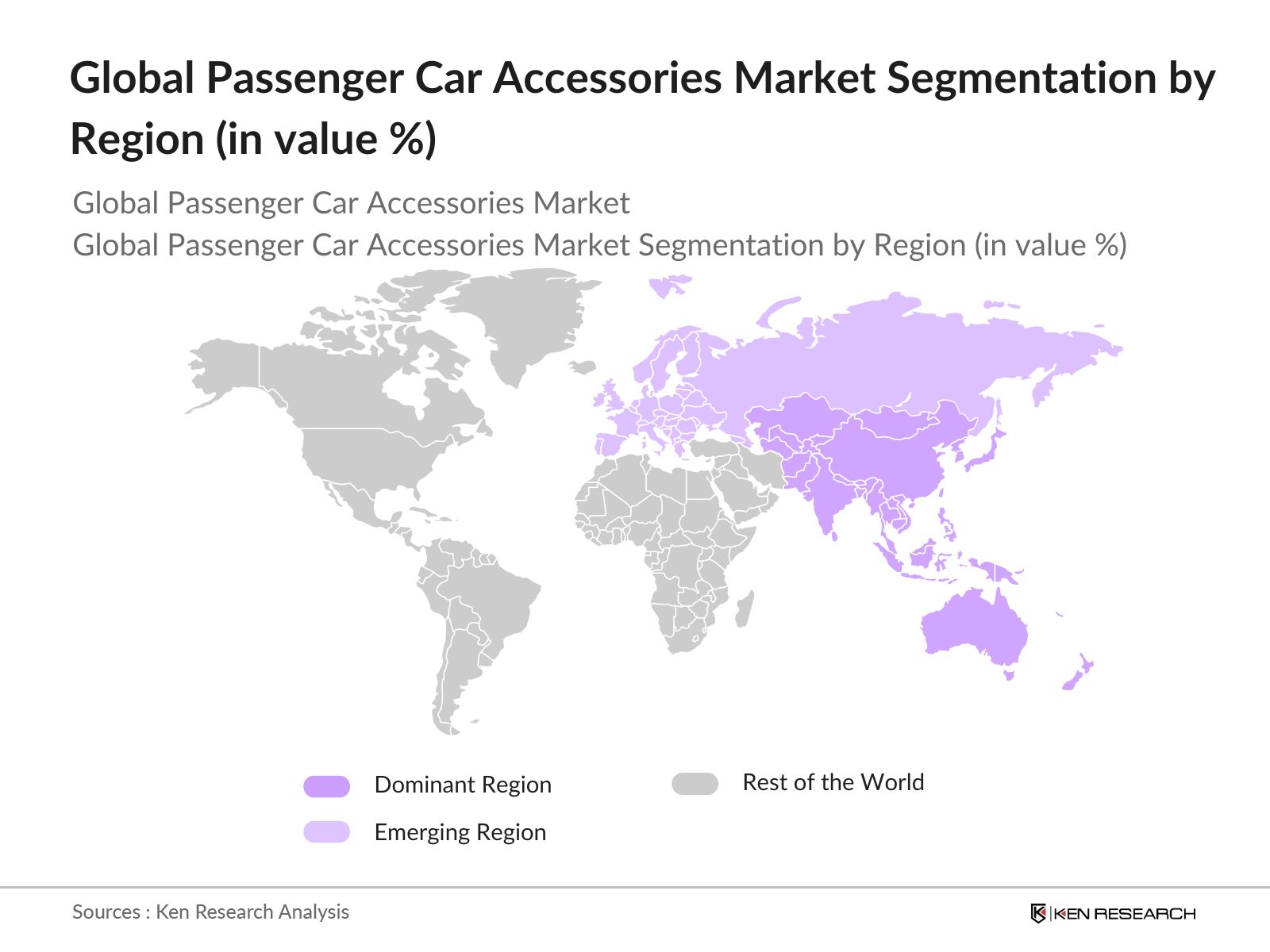

- North America and Asia Pacific are thedominant passenger car accessories market regions. North America's dominance is attributed to high consumer spending power, a strong aftermarket industry, and the significant presence of major automotive brands. In Asia Pacific, demand is largely driven by a rapidly expanding middle class, particularly in China and India, where consumers increasingly seek customization and enhanced in-car technology as part of their automotive ownership experience.

- Governments globally are providing subsidies for EV infrastructure, indirectly promoting EV-specific accessories. In 2024, the U.S. government allocated $4 billion for EV infrastructure, which has supported the growth of EV accessory markets, such as charging adapters and cables. Similar initiatives in Europe have created opportunities for accessory manufacturers to cater to a growing EV customer base.

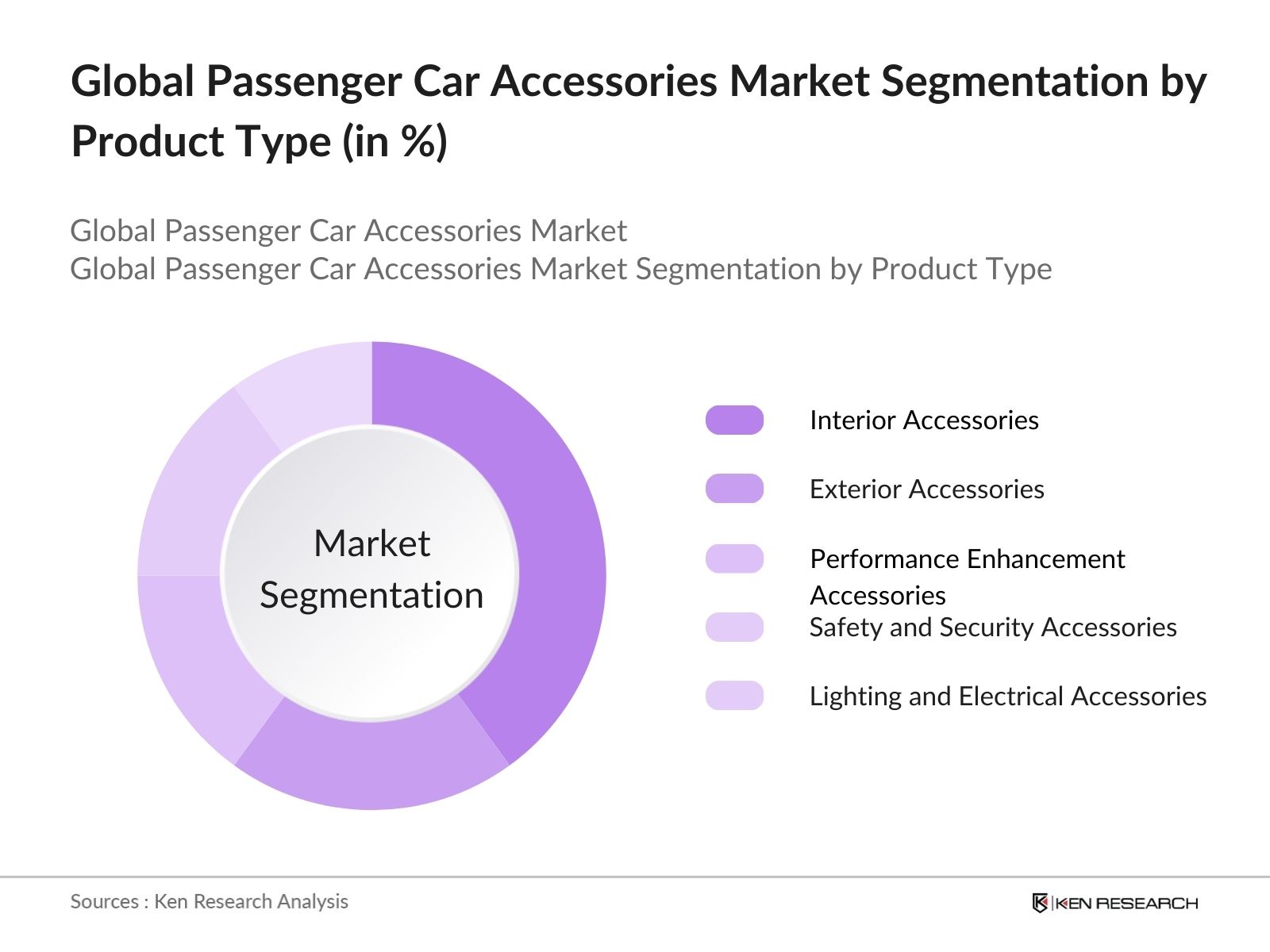

Global Passenger Car Accessories Market Segmentation

By Product Type: The market is segmented by product type into interior accessories, exterior accessories, performance enhancement accessories, safety and security accessories, and lighting and electrical accessories. Among these, interior accessories hold a dominant market share due to the high demand for seat covers, infotainment systems, and floor mats, which offer consumers greater comfort and personalization. Brands like Pioneer and Alpine have strong brand recognition, particularly in infotainment, which continues to drive this segment's leadership in the market.

By Distribution Channel: This market is segmented by distribution channel into OEM (Original Equipment Manufacturer) and Aftermarket. The Aftermarket channel is the dominant segment due to its extensive reach and the increasing consumer preference for third-party accessories, which often offer more affordable and customizable options. The aftermarket is bolstered by a robust network of retailers and online marketplaces, such as Amazon and Alibaba, which provide consumers with easy access to a wide range of accessories.

By Region: The passenger car accessories market is regionally segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific is the leading region, driven by increasing vehicle sales in countries like China, Japan, and India. The demand for personalization and in-car technology among a rising middle-class population in these regions supports this segment's strong position in the market.

Global Passenger Car Accessories Market Competitive Landscape

The market is led by key players who dominate through innovation, strong brand presence, and extensive distribution networks. Companies like Bosch and Continental maintain market leadership by investing in R&D for advanced accessories, including safety systems and infotainment solutions.

Global Passenger Car Accessories Market Analysis

Market Growth Drivers

- Increase in Global Vehicle Production and Rising Consumer Spending on Customization: Global vehicle production in 2024 reached 90 million units, with an upward trajectory due to steady demand in key markets like the United States and China, where annual car sales hit 17 million and 25 million units, respectively. This rise in vehicle production has driven the demand for passenger car accessories as consumers increasingly seek personalization options for aesthetics, comfort, and utility.

- Rising Demand for Advanced Safety Accessories: As safety regulations tighten globally, the demand for advanced safety accessories, such as rear-view cameras, parking sensors, and blind-spot detection systems, has surged. In 2024, the global market for car safety accessories generated $15 billion, with contributions from markets like Japan and Europe, where stringent safety mandates drive high adoption rates. Increased awareness about road safety and governmental incentives for safety compliance contribute to the popularity of these accessories, providing steady growth momentum for the market.

- Growth of E-Commerce and Direct-to-Consumer Models in Car Accessories: E-commerce channels for car accessories have expanded rapidly, reaching $22 billion in sales in 2024 as digital marketplaces make it easier for consumers to access and purchase a variety of products. In North America and Europe, around 40% of car accessory purchases are now made online, boosted by major online retail platforms and a surge in mobile commerce. This trend has enabled consumers to discover and buy specialized accessories directly, driving the growth of the car accessories market globally.

Market Challenges

- High Cost of Advanced Accessories and Installation: Many advanced car accessories, such as GPS systems and automated driving aids, have a high-cost barrier, with some systems costing over $2,000 per vehicle. This expense limits their accessibility to the premium car segment, constraining market penetration among average consumers in developing regions.

- Counterfeit Products and Quality Concerns: The prevalence of counterfeit car accessories has risen in key markets, with an estimated $5 billion worth of counterfeit products circulating globally in 2024. These inferior-quality products compromise vehicle safety and functionality, undermining consumer trust and affecting genuine manufacturers sales.

Global Passenger Car Accessories Market Future Outlook

Over the next five years, the global passenger car accessories industry is anticipated to experience significant growth. This growth will be driven by increasing consumer preference for personalization, integration of smart technologies, and a growing aftermarket segment catering to a variety of budget options.

Future Market Opportunities

- Increasing Adoption of Augmented Reality (AR) in Car Accessory Shopping: By 2029, AR technology will likely be a standard feature on car accessory platforms, allowing users to visualize accessories on their vehicles before purchasing. This trend is expected to add an estimated 1 million users annually to online platforms, enhancing the digital shopping experience and influencing consumer buying behavior across the global market.

- Shift Toward Customized Accessories Using 3D Printing Technology: The integration of 3D printing technology is projected to enable on-demand customization of car accessories, with the market for 3D-printed accessories anticipated to reach 2 million units by 2029. This shift will allow manufacturers to offer tailored solutions, especially in premium segments where personalization is a priority, driving the trend toward unique and customizable accessories.

Scope of the Report

|

Product Type |

Interior Accessories |

|

Distribution Channel |

OEM |

|

Vehicle Type |

Hatchback |

|

Material Type |

Plastic |

|

Region |

North America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

OEM Accessory Suppliers

Aftermarket Retailers and Distributors

Online Automotive Marketplaces

Consumer Electronics Companies

Government and Regulatory Bodies (National Highway Traffic Safety Administration, Ministry of Transport)

Investor and Venture Capitalist Firms

Retail Chains and Specialty Automotive Stores

Companies

Bosch GmbH

Denso Corporation

Magna International Inc.

Continental AG

Panasonic Corporation

Pioneer Corporation

Hyundai Mobis Co., Ltd.

Valeo SA

Garmin Ltd.

Faurecia SE

Table of Contents

1. Global Passenger Car Accessories Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Passenger Car Accessories Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Passenger Car Accessories Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Demand for Customization

3.1.2. Increasing Disposable Income

3.1.3. Advancements in In-Car Technology

3.1.4. Regulatory Standards on Safety Accessories

3.2. Market Challenges

3.2.1. High Cost of Premium Accessories

3.2.2. Counterfeit Products in Emerging Markets

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Expansion in Electric Vehicle Accessories

3.3.2. Increased Focus on Aesthetic Enhancements

3.3.3. Growth in Online Sales Channels

3.4. Trends

3.4.1. Integration of Smart Technologies (Voice Control, IoT)

3.4.2. Rise in Eco-Friendly Accessories

3.4.3. Growth of Aftermarket Customization

3.5. Regulatory Landscape

3.5.1. Environmental Standards for Material Use

3.5.2. Compliance Requirements for Safety Accessories

3.5.3. Certification Processes for Product Quality

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competition Ecosystem

4. Global Passenger Car Accessories Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Interior Accessories

4.1.2. Exterior Accessories

4.1.3. Performance Enhancement Accessories

4.1.4. Safety and Security Accessories

4.1.5. Lighting and Electrical Accessories

4.2. By Distribution Channel (In Value %)

4.2.1. OEM (Original Equipment Manufacturer)

4.2.2. Aftermarket

4.3. By Vehicle Type (In Value %)

4.3.1. Hatchback

4.3.2. Sedan

4.3.3. SUV

4.3.4. Electric Vehicle (EV)

4.4. By Material Type (In Value %)

4.4.1. Plastic

4.4.2. Metal

4.4.3. Leather

4.4.4. Others

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Passenger Car Accessories Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bosch GmbH

5.1.2. Denso Corporation

5.1.3. Magna International Inc.

5.1.4. Continental AG

5.1.5. Panasonic Corporation

5.1.6. Lear Corporation

5.1.7. Faurecia SE

5.1.8. Delphi Technologies

5.1.9. Aisin Seiki Co., Ltd.

5.1.10. Pioneer Corporation

5.1.11. Hella GmbH & Co. KGaA

5.1.12. Robert Bosch GmbH

5.1.13. Garmin Ltd.

5.1.14. Hyundai Mobis Co., Ltd.

5.1.15. Valeo SA

5.2. Cross Comparison Parameters (Revenue, Headquarters, Number of Employees, Market Presence, Product Portfolio, R&D Expenditure, Strategic Initiatives, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Partnerships

5.8. Product Launches and Innovations

6. Global Passenger Car Accessories Market Regulatory Framework

6.1. Safety and Quality Standards

6.2. Environmental Regulations

6.3. Certification Requirements for Accessories

7. Global Passenger Car Accessories Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Passenger Car Accessories Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Vehicle Type (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. Global Passenger Car Accessories Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

An extensive ecosystem map was developed to understand all major stakeholders in the Global Passenger Car Accessories Market. The process included thorough desk research leveraging secondary databases to determine the critical variables affecting market growth and consumer behavior.

Step 2: Market Analysis and Construction

Historical data was compiled and analyzed, focusing on the passenger car accessory penetration rate, OEM to aftermarket ratios, and revenue generation across regions. A thorough analysis of these variables provided reliable insights for future projections.

Step 3: Hypothesis Validation and Expert Consultation

Initial market hypotheses were refined and validated through interviews with industry experts, including key players in both OEM and aftermarket channels. Their insights on operational trends and consumer demands were pivotal in enhancing data accuracy.

Step 4: Research Synthesis and Final Output

Comprehensive interactions with manufacturers provided in-depth data on product demand, performance, and customer preferences, completing the analysis. The final synthesis ensured a well-rounded, validated report reflective of current and future market dynamics.

Frequently Asked Questions

01. How big is the Global Passenger Car Accessories Market?

The Global Passenger Car Accessories Market was valued at USD 189 billion, driven by consumer demand for personalization, technology integration, and safety upgrades in vehicles.

02. What are the challenges in the Global Passenger Car Accessories Market?

Challenges in the Global Passenger Car Accessories Market include high competition in the aftermarket sector, the prevalence of counterfeit products, and fluctuating raw material costs, which impact pricing and availability.

03. Who are the major players in the Global Passenger Car Accessories Market?

Key players in the Global Passenger Car Accessories Market include Bosch GmbH, Continental AG, Denso Corporation, Magna International Inc., and Panasonic Corporation. These companies lead due to strong R&D investment, wide distribution networks, and an innovative product lineup.

04. What are the growth drivers of the Global Passenger Car Accessories Market?

The Global Passenger Car Accessories Market is driven by factors such as increasing consumer preference for vehicle personalization, advancements in infotainment and safety technologies, and a growing aftermarket that caters to a range of consumer preferences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.